Ultra-Low Phase Noise RF Signal Generator Market by Form Factor (Benchtop, Portable, Modular), Type, Application (Radar Systems, Component Testing Equipment, Communication Systems), End Use and Region - Global Forecast to 2027

Updated on : October 23, 2024

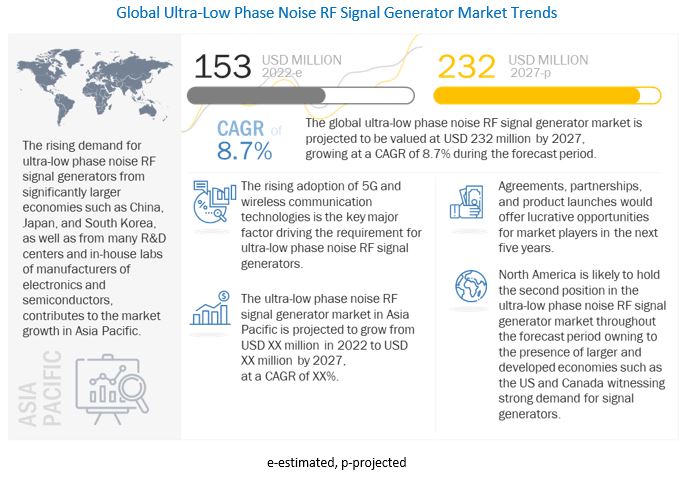

The ultra-low phase noise RF signal generator market is projected to grow from USD 153 million in 2022 to USD 232 million by 2027; growing at a CAGR of 8.7% during the forecast period from 2022 to 2027.

The ultra-low phase noise RF signal generator market is experiencing growing demand, driven by its critical role in applications requiring high precision and stability, such as aerospace and defense, telecommunications, and research and development. These signal generators are essential for testing and measuring RF and microwave components, ensuring minimal signal distortion in sensitive systems like radar, satellite communications, and 5G networks. Key trends influencing the market include the increasing adoption of 5G technology, advancements in wireless communication, and the rising need for high-performance testing equipment in industries where signal integrity is crucial. Furthermore, the growing emphasis on reducing phase noise in high-frequency systems, coupled with ongoing innovations in RF technology and miniaturization, is fueling market growth. As industries demand greater accuracy and reliability in signal generation, the market for ultra-low phase noise RF signal generators is expected to expand further.

The rising adoption of smart and 5G-enabled devices, the increasing demand for portable and handheld RF signal generators, and the surging utilization of synthesized RF signal generators contribute to the growth of the market. A wide range of RF instruments are adopted in automotive applications, and the increasing demand for ultra-low phase noise RF signal generators by the automotive, and aerospace and defense verticals is expected to create growth opportunities for players operating in the ultra-low phase noise RF signal generator industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Rising adoption of smart and 5G-enabled devices

Due to an increase in smartphone sales and the widespread adoption of affordable and high-speed wireless broadband services, wireless data traffic has increased significantly over the last couple of years. Hence, there is a strong need for seamless and high-bandwidth connectivity. Therefore, mobile operators are keen on testing 5G network devices to improve service quality by tracking the transmitted output power, fine-tuning cable systems and antennas, and monitoring the spectrum for sources of interference. Ultra-low phase noise RF signal generators play a vital role in performing frequency testing during the installation of base stations at antenna tower sites and establishing the necessary network infrastructure to manage data traffic. Thus, the growing mobile data traffic due to the increasing adoption of smart devices and deployment of LTE-advanced devices is the major factor that drives the demand for ultra-low phase noise RF signal generators.

There is a rise in the demand for ultra-low phase noise RF signal generators to provide accurate coverage measurements and enable and verify correct 5G NR network planning and rollout of base stations. 5G technology is currently available in limited countries of Europe and East Asia, as well as in major countries such as the US, Canada, and Australia. The rapid developments in 5G technology globally are likely to increase the demand for mobile data services, machine-to-machine (M2M) communication technologies in industrial applications, and high-speed widespread network coverage, which, in turn, is expected to further increase the demand for RF testing devices, including ultra-low phase noise RF signal generators, in the coming years.

