Vegetable Oils in Beauty and Personal Care Market by Application (Color Cosmetics, Skin Care, Hair Care), Nature (Conventional, Organic), Type (Coconut, Sweet Almond, Jojoba, Argan, Apricot, Pomegranate, Avocado) and Region - Global Forecast to 2027

Vegetable Oils in Beauty and Personal Care Market Size

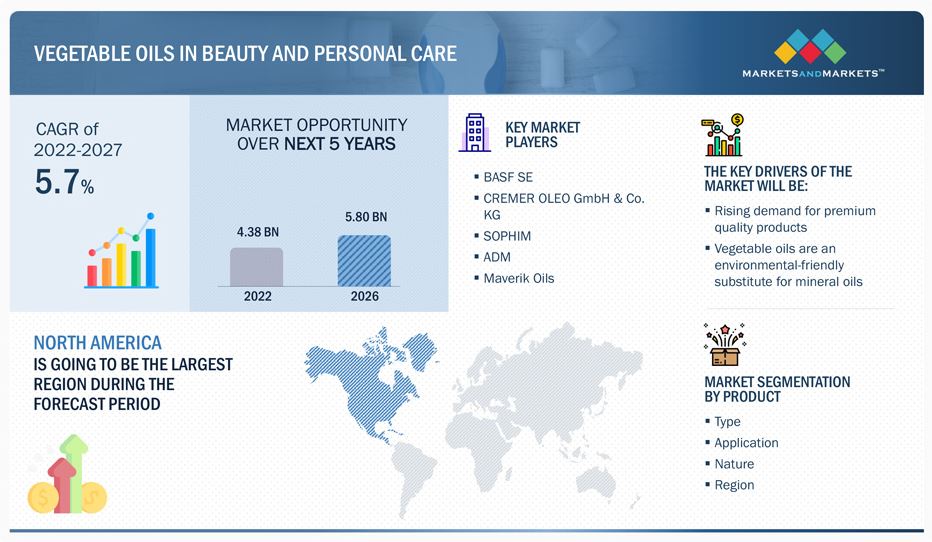

The global vegetable oils in beauty and personal care market was valued at USD 4.4 billion by 2022 and is projected to reach USD 5.8 billion by 2027, at a CAGR of 5.7% during the forecast period in terms of value.

Vegetable Oils in Beauty and Personal Care Market Share & Insight

Vegetable oils from terrestrial plants consist mainly of triglycerides (95-98%) and mono & diglycerides (1%) with micronutrients, particularly molecules like tocopherols and/or polyphenols. According to SOPHIM, “vegetable oils are natural ingredients mainly composed of triglycerides. Vegetable oils include saturated or unsaturated fatty acids (omega 3, 6, 9) and unsaponifiable matter in small quantities but have highly desirable biological properties for cosmetic use.

Consumer demand for healthy, natural ingredients is in tandem with the rising demand for health-consciousness among consumers and the sustainability quotient. Clean label is the new norm among consumers today. The willingness to pay more for recognizable ingredients is strongest in the US, highlighting the importance of clean and clear labeling in the American market. In this report, the vegetable oils in beauty and personal care market have been studied based on type, application, nature, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Rising demand for premium quality products

Recently, there has been an increase in premium cosmetic consumers, specifically in the North American and European regions. This can be attributed to the rising awareness of various skin and hair health benefits associated with natural ingredients-based cosmetic products. As a result, consumers are conscious and always seek transparency on the premium cosmetic products they use daily. Consumers do not prefer synthetic mineral oil-based skin and personal care products, due to which cosmetic manufacturers are now strategizing on using natural ingredients. Nuts and vegetable-based oils fall under natural ingredients that cosmetic product manufacturers, specifically from the premium segment, seek the most. Such specialty natural ingredients enable key functionalities such as moisturization and skin healing properties. Hence, the consumers' concern over the transparency of cosmetic products eventually triggers a rising demand for vegetable oils.

Major premium cosmetic brands are launching premium skincare products based on vegetable oils. Renee Cosmetics (India) expanded its portfolio in January 2021 by launching premium face oils in the skincare segment. The company has released a pre-makeup glass-glow oil and a post-makeup texture-fix oil. Natural oils such as rosehip, cucumber, and sweet orange peel are included in the newly released face oils to help combat signs of aging and stress.

Restraints: Rising vegetable oil prices to affect final product pricing

According to the UN Food and Agriculture Organization, vegetable oil prices increased by 4.2% in January 2022, reaching an all-time high. These oils are used in various products, including cooking oils, food, cosmetics, and biofuels. When commodity prices rise, household goods, menu items, and business supplies follow the course. The price increase is primarily the result of global weather events that have depleted supplies of two key oil commodities: soybeans and palm oil. The cosmetics industry has also been affected by sunflower oil prices increasing; the oil is largely used in cosmetic formulations. In May 2022, the Jakarta government imposed a ban on the export of palm oil for cooking oil and crude and refined palm oils used in consumer products such as cosmetics. The restrictions imposed by Indonesia have raised the prices of palm oil and alternative vegetable oils, which are already in short supply due to droughts in Argentina & Brazil and the Russia-Ukraine war.

Opportunities: Vegetable oils are an environmental-friendly substitute for mineral oils

Mineral oils and waxes are primarily saturated hydrocarbon mixtures with straight chain, branched, ring structures and carbon chain lengths greater than C14. These have been used in skin and lip care cosmetic products for decades due to their excellent skin tolerance, high protecting and cleansing performance, and wide range of viscosity options.

