RF Test Equipment Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Oscilloscopes, Spectrum Analyzers, Signal Generators, Network Analyzers), Frequency Range (More than 6 GHz, 1 to 6 GHz, Less than 1 GHz), Form Factor, End-use Application and Region- Global Forecast, 2027

Updated on : May 12, 2023

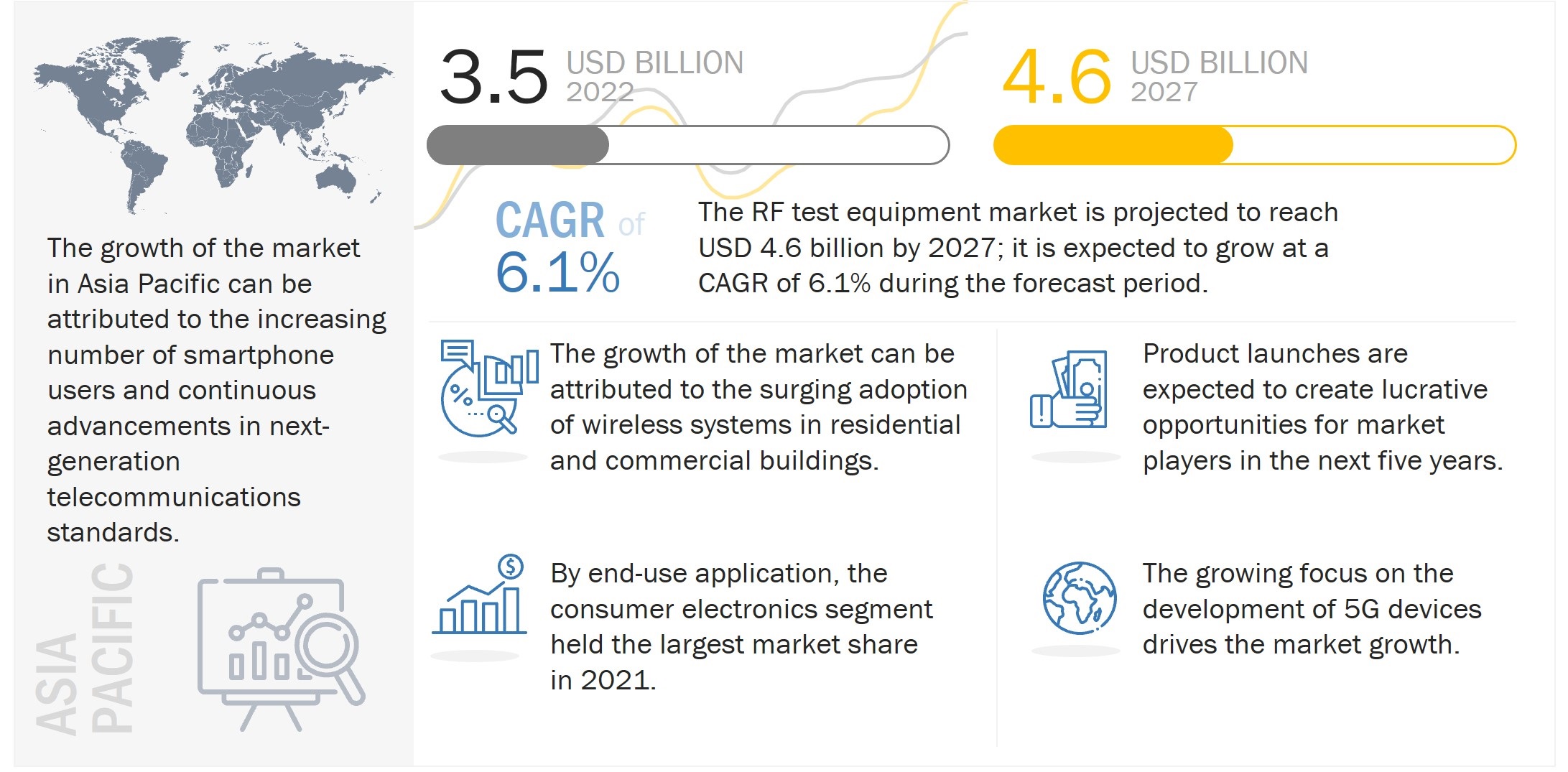

[249 Pages Report] The RF Test Equipment Market Size is projected to reach USD 4.6 billion by 2027 from USD 3.5 billion in 2022, at a CAGR of 6.1% from 2022 to 2027.

Surging adoption of wireless systems in residential and commercial buildings, rising number of smartphone subscriptions, increasing use of 5G-compatible devices, and growing number of IoT-connected devices are some of the major factors driving the RF Test Equipment Industry Growth.

RF Test Equipment Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

RF Test Equipment Market Dynamics

Driver: Increasing use of 5G-compatible devices

5G is the fifth-generation technology standard for broadband cellular networks. In recent years, there has been a significant rise in demand for 5G-compatible devices all over the world, and several sectors, such as manufacturing and telecommunications, are increasingly deploying 5G technology in cellular devices. There has been a surge in demand for RF test equipment in research and development laboratories for designing and testing 5G network-based devices. Rapid developments related to 5G technology and the subsequent increase in the demand for mobile data services, significant adoption of machine-to-machine (M2M) communication technology in industries and increased need for superior network coverage are expected to drive the growth of the market for RF test equipment designed for advanced telecommunication applications and 5G devices.

Restraint: Extended longevity of communication systems

The development of advanced communication systems needs extensive R&D. Moreover, communication systems last longer, and the number of frequent customers is relatively less. This is expected to impede the adoption of RF test equipment annually. For instance, the first-generation (1G) communication technology was commercialized in Japan by Nippon Telegraph and Telephone (NTT) (Japan) in 1979. After a decade, the second-generation (2G) communication system was introduced to improve coverage and capacity. Then, SK Telecom (South Korea) launched the first 3G network based on CDMA in South Korea. Along with the rollout of the 3G network, smartphones were launched in this era. Hence, the 3G network became more common. The fourth generation (4G) devices have been deployed since the beginning of this century, and Internet Protocol (IP) and Long-term Evolution (LTE) standards have been integrated into 4G devices. In 2010, Sprint Nextel launched the first WiMAX smartphone in the US, the HTC-built Evo 4G and the fifth generation (5G) technology was commercialized in 2019. The advancements in evolutionary standards need new network hardware and frequency allocations. The longevity of the technology shift impedes the adoption rate of RF test equipment.

