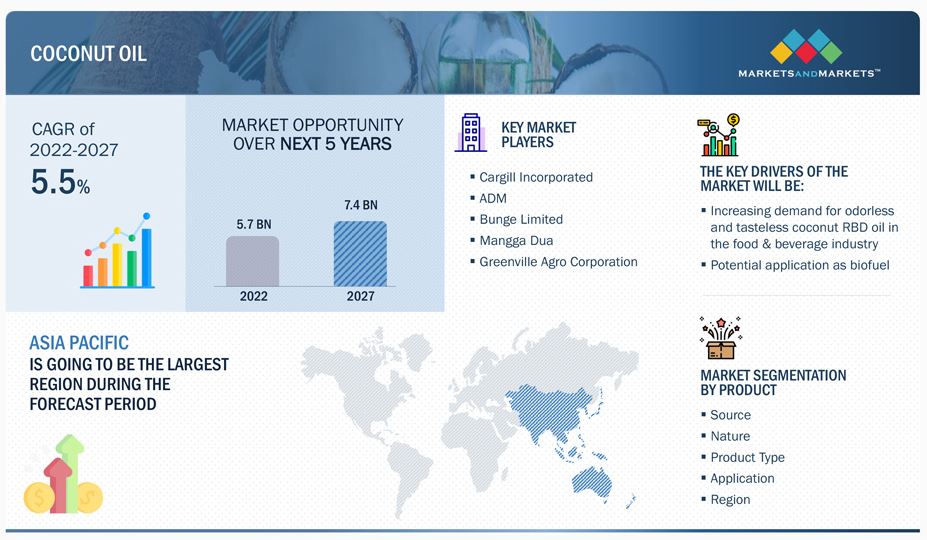

Coconut Oil Market by Product Type (RBD, Virgin, and Crude), Source (Dry Coconut and Wet Coconut), Application (Food & Beverages, Cosmetics & Personal Care Products, and Pharmaceuticals), Nature and Region - Global Forecast to 2027

Coconut Oil Market size is expected to reach USD 7.4 billion by 2027, recording a CAGR of 5.5%. It is estimated to be valued at USD 5.7 billion in 2022. Coconut oil is a major commercial product of coconut. Increasing applications in cosmeceutical and personal care products, increasing demand for odorless and tasteless coconut RBD oil in the food & beverage industry, and rising demand for clean-label products are expected the drive the market for coconut oil.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing demand for odorless and tasteless coconut RBD oil in the food & beverage industry

RBD coconut oil is made from dried coconut with a fatty acid profile rich in medium-chain triglycerides (MCTs). Coconut oil and its special MCTs are digested differently, straight from the GI tract to the liver, helping the body to produce instant, steady energy. It is excellent for extensive frying because of its high smoking point (450 degrees Fahrenheit) and the fact it does not contain a coconut aroma or taste so that the coconut won’t interfere with the flavoring of other foods. The high levels of lauric and caprylic acid also make it a great choice for cooking since these fats are known to fight inflammation caused by unstable polyunsaturated fatty acids, making them a healthier oil to prepare food products. It is also used as a 1:1 replacement for butter, margarine, and other oils in daily cooking, baking, frying, and other food products.

Restraints: Rising concerns regarding the high content of saturated fats in coconut oil

Several studies have claimed that coconut oil raises blood cholesterol, including harmful LDL and, in some cases, triglycerides. Studies have concluded that because its cholesterol-raising effects were comparable to other saturated fats, the oil should not be viewed as a heart-healthy food and should be limited in the diet. According to the Harvard T.H. Chan School of Public Health, in a meta-analysis of 16 clinical trials, coconut oil was found to increase both LDL and HDL cholesterol levels in participants, compared to tropical vegetable oils (e.g., sunflower, canola, olive).

The American Heart Association (AHA) issued a scientific advisory statement in 2017 to replace saturated fats (including coconut and other tropical oils) with unsaturated fats. Based on a review of seven controlled trials, coconut oil was found to raise harmful LDL cholesterol levels.

The AHA advised against using coconut oil and suggested limiting all saturated fat. Those at risk for or who have heart disease advise no more than 6% of total calories from saturated fat, or about 13 grams, based on a 2000-calorie diet. One tablespoon of coconut oil comes close to that limit at about 12 grams of saturated fat. Thus, the harmful effects of coconut oil may hamper the growth of the coconut oil market.

