Thin Insulation Market by Type (Sheets & Films, Vacuum Insulation Panels, Coatings), Material (Metals, Aersgels, Silica), Application (Building Thermal Insulation, Pipe Coating Insulation, Thermal Packaging), and by Region - Global Trends & Forecasts to 2021

[163 Pages Report] Thin Insulation Market is projected to reach USD 2.12 Billion by 2021, registering a CAGR of 5.8% between 2016 and 2021. In this study, 2014 has been considered as the historical year and 2015 as the base year for estimating market size of thin insulation.

Objectives of the Study:

- To define and segment the global thin insulation market by type, material, application, and region

- To identify and analyze the key growth drivers, restraints, and opportunities that influences the thin insulation market

- To estimate and forecast the market for thin insulation, in terms of value

- To analyze the recent market developments and competitive strategies such as expansion, new product launch/development, partnership, and merger & acquisition to draw the competitive landscape in the thin insulation market

- To strategically identify and profile the key market players and analyze their core competencies in each type, material, and application of thin insulation market

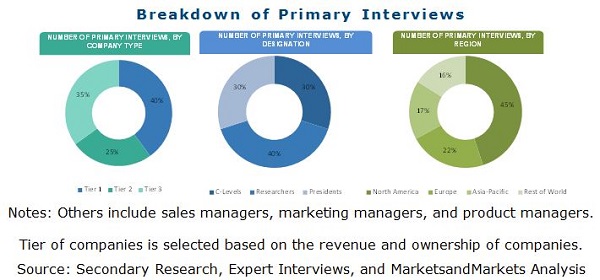

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the thin insulation market. The primary sources mainly include several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. The bottom-up approach has been used to estimate market size of thin insulation, by type, material, application, and region, in terms of both value and volume. The top-down approach has been implemented to validate the market size, in terms of both value and volume. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

Raw material suppliers in the thin insulation market are chemical companies providing raw materials to thin insulation manufacturers. The Dow Corning Corporation (U.S.), Actis Insulation (U.K.), BASF Polyurethanes GmbH (Germany), Kingspan Insulation Ltd. (U.K.), and similar suppliers provide raw materials to the thin insulation manufacturers. Thin insulation manufacturing companies process these raw materials to prepare different types of thin insulation materials suitable for various end-use industries incorporating new technologies.

Target Audience:

- Thin insulation manufacturers

- Thin insulation traders

- Distributors and suppliers

- End-use market participants of different segments of thin insulation

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

This study answers several questions for the stakeholders, primarily which market segments need to be focused in next two to five years for prioritizing the efforts and investments.

Scope of the Report:

This research study categorizes the thin insulation market based on type, material, application, and region and forecasts revenue growth and analysis of trends in each of the submarkets.

On the Basis of Type:

- Sheets & Films

- Vacuum Insulation Panels

- Coatings

- Foils

- Foams

- Others

On the Basis of Material:

- Metals

- Aerogels

- Silica Aerogels

- Plastic Foams

- Fiberglass

- Others

On the Basis of Application:

- Building Thermal Insulation

- Thermal Packaging

- Automotive

- Pipe Coatings

- Wires & Cables

- Others

On the Basis of Region:

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Europe

- Western Europe

- Germany

- U.K.

- France

- Rest of Western Europe

- Eastern & Central Europe

- Russia

- Turkey

- Poland

- Rest of Eastern & Central Europe

- Western Europe

- North America

- U.S.