Opportunity: Surging adoption of RF testing instruments in automotive applications

Automotive radar systems and wireless communication systems have moved to high-frequency bands. Moreover, with technological advances, the requirements of end users are likely to change remarkably in terms of frequencies, phase noise performance, and modulation bandwidth. The market players are extensively focused on developing advanced RF testing solutions to meet these requirements. For instance, modern-day vehicles are integrated with advanced driver-assistance systems (ADAS), such as intelligent collision avoidance systems, smart braking systems, and parking systems. These ADAS are equipped with radar sensors that help drivers avoid accidents and improve passenger safety and security. Major automotive manufacturers have also started using higher frequency radar systems that are more reliable and accurate. These systems enhance the ability of a vehicle to respond to potential dangers on the road. Such developments are expected to create the need for RF test equipment. RF transmitters and receivers integrated into onboard units (OBUs), and road-side units (RSUs) of communications systems must be tested to eliminate the safety risk arising from poor transmit conditions.

Challenge: High capital requirement to remain competitive

Market players that offer RF test equipment need a huge amount of capital to carry out R&D activities and foster the development of advanced products. Moreover, the growing product complexity owing to advancements in communication technologies has led to an increased need for testing the performance efficiency of advanced and connected solutions. Moreover, software upgrades and modular designs have become the trend in the RF testing equipment industry and are prolonging the life of test equipment by adding functionality to hardware. However, with rapid changes in technology, end users have become more concerned about the durability of their equipment, forcing vendors to modify the software to fulfill the changing requirements related to RF testing. This would hinder the growth of new entrants in the market by making the market extremely capital-intensive.

RF test equipment market for consumer electronics to account for the largest market share during forecast period

The consumer electronics segment held the largest market share in 2021 and is expected to retain its market position during the forecast period. With the continuously growing adoption of 5G technology and the upcoming 6G technology, the data transfer rate is expected to increase further, leading to increased demand for RF components integrated into smartphones. Moreover, the growing use of smartphones and the increasing requirement for high-speed data transfer rates are expected to contribute to the RF test equipment market for consumer electronics.

Spectrum analyzers to register highest CAGR in the RF test equipment market during forecast period

The market for spectrum analyzers is expected to grow at the highest CAGR during the forecast period. Major factors contributing to the growth of the spectrum analyzer market include the high adoption of wireless technologies in various applications, such as network-based devices and smart manufacturing. Moreover, technological advancements leading to innovations in the different types of spectrum analyzers, significant improvements in their bandwidth and frequencies, and high adoption of portable devices are other factors contributing to the spectrum analyzer market growth.

Modular RF test equipment to register highest CAGR during forecast period

Modular equipment are available in multiple architectural designs, such as PXI, AXIe, and PCI Express. They are optimized to validate testing environments in manufacturing plants and designs of RF devices and can deliver results much faster than other instruments. Modular signal analyzers are ideal for applications that need fast and high-quality measurements such as large-volume manufacturing, wherein checking quality control, product conformance, and test optimization are essential. By using a single-time base for all acquisition modules and a single integrated trigger circuit to operate the entire system, a modular oscilloscope system achieves much higher synchronization accuracy.

RF Test Equipment Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

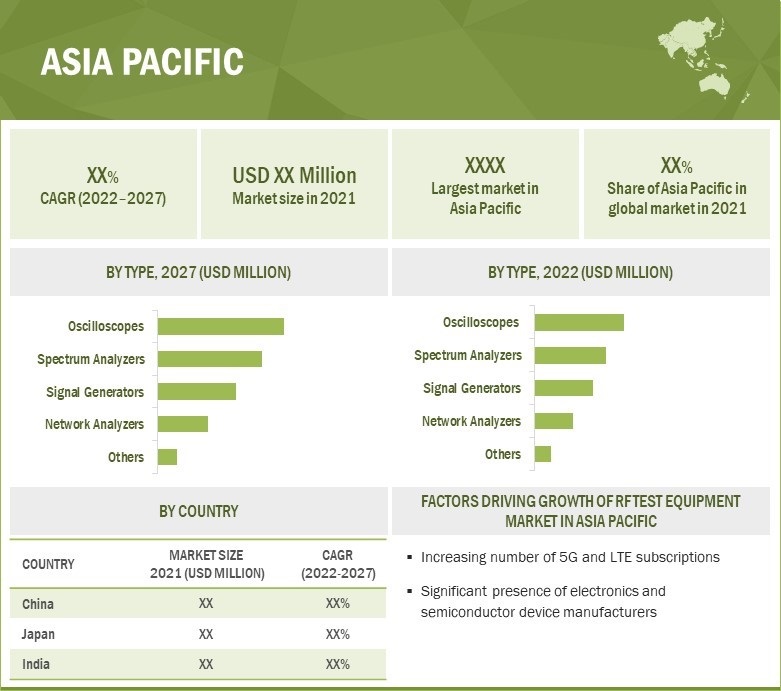

Asia Pacific accounted for the largest share of the RF test equipment market in 2021. The region is also expected to register the highest CAGR during the forecast period. The presence of established connectivity solution providers, such as Huawei (China), MediaTek (Taiwan), and Renesas (Japan) in the region and the constantly growing smartphone subscriptions in the region are some of the key factors driving the market growth in Asia Pacific. Additionally, China, being a global manufacturing hub for consumer electronic products, provides ample growth opportunities for market players offering RF test equipment.

Key Market Players

The key market players in the RF Test Equipment Companies include Keysight Technologies, Inc. (US), Anritsu Group (Japan), Rohde & Schwarz (Germany), Tektronix, Inc. (US), Teledyne Technologies Incorporated (US).

RF Test Equipment Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Type, By Form Factor, By Frequency Range, By End-use Application |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The key players profiled in the report include Keysight Technologies, Inc. (US), Anritsu Group (Japan), Rohde & Schwarz (Germany), Tektronix, Inc. (US), Teledyne Technologies Incorporated (US), Berkeley Nucleonics Corporation (US), AnaPico (Switzerland), B&K Precision Corporation (US), National Instruments Corporation (US), Boonton Electronics (US), Tabor Electronics Ltd. (Israel). |

RF Test Equipment Market Highlights

The study segments the RF test equipment market based on type, form factor, frequency range, end-use application, and region.

|

Aspect |

Details |

|

By Type |

|

|

By Form Factor |

|

|

By Frequency Range |

|

|

By End-use Application |

|

|

By Region |

|

Recent Developments

- In September 2022, Rohde & Schwarz announced the launch of the R&S MXO 4 series oscilloscopes that have the fastest update rate of more than 4.5 million acquisitions per second. The product is available in four-channel models, with bandwidths ranging from 200 MHz to 1.5 GHz.

