Vascular Patches Market by Material (Biologic, Synthetic), Application (Open Repair of Abdominal Aortic Aneurysm, Congenital Heart Disease, Carotid Endarterectomy), End User (Hospitals, Ambulatory Surgical Centers) - Global Forecast to 2027

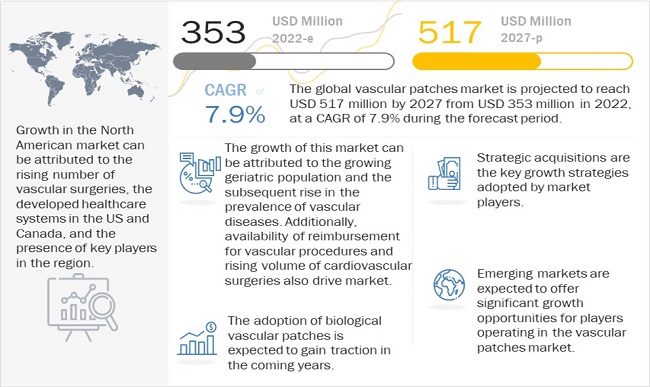

The global vascular patches market is valued at an estimated USD 353 million in 2022 and is projected to reach USD 517 million by 2027, at a CAGR of 7.9% during the forecast period. Market growth is driven by the growing geriatric population and subsequent prevalence of vascular diseases and availability of reimbursement for vascular procedures, coupled with the growing adoption of biological patches.

Global Vascular Patches Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Vascular Patches Market Growth Dynamics

Growing geriatric population and subsequent prevalence of vascular diseases

Rapid growth in the global geriatric population is one of the major factors responsible for the increasing incidence of several diseases/conditions, such as CVDs, high cholesterol, hypertension, strokes, cancer, and aneurysms. Since age is considered a major cause of the deterioration of cardiac health, growth in the aging population is an important indicator of market growth.

- According to the WHO, globally, by 2030, 1 in every six individuals will be aged 60 years or over worldwide. By 2050, the world’s population of people aged 60 years and older will be two times (2.1 billion). The number of individuals aged 80 years or older is expected to grow three times between 2020 and 2050 to reach 426 million.

- Over 46 million older adults aged 65 and older will live in the US in 2021; by 2050, the senior population is expected to grow to over 90 million. It is expected that in 2030, 1 in every 5 US citizens is projected to be 65 years old and over. (Source: Health Resources and Services Administration (HRSA) of the U.S. Department of Health and Human Services (HHS) 2021-2022) Multi-morbidity is the main characteristic feature of patients. It means that two or more chronic diseases are present at the same time. Nearly 80% of 65 years and above-aged people have at least one chronic condition, and 68% have two or more chronic illnesses.

- The American Heart Association (AHA) reports that the incidence of CVD in US men and women aged between 40-59 years is ~40% and ~75% from 60–79 years, and ~86% in those above the age of 80. Thus, the older population presents a major burden for the current US healthcare infrastructure due to the high prevalence of CVD.

Availability of reimbursement for vascular procedures

Multi-morbidity is the main characteristic feature of patients. It means that two or more chronic diseases are present at the same time. Nearly 80% of 65 years and above-aged people have at least one chronic condition, and 68% have two or more chronic illnesses.

The American Heart Association (AHA) reports that the incidence of CVD in US men and women aged between 40-59 years is ~40% and ~75% from 60–79 years, and ~86% in those above the age of 80. Thus, the older population presents a major burden for the current US healthcare infrastructure due to the high prevalence of CVD.

Besides, developing economies like India also provide government assistance in vascular procedures. For instance, Rashtriya Arogya Nidhi, a scheme by the Indian government, provides financial assistance to below-poverty-line patients suffering from major life-threatening diseases to receive medical treatment at any of the super specialty Government hospitals/institutes. Some of the procedures under this scheme include Heart surgery for Congenital and Acquired conditions (C.A.B.G), among others. The availability of reimbursement has led to an increase in the number of vascular surgeries, which is expected to help in the growth of the vascular patches market.