- Canada

- Mexico

- South America

- Brazil

- Rest of South America

- Middle East & Africa

Available Customizations: The following customization options are available in the report:

- Company Information

Analysis and profiling of additional global as well as regional market players (Up to 3)

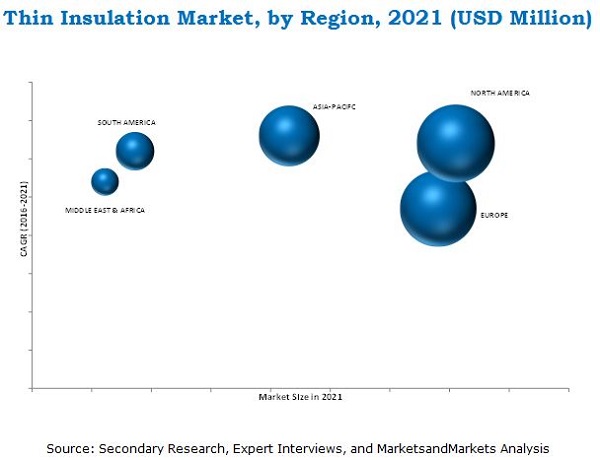

The global thin insulation market size, in terms of value, is projected to reach USD 2.12 Billion by 2021, at a CAGR of 5.8% between 2016 and 2021. The increasing infrastructure development activities in Asia-Pacific and North America and continuous new product launches and joint ventures & collaborations undertaken by different companies are the key factors for the growth of the global thin insulation market.

Thin insulation is widely used in the building thermal insulation application for its thermal resistance or R-value, as higher the R-value, higher will be the heat resistance and lesser the heat will flow. In buildings that have thin walls or timber constructions, the impact of additional insulation is significant. In addition, thin insulation is used in the automotive industry to prevent heat and sound transfer in the vehicle and improve braking performance of the vehicle. It is also used in other end-use industries, thereby driving the thin insulation market.

Plastic foams such as EPS, XPS, polyurethane foams, Polyisocyanurate insulation, phenolic foams, polytetrafluoroethylene, and polyimide are widely used in different applications of thin insulation. These are predominantly used in the oil & gas, construction, and automotive end-use industries due to their excellent thermal resistivity. These foams in particular have become the preferred choice for 10mm to 20mm thickness, solving the space and reliability issues in the construction industry. Thus, the increasing use of these foams in the oil & gas, and automotive end-use industries is expected to drive the thin insulation market during the forecast period.

Asia-Pacific is the fastest-growing thin insulation market globally with China being the largest as well as fastest-growing country in the region. Increasing rural to urban migrations in the region are stimulating the housing construction demand in urban areas; consequently increasing the market size of the thin insulation materials. The growing construction industry (residential and non-residential) and advances in process manufacturing are some of the key drivers for the market in Asia-Pacific. Countries such as India, Indonesia, and China are expected to witness high growth in the thin insulation market, supported by increasing demand from the building & construction industry.

Though the thin insulation market is gaining importance, few factors act as a bottleneck toward the market growth. The major restraint of the thin insulation market is the reducing demand for thin insulation materials due to its high prices. As building thermal insulation is one of the major applications of thin insulation, stagnancy in this industry is subsequently lowering the demand for thin insulation.

Companies such as The Dow Corning Corporation (U.S.), Actis Insulation (U.K.), BASF Polyurethanes GmbH (Germany), and Kingspan Insulation Ltd. (U.K.), are the dominant participants in the global thin insulation market. The diverse product portfolio, strategically positioned R&D centers, continuous adoption of development strategies, and technological advancements are few factors that are responsible for strengthening the position of these companies in the market. They have been adopting various organic and inorganic growth strategies such as joint ventures & collaborations and new product launches to enhance the current market scenario of thin insulation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Thin Insulation Market

4.2 Thin Insulation Market, By Type

4.3 Thin Insulation Market Share, 2015

4.4 Thin Insulation: Market Attractiveness

4.5 Thin Insulation Market: Developing vs Developed Nations

4.6 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Material

5.2.3 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Infrastructure Development Activities in Asia-Pacific Driving the Market

5.3.1.2 A Thinner and Lighter Alternative

5.3.2 Restraints

5.3.2.1 High Capital Costs

5.3.3 Opportunities

5.3.3.1 Potential Substitute for Conventional Insulation Materials

5.3.4 Challenges

5.3.4.1 Withdrawal From Kyoto Protocol

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Supply-Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

