Vibration Sensors Market by Type (Accelerometers, Proximity Probes, Displacement Sensors, Velocity Sensors), Monitoring Process (Online and Portable), Equipment, Industry, and Region - Global Forecast to 2025

Vibration sensors Market

Vibration sensors Market and Top Companies

- Baker Hughes Company (US) − Baker Hughes engages in the provision of oilfield products, services, and digital solutions. The Digital Solutions segment of the company offers vibration sensors under the Bently Nevada brand. Bently Nevada, a Baker Hughes business, offers a plant-wide, holistic suite of machine condition monitoring and protection hardware, software, and services. To grow in the vibration sensors market, the company has developed a wide portfolio of vibration sensors with a variety of models for specific applications. The company has leveraged IoT in its compact and powerful wireless vibration sensors—Ranger Pro and condition-based monitoring system— to improve uptime, productivity, and safety.

- SKF (Sweden) – SKF is a manufacturer of machines and rotating equipment. It provides technical support, maintenance services, condition monitoring, asset efficiency optimization, engineering consultancy, and training services. The company provides vibration sensors for machine condition monitoring systems in industries such as oil and gas, energy and power, food and beverages, metals and mining, cement, and paper and pulp industries, among others. To grow in the vibration sensors market, the company has adopted a mix of organic and inorganic growth strategies, such as collaborations and product launches.

- TE Connectivity (US) − TE Connectivity offers a diversified, market-leading connectivity solutions and sensors product portfolio of vibration sensors. The company has established its presence on a global scale that provides the company with a significant competitive advantage. The company’s production facilities are located in various sites, which helps to reduce transportation costs and increase profit margins.To grow in the vibration sensors market, TE Connectivity has adopted a mix of organic and inorganic growth strategies, such as product launches and acquisitions. For example, in March 2020, it launched the 8911 wireless accelerometer with edge computing for condition monitoring.

- Honeywell International Inc. (US) − Honeywell has a vast experience in offering a diverse range of test and measurement sensors. The company has established its presence on a global scale that provides the company with a significant competitive advantage.To sustain its position in the vibration sensors market, Honeywell offers accelerometers in a full range of configurations, including miniature transducers, bi-axial and tri-axial measurements, and special submersible units. These accelerometers are also available in numerous mounting configurations, including screw type, bolt mount, and epoxy. In addition, Honeywell offers both strain gauge and piezoelectric technology, thus making its product line one of the most robust in the market.

- Emerson Electric Co. (US) – Emerson Electric Co. is one of the key players in the vibration sensors market. The company has achieved a leadership position in the market by developing and providing cutting-edge technologies and products. Emerson has a major presence in the North American vibration sensors market. A mix of organic and inorganic growth strategies has helped the company to retain a sound position in the market. For instance, in November 2019, Emerson introduced the AMS Wireless Vibration Monitor, a low-cost, easy-to-deploy vibration sensor that performs prescriptive analytics on vibration data using native software to automatically identify failure modes and prevent potential problems involving rotating assets.

Vibration sensors Market and Top Industries

- Energy and Power − The power industry is facing challenges owing to the continuously increasing demand for power and the requirement to reduce distribution losses. This has led power generation companies to offer continuous power supply at low costs and monitor their processes for any unwanted changes. Hence, vibration sensors play a crucial role in the power sector. Vibration sensors help in tracking rotor imbalances, aerodynamic asymmetry, surface roughness, and overall performance, as well as carry out offline and online measurements of stress and strain in energy and power industry.

- Oil and gas −Vibration sensors play a vital role in the oil and gas industry by ensuring that the production machinery is operational and the downtime is minimized, thereby leading to a reduction in operating costs and an increase in productivity and monetary gains. These sensors help reduce unplanned outages and optimize machine performance. This, in turn, helps in reducing maintenance and repair costs. Vibration sensors designed for monitoring applications are used to monitor motors, critical pumps, fans, gearboxes, and compressors in the oil and gas industry

- Chemicals − The deterioration in the condition of machines used in chemical plants and their performance is usually associated with vibration, misalignment, and imbalances in moving parts; and poorly lubricated parts. Detecting these underlying problems at an early stage allows the rectification of issues before they affect different processes, thus optimizing the performance of chemical plants. Vibration monitoring equipment and tools are used in the chemicals industry to detect vibration-related issues. These tools help improve the maintenance effectiveness, increase profitability, provide safety warnings, and reduce operating costs of chemical plants. In a general chemical processing plant, vibration sensors with a minimum of 10–10,000 Hz frequencies are required for the effective monitoring of turbines, blades, and gears.

- Automotive − In recent years, the global automotive industry has witnessed strong growth and profitability. The increased demand for automobiles has also encouraged automobile manufacturers to monitor the health of their plant machinery effectively to keep the production line in operating condition. Moreover, condition monitoring has become crucial for maintaining the quality of products and the stability of manufacturing processes. With the help of vibration monitoring equipment and vibration sensors, automobile manufacturing plant managers can ensure the proper functioning of automated machines, metalworking equipment, and robotics, thus ensuring the smooth flow of different production processes.

Vibration sensors Market Technology Trends

Piezoelectric (PE) accelerometers: They use piezoelectric crystals that generate signals when stressed by external factors, such as vibrating parts of machines. Most piezoelectric sensors are based on lead zirconate titanate (PZT) ceramics, which are poled to align the dipoles to make crystals piezoelectric. PZT ceramic crystals are ideal for condition monitoring applications since they offer a wide temperature range, broad dynamic range, and wide frequency bandwidth (usable to >20kHz).

