Autonomous Tractors Market by Power Output (Up to 30 HP, 31–100 HP, 101 HP and Above), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Farm Application, Component and Region - Global Forecast to 2028

Autonomous Tractors Market Size, Trends and Growth Analysis, 2028

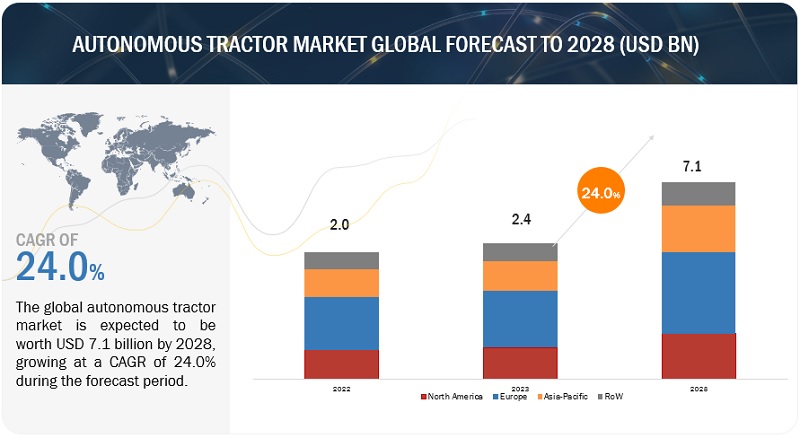

The global autonomous tractors market size was valued at $2.4 billion in 2023, and is projected to reach $7.1 billion by 2028, registering a CAGR of 24.0% from 2023 to 2028. There are a number of important elements that are transforming modern agriculture that can be linked to the global growth of the autonomous tractor market. These factors include increasing demand for sustainable and efficient farming practices.

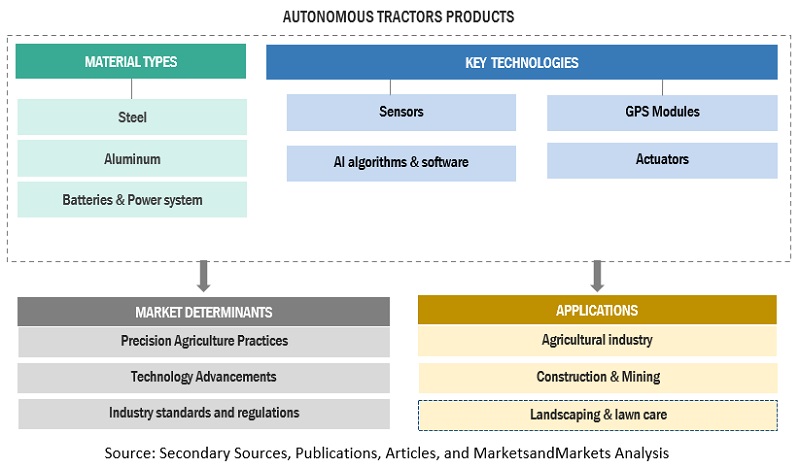

Modern agriculture is facing the challenge of producing higher yields to feed a growing global population while minimizing the environmental impact. Autonomous tractors play a pivotal role in achieving these goals by enabling precision agriculture. These tractors are equipped with advanced sensors, GPS technology, and AI algorithms that allow them to perform tasks with a high level of precision. Since these tractors directly address the need for sustainable and efficient farming practices, therefore the market is anticipated to have significant growth in the upcoming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Autonomous Tractors Market Dynamics

Drivers : Maturing IoT and navigation technologies are driving down cost of automation.

Low-cost IoT devices connected with farm management software are helping farmers to analyze data on weather, temperature, moisture, and even accounting. They further provide insights to help optimize yield, improve planning, and make smarter decisions to maximize productivity. For example, CropX (US) is a company that provides soil sensors for farms that can provide alerts when soil conditions are not optimal. A farmer can receive a notification in real-time in case of lower moisture levels in a certain part of the field and change the delivery of water in the irrigation system, accordingly.

The use of GPS real-time kinematics (RTK) navigation in agriculture has become a standard for auto-steering systems in tractors and combined harvesters. For many applications, the standalone GPS signal can deliver sufficient accuracy without the need for extra radio beacons. The Wheelman Pro auto-steering system from AgJunction (US) that uses GPS costs USD 3,995, making it affordable for many farmers.

For high-precision tasks, multimodal systems based on a combination of GPS, INS, LiDAR, and vision systems are used to provide greater accuracy. EcoRobotix (Switzerland), among other companies, have been automating the seeding and weeding processes by combining both GPS and a vision system. In essence, the integration of IoT and navigation technologies into autonomous tractors is streamlining operations, improving efficiency, and reducing costs in the agricultural sector. This, in turn, is driving autonomous tractors market growth by making them more financially viable and appealing to farmers seeking to modernize their practices while minimizing costs.

Restraint: Lack of technical knowledge among farmers

Since these advanced machines like autonomous tractor integrate complex technologies such as GPS navigation, sensors, machine learning algorithms, and remote monitoring systems, farmers need to have a solid understanding of these components to operate, troubleshoot, and maintain the equipment effectively. Without adequate technical know-how, farmers might struggle to fully harness the capabilities of autonomous tractors, leading to underutilization, increased downtime, and potential errors. Bridging the gap between technological advancements and the knowledge level of farmers will be crucial in unlocking the true potential of autonomous tractors and realizing the promised benefits for the agricultural sector.

