Urgent Care Center Market by Service (Acute Illness Treatment, Trauma/Injury Treatment, Physical Examination, Immunization & Vaccination), Ownership (Corporate Owned, Physician Owned, Hospital Owned), and Region - Global Forecasts to 2023

The global urgent care center market is projected to reach USD 25.93 Billion by 2023, at a CAGR of 5.3% during the forecast period. The growth of this market is driven by factors such as growing investments in urgent care, increasing geriatric population, strategic developments between urgent care providers and hospitals, and affordable care and shorter waiting periods offered by urgent care centers.

Objectives of the Study:

- To define, describe, and forecast the global market by service, ownership, and region

- To provide detailed information regarding factors influencing market growth (drivers, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape of market leaders

- To forecast the size of the market in North America, Europe, Asia Pacific, and the rest of the world

- To profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as acquisitions, expansions, partnerships, and collaborations of the leading players in the market

Research Methodology

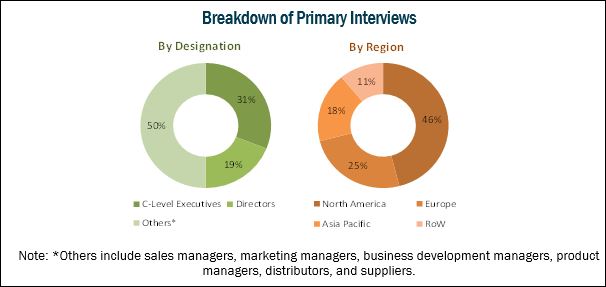

Top-down and bottom-up approaches were used to validate the size of the global urgent care center market and estimate the size of other dependent submarkets. Various secondary sources such as associations like the World Health Organization, Centers for Disease Control and Prevention, World Heart Federation, Society for Cardiovascular Angiography and Interventions, American College of Cardiology, American Heart Association, European Association of Percutaneous Cardiovascular Interventions, Urgent Care Association of America, directories, industry journals, databases, and annual reports of the companies have been used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Some of the major players in the Urgent care center market include Concentrs (US), MedExpress (US), American Family Care (US), NextCare Urgent Care (US), and FastMed Urgent Care (US).

Target Audience:

- Urgent care centers

- Healthcare corporations

- Hospitals

- Primary care facilities

- Medical service providers

- Physicians

- Nurse practitioners

- Radiologists and pathologists

- Freestanding emergency departments

- Venture capitalists

Urgent Care Center Market Scope

The research report categorizes the market into the following segments and subsegments:

By Service

- Acute illness treatment

- Trauma/injury treatment

- Physical examinations

- Immunizations & vaccination

- Other services

By Ownership

- Corporate-owned

- Physician-owned

- Multiple physician-owned

- Single physician-owned

- Hospital-owned

- Others

By Region

-

North America

- US

- Canada

-

Europe

- EU-3

- Rest of Europe (RoE)

- Asia Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe market Russia, Sweden, Austria, Denmark, and other European countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The report describes and studies the global market by service, ownership, and region. It provides detailed information regarding the major factors influencing the growth of this market and the regulatory analysis impacting market dynamics.

On the basis of services, the global market is segmented into acute illness treatment, trauma/injury treatment, physical examination, immunizations & vaccination, and other services (diagnostics, telemedicine, and travel & occupational medicine. The trauma/injury treatment segment is expected to register the highest CAGR during the forecast period. The high growth in this segment can be attributed to the rising number of unintentional, minor injuries and the increasing preference for affordable and immediately available healthcare services.

Based on ownership, the market is segmented into corporate-owned, physician-owned, hospital-owned, and other centers. The physician-owned urgent care centers segment is further categorized into multiple physician-owned, and single physician-owned. The corporate-owned urgent care centers segment is expected to account for the largest share and register the highest CAGR during the forecast period.