The rising need for skilled professionals is a prominent challenge in the vascular patches market

Skilled professionals must handle vascular patches, as improper closure of arteries after surgical procedures may lead to continuous bleeding or may cause ischemia. Some devices even require several steps in sequence while using them.

Currently, the lack of surgeons in developed and developing economies is one of the major factors limiting the adoption of these products. For instance, the Association of American Medical Colleges (AAMC) projects a shortage of about 122,000 physicians by 2032 in the US. A shortage of 12,000 medical specialists, 23,400 surgeons, and 39,100 other specialists, such as neurologists and radiologists, is expected to occur by 2032.

To know about the assumptions considered for the study, download the pdf brochure

In 2021, the biologic vascular patches segment accounted for the largest share of the vascular patches market, by material

Based on material the vascular patches market is segmented as biologic vascular patches and synthetic vascular patches. In 2021, biologic vascular patch accounted for a significant share of the market, primarily due to their benefits such as, ease to use, less risk of developing an infection post-surgery, coupled with better biocompatibility.

In 2021, the carotid endarterectomy (CEA) segment accounted for the largest share of the vascular patches market, by application

Based on application, the vascular patches market is segmented into carotid endarterectomy (CEA), open repair of abdominal aortic aneurysm (AAA), congenital heart diseases, vascular bypass surgery, and other applications. The CEA segment accounted for the largest share by application, due to the rise in the number of carotid endarterectomies surgeries worldwide./p>

In 2021, hospitals accounted for the largest share in the vascular patches market, by end user

The vascular patches market is segmented into hospitals and ambulatory surgical centers. Hospitals accounted for the largest share of the vascular patches market in 2021. The large share of this segment can be attributed to the growing number of hospitals in developing nations, and the increasing government initiatives to make vascular surgeries more affordable

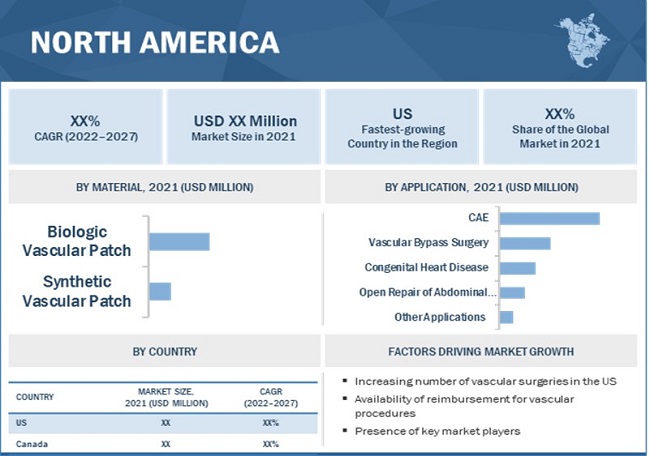

In 2021, North America accounted for the largest share of the vascular patches market

The global vascular patches market is segmented into four major regions namely, North America, Europe, the Asia Pacific, and the Rest of the World. North America accounted for the largest share of the vascular patches market in 2021. Factors such as the rise in the incidence of CVD, advanced healthcare infrastructures, and the presence of key players are contributing to the large share of this regional segment.

Key Market Players

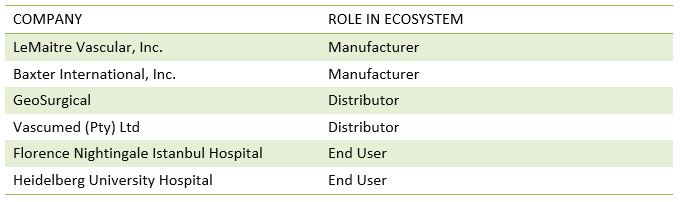

The vascular patches market is dominated by players such as Baxter International, Inc. (US), LeMaitre Vascular, Inc. (US), and W. L. Gore & Associates, Inc. (US).