Opportunity: Integration of smartphones with agricultural hardware and software applications for autonomous tractors

Most smartphone apps are inexpensive and provide crucial information related to farming, such as weather and climate conditions. These apps effectively help farmers to make smart decisions. Smartphones can be integrated with several hardware devices such as sensors, high-resolution cameras, and GPS receivers for various activities such as sample collection, aerial imaging, and record-keeping (experts recommended). Some farming apps can load field information, and smartphones also help small-scale farmers connect with customers and agents. Farmers can access smartphone apps to get precise information on climate, weather, water, seed grains, and fertilizers, which helps them plan, plant, and harvest. Due to its convenient usage and affordability, the demand for the same will surge in the global autonomous tractors market.

To know about the assumptions considered for the study, download the pdf brochure

Challenges in the Autonomous Tractors Market: High cost and complexity of fully autonomous tractors

Autonomous tractors involve substantial upfront costs due to the integration of advanced technologies like GPS, sensors, and AI. These costs can be a deterrent for farmers, especially small-scale operators with limited financial resources, hindering widespread adoption. Additionally, they rely on strong and reliable connectivity for data transmission and control. In areas with poor network coverage, maintaining a consistent connection can be challenging. This can affect the real-time monitoring and coordination of the tractors. The integration of autonomous tractors with existing farm management systems and machinery can be complex, leading to compatibility issues and potential infrastructure upgrades.

Moreover, the advanced technology in tractors demands specialized maintenance and repairs, potentially resulting in higher costs and downtime due to limited availability of skilled technicians. The collection and transmission of extensive data by these tractors also raises concerns about data privacy and security, necessitating robust safeguards against unauthorized access and cyber threats. Additionally, the limited adaptability of some autonomous tractors to specific tasks or crops poses challenges for farmers with diverse operations. Balancing the potential benefits of efficiency, reduced labor costs, and improved yields against the upfront investment and ongoing expenses contributes to uncertainty regarding return on investment. Overcoming farmers' apprehensions, building trust, and enhancing the technology's reliability require collaborative efforts from stakeholders, including innovation, cost reduction, standardized interfaces, and improved training programs to drive wider adoption and foster market growth.

Autonomous Tractors Market Ecosystem

Autonomous tractors fall into the agricultural technology industry. They are a specialized segment within the broader agricultural machinery and equipment sector. The agricultural technology industry encompasses various technological innovations and advancements aimed at improving agricultural practices, efficiency, and sustainability. Prominent companies in this market include AGCO Corporation (US), CNH Industrial N.V. (UK), Mahindra & Mahindra Ltd. (India), Deere & Company (US), Kubota Corporation (Japan), Yanmar Holdings Co., Ltd. (Japan), Autonomous Tractors Corporation (US), SDF Group (Italy), Iseki & CO., LTD. (Japan), TYM Corporation (South Korea), J C Bamford Excavators Ltd. (UK), Tractors and Farm Equipment (India), Sonalika (India), Daedong (South Korea), CLAAS KGaA mBH (Germany) and Argo Tractors (Italy).

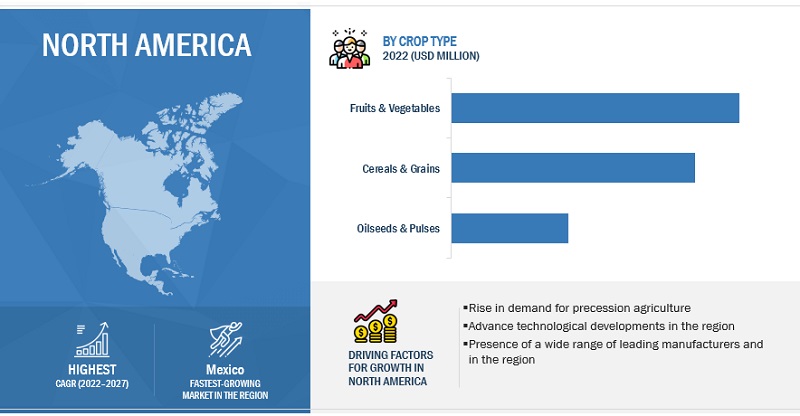

Within the crop type segment, fruits and vegetables is projected to have the highest market share during the forecast period.

The fruits & vegetables segment includes orange, vineyards, and others. With the increase in the global population, the demand for fruits & vegetables is also increasing at a rapid pace. The implementation of autonomous tractors in fruit and vegetable farming also leads to sustainable practices. These vehicles can be programmed to follow specific patterns, avoiding unnecessary damage to crops and minimizing soil compaction. This eco-friendly approach aligns with the increasing focus on sustainable agriculture, which appeals to consumers and regulatory bodies. Therefore, such factors contribute to the growth of the autonomous tractors market and fruit and vegetables category being the largest segment in application segment, it is expected to boost the market growth further.

Within the farm application segment, tillage is predicted to have the largest market value during the forecast period.

Tillage traditionally required significant manual labor and skilled operators to navigate the tractor and implements accurately. With autonomous tractors, farmers can reduce their dependency on skilled labor, especially during peak seasons, leading to cost savings and increased operational flexibility. Additionally, many autonomous tractors are equipped with sensors that can collect valuable data during the tillage process, such as soil moisture levels, compaction, and other soil characteristics. This data can be analyzed to make informed decisions about soil health and future tillage practices, leading to more sustainable farming practices. Agricultural industries worldwide are emphasizing the adoption of advanced technologies to improve farm productivity and address the challenges posed by labor shortages and the need for sustainable practices. These factors further contribute to the growth of autonomous tractors market, particularly in tillage applications.

Within the power output segment, 101 HP and above is anticipated to have the leading market share during the forecast period.

North America and Europe have a larger average farm size as compared to other regions, which drives the demand for high engine power tractors. Tractors rendering above 100 HP are required in these regions to complete farming activities on time. Europe and North America have a high urban population which is dependent on the small farming population in the region. Additionally, the farming population is reducing in terms of migrating to urban areas for better employment opportunities.

