Smart Electric Meter Market by Communication Technology Type (Radio Frequency, Power Line Communication, and Cellular), End-User (Residential, Commercial, and Industrial), Phase (Single Phase, and Three Phase), and Region - Global Forecast to 2023

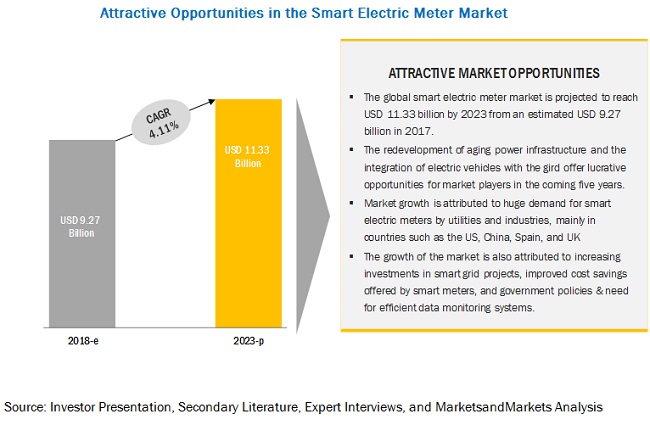

[154 Pages Report] MarketsandMarkets forecasts the Smart Electric Meter Market is projected to reach USD 11.33 billion by 2023, from an estimated USD 9.06 billion in 2017, at a CAGR of 4.11%. The market is set to witness growth due to the increased need for efficient data monitoring systems coupled with favorable government policies for smart meter rollout, improved cost savings owing to the use of smart meters making it a definitive case for adoption, and increasing emphasis on renewable energy sources globally.

The residential segment is expected to hold the largest share of the smart electric meter market, by end-user, during the forecast period.

The residential segment of the global smart electric meter market is expected to hold the largest market share and grow at the second-fastest pace during the forecast period. The installation of smart electric meters in residential places would help in reducing the dependence on fossil fuels, as the smart electric meters can assist the consumers to monitor, regularize, and reduce their consumptions from the grid, and generators, and further integrate their consumptions from renewable energy sources such as solar installations. The widespread use of sophisticated electrical, electronic, and data equipment is driven by the growing importance of power management solutions also driving the smart electric meter market.

The three-phase segment is expected to grow at the fastest pace in the smart electric meter market, by phase, during the forecast period.

The three-phase segment is the fastest-growing market during the forecast period and is projected to dominate the market during the forecast period. Three-phase meters are mostly used in industrial applications and in large commercial applications. The premium price for the three-phase meters over the single-phase meters and the growth in the number of industries and commercial facilities drive the installations of the three-phase smart electric meters.

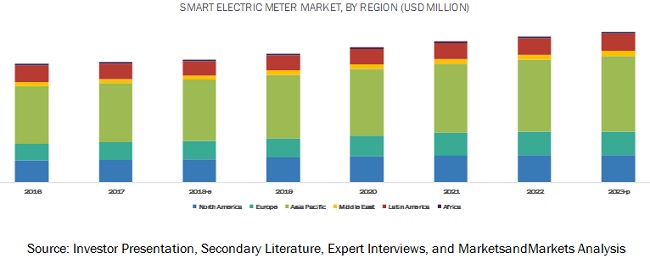

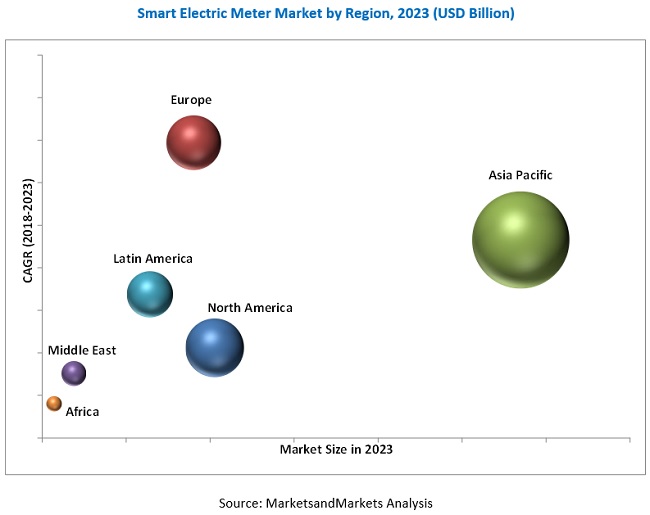

Asia Pacific: Key market for the smart electric meter market during the forecast period