Restraint: High synchronization cost of multiple signal generators employed to analyze CA system performance

In wireless communications, carrier aggregation increases the data rate per user by assigning multiple frequency blocks (known as component carriers) to the same user. A user's maximum data rate increases as more frequency blocks are assigned to the user. Carrier aggregation allows mobile operators to combine two or more LTE carriers into a single data change. However, to achieve carrier aggregation, modulated signals must be provided at different frequencies within the maximum bandwidth of the LTE channel. Modulated signals are sent over multiple antennas using digital signal processing (DSP) technology to increase the data rate. To transmit synchronized modulated signals, multiple wide-bandwidth signal generators are required. The complexity and cost of synchronizing multiple signal generators to realize a carrier aggregation system would increase with the number of carriers and antennas. For instance, a maximum of five carriers can be aggregated with eight antennas, requiring tens of signal generators, which have a substantial cost. Thus, the high cost associated with the use of RF signal generators in carrier aggregation will hinder the market growth over the next few years.

Opportunity: Growing use of RF technology in testing automotive systems

Ultra-low phase noise RF signal generators are likely to witness high demand from the automotive sector with the increasing focus of manufacturers on vehicle automation and electrification. Automated vehicles can safely navigate on roads only if they thoroughly understand the environment and traffic conditions. With the deployment of sensors and cameras, some information regarding the environment and traffic scenario can be made available. Additional information can be provided with the deployment of wireless connectivity solutions. Transmitters and receivers in these connectivity solutions must adhere to minimum standards to ensure the delivery of safety-related data messages even when transmission conditions are poor. The adherence of the connectivity solutions with the required standards can be verified using RF tools integrated with signal generators. To calculate accurate measurements of complex and compact automotive systems, a wide range of RF instruments are adopted. Modern premium cars are equipped with ADAS such as intelligent collision avoidance systems and vulnerable road detection systems. These ADAS are embedded with radar sensors to help drivers avoid emergencies. Major automotive manufacturers have also started adopting higher frequency radar systems that are highly reliable and accurate. These systems enhance the ability of a vehicle to respond to potential dangers on the road. In-car entertainment and driver assistance systems integrated with reverse parking sensors and remote keys are also tested using RF signal generators. With the rising demand for electric vehicles based on advanced communication systems, the global market for ultra-low phase noise RF signal generators is likely to witness significant growth in the next few years.

Challenge: Longer time required for research and development of new communication technologies

The development of mobile wireless communication systems takes a long time and requires extensive R&D. As a result, there is a long-term demand for RF signal generators by end users from research and development laboratories. However, commercialization and deployment of new generation communication technologies take longer; hence, the frequent buyers are fewer. The first-generation (1G) communication system was commercialized in Japan by Nippon Telegraph and Telephone (NTT) (Japan) in 1979. After a decade, the second-generation (2G) communication system was introduced to improve the coverage and capacity. A 3G R&D project started in 1992, and in 2002, SK Telecom (South Korea) launched the first 3G network based on CDMA in South Korea.

Along with the rollout of the 3G network, smartphones were launched in this era. Hence, the 3G network became more common in use. The fourth generation (4G) communication system has been deployed since the beginning of this century, and it uses Internet Protocol (IP) and Long-term Evolution (LTE) standards. In 2010, Sprint Nextel launched the first WiMAX smartphone in the US, the HTC-built Evo 4G. The changes in evolutionary standards require new network hardware and frequency allocations. Full-scale deployment of 5G technology is likely to take longer, leading to slower adoption of ultra-low phase noise RF signal generators during the forecast period.

The increasing adoption of 5G technology and rapid developments in cellular and Wi-Fi technologies likely to spur the market growth for information and communication technology segment

The increasing adoption of 5G technology and the rapid adoption of cellular and Wi-Fi technologies will create a high demand for ultra-low phase noise RF signal generators in the information and communication technology field. An ultra-low phase noise RF signal generator is commonly used in wireless communication applications and typically provides normal analog modulation, for example, amplitude modulation (AM), frequency modulation (FM), and pulse modulation (PM). An analog signal generator supplies sinusoidal continuous wave (CW) signals with the optional capability to add amplitude modulation (AM), frequency modulation (FM), and pulse modulation (PM), which is crucial for the telecom industry. A signal generator is optimized for speed to quickly change the frequency, amplitude, and phase of the signal. It also has the unique capability to be phase coherent at all frequencies.

Benchtop ultra-low phase noise RF signal generators likely to account for largest market share during the forecast period

Benchtop ultra-low phase noise RF signal generators accounted for the largest market share in 2021, and they are expected to dominate the market throughout the forecast period. Benchtop signal generators are increasingly used in many research and development laboratories worldwide because they offer high measurement accuracy at a lower cost. The benchtop is the most used product type in numerous applications, such as wireless communication, automotive, and aerospace and defense. These traditional box instruments are normally configured as benches or racks. Benchtop RF signal generators are suitable for R&D applications, wherein analysis and troubleshooting benefit from direct interaction with the instrument via the front panel. Benchtop models range from RF to microwave and from analog to vector. Some key benefits associated with benchtop RF equipment include measurement consistency and compatibility throughout the development cycle. Modulation capabilities such as FM and digital I/Q to standard-specific formats such as GSM, W-CDMA, HSPA, LTE, LTE-Advanced, GPS, and WLAN are also available in benchtop models.