- In August 2022, Anritsu announced the launch of the world’s first single sweep VNA-spectrum analyzer under the VectorStar Vector Network Analyzer product portfolio. The spectrum analyzer supports a frequency range of 70 KHz to 220 GHz. The solution is highly suitable for effectively testing and verifying active and passive devices.

- In June 2022, Tektronix strengthened its test and measurement equipment product portfolio with the launch of 2 Series Mixed Oscilloscope that can seamlessly transition from the bench to the field and back. The device is extremely thin, which makes it highly portable.

- In April 2022, Keysight Technologies launched the M9484C VXG Vector Signal Generator that offers improved design and validation solutions to foster the development of innovative and advanced electronic devices. These devices are highly suited for wideband multi-channel mmWave Applications.

- In January 2020, Teledyne LeCroy, a subsidiary of Teledyne Technologies, announced the launch of T3 vector network analyzer that offers a bandwidth of 9 KHz to 1.5 GHz. The new device is expected to strengthen the network analyzers portfolio of the company.

Frequently Asked Questions (FAQ):

What is the current size of the global RF test equipment market?

The RF test equipment market is projected to reach USD 4.6 billion by 2027 from USD 3.5 billion in 2022, at a CAGR of 6.1% from 2022 to 2027. Surging adoption of wireless systems in residential and commercial buildings, and rising number of smartphone subscriptions are some of the major factors driving the market growth.

Who are the winners in the global RF test equipment market?

Companies such as Keysight Technologies, Inc. (US), Anritsu Group (Japan), Rohde & Schwarz (Germany), Tektronix, Inc. (US), Teledyne Technologies Incorporated (US) fall under the winners category.

Which region is expected to witness robust growth in the RF test equipment market?

Asia Pacific accounted for the largest share of the RF test equipment market in 2021. The region is also expected to register the highest CAGR during the forecast period. The presence of established connectivity solution providers and the constantly growing smartphone subscriptions in the region are some of the key factors driving the market growth.

What are the opportunities pertaining to the RF test equipment market?

Surging adoption of RF testing instruments in automotive applications and increasing number of space programs globally and the growing advancements in the aerospace industry are expected to provide lucrative opportunities for market players.

What are the strategies adopted by key players?

Product launches and developments, expansions, acquisitions, partnerships, collaborations, and agreements are the major organic and inorganic growth strategies adopted by key players in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 RF TEST EQUIPMENT MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH APPROACH

FIGURE 2 RF TEST EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 TOP-DOWN APPROACH

2.3 FACTOR ANALYSIS

2.3.1 DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3.2 SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.3.3 GROWTH FORECAST ASSUMPTIONS

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: RF TEST EQUIPMENT MARKET

3 EXECUTIVE SUMMARY (Page No. - 50)

3.1 GROWTH RATE ASSUMPTIONS

FIGURE 8 SPECTRUM ANALYZERS SEGMENT TO REGISTER HIGHEST CAGR IN MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 9 MORE THAN 6 GHZ SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY FREQUENCY RANGE, IN 2022

FIGURE 10 BENCHTOP SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY FORM FACTOR, IN 2022

FIGURE 11 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR IN MARKET, BY END-USE APPLICATION, DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN RF TEST EQUIPMENT MARKET

FIGURE 13 INCREASING USE OF WIRELESS DEVICES IN PROXIMITY MARKETING TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

4.2 RF TEST EQUIPMENT, BY TYPE

FIGURE 14 OSCILLOSCOPES TO HOLD LARGEST MARKET SHARE IN 2027

4.3 RF TEST EQUIPMENT, BY FREQUENCY RANGE

FIGURE 15 RF TEST EQUIPMENT WITH FREQUENCY RANGE OF MORE THAN 6 GHZ TO CAPTURE LARGEST MARKET SHARE IN 2027

4.4 RF TEST EQUIPMENT, BY FORM FACTOR

FIGURE 16 BENCHTOP RF TEST EQUIPMENT TO LEAD MARKET THROUGHOUT FORECAST PERIOD

4.5 RF TEST EQUIPMENT, BY END-USE APPLICATION

FIGURE 17 CONSUMER ELECTRONICS TO DOMINATE MARKET FROM 2022 TO 2027

4.6 RF TEST EQUIPMENT, BY REGION

FIGURE 18 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET IN 2027

4.7 RF TEST EQUIPMENT IN EUROPE, BY TYPE AND COUNTRY

FIGURE 19 GERMANY AND OSCILLOSCOPES ACCOUNTED FOR LARGEST SHARE OF EUROPEAN MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 RF TEST EQUIPMENT MARKET DYNAMICS: DRIVERS, OPPORTUNITIES, RESTRAINTS, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Surging adoption of wireless systems in commercial and residential buildings

5.2.1.2 Rising number of smartphone subscriptions

FIGURE 21 SMARTPHONE SUBSCRIPTIONS, 2018—2027 (MILLION)

5.2.1.3 Increasing use of 5G-compatible devices

FIGURE 22 5G MOBILE SUBSCRIBERS, 2021—2027 (MILLION)

5.2.1.4 Growing number of IoT-connected devices

FIGURE 23 SHIPMENT OF CONNECTED DEVICES AND CELLULAR IOT DEVICES, 2018—2027 (MILLION UNITS)

FIGURE 24 IMPACT ANALYSIS: RF TEST EQUIPMENT MARKET DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Extended longevity of communication systems

5.2.2.2 Inclination of customers to take RF test equipment on rent

FIGURE 25 IMPACT ANALYSIS: TEST EQUIPMENT MARKET RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Surging adoption of RF testing instruments in automotive applications

5.2.3.2 Rising use of wireless devices in proximity marketing

5.2.3.3 Increasing number of space programs globally and advancements in aerospace industry

FIGURE 26 IMPACT ANALYSIS: MARKET OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 High capital requirement to remain competitive

5.2.4.2 Complexities related to antenna arrays

FIGURE 27 IMPACT ANALYSIS: MARKET CHALLENGES

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 28 MARKET: SUPPLY CHAIN

TABLE 3 RF TEST EQUIPMENT MARKET: ECOSYSTEM

5.4 RF TEST EQUIPMENT ECOSYSTEM

FIGURE 29 ECOSYSTEM OF RF TEST EQUIPMENT

5.5 AVERAGE SELLING PRICE ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF CMOS RF TEST EQUIPMENT, BY KEY PLAYER

FIGURE 30 AVERAGE SELLING PRICE OF RF TEST EQUIPMENT, BY KEY PLAYER

TABLE 4 AVERAGE SELLING PRICE OF CMOS RF TEST EQUIPMENT, BY KEY PLAYER (USD THOUSAND)