Opportunities: Potential application as biofuel

Biofuel is produced through a chemical reaction called trans-esterification or alcoholysis. This reaction occurs between alcohol such as methanol and vegetable oil in the presence of a catalyst such as sodium or potassium hydroxide. The reaction then yields a biofuel with many similar properties to conventional diesel fuel. Coconut oil blends yield a very comparable output of energy as conventional diesel. At the same time, coconut oil exhaust contains far less harmful emissions than conventional diesel exhaust. Coconut oil in Pacific countries is increasingly used in transport and electricity generation owing to its lower local cost. Other benefits include the support of local agro-industries and a decrease in emissions. The adaptation of biofuel produced from coconut oil in different countries presents ample opportunities for the players in the market.

Challenges: Irregularity in the supply of raw materials

Coconut oil is made from copra and fresh coconut meat. Being a naturally produced fruit in farms, coconut production is vulnerable to several factors, such as diseases and floods, which may decrease its production. It could negatively impact the supply of copra and fresh coconut meat required to produce coconut oil. India is one of the largest producers of coconuts in the world. However, according to the Union Agriculture Ministry, the production of coconut in India shrunk by 10% year-on-year in 2018-19 to its lowest level in the past four years. Coconut production fell to 21,384 million nuts compared to 23,798 million nuts in 2017-18. This slump has been attributed to erratic weather patterns of heavy rains and drought and general neglect of the crop, especially in Kerala, the top coconut producer in India.

According to the Coconut Development Board statistical officer, Vasanthakumar, inadequate rains in Karnataka led to a high incidence of pests and diseases, resulting in the worst productivity decline of 31%. Thus, these factors affect the production of coconut, and there is a challenge of irregularity in the supply of raw materials.

By product type, the virgin segment is projected to grow at the highest CAGR in the coconut oil market during the forecast period

The virgin segment is expected to grow at the highest CAGR in the coconut oil market. Virgin coconut oil is extracted directly from fresh coconut meat. It is done using natural methods such as dry processing, fermentation, churning (centrifugal separation), cold compression, and wet milling; hence, no bleaching or deodorizing occurs. Due to this, virgin coconut oil has more aroma and taste of the coconut compared to RBD oil. It has many advantages, which include the health benefits from the retained vitamins and antioxidants, the antimicrobial and antiviral activity from the lauric acid components, and its easy digestibility due to the presence of medium-chain fatty acids (MCFA). These factors are projected to drive the global coconut oil market segment during the study period.

By source, the dry coconut dominates the coconut oil market during the forecast period

Based on the source, the dry coconut segment is projected to account for the largest market share in the coconut oil market. The increasing demand for RBD coconut oil in the food industry for deep-frying applications and in the cosmeceutical industry for manufacturing soaps is anticipated to drive the segment during the review period.

By application, the food & beverages products segment is projected to account for the largest market share during the forecast period

By application, the food & beverages segment is projected to account for the largest market. Food and beverages include bakery & confectionery, snacks and cereals, beverages, soups, salads, sauces, and other food & beverage applications. Coconut oil adds nutritional & functional value to the final food products. It also has a high smoking point, making it a preferable choice among food product manufacturers.

By nature, the conventional segment is projected to account for a larger share of the coconut oil market during the forecast period

The conventional segment is projected to dominate the coconut oil market by 2027. Conventional farming has higher productivity as compared to organic farming. Moreover, the lack of knowledge regarding ways to shift to organic farming and the red tape involved in acquiring organic certification has supported conventional coconuts farming.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region acquired the largest global coconut oil market share in 2021. The market in the Philippines is estimated to be the major contributor to the growth in the region. It is one of the major coconut oils producing regions globally. It is driven by the robust growth of the food, cosmetics, and pharmaceutical industries, which has supported the industry growth.

Key Market Players:

Key players in this market include Cargill Incorporated (US), ADM (US), Bunge Limited (US), Mangga Dua (Indonesia), Greenville Agro Corporation (Philippines), Royce Food Corporation (Philippines), Novel Nutrients Pvt. Ltd. (India), Aromaax International (India), Adams Group (US), Connoils LLC (US), Tantuco Enterprises, Inc. (the Philippines), Celebes Coconut Corporation (Philippines), CIIF OMG (Philippines), Aluan (Indonesia), Sun Bionaturals Private Ltd (India), Bo International (India), Shree Western G & C Ind. (India), Rmayra Naturals (India), Jiangxi Planty Manor Health Industry Co., Ltd. (China), and Hancole (Philippines).

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Cosmetic products manufacturers

- Coconut oil distributors

- Marketing directors

- Key executives from various key companies and organizations in coconut oil market

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 5.7 billion |

|

Revenue forecast in 2027 |

USD 7.4 billion |

|

Growth Rate |

CAGR of 5.5% from 2022 to 2027 |

|

Base year for estimation |

2021 |

|

Historical data |

2020-2027 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD) and Volume (Ton) |

|

Segments covered |

Source, nature, product type, application, and region |

|

Regional scope |

North America, Europe, Asia Pacific, and RoW |

|

Dominant Geography |

North America |

|

Key companies profiled |

|

This research report categorizes coconut oil market based on source, nature, product type, application, extraction type, and region.

