Artillery Systems Market by Type (Howitzers, Rocket Launchers, Mortars, Anti-air weapons, Artillery), Range(Short-range, Medium-range, Long-range), Subsystem (Turrets, Engines, Fire Control Systems, AHS, Auxiliary Systems), and Region- Global Forecast to 2028

Update: 11/07/2025

Artillery System Market Summary

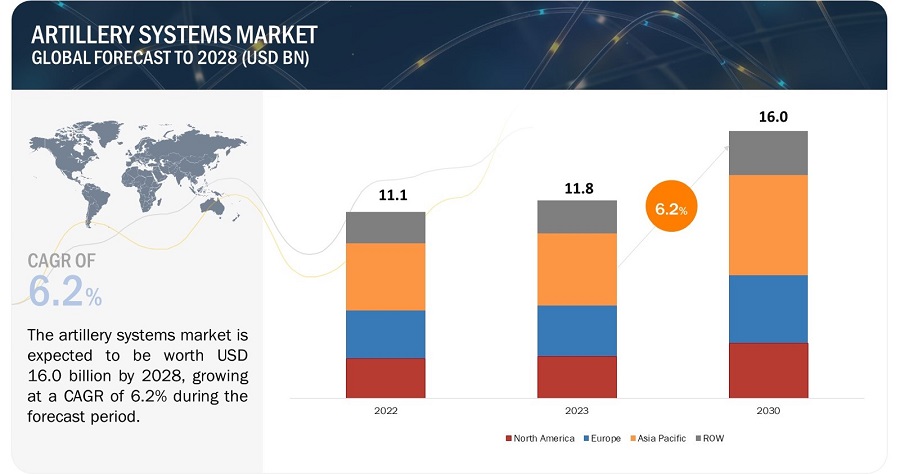

[218 Pages Report] The Artillery Systems Market size was estimated at USD 11.1 billion in 2022 and is predicted to increase from 11.8 Billion in 2023 to approximately USD 16.0 Billion by 2028, expanding at a CAGR of 6.2%.from 2023 to 2028.

Artillery Systems Market Key Takeaways

-

By Market Size & Growth, Artillery Systems Market is projected to reach USD 16.0 Billion by 2028, growing from USD 11.8 Billion in 2023 at a CAGR of 6.2% during the forecast period.

-

By dynamics – growing geopolitical tensions and defense budgets are fueling demand for advanced, long-range artillery systems.

-

By platform – land forces are the largest users, focusing on mobile and self-propelled systems for operational agility.

-

By caliber – 155mm systems dominate, balancing firepower and flexibility for modern combat needs.

-

By type – self-propelled artillery is expanding, driven by better mobility and rapid deployment capabilities.

-

By challenge – integration with digital command systems requires interoperability and modernization.

