Turret System Market by Type (Manned, Unmanned), Component (Turret Drive, Turret Control System, Stabilization Unit), Platform (Land, Airborne, Naval), and Region – Global Forecast to 2027

The Turret System Market size is projected to reach USD 22.6 billion by 2027, registering a CAGR of 2.8% during the forecast period.

Turret System Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Turret System Market dynamics

Driver: Development of modular and scalable turret systems

Turret systems are equipped with multi-mission systems that can be reconfigured to enhance the effectiveness of combat vehicles. These systems have a modular mission payload with an open architecture that can be integrated with other systems to support several operations. The combat vehicles can also be interfaced with third-party payloads such as Remote Weapon System (RWS), interrogation arms, and Reconnaissance, Surveillance, Targeting and Acquisition (RSTA) systems to support combat; chemical, biological, radiological, and nuclear (CBRN) defense; RSTA; and route clearance mission. Turret systems are also equipped with interchangeable weapon systems based on mission requirements. For instance, infantry fighting vehicles can be upgraded with high-caliber weapons and other situational awareness systems to enhance their firepower. The flexibility to install multiple payload systems increases the efficiency of armored vehicles, lowers their lifecycle costs, and reduces soldier workload. Modularity in turret systems has led to the development of new scalable systems that can be easily integrated with other systems.

The demand for autonomous robots is increasing worldwide as they are used for various purposes, including carrying out target acquisition and surveillance operations by defense forces of different countries. Major companies such as Moog Inc. (US), Northrup Grumman Corporation (US), Lockheed Martin Corp. (US), Elbit System (Israel), and Rafael Advanced Defense System Ltd. (Israel) are developing military robots with intelligence, surveillance, reconnaissance (ISR) and target acquisition capabilities.

Restraint: High development cost

New and advanced turret systems require sufficient time, capital, and technical expertise. Developing turret systems with modular designs, increased endurance, and smooth stabilization leads to increased costs. The high costs involved in developing these systems pose a challenge to the growth of the Turret System Industry. In refurbishing existing warfare platforms with modern and advanced turret systems, defense forces do not prefer to spend large amounts of money on modernizing existing military platforms.

Opportunity: Increased adoption of unmanned systems across platforms

The demand for unmanned systems has increased globally in recent years due to their growing use by military forces for carrying out intelligence, surveillance, and reconnaissance (ISR) and combat operations. Furthermore, the declining defense budgets of advanced economies such as the UK, Italy, Spain, Germany, and France have led to the increased procurement of unmanned systems to replace their defense personnel, which use large volumes of equipment and logistic support.

Military forces of various countries are focusing on using unmanned combat ground vehicles on battlefields to reduce casualties, as these vehicles can perform critical and hazardous tasks carried out by warfighters in combat zones. Consequently, the advantages of unmanned combat ground vehicles over manned combat vehicles have increased the adoption by defense forces. For instance, the US Army is procuring unmanned modular infantry systems under its Squad Maneuver Equipment Transport (SMET) program.

Challenges: Hardware and software malfunctions

Autonomous vehicles and systems are prone to hardware and software malfunctions. Even though they are built and designed to withstand harsh situations, they continue to face challenges, such as extreme temperatures, component breakdowns, and software jams, among others. Unmanned armored ground vehicles are controlled by human operators either through tethered modes or operated remotely. In some instances, human operators might lose control of these robots, or robots miscalculate the commands, resulting in ultimate mission failures. Engineers have faced challenges in creating fully autonomous vehicles and systems as this technology is under development.

Land segment to lead turret system market by platform during forecast period

Based on platform, the turret system market has been segmented into land, airborne, and naval. The land segment is likely to grow at the highest CAGR during the forecast period. It is projected to grow from USD 12.0 billion in 2022 to USD 13.9 billion by 2027, registering a CAGR of 2.8%.

Unmanned segment to command turret system market by type during forecast period

Based on type, the turret system market has been segmented into manned and unmanned. The unmanned segment is projected to grow at a higher CAGR than the manned segment, owing to the technological advancements in unmanned turrets, a widely accepted turret weapon system in most countries.

Turret drive segment to dominate turret system market by component during forecast period

Based on component, the turret system market has been segmented into turret drive, turret control system, and stabilization unit. Turret drive is projected to lead the component segment of the turret system market from 2022 to 2027.