As per the World Bank data, the European urban population was 75.7% in 2023 as compared to 57.4% in 1960. This shows the increasing trend of rapid urbanization worldwide. To overcome the above challenges, farmers with large farm holdings opt for autonomous tractors with high power output. The use of these high-powered tractors allows farmers to efficiently handle larger fields, heavy machinery, and more demanding tasks such as tilling, planting, and harvesting. The autonomous tractors market is growing due to the increasing adoption of modern farming techniques, precision agriculture, and the need for higher productivity to meet the demands of a growing population.

Within the component segment, camera/vision segment is projected to have biggest market value during the forecast period.

Camera/vision technologies enable real-time monitoring of the surroundings, enabling the tractor to navigate through complex terrains, detect obstacles, and make intelligent decisions. With increased accuracy in tasks such as planting, spraying, and harvesting, autonomous tractors improve productivity and reduce operational costs for farmers. As the market recognizes the transformative impact of Camera/Vision systems on agricultural practices, the adoption of autonomous tractors is expected to surge, fueling overall market growth.

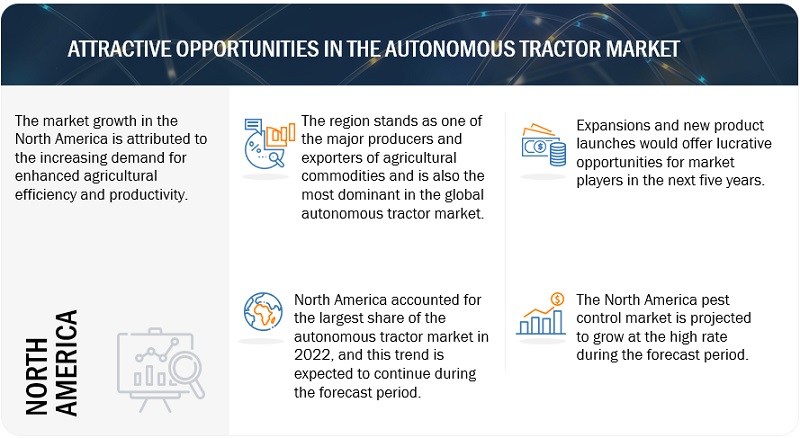

North America is expected to have the largest market share in the autonomous tractors market during the forecast period.

The rapid expansion of the autonomous market in North America can be attributed to a confluence of factors that have created a fertile ground for technological advancement and adoption. The region boasts a robust ecosystem of innovation, with a dense network of tech companies, research institutions, and venture capital firms that actively support and invest in autonomous technologies.

Moreover, favorable regulatory environments and government initiatives aimed at promoting research and development have encouraged the growth of the autonomous tractors market. The agricultural landscape in North America, characterized by large-scale farming operations, also presents a compelling case for autonomous solutions. These factors, coupled with the pressing need for increased efficiency, sustainability, and precision in agriculture, have accelerated the adoption of autonomous technologies in various sectors, positioning North America at the forefront of the global autonomous market expansion.

Key Market Players in the Autonomous Tractors Market

The key players in this include AGCO Corporation (US), CNH Industrial N.V. (UK), Mahindra & Mahindra Ltd. (India), Deere & Company (US), Kubota Corporation (Japan), Yanmar Holdings Co., Ltd. (Japan), Autonomous Tractors Corporation (US), SDF Group (Italy), Iseki & CO., LTD. (Japan), TYM Corporation (South Korea), J C Bamford Excavators Ltd. (UK), Tractors and Farm Equipment (India), Sonalika (India), Daedong (South Korea), CLAAS KGaA mBH (Germany) and Argo Tractors (Italy). Companies are focusing on expanding their production facilities by entering into partnerships and agreements as well as by launching new products to grow their businesses and their market share. New product launches because of extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies are the key strategies adopted by companies in the market.

Autonomous Tractors Market Report Scope

|

Report Metric |

Details |

|

Market revenue in 2023 |

USD 2.4 billion |

|

Revenue prediction in 2028 |

USD 7.1 billion |

|

Growth rate |

CAGR of 24.0% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) and Units |

|

Autonomous Tractors Market Segmentation |

Crop Type, Farm Application, Power Output, Component, and Region. |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

|

|

Market growth driver |

Maturing IoT and navigation technologies to drive the market growth |

|

Largest growing region |

North America |

Autonomous Tractors Market Segmentation

This research report categorizes the market based on crop type, farm application, power output, component, and region.

|

Segment |

Subsegment |

|

Based on farm application |

|

|

Based on the crop type |

|

|

Based on the power output |

|

|

Based on the component |

|

|

Based on the region |

|

Recent Developments in the Autonomous Tractors Market

- In February 2023, Kubota Corporation launched LX20 Series, with the LX3520 and LX4020 serving as the first two models. It is also expanding its popular L02 Series by introducing the L2502 and L4802. With this launch Kubota is expanding its LX series and L02 series with these new tractor launches.

- In June 2022, the farm equipment division of Mahindra introduced six new tractor types. They are included in the tractor platform known as Yuvo Tech+, which was established last year. The m-ZIP 3-cylinder and ELS 4-cylinder engines power these tractors. This launch has helped Mahindra to cater to the needs of Indian farmers and helping the company to enhance their tractors availability list.

- In May 2022, JCB has introduced its new Fastrac 4000 and 8000 Series tractors with an entirely new electronics architecture that offers operators an unrivalled range of options for operating their equipment while delivering improved levels of performance and convenience. With this launch JCB aimed at expanding its market in the tractors segment.