-

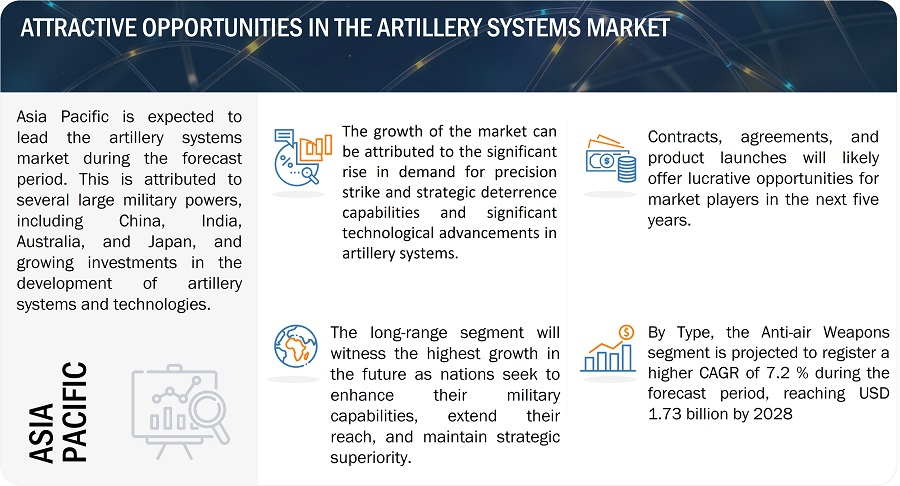

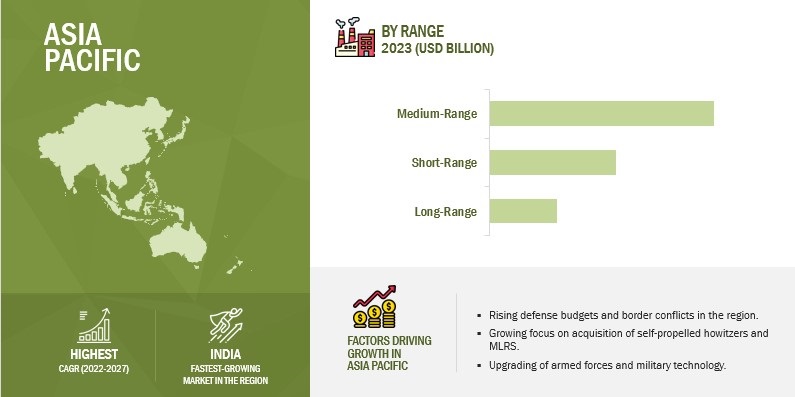

By region – Asia Pacific is seeing the fastest growth, driven by increased procurement in countries like India, China, and South Korea.

-

By opportunity – upgrades of existing systems, especially in Europe and the Middle East, are creating sustained demand.

Market Size & Forecast Report

-

2023 Market Size: USD 11.8 Billion

-

2028 Projected Market Size: USD 16.0 Billion

-

CAGR (2023-2028): 6.2%

-

Asia Pacific : Largest market share

One key driving factor for Artillery Systems Industry is their capability to provide long-range firepower and precision support on the battlefield. Artillery systems play a critical role in modern warfare by delivering large-caliber projectiles to distant targets with accuracy, enabling forces to engage enemy positions, disrupt enemy movements, and provide indirect fire support to friendly troops. The range and precision offered by artillery systems give them a unique advantage in combat situations. They can engage targets beyond the line of sight, meaning they can hit targets that are not directly visible to the operators. This allows artillery units to engage enemy forces from a safe distance, reducing the risk to friendly troops.

Artillery Systems Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Artillery System Market Trends

Drivers: Advancing Artillery Enhancing Capabilities for Modern Warfare

Modernization initiatives in the context of artillery systems refer to the efforts undertaken by defense forces to upgrade and enhance their existing artillery capabilities with the latest technologies, equipment, and operational concepts. These initiatives aim to improve the effectiveness, range, accuracy, mobility, and overall battlefield performance of artillery systems. Modernization involves replacing outdated or obsolete artillery systems with newer models that incorporate advanced features, such as digitalized fire control systems, improved targeting systems, enhanced communication capabilities, and more efficient ammunition. It also entails integrating artillery systems with other modernized components of the military, such as command and control systems, surveillance systems, and unmanned platforms, to enable seamless and network-centric operations.

The drivers behind modernization initiatives include the need to keep pace with evolving threats, technological advancements, and changing operational requirements. Defense forces recognize the importance of having artillery systems that can engage targets accurately, rapidly, and with precision, particularly in complex and dynamic battlefield environments. Modernization initiatives also aim to enhance the survivability of artillery units by integrating them with advanced protection systems, such as active defense systems and improved mobility platforms. Furthermore, modernization initiatives often focus on achieving interoperability and standardization within a country's military or among allied nations. This facilitates joint operations, information sharing, and coordination between different units and branches of the military. Additionally, modernization efforts can result in cost savings by streamlining logistics, maintenance, and training processes through commonality of equipment and systems. Overall, modernization initiatives in the artillery systems domain are driven by the pursuit of maintaining a technological edge, optimizing operational effectiveness, and ensuring the readiness of defense forces in the face of emerging threats and changing warfare dynamics