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Material, Application, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

LeMaitre Vascular, Inc. (US), Baxter International, Inc. (US), W. L. Gore & Associates, Inc. (US), Getinge AB (Sweden), B Braun (Germany), Artivion, Inc (US), Edwards Lifesciences Corporation (US), Aziyo Biologics, Inc. (US), Terumo Corporation (Japan), BD (US), Labcor Laboratórios Ltda. (Brazil), VUP Medical (Czech Republic), Aegis Lifesciences (India), and SynkroMax Biotech Pvt. Ltd. (India) |

This report has segmented the global vascular patches market based on product type, end user type, and region.

By Material

- Biologic Vascular Patches

- Synthetic Vascular Patches

By Application

- Carotid Endarterectomy

- Open Repair of Abdominal Aortic Aneurysm

- Vascular Bypass Surgery

- Congenital Heart Disease

- Other Applications

By End User

- Hospitals

- Ambulatory Surgical Centers

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the world

Recent Developments

- In May 2022, Due to its high demand, Getinge AB increased its high-quality vascular graft production. The increasing manufacturing capacity has been achieved at the firm's factory in France.

- In December 2021, Aziyo Biologics, Inc. received funding of USD 14 million in public equity (PIPE) financing. The funding would support and enhance the Company’s regenerative medicine growth opportunities.

- In July 2020, LeMaitre Vascular acquired the business and assets of Artegraft, Inc. The acquisition strengthened the company’s portfolio of biologic vascular patches.

- In October 2019, LeMaitre Vascular acquired the business and assets of Admedus Ltd. The companies signed the license agreement for the tissue processing technology, limited to the CardioCel and VascuCel product lines.

Frequently Asked Questions (FAQ):

What are the recent trends driving the vascular patches market?

Primary trends driving the vascular patches market are the rising incidence of CVD, growing geriatric population and subsequent prevalence of vascular diseases, rising number of cardiovascular surgeries worldwide, the availability of reimbursement for vascular procedures, growing adoption of biological patches.

Which type of vascular patches are mostly preferred?

Biologic patches are widely used for arterial closure during vascular and cardiac surgery. These patches have several advantages over their synthetic counterparts regarding biocompatibility and ease of use. They also minimize suture line bleeding and reduce the rates of infection.

Who are the key players in the vascular patches market?

The key players in the vascular patches market are Baxter International, Inc. (US), LeMaitre Vascular, Inc. (US), W. L. Gore & Associates, Inc. (US), Getinge AB (Sweden), B Braun (Germany), Artivion, Inc (US), Edwards Lifesciences Corporation (US), Aziyo Biologics, Inc. (US), Terumo Corporation (Japan), BD (US), Labcor Laboratórios Ltda. (Brazil), VUP Medical (Czech Republic), Aegis Lifesciences (India), and SynkroMax Biotech Pvt. Ltd. (India).

Which region is lucrative for the vascular patches market?

The Asia Pacific market is expected to witness the highest growth during the forecast period due to factors such as the presence of a large target population, rising number of vascular surgeries, and increasing healthcare expenditure are driving market growth in the APAC region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 VASCULAR PATCHES MARKET

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY SOURCES

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: VASCULAR PATCHES MARKET

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 9 VASCULAR PATCHES MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

FIGURE 10 VASCULAR PATCHES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 VASCULAR PATCHES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF VASCULAR PATCHES MARKET

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 VASCULAR PATCHES MARKET OVERVIEW

FIGURE 13 RISING PREVALENCE OF CVD AND GROWING VOLUME OF CARDIOVASCULAR SURGERIES TO DRIVE MARKET

4.2 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY MATERIAL (2021)

FIGURE 14 BIOLOGICAL VASCULAR PATCHES ACCOUNTED FOR LARGEST SHARE IN 2021

4.3 VASCULAR PATCHES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 15 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.4 VASCULAR PATCHES MARKET: GEOGRAPHIC MIX

FIGURE 16 ASIA PACIFIC MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4.5 VASCULAR PATCHES MARKET: DEVELOPED VS. EMERGING ECONOMIES

FIGURE 17 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 VASCULAR PATCHES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising incidence of CVD