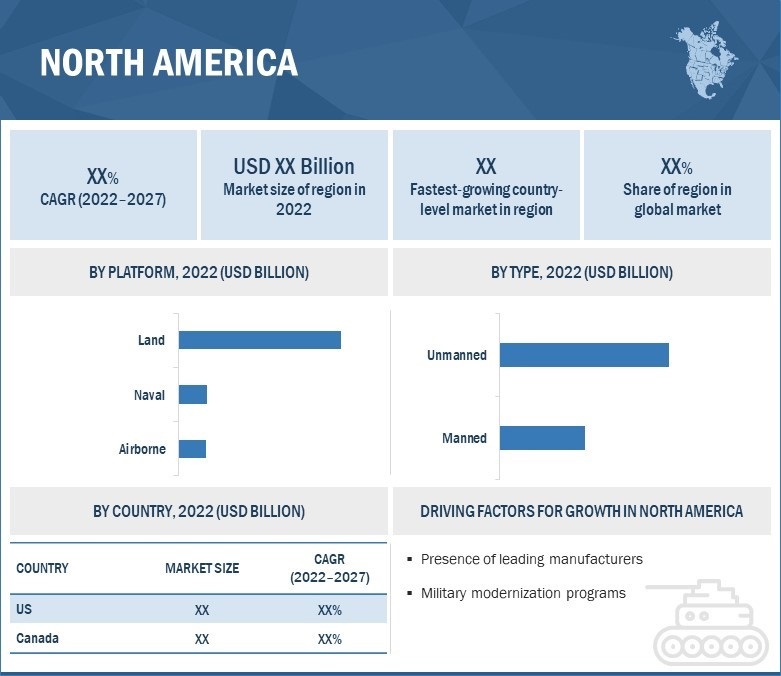

North America to acquire largest share during forecast period

Turret System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Technology trends

Programmable Ammunition

Programmable ammunition has a twin-ammo-feed design or a multiple-ammo-feed design that enables change in the type of ammunition used. It reduces the complexity of using ammunition and provides flexibility to weapon platforms for firing and interchanging different ammunition. For instance, with programmable ammunition, an artillery gun has the ability to fire shells that can be programmed to explode with pinpoint accuracy before, above, or inside a target. Hitting targets such as UAVs and small drones becomes highly accurate with programmable ammunition. It can be deployed on land and naval warfare platforms against light targets.

Key players

Major Players profiled in the Turret System Companies are Moog Inc. (US), Rafael Advanced Defense System Ltd. (Israel), Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), and Elbit System (Israel), among others. The report covers various industry trends and new technological innovations in the turret system market for 2018–2027.

Turret System Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 19.7 billion |

| Projected Market Size | USD 22.6 billion |

| Growth Rate | 2.8% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Platform, Type, Component |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

|

Turret System Market Highlights

The study categorizes the turret system market based on platform, type, component, and region.

|

Aspect |

Details |

|

By Platform |

|

|

By Component |

|

|

By Type |

|

Recent developments

- In September 2022, Elbit Systems was awarded a contract valued at USD 80 million to supply unmanned turrets for Armoured Fighting Vehicles of an Asian-Pacific country. The contract will be performed over three years. Elbit Systems will supply 30mm-gun unmanned light turrets that integrate sensors and display systems for enhanced situational awareness, target acquisition capabilities, fire control systems, and weapon systems of various types, enabling significant mission performance upgrades for the AFVs.

- In October 2020, ASELSAN signed a new sales contract with the Indonesian Navy for Indonesia’s naval platforms. In the contract, ASELSAN will provide the 30mm SMASH Remote Controlled Stabilized Gun System to the Indonesian Navy.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the turret system market?

Response: The turret system market is expected to grow substantially owing to the technological development in designing various armored vehicles and related components for several military applications.

What are the key sustainability strategies adopted by leading players operating in the turret system market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the turret system market. Major players, including Moog Inc. (US), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Elbit System (Israel), and Rheinmetall AG (US), have adopted strategies, such as contracts and agreements, to expand their presence in the market further.

What new emerging technologies and use cases disrupt the turret system market?

Response: Some of the major emerging technologies and use cases disrupting the market include the development of land compact vehicles, unmanned systems across the platform, and others.

Who are the key players and innovators in the ecosystem of the turret system market?

Response: Key players include Moog Inc. (US), Rafael Advanced Defense System Ltd. (Israel), Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), and Elbit System (Israel).