Restraints: Limited Ammunition Storage Space in Artillery Systems

Limited space for ammunition storage poses a significant restraint in the artillery system market. Artillery systems require sufficient storage space to house a substantial quantity of ammunition, which is essential for sustained operations and prolonged engagements. However, various factors contribute to the restraint of limited space for ammunition storage:

- Size and Weight Constraints: Ammunition for artillery systems can be bulky and heavy, requiring dedicated storage facilities that can accommodate the specific dimensions and weight of the munitions. Limited physical space can restrict the quantity of ammunition that can be stored, potentially impacting the operational readiness and effectiveness of artillery units.

- Safety Considerations: Ammunition storage necessitates adherence to strict safety protocols and regulations. Adequate space is required to implement proper storage practices, such as maintaining appropriate distances between ammunition, ensuring proper ventilation, and providing necessary security measures. Limited space may impede the ability to adhere to these safety guidelines, posing risks to personnel and equipment.

- Mobility and Logistics Challenges: Artillery systems often operate in dynamic and rapidly changing environments. Limited space for ammunition storage can present logistical challenges, including the need for frequent resupply and replenishment of ammunition. Insufficient storage capacity can hamper the ability to sustain operations for extended periods without interruption or delays.

- Vulnerability to Attacks: Compact ammunition storage areas are vulnerable to attacks and can be targeted by adversaries seeking to disrupt or destroy artillery capabilities. Limited space for storage reduces the options for dispersing ammunition, making it more susceptible to damage from enemy actions, including direct attacks or indirect fire.

- Cost Implications: Expanding storage facilities or constructing additional ammunition storage infrastructure to overcome space limitations can be costly. Limited budgets may restrict the allocation of funds for such expansion, further exacerbating the constraints on ammunition storage capacity.

Furthermore, the addition of armaments, power systems, and modules results in reducing the existing space in artillery platforms. Limited ammunition carrying capacity of artillery systems affects continuous firing operations. Artillery systems require frequent loading of ammunition from ammunition resupply vehicles. Thus, the limited supply of ammunitions delays bombarding operations by several minutes, thereby acting as a restraint to the artillery systems market.

Opportunities: Unmanned Artillery Systems transform Battlefield due to Autonomous Firepower

Unmanned artillery systems also provide opportunities for increased battlefield adaptability. These systems can be rapidly deployed and repositioned as needed, allowing for dynamic response to changing operational requirements. Additionally, unmanned artillery systems can be integrated with other autonomous platforms, such as drones or ground robots, forming a networked and coordinated unmanned force for enhanced situational awareness and collaborative engagement. Furthermore, the use of unmanned systems can reduce the logistical footprint by requiring fewer personnel and support equipment, thereby streamlining operations and increasing operational efficiency. The development and deployment of unmanned artillery systems also spur innovation in areas such as artificial intelligence, robotics, and advanced sensors, contributing to technological advancements and fostering cross-sector collaboration. Overall, unmanned artillery systems open up opportunities for militaries to improve their effectiveness, flexibility, and cost-efficiency, while staying at the forefront of modern warfare capabilities.

Challenges: High Costs of Artillery Systems

The design and development of self-propelled artillery requires sufficient time, capital, and technical expertise. Self-propelled artillery, also known as mobile artillery or locomotive artillery, are equipped with their own propulsion system to move towards their target. They are used for long-range indirect bombardment support on the battlefield. The unique capabilities of self-propelled artillery, such as high lethality and improved maneuverability, have led to their increased costs. The high costs involved in the development of advanced technologies for self-propelled artillery act as a key challenge to the growth of the artillery systems market, especially for emerging nations. The average cost of a self-propelled artillery unit is 6.7 million; this cost increases depending on advanced specifications of these weapons. Thus, manufacturers prefer prototyping of weapons and their components prior to their development based on the global demand, as failure of the developed model could incur huge losses.

