Vehicle Surveillance Market by in-Vehicle Surveillance (Product - PAS, ACC, HUD LDW, BSD, GPS & Vehicle Type), by Under-Vehicle Surveillance System (Type - Fixed, Portable) and Out Vehicle Surveillance (Hardware & Software) - Global Forecast to 2022

The vehicle surveillance market is expected to grow from USD 49.93 Billion in 2015 to USD 103.21 Billion by 2022, at a CAGR of 11.1% between 2016 and 2022.The report aims to estimate the market size and future growth potential of the vehicle surveillance market across different segments such as products, vehicle types, and geography. The base year considered for the study is 2015 and the market size forecast is given for the period between 2016 and 2022. The growth of the vehicle surveillance market would be primarily driven by factors such as regulations in different countries mandating in-vehicle surveillance products, benefits offered by in-vehicle surveillance systems, increasing sales of premium cars, and the increase in traffic fatalities which demands better traffic control solutions.

According to the MarketsandMarkets forecast, the vehicle surveillance market is expected to grow from USD 49.93 Billion in 2015 to USD 103.21 Billion by 2022, at a CAGR of 11.1% between 2016 and 2022. The growth of the vehicle surveillance market is primarily driven by factors such as regulations in different countries for mandate of in-vehicle surveillance products, wide range of advantages of in-vehicle surveillance systems, and increasing sales of premium cars.

The report covers the vehicle surveillance market on the basis of in-vehicle surveillance by product, vehicle type, and region; under-vehicle surveillance market by type; and out-vehicle surveillance market by type. The market is further segmented on the basis of regions into North America, Europe, APAC, and RoW. The fixed type of vehicle surveillance systems dominated the under-vehicle surveillance market and is expected to be the same till 2022.

Technologies such as autonomous cruise control system (ACCS), lane departure warning system (LDWS), blind spot detection system (BSDS), parking assist system (PAS), and others have enabled the advancement of the automobile industry and promoted the growth of the passenger cars segment worldwide. The U.S. as well as several countries of EU have introduced regulations which mandate certain driver assistance system types in passenger cars as well as in commercial vehicles, which drive the in-vehicle surveillance market.

The parking assist system and navigation systems are expected to dominate the in-vehicle surveillance market between 2016 and 2022. The growth of the in-vehicle surveillance market would be primarily driven by factors such as regulations in different countries for mandate of in-vehicle surveillance products, wide range of advantages of in-vehicle surveillance systems, increasing sales of premium cars, and increase in traffic fatalities which demand traffic control solutions, fuelling the growth of the out-vehicle surveillance market. The penetration of in-vehicle surveillance market in developing countries provides opportunities for the growth of this market. VSaaS is gaining traction in videos surveillance, which provides enormous opportunities for the growth of the out-vehicle surveillance market

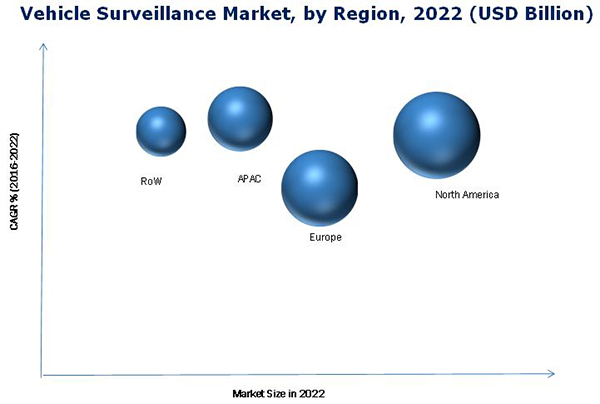

North America is expected to hold the largest share of the market and dominate the vehicle surveillance market between 2016 and 2022. The increase in the demand for premium cars with advanced safety features, increase in population, and improved standard of living would give momentum to the Asia-Pacific in-vehicle surveillance market.