5.2.1.2 Growing geriatric population and subsequent prevalence of vascular diseases

5.2.1.3 Rising number of cardiovascular surgeries worldwide

5.2.1.4 Availability of reimbursement for vascular procedures

5.2.1.5 Growing adoption of biological patches

5.2.2 RESTRAINTS

5.2.2.1 High procedural cost of vascular surgeries and associated products

5.2.2.2 Product failures and recalls

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.3.2 Growth in the number of hospitals & surgical centers

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled professionals

5.3 REGULATORY LANDSCAPE

TABLE 2 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.3.1 NORTH AMERICA

5.3.1.1 US

5.3.1.2 Canada

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.3.1 China

5.3.3.2 Japan

5.3.3.3 India

5.3.4 LATIN AMERICA

5.3.4.1 Brazil

5.3.4.2 Mexico

5.3.5 MIDDLE EAST

5.3.6 AFRICA

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 VASCULAR PATCHES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT FROM NEW ENTRANTS

5.4.2 THREAT FROM SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 DEGREE OF COMPETITION

5.5 TECHNOLOGY ANALYSIS

5.6 VALUE CHAIN ANALYSIS

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 19 VASCULAR PATCHES MARKET: SUPPLY CHAIN ANALYSIS

5.8 ECOSYSTEM ANALYSIS

FIGURE 20 VASCULAR PATCHES MARKET: ECOSYSTEM ANALYSIS

5.8.1 ECOSYSTEM ROLE

6 VASCULAR PATCHES MARKET, BY MATERIAL (Page No. - 55)

6.1 INTRODUCTION

TABLE 7 VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

6.2 BIOLOGIC VASCULAR PATCHES

6.2.1 WIDE USAGE IN ARTERIAL CLOSURE DURING CARDIAC SURGERIES TO DRIVE MARKET

TABLE 8 BIOLOGIC VASCULAR PATCHES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SYNTHETIC VASCULAR PATCHES

6.3.1 HIGH RISK OF INFECTION DESPITE BEING COST-EFFICIENT TO RESTRAIN MARKET

TABLE 9 SYNTHETIC VASCULAR PATCHES MARKET, BY REGION, 2020–2027 (USD MILLION)

7 VASCULAR PATCHES MARKET, BY APPLICATION (Page No. - 58)

7.1 INTRODUCTION

TABLE 10 VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 CAROTID ENDARTERECTOMY

7.2.1 INCREASING PATCH ANGIOPLASTY PROCEDURES TO DRIVE MARKET

TABLE 11 VASCULAR PATCHES MARKET FOR CAROTID ENDARTERECTOMY, BY REGION, 2020–2027 (USD MILLION)

7.3 VASCULAR BYPASS SURGERY

7.3.1 RISING PREVALENCE OF VASCULAR DISEASES TO DRIVE MARKET

TABLE 12 VASCULAR PATCHES MARKET FOR VASCULAR BYPASS SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.4 CONGENITAL HEART DISEASE

7.4.1 USE OF SYNTHETIC & BIOLOGIC VASCULAR PATCHES FOR CORRECTIVE SURGERIES TO DRIVE MARKET

TABLE 13 VASCULAR PATCHES MARKET FOR CONGENITAL HEART DISEASE, BY REGION, 2020–2027 (USD MILLION)

7.5 OPEN REPAIR OF ABDOMINAL AORTIC ANEURYSM

7.5.1 RISING INCIDENCE OF AAA TO DRIVE DEMAND FOR VASCULAR PATCHES

TABLE 14 VASCULAR PATCHES MARKET FOR OPEN REPAIR OF ABDOMINAL AORTIC ANEURYSM, BY REGION, 2020–2027 (USD MILLION)

7.6 OTHER APPLICATIONS

TABLE 15 VASCULAR PATCHES MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

8 VASCULAR PATCHES MARKET, BY END USER (Page No. - 64)

8.1 INTRODUCTION

TABLE 16 VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 RISING BURDEN OF CVD AND DEVELOPING INFRASTRUCTURE IN EMERGING ECONOMIES TO DRIVE MARKET

TABLE 17 VASCULAR PATCHES MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

8.3 AMBULATORY SURGICAL CENTERS

8.3.1 RISING NUMBER OF ASCS TO PROPEL MARKET GROWTH

TABLE 18 VASCULAR PATCHES MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2020–2027 (USD MILLION)

