Unit Load Device Market by Product Type (Lower Deck 3, Lower Deck 6, Lower Deck 11, M 1, Pallets), Application (Commercial, Cargo), Material Type (Metal, Composite), Container Type (Normal, Cold) and Region - Global Forecast to 2021

The unit load device market is projected to grow from USD 1.64 Billion in 2016 to USD 2.02 Billion by 2021, at a CAGR of 4.28% during the forecast period. The base year considered for the study is 2015 and the forecast period is from 2016 to 2021.

Objectives of the Study:

The report analyzes the unit load device market on the basis of product type (LD 3, LD 6, LD 11, M 1, pallets, others), application (commercial and cargo), material (metal, composite, and others), and container type (normal, cold, others), and maps these segments and subsegments across major regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World.

The report provides in-depth market intelligence regarding unit load device and major factors influencing the growth of unit load device market (drivers, restraints, opportunities, and challenges), along with an analysis of micro markets with respect to individual growth trends, future prospects, and their contribution.

The report also covers competitive developments, such as long-term contracts, new product launches and developments, and research & development activities in the market, in addition to business and corporate strategies adopted by key market players.

The unit load device market is projected to grow from USD 1.64 Billion in 2016 to USD 2.02 Billion by 2021, at a CAGR of 4.28% during the forecast period. Various factors, such as increase in demand for lightweight ULDs, growth in international trade, and increase in demand for cold containers are expected to drive the market.

The market is segmented on the basis of product type, application, material, container type, and region. The product type segment is further divided into LD 3, LD 6, LD 11, M 1, pallets, and others. Based on product type, the LD 3 segment is estimated to grow at the highest CAGR during the forecast period. The LD 3 container is mainly utilized in passenger aircraft and growth in the LD 3 container segment can be attributed to the increase in passenger traffic.

Based on application, the unit load device market is segmented into commercial and cargo. Commercial is the largest application segment. Rise in passenger traffic has led to increase in air cargo, thereby propelling the demand for unit load devices for commercial aircraft.

Based on material, the unit load device market is segmented into metal, composite, and others. The composite segment is estimated to grow at the highest CAGR during the forecast period. The aviation industry prefers containers made of composite materials due to high maintenance and replacement costs of aluminum containers and pallets.

Based on container type, the unit load device market is segmented into normal, cold, and others. The normal container segment is estimated to grow at the highest CAGR during the forecast period. Normal containers are used to transport dry cargo. Some of these containers are made of composite materials that are lightweight and durable. Normal containers are used in commercial aircraft as well as cargo aircraft. Rise in aircraft orders will significantly contribute to the increasing demand for unit load devices. The demand for unit load devices is the highest in the Asia-Pacific region and is expected to grow in the future.

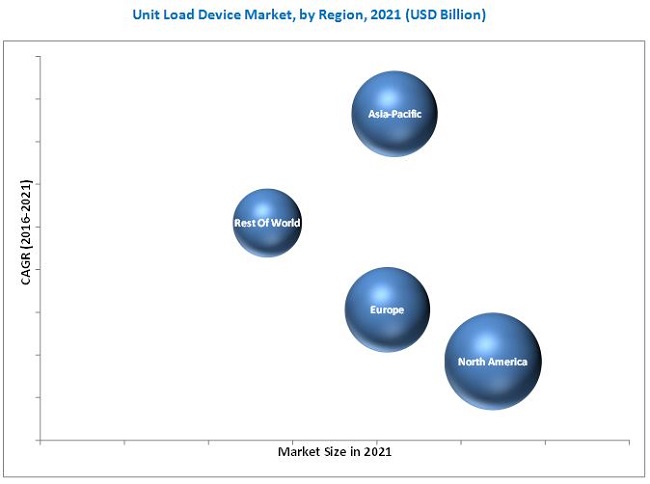

Based on region, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is estimated to lead the market in 2016. Emerging economies, such as China and India are estimated to drive the Asia-Pacific unit load device market. Increase in disposable income of people has resulted in rise in the number of passengers travelling by air. This has further led to increase in cargo traffic, which has contributed to the growing demand for unit load devices in this region.