- In July 2021, AGCO signed a deal with Deutz to supply engines for its Fendt tractors. The partnership includes a supply agreement for updated 6.1 litre and 4.1 litre engines to be used in selected Fendt tractors. The partnership also includes development cooperation on future technologies. In addition, Agco and Deutz will explore closer cooperation on engines or engine installation components below 150 hp.

Frequently Asked Questions (FAQ):

Which are the major companies in the autonomous tractors market?

The key players in this include AGCO Corporation (US), CNH Industrial N.V. (UK), Mahindra & Mahindra Ltd. (India), Deere & Company (US), Kubota Corporation (Japan), Yanmar Holdings Co., Ltd. (Japan), Autonomous Tractors Corporation (US), SDF Group (Italy), Iseki & CO., LTD. (Japan), TYM Corporation (South Korea), J C Bamford Excavators Ltd. (UK), Tractors and Farm Equipment (India), Sonalika (India), Daedong (South Korea), CLAAS KGaA mBH (Germany) and Argo Tractors (Italy).

What are the drivers and opportunities for the autonomous tractors market?

Improved efficiency and productivity through improved crop yields, growing trend of mechanization in the agricultural industry, and maturing IoT and navigation technologies are driving down cost of automation are some of the major drivers. The upcoming opportunities include the untapped market potential and scope for automation in agriculture.

Which region is expected to hold the highest market share in autonomous tractors market?

The market in North America will dominate the market with the largest share in 2023, showcasing strong demand for autonomous tractors in the region.

Which are the key technology trends prevailing in the autonomous tractor market?

The autonomous tractor industry is experiencing technological innovations as companies engaged in the autonomous tractor market are offering faster and more accurate technologies such as artificial intelligence (AI). The autonomy of tractors, which revolutionizes modern agriculture, is made possible by AI technology. Tractors can detect their environment and recognize objects by analyzing data from sensors like LiDAR, radar, and cameras. This allows them to make wise navigational and task-related judgements. For instance, an autonomous tractor using AI algorithms may detect obstacles in the field, such as rocks or trees, and modify its path to prevent collisions. Tractors may also adjust and improve their performance over time thanks to machine learning capabilities.

What is the total CAGR expected to be recorded for the autonomous tractor market during 2023-2028?

The autonomous tractors market is expected to record a CAGR of 24.0% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for enhanced efficiency and productivity through improved crop yields- Advent of mechanization in agricultural sector- Need of IoT and navigation technologies to drive down automationRESTRAINTS- Lack of technical knowledge among farmersOPPORTUNITIES- Rising use of smartphones as agricultural tool- Untapped market potential and scope for automation in agricultureCHALLENGES- Lack of data management in agriculture- High cost and complexity of fully autonomous tractors

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND DEVELOPMENTPROCUREMENTMANUFACTURING/PRODUCTIONDISTRIBUTIONMARKETING AND SALESEND USERS

-

6.3 ECOSYSTEM/MARKET MAPUPSTREAM- Manufacturers of autonomous tractors- Raw material providersDOWNSTREAM- Retailers and distributors

-

6.4 TARIFFS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- europe- Global

-

6.5 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE (AI)SWARM ROBOTICS

- 7.1 INTRODUCTION

-

7.2 TILLAGE (PRIMARY & SECONDARY TILLAGE)NEED TO REDUCE RELIANCE ON LABOR AND OFFER FLEXIBLE OPERATIONS TO BOOST DEMAND FOR AUTONOMOUS TRACTORS

-

7.3 SEED SOWINGGROWING EMPHASIS ON PRECISE AND ACCURATE PLANNING AND MINIMIZING SEED WASTE TO DRIVE MARKET

-

7.4 HARVESTINGFOCUS ON DETECTING CROP POSITION AND ENSURING ACCURACY OF HARVESTING TO BOOST GROWTH

- 7.5 OTHER FARM APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 CEREALS & GRAINSDEMAND FOR HIGHER YIELD, COST-EFFECTIVENESS, AND SUSTAINABLE FARMING PRACTICES TO FUEL DEMAND FOR AUTONOMOUS TRACTORSCORNWHEATRICEOTHER CEREALS & GRAINS

-

8.3 OILSEEDS & PULSESINCREASED EXPORT OF OILSEEDS & GRAINS TO FUEL DEMAND FOR AUTONOMOUS TRACTORSSOYBEANCANOLAOTHER OILSEEDS & PULSES

-

8.4 FRUITS & VEGETABLESNEED TO PREVENT CROP DAMAGE AND REDUCE SOIL COMPACTION TO PROPEL MARKETORANGEVINEYARDSOTHER FRUITS & VEGETABLES

- 9.1 INTRODUCTION

-

9.2 LIDARRISING FOCUS ON ENHANCING PRODUCTIVITY AND DECREASING OPERATIONAL COSTS TO BOOST MARKET

-

9.3 RADAREMPHASIS ON INCREASING PRODUCTIVITY AND REDUCING ACCIDENTS TO DRIVE MARKET

-

9.4 GPSNEED FOR FARMERS TO REDUCE HUMAN INTERVENTION TO DRIVE DEMAND FOR GPS-EQUIPPED AUTONOMOUS TRACTORS

-

9.5 CAMERA/VISION SYSTEMSGROWING ATTENTION TO SAFETY AND PRECISION IN AGRICULTURAL PRACTICES TO BOOST MARKET

-

9.6 ULTRASONIC SENSORSDEMAND FOR TRACTORS WITH HIGH ADAPTABILITY TO CHANGING WEATHER CONDITIONS TO ENCOURAGE MARKET GROWTH

