Utility Communication Market by Technology (Wired, Wireless), Utility (Public, Private), Component (Hardware, Software), Application (Oil & Gas, Electricity T&D), End-User (Residential, Commercial, Industrial) and Region - Global Forecast to 2027

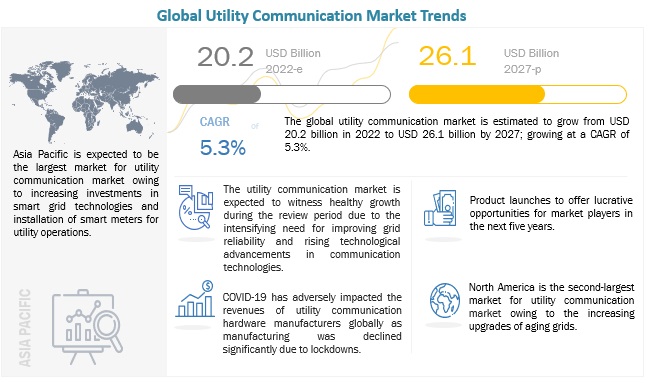

[220 Pages Report] The global utility communication market is estimated to be valued at USD 20.2 billion in 2022 and is projected to reach USD 26.1 billion by 2027 growing at a CAGR of 5.3%. The factors driving the market include the consolidating trend of digitalizing oilfield communications.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Focus on improving grid reliability, increasing operating efficiency, and reducing outage length

Utility communication technologies are required in the power distribution network to make it more reliable. Sensors, processors, communication networks, and switches are used to collect, automate, analyze, and optimize data to improve the operational efficiency of power distribution systems. Automated voltage regulators, remote fault indicators, smart relays, automated feeder switches/reclosers, automated capacitors, transformer monitors, automated feeder monitors, and remote terminal units are the various field devices that are used in improving grid reliability and operating efficiency. Automated voltage regulators help power utilities in reducing peak demands, efficiently utilizing existing assets, and improving power reliability. Utility communication technologies also help grid operators maximize operations remotely by efficient utilization of repair crews and minimizing truck rolls based on real-time data. Hence, the implementation of utility communication helps utilities provide faster service restoration, lower environmental emissions, and maintain a high level of reliability and operating efficiency.

Some of the applications that improve operating efficiency are predictive technologies for advanced maintenance or equipment replacement and system restoration technologies. Hence, increasing focus on improving grid reliability and operating efficiency is likely to fuel the demand for utility communication technologies in the coming years.

Restraints: Lack of standards and interoperability of different IT protocols and components

Interoperability is a critical factor in grid modernization as it enables two or more networks, systems, devices, applications, or components to share and readily use information securely and efficiently with no inconvenience to the user. In electric power systems, interoperability can be defined as the seamless, end-to-end connectivity of hardware and software from the customers’ appliances all the way through the distribution & transmission systems to the power source to enhance the coordination of energy flow with the real-time flow of information and analysis. The lack of communication standards and incompatibility of different IT protocols and components of communication systems are some of the major challenges in the deployment of various devices. Another issue is data storage and management. Recognizing non-quantifiable data from the huge volume data generated by various nodes of the network is a challenge that is being faced by most solution providers

Opportunities: Rise in number of upcoming smart city projects in developing regions

Smart cities are developed in urban areas to create sustainable economic development. According to the United Nations, by 2030, 60% of the world’s population will live in cities, and one in three individuals will live in a city with a population of half a million or more. Currently, there are more than 100 smart city projects across the world, which offer huge opportunities for technology companies, service providers, utility providers, and consulting companies. A key factor to the success of smart cities is an uninterrupted power supply distribution network, which cannot be provided by the traditional grid due to the high level of efficiency required. Hence, smart cities are likely to be dependent on utility communication to provide a robust energy supply. Utility communication assists in enhancing the efficiency, quality, reliability, safety, and security of electric services. Emerging needs such as energy savings and storage also offer lucrative opportunities for the utility communication market.

Challenges: Oil price instability, reduced oil demand, and supply chain disruptions due to COVID-19

The COVID-19 pandemic has dampened the growth of the oil and gas industry by bringing down the demand, and consequently the price, for oil. As of December 31, 2019, West Texas Intermediate (WTI) oil future was at USD 61.1. On March 23, 2020, it was at USD 23.4, a decline of more than 60%. As of May 28, 2020, 212 countries were impacted by this pandemic, and many governments ordered nationwide lockdowns. This has resulted in a considerable decline in transportation and related activities, which has impacted the demand for oil and gas. As of April 2020, OPEC and other oil-producing countries agreed to reduce oil production by 10 million barrels per day (BPD), which is about 23% of their production levels International Energy Agency(IEA) reported that oil demand would decrease by 23.1 million BPD in the second quarter of 2020.