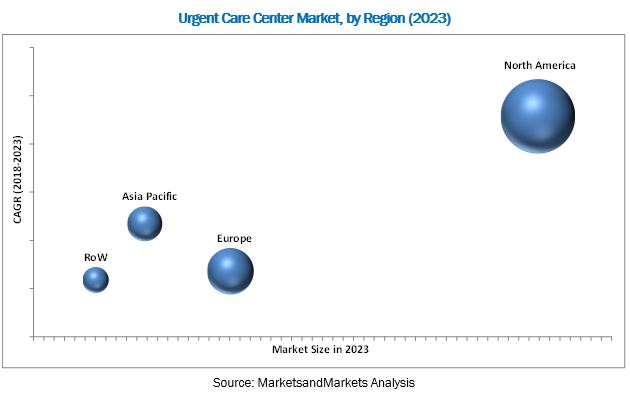

The geographic segments in this report include North America, Europe, Asia Pacific, and RoW. Of these, the North American segment is expected to account for the largest share of the market in 2018. The large share and high growth in this region can be attributed to the growing geriatric population in the region, the affordability and promptness of urgent care services, and the inception of specialty urgent care.

Lack of a skilled workforce could be a challenging factor for this market. Concentra (US), MedExpress (US), American Family Care (US), NextCare Holdings (US), and FastMed Urgent Care (US) are the key players in the Urgent Care Center Market. Other players involved in this market include CityMD (US), CareNow Urgent Care (US), GoHealth Urgent Care (US), HCA Healthcare UK (UK), Columbia Asia Hospitals (India), International SOS (China), and St. Joseph's Health Care London (Canada).

Frequently Asked Questions (FAQs):

What is the size of Urgent Care Center Market?

The global urgent care center market is projected to reach USD 25.93 Billion by 2023, at a CAGR of 5.3%.

What are the major growth factors of Urgent Care Center Market?

The growth of this market is driven by factors such as growing investments in urgent care, increasing geriatric population, strategic developments between urgent care providers and hospitals, and affordable care and shorter waiting periods offered by urgent care centers.

Who all are the prominent players of Urgent Care Center Market?

Some of the major players in the Urgent care center market include Concentrs (US), MedExpress (US), American Family Care (US), NextCare Urgent Care (US), and FastMed Urgent Care (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Methodology Steps

2.1.1 Secondary and Primary Research Methodology

2.1.1.1 Secondary Research

2.1.1.1.1 Secondary Sources

2.1.1.2 Primary Research

2.1.1.2.1 Primary Sources

2.1.1.2.2 Key Insights From Primary Sources

2.1.2 Market Size Estimation Methodology

2.1.3 Research Design

2.1.4 Market Data Estimation and Triangulation

2.1.5 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Market Overview

4.2 Geographic Analysis: Market, By Ownership

4.3 Market, By Service, 2018 vs 2023

4.4 Market, By Ownership, 2018 vs 2023

4.5 Geographic Snapshot of the Market

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Affordable Care and Shorter Waiting Periods Offered By Urgent Care Centers

5.2.1.2 Growing Investments in Urgent Care

5.2.1.3 Strategic Developments Between Urgent Care Providers and Hospitals

5.2.1.4 Increasing Geriatric Population

5.2.2 Opportunities

5.2.2.1 Introduction of Specialty Urgent Care Centers

5.2.2.2 Use of Data Integration and Patient Engagement Technologies

5.2.2.3 Emerging Markets to Offer High Growth Opportunities

5.2.3 Challenges

5.2.3.1 Lack of A Skilled Workforce

6 Market, By Service (Page No. - 38)

6.1 Introduction

6.2 Acute Illness Treatment

6.3 Trauma/Injury Treatment

6.4 Physical Examinations

6.5 Immunization & Vaccination

6.6 Other Services

7 Market, By Ownership (Page No. - 50)

7.1 Introduction

7.2 Corporate-Owned Urgent Care Centers

7.3 Physician-Owned Urgent Care Centers

7.3.1 Multiple-Physician-Owned Urgent Care Centers

7.3.2 Single-Physician-Owned Urgent Care Centers

7.4 Hospital-Owned Urgent Care Centers

7.5 Other Urgent Care Centers

8 Market, By Region (Page No. - 64)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Affordability and Promptness of Urgent Care Services