However, factors, such as high repair cost of unit load devices, and stringent rules and regulations limit the growth of this market. Products offered by various companies in the unit load device market have been listed in the report. The recent developments section of the report includes recent and important developments by various companies between 2014 and 2016. Major companies profiled in the report include are Nordisk Aviation Products AS (Norway), Zodiac Aerospace (France), VRR Aviation (The Netherlands), DoKaSch GmbH (Germany), and Satco, Inc. (U.S.), among others. Contracts accounted for a major share of the total growth strategies adopted by the leading players in the market. This strategy has enabled companies to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

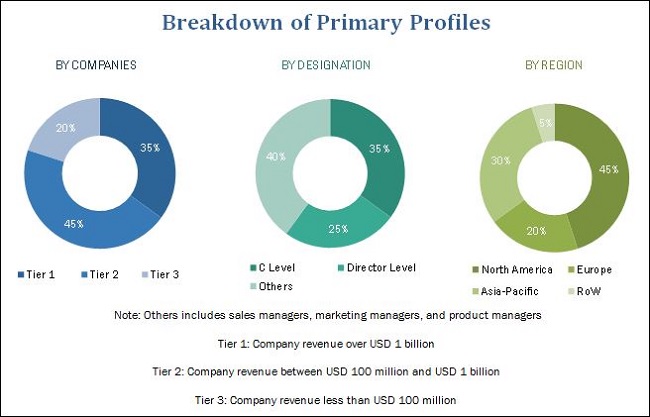

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increase in Demand for Air Travel

2.2.2.2 Increasing Demand for Air Cargo From Freight Forwarders and Uld Management Companies

2.2.3 Supply Side Indicators

2.2.3.1 Use of Refrigerator Technology to Ensure Safe Transport of Perishable Goods

2.2.3.2 Increase in Research & Development Activities

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Development of Lightweight Unit Load Devices to Provide Growth Opportunities to Market Players

4.2 Unit Load Device Market, By Product Type

4.3 Market, By Application

4.4 Market, By Material Type

4.5 Market, By Container Type

4.6 Market, By Region

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Product

5.2.2 By Application

5.2.3 By Material

5.2.4 By Container

5.3 Market Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Demand for Lightweight Ulds

5.4.1.2 Growth in International Trade

5.4.1.3 Increase in Demand for Cold Containers

5.4.2 Restraints

5.4.2.1 High REPAiring Cost of Unit Load Devices

5.4.3 Opportunities

5.4.3.1 Coping With the Growing Aviation Industry

5.4.4 Challenges

5.4.4.1 Competing With Other Modes of Transportation

5.4.4.2 Stringent Regulations for Use of Ulds

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Unit Load Device Mapping, By Application