Rising use of Radar test equipment (RTE) at development, test, evaluation, and production stages to spur market growth

Radar test equipment (RTE) are employed at various stages, including development, test, evaluation, and production cycle, and provide a wide variety of simulated radio frequency (RF) returns that exercise radar sensors. These include fire control, surveillance, guidance, imaging, proximity, fuses, and altimeters. There are two primary types of radar test equipment: target generators and environment simulators. In radar equipment, a test signal is usually required in a form closer to the echo signal of the radar for testing or tuning-related work. The essential requirement in radar testing application is that the precisely adjustable carrier frequency needs to be stable, and the test pulse has a constant adjustable amplitude. In a classical pulse radar with an analog or digital receiver, the major task is to generate a pulse of defined length and defined power modulated with the carrier frequency of the radar, which needs to be synchronized with the timing of the radar during the reception of the signals. This is an essential step for optimizing the received signals.

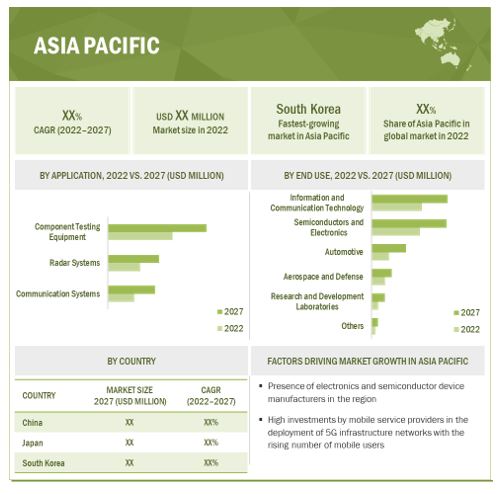

Asia Pacific likely to be the fastest-growing market for ultra-low phase noise RF signal generators between 2022 and 2027

Asia Pacific is likely to be the fastest-growing market for ultra-low phase noise RF signal generators during the forecast period owing to significant demand for RF measurement and testing equipment from the automotive, electronics, and telecommunications sectors, as well as from many research and development (R&D) laboratories in the region. Additionally, the prominent presence of various electronics and connectivity solution providers, namely Huawei (China), MediaTek (Taiwan), Renesas (Japan), Sony (Japan), and Samsung (South Korea), in the region contributes to market growth. Further, with the robust presence of several semiconductor component manufacturers, including Taiwan Semiconductor Manufacturing Company, SK Hynix, and Samsung Electronics, and R&D centers such as the Institute of Microelectronics (IME) (Singapore), Taiwan Semiconductor Research Institute (TSRI), and The Institute of Microelectronics (IME) of Peking University (China), in the region, the demand for ultra-low phase noise RF signal generator in the Asia Pacific region is high.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Anritsu Corporation (Japan), Rohde & Schwarz (Germany), Keysight Technologies (US), Berkeley Nucleonics (US), and AnaPico AG (Switzerland) are among the major players in the ultra-low phase noise RF signal generator companies.

Scope of the report

|

Report Metric |

Details |

| Estimated Market Size | USD 153 million |

| Projected Market Size | USD 232 million |

| Growth Rate | CAGR of 8.7% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million) and Volume/Installed Capacity (Megawatt) |

|

Segments Covered |

By type, form factor, application, and end use |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Anritsu Corporation (Japan), Rohde & Schwarz (Germany), Keysight Technologies (US), Berkeley Nucleonics (US), B&K Precision Corporation (US), Tabor Electronics (Israel), and AnaPico AG (Switzerland) |

This research report categorizes the ultra-low phase noise RF signal generators market, type, form factor, application, end use, and region

Based on Type:

- Synthesized RF Signal Generators

- Free Running RF Signal Generators

Based on Form Factor:

- Benchtop

- Portable

- Modular

Based on Application:

- Radar Systems

- Component Testing Equipment

- Communication Systems

Based on End Use:

- Information And Communication Technology

- Aerospace And Defense

- Semiconductors And Electronics

- Automotive

- Research And Development Laboratories

- Others

Based on the Region

- North America

- Europe

- Asia Pacific

- RoW (South America, Middle East & Africa)

Recent Developments

- In May 2022, Wireless Telecom Group, Inc. (NYSE American: WTT) announced the entry of its Boonton subsidiary into the noise generator market with the introduction of the NGX1000 programmable noise generator