By Nature

- Conventional

- Organic

By Source

- Dry coconut

- Wet coconut

By Product Type

- RBD

- Virgin

- Crude

By Application

- Food & beverages

- Snacks & Cereals

- Beverages

- Nutritional products

- Bakery & Confectionery

- Other food & beverages

- Pharmaceuticals

- Cosmetics & personal care products

- Other applications

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- In November 2021, Bunge planned to build a state-of-the-art, sustainable production facility in the Port of Amsterdam. It will enable the company to offer a broader and more innovative product portfolio of sustainable plant-based oils and fats.

- In February 2020, Bunge Limited launched a new portfolio of products to help replicate the taste, texture, and cooking experience of meat. This portfolio includes specialty fat fractions, shortenings, flakes, and emulsifiers that leverage high-stability sunflower, canola, coconut, and palm fruit oils.

- In July 2019, Bunge Limited launched a new portfolio of products to help replicate the taste, texture, and cooking experience of meat. This portfolio includes specialty fat fractions, shortenings, flakes, and emulsifiers that leverage high-stability sunflower, canola, coconut, and palm fruit oils.

Frequently Asked Questions (FAQ):

Which are the major coconut oil product types considered in this study, and which segments are projected to have promising growth rates in the future?

All the major coconut oil product types, such as RBD, virgin, and crude coconut oil, are considered in the scope of the study. RBD currently accounts for the dominant share in the coconut oil market, followed by virgin coconut oil. However, the virgin coconut oil segment is projected to experience the highest growth rate in the next five years, as it is increasingly used in cosmetics & personal care products.

I am interested in the Asia Pacific market for RBD and virgin coconut oil segment. Is customization available for the same? What would all information be included in the same?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects, including market size, forecast, company profiles & competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- China

- India

- Japan

- Indonesia

- Philippines

- Rest of Asia Pacific (Thailand, Australia, New Zealand, Malaysia, Singapore, and Vietnam)

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the coconut oil market?

Global coconut oil market is characterized by the following drivers:

- Increasing demand for odorless and tasteless coconut RBD oil in the food & beverage industry

RBD coconut oil is made from dried coconut with a fatty acid profile rich in medium-chain triglycerides (MCTs). Coconut oil and its special MCTs are digested differently, straight from the GI tract to the liver, helping the body to produce instant, steady energy. It is great for extensive frying because of its high smoking point (450 degrees Fahrenheit) and the fact it does not contain a coconut aroma or taste, so that the coconut won’t interfere with the flavoring of other foods. The high levels of lauric and caprylic acid also make it an excellent choice for cooking since these fats are known to fight inflammation caused by unstable polyunsaturated fatty acids, making them a healthier oil to prepare food products.

- Rising demand for clean-label products

Growing consumer awareness about the ill effects of artificial food additives/ingredients in food products has increased consumer demand for natural products. Consumers are increasingly focusing on the list of ingredients mentioned in the product as they become aware of what they consume. Such a high level of consumer specificity on the ingredient list of products is a result of the growing level of food safety incidents occurring globally, mainly due to the chemicals in food.

What is the current size of the global coconut oil market?

Coconut Oil Market size is expected to reach USD 7.4 billion by 2027, recording a CAGR of 5.5%. It is estimated to be valued at USD 5.7 billion in 2022

What kind of information is provided in the competitive landscape section?

For the list of the below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market include Cargill Incorporated (US), ADM (US), Bunge Limited (US), Mangga Dua (Indonesia), and Greenville Agro Corporation (Philippines).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.5 VOLUME UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 COCONUT OIL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON PRODUCT TYPE, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC AND PESSIMISTIC SCENARIOS

2.6.3 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 2 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 6 IMPACT OF COVID-19 ON THE GLOBAL MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 7 COCONUT OIL MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET SIZE, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET SIZE, BY NATURE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 12 RISE IN DEMAND FOR COCONUT OIL IN THE FOOD & BEVERAGE AND COSMECEUTICAL INDUSTRIES TO DRIVE THE MARKET

4.2 EUROPE: MARKET FOR COCONUT OIL, BY PRODUCT TYPE AND COUNTRY

FIGURE 13 RBD SEGMENT AND THE NETHERLANDS TO ACCOUNT FOR THE LARGEST MARKET SHARES IN THE EUROPEAN MARKET IN 2022

4.3 MARKET FOR COCONUT OIL, BY PRODUCT TYPE

FIGURE 14 RBD OIL TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 MARKET FOR COCONUT OIL, BY PRODUCT TYPE AND REGION