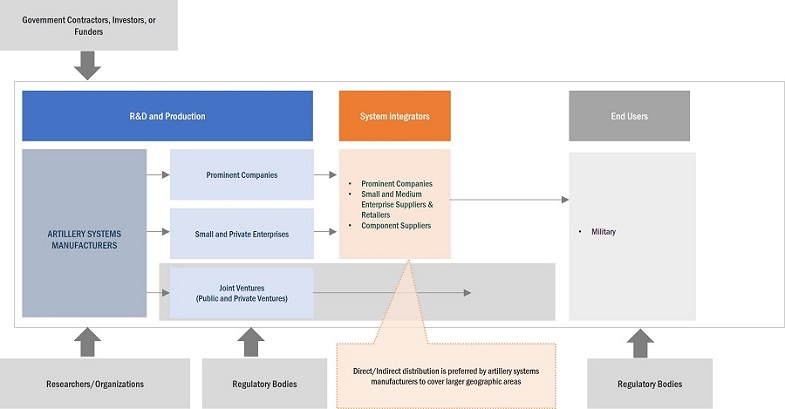

Artillery Systems Market Ecosystem

Lockheed Martin Corporation (US), Bae Systems (UK), Hanwha Group (South Korea), Rheinmetall AG ( Germany), Nexter Group (France), Norinco Internation Cooperation Ltd. (China), Rostec (Russia), Elbit Systems (Israel) are some of the leading companies in the artillery systems market.

Artillery System Market Segments

Based on Howitzer, the Medium Caliber Segment Will Record the Highest Market Share of Artillery Systems During the Forecast Period

Artillery systems in medium caliber howitzer segment which includes caliber of 100 MM- 155 MM are experiencing significant growth due to several factors. Mediu caliber provides a balance between range and lethality. Its larger caliber allows it to achieve extended ranges compared to smaller artillery shells, enabling artillery units to engage targets at greater distances. This increased range enhances the reach and flexibility of artillery systems, enabling them to support operations over a wider area.maneuverability makes it challenging for interceptors to track and engage these weapons effectively. This high explosive capacity makes it capable of engaging a wide range of targets, including fortified positions, armored vehicles, and personnel concentrations. The shell's impact and blast effects can cause significant damage to the target area, disrupting enemy operations and providing a suppression effect.

Based on Mortars, the Small Caliber Segment Will Record the Highest Market Share of Artillery Systems During the Forecast Period

Artillery systems in small caliber mortar segment are witnessing rapid growth due various factors. Firstly, their portability and lightweight design are key advantages. Small caliber mortar systems are more easily transported and deployed, providing greater maneuverability for infantry units. They can be disassembled into smaller components and carried by soldiers, allowing for rapid emplacement and disengagement. This mobility enables infantry forces to quickly establish and relocate mortar positions, maintaining flexibility and adaptability during dynamic combat situations. Secondly, small caliber mortars excel at providing close-range indirect fire support. Their compact size allows them to be effectively employed in complex terrain, urban environments, or restrictive areas where larger artillery systems may be impractical. They can engage targets in close proximity to friendly forces, offering immediate and responsive fire support to troops in direct contact with the enemy.

Based on Artillery, the Coastal Artillery Segment Will Record the Highest Market Share of Artillery Systems During the Forecast Period

Coastal Artillery has secured the largest market share in Artillery segment of artillery systems primarily due to its high accuracy. Coastal artillery systems offer several significant benefits for coastal defense and maritime security. Firstly, these systems provide a formidable deterrent against hostile naval forces and potential amphibious assaults. The presence of coastal artillery acts as a visible and tangible defense, dissuading adversaries from attempting aggressive actions or incursions into coastal areas. Secondly, coastal artillery systems play a critical role in protecting strategic maritime assets and critical infrastructure. They can defend ports, harbors, naval bases, and other vital coastal installations from attacks by hostile ships, submarines, or amphibious forces.