The spread of COVID-19 is also likely to have an adverse effect on the manufacturers of field devices used in utility communication due to the global shutdown and resultant issues arising along the supply chain. The price of raw materials is also expected to increase due to the shortage of supply, which will ultimately lead to delay in order closures. For instance, ABB expects a decline in revenue across all its business segments compared to a year ago, while Siemens witnessed a sharp fall in demand from China, Germany, and Italy, where the impact of COVID-19 is high. This loss will eventually impact the overall revenue of companies. However, the market for software is estimated to have a low to moderate impact as compared to the market for hardware.

By technology, the wireless segment is expected to grow at the fastest rate during the forecast period.

The wireless technology is expected to continue to hold the largest share of the utility communication market, by technology, owing to the high efficiency offered and easy accessibility.

By utiltiy, the private segment is expected to grow at the fastest rate during the forecast period.

By utility private segment is expected to grow at the fastest rate from 2022 to 2027, the rise in the number of private power utilities in the region, drives the growth of private segment during forecasted period.

By application, transmission & distribution segment is expected to grow the fastest during the forecast period.

By application, the utility communication market has been segmented into transmission & distribution, oil & gas utilities and others. The high growth rate of the transmission & distribution segment can be attributed to the replacement of aging power infrastructure and increased demand of electricity.

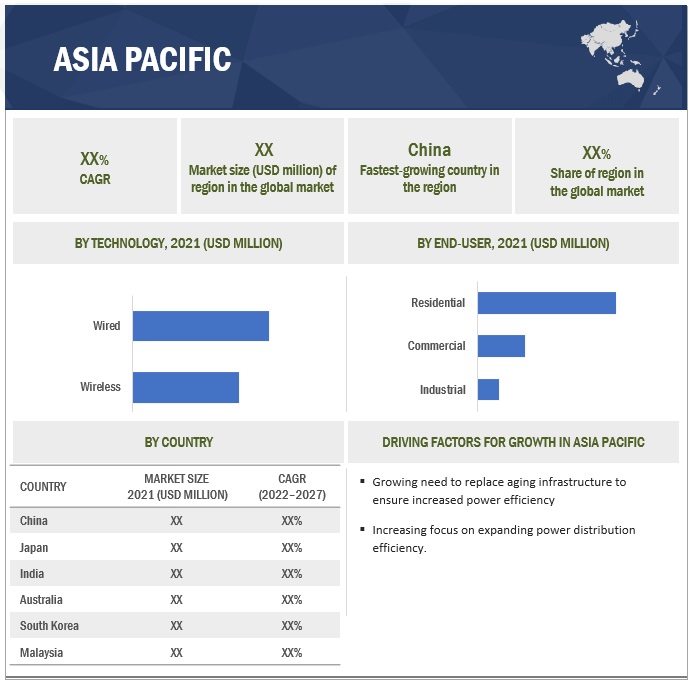

Asia Pacific is expected to be the largest market during the forecast period.

Asia Pacific is expected to be the largest and the fastest growing region in the utility communication market, during the forecast period. The growth of the Asia Pacific utility communication industry is characterized by increasing investments in deployment of smart grids to augment growth of market.

Key Market Players

The major players in the global utility communication market are Hitachi Energy Ltd (Switzerland), Schneider Electric (France), Siemens (Germany), General Electric, and Motorola Solutions, Inc (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/ USD Billion) |

|

Segments covered |

Technology, utility, component, application, end-user and region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America and Middle East & Africa. |

|

Companies covered |

Hitachi Energy Ltd (Switzerland), Schneider Electric (France), Siemens (Germany), General Electric, Motorola Solutions, Inc (US), FUJITSU (Japan), Landis+Gyr (Switzerland), Itron Inc. (US), Sensus, a Xylem brand (US) Telefonaktiebolaget LM Ericsson (Sweden), Digi International Inc. (US), Nokia (Finland), ZTE Corporation (China), Milsoft Utility Solutions (US), Ribbon Communications Operating Company, Inc. (US), Trilliant Holdings Inc (US), Cisco Systems, Inc. (US), Black & Veatch Holding Company (US), Valiant Communications (India), RAD (Israel), Open Systems International, Inc. (Saudi Arabia) |

This research report categorizes the market by technology, utility, component, application, end-user and region.