- In May 2022, AnaPico Switzerland recently introduced a new compact-size broadband frequency synthesizer to generate an accurate and stable signal in both CW and pulse form, covering a frequency range of 100 kHz to 22 GHz

- In April, Keysight Technologies launched a new four-channel vector signal generator capable of generating signals up to 54 GHz with 2.5 GHz of modulation bandwidth per channel

- November 2021, Anritsu Corporation introduced the Rubidium signal generator family that delivers outstanding signal purity and frequency stability, even at high output power levels across a broad frequency range of 9 kHz to 43.5 GHz

- In June 2021, Anritsu Corporation (Anritsu) announced the acquisition of 99.7% of the issued shares of Takasago, Ltd. (Takasago), a subsidiary of NEC Corporation.

- In January 2021, Berkeley Nucleonics Corporation (BNC) acquired the high-voltage and high-current pulse generator lines from Directed Energy, Inc (DEI).

Frequently Asked Questions (FAQs):

Who are the key players in the ultra-low phase noise RF signal generator market? What are the major growth strategies they had taken to strengthen their position in the market?

Anritsu Corporation (Japan), Rohde & Schwarz (Germany), Keysight Technologies (US), Berkeley Nucleonics (US), and AnaPico AG (Switzerland) are the top five major key players in the ultra-low phase noise RF signal generator market. All these players have adopted organic strategies like- product launches and development to improve their ultra-low phase noise RF signal generator portfolio, and inorganic strategies like acquisitions to increase their reach to end user market.

What are the new opportunities for emerging players in ultra-low phase noise RF signal generator market?

A wide range of RF instruments are adopted in automotive applications, and the increasing demand for ultra-low phase noise RF signal generators by the automotive and aerospace and defense verticals is expected to create growth opportunities for players operating in the market.

Which applications of ultra-low phase noise RF signal generator are expected to drive the growth of the market in the next five years?What is the new technology in ultra-low phase noise RF signal generators market offering higher growth potential?

End-use applications such as information and communication technology and automotive are expected to witness significant growth during the forecast period and are expected to contribute significantly to the overall market growth by 2027.

Which region to offer lucrative growth for ultra-low phase noise RF signal generator market by 2027?

Asia Pacific is likely to be the fastest-growing market for ultra-low phase noise RF signal generators during the forecast period owing to significant demand for RF measurement and testing equipment from the automotive, electronics, and telecommunications sectors, as well as from many research and development (R&D) laboratories in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 List of key primary interview participants

2.1.3.3 Key data from primary sources

2.1.3.4 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS – REVENUES GENERATED BY COMPANIES THROUGH SELLING ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS AND RELATED PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

TABLE 1 KEY ASSUMPTIONS: MACRO- AND MICRO-ECONOMIC ENVIRONMENT

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS MARKET

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 GLOBAL MARKET, 2018–2027 (USD MILLION)

FIGURE 9 INFORMATION AND COMMUNICATION TECHNOLOGY SEGMENT TO HOLD LARGEST MARKET SHARE FROM 2022 TO 2027

FIGURE 10 COMPONENT TESTING SEGMENT TO CAPTURE MAJORITY OF MARKET SHARE IN 2027

FIGURE 11 BENCHTOP ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

FIGURE 12 SYNTHESIZED RF SIGNAL GENERATORS TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET

FIGURE 14 ADOPTION OF 5G AND WIRELESS COMMUNICATION TECHNOLOGIES DRIVES MARKET GROWTH

4.2 MARKET, BY APPLICATION

FIGURE 15 COMPONENT TESTING EQUIPMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

4.3 MARKET, BY FORM FACTOR

FIGURE 16 BENCHTOP ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS TO CAPTURE LARGEST MARKET SHARE IN 2027

4.4 MARKET, BY END USE

FIGURE 17 INFORMATION AND COMMUNICATION TECHNOLOGY TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

4.5 MARKET, BY TYPE

FIGURE 18 SYNTHESIZED RF SIGNAL GENERATORS TO HOLD LARGER MARKET SHARE THAN FREE RUNNING RF SIGNAL GENERATORS IN 2027

4.6 MARKET, BY REGION

FIGURE 19 ASIA PACIFIC TO BE LARGEST MARKET FOR ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MARKET

5.2.1 DRIVERS

5.2.1.1 Rising adoption of smart and 5G-enabled devices

5.2.1.2 Increasing demand for portable and handheld RF signal generators

5.2.1.3 Surging utilization of synthesized RF signal generators

FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 High synchronization cost of multiple signal generators employed to analyze CA system performance

FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of RF technology in testing automotive systems

5.2.3.2 Increasing utilization of RF signal generators in aerospace and defense applications

FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Longer time required for research and development of new communication technologies

FIGURE 24 IMPACT ANALYSIS OF CHALLENGES ON MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

TABLE 3 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET: ECOSYSTEM

FIGURE 26 KEY PLAYERS IN ECOSYSTEM

5.5 PRICING ANALYSIS

FIGURE 27 AVERAGE SELLING PRICE OF RF SIGNAL GENERATORS WITH DIFFERENT FREQUENCY RANGES, BY END USE

TABLE 4 AVERAGE SELLING PRICE OF RF SIGNAL GENERATORS WITH DIFFERENT FREQUENCY RANGES FOR TOP THREE END USES (USD THOUSAND)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

FIGURE 28 REVENUE SHIFT FOR MARKET PLAYERS

5.7 KEY TECHNOLOGY TRENDS

5.7.1 TREND OF MODULAR TEST INSTRUMENTS

5.7.2 ADVENT OF MULTI-ANTENNA TECHNIQUES

TABLE 5 MULTI-ANTENNA TECHNIQUES, BY APPLICATION

5.8 PORTER'S FIVE FORCES ANALYSIS

FIGURE 29 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 IMPACT OF PORTER’S FIVE FORCES ON MARKET

TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON MARKET

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USES

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USES (%)

5.9.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 END USES

TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END USERS

5.10 TRADE ANALYSIS

TABLE 9 IMPORT DATA FOR SIGNAL GENERATORS, HS CODE: 854320 (USD MILLION)

FIGURE 33 SIGNAL GENERATORS, IMPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

TABLE 10 EXPORT DATA FOR SIGNAL GENERATORS, HS CODE: 854320 (USD MILLION)

FIGURE 34 SIGNAL GENERATORS, EXPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

5.11 PATENT ANALYSIS

FIGURE 35 NUMBER OF PATENTS GRANTED FOR ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS, 2011–2021

FIGURE 36 GEOGRAPHIC ANALYSIS OF PATENTS GRANTED FOR RF SIGNAL GENERATORS, 2011–2021

TABLE 11 LIST OF FEW PATENTS IN MARKET, 2020–2022

5.12 KEY CONFERENCES AND EVENTS, 2022–2024

5.12.1 DETAILED LIST OF CONFERENCES AND EVENTS

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 CODES AND STANDARDS RELATED TO RF SIGNAL GENERATORS

TABLE 13 CODES AND STANDARDS RELATED TO RF SIGNAL GENERATORS

6 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY FORM FACTOR (Page No. - 78)

6.1 INTRODUCTION

TABLE 14 MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

FIGURE 37 PORTABLE MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

6.2 BENCHTOP

6.2.1 HIGH-PERFORMANCE AND COST-EFFECTIVE SOLUTIONS

TABLE 16 BENCHTOP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 BENCHTOP: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 PORTABLE

6.3.1 SUITABLE FOR AEROSPACE AND DEFENSE AND R&D LABORATORY APPLICATIONS

TABLE 18 PORTABLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 38 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN MARKET FROM 2022 TO 2027

TABLE 19 PORTABLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 MODULAR

6.4.1 IDEAL FOR APPLICATIONS REQUIRING FAST AND HIGH-QUALITY MEASUREMENTS

TABLE 20 MODULAR: ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 MODULAR: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY TYPE (Page No. - 84)

7.1 INTRODUCTION

TABLE 22 MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 39 SYNTHESIZED RF ULTRA-LOW PHASE NOISE SIGNAL GENERATORS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 23 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 SYNTHESIZED RF SIGNAL GENERATORS

7.2.1 ENABLE OUTPUT SIGNAL DETERMINATION AT GREATER ACCURACY

7.3 FREE RUNNING RF SIGNAL GENERATORS

7.3.1 DESIGNED FOR EXPERIMENTS CONDUCTED IN RESEARCH LABS

8 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY APPLICATION (Page No. - 87)

8.1 INTRODUCTION

TABLE 24 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

FIGURE 40 COMMUNICATION SYSTEMS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 25 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 RADAR SYSTEMS

8.2.1 RISING USE OF RTE AT DEVELOPMENT, TESTING, EVALUATION, AND PRODUCTION STAGES TO SPUR MARKET GROWTH

TABLE 26 RADAR SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 RADAR SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 COMPONENT TESTING EQUIPMENT

