Universal Flash Storage Market by Capacity (32 GB, 64 GB, 128 GB, 256 GB, 512 GB), Configuration, End Use (Automotive Electronics, Digital cameras, Gaming Consoles, High-Resolution Displays, Smartphones), Application, and Geography - Global Forecast to 2023

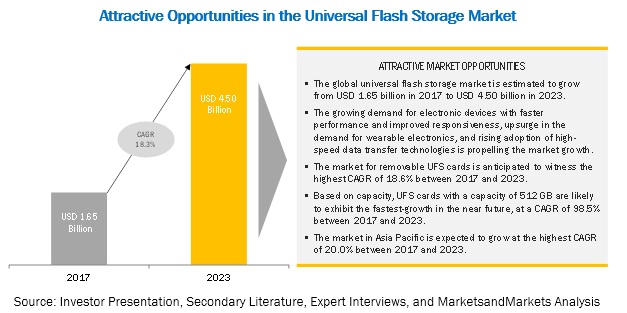

The global Universal Flash Storage market is estimated to grow from USD 1.65 million in 2017 to USD 4.50 million by 2023, at a CAGR of 18.3% between 2017 and 2023. In terms of volume, the global market is estimated to register a shipment of 156.1 million units in 2017 and is likely to witness a shipment of 561.2 million units by 2023, at a CAGR of 23.8% between 2017 and 2023.

By application, the universal flash storage market for the mass storage applications is expected to grow at the highest growth rate during the forecast period.

The Universal Flash Storage market for the mass storage application is anticipated to grow at the highest rate between 2017 and 2023. Mass storage needs to store a huge amount of data in a machine-readable format. The UFS standard follows the SCSI architecture model, but with a subset of SCSI commands. Due to this, the UFS standard supports multiple commands, enabling command queuing and multi-threaded programming. This results in efficient data transfer between the host processor and mass storage. Owing to this, the mass storage application is likely to exhibit the fastest growth during the forecast period.

By configuration, the global universal flash storage market sector for Embedded UFS cards is expected to hold the largest market size during the forecast period

Embedded UFS cards are likely to continue to dominate the market, in terms of size, during the forecast period. The embedded UFS solutions provide the long-term product support, along with foreseeable performance. The market for removable UFS cards is anticipated to register the highest CAGR of 18.6% between 2017 and 2023. Removable UFS cards support multiple commands and enable simultaneous reading and writing, doubling throughput. Due to this, most power-efficient data transport and highest performance in the consumer electronic devices is achieved. Owing to this, the demand for removable UFS solutions is expected to increase in the near future.

North America to account for the largest market size during the forecast period.

In terms of value, North America is expected to continue to lead the global universal flash storage market, followed by Europe and Asia Pacific owing to the rapid adoption of advanced technology products, such as e-Readers, drones, smartphones, tablets, wearable electronics, and AR-VR products, by the consumers.

Market Dynamics

Driver: Growing demand for electronic devices with faster performance and improved responsiveness

The embedded multimedia card (eMMC) storage interface is the most well-known component used in numerous electronic devices all over the world. Though eMMC is the dominating mobile storage interface at present, it is inefficient to read and write data simultaneously due to its parallel interface, which can send data in one direction at a time. On the other hand, UFS works on the serial interface, which enables reading and writing data at the same time, thereby delivering improved capabilities and responsiveness. Another most significant aspect of UFS impending scalability, thereby allowing for bandwidth growth to support future technological advancements in mobile phones such as 4K video capture and virtual reality. Moreover, higher resolution content is also pushing the bandwidth limit of eMMC.

Restraint: High cost associated with the adoption of universal flash storage

The UFS architecture improves the performance of electronic devices such as digital cameras, gaming consoles, smartphones, laptops, and tablets while maintaining the low power consumption. UFS is well placed to introduce multi-core architectures that require high-performance memory. UFS is significantly expensive, and in the beginning, it will be suitable for high-end electronic devices only. UFS is presently being utilized in high-end smartphones, tablets, and ultrabooks. eMMC is expected to continue to be the best choice for mid-to-low-cost mobile applications. However, the cost of UFS is quite higher than eMMC, which is likely to limit its adoption in the near future. Moreover, SATA solid-state drives (SSDs) are also posing competition to UFS for the ultrabook application.