On the basis of by technology, the utility communication market has been segmented as follows:

- Wired

- Wireless

On the basis of by utility, the utility communication market has been segmented as follows:

- Public

- Private

On the basis of by component, the utility communication market has been segmented as follows:

- Hardware

- Software

On the basis of by application, the utility communication market has been segmented as follows:

- Transmission & Distribution

- Oil & Gas Utilities

- Others

On the basis of by end-user, the utility communication market has been segmented as follows:

- Residential

- Commercial

- Industrial

On the basis of region, the utility communication market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In August 2022, Siemens entered into a contract with Rail Vikas Nigam Limited (RVNL) for signaling and telecommunication of the Kolkata Metro Line 3 & 6. Siemens will provide maximum energy savings, network capacity, and decreased headways while ensuring highest possible safety.

- In August 2022, Motorola Solutions, Inc. acquired Barrett Communications, a provider of specialized radio communication for civil security, coast guard, border security, and additional government and private sectors.

- In March 2022, Motorola Solutions, Inc. announced that it has acquired ETRA Ireland Communications Limited, a provider of National Digital Radio Service (NDRS) of Ireland. It will help Motorola Solutions, Inc. to grow its worldwide managed and support services business.

- In August 2021, Motorola Solutions, Inc. signed a contract with Federal Office of Bundeswehr Equipment, Information Technology and In-Service Support (BAAINBw) to provide secure digital radio communications for 16 naval vessels and training platforms for the German Navy.

- In February 2021, Hitachi Energy Ltd won a contract from Centralschweizerische Kraftwerke (CKW) to design and supply a new mission critical communications network based on the industry-leading FOX615 hybrid platform and the FOXMAN network management system.

Frequently Asked Questions (FAQ):

What is the current size of the utility communication market?

The current market size of the global wave energy converter market is estimated at USD 20.2 billion in 2022.

What are the major drivers for utility communication market?

Focus on improving grid reliability, increasing operating efficiency, and reducing outage length.

Which is the fastest-growing region during the forecasted period in the utility communication market?

The asia Pacific utility communication market is estimated to be the largest and the fastest growing region, during the forecast period.

Which is the fastest-growing segment, by component during the forecasted period in utility communication market?

The software segment is estimated to be the largest and fastest growing segment by location. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 UTILITY COMMUNICATION MARKET, BY TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY UTILITY: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY COMPONENT: INCLUSIONS AND EXCLUSIONS

1.3.4 MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.3.5 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.3.6 MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 UTILITY COMMUNICATION MARKET: SEGMENTATION

1.4.2 MARKET: REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 UTILITY COMMUNICATION MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 6 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR UTILITY COMMUNICATION TECHNOLOGIES

2.3.3.1 Demand-side calculations

2.3.3.2 Assumptions for demand-side analysis

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF UTILITY COMMUNICATION TECHNOLOGIES

FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Assumptions for supply-side analysis

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 1 UTILITY COMMUNICATION MARKET: SNAPSHOT

FIGURE 9 WIRED SEGMENT TO DOMINATE UTILITY COMMUNICATIONS MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 10 PUBLIC SEGMENT TO DOMINATE UTILITY COMMUNICATIONS MARKET, BY UTILITY, DURING FORECAST PERIOD

FIGURE 11 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF UTILITY COMMUNICATIONS MARKET, BY COMPONENT, DURING FORECAST PERIOD

FIGURE 12 TRANSMISSION & DISTRIBUTION SEGMENT TO LEAD UTILITY COMMUNICATION MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 13 RESIDENTIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF UTILITY COMMUNICATIONS MARKET, BY END USER, DURING FORECAST PERIOD

FIGURE 14 ASIA PACIFIC DOMINATED GLOBAL UTILITY COMMUNICATION MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UTILITY COMMUNICATION MARKET

FIGURE 15 INCREASING INVESTMENTS IN DEPLOYMENT OF SMART GRID TECHNOLOGIES

4.2 UTILITY COMMUNICATION MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

4.3 UTILITY COMMUNICATION MARKET, BY TECHNOLOGY

FIGURE 17 WIRED SEGMENT DOMINATED MARKET IN 2021

4.4 UTILITY COMMUNICATION MARKET, BY UTILITY

FIGURE 18 PUBLIC SEGMENT DOMINATED MARKET IN 2021

4.5 UTILITY COMMUNICATION MARKET, BY COMPONENT

FIGURE 19 HARDWARE SEGMENT DOMINATED MARKET, BY COMPONENT, IN 2021

4.6 UTILITY COMMUNICATION MARKET, BY APPLICATION

FIGURE 20 TRANSPORTATION & DISTRIBUTION SEGMENT DOMINATED MARKET IN 2021

4.7 UTILITY COMMUNICATION MARKET, BY END USER

FIGURE 21 RESIDENTIAL SEGMENT DOMINATED MARKET IN 2021

4.8 ASIA PACIFIC MARKET, BY END USER AND COUNTRY

FIGURE 22 RESIDENTIAL SEGMENT AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 UTILITY COMMUNICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing investments in smart grids and modernization of electricity networks