In recent years, consumers have been protesting using mineral oil in cosmetic products. The main arguments against mineral oil in cosmetics are that it harms the environment and may contain contaminants. Mineral oil is derived from a finite resource. As a result, protesters argue that it is not sustainable and cannot be used in cosmetic products since it harms the environment. Similarly, protesters claim that mineral oil is contaminated and even carcinogenic.

In April 2021, Bio-Oil, the South African company that created the popular Bio-Oil Skincare Oil, introduced Bio-Oil Skincare Oil (Natural). The popular body and face oil has been reformulated to moisturize skin while reducing the appearance of scars and stretch marks. The company has removed known allergens such as benzyl salicylate and hydroxycitronellal, as well as mineral oils and synthetic ingredients, from the original formula's base and increased the concentration of plant-derived oils, specifically soybean and sunflower seed, in its place. The company also added safflower seed oil to the new, natural Bio-Oil base, which can improve the appearance of non-keloid scars by 14 percent in just eight weeks. Other vegetable oils, such as Jojoba oil, which hydrates without clogging pores because its structure is like the skin's natural oil, are also included on the Bio-Oil (Natural) ingredient list. The oil also contains antioxidant-rich pomegranate and anti-inflammatory chia seed oils. Such alternatives are expected to provide significant growth opportunities for the market in the coming years.

Challenges: Issues related to oxidization

Skincare and makeup cosmetic formulations are typically complex mixtures, with each component influencing efficacy. Vegetable oils are mostly found in liquids, powders, and solid forms of makeup, such as emulsions, lotions, serums, lipsticks, eyeshadows, and mascaras. Vegetable oils are used in cosmetics due to their beneficial properties. However, they are also sensitive to oxygen and can cause off-flavors. The structure of the fatty acids in oils is critical for the shelf life of creams and lotions. Oils are made up of saturated fatty acids with no double bonds, monounsaturated fatty acids with one double bond, or polyunsaturated fatty acids with multiple double bonds.

Polyunsaturated fatty acids are abundant in many vegetable oils, but the main challenge of polyunsaturated fatty acid-rich vegetable oils is that they are oxidatively unstable, which reduces shelf life. When combined with oxygen, fat oxidation of vegetable oils occurs, forming volatile oxidation products. Polyunsaturated fatty acids speed up fat oxidation and increase the number of primary oxidation products formed. These volatile oxidation products cause the rancid aroma of oxidized oil. Oxidation can affect the quality of cosmetic products and cause unwanted aromas and odors.

Most triglyceride components are prone to oxidation and hydrolysis, causing quality changes in color, texture, and odor. According to a recent Vantage Group study, adding jojoba oil to traditional, less stable natural oils can significantly increase the blend's overall Oxidative Stability Index. This means formulators can easily incorporate and protect more sensitive natural oils in their formulations by using jojoba oil. While traditional oils such as avocado and sunflower oil contain triglycerides, jojoba oil is made of straight, unsaturated esters, putting it in the wax category. The chemical structure of jojoba oil is highly stable, demonstrating that it is not only good for the skin but is also a key ally in developing stable and active formulations.

High Emollience and Moisturizing Properties of Shea Oil to Drive Market

Shea oil is a solid fatty oil derived from the shea (Karite) tree's nuts. Shea oil has recently become a popular ingredient in cosmetics and personal care products due to its emollience and moisturizing properties. Like most other vegetable oils and fats, shea oil is a triglyceride. Shea oil contains very high levels of non-glyceride components, with as much as 7% to 10% unsaponifiable matter, including triterpene alcohols esterified to cinnamic acid, acetic acid, and long-chain fatty acids. Shea oil is also rich in vitamins A and E, making it an excellent moisturizer for skin and hair. L’OCCITANE (Manosque, France) offers a range of products based on shea oil, such as Shea Butter Shower Oil, Shea Fabulous Oil, and Shea Face Comforting Oil.

Rising Demand for Vegetable Oil-Based Skincare Products to Drive the Market

Vegetable oils in skin care products are beneficial for repairing damaged and dry skin. Vegetable oils naturally contain qualities known to nourish and protect the skin over beauty and personal care products with chemicals. Vegetable oils contain fatty acids, vitamins, nutrients, minerals, and antioxidant properties to improve skin complexion, repair damage, regenerate, tone, and protect the skin, hydrate, moisturize, and delay signs of aging. Oils obtained from avocados, coconuts, sunflowers, and argan kernels possess nourishing qualities that soothe and soften skin tissues. Biotique (India) offers Almond Oil Deep Cleanse Purifying Cleansing Oil which contains almond, sesame, neem, and staff tree oils.

The North American Vegetable Oils in Beauty and Personal Care Market is Primarily Driven by Growth in the US and Canadian Markets

The market in North America is highly diversified, and manufacturers largely focus on developing vegetable oils to cater to the demand of end users. The native Americans of northern Mexico and the southwestern US have regarded jojoba oil for years due to its valuable qualities. It is used for multiple, varied cosmetic & medicinal purposes such as hair dressings, body oils, and skin salves. The market in North America is mainly dominated by a few companies, such as Cargill, Incorporated (US) and ADM (US). However, local players such as Maverik Oils (US) and ConnOils LLC (US) also provide a wide range of vegetable oils for beauty and personal care.