In this report, the smart electric meter market has been analyzed with respect to 6 regions, namely, Asia Pacific, North America, Europe, Latin America, the Middle East, and Africa. Asia Pacific is expected to be the largest smart electric meter market, by region, during the forecast period. Asia Pacific is the most-populated region in the world and consequently witnesses a high demand for electricity. The rise in investments in smart grid technologies and smart cities, the increase in the number of data centers, and a surge in IT hubs and commercial institutions drive the smart electric meter market in the region. China accounts for the largest share owing to the large-scale rollout plans; the country accounted for the highest installed generation and distribution capacity in the Asia Pacific region, resulting in an increased demand for smart electric meters.

Market Dynamics

Driver: Improved cost saving owing to the use of smart meters make a definitive case for adoption

Smart electric meters can assist the end-users to monitor its electricity consumption data, and thus customize their usage based on the electricity tariff rates. Smart electric meters are intelligent devices, which measure the electrical consumption along with remote meter connection and disconnection, fault detection, reporting, and analysis of the consumed electricity in units on a day-to-day basis. Smart meters can also assist in voltage & power quality monitoring and collection & storage of real-time data in the central system. Hence, a customer can access their energy consumption data anytime and take suitable measures to cut down energy costs. All these allow a reduction in consumption of electricity during peak time as customers can observe, calculate, and analyze their usage to reduce the energy consumption during peak hours, thereby effectively managing energy costs. Such crucial benefits offered by smart electric meters over the conventional meters have attracted the attention of governments and end-users and thus driven the adoption of smart electric meters over the years.

Restraint: High initial investment acting as a restraint for growth in developing economis

One of the major restraints in the deployment of smart meters is the gap between the cost-bearing party and the potential beneficiary, vis-à-vis what would the overall cost be and who would bear it. The overall cost for the installation and operation of smart meters is very high. Smart meter deployment is highly capital-intensive for utilities and consumers. Installation costs for deploying smart electric meters are too high when compared to the traditional electro-mechanical and electronic meters. For instance, smart electric meters cost somewhere around USD 100–500 as compared to the traditional meters, which have the pricing of around USD 10–30. Hence, most utilities are reluctant to shift their focus toward the deployment of new technology. In most countries, the state does not provide subsidies, and hence, funding is a serious restraint for smart electric meter deployment. Due to this reason, countries are still using traditional analogue meters, and thus act as a restraint for the smart electric meter market.

Opportunity: Demand for smart grids and energy efficiency in emerging market

The implementation of a smart grid is in its initial stages in many developing countries. This implementation of the smart grid is being done to gauge the demand for electricity, a post which they are expected to develop the requisite advanced infrastructure which would also comprise of smart electric meters. China is expected to witness an investment of USD 300 billion from 2016 to 2020. Whereas India is expected to connect with 300 consumers by 2019. In September 2017, Tata Power Delhi Distribution Limited (India) announced its plans to roll-out 18 lakh smart meters by 2025. Where South Korea is expected to invest USD 24 billion by 2030. The development and implementation of smart grids across many countries offer a huge opportunity to the smart electric meter market, as the latter perfectly fulfill the needs of a smart grid system. For example, with the help of a smart grid, electric vehicles can identify themselves to the charging station when they are plugged in, and the electricity used can be automatically billed to the owner’s account. Also, the smart electric meter communication infrastructure can be further used to control the distributed generation of electricity remotely. Smart electric meters are a part of a virtual power plant, and therefore, they can be used to measure the electricity delivered by distributed generation to the grid. The tariff management options make it easy for grid operators to integrate renewable and nonrenewable sources to manage the demand for electricity with a perfect mix of energy sources. All these features present a huge opportunity for the smart electric meters market, as the adoption of smart electric meters is essential to meet the energy demand and increase the reliability of operations.