FIGURE 24 GLOBAL INVESTMENTS IN POWER SECTOR, BY TECHNOLOGY, 2016–2021 (USD BILLION)

FIGURE 25 GLOBAL INVESTMENTS IN SMART GRIDS, BY TECHNOLOGY, 2014–2019 (USD BILLION)

5.2.1.2 Rising focus on improving grid reliability, increasing operational efficiency, and reducing outage time

5.2.1.3 Rising trend of digitalizing oilfields

5.2.1.4 Government-led initiatives to support deployment of smart grid technologies

5.2.2 RESTRAINTS

5.2.2.1 High upfront costs for installation and maintenance of smart grid technologies

5.2.2.2 Lack of standards and interoperability of different IT protocols and components

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in number of smart city projects in developing countries

5.2.3.2 Replacement of aging communication systems with advanced communication networks

5.2.3.3 Growing adoption of wireless communication technologies

5.2.4 CHALLENGES

5.2.4.1 Rise in cyberattacks and natural disasters

5.2.4.2 Oil price instability, decline in oil demand, and supply chain disruptions due to COVID-19

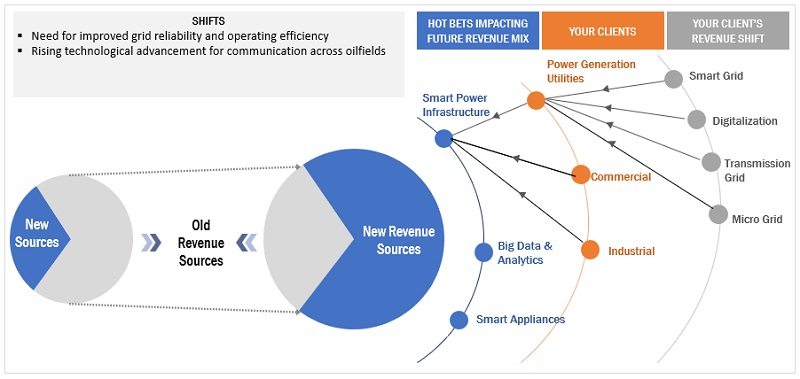

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR UTILITY COMMUNICATION TECHNOLOGY PROVIDERS

FIGURE 26 REVENUE SHIFT FOR UTILITY COMMUNICATION TECHNOLOGY PROVIDERS

5.4 VALUE AND SUPPLY CHAIN ANALYSES

FIGURE 27 UTILITY COMMUNICATIONS MARKET: SUPPLY CHAIN ANALYSIS

TABLE 2 MARKET: VALUE CHAIN ANALYSIS

5.4.1 MANUFACTURERS

5.4.2 SOFTWARE SUPPLIERS

5.4.3 SERVICE PROVIDERS

5.4.4 COMMUNICATION NETWORK PROVIDERS

5.4.5 GRID OPERATORS AND END USERS

5.5 MARKET MAP

FIGURE 28 UTILITY COMMUNICATIONS MARKET: MARKET MAP

5.6 TECHNOLOGY ANALYSIS

5.6.1 TECHNOLOGY TRENDS IN MARKET

5.6.1.1 Use of 5G in oil & gas industry

5.6.1.2 Use of Internet of Things (IoT) technologies in oil & gas industry

5.7 PATENT ANALYSIS

5.7.1 LIST OF MAJOR PATENTS

TABLE 3 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2016–AUGUST 2022

5.8 TRADE ANALYSIS

5.8.1 EXPORT SCENARIO

TABLE 4 EXPORT SCENARIO FOR HS CODE: 853670, BY COUNTRY, 2019–2021 (USD THOUSAND)

FIGURE 29 EXPORT DATA, BY TOP 5 COUNTRIES, 2019–2021 (USD THOUSAND)

5.8.2 IMPORT SCENARIO

TABLE 5 IMPORT SCENARIO FOR HS CODE: 853670, BY COUNTRY, 2019–2021 (USD THOUSAND)

FIGURE 30 IMPORT DATA, BY TOP 5 COUNTRIES, 2019–2021 (USD THOUSAND)

