Version Control Systems Market by Type (Centralized Version Control Systems & Distributed Version Control Systems), Deployment Type (Cloud & On-Premises), Organization Size, Vertical (IT & Telecom, BFSI), and Region - Global Forecast to 2023

[131 Pages Report] The overall version control systems market expected to grow $438.8 million in 2018 to $716.1 million by 2023, at a CAGR of 10.3% from 2018 to 2023. Version control systems allow the entire development team to work collaboratively by providing the log of every change in the software; thereby reducing the complexity of software development process. This is acting as the major driver for the growth of the market. In addition, factors such as the increasing demand for automation and digitalization in the software development process as well as the continuously growing adoption of smartphones and tablets are spurring the adoption of version control systems. The base year considered for the study is 2017, and the forecast has been provided for the period between 2018 and 2023.

Version Control Systems Market: Market Dynamics

Drivers

- Increasing need to reduce complexities in software development

- Increasing demand for automation and digitalization tools

- Continuously growing adoption of smartphones and tablets

Restraints

- Highly competitive market with the presence of IT giants and open-source version control systems providers

- Use of diverse applications in IT organizations

Opportunities

- Growing need for large-scale version control systems

- Availability of cost-effective version control systems for SMEs

Challenges

- Growing amount of data generated by organizations

Increasing need to reduce complexities in software development drives the global version control systems market

Major IT players are investing heavily in the software market to harness the growth potential offered by it. Versioning has become critical to business success because it is an essential component of software change & configuration management process. Developing software without a version control system results in not having the backup of any changes made to the source code, which is risky. Version control systems allow the developers to keep track of all changes in software in a central database, reuse the existing code in a new version, and return to a previous version if necessary. In the software change & configuration management process, version control systems such as Git effectively simplify the complex changes. Version control systems allow the entire development team to work collaboratively by providing the log of every change in the software; thereby reducing the complexity of software development process.

The following are the major objectives of the study.

- To define, describe, and forecast the version control systems market on the basis of type, deployment type, organization size, vertical, and region

- To forecast the market size of segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze micro-markets with respect to individual growth trends and their contribution towards the overall market

- To analyze the degree of competition in the market by identifying various parameters of key market players

- To profile key players and comprehensively analyze their core competencies,

- To provide a detailed competitive landscape of the market, in addition to an analysis of business and corporate strategies to track and analyze competitive developments, such as agreements, collaborations & partnerships, acquisitions, expansions, and new product launches & product enhancements

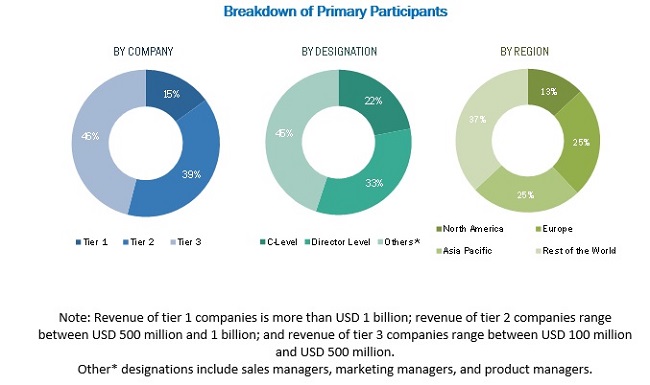

During this research study, major players operating in the version control systems market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The version control systems market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the market are Atlassian (Australia), AWS (US), CA Technologies (US), Canonical (UK), Codice Software (Spain), CollabNet (US), GitHub (US), IBM (US), IC Manage (US), LogicalDOC (US), Luit Infotech (India), Micro Focus (UK), Microsoft (US), Perforce Software (US), SourceGear (US), Apache Software Foundation (US), BitMover Inc. (US), Dynamsoft Corporation (Canada), Eclipse Foundation (Canada), Free Software Foundation (US), March Hare Pty Ltd (Australia), RhodeCode, Inc. (US), Darcs, Mercurial, and Wildbit LLC (US).

Please visit 360Quadrants to see the vendor listing of Best Version Control Systems Quadrant

Major Market Developments

- In February 2018, Atlassian launched Bitbucket Server v5.8, with additional features such as global commit hash search and support for IPv6.

- In May 2018, CA Technologies introduced CA Harvest SCM – version 13.0 (13.0.3)

- In December 2017, IBM released the latest version of Rational Team Concert. This v6.0.5 version comes with revised Quick planner interface and storage facility of large files in an external store.