FIGURE 15 RBD SEGMENT AND ASIA PACIFIC TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET FOR COCONUT OIL, BY APPLICATION

FIGURE 16 FOOD & BEVERAGES SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET FOR COCONUT OIL, BY NATURE

FIGURE 17 CONVENTIONAL SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.7 MARKET FOR COCONUT OIL, BY SOURCE

FIGURE 18 DRY COCONUT SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 19 COVID-19 IMPACT ON THE GLOBAL MARKET: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing applications in cosmeceutical and personal care products

5.2.1.2 Increasing demand for odorless and tasteless coconut RBD oil in the food & beverage industry

5.2.1.3 Rising demand for clean label products

5.2.2 RESTRAINTS

5.2.2.1 Rising concerns regarding the high content of saturated fats in coconut oil

5.2.3 OPPORTUNITIES

5.2.3.1 Potential application as biofuel

5.2.4 CHALLENGES

5.2.4.1 Irregularity in the supply of raw materials

5.3 COVID-19 IMPACT ON THE COCONUT OIL MARKET

6 INDUSTRY TRENDS (Page No. - 53)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 QUALITY AND SAFETY CONTROLLERS

6.2.5 PACKAGING

6.2.6 MARKETING & DISTRIBUTION

6.2.7 END-USE INDUSTRY

FIGURE 21 VALUE CHAIN ANALYSIS OF THE COCONUT OIL MARKET: RESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCING ARE KEY CONTRIBUTORS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS: COCONUT OIL MARKET

TABLE 3 GLOBAL COCONUT OIL AVERAGE SELLING PRICE (ASP), BY PRODUCT TYPE, 2020-2022 (USD/TONS)

TABLE 4 GLOBAL COCONUT OIL AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TONS)

6.5 MARKET MAPPING AND ECOSYSTEM OF COCONUT OIL

6.5.1 DEMAND-SIDE

6.5.2 SUPPLY-SIDE

6.5.3 COCONUT OIL: ECOSYSTEM MAP

6.5.4 COCONUT OIL: MARKET MAP

TABLE 5 COCONUT OIL MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.6 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 22 YC-YCC SHIFT FOR THE COCONUT OIL MARKET

6.7 PATENT ANALYSIS

FIGURE 23 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 24 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 25 TOP 10 APPLICANTS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 6 PATENTS PERTAINING TO COCONUT OIL, 2020–2021

6.8 TRADE ANALYSIS

6.8.1 COCONUT OIL (2018)

TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF COCONUT OIL, 2018 (KG)

6.8.2 COCONUT OIL (2019)

TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF COCONUT OIL, 2019 (KG)

6.8.3 COCONUT OIL (2020)

TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF COCONUT OIL, 2020 (KG)

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET FOR COCONUT OIL: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

6.10.1 CARGILL INCORPORATED: LIQUID COCONUT OIL

6.11 REGULATORY FRAMEWORK

6.11.1 UNITED STATES (US)

6.11.2 EUROPEAN UNION (EU)

6.11.3 EMERGING ECONOMIES – REGULATIONS ON FATS & OILS

7 COCONUT OIL MARKET, BY PRODUCT TYPE (Page No. - 69)

7.1 INTRODUCTION

FIGURE 26 COCONUT OIL MARKET SIZE, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 11 MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 12 MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

7.2 COVID-19 IMPACT ON THE COCONUT OIL MARKET, BY PRODUCT TYPE

7.2.1 OPTIMISTIC SCENARIO

TABLE 13 OPTIMISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2020–2023 (USD MILLION)

7.2.2 REALISTIC SCENARIO

TABLE 14 REALISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2020–2023 (USD MILLION)

7.2.3 PESSIMISTIC SCENARIO

TABLE 15 PESSIMISTIC SCENARIO: MARKET SIZE, BY PRODUCT TYPE, 2020–2023 (USD MILLION)

7.3 RBD

7.3.1 INCREASING APPLICATION IN COSMECEUTICAL PRODUCTS IS EXPECTED TO DRIVE THE DEMAND

TABLE 16 MARKET SIZE FOR RBD COCONUT OIL, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 MARKET SIZE FOR RBD COCONUT OIL, BY REGION, 2020–2027 (TON)

7.4 VIRGIN

7.4.1 WIDE USAGE IN FUNCTIONAL FOOD AND COSMETIC PRODUCTS OWING TO ITS ANTIOXIDANT PROPERTIES

TABLE 18 MARKET SIZE FOR VIRGIN COCONUT OIL, BY REGION, 2020–2027 (USD MILLION)