Challenge: Cybersecurity & data privacy

Smart electric meter solutions provide an array of advantages such as real-time monitoring, ability to monitor and control electricity consumption remotely, and integrative capabilities with external software to enhance the data analysis and decision-making process. Smart equipment, such as a smart electric meter, obtains information and communicates on digital networks. Moreover, this equipment can be controlled over networks, raising concerns regarding data theft and cyber-attacks. Cyber threats are the primary concern while developing any network for monitoring and control critical infrastructures. Thus, there is a need to protect unauthorized access to the network facilities.

The cyber-attacks targeted toward operational functions could result in loss of equipment control as well as unauthorized external control of equipment, hampering the monitoring process. Such sort of disruptions could range from operational irregularities such as loss of equipment and misinterpretation of the data. Unauthorized access through hacking or a cyber-attack could result in the leakage of confidential information, causing heavy losses to companies. Moreover, shortage of human resource to effectively ascertain and mitigate a cyber threat further adds to the problem of data security and cyber-attacks. With the growing awareness of cybersecurity, companies are likely to invest in data & network security and implement standard and bespoke security solutions to mitigate this cyberthreat. Considering these potential threats, end-users prefer conventional equipment, as the smart meter technology is misunderstood due to the lack of knowledge. The successful implementation of the smart meter technology requires proper training, and knowledge impartment is imperative. The misuse of this data can pose a national security threat and thus acts as a challenge for the growth of the smart electric meter market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Phase (Single, Three), Communication Technology Type (Power line communication, radio frequency, cellular), End-User (Industrial, commercial, and residential), and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, Latin America, Middle East, and Africa |

|

Companies covered |

Itron (US), Landis+Gyr (Toshiba Corporation) (Switzerland), Jiangsu Linyang (China), Wasion (China), Aclara Technologies (Hubbell Incorporated) (US), Schneider (France), Siemens (Germany), Honeywell (US), and Iskraemeco (Slovenia) |

The research report categorizes the Smart electric Meter Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Phase

- Single

- Three

By Communication Technology Type

- Power Line Communication (PLC)

- Radio Frequency (RF)

- Cellular

By End-Users

- Industrial

- Commercial

- Residential

By Region

- Asia Pacific

- Europe

- North America

- Middle East

- Latin America

- Africa

Key Market Players

Itron (US), Landis+Gyr (Toshiba Corporation) (Switzerland), Schneider (France), Siemens (Germany), Honeywell (US), Jiangsu Linyang (China), Wasion (China), Aclara Technologies (Hubbell Incorporated) (US), and Iskraemeco (Slovenia).

Itron is one of the major providers of basic meters, digital meters, smart meters, data collection, and utility software systems. Its smart metering systems include automated meter reading (AMR) and advanced metering infrastructure (AMI) technologies used to measure electricity, water, and gas consumption. The company provides its solutions through 3 segments: electricity, gas, and water. The company has adopted contracts & agreements and new product launches as its key strategies. In December 2017, Itron was awarded a contract by Vectren for grid modernization. In January 2017, Itron was awarded a contract by AVANGRID in the US. The scope of the contract includes installation of advanced metering infrastructure (OpenWay Riva) in Ithaca, New York. The company expanded its product portfolio by adding new grid connectivity which would help utilities improve their grid performance, in January 2017. In January 2015, Itron expanded its cellular product portfolio by launching a 4G LTE smart metering solution featuring an OpenWay CENTRON 4G LTE meter.