5.9 CASE STUDY ANALYSIS

5.9.1 HYDRO ONE DEPLOYS TRILLIANT’S SMART METERS AND INTELLIGENT COMMUNICATION NETWORKS

5.9.1.1 Problem Statement

5.9.1.2 Solution

5.9.2 CENTRAL HUDSON DEPLOYS HITACHI ENERGY’S MULTI-UTILITY APPLICATION NETWORKS

5.9.2.1 Problem Statement

5.9.2.2 Solution

5.10 TARIFFS, CODES, AND REGULATIONS

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 PORTER'S FIVE FORCES ANALYSIS

FIGURE 31 UTILITY COMMUNICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER'S FIVE FORCES ANALYSIS

5.11.1 THREAT OF SUBSTITUTES

5.11.2 BARGAINING POWER OF SUPPLIERS

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 THREAT OF NEW ENTRANTS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

6 UTILITY COMMUNICATION MARKET, BY TECHNOLOGY (Page No. - 77)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY TECHNOLOGY, 2021

TABLE 8 UTILITY COMMUNICATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

6.2 WIRED

TABLE 9 WIRED: UTILITY COMMUNICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 10 WIRED: MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 FIBER OPTIC

6.2.1.1 Fiber optic cables transmit data in form of light pulses

TABLE 11 FIBER OPTIC: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 ETHERNET

6.2.2.1 Ethernet offers wide range, versatility, and high speed

TABLE 12 ETHERNET: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.3 POWER LINE CARRIER (PLC)

6.2.3.1 Power line carrier (PLC) enables use of existing infrastructure to transfer data

TABLE 13 POWER LINE CARRIER (PLC): MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.4 SYNCHRONOUS OPTICAL NETWORKING/SYNCHRONOUS DIGITAL HIERARCHY (SONET/SDH)

6.2.4.1 Synchronous optical networking/synchronous digital hierarchy (SONET/SDH) offers flexibility, scalability, high speed, reliability, quality of service (QoS), and standardization

TABLE 14 SONET/SDH: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.5 MULTI-PROTOCOL LABEL SWITCHING (MPLS)

6.2.5.1 MPLS-IP

6.2.5.1.1 MPLS-IP VPN securely connects remote sites

TABLE 15 MPLS-IP: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.5.2 MPLS-TP

6.2.5.2.1 Operation, administration, and maintenance (OAM) of MPLS-TP may operate without any IP layer functionalities

TABLE 16 MPLS-TP: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.6 OTHERS

TABLE 17 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 WIRELESS

TABLE 18 WIRELESS: UTILITY COMMUNICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 19 WIRELESS: MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.3.1 RADIO FREQUENCY (RF) MESH

6.3.1.1 RF mesh offers high bandwidth, minimal latency, and end-to-end security

TABLE 20 RF MESH: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 MOBILE NETWORK

6.3.2.1 Mobile networks are reliable, secure, and affordable

TABLE 21 MOBILE NETWORK: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.3 MICROWAVE AND RADIO COMMUNICATION

6.3.3.1 Microwave and radio communication technologies use electromagnetic waves for communication

TABLE 22 MICROWAVE AND RADIO COMMUNICATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.4 OTHERS

TABLE 23 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 UTILITY COMMUNICATION MARKET, BY UTILITY (Page No. - 89)

7.1 INTRODUCTION

FIGURE 33 MARKET, BY UTILITY, 2021

TABLE 24 UTILITY COMMUNICATION MARKET, BY UTILITY, 2020–2027 (USD MILLION)

7.2 PUBLIC

7.2.1 RISING IMPLEMENTATION OF UTILITY POLICIES, PROGRAMS, AND PRACTICES BY PUBLIC UTILITIES TO SERVE PRIORITIES OF LOCAL COMMUNITIES

TABLE 25 PUBLIC: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 PRIVATE

7.3.1 HIGH ALLOCATION OF FUNDS BY PRIVATE UTILITIES TO DEPLOY SMART UTILITY COMMUNICATION TECHNOLOGIES

TABLE 26 PRIVATE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 UTILITY COMMUNICATION MARKET, BY COMPONENT (Page No. - 92)

8.1 INTRODUCTION

FIGURE 34 MARKET, BY COMPONENT, 2021

TABLE 27 UTILITY COMMUNICATION MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

8.2 HARDWARE

8.2.1 USE OF HARDWARE COMPONENTS TO CONTROL DISTRIBUTION SYSTEMS

TABLE 28 HARDWARE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 SOFTWARE

8.3.1 USE OF SOFTWARE TO ANALYZE DATA AND IDENTIFY PRECISE LOCATIONS FOR REPAIR

TABLE 29 SOFTWARE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 UTILITY COMMUNICATION MARKET, BY APPLICATION (Page No. - 96)