8.2.1.2 Increasing Inclination to Venture Into Urgent Care

8.2.1.3 The Advent of Specialty Urgent Care

8.2.1.4 Increasing Geriatric Population

8.2.2 Canada

8.2.2.1 Long Healthcare Wait Times

8.2.2.2 Increasing Older Population

8.3 Europe

8.3.1 EU-3

8.3.2 Rest of Europe

8.4 Asia Pacific

8.5 Rest of the World (RoW)

9 Competitive Landscape (Page No. - 90)

9.1 Overview

9.2 Ranking of Players, 2017

9.3 Competitive Scenario

9.3.1 Expansions

9.3.2 Acquisitions

9.3.3 Partnerships and Collaborations

9.3.4 Other Strategies

10 Company Profiles (Page No. - 96)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, and Recent Developments)*

10.1 Concentra (A Part of Select Medical Holdings Corporation)

10.2 Medexpress (A Subsidiary of Unitedhealth Group’s Optum Division)

10.3 American Family Care

10.4 Nextcare Holdings

10.5 Fastmed Urgent Care (A Subsidiary of Abry Partners)

10.6 Citymd (A Part of Warburg Pincus)

10.7 Carenow Urgent Care (A Subsidiary of Hospital Corporation of America Inc.)

10.8 Gohealth Urgent Care (A Subsidiary of Access Clinical Partners)

10.9 HCA Healthcare UK (A Subsidiary of the Hospital Corporation of America)

10.10 Columbia Asia Hospitals (A Subsidiary of Columbia Asia)

10.11 International SOS (A Subsidiary of AEA International Holdings Pte. Ltd.)

10.12 St. Joseph's Health Care London (A Part of St. Joseph’s Health Care Society)

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 124)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (67 Tables)

Table 1 Urgent Care Center Market, By Service , 2016–2023 (USD Million)

Table 2 Market for Acute Illness Treatment, By Region, 2016–2023 (USD Million)

Table 3 North America: Market for Acute Illness Treatment, By Country, 2016–2023 (USD Million)

Table 4 Europe: Market for Acute Illness Treatment, By Region, 2016–2023 (USD Million)

Table 5 Market for Trauma/Injury Treatment, By Region, 2016–2023 (USD Million)

Table 6 North America: Market for Trauma/Injury Treatment, By Country, 2016–2023 (USD Million)

Table 7 Europe: Market for Trauma/Injury Treatment, By Region, 2016–2023 (USD Million)

Table 8 Market for Physical Examinations, By Region, 2016–2023 (USD Million)

Table 9 North America: Market for Physical Examinations, By Country, 2016–2023 (USD Million)

Table 10 Europe: Market for Physical Examinations, By Region, 2016–2023 (USD Million)

Table 11 Market for Immunization & Vaccination, By Region, 2016–2023 (USD Million)

Table 12 North America: Market for Immunization & Vaccination, By Country, 2016–2023 (USD Million)

Table 13 Europe: Market for Immunization & Vaccination, By Region, 2016–2023 (USD Million)

Table 14 Market for Other Services, By Region, 2016–2023 (USD Million)

Table 15 North America: Market for Other Services, By Country, 2016–2023 (USD Million)

Table 16 Europe: Market for Other Services, By Region, 2016–2023 (USD Million)

Table 17 Market, By Ownership, 2016–2023 (USD Million)

Table 18 Corporate-Owned Market, By Region, 2016–2023 (USD Million)

Table 19 North America: Corporate-Owned Market, By Country, 2016–2023 (USD Million)

Table 20 Europe: Corporate-Owned Market, By Country, 2016–2023 (USD Million)

Table 21 Physician-Owned Market, By Type, 2016–2023 (USD Million)

Table 22 Physician-Owned Market, By Region, 2016–2023 (USD Million)

Table 23 North America: Physician-Owned Urgent Care Center Market, By Country, 2016–2023 (USD Million)

Table 24 Europe: Physician-Owned Market, By Country, 2016–2023 (USD Million)

Table 25 Multiple-Physician-Owned Market, By Region, 2016–2023 (USD Million)

Table 26 North America: Multiple-Physician-Owned Market, By Country, 2016–2023 (USD Million)

Table 27 Europe: Multiple-Physician-Owned Market, By Country, 2016–2023 (USD Million)

Table 28 Single-Physician-Owned Market, By Region, 2016–2023 (USD Million)

Table 29 North America: Single-Physician-Owned Market, By Country, 2016–2023 (USD Million)

Table 30 Europe: Single-Physician-Owned Market, By Country, 2016–2023 (USD Million)

Table 31 Hospital-Owned Market, By Region, 2016–2023 (USD Million)

Table 32 North America: Hospital-Owned Urgent Care Center Market, By Country, 2016–2023 (USD Million)