9 VASCULAR PATCHES MARKET, BY REGION (Page No. - 67)

9.1 INTRODUCTION

TABLE 19 VASCULAR PATCHES MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: VASCULAR PATCHES MARKET SNAPSHOT

TABLE 20 NORTH AMERICA: VASCULAR PATCHES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 21 NORTH AMERICA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 22 NORTH AMERICA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 23 NORTH AMERICA: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Favorable government reimbursements for vascular surgeries to drive market

TABLE 24 US: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 25 US: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 26 US: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 High incidence of vascular diseases to support market growth

TABLE 27 CANADA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 28 CANADA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 29 CANADA: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 30 EUROPE: VASCULAR PATCHES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 31 EUROPE: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 32 EUROPE: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 33 EUROPE: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Presence of a large target patient population to support market growth

TABLE 34 GERMANY: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 35 GERMANY: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 36 GERMANY: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 High prevalence of CVD to drive demand for vascular patches

TABLE 37 FRANCE: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 38 FRANCE: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 39 FRANCE: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 UK

9.3.3.1 Rising geriatric population and subsequent prevalence of CHD to drive market

TABLE 40 UK: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 41 UK: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 42 UK: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing incidence of CHD to support market growth

TABLE 43 ITALY: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 44 ITALY: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 45 ITALY: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Rising risk of developing CVD due to age-related disorders to support market growth

TABLE 46 SPAIN: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 47 SPAIN: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 48 SPAIN: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 49 REST OF EUROPE: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 50 REST OF EUROPE: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 51 REST OF EUROPE: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: VASCULAR PATCHES MARKET SNAPSHOT (2021)

TABLE 52 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 54 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Rising prevalence of chronic heart diseases to drive market

TABLE 56 CHINA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 57 CHINA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 58 CHINA: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Rising public healthcare spending to drive demand for vascular patches

TABLE 59 JAPAN: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 60 JAPAN: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 61 JAPAN: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising incidence of CVD to drive market

TABLE 62 INDIA: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 63 INDIA: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 INDIA: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 65 REST OF ASIA PACIFIC: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 66 REST OF ASIA PACIFIC: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 67 REST OF ASIA PACIFIC: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 68 REST OF THE WORLD: VASCULAR PATCHES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 69 REST OF THE WORLD: VASCULAR PATCHES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 70 REST OF THE WORLD: VASCULAR PATCHES MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 94)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 71 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

10.3 REVENUE SHARE ANALYSIS

FIGURE 23 VASCULAR PATCHES MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS

10.4 MARKET SHARE ANALYSIS

TABLE 72 VASCULAR PATCHES MARKET: DEGREE OF COMPETITION

FIGURE 24 VASCULAR PATCHES MARKET SHARE ANALYSIS, 2021

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 25 VASCULAR PATCHES MARKET: COMPANY EVALUATION QUADRANT (2021)

10.6 COMPANY FOOTPRINT ANALYSIS

TABLE 73 COMPANY FOOTPRINT

TABLE 74 COMPANY MATERIAL FOOTPRINT

TABLE 75 COMPANY REGIONAL FOOTPRINT

10.7 COMPETITIVE SCENARIO

10.7.1 DEALS

TABLE 76 VASCULAR PATCHES MARKET: DEALS, 2019–2022

10.7.2 OTHER DEVELOPMENTS

TABLE 77 VASCULAR PATCHES MARKET: OTHER DEVELOPMENTS, 2019–2022

11 COMPANY PROFILES (Page No. - 103)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

11.1 KEY PLAYERS

11.1.1 BAXTER INTERNATIONAL, INC.

TABLE 78 BAXTER INTERNATIONAL, INC: COMPANY OVERVIEW

FIGURE 26 BAXTER INTERNATIONAL, INC: COMPANY SNAPSHOT (2021)

11.1.2 LEMAITRE VASCULAR, INC.

TABLE 79 LEMAITRE VASCULAR, INC: COMPANY OVERVIEW

FIGURE 27 LEMAITRE VASCULAR, INC: COMPANY SNAPSHOT (2021)