9.1 INTRODUCTION

FIGURE 35 MARKET, BY APPLICATION, 2021

TABLE 30 UTILITY COMMUNICATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2 TRANSMISSION & DISTRIBUTION

9.2.1 INCREASING DEMAND FOR ELECTRICITY AND REPLACEMENT OF AGING POWER INFRASTRUCTURES

TABLE 31 TRANSMISSION & DISTRIBUTION: UTILITY COMMUNICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 OIL & GAS UTILITIES

9.3.1 GROWING NEED FOR RELIABLE ENERGY SUPPLY

TABLE 32 OIL & GAS UTILITIES: UTILITY COMMUNICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 OTHERS

TABLE 33 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 UTILITY COMMUNICATION MARKET, BY END USER (Page No. - 101)

10.1 INTRODUCTION

FIGURE 36 MARKET, BY END USER, 2021

TABLE 34 UTILITY COMMUNICATION MARKET: BY END USER, 2020–2027 (USD MILLION)

10.2 RESIDENTIAL

10.2.1 GROWING RESIDENTIAL POWER CONSUMPTION

TABLE 35 RESIDENTIAL: UTILITY COMMUNICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 COMMERCIAL

10.3.1 RISING NEED FOR FAST RESTORATION OF SERVICES

TABLE 36 COMMERCIAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.4 INDUSTRIAL

10.4.1 INCREASING DEMAND FOR CONTINUOUS POWER AND ENHANCING ENERGY EFFICIENCY OF OPERATIONS

TABLE 37 INDUSTRIAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

11 UTILITY COMMUNICATION MARKET, BY REGION (Page No. - 105)

11.1 INTRODUCTION

FIGURE 37 REGIONAL SNAPSHOT: ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 38 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

TABLE 38 UTILITY COMMUNICATION MARKET, BY REGION, 2020–2027 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: SNAPSHOT OF MARKET, 2021

TABLE 39 ASIA PACIFIC: UTILITY COMMUNICATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 40 ASIA PACIFIC: MARKET, BY WIRED TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 41 ASIA PACIFIC: MARKET, BY WIRELESS TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 42 ASIA PACIFIC: MARKET, BY UTILITY, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 44 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 46 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.2.1 CHINA

11.2.1.1 Increasing investments in deployment of smart grids

TABLE 47 CHINA: UTILITY COMMUNICATIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.2 JAPAN

11.2.2.1 Growing emphasis on use of renewable energy sources

TABLE 48 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.3 INDIA

11.2.3.1 Increasing efforts to expand renewable power capacity

TABLE 49 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.4 AUSTRALIA

11.2.4.1 Surging need to replace aging grid infrastructures to ensure high efficiency of power plants

TABLE 50 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.5 SOUTH KOREA

11.2.5.1 Increasing focus on improving efficiency of power distribution systems

TABLE 51 SOUTH KOREA: UTILITY COMMUNICATIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.6 MALAYSIA

11.2.6.1 Increasing smart grid-related investments and booming oil & gas industry

TABLE 52 MALAYSIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.7 REST OF ASIA PACIFIC

TABLE 53 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 40 NORTH AMERICA: SNAPSHOT OF MARKET, 2021

TABLE 54 NORTH AMERICA: UTILITY COMMUNICATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY WIRED TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY WIRELESS TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY UTILITY, 2020–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.3.1 US

11.3.1.1 Rising need to upgrade aging infrastructures and focus on grid digitalization

TABLE 62 US: UTILITY COMMUNICATION MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Increasing domestic power consumption and allocation of funds to build improved infrastructures to meet surging energy demand

TABLE 63 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Increasing focus on grid modernization to ensure delivery of reliable and secure energy

TABLE 64 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4 EUROPE

TABLE 65 EUROPE: UTILITY COMMUNICATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY WIRED TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY WIRELESS TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY UTILITY, 2020–2027 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Increasing government-led initiatives toward T&D infrastructure development

TABLE 73 GERMANY: UTILITY COMMUNICATIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.2 FRANCE

11.4.2.1 Ongoing government support to promote use of renewable power sources

TABLE 74 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.3 UK

11.4.3.1 Rising need to monitor complex grids

TABLE 75 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.4 SPAIN

11.4.4.1 Increasing number of metering projects and implementation of smart grids

TABLE 76 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.5 ITALY

11.4.5.1 Escalating demand for next-generation smart meters

TABLE 77 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.6 REST OF EUROPE

TABLE 78 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 79 SOUTH AMERICA: UTILITY COMMUNICATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 80 SOUTH AMERICA: MARKET, BY WIRED TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 81 SOUTH AMERICA: MARKET, BY WIRELESS TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 82 SOUTH AMERICA: MARKET, BY UTILITY, 2020–2027 (USD MILLION)