8.3.1 CIRCUIT DESIGNING AND ELECTRICAL SIGNAL TESTING – KEY APPLICATIONS OF ULTRA-LOW PHASE NOISE RF SIGNAL GENERATORS

TABLE 28 COMPONENT TESTING EQUIPMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 41 ASIA PACIFIC TO COMMAND MARKET FOR COMPONENT TESTING EQUIPMENT FROM 2022 TO 2027

TABLE 29 COMPONENT TESTING EQUIPMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 COMMUNICATION SYSTEMS

8.4.1 INCREASING ADOPTION OF SIGNAL GENERATORS IN TESTING DIGITAL WIRELESS SYSTEMS TO SUPPORT MARKET GROWTH

TABLE 30 COMMUNICATION SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 42 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN MARKET FOR COMMUNICATION SYSTEMS FROM 2022 TO 2027

TABLE 31 COMMUNICATION SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY END USE (Page No. - 94)

9.1 INTRODUCTION

TABLE 32 MARKET, BY END USE, 2018–2021 (USD MILLION)

FIGURE 43 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 33 MARKET, BY END USE, 2022–2027 (USD MILLION)

9.2 INFORMATION AND COMMUNICATION TECHNOLOGY

9.2.1 HIGH ADOPTION OF 5G AND WIRELESS COMMUNICATION TECHNOLOGIES BOOSTS MARKET GROWTH

TABLE 34 INFORMATION AND COMMUNICATION TECHNOLOGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 44 ASIA PACIFIC TO LEAD MARKET FOR INFORMATION AND COMMUNICATION TECHNOLOGY SEGMENT THROUGHOUT FORECAST PERIOD

TABLE 35 INFORMATION AND COMMUNICATION TECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 AEROSPACE AND DEFENSE

9.3.1 REQUIREMENT FOR HIGH-PERFORMANCE AND MISSION-CRITICAL DESIGNS OF NEXT-GENERATION AIRCRAFT TO PROVIDE GROWTH OPPORTUNITIES

TABLE 36 AEROSPACE AND DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 AEROSPACE AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 SEMICONDUCTORS AND ELECTRONICS

9.4.1 HIGH ADOPTION OF SIGNAL GENERATORS TO CHECK PERFORMANCE OF AMPLIFIERS AND FILTERS TO SUPPORT MARKET GROWTH

TABLE 38 SEMICONDUCTORS AND ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 SEMICONDUCTORS AND ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 AUTOMOTIVE

9.5.1 INTEGRATION OF BLUETOOTH-POWERED INFOTAINMENT AND RADIO SYSTEMS IN MODERN VEHICLES TO ACCELERATE MARKET GROWTH

TABLE 40 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 45 EUROPE TO WITNESS HIGHEST CAGR IN MARKET FOR AUTOMOTIVE SEGMENT DURING FORECAST PERIOD

TABLE 41 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 RESEARCH AND DEVELOPMENT LABORATORIES

9.6.1 INCREASED USE OF SIGNAL GENERATORS IN TESTING LABORATORIES DEALING WITH RADIO EQUIPMENT TO PROPEL MARKET GROWTH

TABLE 42 RESEARCH AND DEVELOPMENT LABORATORIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 RESEARCH AND DEVELOPMENT LABORATORIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 OTHERS

TABLE 44 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY REGION (Page No. - 104)

10.1 INTRODUCTION

FIGURE 46 SOUTH KOREA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

TABLE 46 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 49 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.2 NORTH AMERICA

FIGURE 47 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 50 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Presence of key market players to support market growth

TABLE 58 US: ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 59 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growing demand for high-speed communication services to create opportunities for signal generator providers

TABLE 60 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 61 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

10.2.3 MEXICO

10.2.3.1 Surging demand for T&M equipment in telecommunications industry to accelerate market growth

TABLE 62 MEXICO: MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 63 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

10.3 EUROPE

FIGURE 48 SNAPSHOT OF MARKET IN EUROPE

TABLE 64 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Rising demand for wireless and cellular communication networks to propel market growth

TABLE 72 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 73 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Flourishing automotive and robotics & automation industries to contribute to market growth

TABLE 74 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 75 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Growing implementation of cloud computing and IoT technologies to create opportunities for RF product manufacturers

TABLE 76 FRANCE: ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 77 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Government initiatives to fund patent applications to fuel market growth

TABLE 78 ITALY: MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 79 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

10.3.5 REST OF EUROPE (ROE)

TABLE 80 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 81 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

10.4 ASIA PACIFIC

FIGURE 49 SNAPSHOT OF ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET IN ASIA PACIFIC

TABLE 82 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing deployment of 5G networks to drive market growth

TABLE 90 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Strong focus of market players on launching innovative RF products to push market growth