However, the complexity and high cost of in-vehicle surveillance systems restricts the growth of this market. The major vendors in the vehicle surveillance market include Robert Bosch GmbH (Germany), Delphi Automotive PLC (U.K.), DENSO Corporation (Japan), Continental AG (Germany), Magna International Inc. (Canada), Autoliv Inc. (Sweden), Valeo SA (France), Honeywell Security Group (U.S.), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Bosch Security Systems (U.S.), Zhejiang Dahua Technology Co., Ltd. (China), FLIR Systems Inc. (U.S.),, COMM-PORT technologies (U.S.), Law Enforcement Associates (U.S.), and SecuScan (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Vehicle Surveillance Market to Grow at A Significant Rate During the Forecast Period (2016–2022)

4.2 In-Vehicle Surveillance Market, By Product

4.3 Snapshot of the In-Vehicle Surveillance Market for Passenger Cars, By Region and Product

4.4 In-Vehicle Surveillance Market: Regional Snapshot (2015)

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 In-Vehicle Surveillance Market, By Product

5.2.2 In-Vehicle Surveillance Market, By Type of Vehicle

5.2.3 Under-Vehicle Surveillance Market

5.2.4 Out-Vehicle Surveillance Market, By Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Favorable Government Regulations in Several Countries

5.3.1.2 Wide Range of Benefits of In-Vehicle Surveillance Systems

5.3.1.3 Increasing Demand for Premium Cars Equipped With Vehicle Surveillance Systems

5.3.1.4 Demand for Out-Vehicle Surveillance to Prevent Traffic Fatalities

5.3.2 Restraints

5.3.2.1 Complexity and High Cost of the Systems

5.3.3 Opportunities

5.3.3.1 Penetration of Vehicle Surveillance Market in Developing Countries

5.3.3.2 Advanced Vsaas Solutions Offer Great Scope for Out-Vehicle Surveillance

5.3.4 Challenge

5.3.4.1 Need for Further Advancements in Autonomous Car Technology

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis: Vehicle Surveillance Market

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of Substitutes

6.3.4 Threat of New Entrants

6.3.5 Competitive Rivalry

7 In-Vehicle Surveillance Market, By Product (Page No. - 55)

7.1 Introduction

7.2 Blind Spot Detection Systems

7.3 Autonomous Cruise Control Systems

7.4 Parking Assistance System

7.5 Lane Departure Warning System

7.6 Heads-Up Display

7.7 GPS

8 In-Vehicle Surveillance Market, By Vehicle Type (Page No. - 69)

8.1 Introduction

8.2 Passenger Cars

8.3 Commercial Vehicles

9 Under-Vehicle Surveillance System Market (Page No. - 79)

9.1 Introduction

9.2 Under-Vehicle Surveillance Systems

9.3 Types of Under-Vehicle Surveillance Systems

9.3.1 Fixed UVSS Or Static UVSS

9.3.2 Portable UVSS Or Mobile UVSS

9.4 Applications of Under Vehicle Surveillance System

9.4.1 Military, Defense Facilities, and Borders:

9.4.2 Government Buildings, Palaces, Presidential Complexes:

9.4.3 Entrances of Energy Plants(Nuclear Power Plants, Natural Gas Facilities, Oil Refineries, and Water Reservoirs):

9.4.4 Commercial (Office Complexes, Central Banks, International Banks, Chemical Companies, and Insurance Companies):

9.4.5 Prison Facilities:

9.4.6 Parking Garages:

9.4.7 Stadiums and Other Public Venues:

9.4.8 Others (Hotels, Casinos, Resorts):

10 Out-Vehicle Surveillance Market, By Type (Page No. - 85)

10.1 Introduction

10.2 Hardware

10.2.1 Cameras

10.2.2 Monitors

10.2.3 Storage Systems

10.2.4 Other ACCessories

10.3 Software

10.4 Services

11 Vehicle Surveillance Market, By Geography (Page No. - 93)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Rest of Europe (RoE)

11.4 Asia-Pacific (APAC)

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Rest of APAC (RoAPAC)