Which region is expected to hold the highest market share in the turret system market?

Response: North America accounted for the largest share of 47.9% of the market in 2021, while Europe is expected to grow at the highest CAGR of 4.4% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 TURRET SYSTEM MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN TURRET SYSTEM MARKET

1.5 CURRENCY CONSIDERED

1.6 STUDY LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

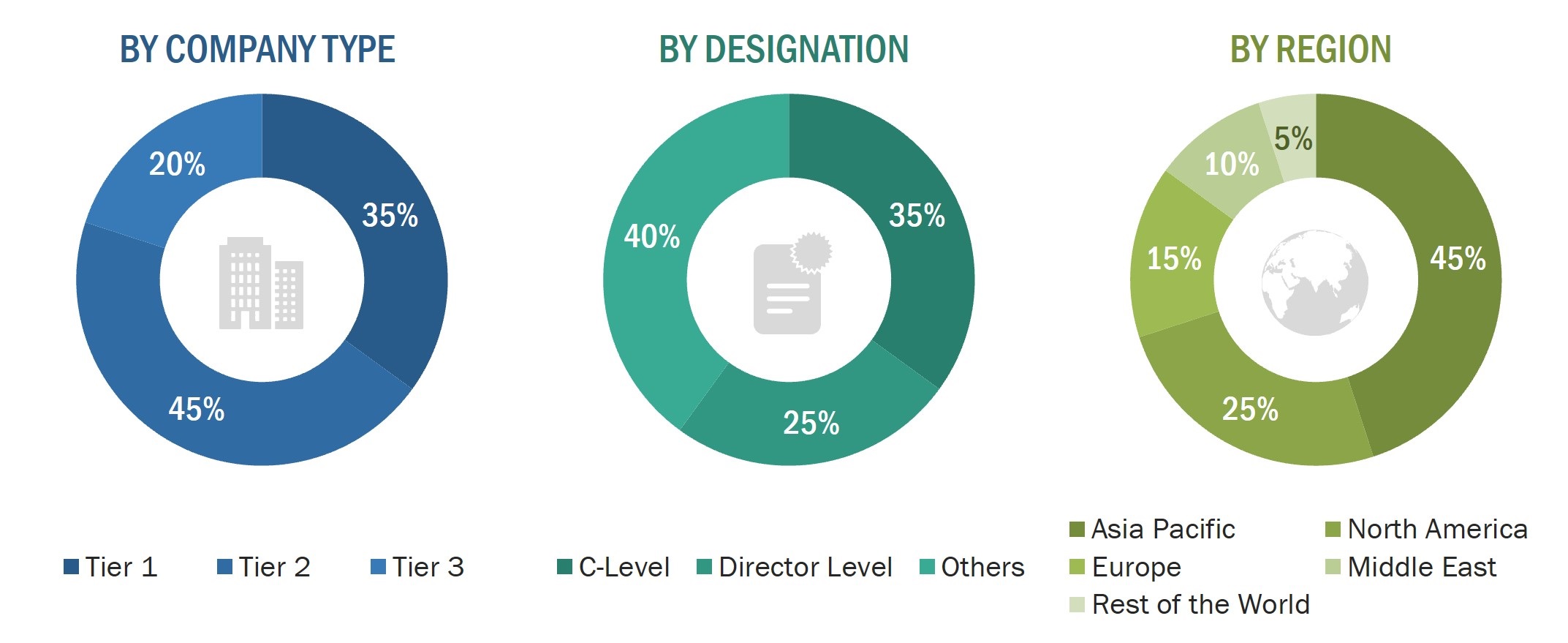

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE INDICATORS

2.2.2 SUPPLY-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

TABLE 2 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH AND METHODOLOGY

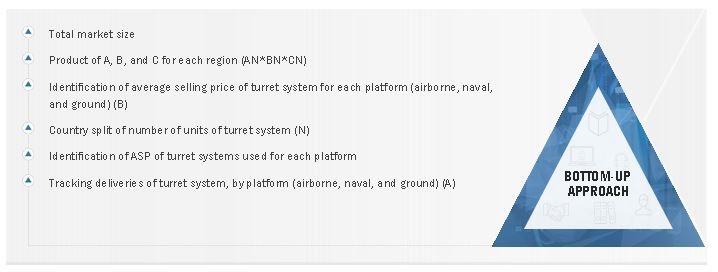

2.4.1 BOTTOM-UP APPROACH

TABLE 3 TURRET SYSTEM MARKET ESTIMATION PROCEDURE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 GROWTH RATE ASSUMPTIONS