Artillery System Market Regions

Asia Pacific is Expected to Lead the Artillery Systems Market in 2023

Artillery systems in the Asia pacific region are experiencing significant growth due to several key factors. Firstly, The Asia-Pacific region is home to several major military powers which includes China, Japan, India, Australia among others. These countries have high military budgets and have been modernizing its military capabilities and has invested heavily in areas such as self-propelled howitzers and MLRS. Secondly, the rapid technological advancements and investments in artillery systems technology drive the market in this region, major Asian pacific countries have developed or invested in the development and procurement of artillery systems

Artillery Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Artillery Systems Companies: Top Key Market Players

some of the leading companies in the Artillery Systems Companies are:

- Lockheed Martin Corporation (US)

- Bae Systems (UK)

- Hanwha Group (South Korea)

- Rheinmetall AG (Germany)

- Nexter Group (France)

- Norinco Internation Cooperation Ltd. (China)

- Rostec (Russia)

- General Dynamics Corporation (US)

- Avibras (Brazil)

- Elbit Systems (Israel)

These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 11.8 Billion in 2023 |

|

Projected Market Size |

USD 16.0 Billion by 2028 |

|

Growth Rate |

6.2% |

|

Forecast Period |

2023 to 2028 |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Type, range, subsystem, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

Norinco Internation Cooperation Ltd. (China), Lockheed Martin Corporation (US), Nexter Group (France), RUAG Group (Switzerland), Rostec (Russia), Thales Group (France), Bae Systems (UK), General Dynamics Corporation (US), ST Engineering (Singapore), Elbit Systems (Israel), Rheinmetall AG (Germany), Leonardo (Italy), Denel SOC Ltd (South Africa), Hanwha Group (South Korea), Avibras (Brazil), Navantia (Spain), Roketsan AS (Turkey), Tata Advanced Systems Limited (India), Arsenal JSco (Bulgaria), Otokar (?Turkey), OTO Melara (Italy), Soltam Systems (Israel), Poongsan Corporation (South Korea), Kalyani Group (India), Aselsan AS (Turkey) |

Artillery Systems Market Highlights

This research report categorizes artillery systems based on Type, range, subsystem, and region.

|

Segment |

Subsegment |

|

By Type: |

|

|

By Subsystem: |

|

|

By Range: |

|

|

By Region: |

|

Recent Developments

- In April 2023, Lockheed Martin Corporation (US) was awarded contract from the US Army. The contract was valued at USD 615 million and was aimed to manufacture HIMARS (High Mobility artillery rocket system) and related equipment.

- In May 2023, Rostec (Russia) announced new improvements in Pantsir S1 Air Defence gun Systems and other artilleries systems with improved guidance and range based on the combat experience in the Ukraine war.

- In November 2020, Bae Systems (UK) was awarded contract worth USD 2.4 billion from ministry of defence UK to supply munitions for artilleries for the UK armed forces for a period of 15 years.

Frequently Asked Questions (FAQ):

What is the current size of the artillery systems market?

The artillery systems market is estimated to be USD 11.8 billion in 2023 and is projected to reach USD 16.0 billion by 2028, at a CAGR of 6.2% from 2023 to 2028.

What are the key sustainability strategies adopted by leading players operating in the artillery systems market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the artillery systems Lockheed Martin Corporation (US), Bae Systems (UK), Hanwha Group (South Korea), Rheinmetall AG ( Germany), Nexter Group (France), Norinco Internation Cooperation Ltd. (China), Rostec (Russia), General Dynamics Corporation (US), Avibras (Brazil), Elbit Systems (Israel) are some of the leading companies in the artillery systems market.

What new emerging technologies and use cases disrupt the artillery systems market?

Response: Some of the major emerging technologies and use cases disrupting the market include

Autonomous Systems: The development of autonomous technologies, such as unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs), is transforming the battlefield. These systems can be used for reconnaissance, surveillance, and targeting purposes. They can locate and engage artillery systems with increased efficiency and reduced risk to human operators.

Counter-Artillery Systems: Technological advancements in counter-artillery systems, such as radar-based detection, electronic warfare capabilities, and improved munitions, are disrupting the growth of artillery systems. These systems can rapidly detect incoming artillery fire, track the projectiles, and neutralize or intercept them before they reach their intended targets.