TABLE 92 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Need for seamless connectivity services to augment demand for RF signal generators

TABLE 94 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 95 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 96 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 98 REST OF THE WORLD: ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 100 REST OF THE WORLD: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 101 REST OF THE WORLD: MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 102 REST OF THE WORLD: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 103 REST OF THE WORLD: MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

TABLE 104 REST OF THE WORLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 South Africa, UAE, and Saudi Arabia to contribute significantly to market growth

TABLE 106 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 107 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

10.5.2 SOUTH AMERICA

10.5.2.1 Increasing adoption of wireless communication networks to foster market growth

TABLE 108 SOUTH AMERICA: ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 109 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 134)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 110 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 111 MARKET: DEGREE OF COMPETITION

11.4 REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 50 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 51 RF SIGNAL GENERATOR MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

11.6 COMPANY FOOTPRINT

TABLE 112 COMPANY APPLICATION FOOTPRINT

TABLE 113 COMPANY END USE FOOTPRINT

TABLE 114 REGIONAL FOOTPRINT OF COMPANIES

TABLE 115 OVERALL FOOTPRINT OF COMPANIES

11.7 COMPETITIVE SCENARIOS AND TRENDS

11.7.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 116 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2018–JANUARY 2022

11.7.2 DEALS

TABLE 117 MARKET: DEALS, JANUARY 2019–DECEMBER 2021

11.7.3 OTHERS

TABLE 118 ULTRA-LOW PHASE NOISE RF SIGNAL GENERATOR MARKET: OTHERS, JANUARY 2019–SEPTEMBER 2021

12 COMPANY PROFILES (Page No. - 151)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 KEY PLAYERS

12.1.1 ANRITSU CORPORATION

TABLE 119 ANRITSU CORPORATION: BUSINESS OVERVIEW

FIGURE 52 ANRITSU CORPORATION: COMPANY SNAPSHOT

TABLE 120 ANRITSU CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 121 ANRITSU CORPORATION: PRODUCT LAUNCHES

TABLE 122 ANRITSU CORPORATION: DEALS

12.1.2 ROHDE & SCHWARZ GMBH & CO KG

TABLE 123 ROHDE & SCHWARZ GMBH & CO KG: BUSINESS OVERVIEW

TABLE 124 ROHDE & SCHWARZ GMBH & CO KG: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 125 ROHDE & SCHWARZ GMBH & CO KG: PRODUCT LAUNCHES

12.1.3 KEYSIGHT TECHNOLOGIES

TABLE 126 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 53 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 127 KEYSIGHT TECHNOLOGIES: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 128 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

12.1.4 BERKELEY NUCLEONICS CORPORATION

TABLE 129 BERKELEY NUCLEONICS CORPORATION: BUSINESS OVERVIEW

TABLE 130 BERKELEY NUCLEONICS CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 131 BERKELEY NUCLEONICS CORPORATION: PRODUCT LAUNCHES

TABLE 132 BERKELEY NUCLEONICS CORPORATION: DEALS

12.1.5 ANAPICO AG

TABLE 133 ANAPICO AG: BUSINESS OVERVIEW

TABLE 134 ANAPICO AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 135 ANAPICO AG: PRODUCT LAUNCHES

12.1.6 BOONTON ELECTRONICS

TABLE 136 BOONTON ELECTRONICS (PART OF WIRELESS TELECOM GROUP): BUSINESS OVERVIEW

TABLE 137 BOONTON ELECTRONICS: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 138 BOONTON ELECTRONICS: PRODUCTS LAUNCHED

TABLE 139 BOONTON ELECTRONICS: DEALS

12.1.7 TEXAS INSTRUMENTS

TABLE 140 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 54 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

TABLE 141 TEXAS INSTRUMENTS: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 142 TEXAS INSTRUMENTS: DEALS

12.1.8 TEKTRONIX, INC. (PART OF DANAHER CORPORATION)

TABLE 143 TEKTRONIX, INC. (PART OF DANAHER CORPORATION): BUSINESS OVERVIEW

FIGURE 55 TEKTRONIX, INC. (PART OF DANAHER CORPORATION): COMPANY SNAPSHOT

TABLE 144 TEKTRONIX INC (PART OF DANAHER CORPORATION): PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.9 B&K PRECISION CORPORATION

TABLE 145 B&K PRECISION CORPORATION: BUSINESS OVERVIEW

TABLE 146 B&K PRECISION CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 147 B&K PRECISION CORPORATION: PRODUCT LAUNCHES