Target Audience for Version Control Systems Market

- Version Control System Providers

- Managed Service Providers

- System Integrators

- IT Infrastructure Managers

- Third-Party Service Providers

- Technology Providers

- Cloud Service Providers

Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type, Deployment Type, Organization Size, Vertical and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA) and Latin America |

|

Companies covered |

Atlassian (Australia), AWS (US), CA Technologies (US), Canonical (UK), Codice Software (Spain), CollabNet (US), GitHub (US), IBM (US), IC Manage (US), LogicalDOC (US), Luit Infotech (India), Micro Focus (UK), Microsoft (US), Perforce Software (US), SourceGear (US), Apache Software Foundation (US), BitMover Inc. (US), Dynamsoft Corporation (Canada), Eclipse Foundation (Canada), Free Software Foundation (US), March Hare Pty Ltd (Australia), RhodeCode, Inc. (US), Darcs, Mercurial, and Wildbit LLC (US). |

The research report categorizes the Version Control Systems Market to forecast the revenues and analyze trends in each of the following subsegments:

Market By Type

- Centralized Version Control Systems (CVCS)

- Distributed Version Control Systems (DVCS)

Version Control Systems Market By Deployment Type

- On-Premises

- Cloud

Market By Organization Size:

- Large Enterprises

- Small & Medium Enterprises

Version Control Systems Market By Vertical:

- IT & Telecom

- BFSI

- Healthcare & Life Sciences

- Retail & CPG

- Education

- Others

Market By Geography

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Rest of Europe

-

Asia Pacific

- Australia & New Zealand (ANZ)

- China

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia (KSA)

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

Critical questions which the report answers

- What are new application areas which the version control system vendors are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Detailed breakdown of the US market

- Detailed breakdown of the UK market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall version control systems market is expected to grow from USD 438.8 million in 2018 to USD 716.1 million by 2023, at a CAGR of 10.3% from 2018 to 2023. Increasing need to reduce complexities in software development; increasing demand for automation and digitalization tools; and continuously growing adoption of smartphones and tablets are the key factors driving the growth of this market.

Version control systems allow software professionals to keep track of the changes to the website content, documents, software, and mobile applications. Version control systems are also known as source control systems or revision control systems. These systems keep a log of changes in the source code which helps software team to return to the previous version of the software if needed. Version control systems play a crucial role in the application lifecycle management, software development management, and change management process. Based on the location of the repository/server, version control systems are of two types, namely, Centralized Version Control Systems (CVCS) and Distributed Version Control Systems (DVCS). In CVCS, all the changes are saved in a single central repository. Whereas, in DVCS, local repositories are provided to the users/developers, along with access to the centralized repository. Thus, each user is allowed to clone the centralized repository and store the entire history of the changes in its local repository.

The distributed version control systems market is expected to grow at the highest CAGR between 2018 and 2023. DVCS offer various advantages over CVCS, so the customers are gradually shifting from CVCS to DVCS. DVCS such as Git are considerably faster and easier to work with when it comes to creating and merging branches and tags. They also allow for flexible workflows, tailored to user’s project and the developer team needs.

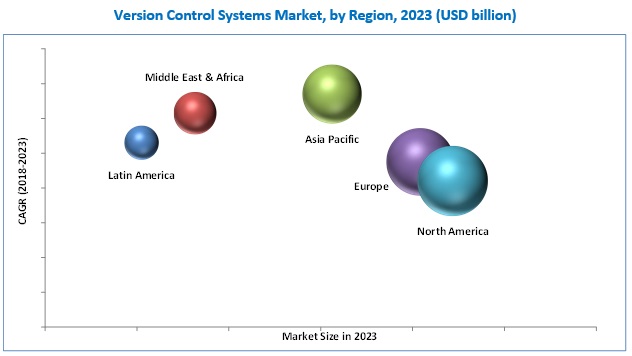

The version control systems market in APAC is expected to grow at the highest CAGR during the forecast period. This growth will likely be driven by factors such as increased spending on improving infrastructures, the emergence of advanced & secured cloud-based solutions, tax reformation policies, smart city initiatives, and digitalization in the region. The small & medium enterprises (SMEs) across various Asia Pacific countries, such as Australia, Malaysia, Japan, and Singapore, are investing in Information Technology (IT) to compete, secure, and capture digital opportunities in the Asia Pacific market. The investment in IT by these countries will contribute significantly to the growth of the Asia Pacific market

Increasing need to reduce complexities during software development drive the growth of version control systems market

IT & Telecom

Majority of the IT & telecom organizations are widely adopting version control systems. With an increase in downloads of different types of mobile applications such as games, news, sports, and entertainment, the need to manage versions of these applications is increasing. The growth in the development of mobile applications, recurring release of updated versions of software, and the need to identify and resolve software bugs have led to an increased demand for version control systems in IT & telecom organizations. Version control systems help the IT & telecom organizations to secure the source code of the current version and work on the latest release.