11.5 Rest of the World (RoW)

11.5.1 Russia

11.5.2 Brazil

11.5.3 Others

12 Competitive Landscape (Page No. - 136)

12.1 Market Player Ranking Analysis of the In-Vehicle Surveillance Market

12.2 New Product Launches

12.3 Expansions

12.4 Agreements/Joint Ventures/Partnerships

12.5 Mergers & Acquisitions

13 Company Profiles (Page No. - 141)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 Robert Bosch GmbH

13.3 Delphi Automotive PLC

13.4 Denso Corporation

13.5 Continental AG

13.6 Magna International Inc

13.7 Autoliv Inc.

13.8 Valeo

13.9 Honeywell Security Group

13.10 Hangzhou Hikvision Digital Technology Company Limited

13.11 Bosch Security System Incorporation

13.12 Zhejiang Dahua Technology Company Limited

13.13 Flir Systems Incorporation

13.14 Comm-Port Technologies

13.15 Law Enforcement Associates

13.16 Secuscan

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 176)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

List of Tables (85 Tables)

Table 1 Currency Table

Table 2 In-Vehicle Surveillance Market, By Product

Table 3 In-Vehicle Surveillance Market, By Type of Vehicle

Table 4 Under-Vehicle Surveillance Market

Table 5 Out-Vehicle Surveillance Market, By Type

Table 6 In-Vehicle Surveillance Market Size, By Product, 2013–2022 (USD Billion)

Table 7 In-Vehicle Surveillance Market for BSD Systems in Passenger Cars, By Region, 2013–2022 (USD Million)

Table 8 In-Vehicle Surveillance Market for BSD Systems in Commercial Vehicles, By Region, 2013–2022 (USD Million)

Table 9 In-Vehicle Surveillance Market for ACC Systems in Passenger Cars, By Region, 2013–2022 (USD Million)

Table 10 In-Vehicle Surveillance Market for ACC Systems in Commercial Vehicles, By Region, 2013–2022 (USD Million)

Table 11 In-Vehicle Surveillance Market for PAS Systems in Passenger Cars, By Region, 2013–2022 (USD Million)

Table 12 In-Vehicle Surveillance Market for PAS Systems in Commercial Vehicles, By Region, 2013–2022 (USD Million)

Table 13 In-Vehicle Surveillance Market for LDW Systems in Passenger Cars, 2013–2022 (USD Million)

Table 14 In-Vehicle Surveillance Market for LDW Systems in Commercial Vehicles, By Region, 2013–2022 (USD Million)

Table 15 In-Vehicle Surveillance Market for HUD Devices in Passenger Cars, By Region, 2013–2022 (USD Million)

Table 16 In-Vehicle Surveillance Market for HUD Devices in Commercial Vehicles, By Region, 2013–2022 (USD Million)

Table 17 In-Vehicle Surveillance Market for GPS in Passenger Cars, By Region, 2013–2022 (USD Million)

Table 18 In-Vehicle Surveillance Market for GPS in Commercial Vehicles, By Region, 2013–2022 (USD Million)

Table 19 In-Vehicle Surveillance Market, By Vehicle Type, 2013–2022 (USD Billion)

Table 20 In-Vehicle Surveillance Market for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 21 In-Vehicle Surveillance Market in North America for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 22 In-Vehicle Surveillance Market in Europe for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 23 In-Vehicle Surveillance Market in APAC for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 24 In-Vehicle Surveillance Market in RoW for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 25 In-Vehicle Surveillance Market in North America for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 26 In-Vehicle Surveillance Market in Europe for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 27 In-Vehicle Surveillance Market in APAC for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 28 In-Vehicle Surveillance Market in RoW for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 29 Under-Vehicle Surveillance Market, By Region, 2014–2022 (USD Million)

Table 30 Under-Vehicle Surveillance Market, By Type, 2013–2022 (USD Million)

Table 31 Out-Vehicle Surveillance Market, By Type, 2013–2022 (USD Million)

Table 32 Out-Vehicle Surveillance Market, By Region, 2013–2022 (USD Million)