5.6 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 31 REVENUE SHIFTS IN MARKET

5.7 TECHNOLOGY TRENDS

5.7.1 EMERGENCE OF 5G NETWORK

5.7.2 COMMERCIALIZATION OF IOT TECHNOLOGY

5.7.3 ADVANCEMENTS IN WARFARE TECHNOLOGY

5.7.4 IMPROVEMENTS IN AUTOMOTIVE TECHNOLOGY

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 RF TEST EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

TABLE 7 KEY BUYING CRITERIA: TOP THREE END-USE APPLICATIONS

5.10 CASE STUDY ANALYSIS

5.10.1 R&S SCOPE RIDER RTH HANDHELD OSCILLOSCOPE HELPED POLITECNICO DI TORINO DESIGN VEHICLES WITH RECORD-LOW FUEL CONSUMPTION

5.10.2 ROHDE & SCHWARZ HELPED MIXCOMM OVERCOME QUICK BEAM SWITCHING ISSUE BY MONITORING SYNCHRONIZATION TIME BETWEEN SIGNAL GENERATOR AND ANALYZER USING RF TEST EQUIPMENT

5.10.3 PANASONIC CORPORATION DEPLOYED RF-TESTED CAMERA SYSTEMS TO ENSURE SECURITY OF INHABITANTS AND VISITORS IN SLOVAKIA

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO

TABLE 8 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.11.2 EXPORT SCENARIO

TABLE 9 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS, 2012–2022

FIGURE 35 NUMBER OF PATENTS GRANTED FOR RF TEST EQUIPMENT, 2012–2022

FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED FOR RF TEST EQUIPMENT, 2021

TABLE 10 LIST OF KEY PATENTS PERTAINING TO RF TEST EQUIPMENT, 2020–2021

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 11 RF TEST EQUIPMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS

5.14 TARIFF ANALYSIS

TABLE 12 MFN TARIFFS FOR HS CODE 9030-COMPLIANT PRODUCTS EXPORTED BY US

TABLE 13 MFN TARIFFS FOR HS CODE 9030-COMPLIANT PRODUCTS EXPORTED BY CHINA

TABLE 14 MFN TARIFFS FOR HS CODE 9030-COMPLIANT PRODUCTS EXPORTED BY JAPAN

5.15 STANDARDS AND REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2 REGULATORY STANDARDS

5.15.3 GOVERNMENT REGULATIONS

5.15.3.1 Canada

5.15.3.2 US

5.15.3.3 Europe

5.15.3.4 Asia Pacific

6 RF TEST EQUIPMENT MARKET, BY TYPE (Page No. - 90)

6.1 INTRODUCTION

FIGURE 37 MARKET, BY TYPE

TABLE 19 MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 38 OSCILLOSCOPES TO ACCOUNT FOR LARGEST SHARE OF MARKET THROUGHOUT FORECAST PERIOD

TABLE 20 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 OSCILLOSCOPES

6.2.1 INCREASING ADOPTION OF MODULAR OSCILLOSCOPES TO PROVIDE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

TABLE 21 RF TEST EQUIPMENT MARKET FOR OSCILLOSCOPES, 2018–2021 (THOUSAND UNITS)

TABLE 22 MARKET FOR OSCILLOSCOPES, 2022–2027 (THOUSAND UNITS)

TABLE 23 OSCILLOSCOPES: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 OSCILLOSCOPES: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 25 OSCILLOSCOPES: MARKET, BY FREQUENCY RANGE, 2018–2021 (USD MILLION)

TABLE 26 OSCILLOSCOPES: MARKET, BY FREQUENCY RANGE, 2022–2027 (USD MILLION)

TABLE 27 OSCILLOSCOPES: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 39 ASIA PACIFIC TO DOMINATE MARKET FOR OSCILLOSCOPES THROUGHOUT FORECAST PERIOD

TABLE 28 OSCILLOSCOPES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 OSCILLOSCOPES: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 30 OSCILLOSCOPES: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 31 OSCILLOSCOPES: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 32 OSCILLOSCOPES: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 33 OSCILLOSCOPES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 34 OSCILLOSCOPES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 35 OSCILLOSCOPES: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 OSCILLOSCOPES: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.3 SPECTRUM ANALYZERS

6.3.1 HIGH VERSATILITY AND AVAILABILITY OF SPECTRUM ANALYZERS IN DIFFERENT FORM FACTORS TO SPIKE THEIR DEMAND

TABLE 37 RF TEST EQUIPMENT MARKET FOR SPECTRUM ANALYZERS, 2018–2021 (THOUSAND UNITS)

TABLE 38 MARKET FOR SPECTRUM ANALYZERS, 2022–2027 (THOUSAND UNITS)

TABLE 39 SPECTRUM ANALYZERS: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 SPECTRUM ANALYZERS: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 41 SPECTRUM ANALYZERS: MARKET, BY FREQUENCY RANGE, 2018–2021 (USD MILLION)

TABLE 42 SPECTRUM ANALYZERS: MARKET, BY FREQUENCY RANGE, 2022–2027 (USD MILLION)

TABLE 43 SPECTRUM ANALYZERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 40 ASIA PACIFIC TO COMMAND MARKET FOR SPECTRUM ANALYZERS DURING FORECAST PERIOD

TABLE 44 SPECTRUM ANALYZERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 SPECTRUM ANALYZERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 46 SPECTRUM ANALYZERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 47 SPECTRUM ANALYZERS: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 48 SPECTRUM ANALYZERS: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 49 SPECTRUM ANALYZERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 50 SPECTRUM ANALYZERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 51 SPECTRUM ANALYZERS: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 SPECTRUM ANALYZERS: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.4 SIGNAL GENERATORS

6.4.1 RISING USE OF SIGNAL GENERATORS IN INDUSTRIAL AND TELECOMMUNICATIONS SECTORS TO STIMULATE MARKET GROWTH

TABLE 53 RF TEST EQUIPMENT MARKET FOR SIGNAL GENERATORS, 2018–2021 (THOUSAND UNITS)

TABLE 54 MARKET FOR SIGNAL GENERATORS, 2022–2027 (USD MILLION)

TABLE 55 SIGNAL GENERATORS: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 SIGNAL GENERATORS: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 57 SIGNAL GENERATORS: MARKET, BY FREQUENCY RANGE, 2018–2021 (USD MILLION)