2.7 RESEARCH ASSUMPTIONS

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 8 LAND SEGMENT PROJECTED TO DOMINATE TURRET SYSTEM MARKET FROM 2022 TO 2027

FIGURE 9 TURRET DRIVE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

FIGURE 10 UNMANNED SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 11 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN TURRET SYSTEM MARKET

FIGURE 12 SURGE IN ADOPTION OF UNMANNED SYSTEMS TO DRIVE MARKET GROWTH

4.2 TURRET SYSTEM MARKET, BY PLATFORM

FIGURE 13 LAND SEGMENT ESTIMATED TO LEAD MARKET FROM 2018 TO 2027

4.3 TURRET SYSTEM MARKET, BY COMPONENT

FIGURE 14 TURRET DRIVE SEGMENT PROJECTED TO DOMINATE MARKET FROM 2018 TO 2027

4.4 TURRET SYSTEM MARKET, BY TYPE

FIGURE 15 MANNED SEGMENT LIKELY TO STEER MARKET FROM 2018 TO 2027

4.5 TURRET SYSTEM MARKET, BY COUNTRY

FIGURE 16 INDIA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TURRET SYSTEM MARKET

5.2.1 DRIVERS

5.2.1.1 Improving ISR and target acquisition capabilities of defense forces

5.2.1.2 Increasing demand for land vehicles to tackle cross-border conflicts

5.2.1.3 Rising incidence of global asymmetric warfare

5.2.2 RESTRAINTS

5.2.2.1 Absence of major platform OEMs in Middle East and Asia Pacific

5.2.2.2 Occurrence of mechanical and electrical failure in turret system and their components

5.2.3 OPPORTUNITIES

5.2.3.1 Global military modernization plans

5.2.3.2 Surging adoption of unmanned systems across platforms

5.2.3.3 Development of modular and scalable turret system

5.2.4 CHALLENGES

5.2.4.1 Hardware and software malfunctions

5.2.4.2 Survivability issues

5.2.4.3 High development cost

5.3 AVERAGE SELLING PRICE TREND

5.3.1 AVERAGE SELLING PRICE TREND, LAND PLATFORM

TABLE 4 AVERAGE SELLING PRICE OF MAIN BATTLE TANKS (USD MILLION)

TABLE 5 AVERAGE SELLING PRICE OF INFANTRY FIGHTING VEHICLES (USD MILLION)

TABLE 6 AVERAGE SELLING PRICE OF ARMORED PERSONNEL CARRIERS (USD MILLION)

TABLE 7 AVERAGE SELLING PRICE OF MINE-RESISTANT AMBUSH-PROTECTED VEHICLES (USD MILLION)

TABLE 8 AVERAGE SELLING PRICE OF LIGHT-PROTECTED VEHICLES (USD MILLION)

TABLE 9 AVERAGE SELLING PRICE OF SELF-PROPELLED HOWITZERS (USD MILLION)

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.5 MARKET ECOSYSTEM

FIGURE 19 TURRET SYSTEM: MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

TABLE 10 TURRET SYSTEM: MARKET ECOSYSTEM

5.6 PRICING ANALYSIS

5.6.1 AVERAGE SELLING PRICE ANALYSIS, BY TURRET SYSTEM PLATFORM

TABLE 11 LAND PLATFORM PRICING, BY VEHICLE TYPE

FIGURE 20 AVERAGE SELLING PRICE TREND, BY LAND VEHICLE PLATFORM

5.7 VALUE CHAIN ANALYSIS OF TURRET SYSTEM MARKET

FIGURE 21 VALUE CHAIN ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.8.1 KEY TECHNOLOGY

5.8.1.1 Advanced control software

5.8.2 COMPLEMENTARY TECHNOLOGY

5.8.2.1 Electro-optical and radar sensor payloads for unmanned armored vehicles

5.8.2.2 Design and implementation of solar-powered armored vehicles

5.8.2.3 Development of multi-payload unmanned armored vehicles

5.9 PORTER’S FIVE FORCES MODEL

5.9.1 TURRET SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 TURRET SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.2 THREAT OF NEW ENTRANTS