Recent Developments

- In February 2018, Landis+Gyr entered into a contract with Elektroset for providing advanced metering infrastructure technology for the utility’s grid modernization program. This contract will strengthen Landis+Gyr’s presence in the US.

- In February 2018, Iskraemeco signed a contract with Bahrain Electricity and Water Distribution (EWA) (Bahrain) for 50,000 smart meters for residential and commercial users. This contract will help Iskraemeco enhance its market position in the Middle East.

- In January 2018, Landis+Gyr launched Gridstream Connect, a next-generation IoT platform for utilities, consumers, and smart cities. This new product development will strengthen the company’s portfolio.

- In May 2017, to support its growing international businesses, Aclara opened a new headquarters for international operations in Bilbao, Spain, and a new office in Cambridge, UK.

- In April 2017, Schneider and Accenture in collaboration have completed the development of the Schneider Electric digital services factory which enables Schneider to rapidly build and scale new offerings in areas such as predictive maintenance, asset monitoring, and energy optimization.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Smart Electric Meter market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Countries Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Smart Electric Meter Market

4.2 Smart Electric Meter, By End-User

4.3 Smart Electric Meter, By Country

4.4 Asia Pacific Market, By End-User & Country

4.5 Smart Electric Meter, By Phase

4.6 Smart Electric Meter, By Communication Technology Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Need for Efficient Data Monitoring Systems Coupled With Favorable Government Policies for Smart Meter Rollout