FIGURE 41 SIGNAL GENERATORS WITH MORE THAN 6 GHZ FREQUENCY TO LEAD MARKET DURING FORECAST PERIOD

TABLE 58 SIGNAL GENERATORS: MARKET, BY FREQUENCY RANGE, 2022–2027 (USD MILLION)

TABLE 59 SIGNAL GENERATORS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 SIGNAL GENERATORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 SIGNAL GENERATORS: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 62 SIGNAL GENERATORS: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 63 SIGNAL GENERATORS: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 SIGNAL GENERATORS: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 65 SIGNAL GENERATORS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 SIGNAL GENERATORS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 SIGNAL GENERATORS: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 SIGNAL GENERATORS: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.5 NETWORK ANALYZERS

6.5.1 ADOPTION OF NETWORK ANALYZERS TO DIFFERENTIATE BETWEEN TWO-PORT NETWORKS TO DRIVE MARKET

TABLE 69 NETWORK ANALYZERS: RF TEST EQUIPMENT MARKET, 2018–2021 (THOUSAND UNITS)

TABLE 70 NETWORK ANALYZERS: MARKET, 2022–2027 (THOUSAND UNITS)

TABLE 71 NETWORK ANALYZERS: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 72 NETWORK ANALYZERS: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 73 NETWORK ANALYZERS: MARKET, BY FREQUENCY RANGE, 2018–2021 (USD MILLION)

FIGURE 42 NETWORK ANALYZERS WITH FREQUENCY OF MORE THAN 6 GHZ TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 74 NETWORK ANALYZERS: MARKET, BY FREQUENCY RANGE, 2022–2027 (USD MILLION)

TABLE 75 NETWORK ANALYZERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 NETWORK ANALYZERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 77 NETWORK ANALYZERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 78 NETWORK ANALYZERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 79 NETWORK ANALYZERS: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 NETWORK ANALYZERS: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 NETWORK ANALYZERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 NETWORK ANALYZERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 NETWORK ANALYZERS: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 NETWORK ANALYZERS: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

6.6 OTHERS

TABLE 85 OTHERS: RF TEST EQUIPMENT MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 OTHERS: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 OTHERS: MARKET, BY FREQUENCY RANGE, 2018–2021 (USD MILLION)

TABLE 88 OTHERS: MARKET, BY FREQUENCY RANGE, 2022–2027 (USD MILLION)

TABLE 89 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 91 OTHERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 92 OTHERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 93 OTHERS: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 94 OTHERS: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 OTHERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 OTHERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 OTHERS: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 OTHERS: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

7 RF TEST EQUIPMENT MARKET, BY FORM FACTOR (Page No. - 122)

7.1 INTRODUCTION

FIGURE 43 MARKET, BY FORM FACTOR

TABLE 99 MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

FIGURE 44 MODULAR RF TEST EQUIPMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 100 MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

7.2 RACKMOUNT

7.2.1 FLEXIBLE MOUNTING AND FLOOR SPACE-SAVING CAPABILITIES OF RACKMOUNT RF TEST EQUIPMENT TO DRIVE THEIR ADOPTION

7.3 BENCHTOP

7.3.1 EXTENSIVE USE OF BENCHTOP RF TEST EQUIPMENT IN R&D TO ACCELERATE MARKET GROWTH

7.4 PORTABLE

7.4.1 SIGNIFICANT ADOPTION OF PORTABLE RF TEST EQUIPMENT IN ON-FIELD APPLICATIONS TO STIMULATE MARKET GROWTH

7.5 MODULAR

7.5.1 GROWING USE OF MODULAR RF TEST EQUIPMENT FOR CONFORMANCE-DRIVEN LARGE-VOLUME MANUFACTURING TO SUPPORT MARKET GROWTH

8 RF TEST EQUIPMENT MARKET, BY FREQUENCY RANGE (Page No. - 126)

8.1 INTRODUCTION

FIGURE 45 MARKET, BY FREQUENCY RANGE

TABLE 101 MARKET, BY FREQUENCY RANGE, 2018–2021 (USD MILLION)

FIGURE 46 RF TEST EQUIPMENT WITH FREQUENCY OF MORE THAN 6 GHZ TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 102 MARKET, BY FREQUENCY RANGE, 2022–2027 (USD MILLION)

8.2 MORE THAN 6 GHZ

8.2.1 ADVANCEMENTS IN TELECOMMUNICATIONS INDUSTRY TO AUGMENT DEMAND FOR RF TEST EQUIPMENT WITH MORE THAN 6 GHZ

TABLE 103 MORE THAN 6 GHZ: MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 47 SPECTRUM ANALYZERS WITH MORE THAN 6 GHZ OF FREQUENCY RANGE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 104 MORE THAN 6 GHZ: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3 1 TO 6 GHZ

8.3.1 USE OF RF TEST EQUIPMENT FROM PRODUCT DEVELOPMENT TO INSTALLATION PHASES IN INDUSTRIES TO FUEL MARKET GROWTH

TABLE 105 1 TO 6 GHZ: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 106 1 TO 6 GHZ: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.4 LESS THAN 1 GHZ

8.4.1 ADOPTION OF RF EQUIPMENT TO TEST ACCURACY OF LOW-FREQUENCY STANDALONE DEVICES TO FOSTER MARKET GROWTH

TABLE 107 LESS THAN 1 GHZ: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 108 LESS THAN 1 GHZ: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9 RF TEST EQUIPMENT MARKET, BY END-USE APPLICATION (Page No. - 133)

9.1 INTRODUCTION

FIGURE 48 MARKET, BY END-USE APPLICATION

TABLE 109 MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

FIGURE 49 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 110 MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

9.2 CONSUMER ELECTRONICS

9.2.1 POPULARITY OF 5G DEVICES TO BOOST DEMAND FOR RF TEST EQUIPMENT IN CONSUMER ELECTRONICS APPLICATIONS

TABLE 111 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 50 SPECTRUM ANALYZERS TO REGISTER HIGHEST CAGR IN MARKET FOR CONSUMER ELECTRONICS DURING FORECAST PERIOD

TABLE 112 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.3 TELECOMMUNICATIONS

9.3.1 RAPID PROLIFERATION OF 5G NETWORKS TO CREATE GROWTH OPPORTUNITIES FOR PROVIDERS OF RF TEST EQUIPMENT

TABLE 113 TELECOMMUNICATIONS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 114 TELECOMMUNICATIONS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.4 AUTOMOTIVE