-

9.7 HANDHELD DEVICESFOCUS ON REDUCING HUMAN INTERVENTION IN TRACTOR OPERATIONS TO PROPEL MARKET GROWTH

- 10.1 INTRODUCTION

-

10.2 UP TO 30 HPRISING DEMAND FOR TRACTORS WITH HIGH FUEL-EFFICIENCY AND DECREASED POWER USAGE TO PROPEL MARKET

-

10.3 31-100 HPGROWING EMPHASIS ON COST AND POWER EFFICIENCY TO ENCOURAGE MARKET EXPANSION

-

10.4 101 HP & ABOVERISING NEED TO EFFECTIVELY MANAGE LARGE FIELDS AND DEMANDING TASKS TO PROMOTE MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing use of sensing technologies in farms to drive marketCANADA- Rising adoption of farm mechanization techniques to spur demand for autonomous tractorsMEXICO- Government initiatives to promote adoption of climate monitoring techniques to boost market

-

11.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Growth in production of vegetables and cotton to drive demand for autonomous tractorsINDIA- Increasing adoption of agricultural technology to propel marketJAPAN- Increasing government initiatives and agricultural developments to drive marketSOUTH KOREA- Increased rice cultivation and adoption of new technologies to drive marketREST OF ASIA PACIFIC

-

11.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Adoption of precision farming technology to drive marketFRANCE- Increased agricultural GDP in France to spur demand for automation to drive demand for autonomous tractorsITALY- Need for customized vineyard operations to encourage market expansionUK- Growing popularity of robotics and agricultural automation to drive market demandTURKEY- Rising consumption of nuts and tobacco to boost adoption of autonomous tractorsREST OF EUROPE

-

11.5 REST OF WORLDROW: RECESSION IMPACT ANALYSISBRAZIL- Need to address labor shortages and reduce human intervention to drive demand for autonomous tractorsRUSSIA- Increasing export of wheat to drive adoption of autonomous tractorsOTHERS IN ROW

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS

-

12.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSAGCO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCNH INDUSTRIAL N.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMAHINDRA & MAHINDRA LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDEERE & COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUBOTA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYANMAR HOLDINGS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAUTONOMOUS TRACTOR CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSDF GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewISEKI & CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTYM CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJ C BAMFORD EXCAVATORS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRACTORS AND FARM EQUIPMENT LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSONALIKA GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDAEDONG CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCLAAS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARGO TRACTORS SPA.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 TECHNOLOGY PROVIDERSBEAR FLAG ROBOTICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRIMBLE INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGJUNCTION INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAVEN INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGXEED B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAG LEADER TECHNOLOGYNAÏO TECHNOLOGIESTOPCON AGRICULTUREECOROBOTIX SA

- 14.1 INTRODUCTION

-

14.2 AGRICULTURAL ROBOTS MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWAGRICULTURAL ROBOTS MARKET, BY TYPEAGRICULTURAL ROBOTS MARKET, BY REGION

-

14.3 PRECISION FARMING MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWPRECISION FARMING MARKET, BY OFFERINGPRECISION FARMING MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- TABLE 4 AUTONOMOUS TRACTORS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2019–2022 (USD MILLION)

- TABLE 7 AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2023–2028 (USD MILLION)

- TABLE 8 TILLAGE: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 9 TILLAGE: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 10 SEED SOWING: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 11 SEED SOWING: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 12 HARVESTING: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 13 HARVESTING: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 OTHER FARM APPLICATIONS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 15 OTHER FARM APPLICATIONS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 17 AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 18 CEREALS & GRAINS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 CEREALS & GRAINS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 CEREALS & GRAINS: AUTONOMOUS TRACTORS MARKET, BY SUB-CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 21 CEREALS & GRAINS: AUTONOMOUS TRACTORS MARKET, BY SUB-CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 22 OILSEEDS & PULSES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 OILSEEDS & PULSES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 OILSEEDS & PULSES: AUTONOMOUS TRACTORS MARKET, BY SUB-CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 25 OILSEEDS & PULSES: AUTONOMOUS TRACTORS MARKET, BY SUB-CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 26 FRUITS & VEGETABLES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 FRUITS & VEGETABLES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 FRUITS & VEGETABLES: AUTONOMOUS TRACTORS MARKET, BY SUB-CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 29 FRUITS & VEGETABLES: AUTONOMOUS TRACTORS MARKET, BY SUB-CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 30 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (‘000 UNITS)

- TABLE 31 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (‘000 UNITS)

- TABLE 32 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 33 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 34 LIDAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (‘000 UNITS)

- TABLE 35 LIDAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 36 LIDAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 LIDAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 RADAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (‘000 UNITS)

- TABLE 39 RADAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 40 RADAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 RADAR: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 GPS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (‘000 UNITS)

- TABLE 43 GPS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 44 GPS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 GPS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 CAMERA/VISION SYSTEMS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (‘000 UNITS)

- TABLE 47 CAMERA/VISION SYSTEMS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 48 CAMERA/VISION SYSTEMS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 CAMERA/VISION SYSTEMS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 ULTRASONIC SENSORS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (‘000 UNITS)

- TABLE 51 ULTRASONIC SENSORS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 52 ULTRASONIC SENSORS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 ULTRASONIC SENSORS: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 HANDHELD DEVICES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (‘000 UNITS)

- TABLE 55 HANDHELD DEVICES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 56 HANDHELD DEVICES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 HANDHELD DEVICES: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 59 AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 60 UP TO 30 HP: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (UNITS)

- TABLE 61 UP TO 30 HP: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 62 31-100 HP: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (UNITS)

- TABLE 63 31-100 HP: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 64 101 HP & ABOVE: AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (UNITS)

- TABLE 65 101 HP & ABOVE: AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 68 AUTONOMOUS TRACTORS MARKET, BY REGION, 2019–2022 (UNITS)

- TABLE 69 AUTONOMOUS TRACTORS MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 70 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 71 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 72 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (’000 UNITS)