BFSI

There is a rapid adoption of version control systems in the banking, financial services & insurance (BFSI) vertical. BFSI organizations rely on software and mobile applications to execute customer queries and other financial activities. The high dependency on software will require the banks to upgrade various software and applications so that the most recent transactions and data reflect at numerous branches simultaneously. BFSI organizations need version control systems to track the old versions of software and provide upgraded versions of the same. Version control systems providers offer software development services in conjunction with the operational requirements of BFSI organizations. They work on the current version of the software while updating the same to ensure availability and access to data and transaction status to employees/customers. With the evolution of customer requirements and increasing number of mobile applications users, there is a sudden growth of cyber-attacks at user mobile application side.

Retail & CPG

Many retail and consumer packaged goods companies have a decentralized business model with multiple facility locations and distribution centers, enabling them to put their products closer to their customers. Multiple locations, however, means that the compliance team is not involved in the facility management and the day-to-day operations. As a result, they face unique challenges as they seek to establish and enforce policies, procedures, contracts, and employee training under the given operating conditions while meeting regulatory guidelines. According to the changing consumer needs, these companies continuously update their website content and mobile applications. Version control systems track these updates and changes. For better change management, enterprises in the retail & CPG industry vertical are adopting version control systems.

Healthcare & Life Sciences

The rise in demand for artificial intelligence and machine learning technology will gradually increase the deployment of various software and applications in the healthcare & life sciences vertical. Use of solutions such as mHealth, smartphone applications, and wearable technology products are leading to a rise in the demand for latest versions of different software. The healthcare & life sciences vertical software store crucial patient and drug information. These software need to be secured from cyberattacks. Healthcare organizations use software such as disease identification, personalized treatment, drug discovery, radiotherapy, medical devices, electronic health records (EHRs), mobile devices, and health information technology (HIT) systems. These software require consistent patches and regular updates. Software updates and management of the latest versions of software is accomplished through version control systems. The other benefits of these solutions include simplified work processes, real-time software upgrades, interoperability between software, and value-based delivery model.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for version control systems?

Use of diverse applications in IT organizations is one of the major factors restraining the growth of the market. The structure of IT organizations is transforming with the shift from traditional business processes to several automated applications to increase efficiency. This leads to increased complexities in managing the versions of various software used in an organization. With such a diverse IT infrastructure, it would also become more challenging to identify the authenticity of users accessing different applications from several vendors while performing change management.

Key players in the version control systems market include Atlassian (Australia), AWS (US), CA Technologies (US), Canonical (UK), Codice Software (Spain), CollabNet (US), GitHub (US), IBM (US), IC Manage (US), LogicalDOC (US), Luit Infotech (India), Micro Focus (UK), Microsoft (US), Perforce Software (US), SourceGear (US), Apache Software Foundation (US), BitMover Inc. (US), Dynamsoft Corporation (Canada), Eclipse Foundation (Canada), Free Software Foundation (US), March Hare Pty Ltd (Australia), RhodeCode, Inc. (US), Darcs, Mercurial, and Wildbit LLC (US). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

Frequently Asked Questions (FAQ):

How big is the Version Control Systems Market?

What is growth rate of the Version Control Systems Market?

What are the top trends in Version Control Systems Market?

Who are the key players in Version Control Systems Market?

Who will be the leading hub for Version Control Systems Market?