Variable capacitance (VC) accelerometers: VC accelerometers derive acceleration measurements from changes in capacitance of a seismic mass moving between 2 parallel capacitor plates. These sensors are typically manufactured from silicon wafers and are fabricated into miniaturized MEMS chips.

Piezoresistive accelerometers: They are most suitable for impulse/impact measurements where frequency range and g level are typically high. Being a DC-response device, the desired velocity and displacement information can be accurately derived from its acceleration output without integration error. Piezoresistive accelerometers are commonly used in automotive safety testing, weapons testing, and higher shock range measurements beyond the usable range of VC accelerometers.

IOT-based wireless vibration sensors: New IoT-based solutions offered by companies such as Baker Hughes Company (US), Omron Corp. (Japan), Emerson Electric Co.(US), and TE Connectivity (Switzerland) are flexible and easy to deploy. As such, they are being adopted in various industries. The factors fueling the adoption of IoT-based wireless vibration sensors include ever-increasing demand for cost-effective data from plant operators; improved battery life of wireless sensors; increased adoption of IoT in different industries, and easy availability of edge-computing IoT devices that enable enhanced wireless communication.

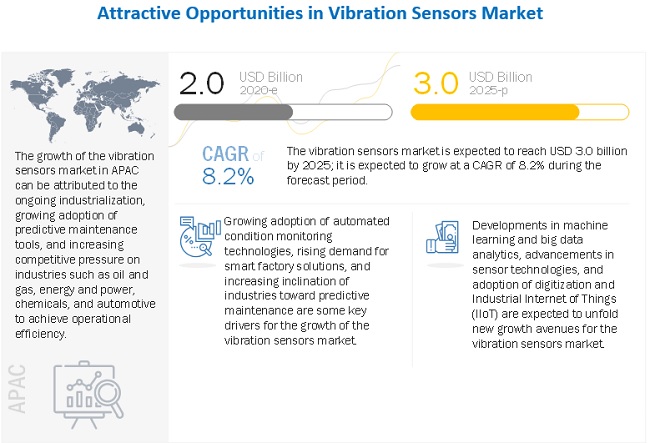

The global Vibration sensors market was valued at USD 2.0 billion in 2020 and is projected to reach USD 3.0 billion by 2025; it is expected to grow at a CAGR of 8.2% from 2020 to 2025.

A few key factors driving the growth of the vibration sensor market are growing adoption of automated condition monitoring technologies for the development of smart factories, rising use of wireless systems for machine condition monitoring, ongoing transition from preventive to predictive maintenance, and increasing demand for vibration sensors from emerging applications.

Impact of AI Vibration Sensors Market

The impact of artificial intelligence (AI) on the vibration sensors market is significantly enhancing the precision and intelligence of condition monitoring systems across industries such as manufacturing, automotive, and energy. AI-powered vibration sensors can analyze complex vibration patterns in real time, enabling predictive maintenance by detecting anomalies and forecasting potential equipment failures before they occur. This results in reduced downtime, lower maintenance costs, and improved operational efficiency. Additionally, AI facilitates the automation of data interpretation, turning raw sensor outputs into actionable insights, thereby driving smarter decision-making and accelerating the adoption of Industry 4.0 technologies.

To know about the assumptions considered for the study, Request for Free Sample Report

Vibration sensors market for online vibration monitoring to grow at higher CAGR during forecast period

The vibration sensor market for online vibration monitoring is expected to grow at a higher CAGR during the forecast period. Currently, online vibration monitoring is a preferred monitoring process as it is more advanced than portable condition monitoring and provides real-time machine data to plant operators. This monitoring process is widely used in critical plants that work continuously and are highly prone to defects.

Accelerometers to hold largest share of market during forecast period

Accelerometers are expected to account for the largest share of the global vibration sensors market during the forecast period. The growth of this segment can be attributed to the increased use of accelerometers for collecting vibration monitoring data. Piezoelectric accelerometers are the most commonly used sensors in vibration monitoring applications. They are suitable for a wide band of frequencies, ranging from very low to very high frequencies. These accelerometers are also available in a wide variety of application-specific designs.

The vibration sensors market for an automotive industry expected to grow at the highest CAGR market during the forecast period”

The automotive segment of the market is projected to grow at the highest CAGR during the forecast period. The global automotive industry is focusing on automating and upgrading assembly lines, which require motor monitoring systems and vibration sensors. Motor current signature analysis helps reduce machine failures and extends the life of machines. The automotive industry is witnessing significant growth in the number of units produced per day. The machinery on the production floor is required to be maintained properly to minimize the production cycle and increase production output.