5.2.1.2 Improved Cost Savings Owing to the Use of Smart Meters Make A Definitive Case for Adoption

5.2.1.3 Increased Investment in Smart Grid Projects in Key Regions Such as Europe and North America

5.2.1.4 Increasing Emphasis on Renewable Energy Sources Globally

5.2.2 Restraints

5.2.2.1 High Initial Investment Acting as A Restraint for Growth in Developing Economies

5.2.2.2 Delay in Smart Meter Rollout Projects

5.2.3 Opportunities

5.2.3.1 Demand for Smart Grids and Energy Efficiency in Emerging Markets

5.2.3.2 Electric Vehicle and Grid Integration

5.2.4 Challenges

5.2.4.1 Cybersecurity & Data Privacy

6 Smart Electric Meter, By Phase (Page No. - 45)

6.1 Introduction

6.2 Single Phase

6.3 Three Phase

7 Smart Electric Meter, By Communication Technology Type (Page No. - 49)

7.1 Introduction

7.2 Power Line Communication

7.3 Radio Frequency

7.4 Cellular

8 Smart Electric Meter, By End-User (Page No. - 54)

8.1 Introduction

8.2 Residential

8.3 Commercial

8.4 Industrial

9 Smart Electric Meter Market, By Region (Page No. - 59)

9.1 Introduction

9.2 Asia Pacific

9.2.1 By Phase

9.2.2 By Communication Technology Type

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 China

9.2.4.2 Japan

9.2.4.3 Australia

9.2.4.4 India

9.2.4.5 Rest of Asia Pacific

9.3 North America

9.3.1 By Phase

9.3.2 By Communication Technology Type

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 US

9.3.4.2 Canada

9.4 Europe

9.4.1 By Phase

9.4.2 By Communication Technology Type

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 UK

9.4.4.2 Germany

9.4.4.3 France

9.4.4.4 Rest of Europe

9.5 Latin America

9.5.1 By Phase

9.5.2 By Communication Technology Type

9.5.3 By End-User

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.2 Mexico

9.5.4.3 Rest of Latin America

9.6 Middle East

9.6.1 By Phase

9.6.2 By Communication Technology Type

9.6.3 By End-User

9.6.4 By Country

9.6.4.1 Saudi Arabia

9.6.4.2 UAE

9.6.4.3 Kuwait

9.6.4.4 Rest of the Middle East

9.7 Africa

9.7.1 By Phase

9.7.2 By Communication Technology Type

9.7.3 By End-User

9.7.4 By Country

9.7.4.1 South Africa

9.7.4.2 Rest of Africa

10 Competitive Landscape (Page No. - 99)

10.1 Introduction

10.2 Key Players & Market Structure

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 New Product Launches

10.3.3 Investments & Expansions

10.3.4 Mergers & Acquisitions

10.3.5 Partnerships, Collaborations, Alliances, & Joint Ventures

11 Company Profiles (Page No. - 105)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Benchmarking

11.2 Landis+Gyr (Toshiba Corporation)

11.3 Itron

11.4 Honeywell

11.5 Aclara

11.6 Microchip Technology

11.7 Iskraemeco

11.8 Wasion Group

11.9 Schneider Electric

11.10 Jiangsu Linyang

11.11 Siemens

11.12 Genus Power Infrastructure

11.13 Networked Energy Services

11.14 Holley Metering

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 146)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (83 Tables)

Table 1 Global Smart Electric Meter Market Snapshot

Table 2 Key Smart Grid Investment Initiatives

Table 3 Market Size, By Phase, 2016–2023 (USD Million)

Table 4 Single Phase: Market Size, By Region, 2016–2023 (USD Million)

Table 5 Three Phase: Market Size, By Region, 2016–2023 (USD Million)

Table 6 Market Size, By Communication Technology Type, 2016–2023 (USD Million)

Table 7 Power Line Communication Technology: Market Size, By Region, 2016–2023 (USD Million)

Table 8 Radio Frequency Communication Technology: Market Size, By Region, 2016–2023 (USD Million)

Table 9 Cellular Communication Technology: Market Size, By Region, 2016–2023 (USD Million)

Table 10 Market Size, By End-User, 2016–2023 (USD Million)

Table 11 Residential: Market Size, By Region, 2016–2023 (USD Million)

Table 12 Commercial: Market Size, By Region, 2016–2023 (USD Million)

Table 13 Industrial: Market Size, By Region, 2016–2023 (USD Million)

Table 14 Market Size, By Region, 2016–2023 (Million Units)

Table 15 Market Size, By Region, 2016–2023 (USD Million)

Table 16 Asia Pacific: Market Size, By Phase, 2016–2023 (USD Million)

Table 17 Asia Pacific: Market Size, By Communication Technology Type, 2016–2023 (USD Million)

Table 18 Asia Pacific: Market Size, By End-User, 2016–2023 (USD Million)

Table 19 Asia Pacific: Residential Market Size, By Country, 2016–2023 (USD Million)

Table 20 Asia Pacific: Commercial Market Size, By Country, 2016–2023 (USD Million)

Table 21 Asia Pacific: Industrial Market Size, By Country, 2016–2023 (USD Million)

Table 22 Asia Pacific: Smart Electric Meter Size, By Country, 2016–2023 (USD Million)

Table 23 China: Market Size, By End-User, 2016–2023 (USD Million)

Table 24 Japan: Market Size, By End-User, 2016–2023 (USD Million)

Table 25 Australia: Market Size, By End-User, 2016–2023 (USD Million)

Table 26 India: Market Size, By End-User, 2016–2023 (USD Million)

Table 27 Rest of Asia Pacific: Market Size, By End-User, 2016–2023 (USD Million)

Table 28 North America: Market Size, By Phase, 2016–2023 (USD Million)

Table 29 North America: Market Size, By Communication Technology Type, 2016–2023 (USD Million)

Table 30 North America: Market Size, By End-User, 2016–2023 (USD Million)

Table 31 North America: Residential Market Size, By Country, 2016–2023 (USD Million)

Table 32 North America: Commercial Market Size, By Country, 2016–2023 (USD Million)

Table 33 North America: Industrial Market Size, By Country, 2016–2023 (USD Million)

Table 34 North America: Smart Electric Meter Size, By Country, 2016–2023 (USD Million)

Table 35 US: Market Size, By End-User, 2016–2023 (USD Million)

Table 36 Canada: Market Size, By End-User, 2016–2023 (USD Million)