TABLE 19 MARKET SIZE FOR VIRGIN COCONUT OIL, BY REGION, 2020–2027 (TON)

7.5 CRUDE

7.5.1 CRUDE COCONUT OIL IS USED IN PRODUCTS SUCH AS SURFACTANTS AND LUBRICANTS

TABLE 20 MARKET SIZE FOR CRUDE COCONUT OIL, BY REGION, 2020–2027 (USD MILLION)

TABLE 21 MARKET SIZE FOR CRUDE COCONUT OIL, BY REGION, 2020–2027 (TON)

8 COCONUT OIL MARKET, BY SOURCE (Page No. - 76)

8.1 INTRODUCTION

FIGURE 27 COCONUT OIL MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 22 MARKET SIZE, BY SOURCE, 2020–2027 (USD MILLION)

8.2 COVID-19 IMPACT ON THE COCONUT OIL MARKET, BY SOURCE

8.2.1 OPTIMISTIC SCENARIO

TABLE 23 OPTIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 24 REALISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 25 PESSIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

8.3 WET COCONUT

8.3.1 INCREASING DEMAND FOR VIRGIN COCONUT OIL IS EXPECTED TO DRIVE THE DEMAND FOR THE WET COCONUT SEGMENT

TABLE 26 WET COCONUT: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

8.4 DRY COCONUT

8.4.1 INCREASING APPLICATIONS OF RBD OIL IN FOOD & COSMECEUTICAL INDUSTRIES TO INCREASE THE DEMAND FOR DRY COCONUTS

TABLE 27 DRY COCONUT: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9 COCONUT OIL MARKET, BY APPLICATION (Page No. - 81)

9.1 INTRODUCTION

FIGURE 28 COCONUT OIL MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 28 MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.2 COVID-19 IMPACT ON THE GLOBAL MARKET, BY APPLICATION

9.2.1 OPTIMISTIC SCENARIO

TABLE 29 OPTIMISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2020–2023 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 30 REALISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2020–2023 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 31 PESSIMISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2020–2023 (USD MILLION)

9.3 FOOD & BEVERAGES

TABLE 32 FOOD & BEVERAGES: COCONUT OIL MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 FOOD & BEVERAGES: MARKET SIZE, BY SUBAPPLICATION, 2020–2027 (USD MILLION)

9.3.1 BAKERY & CONFECTIONERY

9.3.1.1 Use of coconut oil as a substitute for fats

9.3.2 SNACKS & CEREALS

9.3.2.1 High smoke point of RBD coconut oil leading to its usage in deep frying

9.3.3 BEVERAGES

9.3.3.1 Increasing demand for healthy beverages

9.3.4 NUTRITIONAL PRODUCTS

9.3.4.1 Health benefits offered by MCTs in coconut oil

9.3.5 OTHER FOOD & BEVERAGE APPLICATIONS

9.3.5.1 Coconut oil is widely used in salad dressings

9.4 COSMETICS & PERSONAL CARE PRODUCTS

9.4.1 A WIDE VARIETY OF APPLICATIONS IN COSMETICS & PERSONAL CARE PRODUCTS IS DRIVING THE MARKET

TABLE 34 COSMETICS & PERSONAL CARE PRODUCTS: MARKET SIZE FOR COCONUT OIL, BY REGION, 2020–2027 (USD MILLION)

9.5 PHARMACEUTICALS

9.5.1 INCREASING APPLICATIONS AS A BASE AND CARRIER OIL

TABLE 35 PHARMACEUTICALS: COCONUT OIL MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.6 OTHER APPLICATIONS

9.6.1 WIDE USAGE IN SURFACTANTS

TABLE 36 OTHER APPLICATIONS: MARKET SIZE FOR COCONUT OIL, BY REGION, 2020–2027 (USD MILLION)

10 COCONUT OIL MARKET, BY NATURE (Page No. - 89)

10.1 INTRODUCTION

FIGURE 29 COCONUT OIL MARKET SIZE, BY NATURE, 2022 VS. 2027 (USD MILLION)

TABLE 37 MARKET SIZE FOR COCONUT OIL, BY NATURE, 2020–2027 (USD MILLION)

10.2 COVID-19 IMPACT ON THE COCONUT OIL MARKET, BY NATURE

10.2.1 OPTIMISTIC SCENARIO

TABLE 38 OPTIMISTIC SCENARIO: MARKET SIZE, BY NATURE, 2020–2023 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 39 REALISTIC SCENARIO: MARKET SIZE, BY NATURE, 2020–2023 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 40 PESSIMISTIC SCENARIO: MARKET SIZE, BY NATURE, 2020–2023 (USD MILLION)