5.9.3 THREAT OF SUBSTITUTES

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 BARGAINING POWER OF BUYERS

5.9.6 INTENSITY OF COMPETITIVE RIVALRY

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING TURRET SYSTEM, BY TYPE

TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING TURRET SYSTEM, BY TYPE (%)

5.10.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR TURRET SYSTEM, BY PLATFORM

TABLE 13 KEY BUYING CRITERIA FOR TURRET SYSTEM, BY PLATFORM

5.11 USE CASES

5.11.1 VICTORY: VEHICLE INTEGRATION FOR C4ISR/ELECTRONIC WARFARE INTEROPERABILITY

5.11.2 ELECTRIC ARMOR

5.11.3 SEE-THROUGH ARMOR

5.11.4 ADAPTIV–CAMOUFLAGE SYSTEMS

5.11.5 HYBRID DIESEL-ELECTRIC SYSTEMS

5.12 KEY CONFERENCES AND EVENTS, 2022–23

TABLE 14 TURRET SYSTEM MARKET: CONFERENCES AND EVENTS, 2022–2023

5.13 TRADE DATA ANALYSIS

5.13.1 IMPORT DATA FOR LAND VEHICLE PLATFORMS (VALUE), BY REGION, 2015–2020

TABLE 15 REGION-WISE IMPORT DATA FOR ARMORED VEHICLES (USD), 2015–2020

5.14 REGULATORY LANDSCAPE

TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

TABLE 19 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

6 INDUSTRY TRENDS (Page No. - 77)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS) AND NANOTECHNOLOGY

6.2.2 INTEGRATED TURRET SYSTEM

6.2.3 TURRET DRIVE SERVO SYSTEM (TDSS) TECHNOLOGY

6.2.4 REACTIVE ARMOR TECHNOLOGY

6.2.5 INTEROPERABLE COMMUNICATION SYSTEMS

6.2.6 PROGRAMMABLE AMMUNITION

6.2.7 LINKLESS FEED SYSTEMS

6.2.8 IMPROVED AMMUNITION-CARRYING CAPABILITY

6.2.9 AMMUNITION FEED CHUTES

6.2.10 SENSOR FUSION TECHNOLOGY

6.2.11 ADVANCED AUTOLOADERS

6.3 INNOVATIONS & PATENT REGISTRATIONS

TABLE 21 TURRET SYSTEM & PLATFORMS: KEY PATENTS, 2017–2022

7 TURRET SYSTEM MARKET, BY PLATFORM (Page No. - 81)

7.1 INTRODUCTION

FIGURE 25 LAND SEGMENT PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 22 TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 23 TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

7.2 LAND

7.2.1 MOBILE/VEHICULAR

7.2.1.1 Main battle tanks (MBTs)

7.2.1.1.1 Increasing demand for MBTs for offensive cross-country operations

FIGURE 26 MBT PRODUCTION DATA, BY COUNTRY & MODEL, 2021 (UNITS)

7.2.1.2 Infantry fighting vehicles (IFVs)

7.2.1.2.1 IFV procurement by emerging countries to lead increasing demand

7.2.1.3 Armored personnel carriers (APCs)

7.2.1.3.1 Increasing demand for APCs due to terrorist attacks and asymmetric warfare operations

7.2.1.4 Armored amphibious vehicles (AAVs)

7.2.1.4.1 AAVs used by military forces for amphibious operations estimated to increase their demand

7.2.1.5 Mine-resistant ambush protected (MRAP)

7.2.1.5.1 Laser fit, along with a robotic arm, in MRAP protects troops from IEDs and mines

7.2.1.6 Light armored vehicles (LAVs)

7.2.1.6.1 Increasing use of LAVs for border patrolling, ISR activities, and defense personnel transportation

7.2.1.7 Self-propelled Howitzers (SPHs)

7.2.1.7.1 Increasing demand for 155 mm guns for long-range firing operations

7.2.1.8 Air defense vehicles

7.2.1.8.1 Adoption of vehicle-mounted antiaircraft guns for air defense roles

FIGURE 27 AIR DEFENSE VEHICLE/ROCKET LAUNCHER VEHICLE PRODUCTION DATA, BY COUNTRY, 2021 (UNITS)