The US market accounted for the largest share of North America in 2021. The market for vegetable oils such as coconut, olive, soybean, jojoba, shea, and avocado is witnessing high growth due to growing applications in various end-use industries such as hair & makeup and cosmetics. Kiehl's, a US-based company (acquired by L'Oréal in 2020), provides skincare, body care, and hair care solutions. It uses a variety of oils in its products, including the popular jojoba oil, coconut oil shampoo, and argan oil body lotion, among others.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market include BASF SE (Germany), CREMER OLEO GmbH & Co. KG (Germany), SOPHIM (France), ADM (US), Maverik Oils (US), Australian Botanical Products (Australia), Zapach International (India), Ernesto Ventós S.A. (Spain), Louis Dreyfus Company (Netherlands), Cargill, Incorporated (US), Vantage Specialty Chemicals (US), OLVEA (France), All Organic Treasures GmbH (Germany), Gustav Heess GmbH (Germany), PRODIGIA (Morocco), Jayant Agro-Organics Limited (India), Sigma Oil Seeds B.V. (Netherlands), and ConnOils LLC (US).

Please visit 360Quadrants to see the vendor listing of Top 20 Personal Care Ingredients Companies, Worldwide 2023

Target Audience:

- Supply-side: Vegetable oil producers, suppliers, distributors, importers, and exporters

- Demand-side: Skin care product manufacturers, cosmetic manufacturers, hair care product manufacturers, personal care product manufacturers

- Regulatory bodies: Government agencies and Non-Governmental Organizations (NGOs)

- Commercial R&D institutions and financial institutions

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- Indian Vegetable Oil Producers’ Association (IVPA)

- American Fats and Oils Association (AFOA)

- European Federation of Essential Oils (EFEO)

- FEDIOL

- Australian Oilseeds Federation Inc. (AOF)

- The Brazilian Association of Vegetable Oil Industries (ABIOVE)

- The American Seed Trade Association (ASTA)

- Canola Council of Canada

- Organic Seed Growers & Trade Association (OSGATA)

- United Coconut Associations of the Philippines, Inc. (UCAP)

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 4.4 billion |

|

Revenue forecast in 2027 |

USD 5.8 billion |

|

Growth Rate |

CAGR of 5.7% from 2022 to 2027 |

|

Base year for estimation |

2021 |

|

Historical data |

2022-2027 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD), Volume (KT) |

|

Segments covered |

Type, Application, Nature, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, and RoW |

|

Dominant Geography |

North America |

|

Key companies profiled |

|

This research report categorizes the vegetable oils in beauty and personal care market, based on product type, application, source, method of extraction and region.

By Type

- Orange

- Sweet Almond Oil

- Coconut Oil

- Sesame Oil

- Avocado Oil

- Argan Oil

- Macadamia Oil

- Castor Oil

- Shea Oil

- Apricot Oil

- Pomegranate Oil

- Evening Primrose Oil

- Borage Oil

- Baobab Oil

- Jojoba Oil

- Other Types

Other types include rosehip, mango, plum, sunflower, olive, soybean, canola, hemp, palm, and calendula.

By Application

- Color Cosmetics

- Skin Care

- Hair Care

- Other Applications

Other applications include baby care products, oral care, and perfumes.

By Nature

- Conventional

- Organic

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

The rest of the world includes South America, the Middle East, and Africa.

Recent Developments

- In February 2022, OLVEA launched a new grapeseed oil, upcycled from winemaking products, and leveraged it for its multiple functions and cosmetic benefits.

- In May 2022, IXOM acquired Australian Botanical Products. This acquisition will strengthen and grow IXOM's specialized product portfolio and add local fragrance manufacturing capabilities.

- In April 2022, Jojoba Desert (A.C.S) LTD using concentrated phytoene and jojoba oil launched Jojoba Desert's JD Phyto-Or 1% promotes healthy hair and natural active skin repair. Adding JD Jojoba Oil facilitates full phytoene solubility and booster for moisture and sensory properties. This product launch has broadened the company's skincare and haircare ingredients using jojoba oil.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the vegetable oils in beauty and personal care market?

The market is expected to grow in Asia Pacific and is expected to dominate during the forecast period. The international cosmetics market, previously dominated by major Western countries, is now witnessing developing markets in the Asia Pacific region. This can be attributed to the growing popularity of Korean beauty and Japanese beauty products in South Korean and Japanese markets.

What is the current size of the global vegetable oils in beauty and personal care market?

The global vegetable oils in beauty and personal care market is projected to reach USD 5.8 billion by 2027 from USD 4.4 billion by 2022, at a CAGR of 5.7% during the forecast period in terms of value.

Which are the key players in the market, and how intense is the competition?

The key players in this market include BASF SE (Germany), CREMER OLEO GmbH & Co. KG (Germany), SOPHIM (France), ADM (US), Maverik Oils (US), Australian Botanical Products (Australia), Zapach International (India), Ernesto Ventós S.A. (Spain), Louis Dreyfus Company (Netherlands), Cargill, Incorporated (US), Vantage Specialty Chemicals (US), OLVEA (France), All Organic Treasures GmbH (Germany), Gustav Heess GmbH (Germany), PRODIGIA (Morocco), Jayant Agro-Organics Limited (India), Sigma Oil Seeds B.V. (Netherlands), and ConnOils LLC (US). The global vegetable oils in beauty and personal care market witnesses increased scope for growth. The market is seeing an increase in the number of mergers and acquisitions and new product launches. Moreover, the companies involved in the production of vegetables oils are investing a considerable proportion of their revenues in research and development activities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

FIGURE 5 MARKET SIZE ESTIMATION (DEMAND SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 MARKET ASSUMPTIONS

2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 2 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET SHARE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY NATURE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET SHARE AND CAGR, BY REGION (2021)

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET

FIGURE 13 GROWING AWARENESS OF NATURAL INGREDIENTS AND DEVELOPMENT OF SUSTAINABLE COSMETIC PRODUCTS TO DRIVE MARKET

4.2 EUROPE: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY APPLICATION & COUNTRY

FIGURE 14 GERMANY ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY APPLICATION