7 Thin Insulation Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Sheets & Films

7.3 Vacuum Insulation Panels (VIP)

7.4 Coatings

7.5 Foils

7.6 Foams

7.7 Others

8 Thin Insulation Market, By Material (Page No. - 56)

8.1 Introduction

8.2 Market Size & Projection

8.3 Aerogels

8.4 Silica Aerogels

8.5 Metals

8.6 Plastic Foams

8.7 Fiberglass

8.8 Others

9 Thin Insulation Market, By Application (Page No. - 66)

9.1 Introduction

9.2 Building Thermal Insulation

9.3 Thermal Packaging

9.4 Automotive

9.5 Wires & Cables

9.6 Pipe Coatings

9.7 Others

10 Thin Insulation Market, Regional Analysis (Page No. - 75)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Malaysia

10.2.6 Thailand

10.2.7 Indonesia

10.2.8 Rest of Asia-Pacific

10.3 North America

10.3.1 U.S.

10.3.2 Mexico

10.3.3 Canada

10.4 Europe

10.4.1 Western Europe

10.4.1.1 Germany

10.4.1.2 U.K.

10.4.1.3 France

10.4.1.4 Rest of Western Europe

10.4.2 Central & Eastern Europe

10.4.2.1 Russia

10.4.2.2 Turkey

10.4.2.3 Poland

10.4.2.4 Rest of Central & Eastern Europe

10.5 South America

10.5.1 Brazil

10.5.2 Rest of South America

10.6 Middle East & Africa

11 Competitive Landscape (Page No. - 123)

11.1 Introduction

11.2 New Product Launches: the Most Popular Growth Strategy

11.3 Maximum Developments in Europe, 20112016

11.4 Competitive Situation and Trends

11.4.1 New Product Launch

11.4.2 Agreement/Collaboration

11.4.3 Merger & Acquisition

11.4.4 Expansion, 20112016

11.4.5 Joint Venture

12 Company Profiles (Page No. - 131)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 BASF Polyurethanes GmbH

12.2 DOW Corning

12.3 Kingspan Insulation

12.4 The DOW Chemical Company

12.5 Actis Insulation Ltd.

12.6 Owens Corning

12.7 Johns Manville

12.8 Celotax Saint Gobain

12.9 Huntsman Corporation

12.10 Xtratherm

12.11 Rockwool Group

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 153)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Available Customizations

13.6 Related Reports

List of Tables (112 Tables)

Table 1 Thin Insulation Market, By Type

Table 2 Thin Insulation Market, By Material

Table 3 Thin Insulation Market, By Application

Table 4 Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 5 Sheets & Films Market Size, By Region, 20142021 (USD Million)

Table 6 Vacuum Insulation Panels Market Size, By Region, 20142021 (USD Million)

Table 7 Coatings Market Size, By Region, 20142021 (USD Million)

Table 8 Foils Market Size, By Region, 20142021 (USD Million)

Table 9 Foams Market Size, By Region, 20142021 (USD Million)

Table 10 Others Market Size By Region, 20142021 (USD Million)

Table 11 Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 12 Aerogels Market Size, By Region, 20142021 (USD Million)

Table 13 Silica Aerogels Market Size, By Region, 20142021 (USD Million)

Table 14 Metals Market Size, By Region, 20142021 (USD Million)

Table 15 Plastic Foams Market Size, By Region, 20142021 (USD Million)

Table 16 Fiberglass Market Size, By Region, 20142021 (USD Million)

Table 17 Others Market Size, By Region, 20142021 (USD Million)

Table 18 Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 19 Thin Insulation Market Size in Building Thermal Insulation, By Region, 20142021 (USD Million)

Table 20 Thin Insulation Market Size in Thermal Packaging, By Region, 20142021 (USD Million)