To know about the assumptions considered for the study, download the pdf brochure

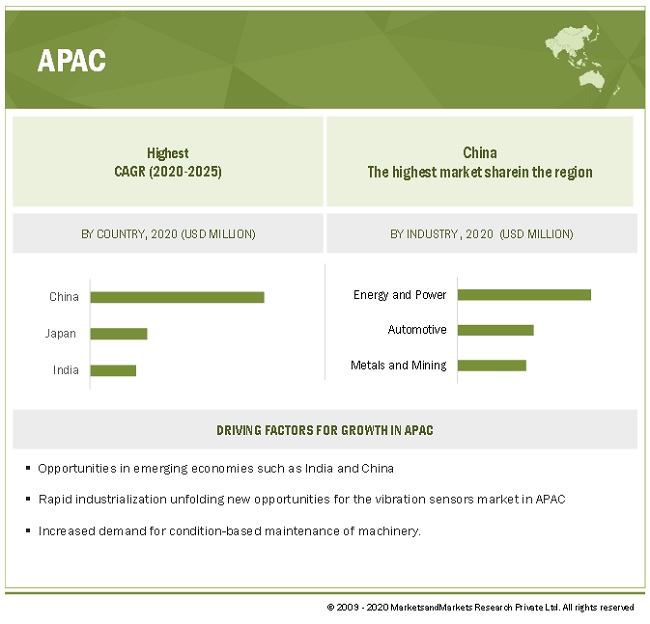

“Vibration sensors market for APAC to grow at the highest CAGR during the forecast period”

The market in APAC is expected to grow at the highest CAGR during the forecast period. Ongoing industrialization, growing adoption of predictive maintenance tools, and increasing competitive pressure on industries such as oil and gas, energy and power, chemicals, and automotive to achieve operational efficiency are fueling the growth of vibration sensor market in APAC. The expansion of manufacturing activities as a result of the migration of production bases to APAC countries, such as China, India, and South Korea, with low labor costs, is also driving the growth of the vibration sensors market in APAC.

Market Dynamics

Driver: Ongoing transition to from preventive to predictive maintenance

The predictive maintenance is gaining rapid popularity in the global manufacturing sector owing to the benefits offered by it. It is being implemented on a large scale, especially in capital-intensive industries such as automotive and oil and gas. Several predictive maintenance tools and techniques are available to monitor the condition of machines and equipment to identify the symptoms of wear and other failures. Therefore, the transition from preventive to predictive maintenance contributes significantly to the growth of the vibration sensors market.

Restraint: Adherence to regulatory standards

Currently, various standards govern or guide vibration monitoring and analysis, including some that establish classifications of the measurement and data analysis methods. For machine vibration monitoring and analysis, a number of relevant standards are developed and published by the International Organization for Standardization (ISO). Manufacturers of various sensors, equipment, and tools related to vibration monitoring have to comply with these industry standards. The industry standards take away the liberty of the manufacturers to design their products according to their standardized procedures and may also add to the overall cost of the product.

Opportunity: Development of advanced sensor technologies

The sensor technology has been advancing at a rapid rate. The use of advanced sensors such as wireless sensors, fiber-optic sensors, and micro-electro-mechanical system (MEMS) sensors is increasing continuously across the world. Sensors that are resistant to extreme climatic conditions are largely deployed in monitoring applications. Numerous sensors are installed in the wireless sensor networks to offer accurate results. Thus, the use of these advanced sensor technologies acts as a growth opportunity for the vibration sensors market.

Challenge: Limited accessibility to expertise at remote locations

Vibration sensors are deployed by a number of companies to achieve operational excellence in their manufacturing processes by reducing the instances of equipment failure. The oil and gas production facilities and power generation plants are located in remote locations owing to which the availability of expertise at these locations becomes a challenge. Technical expertise is necessary to verify the key parameters, such as system optimization, software updates, system networking, and data transmission, of monitoring systems. Therefore, it becomes difficult to implement vibration monitoring solutions and vibration sensors in remote locations where access to expertise is difficult.

Vibration sensors market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 2.0 billion in 2020 |

| Projected Market Size | USD 3.0 billion by 2025 |

| Growth Rate | CAGR of 8.2% |

|

Years considered |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million/billion), Volume (Thousand Units) |

|

Segments covered |

Type, monitoring process, equipment, industry, and Geography |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Baker Hughes Company (US), TE Connectivity (Switzerland), SKF (Sweden), Honeywell International Inc. (US), Emerson Electric Co. (US), Robert Bosch (Germany), NXP Semiconductors (Switzerland) Omron Corp. (Japan), Rockwell Automation Inc. (US), National Instruments (US), Robert Bosch (Germany), Dytran Instruments, Inc. - total 20 major players have been covered |

This report categorizes the market based on type, monitoring process, equipment, industry, and geography.

Vibration sensors Market, by Type

- Accelerometers

- Proximity Probes

- Displacement Sensors

- Velocity Sensors

Vibration sensors Market, by Monitoring Process

- Online Vibration Monitoring

- Portable Vibration Monitoring

Vibration sensors Market, by Equipment

- Embedded Systems

- Vibration Analyzers

- Vibration Meters

Vibration sensors Market, by Industry

- Oil and Gas

- Energy and Power

- Metals and Mining

- Chemicals

- Automotive

- Aerospace and Defense

- Food and Beverages

- Semiconductors and Electronics

- Pharmaceuticals

- Healthcare

- Others (machine manufacturing, cement, railways, marine, and pulp and paper industries)

Vibration sensor Market, by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Key Market Players

Baker Hughes Company (US), TE Connectivity (Switzerland), SKF (Sweden), Honeywell International Inc. (US), Emerson Electric Co. (US), Robert Bosch (Germany), NXP Semiconductors (Switzerland) Omron Corp. (Japan), Rockwell Automation Inc. (US), National Instruments (US), Robert Bosch (Germany), Dytran Instruments, Inc. (US), KEYENCE Corp. (Japan), Fluke Corp. (US), Wilcoxon Sensing Technologies (US), PCB Piezotronics (US), and SPM instrument (Sweden), are among the major players in the vibration sensors market.