7.2.1.9 Armored Mortar Carriers (AMCs)

7.2.1.9.1 Philippines, India, Turkey, and US to lead in AMC procurement

7.2.1.10 Unmanned Armored Ground Vehicles (AGVs)

7.2.1.10.1 Increasing R&D activities to develop unmanned AGVs for warfare

7.2.2 STATIONARY

7.2.2.1 Remote Weapon Stations (RWSs)

7.2.2.1.1 Increasing demand for advanced remote weapon stations to drive market

7.2.2.2 Air Defense Guns

7.2.2.2.1 Air defense guns widely used in remote weapon stations

7.2.2.3 Mortars

7.2.2.3.1 Huge investments in technologically advanced mortars to fuel market

7.3 AIRBORNE

7.3.1 ATTACK HELICOPTERS

7.3.1.1 Increasing procurement by emerging economies to fuel turret system needs in military helicopters

7.3.2 MARITIME HELICOPTERS

7.3.2.1 Advanced warfare capabilities in maritime helicopters to boost demand

7.3.3 FIGHTER AIRCRAFT

7.3.3.1 Increasing modernization programs by militaries to drive segment

7.3.4 SPECIAL MISSION AIRCRAFT

7.3.4.1 Increasing demand for modernized special mission aircraft for tactical operations to fuel market growth

7.3.5 UNMANNED AERIAL VEHICLES (UAV)

7.3.5.1 Wide range of combat UAVs for military applications to drive segment

7.4 NAVAL

7.4.1 DESTROYERS

7.4.1.1 Protect large vessels against small but powerful short-range attackers

7.4.2 FRIGATES

7.4.2.1 Increasing use of autonomous systems on frigates to drive market

7.4.3 CORVETTES

7.4.3.1 Ongoing procurement of corvettes across militaries to increase demand for turret system

7.4.4 OFFSHORE SUPPORT VESSELS (OSV)

7.4.4.1 Technological advancements in OSVs to fuel turret requirement

7.4.5 AMPHIBIOUS VESSELS

7.4.5.1 Increasing demand for amphibious warfare ships by various countries to drive market

7.4.6 PATROL AND MINE COUNTERMEASURE VESSELS

7.4.6.1 Increasing demand for patrol and mine countermeasure vessels for cross-border protection

7.4.7 SUBMARINES

7.4.7.1 Increasing investments in submarines expected to drive market

7.4.8 UNMANNED SURFACE VEHICLES (USV)

7.4.8.1 Increasing procurement of USVs to drive demand for turret system

8 TURRET SYSTEM MARKET, BY COMPONENT (Page No. - 93)

8.1 INTRODUCTION

FIGURE 28 TURRET DRIVE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 24 TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 25 TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

8.2 TURRET DRIVE

8.2.1 INCREASING PROCUREMENT OF TURRET DRIVES

8.2.2 MANUAL

8.2.3 ELECTRIC

8.2.4 ELECTROMECHANICAL

8.2.5 ELECTROHYDRAULIC

8.3 TURRET CONTROL UNIT

8.3.1 DEMAND FOR HIGHLY ADVANCED TURRET CONTROL UNITS TO DRIVE MARKET

8.3.2 MOTOR CONTROLLER

8.3.3 POWER UNIT

8.3.4 OTHERS

8.4 STABILIZATION UNIT

8.4.1 DEVELOPMENT OF MODERNIZED TURRET STABILIZATION UNITS TO CREATE MORE DEMAND

9 TURRET SYSTEM MARKET, BY TYPE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 29 UNMANNED SEGMENT PROJECTED TO LEAD TURRET SYSTEM MARKET FROM 2022 TO 2027

TABLE 26 TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 27 TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

9.2 MANNED TURRETS

9.2.1 ENHANCED ATTACKING CAPABILITIES OF MANNED TURRETS TO DRIVE MARKET

9.3 UNMANNED TURRETS

9.3.1 COMBAT-PROVEN, TECHNOLOGICALLY ADVANCED UNMANNED TURRETS TO FUEL MARKET GROWTH

10 REGIONAL ANALYSIS (Page No. - 100)

10.1 INTRODUCTION

FIGURE 30 EUROPE TURRET SYSTEM MARKET PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 28 TURRET SYSTEM MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 29 TURRET SYSTEM MARKET, BY REGION, 2022–2027 (USD BILLION)