11.1.3 W. L. GORE & ASSOCIATES, INC.

TABLE 80 W. L. GORE & ASSOCIATES: COMPANY OVERVIEW

11.1.4 GETINGE AB

TABLE 81 GETINGE AB: COMPANY OVERVIEW

FIGURE 28 GETINGE AB: COMPANY SNAPSHOT (2021)

TABLE 82 EXCHANGE RATES UTILIZED FOR CONVERSION OF SEK TO USD

11.1.5 B. BRAUN

TABLE 83 B. BRAUN: COMPANY OVERVIEW

FIGURE 29 B. BRAUN: COMPANY SNAPSHOT (2021)

TABLE 84 EXCHANGE RATES UTILIZED FOR CONVERSION OF EUROS TO USD

11.1.6 EDWARDS LIFESCIENCES CORPORATION

TABLE 85 EDWARDS LIFESCIENCES CORPORATION: COMPANY OVERVIEW

FIGURE 30 EDWARDS LIFESCIENCES CORPORATION: COMPANY SNAPSHOT (2021)

11.1.7 BECTON, DICKINSON AND COMPANY

TABLE 86 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

FIGURE 31 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

11.1.8 AZIYO BIOLOGICS, INC.

TABLE 87 AZIYO BIOLOGICS, INC: COMPANY OVERVIEW

FIGURE 32 AZIYO BIOLOGICS, INC: COMPANY SNAPSHOT (2021)

11.1.9 TERUMO CORPORATION

TABLE 88 TERUMO CORPORATION: COMPANY OVERVIEW

FIGURE 33 TERUMO CORPORATION: COMPANY SNAPSHOT (2022)

TABLE 89 EXCHANGE RATES UTILIZED FOR CONVERSION OF YEN TO USD

11.1.10 ARTIVION, INC.

TABLE 90 ARTIVION, INC.: COMPANY OVERVIEW

FIGURE 34 ARTIVION, INC: COMPANY SNAPSHOT (2021)

11.1.11 LABCOR LABORATÓRIOS LTDA.

TABLE 91 LABCOR LABORATÓRIOS LTDA.: COMPANY OVERVIEW

11.2 OTHER PLAYERS

11.2.1 VUP MEDICAL

TABLE 92 VUP MEDICAL: COMPANY OVERVIEW

11.2.2 AEGIS LIFESCIENCES

TABLE 93 AEGIS LIFESCIENCES: COMPANY OVERVIEW

11.2.3 SYNKROMAX BIOTECH PVT. LTD.

TABLE 94 SYNKROMAX BIOTECH PVT. LTD: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 129)

12.1 INDUSTRY EXPERT INSIGHTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

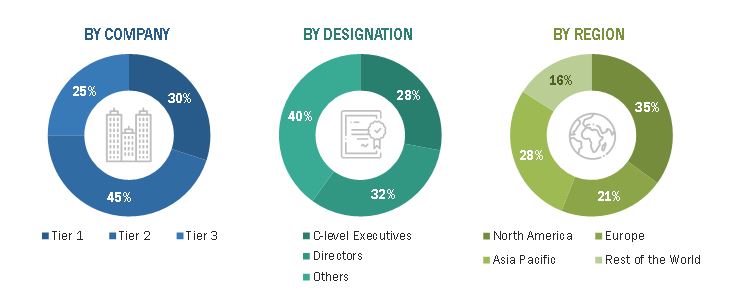

This study involved four major activities in estimating the current size of the vascular patches market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2019, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

Both top-down and bottom-up approaches were used to estimate and validate the vascular patches market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the vascular patches market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global vascular patches market on the basis of material, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall vascular patches market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to five main regions—North America, Europe, the Asia Pacific, and the Rest of the World

- To strategically profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as acquisition, increased production capacity, and other growth strategies in the vascular patches market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Geographic Analysis

- Further breakdown of the vascular patches market into specific countries/regions in the Rest of Europe, the Rest of Asia Pacific, and the Rest of the World

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vascular Patches Market