- TABLE 73 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (’000 UNITS)

- TABLE 74 AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 75 AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 76 AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 77 AUTONOMOUS TRACTORS MARKET, BY CROP TYPE 2023–2028 (USD MILLION)

- TABLE 78 AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2019–2022 (USD MILLION)

- TABLE 79 AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2019–2022 (’000 UNITS)

- TABLE 81 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2023–2028 (’000 UNITS)

- TABLE 82 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (’000 UNITS)

- TABLE 83 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (’000 UNITS)

- TABLE 84 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 87 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 88 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2019–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 US: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 93 US: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 94 CANADA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 95 CANADA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 96 MEXICO: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 97 MEXICO: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 98 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2019–2022 (UNITS)

- TABLE 99 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2023–2028 (UNITS)

- TABLE 100 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (’000 UNITS)

- TABLE 101 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (’000 UNITS)

- TABLE 102 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 105 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 106 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 CHINA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 111 CHINA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 112 INDIA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 113 INDIA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 114 JAPAN: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 115 JAPAN: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 116 SOUTH KOREA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 117 SOUTH KOREA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 118 REST OF ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 119 REST OF ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 120 EUROPE: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2019–2022 (UNITS)

- TABLE 121 EUROPE: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2023–2028 (UNITS)

- TABLE 122 EUROPE: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (’000 UNITS)

- TABLE 123 EUROPE: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (’000 UNITS)

- TABLE 124 EUROPE: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 125 EUROPE: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 127 EUROPE: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 128 EUROPE: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 129 EUROPE: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2019–2022 (USD MILLION)

- TABLE 131 EUROPE: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 SGERMANY: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 133 GERMANY: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 134 FRANCE: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 135 FRANCE: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 136 ITALY: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 137 ITALY: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 138 UK: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 139 UK: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 140 TURKEY: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 141 TURKEY: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 142 REST OF EUROPE: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 143 REST OF EUROPE: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 144 ROW: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2019–2022 (UNITS)

- TABLE 145 ROW: AUTONOMOUS TRACTORS MARKET, BY COUNTRY, 2023–2028 (UNITS)

- TABLE 146 ROW: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 147 ROW: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 148 ROW: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2019–2022 (’000 UNITS)

- TABLE 149 ROW: AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023–2028 (’000 UNITS)

- TABLE 150 ROW: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 151 ROW: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 152 ROW: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 153 ROW: AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 154 ROW: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2019–2022 (USD MILLION)

- TABLE 155 ROW: AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 BRAZIL: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 157 BRAZIL: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 158 RUSSIA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 159 RUSSIA: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 160 OTHERS IN ROW: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2019–2022 (UNITS)

- TABLE 161 OTHERS IN ROW: AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023–2028 (UNITS)

- TABLE 162 AUTONOMOUS TRACTORS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 163 COMPANY FOOTPRINT, BY FARM APPLICATION

- TABLE 164 COMPANY FOOTPRINT, BY CROP TYPE

- TABLE 165 COMPANY FOOTPRINT, BY REGION

- TABLE 166 OVERALL COMPANY FOOTPRINT

- TABLE 167 LIST OF TECHNOLOGY PROVIDERS

- TABLE 168 COMPETITIVE BENCHMARKING, BY COMPONENT AND REGION

- TABLE 169 AUTONOMOUS TRACTORS MARKET: PRODUCT LAUNCHES, 2021–2023

- TABLE 170 AUTONOMOUS TRACTORS MARKET: DEALS, 2021–2022

- TABLE 171 AUTONOMOUS TRACTORS MARKET: OTHERS, 2019

- TABLE 172 AGCO CORPORATION: BUSINESS OVERVIEW

- TABLE 173 AGCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 AGCO CORPORATION: PRODUCT LAUNCHES

- TABLE 175 AGCO CORPORATION: DEALS

- TABLE 176 CNH INDUSTRIAL N.V.: BUSINESS OVERVIEW

- TABLE 177 CNH INDUSTRIAL N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 CNH INDUSTRIAL N.V.: PRODUCT LAUNCHES

- TABLE 179 MAHINDRA & MAHINDRA LTD.: BUSINESS OVERVIEW

- TABLE 180 MAHINDRA & MAHINDRA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 MAHINDRA & MAHINDRA LTD.: PRODUCT LAUNCHES

- TABLE 182 DEERE & COMPANY: BUSINESS OVERVIEW

- TABLE 183 DEERE & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 DEERE & COMPANY: PRODUCT LAUNCHES

- TABLE 185 KUBOTA CORPORATION: BUSINESS OVERVIEW

- TABLE 186 KUBOTA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 KUBOTA CORPORATION: PRODUCT LAUNCHES

- TABLE 188 YANMAR HOLDINGS CO., LTD.: BUSINESS OVERVIEW

- TABLE 189 YANMAR HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 AUTONOMOUS TRACTOR CORPORATION: BUSINESS OVERVIEW

- TABLE 191 AUTONOMOUS TRACTOR CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 192 SDF GROUP: BUSINESS OVERVIEW

- TABLE 193 SDF GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 194 SDF GROUP: OTHERS

- TABLE 195 ISEKI & CO., LTD.: BUSINESS OVERVIEW

- TABLE 196 ISEKI & CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 TYM CORPORATION: BUSINESS OVERVIEW

- TABLE 198 TYM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 J C BAMFORD EXCAVATORS LTD.: BUSINESS OVERVIEW

- TABLE 200 J C BAMFORD EXCAVATORS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 J C BAMFORD EXCAVATORS LTD.: PRODUCT LAUNCHES