FIGURE 15 SKIN CARE SEGMENT IS PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY NATURE

FIGURE 16 ORGANIC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY APPLICATION & REGION

FIGURE 17 ASIA PACIFIC REGION TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 18 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INTRODUCTION

5.2.1.1 Production scenario: Increasing production of vegetable oils

FIGURE 19 MAJOR VEGETABLE OIL GLOBAL PRODUCTION, BY OIL TYPE (2019−2021) (MILLION) (METRIC TONS)

FIGURE 20 MAJOR VEGETABLE OIL GLOBAL PRODUCTION (2018−2021) (MILLION) (METRIC TONS)

5.2.2 RISING INCIDENCE OF SKIN AND HAIR DISORDERS

FIGURE 21 ACNE INCIDENCE RATE IN MALES, FEMALES, AND BOTH SEXES COMBINED (2010 VS. 2019)

FIGURE 22 ACNE PREVALENCE RATE IN MALES, FEMALES, AND BOTH SEXES COMBINED (2010 VS. 2019)

5.3 MARKET DYNAMICS

FIGURE 23 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Rising awareness of natural ingredients in personal care products

5.3.1.2 Sustainable development of cosmetic products

5.3.1.3 Rising demand for premium quality products

5.3.2 RESTRAINTS

5.3.2.1 Rising vegetable oil prices to affect final product pricing

FIGURE 24 MONTHLY INTERNATIONAL PRICE INDICES FOR VEGETABLE OIL (2021−2022)

5.3.2.2 Excessive land usage for production of vegetable oils

FIGURE 25 GLOBAL AREA OF LAND REQUIRED TO PRODUCE ONE TON OF VEGETABLE OIL (2019)

5.3.3 OPPORTUNITIES

5.3.3.1 Environmental-friendly substitute for mineral oils

5.3.4 CHALLENGES

5.3.4.1 Issues related to oxidization

5.3.4.2 Mislabeling of skin & hair care products

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 MANUFACTURING

6.2.4 PACKAGING, STORAGE, AND DISTRIBUTION

6.2.5 END USERS

FIGURE 26 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: VALUE CHAIN

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 27 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: SUPPLY CHAIN

6.4 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: MARKET MAP

6.4.1 DEMAND SIDE

6.4.2 SUPPLY SIDE

FIGURE 28 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE: ECOSYSTEM MAP

6.4.3 ECOSYSTEM MAP

TABLE 3 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE: ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 29 REVENUE SHIFT IMPACTING MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 MECHANICAL EXTRACTION

6.6.2 SOLVENT EXTRACTION

6.6.3 GREEN TECHNOLOGIES

6.7 PRICING ANALYSIS

6.7.1 AVERAGE SELLING PRICE, BY KEY PLAYERS

FIGURE 30 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: AVERAGE SELLING PRICES BY KEY PLAYERS

TABLE 4 SELLING PRICE OF KEY PLAYERS FOR SWEET ALMOND OIL (USD/KG)

TABLE 5 SELLING PRICE OF KEY PLAYERS FOR AVOCADO OIL (USD/KG)

TABLE 6 SELLING PRICE OF KEY PLAYERS FOR ARGAN OIL (USD/KG)

FIGURE 31 AVERAGE SELLING PRICE IN KEY REGIONS, BY TYPE, 2018–2021 (USD/KG)

TABLE 7 NORTH AMERICA: AVERAGE SELLING PRICE, BY TYPE, 2018–2021 (USD/KG)

TABLE 8 EUROPE: AVERAGE SELLING PRICE, BY TYPE, 2018–2021 (USD/KG)

TABLE 9 ASIA PACIFIC: AVERAGE SELLING PRICE, BY TYPE, 2018–2021 (USD/KG)

TABLE 10 ROW: AVERAGE SELLING PRICE, BY TYPE, 2018–2021 (USD/KG)

6.8 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: PATENT ANALYSIS

FIGURE 32 NUMBER OF PATENTS GRANTED FOR VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, 2011–2021

FIGURE 33 REGIONAL ANALYSIS OF PATENTS GRANTED FOR VEGETABLE OILS IN BEAUTY AND PERSONAL CARE, 2019−2022

6.8.1 LIST OF MAJOR PATENTS

TABLE 11 PATENTS IN VEGETABLE OILS, 2019–2022

6.9 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: TRADE ANALYSIS

6.9.1 EXPORT SCENARIO: VEGETABLE OILS

FIGURE 34 VEGETABLE OILS EXPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 12 EXPORT DATA OF VEGETABLE OILS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.2 IMPORT SCENARIO: VEGETABLE OILS

FIGURE 35 VEGETABLE OILS IMPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 13 IMPORT DATA OF VEGETABLE OILS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.3 EXPORT SCENARIO: COCONUT OIL

FIGURE 36 COCONUT OIL EXPORT BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 14 EXPORT DATA OF COCONUT OIL FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.4 IMPORT SCENARIO: COCONUT OIL

FIGURE 37 COCONUT OIL IMPORTS BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 15 IMPORT DATA OF COCONUT OIL FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.10 CASE STUDIES: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET

6.10.1 LOUIS DREYFUS COMPANY (LDC): INNOVATION OF SOFTWARE TO IMPROVE EFFICIENCY

6.10.2 SOPHIM: LOCAL SOURCING

6.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 16 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: KEY CONFERENCES AND EVENTS