10.2 NORTH AMERICA

10.2.1 PESTLE ANALYSIS: NORTH AMERICA

10.2.1.1 Political

10.2.1.2 Economic

10.2.1.3 Social

10.2.1.4 Technological

10.2.1.5 Environmental

10.2.1.6 Legal

FIGURE 31 NORTH AMERICA: TURRET SYSTEM MARKET SNAPSHOT

TABLE 30 NORTH AMERICA: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 31 NORTH AMERICA: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 32 NORTH AMERICA: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 33 NORTH AMERICA: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 34 NORTH AMERICA: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 35 NORTH AMERICA: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 36 NORTH AMERICA: TURRET SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 37 NORTH AMERICA: TURRET SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.2.2 US

10.2.2.1 US most lucrative market for turret system

TABLE 38 US: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 39 US: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 40 US: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 41 US: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 42 US: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 43 US: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.2.3 CANADA

10.2.3.1 Market growth driven by military modernization programs

TABLE 44 CANADA: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 45 CANADA: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 46 CANADA: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 47 CANADA: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 48 CANADA: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 49 CANADA: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.3 EUROPE

10.3.1 PESTLE ANALYSIS: EUROPE

10.3.1.1 Political

10.3.1.2 Economic

10.3.1.3 Social

10.3.1.4 Technological

10.3.1.5 Environmental

10.3.1.6 Legal

FIGURE 32 EUROPE: TURRET SYSTEM MARKET SNAPSHOT

TABLE 50 EUROPE: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 51 EUROPE: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 52 EUROPE: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 53 EUROPE: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 54 EUROPE: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 55 EUROPE: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 56 EUROPE: TURRET SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 57 EUROPE: TURRET SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.3.2 UK

10.3.2.1 Mid-life upgrade of warrior infantry fighting vehicles to drive turret system market

TABLE 58 UK: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 59 UK: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 60 UK: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 61 UK: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 62 UK: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 63 UK: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.3.3 GERMANY

10.3.3.1 Largest west European spender on armored vehicles

TABLE 64 GERMANY: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 65 GERMANY: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 66 GERMANY: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 67 GERMANY: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 68 GERMANY: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 69 GERMANY: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.3.4 FRANCE

10.3.4.1 Procurement of new-generation combat vehicles for defense forces to drive market

TABLE 70 FRANCE: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 71 FRANCE: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 72 FRANCE: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 73 FRANCE: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 74 FRANCE: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 75 FRANCE: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.3.5 POLAND

10.3.5.1 Procurement of light tanks equipped with ceramic-aramid armor to drive market

TABLE 76 POLAND: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 77 POLAND: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 78 POLAND: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 79 POLAND: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 80 POLAND: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 81 POLAND: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.3.6 ITALY

10.3.6.1 Country’s growing focus on military power to drive market

TABLE 82 ITALY: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 83 ITALY: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 84 ITALY: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 85 ITALY: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 86 ITALY: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 87 ITALY: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.3.7 REST OF EUROPE

10.3.7.1 Presence of major countries in Rest of Europe to drive market

TABLE 88 REST OF EUROPE: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 89 REST OF EUROPE: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 90 REST OF EUROPE: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 91 REST OF EUROPE: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 92 REST OF EUROPE: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 93 REST OF EUROPE: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.4 ASIA PACIFIC

10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

10.4.1.1 Political

10.4.1.2 Economic

10.4.1.3 Social

10.4.1.4 Technological

10.4.1.5 Environmental

10.4.1.6 Legal

FIGURE 33 ASIA PACIFIC: TURRET SYSTEM MARKET SNAPSHOT

TABLE 94 ASIA PACIFIC: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 95 ASIA PACIFIC: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 96 ASIA PACIFIC: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 97 ASIA PACIFIC: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 98 ASIA PACIFIC: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 99 ASIA PACIFIC: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 100 ASIA PACIFIC: TURRET SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 101 ASIA PACIFIC: TURRET SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.4.2 CHINA

10.4.2.1 Increasing investment to strengthen military to fuel demand for turret system

TABLE 102 CHINA: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 103 CHINA: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 104 CHINA: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 105 CHINA: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 106 CHINA: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 107 CHINA: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.4.3 INDIA

10.4.3.1 Increasing procurement of armored vehicles to tackle border disputes

TABLE 108 INDIA: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 109 INDIA: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 110 INDIA: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 111 INDIA: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 112 INDIA: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 113 INDIA: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.4.4 JAPAN

10.4.4.1 High-end indigenous military technologies to drive market

TABLE 114 JAPAN: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 115 JAPAN: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 116 JAPAN: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 117 JAPAN: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 118 JAPAN: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 119 JAPAN: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.4.5 AUSTRALIA