Who are the key players and innovators in the ecosystem of the artillery systemse market?

Response: . Lockheed Martin Corporation (US), Bae Systems (UK), Hanwha Group (South Korea), Rheinmetall AG ( Germany), Nexter Group (France), Norinco Internation Cooperation Ltd. (China), Rostec (Russia), General Dynamics Corporation (US), Avibras (Brazil), Elbit Systems (Israel).

Which region is expected to hold the highest market share in the artillery systems market?

Response: In 2023, Asia Pacific is expected to hold the greatest market share for artillery systems, and during the forecast period, India is anticipated to grow at the highest CAGR.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Incorporation of latest technologies and equipment- Strategic importance of artillery in modern warfare- Rising preference for multi-role capabilitiesRESTRAINTS- Limited ammunition storage space in artillery systems- Need for high maintenance and logistics in artillery operationsOPPORTUNITIES- Adaptability of unmanned artillery systems- Increased defense budgetsCHALLENGES- Complex procurement procedures- High cost of artillery systems

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.4 IMPACT OF RECESSION ON ARTILLERY SYSTEMS MARKET

- 5.5 AVERAGE SELLING PRICE ANALYSIS

- 5.6 ARTILLERY SYSTEMS VOLUME, BY TYPE

-

5.7 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 USE CASE ANALYSISINACCURATE TARGETINGTACTICAL FIRE SUPPORT

-

5.10 TRADE ANALYSISIMPORT VALUE OF ARTILLERY WEAPONS (PRODUCT HARMONIZED SYSTEM CODE: 930110)EXPORT VALUE OF ARTILLERY WEAPONS (PRODUCT HARMONIZED SYSTEM CODE: 930110)

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGY TRENDSPROGRAMMABLE AMMUNITIONIMPROVED AMMUNITION-CARRYING CAPABILITYADVANCED AUTOLOADERSINTEGRATED TURRET GUN SYSTEMSHYBRID POWER SYSTEMSMULTIPLE ROUNDS SIMULTANEOUS IMPACTTRAJECTORY CORRECTION SYSTEMSADVANCED FIRE CONTROL SYSTEMS

-

6.3 IMPACT OF MEGATRENDSINTEGRATION OF INTERNET OF THINGS

- 6.4 SUPPLY CHAIN ANALYSIS

- 7.1 INTRODUCTION

-

7.2 HOWITZERSGROWING GEOPOLITICAL TENSIONS TO DRIVE GROWTHMEDIUM CALIBERLARGE CALIBER

-

7.3 MORTARSEXTENSIVE USE OF LIGHTWEIGHT AND PORTABLE MORTARS TO DRIVE GROWTHSMALL CALIBERMEDIUM CALIBER

-

7.4 ANTI-AIR WEAPONSRISING AERIAL THREATS TO DRIVE GROWTHAIR DEFENSE GUNSCOUNTER ROCKET, ARTILLERY, AND MORTAR (C-RAM)

-

7.5 ROCKET LAUNCHERSINCREASING PREFERENCE FOR LONG-RANGE CAPABILITIES TO DRIVE GROWTHMAN-PORTABLE AIR-DEFENSE SYSTEMS (MANPADS)MULTIPLE LAUNCH ROCKET SYSTEMS (MLRS)

-

7.6 ARTILLERYNEED FOR MARITIME SECURITY TO DRIVE GROWTHNAVAL ARTILLERYCOASTAL ARTILLERY

-

8.1 INTRODUCTIONTURRETSENGINESFIRE CONTROL SYSTEMSAMMUNITION HANDLING SYSTEMSCHASSISAUXILIARY SYSTEMS

- 9.1 INTRODUCTION

-

9.2 SHORT-RANGENEED FOR CLOSE-RANGE ENGAGEMENTS TO DRIVE GROWTH

-

9.3 MEDIUM-RANGEEFFECTIVE FIRE SUPPORT CAPABILITIES TO DRIVE GROWTH

-

9.4 LONG-RANGEVERSATILITY OF LONG-RANGE ARTILLERY SYSTEMS TO DRIVE GROWTH

- 10.1 INTRODUCTION

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

-

10.3 NORTH AMERICAPESTLE ANALYSISRECESSION IMPACT ANALYSISUS- Advancements in technology to drive growthCANADA- Increased defense budgets to drive growth