10.3 CONVENTIONAL

10.3.1 INCREASED COCONUT PRODUCE BY CONVENTIONAL FARMING IS PROJECTED TO DRIVE THE GROWTH OF THE SEGMENT

TABLE 41 CONVENTIONAL COCONUT OIL MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.4 ORGANIC

10.4.1 INCREASING DEMAND FOR CLEAN LABEL PRODUCTS IS EXPECTED TO BOOST THE ORGANIC SEGMENT

TABLE 42 ORGANIC COCONUT OIL MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

11 EXTRACTION METHODS (Page No. - 93)

11.1 INTRODUCTION

11.2 TRADITIONAL BOILING METHOD

11.3 ENZYMATIC PROCESS

11.4 FERMENTATION

11.5 CHILLING, FREEZING, AND THAWING

11.6 WET EXTRACTION

11.7 DRY PROCESSING METHOD

12 COCONUT OIL MARKET, BY REGION (Page No. - 95)

12.1 INTRODUCTION

FIGURE 30 REGIONAL SNAPSHOT: NETHERLANDS AND THE PHILIPPINES TO ACCOUNT FOR THE HIGHEST CAGRS IN THE COCONUT OIL MARKET DURING THE FORECAST PERIOD

TABLE 43 MARKET SIZE FOR COCONUT OIL, BY REGION, 2020–2027 (USD MILLION)

TABLE 44 MARKET SIZE FOR COCONUT OIL, BY REGION, 2020–2027 (TON)

12.2 COVID-19 IMPACT ON THE COCONUT OIL MARKET, BY REGION

12.2.1 OPTIMISTIC SCENARIO

TABLE 45 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

12.2.2 REALISTIC SCENARIO

TABLE 46 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

12.2.3 PESSIMISTIC SCENARIO

TABLE 47 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

12.3 NORTH AMERICA

TABLE 48 NORTH AMERICA: COCONUT OIL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY NATURE, 2020–2027 (USD MILLION)

12.3.1 US

12.3.1.1 Increase in use in bakery products

TABLE 54 US: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 55 US: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.3.2 CANADA

12.3.2.1 Rise in demand for natural and organic food & beverage products to contribute to the growth of the coconut oil market

TABLE 56 CANADA: COCONUT OIL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 57 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 Large-scale usage in soaps and detergents

TABLE 58 MEXICO: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 MEXICO: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.4 EUROPE

FIGURE 31 EUROPE: COCONUT OIL MARKET SNAPSHOT

TABLE 60 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 64 EUROPE: MARKET SIZE, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY NATURE, 2020–2027 (USD MILLION)

12.4.1 GERMANY

12.4.1.1 High consumption of bakery products to drive the global market

TABLE 66 GERMANY: COCONUT OIL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 67 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.4.2 UK

12.4.2.1 Increase in demand for cosmeceutical products

TABLE 68 UK: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 69 UK: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 Presence of various bakery products as a daily staple in France is projected to drive the growth of the market

TABLE 70 FRANCE: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.4.4 ITALY

12.4.4.1 Booming bakery and confectionery to drive the growth of the global market

TABLE 72 ITALY: COCONUT OIL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 73 ITALY: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.4.5 SPAIN

12.4.5.1 Increasing usage of coconut oil as a natural ingredient in the food and cosmetic industries

TABLE 74 SPAIN: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 SPAIN: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.4.6 NETHERLANDS

12.4.6.1 Increase in application in the confectionery industry

TABLE 76 NETHERLANDS: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 NETHERLANDS: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.4.7 REST OF EUROPE

TABLE 78 REST OF EUROPE: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 79 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: COCONUT OIL MARKET SNAPSHOT

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2020–2027 (USD MILLION)

12.5.1 CHINA

12.5.1.1 Rise in demand for coconut oil by food manufacturers

TABLE 86 CHINA: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 87 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.5.2 INDIA

12.5.2.1 Growth in use of coconut oil in cosmeceutical products

TABLE 88 INDIA: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.5.3 JAPAN

12.5.3.1 Rise in demand for virgin coconut oil in food and cosmeceutical industries

TABLE 90 JAPAN: COCONUT OIL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 JAPAN: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.5.4 VIETNAM

12.5.4.1 Increase in demand for local food products

TABLE 92 VIETNAM: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 93 VIETNAM: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.5.5 INDONESIA

12.5.5.1 Large-scale availability of organic coconut and coconut oil

TABLE 94 INDONESIA: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 95 INDONESIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.5.6 PHILIPPINES