Table 21 Thin Insulation Market Size in Automotive, By Region, 20142021 (USD Million)

Table 22 Thin Insulation Market Size in Wires & Cables, By Region, 20142021 (USD Million)

Table 23 Thin Insulation Market Size in Pipe Coatings, By Region, 20142021 (USD Million)

Table 24 Thin Insulation Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 25 Thin Insulation Market Size, By Region, 20142021 (USD Million)

Table 26 Asia-Pacific: Thin Insulation Market Size, By Country, 20142021 (USD Million)

Table 27 Asia-Pacific: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 28 Asia-Pacific: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 29 Asia-Pacific: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 30 China: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 31 China: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 32 China: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 33 India: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 34 India: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 35 India: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 36 Japan: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 37 Japan: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 38 Japan: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 39 South Korea: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 40 South Korea: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 41 South Korea: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 42 Malaysia: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 43 Malaysia: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 44 Malaysia: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 45 Thailand: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 46 Thailand: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 47 Thailand: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 48 Indonesia: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 49 Indonesia: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 50 Indonesia: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 51 Rest of Asia-Pacific: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 52 Rest of Asia-Pacific: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 53 Rest of Asia-Pacific: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 54 North America: Thin Insulation Market Size, By Country, 20142021 (USD Million)

Table 55 North America: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 56 North America: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 57 North America: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 58 U.S.: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 59 U.S.: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 60 U.S.: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 61 Mexico: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 62 Mexico: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 63 Mexico: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 64 Canada: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 65 Canada: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 66 Canada: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 67 Europe: Thin Insulation Market Size, By Country, 20142021 (USD Million)

Table 68 Europe: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 69 Europe: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 70 Europe: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 71 Germany: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 72 Germany: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 73 Germany: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 74 U.K.: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 75 U.K.: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 76 U.K.: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 77 France: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 78 France: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 79 France: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 80 Rest of Western Europe: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 81 Rest of Western Europe: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 82 Rest of Western Europe: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 83 Russia: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 84 Russia: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 85 Russia: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 86 Turkey: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 87 Turkey: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 88 Turkey: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 89 Poland: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 90 Poland: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 91 Poland: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 92 Rest of Central & Eastern Europe: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 93 Rest of Central & Eastern Europe: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 94 Rest of Central & Eastern Europe: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 95 South America: Thin Insulation Market Size, By Country, 20142021 (USD Million)

Table 96 South America: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 97 South America: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 98 South America: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 99 Brazil: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 100 Brazil: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 101 Brazil: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 102 Rest of South America: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 103 Rest of South America: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 104 Rest of South America: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 105 Middle East & Africa: Thin Insulation Market Size, By Type, 20142021 (USD Million)

Table 106 Middle East & Africa: Thin Insulation Market Size, By Material, 20142021 (USD Million)

Table 107 Middle East & Africa: Thin Insulation Market Size, By Application, 20142021 (USD Million)

Table 108 New Product Launch, 20112016

Table 109 Agreement/Collaboration, 20112016

Table 110 Merger & Acquisition, 20112016

Table 111 Expansion, 20112016

Table 112 Joint Venture, 2011-2016

List of Figures (55 Figures)

Figure 1 Thin Insulation Market Segmentation

Figure 2 Thin Insulation Market: Research Design

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Data Triangulation Methodology

Figure 6 Asia-Pacific is the Fastest Growing Market for Thin Insulation Between 2016-2021

Figure 7 Building Thermal Insulation is the Fastest-Growing Application of Thin Insulation Market, 20162021 (USD Million)

Figure 8 Foams Segment to Account for Largest Share in North America During Forecast Period

Figure 9 Plastic Foams Segment to Dominate the Thin Insulation Market During Forecast Period

Figure 10 Significant Growth in the Thin Insulation Market

Figure 11 Foams to Be the Fastest-Growing Segment in Thin Insulation Market Between 2016 and 2021