-

10.4 EUROPEPESTLE ANALYSISRECESSION IMPACT ANALYSISUK- Presence of prominent OEMs to drive growthFRANCE- Increased investments in artillery system manufacturing to drive growthGERMANY- Acquisition of new artillery systems to drive growthPOLAND- Strategic partnerships with allied countries to drive growthITALY- International collaborations to drive growthRUSSIA- Military modernization programs to drive growthREST OF EUROPE

-

10.5 ASIA PACIFICPESTLE ANALYSISRECESSION IMPACT ANALYSISCHINA- Regional security concerns to drive growthJAPAN- Rising geopolitical tension to drive growthINDIA- Territorial and border disputes to drive growthSOUTH KOREA- Need for robust counterbattery capabilities to drive growthSINGAPORE- Incorporation of advanced technologies to drive growthREST OF ASIA PACIFIC

-

10.6 ROWRECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- Need for advanced artillery systems to drive growthLATIN AMERICA- Developments in artillery systems to drive growth

- 11.1 INTRODUCTION

- 11.2 COMPETITIVE OVERVIEW

- 11.3 RANKING ANALYSIS, 2022

- 11.4 MARKET SHARE ANALYSIS, 2022

- 11.5 REVENUE ANALYSIS, 2022

-

11.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 COMPANY FOOTPRINT ANALYSIS

-

11.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHANWHA GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELBIT SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEXTER GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRUAG GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsNORINCO INTERNATIONAL COOPERATION LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsROSTEC- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsST ENGINEERING- Business overview- Products/Solutions/Services offeredRHEINMETALL AG- Business overview- Products/Solutions/Services offeredLEONARDO- Business overview- Products/Solutions/Services offered- Recent developmentsDENEL SOC LTD.- Business overview- Products/Solutions/Services offeredAVIBRAS- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSNAVANTIAROKETSAN ASTATA ADVANCED SYSTEMS LIMITEDARSENAL JSCOOTOKAROTO MELARASOLTAM SYSTEMSPOONGSAN CORPORATIONKALYANI GROUPASELSAN A.S.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- TABLE 4 AVERAGE SELLING PRICE OF ARTILLERY SYSTEMS (USD MILLION)

- TABLE 5 ARTILLERY SYSTEMS VOLUME, BY TYPE

- TABLE 6 ARTILLERY SYSTEMS MARKET ECOSYSTEM

- TABLE 7 COUNTRY-WISE IMPORTS, 2021−2022 (USD THOUSAND)

- TABLE 8 COUNTRY-WISE EXPORTS, 2021−2022 (USD THOUSAND)

- TABLE 9 PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ARTILLERY SYSTEMS, BY TYPE (%)

- TABLE 11 KEY BUYING CRITERIA FOR ARTILLERY SYSTEMS, BY RANGE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023−2024

- TABLE 17 ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 18 ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 HOWITZERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 20 HOWITZERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 MORTARS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 22 MORTARS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 ANTI-AIR WEAPONS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 24 ANTI-AIR WEAPONS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 ROCKET LAUNCHERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 ROCKET LAUNCHERS: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 ARTILLERY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 ARTILLERY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019–2022 (USD MILLION)

- TABLE 30 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023–2028 (USD MILLION)

- TABLE 31 ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 32 ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 33 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 34 ARTILLERY SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 ARTILLERY SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019–2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019–2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019–2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 54 US: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 55 US: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 US: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 57 US: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 58 CANADA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 59 CANADA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 60 CANADA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 61 CANADA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 62 EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 63 EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 65 EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 66 EUROPE: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019–2022 (USD MILLION)