Recent Developments in Vibration Sensors Industry

- In March 2020, SKF (Sweden) launched a compact and cost-effective vibration and temperature sensor, SKF Enlight Collect IMx-1, for monitoring the condition of rotating parts on heavy industrial machinery.

- In March 2020, TE Connectivity (US) acquired First Sensor AG (Germany), a provider of sensing solutions. Post the acquisition, TE holds 71.87% shares of First Sensor. By combining the portfolios of both the company, TE will be able to offer even more varied products, including innovative and market-leading sensors.

- In November 2019, Emerson Electric Co. (US) introduced the AMS Wireless Vibration Monitor, a low-cost, easy-to-deploy vibration sensor that performs prescriptive analytics on vibration data using native software to automatically identify failure modes and prevent potential problems involving rotating assets. The compact device makes it economically feasible to fully monitor motors, pumps, fans, and other critical plant equipment to reduce downtime and achieve more reliable operations.

Frequently Asked Questions (FAQ):

Which industries are expected to drive the growth of the vibration sensors market in the next 5 years?

Industries such as oil and gas, energy and power, metals and mining, automotive, chemicals, aerospace and defense are expected to drive the growth of the vibration sensors market in next 5 years. Vibration sensors play a vital role in the oil and gas industry by ensuring that the production machinery is operational and the downtime is minimized. In energy and power industry vibration sensors monitor the condition of turbines and help them make the required changes by examining their components.

Which are the major companies in the Vibration sensors market? What are their major strategies to strengthen their market presence?

Baker Hughes Company (US), TE Connectivity (Switzerland), SKF (Sweden), Honeywell International Inc. (US), Emerson Electric Co. (US), Robert Bosch (Germany), and NXP Semiconductors (Switzerland) Omron Corp. (Japan), Rockwell Automation Inc. (US), National Instruments (US), Robert Bosch (Germany), Dytran Instruments, Inc. (US), KEYENCE Corp. (Japan), Fluke Corp. (US), Wilcoxon Sensing Technologies (US), PCB Piezotronics (US), and SPM instrument (Sweden), are among the major players in the vibration sensors market. Product launches, acquisitions, and partnerships have been the major strategies for these companies to grow in the vibration sensors market.

Which is the best region to invest for this market?

The vibration sensors market in APAC is expected to grow at the highest CAGR during the forecast period. Ongoing industrialization, growing adoption of predictive maintenance tools, and increasing competitive pressure on industries such as oil and gas, energy and power, chemicals, and automotive to achieve operational efficiency are fueling the growth of the vibration sensors market in APAC. The expansion of manufacturing activities as a result of the shifting of production bases to APAC countries, such as China, India, and South Korea, with low labor costs, is driving the demand for vibration sensors in the region.

Which type of vibration sensors are expected to hold the largest share during the forecast perod?

Accelerometers are expected to account for the largest share of the vibration sensors market during the forecast period. The growth of this segment can be attributed to the increased use of accelerometers for collecting vibration monitoring data. Piezoelectric accelerometers are the most commonly used sensors in vibration monitoring applications. They are suitable for a wide band of frequencies, ranging from very low to very high frequencies. These accelerometers are also available in a wide variety of application-specific designs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 VIBRATION SENSORS MARKET: INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 VIBRATION SENSORS MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving market size using bottom-up analysis (demand side)

FIGURE 4 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: (SUPPLY SIDE)— REVENUE GENERATED BY COMPANIES IN MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 9 COMPARISON OF DIFFERENT SCENARIOS OF VIBRATION SENSOR MARKET WITH RESPECT TO IMPACT OF COVID-19

FIGURE 10 ONLINE VIBRATION MONITORING SEGMENT TO ACCOUNT FOR LARGE SHARE OF MARKET FROM 2020 TO 2025

FIGURE 11 ACCELEROMETERS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2020 TO 2025

FIGURE 12 AUTOMOTIVE SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN VIBRATION SENSORS MARKET

FIGURE 14 INCREASED ADOPTION OF AUTOMATED CONDITION MONITORING AND PREDICTIVE MAINTENANCE TECHNOLOGIES TO LEAD TO MARKET GROWTH FROM 2020 TO 2025

4.2 MARKET IN APAC, BY INDUSTRY AND COUNTRY

FIGURE 15 ENERGY AND POWER AND CHINA TO HOLD LARGEST SHARES OF MARKET IN APAC IN 2020

4.3 MARKET, BY EQUIPMENT

FIGURE 16 EMBEDDED SYSTEMS SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.4 MARKET, BY GEOGRAPHY

FIGURE 17 US ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 VIBRATION SENSORS MARKET DYNAMICS

FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 19 MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Growing adoption of automated condition monitoring technologies for development of smart factories

5.2.1.2 Rising use of wireless systems for machine condition monitoring

5.2.1.3 Ongoing transition from preventive to predictive maintenance

5.2.1.4 Increasing demand for vibration sensors from emerging applications

5.2.2 RESTRAINTS

FIGURE 20 MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 Additional retrofitting costs for incorporating vibration monitoring solutions in existing machinery

5.2.2.2 Adherence to regulatory standards

5.2.3 OPPORTUNITIES

FIGURE 21 VIBRATION SENSORS MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Advent of machine learning and big data analytics

5.2.3.2 Development of advanced sensor technologies

5.2.3.3 Adoption of IIoT in different industries for vibration monitoring

5.2.3.4 Government support to fight against COVID-19-induced economic crisis

5.2.4 CHALLENGES

FIGURE 22 MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 Limited accessibility to expertise at remote locations