9.4.1 INTEGRATION OF COMPLEX ELECTRONIC SYSTEMS IN AUTOMATED CARS TO SPIKE DEMAND FOR RF TEST EQUIPMENT

TABLE 115 AUTOMOTIVE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 51 SPECTRUM ANALYZERS TO REGISTER HIGHEST CAGR IN MARKET FOR AUTOMOTIVE DURING FORECAST PERIOD

TABLE 116 AUTOMOTIVE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.5 INDUSTRIAL

9.5.1 ADOPTION OF INDUSTRY 4.0 BY MANUFACTURING FIRMS TO CREATE REQUIREMENTS FOR RF TEST EQUIPMENT

TABLE 117 INDUSTRIAL: RF TEST EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 118 INDUSTRIAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.6 AEROSPACE AND DEFENSE

9.6.1 REQUIREMENT TO TEST RELIABILITY OF AEROSPACE COMPONENTS AND SYSTEMS TO FUEL DEMAND FOR RF TEST EQUIPMENT

TABLE 119 AEROSPACE AND DEFENSE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 120 AEROSPACE AND DEFENSE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.7 MEDICAL

9.7.1 NEED TO TEST MEDICAL DEVICES IN REAL-WORLD ENVIRONMENT TO SURGE DEMAND FOR RF TEST EQUIPMENT

TABLE 121 MEDICAL: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 122 MEDICAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.8 RESEARCH AND DEVELOPMENT

9.8.1 REQUIREMENT FOR HIGH-END RF TEST EQUIPMENT IN R&D APPLICATIONS TO DRIVE MARKET

TABLE 123 RESEARCH AND DEVELOPMENT: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 124 RESEARCH AND DEVELOPMENT: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10 RF TEST EQUIPMENT MARKET, BY REGION (Page No. - 145)

10.1 INTRODUCTION

FIGURE 52 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

TABLE 125 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 53 NORTH AMERICA: MARKET SNAPSHOT

TABLE 127 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rising investments in revitalizing digital infrastructure to provide lucrative opportunities to market players

TABLE 131 US: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 132 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Thriving telecommunications sector to drive market growth

TABLE 133 CANADA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 134 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Booming manufacturing sector to stimulate demand for RF test equipment

TABLE 135 MEXICO: RF TEST EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 54 EUROPE: MARKET SNAPSHOT

TABLE 137 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 138 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 139 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 140 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Established automotive and healthcare industries to contribute to market growth

TABLE 141 GERMANY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 142 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Surging demand for advanced healthcare solutions to provide growth opportunities for market players

TABLE 143 UK: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 144 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Rapid advancements in transportation and communication industries to spur demand for RF test equipment

TABLE 145 FRANCE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 146 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Rapid development of industrial sector to foster market growth

TABLE 147 ITALY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 148 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 149 REST OF EUROPE: RF TEST EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 150 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 55 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 151 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Thriving telecommunications sector to provide lucrative growth opportunities for market players

TABLE 155 CHINA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 156 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Prominent presence of RF test equipment and connectivity solution providers to fuel market growth

TABLE 157 JAPAN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 158 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Strong focus on improving communication infrastructure to accelerate demand for RF test equipment

TABLE 159 INDIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 160 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Investments by mobile operators to strengthen 5G infrastructure to support market growth

TABLE 161 SOUTH KOREA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 162 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 163 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 165 ROW: RF TEST EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 166 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 167 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 168 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Growing demand for 5G and IoT-based devices to drive market

TABLE 169 SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Increasing investments in developing communication and network infrastructure to create lucrative opportunities for market players

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 171)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 173 OVERVIEW OF STRATEGIES DEPLOYED BY KEY RF TEST EQUIPMENT PROVIDERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC STRATEGIES

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 174 RF TEST EQUIPMENT MARKET: MARKET SHARE ANALYSIS (2021)

11.4 RANKING ANALYSIS: RF TEST EQUIPMENT TYPE, BY MARKET PLAYER

11.5 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 56 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET, 2017–2021

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 57 RF TESTING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2021

11.7 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT

TABLE 175 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 176 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) IN MARKET

TABLE 177 RF TESTING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (TYPE FOOTPRINT)

TABLE 178 RF TESTING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (END-USE APPLICATION FOOTPRINT)

TABLE 179 RF TESTING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (REGION FOOTPRINT)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 58 START-UP/SME EVALUATION QUADRANT

11.8 COMPANY FOOTPRINT

TABLE 180 COMPANY FOOTPRINT

TABLE 181 COMPANY TYPE FOOTPRINT

TABLE 182 COMPANY END-USE APPLICATION FOOTPRINT

TABLE 183 COMPANY REGION FOOTPRINT

11.9 COMPETITIVE SCENARIOS AND TRENDS

11.9.1 PRODUCT LAUNCHES

TABLE 184 PRODUCT LAUNCHES, MARCH 2019–MAY 2022

11.9.2 DEALS

TABLE 185 DEALS, MARCH 2019–MAY 2022

11.9.3 OTHERS

TABLE 186 OTHERS, JANUARY 2020–JANUARY 2022

12 COMPANY PROFILES (Page No. - 194)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 KEYSIGHT TECHNOLOGIES, INC.

TABLE 187 KEYSIGHT TECHNOLOGIES, INC.: COMPANY OVERVIEW

FIGURE 59 KEYSIGHT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 188 KEYSIGHT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

TABLE 189 KEYSIGHT TECHNOLOGIES, INC.: DEALS

TABLE 190 KEYSIGHT TECHNOLOGIES, INC.: OTHERS

12.2.2 ANRITSU GROUP

TABLE 191 ANRITSU GROUP: COMPANY OVERVIEW

FIGURE 60 ANRITSU GROUP: COMPANY SNAPSHOT

TABLE 192 ANRITSU GROUP: PRODUCT LAUNCHES

TABLE 193 ANRITSU GROUP: DEALS

12.2.3 ROHDE & SCHWARZ

TABLE 194 ROHDE & SCHWARZ: COMPANY OVERVIEW

TABLE 195 ROHDE & SCHWARZ: PRODUCT LAUNCHES

TABLE 196 ROHDE & SCHWARZ: DEALS

TABLE 197 ROHDE & SCHWARZ: OTHERS

12.2.4 TEKTRONIX, INC. (FORTIVE CORPORATION)

TABLE 198 TEKTRONIX, INC. (FORTIVE CORPORATION): COMPANY OVERVIEW

FIGURE 61 TEKTRONIX, INC. (FORTIVE CORPORATION): COMPANY SNAPSHOT

TABLE 199 TEKTRONIX, INC. (FORTIVE CORPORATION): PRODUCT LAUNCHES

12.2.5 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 200 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