6.12 TARIFF AND REGULATORY LANDSCAPE

6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.2 REGULATORY FRAMEWORK

6.12.2.1 North America

6.12.2.1.1 US

6.12.2.1.2 Canada

6.12.2.2 Europe

6.12.2.3 Asia Pacific

6.12.2.3.1 India

6.12.2.4 Rest of the World

6.12.2.4.1 Brazil

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 21 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 INTENSITY OF COMPETITIVE RIVALRY

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT OF SUBSTITUTES

6.13.5 THREAT OF NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

6.14.2 BUYING CRITERIA

FIGURE 39 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE (Page No. - 95)

7.1 INTRODUCTION

FIGURE 40 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET (USD MILLION), BY TYPE, 2022 VS. 2027

TABLE 24 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 26 MARKET, BY TYPE, 2018–2021 (KT)

TABLE 27 MARKET, BY TYPE, 2022–2027 (KT)

7.2 SWEET ALMOND OIL

7.2.1 EFFICIENCY AGAINST SKIN DISORDERS TO DRIVE MARKET

TABLE 28 SWEET ALMOND OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 SWEET ALMOND OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 SWEET ALMOND OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 31 SWEET ALMOND OIL: MARKET, BY REGION, 2022–2027 (KT)

7.3 COCONUT OIL

7.3.1 WIDE APPLICATION IN COOKING AND COSMETICS TO DRIVE MARKET

TABLE 32 COCONUT OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 COCONUT OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 COCONUT OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 35 COCONUT OIL: MARKET, BY REGION, 2022–2027 (KT)

7.4 SESAME OIL

7.4.1 PRESENCE OF SKIN CONDITIONING AGENTS TO DRIVE UTILIZATION IN COSMECEUTICAL APPLICATIONS

TABLE 36 SESAME OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 SESAME OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 SESAME OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 39 SESAME OIL: MARKET, BY REGION, 2022–2027 (KT)

7.5 AVOCADO OIL

7.5.1 DEEP SKIN PENETRATION AND HIGH VITAMIN E LEVELS IN AVOCADO OIL TO DRIVE MARKET

TABLE 40 AVOCADO OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 AVOCADO OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 AVOCADO OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 43 AVOCADO OIL: MARKET, BY REGION, 2022–2027 (KT)

7.6 ARGAN OIL

7.6.1 HIGH ANTIOXIDANT CAPACITY TO DRIVE DEMAND IN SKIN & HAIR CARE PRODUCTS

TABLE 44 ARGAN OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 ARGAN OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 ARGAN OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 47 ARGAN OIL: MARKET, BY REGION, 2022–2027 (KT)

7.7 MACADAMIA OIL

7.7.1 NATURAL MOISTURIZING BENEFITS TO DRIVE MARKET

TABLE 48 MACADAMIA OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MACADAMIA OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 MACADAMIA OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 51 MACADAMIA OIL: MARKET, BY REGION, 2022–2027 (KT)

7.8 CASTOR OIL

7.8.1 WIDE APPLICATION IN HAIR, SKIN, AND NAIL PRODUCTS TO DRIVE MARKET

TABLE 52 CASTOR OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 CASTOR OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 CASTOR OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 55 CASTOR OIL: MARKET, BY REGION, 2022–2027 (KT)

7.9 SHEA OIL

7.9.1 HIGH EMOLLIENCE AND MOISTURIZING PROPERTIES TO DRIVE MARKET

TABLE 56 SHEA OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 SHEA OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 SHEA OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 59 SHEA OIL: MARKET, BY REGION, 2022–2027 (KT)

7.10 APRICOT OIL

7.10.1 HIGH ABSORPTION RATE AND RESIDUE-FREE OIL PROPERTIES TO DRIVE MARKET

TABLE 60 APRICOT OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 APRICOT OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 APRICOT OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 63 APRICOT OIL: MARKET, BY REGION, 2022–2027 (KT)

7.11 POMEGRANATE OIL

7.11.1 HIGH SPF VALUE TO DRIVE ADOPTION IN BEAUTY & PERSONAL CARE PRODUCTS

TABLE 64 POMEGRANATE OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 POMEGRANATE OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 POMEGRANATE OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 67 POMEGRANATE OIL: MARKET, BY REGION, 2022–2027 (KT)

7.12 EVENING PRIMROSE OIL

7.12.1 SKIN HORMONE MODULATION CAPABILITY TO DRIVE ADOPTION IN ACNE MANAGEMENT PRODUCTS

TABLE 68 EVENING PRIMROSE OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 EVENING PRIMROSE OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 EVENING PRIMROSE OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 71 EVENING PRIMROSE OIL: MARKET, BY REGION, 2022–2027 (KT)

7.13 BORAGE OIL

7.13.1 ELONGATED SHELF LIFE TO DRIVE MARKET ADOPTION OF BEAUTY PRODUCTS

TABLE 72 BORAGE OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 BORAGE OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 BORAGE OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 75 BORAGE OIL: MARKET, BY REGION, 2022–2027 (KT)

7.14 BAOBAB OIL

7.14.1 SKIN REGENERATION PROPERTIES TO DRIVE MARKET DEMAND

TABLE 76 BAOBAB OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 BAOBAB OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 BAOBAB OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 79 BAOBAB OIL: MARKET, BY REGION, 2022–2027 (KT)

7.15 JOJOBA OIL

7.15.1 HYPOALLERGENIC PROPERTIES TO DRIVE UTILIZATION IN COSMETIC APPLICATIONS

TABLE 80 JOJOBA OIL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 JOJOBA OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 JOJOBA OIL: MARKET, BY REGION, 2018–2021 (KT)

TABLE 83 JOJOBA OIL: MARKET, BY REGION, 2022–2027 (KT)