What are the top opportunities in Version Control Systems Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Market

4.2 North America: Market By Type

4.3 Europe: Market By Deployment Type

4.4 Middle East & Africa: Market By Organization Size

4.5 Asia Pacific: Market By Vertical

4.6 Version Control Systems Market, By Vertical & Region

5 Market Overview (Page No. - 33)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing Need to Reduce Complexities in Software Development

5.1.1.2 Increasing Demand for Automation and Digitalization Tools

5.1.1.3 Continuously Growing Adoption of Smartphones and Tablets

5.1.2 Restraints

5.1.2.1 Highly Competitive Market With the Presence of IT Giants and Open-Source Version Control Systems Providers

5.1.2.2 Use of Diverse Applications in IT Organizations

5.1.3 Opportunities

5.1.3.1 Growing Need for Large-Scale Version Control Systems

5.1.3.2 Availability of Cost-Effective Version Control Systems for SMEs

5.1.4 Challenges

5.1.4.1 Growing Amount of Data Generated By Organizations

5.2 Industry Trends

5.2.1 Evolution

5.2.2 Architecture

5.2.3 Case Studies

5.2.4 Market: Case Studies

5.2.4.1 Case Study 1: British Airways Deploys Micro Focus Software to Manage Software Development

5.2.4.2 Case Study 2: eBay Using Micro Focus Software for Continuous Process Improvement

6 Version Control Systems Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Centralized Version Control Systems (CVCS)

6.3 Distributed Version Control Systems (DVCS)

7 Market By Deployment Type (Page No. - 46)

7.1 Introduction

7.2 Cloud

7.3 On-Premises

8 Version Control Systems Market By Organization Size (Page No. - 50)

8.1 Introduction

8.2 Small & Medium Enterprises

8.3 Large Enterprises

9 Version Control Systems Market, By Vertical (Page No. - 54)

9.1 Introduction

9.2 IT & Telecom

9.3 BFSI

9.4 Healthcare & Life Sciences

9.5 Education

9.6 Retail & CPG

9.7 Others

10 Geographic Analysis (Page No. - 60)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 Australia & New Zealand (ANZ)

10.4.2 China

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Middle East & Africa (MEA)

10.5.1 Kingdom of Saudi Arabia (KSA)

10.5.2 South Africa

10.5.3 Rest of Middle East & Africa

10.6 Latin America

10.6.1 Mexico

10.6.2 Brazil

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 79)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches & Product Enhancements

11.2.2 Agreements, Collaborations, & Partnerships

11.2.3 Acquisitions

11.2.4 Expansions

11.3 Market Ranking of Key Players

12 Company Profiles (Page No. - 85)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Atlassian

12.2 AWS

12.3 CA Technologies

12.4 Canonical

12.5 Codice Software

12.6 Collabnet

12.7 Github

12.8 IBM

12.9 IC Manage

12.10 Logicaldoc

12.11 Luit Infotech

12.12 Micro Focus

12.13 Microsoft

12.14 Perforce Software

12.15 Sourcegear

13 Key Innovators (Page No. - 119)

13.1 APAChe Software Foundation

13.2 Bitmover Inc.

13.3 Darcs

13.4 Dynamsoft

13.5 Eclipse Foundation

13.6 Free Software Foundation

13.7 March Hare Pty Ltd

13.8 Mercurial

13.9 Rhodecode

13.10 Wildbit LLC

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 123)

14.1 Industry Excerpts

14.2 Discussion Guide

14.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (48 Tables)

Table 1 Version Control Systems Market Size, By Type, 2016–2023 (USD Million)

Table 2 CVCS: Market Size By Region, 2016–2023 (USD Million)

Table 3 DVCS: Market Size By Region, 2016–2023 (USD Million)

Table 4 Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 5 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 6 On-Premises: Market Size By Region, 2016–2023 (USD Million)

Table 7 Market Size, By Organization Size, 2016–2023 (USD Million)

Table 8 Small & Medium Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 9 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 10 Version Control Systems Market Size, By Vertical, 2016–2023 (USD Million)

Table 11 IT & Telecom Segment: Market Size By Region, 2016–2023 (USD Million)

Table 12 BFSI Segment: Market Size By Region, 2016–2023 (USD Million)

Table 13 Healthcare & Life Sciences Segment: Market Size By Region, 2016–2023 (USD Million)

Table 14 Education Segment: Market Size By Region, 2016–2023 (USD Million)

Table 15 Retail & CPG Segment: Market Size By Region, 2016–2023 (USD Million)

Table 16 Others Segment: Market Size By Region, 2016–2023 (USD Million)

Table 17 Version Control Systems Market, By Region, 2016–2023 (USD Million)

Table 18 North America Market By Type, 2016–2023 (USD Million)

Table 19 North America Market By Organization Size, 2016–2023 (USD Million)

Table 20 North America Market By Deployment Type, 2016–2023 (USD Million)

Table 21 North America Market By Vertical, 2016–2023 (USD Million)

Table 22 North America Market By Country, 2016–2023 (USD Million)