Table 33 Out-Vehicle Surveillance Market, By Hardware, 2014–2022 (USD Million)

Table 34 Out-Vehicle Surveillance Market for Hardware, By Region, 2014–2022 (USD Million)

Table 35 Out-Vehicle Surveillance Market for Software, By Region, 2014–2022 (USD Million)

Table 36 Out-Vehicle Surveillance Market for Services, By Region, 2014–2022 (USD Million)

Table 37 In-Vehicle Surveillance Market in North America , By Product Type, 2013–2022 (USD Million)

Table 38 In-Vehicle Surveillance Market in North America, By Product Type, 2013–2022 (Million Units)

Table 39 In-Vehicle Surveillance Market in North America, By Country, 2013–2022 (USD Million)

Table 40 Out-Vehicle Surveillance Market in North America, By Type, 2013–2022 (USD Billion)

Table 41 In-Vehicle Surveillance Market in U.S. for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 42 In-Vehicle Surveillance Market in U.S. for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 43 In-Vehicle Surveillance Market in Canada for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 44 In-Vehicle Surveillance Market in Canada for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 45 In-Vehicle Surveillance Market in Mexico for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 46 In-Vehicle Surveillance Market in Mexico for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 47 In-Vehicle Surveillance Market in Europe, By Product Type, 2013–2022 (USD Million)

Table 48 In-Vehicle Surveillance Market in Europe, By Product Type, 2013–2022 (Million Units)

Table 49 In-Vehicle Surveillance Market in Europe, By Country, 2013–2022 (USD Million)

Table 50 In-Vehicle Surveillance Market in Germany for Passenger Cars, By Product, 2013–2022 (USD Million)

Table 51 In-Vehicle Surveillance Market in Germany for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 52 In-Vehicle Surveillance Market in U.K. for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 53 In-Vehicle Surveillance Market in U.K. for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 54 In-Vehicle Surveillance Market in France for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 55 In-Vehicle Surveillance Market in France for Commercial Vehicles, By Product, 2013–2022 (USD Million)

Table 56 In-Vehicle Surveillance Market in RoE for Passenger Cars, By Product, 2013–2022 (USD Million)

Table 57 In-Vehicle Surveillance Market in RoW for Commercial Vehicles, By Product, 2013–2022 (USD Million)

Table 58 Out Vehicle Surveillance Market in Europe, By Type, 2013–2022 (USD Billion)

Table 59 In-Vehicle Surveillance Market in APAC, By Product, 2013–2022 (USD Million)

Table 60 In-Vehicle Surveillance Market in APAC, By Product, 2013–2022 (Million Units)

Table 61 In-Vehicle Surveillance Market Size in APAC, By Country, 2013–2022 (USD Million)

Table 62 Out-Vehicle Surveillance Market in APAC, By Type, 2013–2022 (USD Million)

Table 63 In-Vehicle Surveillance Market in China for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 64 In-Vehicle Surveillance Market in China for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 65 In-Vehicle Surveillance Market in Japan for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 66 In-Vehicle Surveillance Market in Japan for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 67 In-Vehicle Surveillance Market in India for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 68 In-Vehicle Surveillance Market Size in India for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 69 In-Vehicle Surveillance Market in RoAPAC for Passenger Cars, Product Type, 2013–2022 (USD Million)

Table 70 In-Vehicle Surveillance Market in RoAPAC for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 71 In-Vehicle Surveillance Market in RoW, By Product Type, 2013–2022 (USD Million)

Table 72 In-Vehicle Surveillance Market Size in RoW, By Product Type, 2013–2022 (Million Units)

Table 73 In-Vehicle Surveillance Market in RoW, By Country, 2013–2022 (USD Million)

Table 74 Out-Vehicle Surveillance Market in RoW, By Type, 2013–2022 (USD Million)