FIGURE 62 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

TABLE 201 TELEDYNE TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 202 TELEDYNE TECHNOLOGIES: OTHERS

12.2.6 BERKELEY NUCLEONICS CORPORATION

TABLE 203 BERKELEY NUCLEONICS CORPORATION: COMPANY OVERVIEW

TABLE 204 BERKELEY NUCLEONICS CORPORATION: PRODUCT LAUNCHES

12.2.7 ANAPICO

TABLE 205 ANAPICO: COMPANY OVERVIEW

TABLE 206 ANAPICO: PRODUCT LAUNCHES

TABLE 207 ANAPICO: DEALS

12.2.8 B&K PRECISION CORPORATION

TABLE 208 B&K PRECISION CORPORATION: COMPANY OVERVIEW

TABLE 209 B&K PRECISION CORPORATION: PRODUCT LAUNCHES

12.2.9 NATIONAL INSTRUMENTS CORPORATION

TABLE 210 NATIONAL INSTRUMENTS CORPORATION: COMPANY OVERVIEW

FIGURE 63 NATIONAL INSTRUMENTS CORPORATION: COMPANY SNAPSHOT

TABLE 211 NATIONAL INSTRUMENTS CORPORATION: PRODUCT LAUNCHES

TABLE 212 NATIONAL INSTRUMENTS CORPORATION: DEALS

12.2.10 BOONTON ELECTRONICS

TABLE 213 BOONTON ELECTRONICS: COMPANY OVERVIEW

TABLE 214 BOONTON ELECTRONICS: PRODUCT LAUNCHES

12.2.11 TABOR ELECTRONICS LTD.

TABLE 215 TABOR ELECTRONICS LTD.: COMPANY OVERVIEW

TABLE 216 TABOR ELECTRONICS LTD.: PRODUCT LAUNCHES

TABLE 217 TABOR ELECTRONICS LTD.: DEALS

TABLE 218 TABOR ELECTRONICS LTD.: OTHERS

12.3 OTHER PLAYERS

12.3.1 TERADYNE, INC.

12.3.2 SIGNALCORE, INC.

12.3.3 DS INSTRUMENTS

12.3.4 RF-LAMBDA

12.3.5 STANFORD RESEARCH SYSTEMS

12.3.6 AIM & THURLBY THANDAR INSTRUMENTS (AIM-TTI)

12.3.7 VAUNIX TECHNOLOGY CORPORATION

12.3.8 RIGOL TECHNOLOGIES CO., LTD.

12.3.9 AARONIA AG

12.3.10 VIAVI SOLUTIONS INC.

12.3.11 EXFO INC.

12.3.12 YOKOGAWA TEST & MEASUREMENT CORPORATION

12.3.13 ERA INSTRUMENTS

12.3.14 SALUKI TECHNOLOGY INC.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 243)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

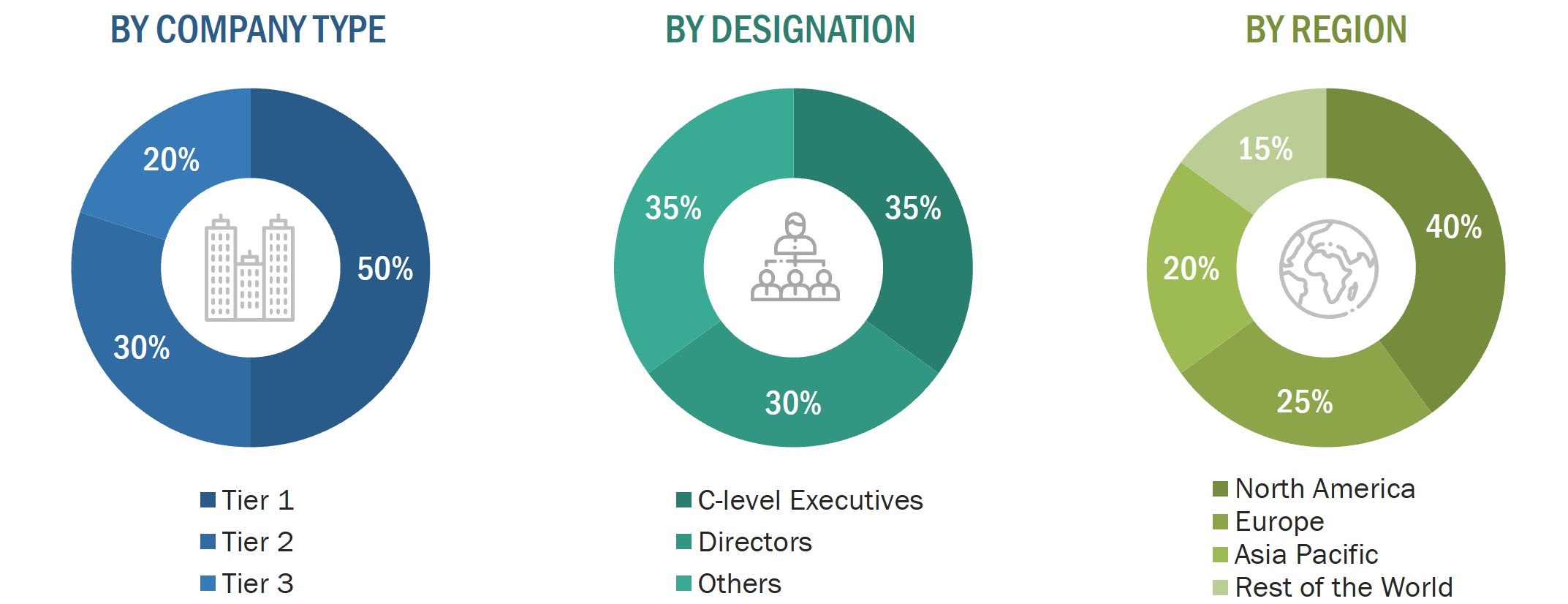

The research study involved 4 major activities in estimating the size of the RF test equipment market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In secondary research, various secondary sources have been referred to for obtaining the information that was needed for the study. Various secondary sources that were used for the research include, corporate filings such as annual reports, press releases, investor presentations, and financial statements, trade, business, and professional associations, whitepapers, journals based on RF test equipment, certified publications, and articles from recognized authors and databases.