Opportunity: Adoption of IOT

The Internet of Things (IoT) is emerging as a potential opportunity for the players in the UFS market, exclusively for the manufacturers of security devices and smart drones. At present, these equipment rely on microSD for video storage.

With the advent of the connected world, the demand for enhanced hardware functionality, faster networks, and richer content is likely to continue to increase. These developments will increase the requirements and would create challenges for mobile data and storage while catering to the specific requirements. UFS is expected to play a pivotal role into the next-generation of high-performance mobile storage.

Furthermore, as the connectivity services are growing at a rapid pace with the slashing prices and the emergence of new applications, the installed base of IoT will increase, which would lead to demand for high storage memory devices, creating growth avenues for the UFS market.

Challenge: Complexities associated with the UFS architecture

Universal Flash Storage is an unconventional protocol to take advantage of solid-state drives (SSDs) and utilize them as secondary storage while reducing the drawbacks of flash memories. Though there are several advantages of UFS, the protocols on which UFS are based are quite complex. UFS has MIPI M-PHY and UniPro as the standard layers to communicate with the devices. To incorporate UFS in the prescribed design of a device, a substantial amount of efforts are required. Original Equipment Manufacturers (OEMs) need to provide compliance and protocol analysis for UFS designs. The decode application of UFS protocols ensures faster and better development of mobile products, which requires specialized skills and expertise. This will further consume a lot of time, which is not easily available while designing large SoC (system on chip). The UFS device is only one part of this SoC.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152023 |

|

Base year considered |

2016 |

|

Forecast period |

20172023 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Application, Capacity, Configuration, End Use, and Geography |

|

Geographies covered |

North America, Europe, APAC, RoW (South America, Middle East, and Africa) |

|

Companies covered |

Samsung (South Korea), Toshiba (Japan), SK Hynix (South Korea), Mircron (USA), Phison (Taiwan) |

The research report categorizes the Universal Flash Storage market to forecast the revenues and analyze the trends in each of the following sub-segments:

Universal Flash Storage Market, By Application

- Mass Storage

- Boot Storage

- XiP Flash

- External Card

Universal Flash Storage Market, By Capacity

- 32 GB

- 64 GB

- 128 GB

- 256 GB

- 512 GB

Universal Flash Storage Market, By Configuration

- Embedded

- Removable

Universal Flash Storage Market, By End Use

- Automotive Electronics

- Digital Cameras

- Gaming Consoles

- High-Resolution Displays

- Laptops

- Smartphones

- Others

Universal Flash Storage Market, By Geography

- North America

- Europe

- Asia Pacific (APAC)

- RoW

Key Market Players:

Samsung (South Korea), Toshiba (Japan), SK Hynix (South Korea), Mircron (USA), Phison (Taiwan)

Samsung is one of the leading market players in the universal flash storage market. The company holds a pioneering position in the market owing to its comprehensive product offering. The company offers the UFS solutions under the Device Solutions division. DRAM, Flash storage, including V-NAND technology, Client SSD, Enterprise SSD, eMMC are also being offered under this business division. The companys wide portfolio of products and services help it to compete in different market segments at different levels of the value chain. The companys dedicated memory business unit extensively works for the development of various DRAM and NAND products with higher densities.

Recent Developments:

- In October 2016, Cadence announced the launch of 10 new Verification IP solutions, including UFS 2.1, to improve data security through the use of inline cryptography between UFS storage device and the SoC..

- In July 2016, Samsung launched the removable memory card line-up, with the capacity up to 256 GB. These removable memory cards are based on the JEDEC UFS 1.0 card extension standard. These cards are meant for high-resolution mobile shooting devices, such as 3D VR cameras, DSLR cameras, drones, and action cams.

- In August 2016, the company announced the commencement of mass production of UFS 2.1 solutions on its own second-generation 3D NAND flash, in-house firmware, and controller. These solutions are available in 32, 64, and 128 GB variants.

- In January 2016, Synopsys announced the success of SK Hynix, Inc. in achieving the first-pass silicon success for its 64 GB UFS 2.0 device, using Synopsys' DesignWare UFS Host Controller, UniPro Host Controller, and M-PHY IP.