Table 33 Europe: Hospital-Owned Market, By Country, 2016–2023 (USD Million)

Table 34 Other Market, By Region, 2016–2023 (USD Million)

Table 35 North America: Other Market, By Country, 2016–2023 (USD Million)

Table 36 Europe: Other Market, By Region, 2016–2023 (USD Million)

Table 37 Market, By Region, 2016–2023 (USD Million)

Table 38 North America: Market, By Country, 2016–2023 (USD Million)

Table 39 North America: Market, By Service, 2016–2023 (USD Million)

Table 40 North America: Market, By Ownership, 2016–2023 (USD Million)

Table 41 North America: Physician-Owned Market, By Type, 2016–2023 (USD Million)

Table 42 US: Market, By Service, 2016–2023 (USD Million)

Table 43 US: Market, By Ownership, 2016–2023 (USD Million)

Table 44 US: Physician-Owned Market, By Type, 2016–2023 (USD Million)

Table 45 Canada: Market, By Service, 2016–2023 (USD Million)

Table 46 Canada: Market, By Ownership, 2016–2023 (USD Million)

Table 47 Canada: Physician-Owned Urgent Care Center Market, By Type, 2016–2023 (USD Million)

Table 48 Europe: Market, By Region, 2016–2023 (USD Million)

Table 49 Europe: Market, By Service, 2016–2023 (USD Million)

Table 50 Europe: Market, By Ownership, 2016–2023 (USD Million)

Table 51 Europe: Physician-Owned Market, By Type, 2016–2023 (USD Million)

Table 52 EU-3: Market, By Service, 2016–2023 (USD Million)

Table 53 EU-3: Market, By Ownership, 2016–2023 (USD Million)

Table 54 EU-3: Physician-Owned Market, By Type, 2016–2023 (USD Million)

Table 55 RoE: Market, By Service, 2016–2023 (USD Million)

Table 56 RoE: Market, By Ownership, 2016–2023 (USD Million)

Table 57 RoE: Physician-Owned Market, By Type, 2016–2023 (USD Million)

Table 58 Asia Pacific: Market, By Service, 2016–2023 (USD Million)

Table 59 Asia Pacific: Market, By Ownership, 2016–2023 (USD Million)

Table 60 Asia Pacific: Physician-Owned Urgent Care Center Market, By Type, 2016–2023 (USD Million)

Table 61 RoW: Market, By Service, 2016–2023 (USD Million)

Table 62 RoW: Market, By Ownership, 2016–2023 (USD Million)

Table 63 RoW: Physician-Owned Market, By Type, 2016–2023 (USD Million)

Table 64 Expansions

Table 65 Acquisitions

Table 66 Partnerships & Collaborations

Table 67 Other Strategies

List of Figures (23 Figures)

Figure 1 Breakdown of Primary Interviews: By Designation, and Region

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Urgent Care Center Market, By Service (2018–2023)

Figure 6 Market, By Ownership, 2018 vs 2023

Figure 7 Geographical Snapshot of the Market (2018–2023)

Figure 8 Affordable Care and Shorter Waiting Periods Offered By Urgent Care Centers to Drive the Growth of the Market

Figure 9 Corporate-Owned Urgent Care Centers Segment to Account for the Largest Market Share in 2018

Figure 10 Acute Illness Treatment Services to Dominate the Urgent Care Center Market in 2023

Figure 11 Corporate-Owned Urgent Care Center to Account for the Largest Market Share in 2018

Figure 12 North America to Register the Highest CAGR in the Forecast Period

Figure 13 Market: Drivers, Opportunities, and Challenges

Figure 14 The Acute Illness Treatment Segment to Dominate the Market in 2018

Figure 15 Corporate-Owned Urgent Care Centers to Command the Largest Share of the Global Market in 2018

Figure 16 Multiple-Physician-Owned Urgent Care Centers to Command the Largest Share in 2018

Figure 17 North America to Dominate the Market in 2018

Figure 18 North America: Market Snapshot

Figure 19 Europe: Market Snapshot

Figure 20 Asia Pacific: Market Snapshot

Figure 21 RoW: Market Snapshot

Figure 22 Concentra Led the Market in 2017

Figure 23 Key Developments of the Prominent Players in the Market (2015–2018)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Urgent Care Center Market