6.3 Cost of Unit Load Devices, By Container and Pellets

6.4 Cost Associated With Unit Load Device Market

6.5 Emerging Trends

6.5.1 Lightweight Unit Load Devices

6.5.2 Advanced Refrigeration Technology

6.5.3 Unit Load Device Identification Systems

6.5.4 Fireproof and Blast Mitigation Units

6.6 Innovation and Patent Registrations

7 Unit Load Device Market, By Product Type (Page No. - 52)

7.1 Introduction

7.2 LD 3 Container

7.3 LD 6 Container

7.4 LD 11 Container

7.5 M 1 Container

7.6 Pallets

7.7 Others

8 Unit Load Device Market, By Application (Page No. - 59)

8.1 Introduction

8.2 Commercial

8.3 Cargo

9 Unit Load Device Market, By Material Type (Page No. - 63)

9.1 Introduction

9.2 Composite

9.3 Metal

9.4 Others

10 Unit Load Device Market, By Container Type (Page No. - 66)

10.1 Introduction

10.2 Normal Container

10.3 Cold Container

10.4 Others

11 Regional Analysis (Page No. - 70)

11.1 Introduction

11.2 North America

11.2.1 By Product Type

11.2.2 By Application

11.2.3 By Container Type

11.2.4 By Country

11.2.4.1 U.S.

11.2.4.1.1 By Product Type

11.2.4.1.2 By Application

11.2.4.1.3 By Container Type

11.2.4.2 Canada

11.2.4.2.1 By Product Type

11.2.4.2.2 By Application

11.2.4.2.3 By Container Type

11.3 Europe

11.3.1 By Product Type

11.3.2 By Application

11.3.3 By Country

11.3.3.1 U.K.

11.3.3.1.1 By Product Type

11.3.3.1.2 By Application

11.3.3.1.3 By Container Type

11.3.3.2 Germany

11.3.3.2.1 By Product Type

11.3.3.2.2 By Application

11.3.3.2.3 By Container Type

11.3.3.3 France

11.3.3.3.1 By Product Type

11.3.3.3.2 By Application

11.3.3.3.3 By Container Type

11.3.3.4 Russia

11.3.3.4.1 By Product Type

11.3.3.4.2 By Application

11.3.3.4.3 By Container Type

11.4 Asia-Pacific

11.4.1 By Product Type

11.4.2 By Application

11.4.3 By Container Type

11.4.4 By Country

11.4.4.1 China

11.4.4.1.1 By Product Type

11.4.4.1.2 By Application

11.4.4.1.3 By Container Type

11.4.4.2 Japan

11.4.4.2.1 By Product Type

11.4.4.2.2 By Application

11.4.4.2.3 By Container Type

11.4.4.3 India

11.4.4.3.1 By Product Type

11.4.4.3.2 By Application

11.4.4.3.3 By Container Type

11.4.4.4 Australia

11.4.4.4.1 By Product Type

11.4.4.4.2 By Application

11.4.4.4.3 By Container Type

11.5 Rest of the World

11.5.1 By Product Type

11.5.2 By Application

11.5.3 By Container Type

11.5.4 By Country

11.5.4.1 Brazil

11.5.4.1.1 By Product Type

11.5.4.1.2 By Application

11.5.4.1.3 By Container Type

11.5.4.2 U.A.E.

11.5.4.2.1 By Product Type

11.5.4.2.2 By Application

11.5.4.2.3 By Container Type

11.5.4.3 South Africa

11.5.4.3.1 By Product Type

11.5.4.3.2 By Application

11.5.4.3.3 By Container Type

12 Competitive Landscape (Page No. - 105)

12.1 Introduction

12.2 Competitive Situations and Trends

12.2.1 Contracts

12.2.2 New Product Launches

12.2.3 Mergers & Acquisitions

12.2.4 Partnerships

13 Company Profiles (Page No. - 115)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 Brambles Limited (Chep Aerospace Solutions)

13.3 Zodiac Aerospace

13.4 Transdigm Group Incorporated (Nordisk Aviation Products As)

13.5 VRR Aviation

13.6 Envirotainer

13.7 Dokasch GmbH

13.8 Acl Airshop

13.9 Satco, Inc.

13.10 Palnet GmbH Air Cargo Products

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 144)

14.1 Discussion Guide

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (83 Tables)

Table 1 Assumptions of the Research Study

Table 2 Unit Load Device Market, By Product

Table 3 Market, By Application

Table 4 Market, By Container

Table 5 Key Growth Factors of Unit Load Device

Table 6 High Repairing Cost: Key Restraint for Growth of Market

Table 7 Key Opportunity for Growth of Market

Table 8 Major Challenges for Growth of the Market

Table 9 Cargo Applications has Extra Maintenance Cost in Market

Table 10 Innovation & Patent Registration, December 2011 - January 2016

Table 11 Market Size, By Product Type, 2014-2021 (USD Million)

Table 12 LD 3: Market Size, By Region, 2014-2021 (USD Million)

Table 13 LD 6: Market Size, By Region, 2014-2021 (USD Million)

Table 14 LD 11: Market Size, By Region, 2014-2021 (USD Million)

Table 15 M 1: Market Size, By Region, 2014-2021 (USD Million)

Table 16 Pallets: Market Size, By Region, 2014-2021 (USD Million)

Table 17 Market Size, By Application, 2014-2021 (USD Million)

Table 18 Commercial: Market Size, By Region, 2014-2021 (USD Million)

Table 19 Cargo: Market Size, By Region, 2014-2021 (USD Million)

Table 20 Market Size, By Material Type, 2014-2021 (USD Million)

Table 21 Market Size, By Container Type, 2014–2021 (USD Million)

Table 22 Normal Container: Market Size, By Region, 2014-2021 (USD Million)

Table 23 Cold Container: Market Size, By Region, 2014-2021 (USD Million)

Table 24 Market Size, By Region, 2014-2021 (USD Million)

Table 25 North America: Market Size, By Product Type, 2014-2021 (USD Million)

Table 26 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 27 North America: Market Size, By Container Type, 2014-2021 (USD Million)

Table 28 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 29 U.S.: Market Size, By Product Type, 2014-2021 (USD Million)