Table 37 Europe: Market Size, By Phase, 2016–2023 (USD Million)

Table 38 Europe: Market Size, By Communication Technology Type, 2016–2023 (USD Million)

Table 39 Europe: Market Size, By End-User, 2016–2023 (USD Million)

Table 40 Europe: Residential Market Size, By Country, 2016–2023 (USD Million)

Table 41 Europe: Commercial Market Size, By Country, 2016–2023 (USD Million)

Table 42 Europe: Industrial Market Size, By Country, 2016–2023 (USD Million)

Table 43 Europe: Smart Electric Meter Size, By Country, 2016–2023 (USD Million)

Table 44 UK: Market Size, By End-User, 2016–2023 (USD Million)

Table 45 Germany: Market Size, By End-User, 2016–2023 (USD Million)

Table 46 France: Market Size, By End-User, 2016–2023 (USD Million)

Table 47 Rest of Europe: Market Size, By End-User, 2016–2023 (USD Million)

Table 48 Latin America: Market Size, By Phase, 2016–2023 (USD Million)

Table 49 Latin America: Market Size, By Communication Technology Type, 2016–2023 (USD Million)

Table 50 Latin America: Market Size, By End-User, 2016–2023 (USD Million)

Table 51 Latin America: Residential Market Size, By Country, 2016–2023 (USD Million)

Table 52 Latin America: Commercial Market Size, By Country, 2016–2023 (USD Million)

Table 53 Latin America: Industrial Market Size, By Country, 2016–2023 (USD Million)

Table 54 Latin America: Smart Electric Meter Size, By Country, 2016–2023 (USD Million)

Table 55 Brazil: Market Size, By End-User, 2016–2023 (USD Million)

Table 56 Mexico: Market Size, By End-User, 2016–2023 (USD Million)

Table 57 Latin America: Market Size, By End-User, 2016–2023 (USD Million)

Table 58 Middle East: Market Size, By Phase, 2016–2023 (USD Million)

Table 59 Middle East: Market Size, By Communication Technology Type, 2016–2023 (USD Million)

Table 60 Middle East: Market Size, By End-User, 2016–2023 (USD Million)

Table 61 Middle East: Residential Market Size, By Country, 2016–2023 (USD Million)

Table 62 Middle East: Commercial Market Size, By Country, 2016–2023 (USD Million)

Table 63 Middle East: Industrial Market Size, By Country, 2016–2023 (USD Million)

Table 64 Middle East: Smart Electric Meter Size, By Country, 2016–2023 (USD Million)

Table 65 Saudi Arabia: Market Size, By End-User, 2016–2023 (USD Million)

Table 66 UAE: Market Size, By End-User, 2016–2023 (USD Million)

Table 67 Kuwait: Market Size, By End-User, 2016–2023 (USD Million)

Table 68 Rest of the Middle East: Market Size, By End-User, 2016–2023 (USD Million)

Table 69 Africa: Market Size, By Phase, 2016–2023 (USD Million)

Table 70 Africa: Market Size, By Communication Technology Type, 2016–2023 (USD Million)

Table 71 Africa: Market Size, By End-User, 2016–2023 (USD Million)

Table 72 Africa: Residential Market Size, By Country, 2016–2023 (USD Million)

Table 73 Africa: Commercial Market Size, By Country, 2016–2023 (USD Million)

Table 74 Africa: Industrial Market Size, By Country, 2016–2023 (USD Million)

Table 75 Africa: Smart Electric Meter Size, By Country, 2016–2023 (USD Million)

Table 76 South Africa: Market Size, By End-User, 2016–2023 (USD Million)

Table 77 Rest of Africa: Market Size, By End-User, 2016–2023 (USD Million)

Table 78 Landis+Gyr Was the Most Active Player in the Market, January 2014–March 2018