12.5.6.1 Wide availability of coconut oil in all product types

TABLE 96 PHILIPPINES: COCONUT OIL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 97 PHILIPPINES: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.5.7 REST OF ASIA PACIFIC

TABLE 98 REST OF ASIA PACIFIC: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 99 REST OF ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.6 REST OF THE WORLD (ROW)

TABLE 100 ROW: COCONUT OIL MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 101 ROW: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 102 ROW: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 103 ROW: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (TON)

TABLE 104 ROW: MARKET SIZE, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 105 ROW: MARKET SIZE, BY NATURE, 2020–2027 (USD MILLION)

12.6.1 SOUTH AMERICA

12.6.1.1 Rise in demand for natural ingredients in the cosmeceutical industry

TABLE 106 SOUTH AMERICA: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 107 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Increasing import of coconut oil

TABLE 108 AFRICA: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

12.6.3 MIDDLE EAST

12.6.3.1 Increasing demand for edible oils

TABLE 110 MIDDLE EAST: MARKET SIZE FOR COCONUT OIL, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 111 MIDDLE EAST: MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 130)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2020

TABLE 112 COCONUT OIL MARKET SHARE ANALYSIS, 2020

13.3 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

13.4 COVID-19-SPECIFIC COMPANY RESPONSE

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 34 COCONUT OIL MARKET, COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

13.6 PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 113 COMPANY FOOTPRINT, BY APPLICATION

TABLE 114 COMPANY FOOTPRINT, BY PRODUCT TYPE

TABLE 115 COMPANY FOOTPRINT, BY NATURE

TABLE 116 COMPANY REGIONAL, BY REGIONAL FOOTPRINT

TABLE 117 OVERALL COMPANY FOOTPRINT

13.7 MARKET FOR COCONUT OIL, STARTUP/SME EVALUATION QUADRANT, 2020

13.7.1 PROGRESSIVE COMPANIES

13.7.2 STARTING BLOCKS

13.7.3 RESPONSIVE COMPANIES

13.7.4 DYNAMIC COMPANIES

FIGURE 35 MARKET FOR COCONUT OIL: COMPANY EVALUATION QUADRANT, 2020 (STARTUPS/SMES)

13.8 PRODUCT FOOTPRINT (STARTUP/SMES)

TABLE 118 COMPANY FOOTPRINT, BY APPLICATION (STARTUP/SME)

TABLE 119 COMPANY FOOTPRINT, BY PRODUCT TYPE (STARTUP/SME)

TABLE 120 COMPANY FOOTPRINT, BY NATURE (STARTUP/SME)

TABLE 121 COMPANY REGIONAL, BY REGIONAL FOOTPRINT (STARTUP/SME)

TABLE 122 OVERALL COMPANY FOOTPRINT (STARTUP/SME)

13.9 COMPETITIVE SCENARIO

13.9.1 NEW PRODUCT LAUNCHES

TABLE 123 MARKET FOR COCONUT OIL: NEW PRODUCT LAUNCHES, FEBRUARY 2020

13.9.2 OTHERS

TABLE 124 MARKET FOR COCONUT OIL: OTHERS, JULY 2019–NOVEMBER 2021

14 COMPANY PROFILES (Page No. - 143)

(Business overview, Products/Services/Solutions offered, Recent developments & MnM View)*