12.1.10 TABOR ELECTRONICS LTD.

TABLE 148 TABOR ELECTRONICS LTD.: BUSINESS OVERVIEW

TABLE 149 TABOR ELECTRONICS LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 150 TABOR ELECTRONICS LTD.: PRODUCT LAUNCHES

TABLE 151 TABOR ELECTRONICS LTD.: DEALS

TABLE 152 TABOR ELECTRONICS LTD.: OTHERS

12.2 OTHER PLAYERS

12.2.1 SIGNALCORE, INC.

12.2.2 DS INSTRUMENTS

12.2.3 RF LAMBDA

12.2.4 STANFORD RESEARCH SYSTEMS

12.2.5 NATIONAL INSTRUMENTS

12.2.6 PICO TECHNOLOGY

12.2.7 TRANSCOM INSTRUMENTS

12.2.8 NOVATECH INSTRUMENTS, INC.

12.2.9 VAUNIX TECHNOLOGY CORPORATION

12.2.10 SALUKI TECHNOLOGY INC.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 186)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

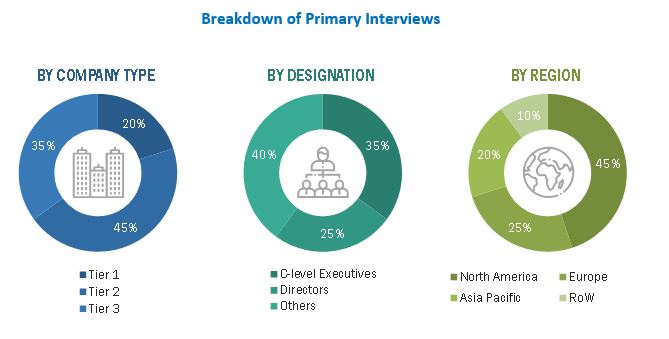

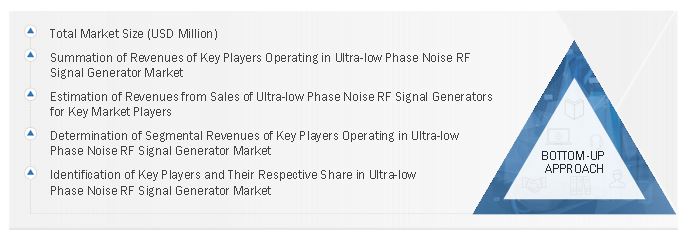

In order to estimate the size of the ultra-low phase noise RF signal generators market, four major activities were performed. Secondary research has been conducted extensively to collect information regarding the market, the peer market, and the parent market. This was followed by a primary research study involving industry experts across the value chain to validate the findings, assumptions, and sizing. The total market size has been estimated using both top-down and bottom-up approaches. Then, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred for this research study to identify and collect information. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

After understanding and analyzing the ultra-low phase noise RF signal generators market through secondary research, extensive primary research was conducted. A number of primary interviews have been conducted with key opinion leaders from supply-side vendors and demand-side vendors in four major regions - North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). The qualitative and quantitative information on the market has been obtained by interviewing a variety of sources on both the supply and demand sides. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the ultra-low phase noise RF signal generators market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Secondary research has been conducted to identify the key players in the industry and market.

- Through primary and secondary research processes, the supply chain and market size of the industry have been determined.

- Global numbers are calculated based on revenue from various manufacturers of intelligent power modules.

- Secondary and primary sources were used to determine the percentage shares split and breakdowns.

Global Ultra-low phase noise RF signal generators Market Size: Bottom-Up Approach

Data Triangulation

With the overall market size derived from the estimation process described previously, the global market was divided into several segments and subsegments. In order to gather the exact statistics for segments and subsegments, the data triangulation and breakdown procedures have been applied, wherever possible. By analyzing various factors and trends from both the demand and supply sides, the data has been triangulated. Furthermore, the ultra-low phase noise RF signal generators market has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe, segment, and forecast the ultra-low phase noise RF signal generator market size, by form factor, end use, application, and type, in terms of value

- To forecast the market size for various segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the ultra-low phase noise RF signal generator market

- To study the complete value chain and allied industry segments and carry out an ultra-low phase noise RF signal generator value chain

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) pertaining to ultra-low phase noise RF signal generators

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape

- To strategically profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To analyze competitive developments witnessed by players in the ultra-low phase noise RF signal generator market, such as contracts, product launches/developments, expansions, and research and development (R&D) activities.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the ultra-low phase noise RF signal generators market

- To strategically profile key players and provide details of the current competitive landscape

- To analyze strategic approaches adopted by players in the ultra-low phase noise RF signal generators market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ultra-Low Phase Noise RF Signal Generator Market