5.2.4.2 Trade restrictions imposed by US on China

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED AT ORIGINAL EQUIPMENT MANUFACTURERS AND SYSTEM INTEGRATORS STAGES

5.4 COVID-19 IMPACT ON VALUE CHAIN

5.4.1 DISRUPTION IN SUPPLY CHAIN OF MANUFACTURING INDUSTRY

5.4.1.1 Supply chain disruptions

5.4.1.2 Temporary shutdown of manufacturing units

5.4.1.3 Decrease in demand for goods

5.4.2 COMPONENT MANUFACTURER ECOSYSTEM

5.4.3 SYSTEM INTEGRATOR ECOSYSTEM

5.5 STRATEGIES TO MINIMIZE IMPACT OF COVID-19

5.5.1 REAL-TIME VISIBILITY OF SUPPLY CHAIN

5.5.2 EFFECTIVE IMPLEMENTATION OF ENABLING TECHNOLOGIES

5.6 USE CASES OF VIBRATION SENSORS

5.7 CASE STUDY ANALYSIS

5.8 TECHNOLOGY TRENDS

5.8.1 PIEZOELECTRIC VIBRATION SENSORS VS VARIABLE CAPACITANCE VIBRATION SENSORS VS PIEZORESISTIVE VIBRATION SENSORS

5.8.2 IOT-BASED WIRELESS VIBRATION SENSORS

5.8.3 MATERIALS USED IN VIBRATION SENSORS

5.9 PATENT ANALYSIS

TABLE 1 PATENT REGISTRATIONS RELATED TO VIBRATION SENSORS

5.1 AVERAGE SELLING PRICE (ASP) TREND

TABLE 2 MARKET ASP, BY TYPE, 2017–2025 (USD)

6 VIBRATION SENSORS MARKET, BY TYPE (Page No. - 62)

6.1 INTRODUCTION

FIGURE 24 ACCELEROMETERS SEGMENT PROJECTED TO HOLD LARGEST SIZE OF MARKET FROM 2020 TO 2025

TABLE 3 MARKET, BY TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 4 MARKET, BY TYPE, 2017–2025 (USD MILLION)

6.2 ACCELEROMETERS

6.2.1 RISE IN ADOPTION OF PIEZOELECTRIC ACCELEROMETERS FOR VIBRATION ANALYSIS IN INDUSTRIES

TABLE 5 MARKET FOR ACCELEROMETERS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 6 MARKET FOR ACCELEROMETERS, BY REGION, 2017–2025 (USD MILLION)

6.3 PROXIMITY PROBES

6.3.1 SURGE IN USE OF PROXIMITY PROBES TO MONITOR MOVEMENTS OF ROTATING EQUIPMENT AND DETECT DEFECTS IN THEM

TABLE 7 VIBRATION SENSOR MARKET FOR PROXIMITY PROBES, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 8 MARKET FOR PROXIMITY PROBES, BY REGION, 2017–2025 (USD MILLION)

6.4 VELOCITY SENSORS

6.4.1 RISE IN ADOPTION OF VELOCITY SENSORS FOR CARRYING OUT LOW- TO MEDIUM-FREQUENCY MEASUREMENTS

TABLE 9 MARKET FOR VELOCITY SENSORS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 10 MARKET FOR VELOCITY SENSORS, BY REGION, 2017–2025 (USD MILLION)

6.5 DISPLACEMENT SENSORS

6.5.1 INCREASE IN USE OF CAPACITIVE AND EDDY CURRENT DISPLACEMENT SENSORS FOR HIGH-RESOLUTION AND HIGH-SPEED MEASUREMENTS

TABLE 11 MARKET FOR DISPLACEMENT SENSORS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 12 MARKET FOR DISPLACEMENT SENSORS, BY REGION, 2017–2025 (USD MILLION)

6.6 IMPACT OF COVID-19

7 VIBRATION SENSORS MARKET, BY MONITORING PROCESS (Page No. - 70)

7.1 INTRODUCTION

FIGURE 25 ONLINE VIBRATION MONITORING SEGMENT TO LEAD MARKET FROM 2020 TO 2025

TABLE 13 MARKET, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

7.2 ONLINE VIBRATION MONITORING

7.2.1 RISE IN USE OF ONLINE VIBRATION MONITORING SYSTEMS TO ENSURE CONTINUOUS PRODUCTION AND SAFETY IN MANUFACTURING PLANTS

TABLE 14 MARKET FOR ONLINE VIBRATION MONITORING, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 15 MARKET FOR ONLINE VIBRATION MONITORING, BY REGION, 2017–2025 (USD MILLION)

TABLE 16 MARKET IN NORTH AMERICA FOR ONLINE VIBRATION MONITORING, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 17 VIBRATION SENSORS MARKET IN EUROPE FOR ONLINE VIBRATION MONITORING, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 18 MARKET IN APAC FOR ONLINE VIBRATION MONITORING, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 19 MARKET IN ROW FOR ONLINE VIBRATION MONITORING, BY REGION, 2017–2025 (USD MILLION)