Table 23 Europe Version Control Systems Market, By Type, 2016–2023 (USD Million)

Table 24 Europe Market By Organization Size, 2016–2023 (USD Million)

Table 25 Europe Market By Deployment Type, 2016–2023 (USD Million)

Table 26 Europe Market By Vertical, 2016–2023 (USD Million)

Table 27 Europe Market By Country, 2016–2023 (USD Million)

Table 28 Asia Pacific Market By Type, 2016–2023 (USD Million)

Table 29 Asia Pacific Market By Organization Size, 2016–2023 (USD Million)

Table 30 Asia Pacific Market By Deployment Type, 2016–2023 (USD Million)

Table 31 Asia Pacific Market By Vertical, 2016–2023 (USD Million)

Table 32 Asia Pacific Market By Country, 2016–2023 (USD Million)

Table 33 Middle East & Africa Market By Type, 2016–2023 (USD Million)

Table 34 Middle East & Africa Market By Organization Size, 2016–2023 (USD Million)

Table 35 Middle East & Africa Market By Deployment Type, 2016–2023 (USD Million)

Table 36 Middle East & Africa Market By Vertical, 2016–2023 (USD Million)

Table 37 Middle East & Africa Market By Country, 2016–2023 (USD Million)

Table 38 Latin America Version Control Systems Market, By Type, 2016–2023 (USD Million)

Table 39 Latin America Market By Organization Size, 2016–2023 (USD Million)

Table 40 Latin America Market By Deployment Type, 2016–2023 (USD Million)

Table 41 Latin America Market By Vertical, 2016–2023 (USD Million)

Table 42 Latin America Market By Country, 2016–2023 (USD Million)

Table 43 Market Evaluation Framework

Table 44 New Product Launches & Product Enhancements, February 2018-May 2018

Table 45 Agreements, Collaborations, & Partnerships, February 2016-April 2018

Table 46 Acquisitions, May 2016-May 2018

Table 47 Expansions, January 2016-April 2018

Table 48 Market Ranking of Key Players in 2017

List of Figures (36 Figures)

Figure 1 Version Control Systems Market: Research Design

Figure 2 Data Triangulation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions

Figure 6 Version Control Systems Market, By Type, 2018 & 2023 (USD Million)

Figure 7 Market By Deployment Type, 2018 & 2023 (USD Million)

Figure 8 Market By Organization Size, 2018 & 2023 (USD Million)

Figure 9 Market By Vertical (2018)

Figure 10 Market By Region, 2018 & 2023 (USD Million)

Figure 11 Asia Pacific Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 Increasing Need to Reduce Complexities During Software Development is Driving the Version Control Systems Market

Figure 13 DVCS Segment Projected to Grow at A Higher CAGR During Forecast Period

Figure 14 Cloud Segment Expected to Grow at A Higher CAGR During Forecast Period

Figure 15 Small & Medium Enterprises Segment Expected to Grow at A Higher CAGR During Forecast Period

Figure 16 IT & Telecom Segment Projected to Grow at the Highest CAGR During Forecast Period

Figure 17 North America and IT & Telecom Vertical Estimated to Lead Market in 2018

Figure 18 Market Drivers, Restraints, Opportunities, and Challenges

Figure 19 Evolution of the Version Control Systems Market

Figure 20 Centralized Version Control System Architecture

Figure 21 Distributed Version Control System Architecture

Figure 22 DVCS Segment is Estimated to Lead the Market in 2018

Figure 23 On-Premises Segment Estimated to Lead Market in 2018

Figure 24 Large Enterprises Segment Estimated to Lead Market in 2018

Figure 25 Market, By Vertical, 2018-2023 (USD Million)

Figure 26 North America Estimated to Be Largest Market for Version Control Systems in 2018

Figure 27 Version Control Systems Market in Asia Pacific to Grow at Highest CAGR During Forecast Period

Figure 28 North America Market Snapshot

Figure 29 Asia Pacific Market Snapshot

Figure 30 Companies Adopted New Product Launches & Product Enhancements as the Key Growth Strategy Between January 2016 and May 2018

Figure 31 Atlassian: Company Snapshot

Figure 32 AWS: Company Snapshot

Figure 33 CA Technologies: Company Snapshot

Figure 34 IBM: Company Snapshot

Figure 35 Micro Focus: Company Snapshot

Figure 36 Microsoft: Company Snapshot

Growth opportunities and latent adjacency in Version Control Systems Market