- In July 2016, Arasan announced the availability of the UFS 3.0 controller IP. These IP solutions are meant for the next-generation mobile storage applications.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Universal Flash Storage market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primary Interviews

2.1.2.3 Key Data Points From Primary Sources

2.1.2.4 Key Industry Insights

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 32)

4.1 Universal Flash Storage Market

4.2 Market, By Configuration

4.3 Market, By Application

4.4 Market, By Capacity

4.5 Market, By End Use

4.6 Market, By Geography

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Electronic Devices With Faster Performance and Improved Responsiveness

5.2.1.2 Rising Adoption of High-Speed Data Transfer Technologies

5.2.1.3 Increasing Demand for Wearable Electronics

5.2.2 Restraints

5.2.2.1 High Cost Associated With the Adoption of Universal Flash Storage (UFS)

5.2.3 Opportunities

5.2.3.1 Adoption of IoT

5.2.4 Challenges

5.2.4.1 Complexities Associated With the UFS Architecture

5.3 Value Chain Analysis

6 Universal Flash Storage Market, By Configuration (Page No. - 41)

6.1 Introduction

6.2 Embedded

6.3 Removable

7 Universal Flash Storage Market, By Capacity (Page No. - 47)

7.1 Introduction

7.2 32 GB

7.3 64 GB

7.4 128 GB

7.5 256 GB

7.6 512 GB

8 Universal Flash Storage Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Boot Storage

8.3 External Card

8.4 Mass Storage

8.5 XIP Flash

9 Universal Flash Storage Market, By End Use (Page No. - 58)

9.1 Introduction

9.2 Automotive Electronics

9.3 Digital Cameras

9.4 Gaming Consoles

9.5 High-Resolution Displays

9.6 Laptops

9.7 Smartphones

9.8 Others (E-Readers, GPS, Tablets)

10 Geographic Analysis (Page No. - 67)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East

10.5.2 South America

10.5.3 Africa

11 Competitive Landscape (Page No. - 88)

11.1 Introduction

11.2 Market Ranking Analysis, 2017

11.3 Competitive Situation and Trends

11.3.1 Battle for Market Share: Product Launches is the Key Strategy

11.3.2 Product Launches

11.3.3 Partnerships/Agreements/Strategic Alliances/Collaborations

12 Company Profiles (Page No. - 93)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

12.1 Samsung

12.2 Toshiba

12.3 SK Hynix

12.4 Micron

12.5 Phison

12.6 Silicon Motion

12.7 Synopsys

12.8 Cadence

12.9 GDA IP Technologies

12.10 Arasan

12.11 Key Innovators

12.11.1 Tuxera

12.11.2 Avery

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 122)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (36 Tables)

Table 1 List of Major Secondary Sources

Table 2 Market in Terms of Value and Volume, 20152023

Table 3 Market, By Configuration, 20152023 (USD Million)

Table 4 Market for Embedded Memory Solutions, By Region, 20152023 (USD Million)

Table 5 Market for Removable Memory Solutions, By Region, 20152023 (USD Million)

Table 6 Market, By Capacity, 20152023 (USD Million)

Table 7 Market, By Capacity, 20152023 (Million Units)

Table 8 Market, By Application, 20152023 (USD Million)

Table 9 Market, By End Use, 20152023 (USD Million)

Table 10 Market for Automotive Electronics, By Region, 20152023 (USD Million)

Table 11 Market for Digital Cameras, By Region, 20152023 (USD Million)

Table 12 Market for Gaming Consoles, By Region, 20152023 (USD Million)

Table 13 Market for High-Resolution Displays, By Region, 20152023 (USD Million)

Table 14 Market for Laptops, By Region, 20152023 (USD Million)

Table 15 Market for Smartphones, By Region, 20152023 (USD Million)

Table 16 Market for Others, By Region, 20152023 (USD Million)

Table 17 Market, By Region, 20152023 (USD Billion)

Table 18 Market in North America, By End Use, 20152023 (USD Million)

Table 19 North America Market, By Application, 20152023 (USD Million)

Table 20 Market in North America, By Configuration, 20152023 (USD Million)