Table 79 Contracts & Agreements, 2014–February 2018

Table 80 New Product Launches, 2014–January 2018

Table 81 Investments & Expansions, 2014–May 2017

Table 82 Mergers & Acquisitions, 2014–August 2017

Table 83 Partnerships, Collaborations, Alliances, & Joint Ventures, 2014–March 2018

List of Figures (39 Figures)

Figure 1 Market Segmentation: Smart Electric Meters

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Asia Pacific Dominated the Market in 2017

Figure 7 Comparison of Regional Market Without Chinese Market (2017)

Figure 8 Three-Phase Segment is Expected to Dominate the Market During the Forecast Period

Figure 9 Residential End-User Segment to Dominate the Smart Electric Meter Industry During the Forecast Period

Figure 10 Market Share (Value), By End-User Type, 2017

Figure 11 PLC Communication Technology Type Segment to Dominated the Market During the Forecast Period

Figure 12 Top Market Developments (2014–2017)

Figure 13 Electric Vehicle & Grid Integration: an Attractive Opportunity for the Smart Electric Meter Industry in the Future

Figure 14 Commercial End-User Segment is Expected to Grow at the Highest Rate During the Forecast Period

Figure 15 Germany Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 China Held the Largest Share in the Market in 2017

Figure 17 Three-Phase Segment is Expected to Grow at the Highest Rate During the Forecast Period

Figure 18 PLC Segment is Expected to Dominate the Communication Technology Type Market During the Forecast Period

Figure 19 Market Dynamics: Smart Electric Meter

Figure 20 Total Renewable Energy Capacity

Figure 21 Electric Car Sales, 2012–2016

Figure 22 Electric Car Sales, By Country, 2012–2016

Figure 23 The Three Phase Segment is Expected to Have the Largest Market Share During the Forecast Period

Figure 24 The PLC Communication Technology Type Segment is Expected to Have the Largest Market Share During the Forecast Period

Figure 25 Europe is the Fastest Growing Region in the Power Line Communication-Based Smart Electricity Meter Segment, 2018 vs 2023

Figure 26 The Residential End-User Segment is Expected to Account for the Largest Market, 2018 vs 2023

Figure 27 Asia Pacific Dominated the Market in 2017

Figure 28 Market Size, By Region, 2018–2023 (USD Million)

Figure 29 Asia Pacific: Market Snapshot

Figure 30 North America: Market Snapshot

Figure 31 Key Developments in the Market, January 2014–March 2018

Figure 32 Market Shares of the Major Players in the Market, By Value, 2016

Figure 33 Itron: Company Snapshot

Figure 34 Honeywell: Company Snapshot

Figure 35 Microchip Technology: Company Snapshot

Figure 36 Wasion Group: Company Snapshot

Figure 37 Schneider Electric: Company Snapshot

Figure 38 Siemens: Company Snapshot

Figure 39 Genus Power Infrastructure: Company Snapshot

The smart electric meter market is projected to grow from an estimated USD 9.27 billion in 2018 to USD 11.33 billion by 2023, at a CAGR of 4.11%, from 2018 to 2023. The increased need for efficient data monitoring systems, coupled with favourable government policies for a smart meter rollout is driving the market for smart electric meters. Other factors include improved cost savings, increased investment in smart grid projects in Europe and North America, and increased emphasis on renewable energy sources.

The Commercial segment, by end user, is expected to be the fastest growing during the forecast period

The report segments the smart electric meter market, based on end-user, into residential, commercial, and industrial. The residential segment led the smart electric meter market by end-user from 2018 to 2023, owing to the widespread use of sophisticated electrical, electronic, and data equipment. The commercial segment is expected to be the fastest-growing segment of the smart electric meter market, by end-user, during the forecast period.

The PLC segment, by communication technology, is expected to be the fastest growing during the forecast period

The global smart electric meter market, by communication technology type, has been segmented into PLC, RF, and cellular-based meters. The PLC segment is the fastest-growing market during the forecast period and is also projected to dominate the market during the same period. PLC is the most used communication technology due to its advantages such as the use of the existing utility infrastructure of poles & wires, improved cost-effectiveness for rural lines, and usability in challenging terrain.