10.4.5.1 Manufacture and modernization of combat fleets to drive market growth

TABLE 120 AUSTRALIA: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 121 AUSTRALIA: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 122 AUSTRALIA: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 123 AUSTRALIA: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 124 AUSTRALIA: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 125 AUSTRALIA: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.4.6 SOUTH KOREA

10.4.6.1 Robotics technologies to raise demand for turret system in unmanned ground vehicles

TABLE 126 SOUTH KOREA: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 127 SOUTH KOREA: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 128 SOUTH KOREA: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 129 SOUTH KOREA: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 130 SOUTH KOREA: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 131 SOUTH KOREA: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.4.7 SINGAPORE

10.4.7.1 Deployment of technologically advanced armored vehicles on battlefields to boost market

TABLE 132 SINGAPORE: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 133 SINGAPORE: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 134 SINGAPORE: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 135 SINGAPORE: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 136 SINGAPORE: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 137 SINGAPORE: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.4.8 REST OF ASIA PACIFIC

10.4.8.1 Unmanned armored vehicles to fuel market for turret system

TABLE 138 REST OF ASIA PACIFIC: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 139 REST OF ASIA PACIFIC: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 140 REST OF ASIA PACIFIC: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 141 REST OF ASIA PACIFIC: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 142 REST OF ASIA PACIFIC: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 143 REST OF ASIA PACIFIC: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.5 REST OF THE WORLD

TABLE 144 REST OF THE WORLD: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 145 REST OF THE WORLD: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 146 REST OF THE WORLD: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 147 REST OF THE WORLD: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 148 REST OF THE WORLD: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 149 REST OF THE WORLD: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 150 REST OF THE WORLD: TURRET SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 151 REST OF THE WORLD: TURRET SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Social unrest and market instability to drive turret system demand

TABLE 152 MIDDLE EAST: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 153 MIDDLE EAST: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 154 MIDDLE EAST: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 155 MIDDLE EAST: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 156 MIDDLE EAST: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 157 MIDDLE EAST: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

10.5.2 LATIN AMERICA & AFRICA

10.5.2.1 Increased demand for unmanned military ground vehicles to boost market

TABLE 158 LATIN AMERICA & AFRICA: TURRET SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

TABLE 159 LATIN AMERICA & AFRICA: TURRET SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD BILLION)

TABLE 160 LATIN AMERICA & AFRICA: TURRET SYSTEM MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 161 LATIN AMERICA & AFRICA: TURRET SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 162 LATIN AMERICA & AFRICA: TURRET SYSTEM MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 163 LATIN AMERICA & AFRICA: TURRET SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

The study involved four major activities in estimating the current size of the turret system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary research

The market share of companies offering turret systems was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them on their performance and quality. In the secondary research process, sources such as government databases; SIPRI; corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles by recognized authors; and directories and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry's value and supply chain. It was also used to identify the key players by various products, market classifications, and segmentation according to their offerings. Secondary information helped in understanding different industry trends related to turret system platforms, type, component, and region, as well as key developments from the market and technology-oriented perspectives.

Primary research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from systems manufacturers; army personnel; turret system manufacturers; integrators; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the turret system market. The research methodology used to estimate the market size includes the following details.

Key players in the turret system market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the turret system market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the turret system market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Turret System Market: Bottom-up approach

Data triangulation

After arriving at the overall market size, the total market was split into different segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for turret system segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the turret system market based on platform, type, component, and region for the forecast period from 2022 to 2027

- To forecast the size of the segments of the turret system market with respect to six major regions, including North America, Europe, Asia Pacific, and the Rest of the World, which comprises the Middle East and, Latin America & Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the turret system market

- To identify the opportunities for stakeholders in the market by identifying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and Research & Development (R&D) activities in the turret system market

- To anticipate the status of the turret system market procurements by different countries, technological advancements, and joint developments by leading players for analyzing the degree of competition in the market

- To provide a comprehensive competitive landscape of the turret system market, along with an overview of the different strategies adopted by the key market players to strengthen their position in the market

Available customizations

MarketsandMarkets offers the following customizations for this market report:

- Market sizing and forecast for additional countries

- Platform and type breakdown at the country level

- Additional five companies profiling

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company in the turret system market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Turret System Market