Table 21 Market in North America, By Country, 20152023 (USD Million)

Table 22 Market in Europe, By End Use, 20152023 (USD Million)

Table 23 Market in Europe, By Application, 20152023 (USD Million)

Table 24 Market in Europe, By Configuration, 20152023 (USD Million)

Table 25 Market in Europe, By Country, 20152023 (USD Million)

Table 26 Market in APAC, By End Use, 20152023 (USD Million)

Table 27 Market in APAC, By Application, 20152023 (USD Million)

Table 28 Market in APAC, By Configuration, 20152023 (USD Million)

Table 29 Market in APAC, By Country, 20152023 (USD Million)

Table 30 Market in RoW, By End Use, 20152023 (USD Million)

Table 31 Market in RoW, By Application, 20152023 (USD Million)

Table 32 Market in RoW, By Configuration, 20152023 (USD Million)

Table 33 Market in RoW, By Region, 20152023 (USD Million)

Table 34 Ranking of Key Players in the Market, 2016

Table 35 Most Significant Product Launches in the Market

Table 36 Most Significant Collaborations, Partnerships, and Joint Ventures in the Market

List of Figures (46 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach to Arrive at the Market Size

Figure 4 Top-Down Approach to Arrive at the Market Size

Figure 5 Data Triangulation Methodology

Figure 6 Market (20172023)

Figure 7 Market Snapshot, By Application

Figure 8 Market Snapshot, By Capacity

Figure 9 Market Snapshot, By Configuration

Figure 10 Market Snapshot, By End Use

Figure 11 Market, By Region, 2016

Figure 12 Attractive Growth Opportunities in the Market

Figure 13 Embedded UFS Solutions to Hold A Larger Share of the Market in 2017

Figure 14 Market for Mass Storage Devices to Grow at the Highest CAGR During the Forecast Period

Figure 15 UFS Cards With A Capacity of 256 GB to Hold the Largest Market Size Between 2017 and 2023

Figure 16 Smartphones Expected to Hold the Largest Share of the Market in 2017

Figure 17 US to Hold the Largest Share of the Market in 2017

Figure 18 Growing Demand for Electronic Devices With Faster Performance and Improved Responsiveness to Drive the Market Growth

Figure 19 Value Chain Analysis of the Market

Figure 20 Market Segmentation, By Configuration

Figure 21 Market for Removable Memory Solutions to Grow at A Higher CAGR Between 2017 and 2023

Figure 22 Market Segmentation, By Capacity

Figure 23 Market for Universal Flash Storage Cards With 512 GB & Greater Capacity to Grow at the Highest CAGR Between 2017 and 2023

Figure 24 UFS Market Segmentation Based on Application, Along With Market Share of Each Segment, 2017

Figure 25 UFS Market for Mass Storage Application to Exhibit the Highest CAGR Between 2017 and 2023

Figure 26 Market Segmentation, By End Use

Figure 27 Market for Automotive Electronics to Grow at the Highest CAGR of Between 2017 and 2023

Figure 28 Geographic Snapshot: Global Market, 20172023

Figure 29 Market in APAC to Exhibit the Highest CAGR During 20172023

Figure 30 Market Snapshot in North America

Figure 31 US to Dominate the Market in North America

Figure 32 Market Snapshot in Europe

Figure 33 Germany to Lead the European Market, in Terms of Size, During the Forecast Period

Figure 34 Market Snapshot in Asia Pacific

Figure 35 Market in China to Grow at the Highest CAGR During 20172023

Figure 36 South America to Exhibit the Fastest Growth in the Market in RoW During 20172023

Figure 37 Product Launches is the Key Growth Strategy Between January 2015 and May 2017

Figure 38 Market Evolution Framework: Product Launches is Fuelling the Growth of the Market

Figure 39 Samsung: Company Snapshot

Figure 40 Toshiba: Company Snapshot

Figure 41 SK Hynix: Company Snapshot

Figure 42 Micron: Company Snapshot

Figure 43 Phison: Company Snapshot

Figure 44 Silicon Motion: Company Snapshot

Figure 45 Synopsys: Company Snapshot

Figure 46 Cadence: Company Snapshot

Growth opportunities and latent adjacency in Universal Flash Storage Market