7.3 PORTABLE VIBRATION MONITORING

7.3.1 PORTABLE VIBRATION MONITORING REDUCES MACHINE MAINTENANCE COSTS

TABLE 20 MARKET FOR PORTABLE VIBRATION MONITORING, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 21 MARKET FOR PORTABLE VIBRATION MONITORING, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 MARKET IN NORTH AMERICA FOR PORTABLE VIBRATION MONITORING, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 23 MARKET IN EUROPE FOR PORTABLE VIBRATION MONITORING, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 24 MARKET IN APAC FOR PORTABLE VIBRATION MONITORING, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 25 MARKET IN ROW FOR PORTABLE VIBRATION MONITORING, BY REGION, 2017–2025 (USD MILLION)

7.4 IMPACT OF COVID-19

8 VIBRATION SENSORS MARKET, BY EQUIPMENT (Page No. - 78)

8.1 INTRODUCTION

FIGURE 26 EMBEDDED SYSTEMS SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 26 MARKET, BY EQUIPMENT, 2017–2025 (USD MILLION)

8.2 EMBEDDED SYSTEMS

8.2.1 INCREASED USE OF VIBRATION SENSOR-BASED EMBEDDED SYSTEMS IN DIFFERENT INDUSTRIES

TABLE 27 MARKET FOR EMBEDDED SYSTEMS, BY INDUSTRY, 2017–2025 (USD MILLION)

8.3 VIBRATION ANALYZERS

8.3.1 VIBRATION DATA GATHERED THROUGH VIBRATION ANALYZERS SUPPORTS EFFICIENT MACHINE CONDITION MONITORING

TABLE 28 MARKET FOR VIBRATION ANALYZERS, BY INDUSTRY, 2017–2025 (USD MILLION)

8.4 VIBRATION METERS

8.4.1 ENERGY AND POWER INDUSTRY EXPECTED TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR VIBRATION METERS

TABLE 29 MARKET FOR VIBRATION METERS, BY INDUSTRY, 2017–2025 (USD MILLION)

8.5 IMPACT OF COVID-19

9 VIBRATION SENSORS MARKET, BY INDUSTRY (Page No. - 84)

9.1 INTRODUCTION

FIGURE 27 ENERGY AND POWER SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2025

TABLE 30 MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

9.2 OIL AND GAS

9.2.1 VIBRATION SENSORS PLAY VITAL ROLE IN OIL AND GAS INDUSTRY

TABLE 31 MARKET FOR OIL AND GAS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 32 MARKET FOR OIL AND GAS, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 33 MARKET FOR OIL AND GAS, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 34 VIBRATION SENSOR MARKET FOR OIL AND GAS, BY REGION, 2017–2025 (USD MILLION)

9.3 ENERGY AND POWER

9.3.1 REQUIREMENT OF PREDICTIVE MAINTENANCE IN POWER GENERATION PLANTS TO LEAD TO DEMAND FOR VIBRATION SENSORS

TABLE 35 MARKET FOR ENERGY AND POWER, BY TYPE,2017–2025 (USD MILLION)

TABLE 36 MARKET FOR ENERGY AND POWER, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 37 MARKET FOR ENERGY AND POWER, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 38 MARKET FOR ENERGY AND POWER, BY REGION, 2017–2025 (USD MILLION)

9.4 METALS AND MINING

9.4.1 INCREASED DEMAND FOR REMOTE DIAGNOSTICS IN METALS AND MINING INDUSTRY TO SUPPORT GROWTH OF MARKET

TABLE 39 VIBRATION SENSORS MARKET FOR METALS AND MINING, BY TYPE, 2017–2025 (USD MILLION)

TABLE 40 MARKET FOR METALS AND MINING, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 41 MARKET FOR METALS AND MINING, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 42 MARKET FOR METALS AND MINING, BY REGION, 2017–2025 (USD MILLION)

9.5 CHEMICALS

9.5.1 SURGED USE OF VIBRATION SENSORS IN CHEMICALS INDUSTRY TO MONITOR DIFFERENT PROCESSES ON REAL-TIME BASIS

TABLE 43 MARKET FOR CHEMICALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 44 MARKET FOR CHEMICALS, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 45 MARKET FOR CHEMICALS, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 46 MARKET FOR CHEMICALS, BY REGION, 2017–2025 (USD MILLION)

9.6 AUTOMOTIVE

9.6.1 INCREASED ADOPTION OF ONLINE VIBRATION MONITORING IN AUTOMOTIVE INDUSTRY

TABLE 47 MARKET FOR AUTOMOTIVE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 48 MARKET FOR AUTOMOTIVE, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 49 MARKET FOR AUTOMOTIVE, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 50 VIBRATION SENSORS MARKET FOR AUTOMOTIVE, BY REGION, 2017–2025 (USD MILLION)

9.7 AEROSPACE AND DEFENSE

9.7.1 SURGED ADOPTION OF VIBRATION SENSORS IN AEROSPACE AND DEFENSE INDUSTRY TO DETECT POTENTIAL FAULTS

TABLE 51 MARKET FOR AEROSPACE AND DEFENSE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 52 MARKET FOR AEROSPACE AND DEFENSE, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 53 MARKET FOR AEROSPACE AND DEFENSE, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 54 MARKET FOR AEROSPACE AND DEFENSE, BY REGION, 2017–2025 (USD MILLION)

9.8 FOOD AND BEVERAGES

9.8.1 INCREASED DEMAND FOR VIBRATION SENSORS FROM FOOD AND BEVERAGES INDUSTRY TO MAINTAIN PRODUCT QUALITY

TABLE 55 MARKET FOR FOOD AND BEVERAGES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 56 MARKET FOR FOOD AND BEVERAGES, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 57 MARKET FOR FOOD AND BEVERAGES, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 58 MARKET FOR FOOD AND BEVERAGES, BY REGION, 2017–2025 (USD MILLION)