Table 75 In-Vehicle Surveillance Market in Russia for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 76 In-Vehicle Surveillance Market in Russia for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 77 In-Vehicle Surveillance Market Size in Brazil for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 78 In-Vehicle Surveillance Market Size in Brazil for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 79 In-Vehicle Surveillance Market Size in Other Regions in RoW for Passenger Cars, By Product Type, 2013–2022 (USD Million)

Table 80 In-Vehicle Surveillance Market Size in Other Regions in RoW for Commercial Vehicles, By Product Type, 2013–2022 (USD Million)

Table 81 Key Player Rank for In-Vehicle Surveillance Market (2015)

Table 82 New Product Launches, 2010–2015

Table 83 Expansions, 2010–2015

Table 84 Agreements/Joint Ventures/Partnerships, 2010–2015

Table 85 Mergers & Acquisitions, 2010–2015

List of Figures (87 Figures)

Figure 1 Vehicle Surveillance Market

Figure 2 In-Vehicle Surveillance Market

Figure 3 Under-Vehicle Surveillance Market

Figure 4 Out-Vehicle Surveillance Market, By Type

Figure 5 Global Vehicle Surveillance Market: Research Design

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 In-Vehicle Surveillance Market for Passenger Car, By Product: Snapshot (2015 vs 2022)

Figure 10 In-Vehicle Surveillance Market, By Product (2015–2022)

Figure 11 In-Vehicle Surveillance Market, By Region, 2015

Figure 12 Out-Vehicle Surveillance Market, By Region

Figure 13 Lucrative Growth Opportunities for the Vehicle Surveillance Market Between 2016 and 2022

Figure 14 Parking Assist System Market to Play A Major Role in the In-Vehicle Surveillance Market (2016–2022)

Figure 15 Europe Held the Major Share of the In-Vehicle Surveillance Market in 2015

Figure 16 The U.S. Held the Largest Share of the In-Vehicle Surveillance Market

Figure 17 Favourable Regulations in Different Countries Drive the In-Vehicle Surveillance Market

Figure 18 Value Chain Analysis (2015) of Vehicle Surveillance Market: Major Value Added By Component Manufacturers and Product Manufacturers

Figure 19 Porter’s Five Forces Analysis: Vehicle Surveillance Market (2015)

Figure 20 Porter’s Five Forces Analysis: the Vehicle Surveillance Market

Figure 21 Bargaining Power of Suppliers for the Vehicle Surveillance Market

Figure 22 Bargaining Power of Buyers for the Vehicle Surveillance Market

Figure 23 Threat of Substitutes for the Vehicle Surveillance Market

Figure 24 Threat of New Entrants for the Vehicle Surveillance Market

Figure 25 Competitive Rivalry for the Vehicle Surveillance Market

Figure 26 Parking Assistance Systems Would Hold the Largest Market Size During the Forecast Period

Figure 27 Europe Expected to Be the Leading Region for Blind Spot Detection Systems Market for Passenger Cars in 2016

Figure 28 North American Market for Autonomous Cruise Control Systems in Passenger Cars Expected to Grow at the Highest Rate During the Forecast Period

Figure 29 North America Plays A Major Role in In-Vehicle Surveillance Market for Autonomous Cruise Control Systems in Commercial Vehicles

Figure 30 Europe Expected to Lead the Market for Parking Assistance Systems in Passenger Cars During the Forecast Period

Figure 31 North America Expected to Hold the Largest Share of the Market for Parking Assistance Systems in Commercial Vehicles in 2016

Figure 32 North America Expected to Hold the Largest Share of the In-Vehicle Surveillance Market for Lane Departure Warning Systems, 2016-2022

Figure 33 North American Market Expected to Grow at the High CAGR for Heads-Up Display Devices in Passenger Cars During the Forecast Period

Figure 34 Europe Expected to Hold the Largest Market Size for GPS in Passenger Cars During the Forecast Period

Figure 35 North America Expected to Dominate the Market for GPS in Commercial Vehicles During the Forecast Period

Figure 36 Passenger Cars Expected to Dominate the In-Vehicle Surveillance Market During the Forecast Period