- TABLE 202 TRACTORS AND FARM EQUIPMENT LIMITED: BUSINESS OVERVIEW

- TABLE 203 TRACTORS AND FARM EQUIPMENT LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 204 TRACTORS AND FARM EQUIPMENT LIMITED: PRODUCT LAUNCHES

- TABLE 205 SONALIKA GROUP: BUSINESS OVERVIEW

- TABLE 206 SONALIKA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 SONALIKA GROUP: PRODUCT LAUNCHES

- TABLE 208 DAEDONG CORPORATION: BUSINESS OVERVIEW

- TABLE 209 DAEDONG CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 DAEDONG CORPORATION: PRODUCT LAUNCHES

- TABLE 211 CLAAS: BUSINESS OVERVIEW

- TABLE 212 CLAAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 CLAAS: PRODUCT LAUNCHES

- TABLE 214 ARGO TRACTORS S.P.A.: BUSINESS OVERVIEW

- TABLE 215 ARGO TRACTORS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 BEAR FLAG ROBOTICS: BUSINESS OVERVIEW

- TABLE 217 BEAR FLAG ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 TRIMBLE INC.: BUSINESS OVERVIEW

- TABLE 219 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 221 TRIMBLE INC.: DEALS

- TABLE 222 AGJUNCTION INC.: BUSINESS OVERVIEW

- TABLE 223 AGJUCNTION INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 AGJUNCTION INC.: PRODUCT LAUNCHES

- TABLE 225 RAVEN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 226 RAVEN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 RAVEN INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 228 AGXEED B.V.: BUSINESS OVERVIEW

- TABLE 229 AGXEED B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 AGRICULTURAL ROBOTS MARKET, BY TYPE, 2017–2026 (USD MILLION)

- TABLE 231 AGRICULTURAL ROBOTS MARKET, BY REGION, 2017–2026 (USD MILLION)

- TABLE 232 PRECISION FARMING MARKET, BY OFFERING, 2018–2030 (USD MILLION)

- TABLE 233 PRECISION FARMING MARKET, BY REGION, 2018–2030 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

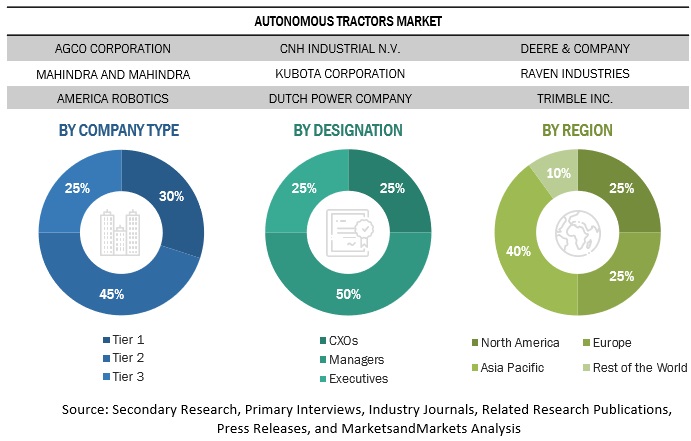

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 AUTONOMOUS TRACTORS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 AUTONOMOUS TRACTORS MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 6 AUTONOMOUS TRACTORS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 AUTONOMOUS TRACTORS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 RECESSION INDICATORS

- FIGURE 10 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 11 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON AUTONOMOUS TRACTORS MARKET

- FIGURE 13 GLOBAL AUTONOMOUS TRACTORS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 14 AUTONOMOUS TRACTORS MARKET SIZE, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 AUTONOMOUS TRACTORS MARKET SIZE, BY FARM APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT, 2023 VS. 2028 (UNITS)

- FIGURE 17 AUTONOMOUS TRACTORS MARKET, BY COMPONENT, 2023 VS. 2028 (’000 UNITS)

- FIGURE 18 AUTONOMOUS TRACTORS MARKET SHARE (VOLUME), BY REGION, 2022

- FIGURE 19 GROWING TREND OF MECHANIZATION IN AGRICULTURE INDUSTRY TO DRIVE DEMAND FOR AUTONOMOUS TRACTORS DURING FORECAST PERIOD

- FIGURE 20 GERMANY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 21 NORTH AMERICA TO DOMINATE COMPONENT MARKET DURING FORECAST PERIOD

- FIGURE 22 FRUITS & VEGETABLES CROP TYPE TO DOMINATE MARKET IN 2023

- FIGURE 23 US AND CHINA TO DOMINATE MARKET IN 2022

- FIGURE 24 PER CAPITA ARABLE LAND, 1965–2020 (HA)

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AUTONOMOUS TRACTORS MARKET

- FIGURE 26 AVERAGE FARM SIZE, 2014–2021 (ACRES)

- FIGURE 27 AUTONOMOUS TRACTORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 AUTONOMOUS TRACTORS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 AUTONOMOUS TRACTORS MARKET: MARKET MAP

- FIGURE 30 AUTONOMOUS TRACTORS MARKET, BY FARM APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 31 AUTONOMOUS TRACTORS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 32 AUTONOMOUS TRACTORS MARKET SIZE, BY COMPONENT, 2023 VS. 2028 (‘000 UNITS)

- FIGURE 33 AUTONOMOUS TRACTORS MARKET SIZE, BY POWER OUTPUT, 2023 VS. 2028 (‘000 UNITS)

- FIGURE 34 AUTONOMOUS TRACTORS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 MEXICO TO ACCOUNT FOR HIGHEST GROWING RATE DURING FORECAST PERIOD

- FIGURE 36 INFLATION: COUNTRY-LEVEL DATA (2017–2021)

- FIGURE 37 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 38 ASIA PACIFIC: AUTONOMOUS TRACTORS MARKET SNAPSHOT, 2022