Table 30 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 31 U.S.: Market Size, By Container Type, 2014-2021 (USD Million)

Table 32 Canada: Size, By Product Type, 2014-2021 (USD Million)

Table 33 Canada: Market Size, By Application, 2014-2021 (USD Million)

Table 34 Canada: Market Size, By Container Type, 2014-2021 (USD Million)

Table 35 Europe: Market Size, By Product Type, 2014-2021 (USD Million)

Table 36 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 37 Europe: Market Size, By Container Type, 2014-2021 (USD Million)

Table 38 Europe: Market Size, By Country, 2014-2021 (USD Million)

Table 39 U.K.: Market Size, By Product Type, 2014-2021 (USD Million)

Table 40 U.K.: Market Size, By Application, 2014-2021 (USD Million)

Table 41 U.K.: Market Size, By Container Type, 2014-2021 (USD Million)

Table 42 Germany: Market Size, By Product Type, 2014-2021 (USD Million)

Table 43 Germany: Market Size, By Application, 2014-2021 (USD Million)

Table 44 Germany: Market Size, By Container Type, 2014-2021 (USD Million)

Table 45 France: Market Size, By Product Type, 2014-2021 (USD Million)

Table 46 France: Market Size, By Application, 2014-2021 (USD Million)

Table 47 France: Market Size, By Container Type, 2014-2021 (USD Million)

Table 48 Russia: Market Size, By Product Type, 2014-2021 (USD Million)

Table 49 Russia: Market Size, By Application, 2014-2021 (USD Million)

Table 50 Russia: Market Size, By Container Type, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Product Type, 2014-2021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Application, 2014-2021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Container Type, 2014-2021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Region, 2014-2021 (USD Million)

Table 55 China: Market Size, By Product Type, 2014-2021 (USD Million)

Table 56 China: Market Size, By Application, 2014-2021 (USD Million)

Table 57 China: Market Size, By Container Type, 2014-2021 (USD Million)

Table 58 Japan: Market Size, By Product Type, 2014-2021 (USD Million)

Table 59 Japan: Market Size, By Application, 2014-2021 (USD Million)

Table 60 Japan: Market Size, By Container Type, 2014-2021 (USD Million)

Table 61 India: Market Size, By Product Type, 2014-2021 (USD Million)

Table 62 India: Market Size, By Application, 2014-2021 (USD Million)

Table 63 India: Market Size, By Container Type, 2014-2021 (USD Million)

Table 64 Australia: Market Size, By Product Type, 2014-2021 (USD Million)

Table 65 Australia: Market Size, By Application, 2014-2021 (USD Million)

Table 66 Australia: Market Size, By Container Type, 2014-2021 (USD Million)

Table 67 Rest of the World: Market Size, By Product Type, 2014-2021 (USD Million)

Table 68 Rest of the World: Market Size, By Application, 2014-2021 (USD Million)

Table 69 Rest of the World: Market Size, By Container Type, 2014-2021 (USD Million)

Table 70 Rest of the World: Market Size, By Country, 2014-2021 (USD Million)

Table 71 Brazil: Market Size, By Product Type, 2014-2021 (USD Million)

Table 72 Brazil: Market Size, By Application, 2014-2021 (USD Million)

Table 73 Brazil: Market Size, By Container Type, 2014-2021 (USD Million)

Table 74 U.A.E.: Market Size, By Product Type, 2014-2021 (USD Million)

Table 75 U.A.E.: Market Size, By Application, 2014-2021 (USD Million)

Table 76 U.A.E.: Market Size, By Container Type, 2014-2021 (USD Million)

Table 77 South Africa: Market Size, By Product Type, 2014-2021 (USD Million)

Table 78 South Africa: Market Size, By Application, 2014-2021 (USD Million)

Table 79 South Africa: Market Size, By Container Type, 2014-2021 (USD Million)

Table 80 Contracts, June 2013-August 2016

Table 81 New Product Launches, September 2015– June 2016

Table 82 Mergers & Acquisitions, June 2014– December 2015

Table 83 Partnership, December 2014– June 2016

List of Figures (49 Figures)

Figure 1 Unit Load Device Market

Figure 2 Report Flow

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Market, By Application, 2016 & 2021 (USD Million)

Figure 9 Market, By Material Type, 2016 & 2021 (USD Million)