Figure 37 Parking Assist Systems and LDWS Expected to Dominate the North American In-Vehicle Surveillance Market for Passenger Cars By 2022

Figure 38 Parking Assist Systems Expected to Dominate the In-Vehicle Surveillance Market for Passenger Cars in North America During the Forecast Period

Figure 39 Parking Assist Systems Expect to Dominate the North American In-Vehicle Surveillance Market for Commercial Vehicles

Figure 40 Parking Assistance System Expected to Dominate the European In-Vehicle Surveillance Market for Commercial Vehicles During the Forecast Period

Figure 41 Working of an UVSS System

Figure 42 Under-Vehicle Surveillance Market in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 43 Hardware Expected to Hold the Largest Market Size for Out-Vehicle Surveillance Products By 2022

Figure 44 Out-Vehicle Surveillance Market for Cameras Expected to Grow at the Highest Rate During the Forecast Period

Figure 45 Out-Vehicle Surveillance Market for Hardware in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 46 North America Expected to Hold A Major Share of the Out-Vehicle Surveillance Market for Services in 2016

Figure 47 Geographic Snapshot for the In-Vehicle Surveillance Market: (2016–2022 )

Figure 48 North America: In-Vehicle Surveillance Market Snapshot (2015–2022)

Figure 49 Pas and LDWS Would Hold the Largest Share of the In-Vehicle Surveillance Market By 2022

Figure 50 U.S. Expected to Dominated the North American In-Vehicle Surveillance Market During the Forecast Period

Figure 51 The U.S. In-Vehicle Surveillance Market for HUD Devices in Passenger Cars Expected to Grow at the Highest Rate During the Forecast Period

Figure 52 LDWS and PAS Expected to Dominate the In-Vehicle Surveillance Market for Commercial Vehicles By 2022

Figure 53 In-Vehicle Surveillance Market in Canada for HUD Devices in Passenger Cars Expected to Grow at the Highest Rate During the Forecast Period

Figure 54 Europe: In-Vehicle Surveillance Market Snapshot (2015–2022 )

Figure 55 PAS Expected to Dominate the European In-Vehicle Surveillance Market By 2022

Figure 56 Germany Expected to Be the Leading Region of the European In-Vehicle Surveillance Market in 2016

Figure 57 ACC Systems Expected to Dominate the In-Vehicle Surveillance Market, By 2022

Figure 58 ACC Expected to Be the Fastest-Growing Segment of the In-Vehicle Surveillance Market in U.K. for Passenger Cars During the Forecast Period

Figure 59 PAS Expected to Dominate the French In-Vehicle Surveillance Market for Passenger Cars By 2022

Figure 60 LDW Systems Expected to Dominate the In-Vehicle Surveillance Market in APAC By 2022

Figure 61 China Expected to Dominated the in In-Vehicle Surveillance Market, By 2022

Figure 62 Hardware Expected to Dominate the Out-Vehicle Surveillance Market During the Forecast Period

Figure 63 GPS Expected to Dominate the In-Vehicle Surveillance Market for Passenger Cars During 2016–2022

Figure 64 GPS Systems Expected to Dominate the In-Vehicle Surveillance Market in China By 2022

Figure 65 GPS Systems Expected to Dominate the In-Vehicle Surveillance Market in Japan By 2022

Figure 66 GPS Segment Expected to Lead the Indian In-Vehicle Surveillance Market for Passenger Cars During Forecast Period

Figure 67 GPS Systems Expected to Dominate the In-Vehicle Surveillance Market in RoW By 2022

Figure 68 Brazilian In-Vehicle Surveillance Market Expected to Grow at the Highest Rate During the Forecast Period

Figure 69 GPS Expected to Dominate the In-Vehicle Surveillance Market for Passenger Cars in Russia During the Forecast Period

Figure 70 GPS Expected to Dominate the Brazilian In-Vehicle Surveillance Market for Passenger Cars During the Forecast Period

Figure 71 New Product Development Was the Key Growth Strategy Over the Last Four Years (2011–2015)