7.16 OTHER TYPES

TABLE 84 OTHER TYPES: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 OTHER TYPES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 OTHER TYPES: MARKET, BY REGION, 2018–2021 (KT)

TABLE 87 OTHER TYPES: MARKET, BY REGION, 2022–2027 (KT)

8 VEGETABLE OILS IN THE BEAUTY AND PERSONAL CARE MARKET, BY NATURE (Page No. - 130)

8.1 INTRODUCTION

FIGURE 41 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET (USD MILLION), BY NATURE, 2022 VS. 2027

TABLE 88 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY NATURE, 2018–2021 (USD MILLION)

TABLE 89 MARKET, BY NATURE, 2022–2027 (USD MILLION)

8.2 CONVENTIONAL

8.2.1 RAW MATERIAL CULTIVATION RESULTING IN HIGHER YIELD TO DRIVE DEMAND

TABLE 90 CONVENTIONAL: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 CONVENTIONAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 92 CONVENTIONAL: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 CONVENTIONAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3 ORGANIC

8.3.1 RISING TREND OF CONSUMERS CHOOSING ORGANIC PRODUCE TO DRIVE MARKET

TABLE 94 ORGANIC: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 ORGANIC: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 96 ORGANIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 97 ORGANIC: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY APPLICATION (Page No. - 138)

9.1 INTRODUCTION

FIGURE 42 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET (USD MILLION), BY APPLICATION, 2022 VS. 2027

TABLE 98 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 COLOR COSMETICS

9.2.1 VEGETABLE OILS INCORPORATED IN COSMETIC PRODUCTS OWING TO ALL-NATURAL PROPERTIES

TABLE 100 COLOR COSMETICS: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 COLOR COSMETICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 HAIR CARE

9.3.1 VEGETABLE OILS IN HAIR CARE FORMULATIONS HELP TREAT DAMAGED HAIR

TABLE 102 HAIR CARE: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 103 HAIR CARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 SKIN CARE

9.4.1 RISING DEMAND FOR VEGETABLE OIL-BASED SKINCARE PRODUCTS DUE TO MOISTURIZING BENEFITS

TABLE 104 SKIN CARE: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 SKIN CARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 OTHER APPLICATIONS

TABLE 106 OTHER APPLICATIONS: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION (Page No. - 145)

10.1 INTRODUCTION

FIGURE 43 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

FIGURE 44 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 108 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 109 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET SNAPSHOT

TABLE 110 NORTH AMERICA: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (KT)

TABLE 115 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 116 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY NATURE, 2018–2021 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET, BY NATURE, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Adoption of vegetable oils over mineral oils in cosmetic products to drive market

TABLE 120 US: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 121 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising demand for natural beauty & skin care products to drive market

TABLE 122 CANADA: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 123 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Large-scale use of coconut oil in soaps and personal care products to drive market

TABLE 124 MEXICO: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 125 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3 EUROPE

TABLE 126 EUROPE: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 129 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY TYPE, 2018–2021 (KT)

TABLE 131 EUROPE: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 132 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY NATURE, 2018–2021 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY NATURE, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rising growth of cosmetics industry to drive demand for natural ingredients

TABLE 136 GERMANY: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 137 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 UNITED KINGDOM

10.3.2.1 Wide usage of coconut and shea oil in cosmetic products to drive market

TABLE 138 UK: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 139 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.3 ITALY

10.3.3.1 Growing demand for baobab and olive oil in personal care to support market growth

TABLE 140 ITALY: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 141 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Increased usage of vegetable oils like jojoba oil in skincare to drive demand

TABLE 142 FRANCE: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 143 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Growing focus on natural skin care products to drive market

TABLE 144 SPAIN: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 145 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 146 REST OF EUROPE: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 46 SKIN CARE SEGMENT TO DOMINATE ASIA PACIFIC REGION DURING FORECAST PERIOD (USD MILLION)

TABLE 148 ASIA PACIFIC: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (KT)

TABLE 153 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 154 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY NATURE, 2018–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY NATURE, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Expansion of leading natural cosmetic companies in China to drive market

TABLE 158 CHINA: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 159 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Increasing consumer awareness of natural ingredient-based cosmetic products to drive market

TABLE 160 INDIA: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 161 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Rising demand for olive oil and Tsubaki oil to drive market

TABLE 162 JAPAN: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 163 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.4.1 Rising production of macadamia nuts owing to the increasing utilization of macadamia oil to drive market

FIGURE 47 AUSTRALIAN MACADAMIA PRODUCTION (2017-2021) (METRIC TONS)

TABLE 164 AUSTRALIA & NEW ZEALAND: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 165 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 166 REST OF ASIA PACIFIC: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 168 REST OF THE WORLD: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 169 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 170 REST OF THE WORLD: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 171 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 172 REST OF THE WORLD: MARKET, BY TYPE, 2018–2021 (KT)

TABLE 173 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 174 REST OF THE WORLD: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 175 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 176 REST OF THE WORLD: MARKET, BY NATURE, 2018–2021 (USD MILLION)

TABLE 177 REST OF THE WORLD: MARKET, BY NATURE, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Growing consumer demand for chemical-free cosmetics to drive market

TABLE 178 MIDDLE EAST: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 179 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Gradual shift toward natural alternatives over synthetic beauty products to drive market

TABLE 180 SOUTH AMERICA: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 181 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 Availability of argan and jojoba oil to drive demand for cosmetics

TABLE 182 AFRICA: VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 183 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 209)

11.1 OVERVIEW

TABLE 184 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: DEGREE OF COMPETITION (FRAGMENTED)