Figure 10 Market, By Product Type, 2016 & 2021

Figure 11 Market, By Container Type, 2016 & 2021

Figure 12 North America Estimated to Capture the Highest Market Share in 2016

Figure 13 Growth Strategies Adopted By Market Players in Unit Load Device Market Between June 2013 to August 2016

Figure 14 Attractive Market Opportunities in the Market

Figure 15 Market, By Product Type, 2016 & 2021 (USD Million)

Figure 16 Commercial Segment Projected to Dominate Market During the Forecast Period 2021

Figure 17 Metal Material is Projected to Dominate Market During the Forecast Period 2021

Figure 18 Market, By Container Type, 2016 & 2021 (USD Million)

Figure 19 APAC Projected to Lead the Market During the Forecast Period

Figure 20 Asia-Pacific Estimated to Grow at the Highest Rate During the Forecast Period

Figure 21 Market, By Product

Figure 22 Market, By Application

Figure 23 Market, By Material

Figure 24 Market, By Container

Figure 25 Market, By Region

Figure 26 Evolution of Unit Load Device

Figure 27 Factors Affecting Growth of Unit Load Device Market

Figure 28 LD 3 Segment Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 29 Commercial Application Segment Projected to Lead the Market in 2016

Figure 30 Metal Segment Estimated to Lead the Market in 2016

Figure 31 Normal Container Segment of Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Asia-Pacific Projected to Witness the Highest Growth During the Forecast Period

Figure 33 Market Snapshot: U.S. Projected to Witness Highest Growth During the Forecast Period

Figure 34 Market Snapshot: Russia Projected to Witness Highest Growth During the Forecast Period

Figure 35 Market Snapshot: Japan Projected to Witness Highest Growth During the Forecast Period

Figure 36 Market Snapshot: Brazil Projected to Witness Highest Growth During the Forecast Period

Figure 37 Companies Adopted New Product Launches as the Key Growth Strategy From June 2013 to August 2016

Figure 38 Factors Influencing Unit Load Device Market, By Region, June 2013 to August 2016

Figure 39 Market, By Region, 2013-2016

Figure 40 Market has Witnessed Significant Growth Between June 2013 to August 2016

Figure 41 Contracts Strategy Adopted By Major Market Players in Market Between June 2013 to August 2016

Figure 42 Regional Revenue Mix of Top Players (2015)

Figure 43 Financial Highlights of Key Players (2015)

Figure 44 Brambles Limited: Company Snapshot

Figure 45 Brambles Limited: SWOT Analysis

Figure 46 Zodiac Aerospace: Company Snapshot

Figure 47 Zodiac Aerospace: SWOT Analysis

Figure 48 Transdigm Group Incorporated: Company Snapshot

Figure 49 Transdigm Group Incorporated: SWOT Analysis

Research Methodology:

Market size estimation for various segments and subsegments of the unit load device market was arrived through extensive secondary research sources, such as annual report and publications from IATA, ISO, and the Boeing Business Outlook, among others, corroboration with primaries, and further market triangulation with the help of statistical techniques using econometric tools. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data is consolidated with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key market players in the unit load device market are Nordisk Aviation Products AS (Norway), Zodiac Aerospace (France), VRR Aviation (The Netherlands), DoKaSch GmbH (Germany), and Satco, Inc. (U.S.), among others. These players adopted strategies, such as contracts, new product developments, agreements, and collaborations to strengthen their position in the market.

Target Audience

- Passenger aircraft carriers

- Freight companies

- Unit load device suppliers

- Unit load device manufacturers

- Service and solution providers

- Regulatory bodies

- ULD operators

Scope of the Report

This research report categorizes the unit load device market into the following segments and subsegments:

-

Unit Load Device Market, by Product Type

- LD 3

- LD 6

- LD 11

- M 1

- Pallets

- Others

-

Unit Load Device Market, by Application

- Commercial

- Cargo

-

Unit Load Device Market, by Material

- Metal

- Composite

- Others

-

Unit Load Device Market, by Container Type

- Normal

- Cold

- Others

-

Unit Load Device Market, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Customizations available for the report:

With the given market data, MarketsandMarkets offers customizations as per the specific needs of the company. The following customization options are available for the report:

-

Company Information

- Detailed analysis and profiles of additional market players (Up to five)

- Further breakdown of the Rest of the World into the Middle East, Africa, and Latin America

Growth opportunities and latent adjacency in Unit Load Device Market