Figure 72 Battle for Market Share: New Product Launches & Expansions Were Key Strategies

Figure 73 Geographic Revenue Mix of the Top Market Players in Vehicle Surveillance Market

Figure 74 Robert Bosch GmbH: Company Snapshot

Figure 75 Robert Bosch GmbH: SWOT Analysis

Figure 76 Delphi Automotive PLC : Company Snapshot

Figure 77 Delphi Automotive PLC: SWOT Analysis

Figure 78 Denso Corporation: Company Snapshot

Figure 79 Denso Corporation: SWOT Analysis

Figure 80 Continental AG: Company Snapshot

Figure 81 SWOT Analysis: Continental AG

Figure 82 Magna International Inc: Company Snapshot

Figure 83 Autoliv Inc. : Company Snapshot

Figure 84 Valeo : Company Snapshot

Figure 85 Flir Systems Incorporation: Company Snapshot

Figure 86 Marketsandmarkets Knowledge Store Snapshot

Figure 87 Marketsandmarkets Knowledge Store: Semiconductor & Electronics Industry Snapshot

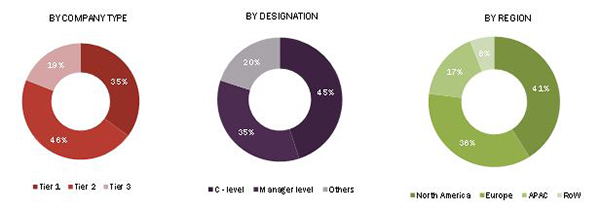

The research methodology used to estimate and forecast the vehicle surveillance market begins with capturing data on the sales of vehicles and the penetration of products in vehicles per country through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global vehicle surveillance market. After arriving at the overall market size, the total market was split into several segments and subsegments which are then verified through primary research by conducting extensive interviews with CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The vehicle surveillance market ecosystem includes component manufacturers and software providers, product manufacturers, system integrators, and distributors. The major stakeholders in the industry include vehicle surveillance product manufacturers such as Robert Bosch GmbH (Germany), Delphi Automotive PLC (U.K.), DENSO Corporation (Japan), Continental AG (Germany), Honeywell Security Group (U.S.), Hangzhou Hikvision Digital Technology Co. Ltd. (China), COMM-PORT Technologies (U.S.), Law Enforcement Associates (U.S.), and SecuScan (Germany).

Key Target audience

- End users of vehicle surveillance

- Vehicle surveillance hardware and component providers

- Software providers

- System integrators

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to video surveillances government bodies such as regulating authorities and policy makers

- Venture capitalists, private equity firms, and startup companies

Scope of the Report

The research report segments the vehicle surveillance market into the following submarkets:

In-vehicle surveillance market, by product:

- Blind Spot Detection System (BSDS)

- Autonomous Cruise Control System (ACCS)

- Parking Assist System (PAS)

- Lane Departure Warning System (LDW)

- Heads-Up Display Device (HUDD)

- Global Positioning System (GPS)

In-Vehicle Surveillance Market, by Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

Under-Vehicle Surveillance Market, by Type (UVSS):

- Fixed/Static Under-Vehicle Surveillance System

- Portable/Mobile Under-Vehicle Surveillance System

Out-Vehicle Surveillance Market, by Type:

-

Hardware

- Camera

- Monitor

- Storage

- Other Accessories

- Software

- Services

By Geography:

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- U.K.

- France

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Rest of APAC

-

RoW

- Russia

- Brazil

- Others

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Vehicle Surveillance Market

I would like to understand whether this is relevant and can provide my questions. I'm working with a company that provides smart inspection systems to the automotive security market and I'm trying to get to an addressable market for them.

Basis for assumptions made in report. We believe, we are a leader in the under vehicle inspection business for the last 4 years by volume and advanced technology and we were never contacted for the report. Other UVIS companies referred to are either very small volume < 30 systems per year or out of business.

Looking for market research only for Under vehicle scanner system. What is the market potential, scope etc.? Please provide me sample report for the same.