- FIGURE 39 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 40 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 41 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 43 ROW: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 44 ROW: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 45 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 46 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 47 COMPANY EVALUATION MATRIX FOR TECHNOLOGY PROVIDERS, 2022

- FIGURE 48 AGCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 CNH INDUSTRIAL N.V.: COMPANY SNAPSHOT

- FIGURE 50 MAHINDRA & MAHINDRA LTD.: COMPANY SNAPSHOT

- FIGURE 51 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 52 KUBOTA CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 YANMAR HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 54 SDF GROUP: COMPANY SNAPSHOT

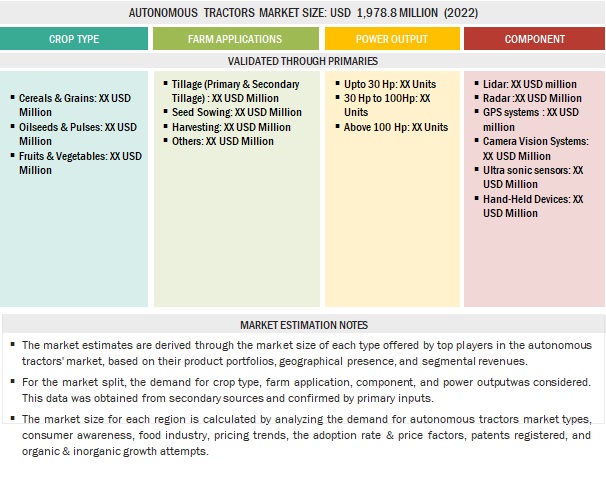

- FIGURE 55 TRIMBLE INC.: COMPANY SNAPSHOT

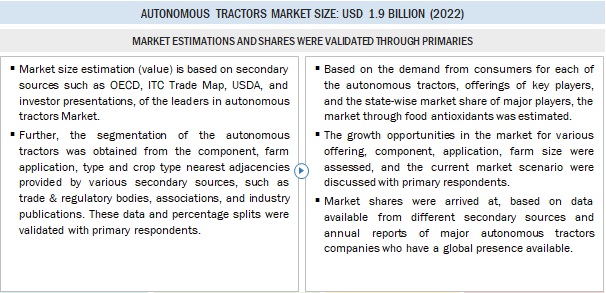

The study involved secondary research and primary research activities in estimating the current size of the autonomous tractors market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, autonomous tractors market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives.

Primary Research

The autonomous tractor market includes several stakeholders in the supply chain, including raw material suppliers, technology and service providers, and regulatory organizations. The demand side of the market is characterized by farm machinery associations, tractor dealers, and distributors. Manufacturers, technology & service providers, and raw material suppliers characterize the supply side.

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the insect repellents sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in the autonomous tractor market.

To know about the assumptions considered for the study, download the pdf brochure

Autonomous Tractors Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The revenues of major autonomous tractors were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the autonomous tractors market has been arrived at.

-

Bottom-up approach:

- The market sizes were analyzed based on the share of autonomous tractors’ market for each farm application at regional and country levels. Thus, with a bottom-up approach to the application at the country level, the global market for autonomous tractors was estimated.

- The global market for applications was estimated based on the demand for applications, offerings of key players, and the region-wise market share of major players.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the market growth market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Autonomous Tractors Market Size: Bottom-Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. This approach was employed to determine the size of the market in particular regions.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Autonomous Tractors Market Size: Top-Down Approach

The top-down approach used was used to triangulate the data obtained through this study is explained in the next section:

- For the calculation of each type of specific market segment, the most appropriate immediate parent market size was used for implementing the top-down procedure. In the top-down approach, the market size was conducted a detailed analysis of the segmental revenues of the major players (top 20) operating in the market in terms of value was conducted.

- Secondary sources of data such as FAO, ITC Trade Map data, and the secondary reports from FDA, USDA, and EFSA were considered; further, appropriate weightage was assigned to the data derived from each parameter to arrive at the final shares for each region. The regional demand-supply trends, presence of manufacturing units, and regulatory scenario were also analyzed to further validate the shares arrived at. These shares were then confirmed with primary respondents from across regions.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the autonomous tractors market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Autonomous Tractors Market Definition

Autonomous tractors operate without the presence of a human in the tractor. These tractors are programmed independently to perceive position, choose speed, and prevent obstacles during the task in the field. Autonomous tractors use GPS and other major wireless technology on the farmland without the need of an operator. Autonomous tractor technology provides user consistency and application efficiency, consequently minimizing fertilizer, labour, and pesticide usage while maximizing yield.

Autonomous tractors are equipped with advanced sensors, GPS technology, and artificial intelligence systems. They perform various farming tasks, such as plowing, planting, and harvesting, without human intervention. These tractors aim to enhance efficiency, reduce labor requirements, and optimize crop management through precise and automated operations in the field.

Key Stakeholders

- Government and research organizations

- Associations and industrial bodies

- Raw material suppliers for tractors and distributors

- Autonomous tractor component manufacturers

- Autonomous tractors, distributors, and suppliers

- Agriculture equipment and component manufacturing associations

- Agricultural institutes and universities

- Consumers such as farmers

- Logistical service providers

- Technology providers to autonomous tractor component manufacturing companies

- Government, legislative, and regulatory bodies

Autonomous Tractors Market Report Objectives

Market Intelligence

- Determining and projecting the size of the autonomous tractor market based on mode of application, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the autonomous tractor market

Competitive Intelligence

- Identifying and profiling the key market players in the autonomous tractors market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations, and technology in the autonomous tractor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the Rest of Europe autonomous tractors market into Spain, Poland, and Austria.

- Further breakdown of the Rest of Asia Pacific autonomous tractor market into Indonesia and Thailand.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Autonomous Tractors Market