9.9 SEMICONDUCTORS AND ELECTRONICS

9.9.1 SURGED USE OF VIBRATION SENSORS IN SEMICONDUCTORS AND ELECTRONICS INDUSTRY TO MINIMIZE DOWNTIME, MAXIMIZE PROCESS YIELD, AND OPTIMIZE MACHINE MAINTENANCE

TABLE 59 MARKET FOR SEMICONDUCTORS AND ELECTRONICS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 60 MARKET FOR SEMICONDUCTORS AND ELECTRONICS, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 61 MARKET FOR SEMICONDUCTORS AND ELECTRONICS, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 62 MARKET FOR SEMICONDUCTORS AND ELECTRONICS, BY REGION, 2017–2025 (USD MILLION)

9.1 PHARMACEUTICALS

9.10.1 INCREASED DEMAND FOR VIBRATION SENSORS FROM PHARMACEUTICALS INDUSTRY TO ENSURE SAFETY AND MAINTENANCE OF AIR HANDLING UNITS

TABLE 63 MARKET FOR PHARMACEUTICALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 64 MARKET FOR PHARMACEUTICALS, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 65 MARKET FOR PHARMACEUTICALS, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 66 MARKET FOR PHARMACEUTICALS, BY REGION, 2017–2025 (USD MILLION)

9.11 HEALTHCARE

9.11.1 RELIANCE OF HEALTHCARE EQUIPMENT ON SENSOR SIGNALS FOR CONTROL ACTIVITIES, ACCURATE DIAGNOSIS, AND TREATMENT

TABLE 67 MARKET FOR HEALTHCARE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 68 MARKET FOR HEALTHCARE, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 69 MARKET FOR HEALTHCARE, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 70 VIBRATION SENSORS MARKET FOR HEALTHCARE, BY REGION, 2017–2025 (USD MILLION)

9.12 OTHERS

TABLE 71 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 72 MARKET FOR OTHER INDUSTRIES, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 73 MARKET FOR OTHER INDUSTRIES, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

TABLE 74 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2025 (USD MILLION)

9.13 IMPACT OF COVID-19

10 GEOGRAPHIC ANALYSIS (Page No. - 106)

10.1 INTRODUCTION

FIGURE 28 MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 75 MARKET, BY REGION, 2017–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

TABLE 76 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 77 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 78 MARKET IN NORTH AMERICA, BY EQUIPMENT, 2017–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Market in US for automotive and aerospace and defense industries to be impacted by COVID-19

10.2.1.2 Impact of COVID-19

TABLE 79 MARKET IN US, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 80 MARKET IN US, BY TYPE, 2017–2025 (USD MILLION)

TABLE 81 MARKET IN US, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Impact of COVID-19 on oil and gas industry of Canada to affect the growth of vibration sensors market in-country in 2020

10.2.2.2 Impact of COVID-19

TABLE 82 MARKET IN CANADA, BY EQUIPMENT,2017–2025 (USD MILLION)

TABLE 83 MARKET IN CANADA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 84 MARKET IN CANADA, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Adoption of industrial automation to contribute to the growth of the market in Mexico

10.2.3.2 Impact of COVID-19

10.3 EUROPE

FIGURE 30 EUROPE: VIBRATION SENSORS MARKET SNAPSHOT

TABLE 85 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY EQUIPMENT, 2017–2025 (USD MILLION))

10.3.1 GERMANY

10.3.1.1 Industry 4.0 to drive the growth of market in Germany

10.3.1.2 Impact of COVID-19

TABLE 88 VIBRATION SENSOR MARKET IN GERMANY, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 89 MARKET IN GERMANY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 90 MARKET IN GERMANY, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.3.2 UK

10.3.2.1 Impact of COVID-19 on manufacturing activities in UK to affect the growth of market in-country

10.3.2.2 Impact of COVID-19

TABLE 91 MARKET IN UK, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 92 MARKET IN UK, BY TYPE, 2017–2025 (USD MILLION)

TABLE 93 MARKET IN UK, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Aerospace and defense industry to drive the growth of market in France

10.3.3.2 Impact of COVID-19

TABLE 94 VIBRATION SENSORS MARKET IN FRANCE, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 95 MARKET IN FRANCE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 96 MARKET IN FRANCE, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 31 APAC: MARKET SNAPSHOT

TABLE 97 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 98 MARKET IN APAC, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 99 MARKET IN APAC, BY EQUIPMENT, 2017–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increased adoption of industrial automation in China to fuel the growth of market in-country

10.4.1.2 Impact of COVID-19

TABLE 100 VIBRATION SENSOR MARKET IN CHINA, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 101 MARKET IN CHINA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 102 MARKET IN CHINA, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Automotive industry to act as a key contributor to the growth of the market in Japan from 2020 to 2025

10.4.2.2 Impact of COVID-19

TABLE 103 MARKET IN JAPAN, BY EQUIPMENT 2017–2025 (USD MILLION)

TABLE 104 MARKET IN JAPAN, BY TYPE, 2017–2025 (USD MILLION)

TABLE 105 MARKET IN JAPAN, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Make in India initiative to fuel growth prospects for market in India

10.4.3.2 Impact of COVID-19

TABLE 106 VIBRATION SENSORS MARKET IN INDIA, BY EQUIPMENT, 2017–2025 (USD MILLION)