In the RF test equipment market report, the top-down as well as the bottom-up approaches have been used for the estimation of the global market size, along with several other dependent submarkets. The major players in the market were identified with the help of extensive secondary research and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the RF test equipment market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the RF test equipment market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the RF test equipment market that influence the entire market and participants across the supply chain.

- Analyzing major manufacturers of RF test equipment (OEMs) and studying their product portfolios

- Analyzing trends related to the adoption of RF test equipment based on end-use applications

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships and forecasting the market size based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to identify adoption trends of RF test equipment

- Segmenting the overall market into various segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall RF test equipment market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The RF test equipment market size has been validated using both top-down and bottom-up approaches.

How Oscilloscopes is going to impact the RF Test Equipment Market?

Oscilloscopes can have a significant impact on the RF test equipment market in several ways.

First, oscilloscopes can be used in the design and testing of RF circuits, making them a complementary tool to RF test equipment. This means that some oscilloscope manufacturers can also offer RF test equipment, providing integrated solutions for customers.

Secondly, as the demand for higher data rates and faster communication grows, RF signals become more complex and difficult to analyze. Oscilloscopes with higher bandwidth and advanced features can help engineers and technicians to better visualize and analyze complex RF signals.

Thirdly, the convergence of RF and digital technologies in modern communication systems requires equipment that can perform both RF and digital measurements. Oscilloscopes with built-in signal generators and network analysis capabilities can help bridge this gap, making it easier to measure and analyze complex signals.

Lastly, the growing trend towards modular and scalable test equipment architectures can also benefit the oscilloscope market. For example, some RF test equipment manufacturers offer modular solutions that allow customers to add different modules to their test systems as needed. Oscilloscopes can be one of the modules that are added to the system, providing additional measurement capabilities and flexibility.

Some futuristic growth use-cases of Network Analyzers Market

The network analyzers market is expected to grow significantly in the coming years, driven by various futuristic use-cases. Some of the potential growth opportunities for network analyzers include:

5G Networks: As the adoption of 5G networks continues to rise, the demand for network analyzers is also expected to increase. Network analyzers can be used to measure the performance of 5G networks, including factors such as signal strength, signal-to-noise ratio, and spectral efficiency.

IoT: The growth of the Internet of Things (IoT) is expected to drive demand for network analyzers, as these devices are used to measure and analyze wireless signals in IoT applications, such as smart homes and smart cities.

Automotive: With the increasing use of electronics in automobiles, network analyzers are becoming more important for testing and measuring the performance of automotive electronic systems, such as infotainment systems, sensors, and communication modules.

Aerospace and Defense: The aerospace and defense industry is another potential growth area for network analyzers, as these devices are used to measure and test the performance of avionics and communication systems in airplanes and other aerospace vehicles.

Virtualization: As more organizations move to cloud-based services and adopt network virtualization technologies, the need for network analyzers that can measure and analyze virtual network performance is expected to increase.

Industries That Will Be Impacted in the Future by Spectrum Analyzers Market

The spectrum analyzer market is expected to impact several industries in the future. Some of the industries that are likely to be impacted include:

Telecommunications: With the increasing demand for high-speed data transfer, advanced network security, and network virtualization, the telecommunications industry is expected to be a major user of spectrum analyzers. Spectrum analyzers are used to analyze and test the frequency spectrum of wireless communication systems, which is critical to ensuring proper operation and minimizing interference.

Aerospace and defense: Spectrum analyzers are used in the aerospace and defense industry to analyze and test various types of electronic systems, including radar, communication, and electronic warfare systems. The growing need for advanced defense systems and the increasing use of electronic systems in aircraft are expected to drive the demand for spectrum analyzers in this industry.

Medical: Spectrum analyzers are also used in the medical industry to analyze and test various types of electronic medical devices, such as MRI machines and ultrasound equipment. As medical devices become more complex and sophisticated, the demand for spectrum analyzers is likely to increase.

Automotive: The automotive industry is another potential user of spectrum analyzers, as these devices are used to test and analyze the frequency spectrum of various types of electronic systems in vehicles, including navigation systems and entertainment systems. As more vehicles become connected and autonomous, the demand for spectrum analyzers in the automotive industry is expected to increase.

Research and development: Spectrum analyzers are also used in research and development in a wide range of fields, including physics, chemistry, and materials science. As research in these fields becomes more advanced and sophisticated, the demand for spectrum analyzers is likely to increase.

Growth Opportunities and Key Challenges for RF Testing in the Future

RF testing is a critical component of the product design and manufacturing process in the electronics industry, ensuring that devices meet regulatory standards, perform as intended, and are reliable. As technology advances, there are several growth opportunities and key challenges for RF testing in the future:

Growth Opportunities:

Increasing demand for wireless communication systems: With the growth of 5G and the Internet of Things (IoT), there is an increasing demand for wireless communication systems. This will lead to a higher demand for RF testing equipment such as spectrum analyzers, network analyzers, and signal generators.

Emergence of new technologies: The emergence of new technologies such as self-driving cars and drones require advanced RF testing equipment that can test these devices in real-world scenarios. This will create a new market for RF testing equipment.

Growing need for compliance testing: With the increasing number of regulatory standards, such as FCC, CE, and ETSI, there is a growing need for RF testing equipment that can perform compliance testing.

Key Challenges:

Complex and rapidly evolving technology: The complexity of the technology used in wireless communication systems and other devices is increasing, making it difficult for RF testing equipment to keep up. Manufacturers will need to invest in research and development to keep up with the latest advancements.

Cost: RF testing equipment can be expensive, which can make it challenging for small to medium-sized businesses to invest in the equipment needed for product development and testing.

Short product life cycles: Many electronic devices have short product life cycles, which means that RF testing equipment needs to be versatile and adaptable to different products and standards. This can make it challenging for manufacturers to keep up with the changing demands of the market.

The main objectives of this study are as follows:

- To describe and forecast the RF test equipment market, by type, form factor, frequency range, and end-use application, in terms of value

- To describe and forecast the RF test equipment market, by type, in terms of volume

- To describe and forecast the market for various segments across four key regions: North America, Europe, Asia Pacific, and Rest of the World, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the RF test equipment market

- To provide an overview of the value chain pertaining to the RF test equipment ecosystem, along with the average selling price of RF test equipment

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, technology trends, key stakeholders and buying criteria, key conferences, and case studies pertaining to the market under study

- To strategically analyze micromarkets regarding individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze competitive developments such as partnerships, acquisitions, collaborations, and expansions in the RF test equipment market

- To profile key players in the RF test equipment market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-Wise Information:

- Detailed analysis of additional countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in RF Test Equipment Market