Figure 12 Building Thermal Insulation Application Accounted for the Largest Share in the Thin Insulation Market in 2015

Figure 13 Thin Insulation Market to Register High Growth in Emerging Economies Between 2016 and 2021

Figure 14 U.S. to Emerge as A Lucrative Market for Thin Insulation Between 2016 and 2021

Figure 15 High Growth Potential in the Asia-Pacific Region for Thin Insulation

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Thin Insulation Market

Figure 17 Supply-Chain Analysis of the Thin Insulation Market

Figure 18 Porters Five Forces Analysis

Figure 19 Foams Dominates the Thin Insulation Market, 20162021

Figure 20 Asia-Pacific is the Fastest-Growing Market for Sheets & Films Segment, 2016-2021

Figure 21 Asia-Pacific: Fastest-Growing Market for Vacuum Insulation Panels, 2016 vs 2021

Figure 22 Europe to Dominate the Thin Insulation Market for Coatings Segment, 2016-2021

Figure 23 Asia-Pacific is the Fastest-Growing Thin Insulation Market for Foils Segment, 2016-2021

Figure 24 Foams is A High Growth Market for Thin Insulation in Asia-Pacific

Figure 25 Aerogels Dominates the Thin Insulation Market

Figure 26 North America Dominates Aerogels Segment of Thin Insulation Market, 20162021

Figure 27 Europe Dominates Silica Aerogels Segment of Thin Insulation Market, 20162021

Figure 28 North America is the Largest Market for Metals Segment, 2021

Figure 29 Asia-Pacific to Register Highest Growth in Plastic Foams Segment of Thin Insulation Market, 20162021

Figure 30 Europe Dominated Fiberglass Segment of Thin Insulation Market in 2016

Figure 31 Building Thermal Insulation Expected to Drive Thin Insulation Market, 2016 vs 2021

Figure 32 North America: Largest Market for Thin Insulation in Building Thermal Insulation Application, 2021

Figure 33 Asia-Pacific: Fastest-Growing Market for Thin Insulation in Thermal Packaging Application

Figure 34 Asia-Pacific: Fastest-Growing Market for Thin Insulation in Automotive Application

Figure 35 North America: Largest Market for Thin Insulation in Wires & Cables Application, By 2021

Figure 36 Asia-Pacific: Fastest-Growing Market of Thin Insulation in Pipe Coatings Application, 2016-2021

Figure 37 Rapidly Growing Markets are Emerging as New Strategic Locations, 20162021

Figure 38 Asia-Pacific Market Snapshot: China A Lucrative Market for Thin Insulation

Figure 39 North America Thin Insulation Market Snapshot: U.S. is the Most Lucrative Market for Thin Insulation

Figure 40 Europe Market Snapshot: Germany Was A Lucrative Thin Insulation Market, 2015

Figure 41 South America Market Snapshot: Brazil is A Lucrative Market for Thin Insulation

Figure 42 Middle East & Africa Market Snapshot

Figure 43 Companies Primarily Adopted Inorganic Growth Strategies (20112016)

Figure 44 New Product Launch Was the Most Popular Strategy Adopted Between 2011 and 2016

Figure 45 Europe Dominated the Thin Insulations Market, in Terms of Development Activities, in 2014

Figure 46 BASF Polyurethanes GmbH: Company Snapshot

Figure 47 DOW Corning: Company Snapshot

Figure 48 DOW Corning: SWOT Analysis

Figure 49 Kingspan Insulation: Company Snapshot

Figure 50 Kingspan : SWOT Analysis

Figure 51 The DOW Chemical Company : Company Snapshot

Figure 52 The DOW Chemical Company: SWOT Analysis

Figure 53 Owens Corning: Company Snapshot

Figure 54 Huntsman Corporation: Company Snapshot

Figure 55 Rockwool Group: Company Snapshot

Growth opportunities and latent adjacency in Thin Insulation Market