TABLE 107 MARKET IN INDIA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 108 MARKET INDIA, BY MONITORING PROCESS, 2017–2025 (USD MILLION)

10.4.4 REST OF APAC

10.4.4.1 Impact of COVID-19

10.5 ROW

10.5.1 IMPACT OF COVID-19

TABLE 109 VIBRATION SENSORS MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 110 MARKET IN ROW, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 111 MARKET IN ROW, BY EQUIPMENT, 2017–2025 (USD MILLION)

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 Oil and gas industry to drive growth of market in Middle East

10.5.3 SOUTH AMERICA

10.5.3.1 Establishment of manufacturing units to fuel growth of market in South America

11 COMPETITIVE LANDSCAPE (Page No. - 130)

11.1 OVERVIEW

FIGURE 32 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGIES FROM JANUARY 2018 TO JUNE 2020

11.2 VIBRATION SENSORS MARKET SHARE ANALYSIS

11.3 MARKET PLAYER RANKING ANALYSIS

FIGURE 33 TOP 5 PLAYERS IN MARKET, 2019

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 34 MARKET COMPANY EVALUATION QUADRANT, 2019

11.4.5 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS

FIGURE 35 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN MARKET

12 COMPANY PROFILES (Page No. - 135)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 KEY PLAYERS

12.1.1 BAKER HUGHES COMPANY

FIGURE 36 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

12.1.2 SKF

FIGURE 37 SKF: COMPANY SNAPSHOT

12.1.3 TE CONNECTIVITY

FIGURE 38 TE CONNECTIVITY: COMPANY SNAPSHOT

12.1.4 HONEYWELL INTERNATIONAL INC.

FIGURE 39 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

12.1.5 EMERSON ELECTRIC CO.

FIGURE 40 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

12.1.6 ROBERT BOSCH

FIGURE 41 ROBERT BOSCH: COMPANY SNAPSHOT

12.1.7 NXP SEMICONDUCTORS

FIGURE 42 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

12.1.8 ROCKWELL AUTOMATION, INC.

FIGURE 43 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

12.1.9 OMRON CORPORATION

FIGURE 44 OMRON CORPORATION: COMPANY SNAPSHOT

12.1.10 DYTRAN INSTRUMENTS, INC.

12.1.11 NATIONAL INSTRUMENTS

FIGURE 45 NATIONAL INSTRUMENTS: COMPANY SNAPSHOT

12.2 OTHER KEY PLAYERS

12.2.1 KEYENCE CORPORATION

12.2.2 FLUKE CORPORATION

12.2.3 WILCOXON SENSING TECHNOLOGIES

12.2.4 PCB PIEZOTRONICS

12.2.5 MURATA MANUFACTURING CO., LTD.

12.2.6 STMICROELECTRONICS

12.2.7 ABB

12.2.8 MONTRONIX

12.2.9 ANALOG DEVICES, INC.

12.2.10 ALTHEN SENSORS & CONTROLS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12.3 RIGHT TO WIN

13 APPENDIX (Page No. - 161)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

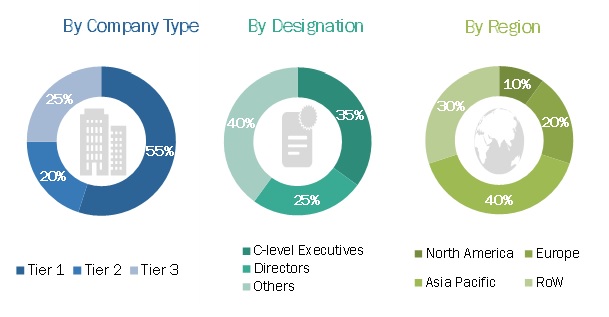

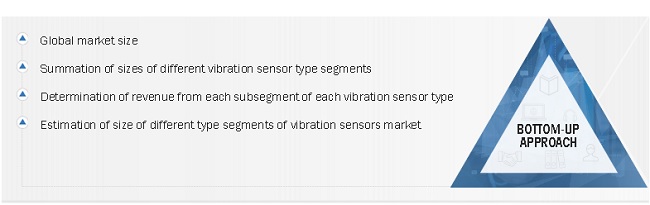

The study involved 4 major activities to estimate the size of the vibration sensors market. Exhaustive secondary research has been conducted to collect information on the vibration sensors market. Validation of these findings, assumptions, and sizing with industry experts across value chain through primary research has been the next step. Both, top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, machine condition monitoring related journals, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases. A few examples of secondary sources are Manufacturing Enterprise Systems Association (MESA), Institute of Electrical and Electronics Engineers (IEEE) Sensors Council, Sensors and IoT Industry Association, and Measurement, Control, and Automation Association (MCAA).

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed with to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the vibration sensors market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the overall vibration sensors market and the market based on subsegments. The research methodology used to estimate the market size has been given below:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both demand and supply sides of the vibration sensors market.

Report Objectives

- To describe and forecast the vibration sensors market, in terms of value, based on type, equipment, monitoring process, and industry

- To describe and forecast the vibration sensors market, in terms of volume, based on type

- To describe and forecast the market, in terms of value, for 4 key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends and their contributions to the total market

- To profile the key players and comprehensively analyze their market position in terms of their market ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze the competitive growth strategies—collaborations, partnerships, acquisitions, product launches and developments, research and development (R&D) activities—adopted by the key players operating in the vibration sensors market

- To analyze the impact of the COVID-19 on the growth of vibration sensors market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Vibration Sensors Market