The Three-phase segment, by phase type, is expected to be the fastest growing during the forecast period

The report further segments the smart electric meter market, by phase, into single-phase and three-phase configurations. The three-phase segment is the fastest-growing market during the forecast period and is also projected to dominate the market during the same period. Three-phase meters are mostly used in industrial applications and in large commercial applications. Single-phase smart electric meters are mostly used in residential applications and across various industries such as chemical plants, food & beverage, cement, steel manufacturing, automotive.

The Asia Pacific region is expected to be the largest market during the forecast period

In this report, the smart electric meter market has been analyzed with respect to six regions, namely, Asia Pacific, North America, Europe, the Middle East, Latin America, and Africa. Asia Pacific is expected to dominate the smart electric meter market during the forecast period because of the rise in investments in smart grid technologies and smart cities, the increase in the number of data centers, and a surge in IT hubs and commercial institutions. Europe is expected to grow at the fastest rate during the forecast period because of government initiatives such as the European Union’s (EU) 20:20:20 plan, which aims at reducing greenhouse gas emissions.

The figure below shows the projected market sizes of various regions with respective CAGRs for 2023.

To know about the assumptions considered for the study, download the pdf brochure

The major factor restraining the growth of the smart electric meter market are the delay in smart meter rollout projects, and high initial investment acting as a restraint for growth in developing economies.

Some of the leading players in the smart electric meter market include Itron (US), Landis+Gyr (Toshiba Corporation) (Switzerland), Jiangsu Linyang (China), Wasion (China), Aclara Technologies (Hubbell Incorporated) (US), Schneider (France), Siemens (Germany), Honeywell (US), and Iskraemeco (Slovenia).

Major strategies adopted by the players are new product launches; contracts & agreements; partnerships, collaborations, alliances, and joint ventures; mergers & acquisitions; and investments & expansions from 2014 to March 2018. Contracts & agreements were the most adopted strategy. Industry players also adopted new product launches, and partnerships, collaborations, alliances, and joint ventures, which were the second- and third-most widely followed strategies during the same period.

Landis+Gyr was founded in 1896 and is headquartered in Zug, Switzerland. In 2011, Toshiba Corporation (Japan) acquired a 60% stake in Landis+Gyr AG, with the remaining 40% held by Innovation Network Corporation of Japan. It offers a wide portfolio of products, systems, and services, including energy meters, integrated metering solutions, advanced metering, sensing and automation tools, load control, analytics, as well as energy storage. The company has adopted contracts & agreements and new product launches as its key strategies. In February 2018, Landis+Gyr entered a contract with Elektroset for providing an advanced metering infrastructure technology for the utility’s grid modernization program. This contract will strengthen Landis+Gyr’s presence in the US. In November 2017, the company expanded its distribution sensor product portfolio by adding a cellular communication option to its S610 Line Sensor, which is used for detecting and locating faults quickly, monitoring power flows, and improving grid reliability.

Itron is one of the major providers of basic meters, digital meters, smart meters, data collection, and utility software systems. Its smart metering systems include automated meter reading (AMR) and advanced metering infrastructure (AMI) technologies used to measure electricity, water, and gas consumption. The company provides its solutions through 3 segments: electricity, gas, and water. The company has adopted contracts & agreements and new product launches as its key strategies. In December 2017, Itron was awarded a contract by Vectren for grid modernization. In January 2017, Itron was awarded a contract by AVANGRID in the US. The scope of the contract includes the installation of advanced metering infrastructure (OpenWay Riva) in Ithaca, New York. The company expanded its product portfolio by adding new grid connectivity which would help utilities improve their grid performance, in January 2017. In January 2015, Itron expanded its cellular product portfolio by launching a 4G LTE smart metering solution featuring an OpenWay CENTRON 4G LTE meter.

Growth opportunities and latent adjacency in Smart Electric Meter Market