TABLE 83 SOUTH AMERICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 84 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 86 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increasing investments in adoption of renewable energy sources

TABLE 87 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Growing focus on deployment of smart grids and increasing investments in oilfield communication technologies

TABLE 88 ARGENTINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

TABLE 89 REST OF SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

TABLE 90 MIDDLE EAST & AFRICA: UTILITY COMMUNICATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY WIRED TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: MARKET, BY WIRELESS TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: MARKET, BY UTILITY, 2020–2027 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.6.1 SAUDI ARABIA

11.6.1.1 Rising adoption of smart city solutions

TABLE 98 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.6.2 UAE

11.6.2.1 Increasing investments in oil & gas industry

TABLE 99 UAE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.6.3 IRAN

11.6.3.1 Surging requirement for smart grids

TABLE 100 IRAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.6.4 SOUTH AFRICA

11.6.4.1 Escalating need to modernize aging grid infrastructures

TABLE 101 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 102 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 140)

12.1 OVERVIEW

FIGURE 41 KEY DEVELOPMENTS IN MARKET, 2018–2022

12.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 103 MARKET: DEGREE OF COMPETITION

FIGURE 42 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2021

12.3 MARKET EVALUATION FRAMEWORK

TABLE 104 MARKET EVALUATION FRAMEWORK, 2018–2021

12.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 43 SEGMENTAL REVENUE ANALYSIS, 2017–2021

12.5 COMPETITIVE SCENARIOS AND TRENDS

12.5.1 DEALS

TABLE 105 UTILITY COMMUNICATIONS MARKET: DEALS, 2018–2022

12.5.2 OTHERS

TABLE 106 MARKET: PRODUCT LAUNCHES, 2018–2022

TABLE 107 MARKET: OTHERS, 2018–2022

12.6 COMPETITIVE LEADERSHIP MAPPING

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 44 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 108 COMPANY: TECHNOLOGY FOOTPRINT

TABLE 109 COMPANY: END USER FOOTPRINT

TABLE 110 COMPANY: REGIONAL FOOTPRINT

13 COMPANY PROFILES (Page No. - 152)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 HITACHI ENERGY LTD

TABLE 111 HITACHI ENERGY LTD: COMPANY OVERVIEW

FIGURE 45 HITACHI ENERGY LTD: COMPANY SNAPSHOT, 2021

TABLE 112 HITACHI ENERGY LTD: PRODUCTS OFFERED

TABLE 113 HITACHI ENERGY LTD: PRODUCT LAUNCHES

TABLE 114 HITACHI ENERGY LTD: DEALS

13.1.2 SCHNEIDER ELECTRIC

TABLE 115 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

FIGURE 46 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 116 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 117 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 118 SCHNEIDER ELECTRIC: OTHERS

13.1.3 GENERAL ELECTRIC

TABLE 119 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 47 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 120 GENERAL ELECTRIC: PRODUCTS OFFERED