11.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 48 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD BILLION)

11.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 185 KEY PLAYER STRATEGIES

11.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 49 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.4.5 PRODUCT FOOTPRINT

TABLE 186 COMPANY FOOTPRINT, BY TYPE

TABLE 187 COMPANY FOOTPRINT, BY APPLICATION

TABLE 188 COMPANY FOOTPRINT, BY REGION

TABLE 189 OVERALL COMPANY FOOTPRINT

11.5 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: EVALUATION QUADRANT FOR STARTUPS/SMES

11.5.1 PROGRESSIVE COMPANIES

11.5.2 STARTING BLOCKS

11.5.3 RESPONSIVE COMPANIES

11.5.4 DYNAMIC COMPANIES

FIGURE 50 VEGETABLE OILS IN COSMETICS AND PERSONAL CARE MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

11.5.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 190 VEGETABLE OILS IN COSMETICS AND PERSONAL CARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 191 VEGETABLE OILS IN COSMETICS AND PERSONAL CARE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.6 COMPETITIVE SCENARIO

11.6.1 PRODUCT LAUNCHES

TABLE 192 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: PRODUCT LAUNCHES (2022)

11.6.2 DEALS

TABLE 193 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: DEALS (2020−2021)

11.6.3 OTHERS

TABLE 194 VEGETABLE OILS IN BEAUTY AND PERSONAL CARE MARKET: OTHERS (2021)

12 COMPANY PROFILES (Page No. - 224)

12.1 INTRODUCTION

(Business overview, Products offered, Recent developments & MnM View)*

12.2 KEY PLAYER

12.2.1 ADM

TABLE 195 ADM: BUSINESS OVERVIEW

FIGURE 51 ADM: COMPANY SNAPSHOT

TABLE 196 ADM: PRODUCTS OFFERED

12.2.2 BASF SE

TABLE 197 BASF SE: BUSINESS OVERVIEW

FIGURE 52 BASF SE: COMPANY SNAPSHOT

TABLE 198 BASF SE: PRODUCTS OFFERED

TABLE 199 BASF SE: OTHERS

12.2.3 LOUIS DREYFUS COMPANY

TABLE 200 LOUIS DREYFUS COMPANY: BUSINESS OVERVIEW

FIGURE 53 LOUIS DREYFUS COMPANY: COMPANY SNAPSHOT

TABLE 201 LOUIS DREYFUS COMPANY: PRODUCTS OFFERED

TABLE 202 LOUIS DREYFUS COMPANY: DEALS

12.2.4 CARGILL, INCORPORATED

TABLE 203 CARGILL, INCORPORATED: BUSINESS OVERVIEW

FIGURE 54 CARGILL, INCORPORATED: COMPANY SNAPSHOT

TABLE 204 CARGILL, INCORPORATED: PRODUCTS OFFERED

TABLE 205 CARGILL, INCORPORATED: DEALS

12.2.5 MAVERIK OILS

TABLE 206 MAVERIK OILS: BUSINESS OVERVIEW

TABLE 207 MAVERIK OILS: PRODUCTS OFFERED

12.2.6 ALL ORGANIC TREASURES GMBH

TABLE 208 ALL ORGANIC TREASURES GMBH: BUSINESS OVERVIEW

TABLE 209 ALL ORGANIC TREASURES GMBH: PRODUCTS OFFERED

12.2.7 SOPHIM

TABLE 210 SOPHIM: BUSINESS OVERVIEW

TABLE 211 SOPHIM: PRODUCTS OFFERED

TABLE 212 SOPHIM: PRODUCT LAUNCHES

12.2.8 OLVEA

TABLE 213 OLVEA: BUSINESS OVERVIEW

TABLE 214 OLVEA: PRODUCTS OFFERED

TABLE 215 OLVEA: PRODUCT LAUNCHES

12.2.9 CREMER OLEO GMBH & CO. KG

TABLE 216 CREMER OLEO GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 217 CREMER OLEO GMBH & CO. KG: PRODUCTS OFFERED