14.1 KEY PLAYERS

14.1.1 CARGILL INCORPORATED

TABLE 125 CARGILL INCORPORATED: BUSINESS OVERVIEW

FIGURE 36 CARGILL INCORPORATED: COMPANY SNAPSHOT

TABLE 126 CARGILL INCORPORATED: PRODUCTS OFFERED

14.1.2 ADM

TABLE 127 ADM: BUSINESS OVERVIEW

FIGURE 37 ADM: COMPANY SNAPSHOT

TABLE 128 ADM: PRODUCTS OFFERED

14.1.3 BUNGE LIMITED

TABLE 129 BUNGE LIMITED: BUSINESS OVERVIEW

FIGURE 38 BUNGE LIMITED: COMPANY SNAPSHOT

TABLE 130 BUNGE LIMITED: PRODUCTS OFFERED

TABLE 131 BUNGE LIMITED: NEW PRODUCT LAUNCHES

TABLE 132 BUNGE LIMITED: OTHERS

14.1.4 MANGGA DUA

TABLE 133 MANGGA DUA: BUSINESS OVERVIEW

TABLE 134 MANGGA DUA: PRODUCTS OFFERED

14.1.5 GREENVILLE AGRO CORPORATION

TABLE 135 GREENVILLE AGRO CORPORATION: BUSINESS OVERVIEW

TABLE 136 GREENVILLE AGRO CORPORATION: PRODUCTS OFFERED

14.1.6 ADAMS GROUP

TABLE 137 ADAMS GROUP: BUSINESS OVERVIEW

TABLE 138 ADAMS GROUP: PRODUCTS OFFERED

14.1.7 NOVEL NUTRIENTS PVT. LTD.

TABLE 139 NOVEL NUTRIENTS PVT. LTD.: BUSINESS OVERVIEW

TABLE 140 NOVEL NUTRIENTS PVT. LTD.: PRODUCTS OFFERED

14.1.8 AROMAAZ INTERNATIONAL

TABLE 141 AROMAAZ INTERNATIONAL: BUSINESS OVERVIEW

TABLE 142 AROMAAZ INTERNATIONAL: PRODUCTS OFFERED

14.1.9 ROYCE FOOD CORPORATION

TABLE 143 ROYCE FOOD CORPORATION: BUSINESS OVERVIEW

TABLE 144 ROYCE FOOD CORPORATION: PRODUCTS OFFERED

14.1.10 CONNOILS LLC

TABLE 145 CONNOILS LLC: BUSINESS OVERVIEW

TABLE 146 CONNOILS LLC: PRODUCTS OFFERED

14.1.11 TANTUCO ENTERPRISES, INC.

TABLE 147 TANTUCO ENTERPRISES, INC.: BUSINESS OVERVIEW

TABLE 148 TANTUCO ENTERPRISES, INC.: PRODUCTS OFFERED

14.1.12 CELEBES COCONUT CORPORATION

TABLE 149 CELEBES COCONUT CORPORATION: BUSINESS OVERVIEW

TABLE 150 CELEBES COCONUT CORPORATION: PRODUCTS OFFERED

14.1.13 COCONUT INDUSTRY INVESTMENT FUND OIL MILLS GROUP

TABLE 151 COCONUT INDUSTRY INVESTMENT FUND OIL MILLS GROUP: BUSINESS OVERVIEW

TABLE 152 COCONUT INDUSTRY INVESTMENT FUND OIL MILLS GROUP: PRODUCTS OFFERED

14.1.14 ALUAN

TABLE 153 ALUAN: BUSINESS OVERVIEW

TABLE 154 ALUAN: PRODUCTS OFFERED

14.1.15 SUN BIONATURALS PRIVATE LTD

TABLE 155 SUN BIONATURALS PRIVATE LTD: BUSINESS OVERVIEW

TABLE 156 SUN BIONATURALS PRIVATE LTD: PRODUCTS OFFERED

*Details on Business overview, Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 BO INTERNATIONAL

14.2.2 SHREE WESTERN G & C IND.

14.2.3 RMAYRA NATURALS

14.2.4 JIANGXI PLANTY MANOR HEALTH INDUSTRY CO., LTD.

14.2.5 HANCOLE

15 ADJACENT AND RELATED MARKETS (Page No. - 168)

15.1 INTRODUCTION

TABLE 157 ADJACENT MARKETS TO COCONUT OIL

15.2 LIMITATIONS

15.3 FATS & OILS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 158 FATS & OILS MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

15.4 OILSEEDS MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 159 OILSEEDS MARKET SIZE, BY TYPE, 2017–2025 (USD BILLION)

16 APPENDIX (Page No. - 171)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

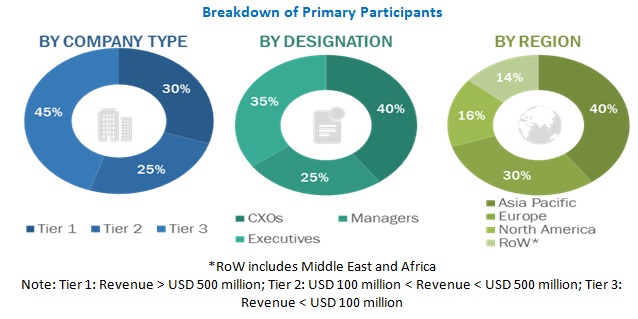

The study involved four major activities in estimating coconut oil market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including food & beverage manufacturers, cosmeceutical manufacturers, pharmaceutical manufacturers and suppliers, importers and exporters, and intermediary suppliers such as traders and distributors of coconut oil products. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include coconut oil manufacturers, exporters, and importers. The primary sources from the demand-side include pharmaceutical manufacturers, cosmeceutical manufacturers, food & beverage manufacturers, and other end-use sectors.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- To describe and forecast coconut oil market, in terms of source, nature, product type, application, and region

- To describe and forecast coconut oil market, in terms of value, by region–North America, Europe, Asia Pacific, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific coconut oil market, by key country

- Further breakdown of the Rest of European coconut oil market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Coconut Oil Market