TABLE 121 GENERAL ELECTRIC: OTHERS

13.1.4 SIEMENS

TABLE 122 SIEMENS: COMPANY OVERVIEW

FIGURE 48 SIEMENS: COMPANY SNAPSHOT, 2021

TABLE 123 SIEMENS: PRODUCTS OFFERED

TABLE 124 SIEMENS: DEALS

TABLE 125 SIEMENS: OTHERS

13.1.5 MOTOROLA SOLUTIONS, INC.

TABLE 126 MOTOROLA SOLUTIONS, INC.: COMPANY OVERVIEW

FIGURE 49 MOTOROLA SOLUTIONS, INC.: COMPANY SNAPSHOT, 2021

TABLE 127 MOTOROLA SOLUTIONS, INC.: PRODUCTS OFFERED

TABLE 128 MOTOROLA SOLUTIONS, INC.: PRODUCT LAUNCHES

TABLE 129 MOTOROLA SOLUTIONS, INC.: DEALS

TABLE 130 MOTOROLA SOLUTIONS, INC.: OTHERS

13.1.6 LANDIS+GYR

TABLE 131 LANDIS+GYR: COMPANY OVERVIEW

FIGURE 50 LANDIS+GYR: COMPANY SNAPSHOT, 2022

TABLE 132 LANDIS+GYR: PRODUCTS OFFERED

TABLE 133 LANDIS+GYR: PRODUCT LAUNCHES

TABLE 134 LANDIS+GYR: DEALS

13.1.7 SENSUS, A XYLEM BRAND

TABLE 135 SENSUS, A XYLEM BRAND: COMPANY OVERVIEW

TABLE 136 SENSUS, A XYLEM BRAND: PRODUCTS OFFERED

TABLE 137 SENSUS, A XYLEM BRAND: PRODUCT LAUNCHES

13.1.8 ITRON INC.

TABLE 138 ITRON INC.: COMPANY OVERVIEW

FIGURE 51 ITRON INC.: COMPANY SNAPSHOT

TABLE 139 ITRON INC.: PRODUCTS OFFERED

13.1.9 TELEFONAKTIEBOLAGET LM ERICSSON

TABLE 140 TELEFONAKTIEBOLAGET LM ERICSSON: COMPANY OVERVIEW

FIGURE 52 TELEFONAKTIEBOLAGET LM ERICSSON: COMPANY SNAPSHOT, 2021

TABLE 141 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCTS OFFERED

TABLE 142 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCT LAUNCHES

TABLE 143 TELEFONAKTIEBOLAGET LM ERICSSON: DEALS

13.1.10 FUJITSU

TABLE 144 FUJITSU: COMPANY OVERVIEW

FIGURE 53 FUJITSU: COMPANY SNAPSHOT, 2021

TABLE 145 FUJITSU: PRODUCTS OFFERED

TABLE 146 FUJITSU: DEALS

13.1.11 BLACK & VEATCH HOLDING COMPANY

TABLE 147 BLACK & VEATCH HOLDING COMPANY: COMPANY OVERVIEW

TABLE 148 BLACK & VEATCH HOLDING COMPANY: PRODUCTS OFFERED

TABLE 149 BLACK & VEATCH HOLDING COMPANY: DEALS

13.1.12 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.

TABLE 150 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: COMPANY OVERVIEW

FIGURE 54 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: COMPANY SNAPSHOT, 2021

TABLE 151 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: PRODUCTS OFFERED

TABLE 152 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: PRODUCT LAUNCHES

TABLE 153 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.: DEALS

13.1.13 NOKIA

TABLE 154 NOKIA: COMPANY OVERVIEW

FIGURE 55 NOKIA: COMPANY SNAPSHOT, 2021

TABLE 155 NOKIA: PRODUCTS OFFERED

TABLE 156 NOKIA: DEALS

13.1.14 DIGI INTERNATIONAL INC.

TABLE 157 DIGI INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 56 DIGI INTERNATIONAL INC.: COMPANY SNAPSHOT, 2021

TABLE 158 DIGI INTERNATIONAL INC.: PRODUCTS OFFERED

13.1.15 RAD

TABLE 159 RAD: COMPANY OVERVIEW

TABLE 160 RAD: PRODUCTS OFFERED

TABLE 161 RAD: PRODUCT LAUNCHES

13.1.16 TRILLIANT HOLDINGS INC

TABLE 162 TRILLIANT HOLDINGS INC: COMPANY OVERVIEW

TABLE 163 TRILLIANT HOLDINGS INC: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 ZTE CORPORATION.

13.2.2 MILSOFT UTILITY SOLUTIONS

13.2.3 CISCO SYSTEMS, INC.

13.2.4 VALIANT COMMUNICATIONS

13.2.5 OPEN SYSTEMS INTERNATIONAL, INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 211)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

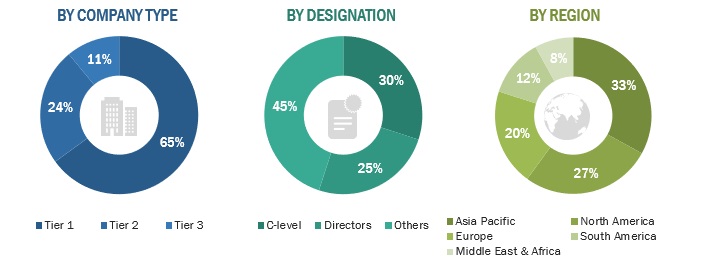

This study involved four major activities in estimating the current size of the utility communication market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, and UNESCO Institute of Statistics to identify and collect information useful for a technical, market-oriented, and commercial study of the utility communications market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, service providers, technology developers, and organizations related to all the segments of the nuclear industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SME), C-level executives of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess the prospects of the market. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Utility Communication Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Objectives of the Study

- To forecast and describe the utility communication market size, by technology, utility, component, application, end-user, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value

- To strategically analyze micro markets with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the market and analyze the impact of the pandemic on the overall market and value chain

- To forecast the growth of the utility communications market with respect to five major regions, namely, North America, Europe, Asia Pacific, South America and Middle East & Africa

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Utility Communication Market