TABLE 218 CREMER OLEO GMBH & CO. KG: DEALS

TABLE 219 CREMER OLEO GMBH & CO. KG: OTHERS

12.2.10 JAYANT AGRO-ORGANICS LIMITED

TABLE 220 JAYANT AGRO-ORGANICS LIMITED: COMPANY OVERVIEW

FIGURE 55 JAYANT AGRO-ORGANICS LIMITED: COMPANY SNAPSHOT

TABLE 221 JAYANT AGRO-ORGANICS LIMITED: PRODUCTS OFFERED

12.2.11 GUSTAV HEESS OLEOCHEMICAL PRODUCTS GMBH

TABLE 222 GUSTAV HEESS OLEOCHEMICAL PRODUCTS GMBH: BUSINESS OVERVIEW

TABLE 223 GUSTAV HEESS OLEOCHEMICAL PRODUCTS GMBH: PRODUCTS OFFERED

12.2.12 CONNOILS LLC

TABLE 224 CONNOILS LLC: BUSINESS OVERVIEW

TABLE 225 CONNOILS LLC: PRODUCTS OFFERED

12.2.13 AUSTRALIAN BOTANICAL PRODUCTS

TABLE 226 AUSTRALIAN BOTANICAL PRODUCTS: BUSINESS OVERVIEW

TABLE 227 AUSTRALIAN BOTANICAL PRODUCTS: PRODUCTS OFFERED

TABLE 228 AUSTRALIAN BOTANICAL PRODUCTS: DEALS

12.2.14 ERNESTO VENTÓS S.A

TABLE 229 ERNESTO VENTÓS S.A: BUSINESS OVERVIEW

TABLE 230 ERNESTO VENTÓS S.A: PRODUCTS OFFERED

12.2.15 VANTAGE

TABLE 231 VANTAGE: BUSINESS OVERVIEW

TABLE 232 VANTAGE: PRODUCTS OFFERED

TABLE 233 VANTAGE: DEALS

12.3 OTHER PLAYERS (SMES/STARTUPS)

12.3.1 PRODIGIA

TABLE 234 PRODIGIA: BUSINESS OVERVIEW

TABLE 235 PRODIGIA: PRODUCTS OFFERED

12.3.2 ZAPACH INTERNATIONAL

TABLE 236 ZAPACH INTERNATIONAL: BUSINESS OVERVIEW

TABLE 237 ZAPACH INTERNATIONAL: PRODUCTS OFFERED

12.3.3 SIGMA OIL SEEDS B.V.

TABLE 238 SIGMA OIL SEEDS B.V.: BUSINESS OVERVIEW

TABLE 239 SIGMA OIL SEEDS B.V.: PRODUCTS OFFERED

12.3.4 JOJOBA DESERT (A.C.S) LTD.

TABLE 240 JOJOBA DESERT (A.C.S) LTD: COMPANY OVERVIEW

TABLE 241 JOJOBA DESERT (A.C.S) LTD: PRODUCTS OFFERED

TABLE 242 JOJOBA DESERT (A.C.S) LTD: PRODUCT LAUNCHES

12.3.5 HENRY LAMOTTE OILS GMBH

TABLE 243 HENRY LAMOTTE OILS GMBH: COMPANY OVERVIEW

TABLE 244 HENRY LAMOTTE OILS GMBH: PRODUCTS OFFERED

12.3.6 SONNEBORN LLC

12.3.7 BIOLIE

12.3.8 AU NATURAL ORGANICS COMPANY

12.3.9 AOS PRODUCTS PVT. LTD.

12.3.10 AG INDUSTRIES

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKETS (Page No. - 271)

13.1 INTRODUCTION

TABLE 245 ADJACENT MARKETS TO VEGETABLE OILS IN BEAUTY AND PERSONAL CARE

13.2 LIMITATIONS

13.3 ESSENTIAL OIL MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 ESSENTIAL OIL MARKET, BY APPLICATION

13.4 ESSENTIAL OIL MARKET, BY REGION

TABLE 246 ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 247 ESSENTIAL OILS MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5 COCONUT OIL MARKET

13.5.1 MARKET DEFINITION

13.5.2 MARKET OVERVIEW

13.6 COCONUT OIL MARKET, BY NATURE

TABLE 248 COCONUT OIL MARKET, BY NATURE, 2020–2027 (USD MILLION)

13.7 COCONUT OIL MARKET, BY REGION

TABLE 249 COCONUT OIL MARKET, BY REGION, 2020–2027 (USD MILLION)

14 APPENDIX (Page No. - 276)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

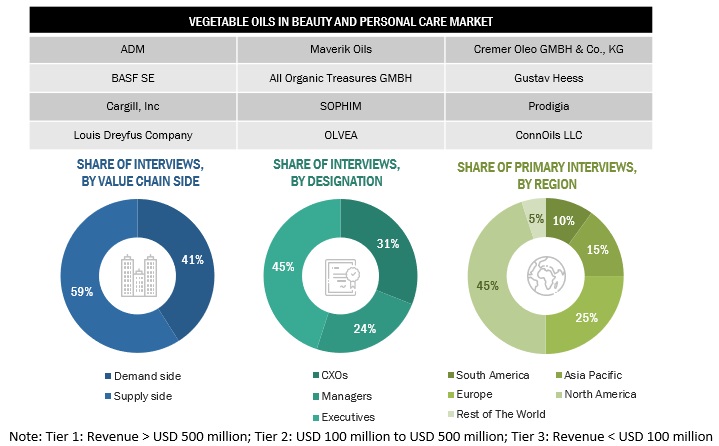

This research involves extensive secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of vegetable oils in the beauty and personal care market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Drug Administration (FDA), American Seed Trade Association (ASTA), Canola Council of Canada, Organic Seed Growers & Trade Association (OSGATA), United Coconut Association of the Philippines, Inc. (UCAP), were referred to identify and collect information for this study. The secondary sources include medical journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The vegetable oils in the beauty and personal care market comprises several stakeholders, including vegetable oil suppliers, ingredient suppliers, skin care, hair care, cosmetics manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, vegetable oil distributors and wholesalers, importers & exporters of vegetables and vegetable oils, vegetable oil manufacturers, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, CEOs of personal care products, cosmetic product manufacturers, skin care and hair care manufacturing companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of vegetable oils in the beauty and personal care market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- Primary and secondary research determined the industry's supply chain and market size.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The peer market—the coconut and essential oils market—was considered to further validate the market details of vegetable oils in beauty and personal care.

-

Bottom-up approach:

- The market size was analyzed based on the share of each type of vegetable oil and its application at regional and country levels. Thus, the global market was estimated with a bottom-up approach at the country level.

- Other factors include the penetration rate of vegetable oils in distinguished application sectors, such as skin care, hair care, and cosmetics; consumer awareness; function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting vegetable oils in the beauty and personal care market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall vegetable oils in beauty and personal care market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for vegetable oils in beauty and personal care market on the basis of type, application, nature, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the vegetable oils in beauty and personal care market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European vegetable oils in beauty and personal care market, by key country

- Further breakdown of the Rest of South America vegetable oils in beauty and personal care market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vegetable Oils in Beauty and Personal Care Market