- TABLE 67 EUROPE: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023–2028 (USD MILLION)

- TABLE 68 EUROPE: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019–2022 (USD MILLION)

- TABLE 69 EUROPE: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019–2022 (USD MILLION)

- TABLE 71 EUROPE: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019–2022 (USD MILLION)

- TABLE 73 EUROPE: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023–2028 (USD MILLION)

- TABLE 74 EUROPE: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019–2022 (USD MILLION)

- TABLE 75 EUROPE: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023–2028 (USD MILLION)

- TABLE 76 EUROPE: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019–2022 (USD MILLION)

- TABLE 77 EUROPE: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 79 EUROPE: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 UK: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 81 UK: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 UK: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 83 UK: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 84 FRANCE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 85 FRANCE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 FRANCE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 87 FRANCE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 88 GERMANY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 89 GERMANY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 GERMANY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 91 GERMANY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 92 POLAND: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 93 POLAND: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 94 POLAND: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 95 POLAND: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 96 ITALY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 97 ITALY: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 ITALY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 99 ITALY: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 100 RUSSIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 101 RUSSIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 RUSSIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 103 RUSSIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 104 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 CHINA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 127 CHINA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 CHINA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 129 CHINA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 130 JAPAN: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 131 JAPAN: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 132 JAPAN: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 133 JAPAN: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 134 INDIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 135 INDIA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 136 INDIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 137 INDIA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 138 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 139 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 140 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 141 SOUTH KOREA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 142 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 143 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 144 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 145 SINGAPORE: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 150 ROW: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 151 ROW: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 152 ROW: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 153 ROW: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 154 ROW: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2019–2022 (USD MILLION)

- TABLE 155 ROW: ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023–2028 (USD MILLION)

- TABLE 156 ROW: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2019–2022 (USD MILLION)

- TABLE 157 ROW: ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023–2028 (USD MILLION)

- TABLE 158 ROW: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2019–2022 (USD MILLION)

- TABLE 159 ROW: ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023–2028 (USD MILLION)

- TABLE 160 ROW: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2019–2022 (USD MILLION)

- TABLE 161 ROW: ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023–2028 (USD MILLION)

- TABLE 162 ROW: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2019–2022 (USD MILLION)

- TABLE 163 ROW: ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023–2028 (USD MILLION)

- TABLE 164 ROW: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2019–2022 (USD MILLION)

- TABLE 165 ROW: ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023–2028 (USD MILLION)

- TABLE 166 ROW: ARTILLERY SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 167 ROW: ARTILLERY SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 176 KEY DEVELOPMENTS BY LEADING PLAYERS IN ARTILLERY SYSTEMS MARKET, 2020–2023

- TABLE 177 ARTILLERY SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 178 COMPANY FOOTPRINT

- TABLE 179 REGION FOOTPRINT

- TABLE 180 WEAPON TYPE FOOTPRINT

- TABLE 181 ARTILLERY SYSTEMS MARKET: PRODUCT LAUNCHES, SEPTEMBER 2021–JUNE 2023

- TABLE 182 ARTILLERY SYSTEMS MARKET: DEALS, MARCH 2019–MAY 2023

- TABLE 183 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 184 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 186 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 187 BAE SYSTEMS: BUSINESS OVERVIEW

- TABLE 188 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 BAE SYSTEMS: DEALS

- TABLE 190 HANWHA GROUP: BUSINESS OVERVIEW

- TABLE 191 HANWHA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 HANWHA GROUP: DEALS

- TABLE 193 ELBIT SYSTEMS: BUSINESS OVERVIEW

- TABLE 194 ELBIT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ELBIT SYSTEMS: DEALS

- TABLE 196 NEXTER GROUP: BUSINESS OVERVIEW

- TABLE 197 NEXTER GROUP: PRODUCT LAUNCHES

- TABLE 198 NEXTER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 NEXTER GROUP: DEALS

- TABLE 200 RUAG GROUP: BUSINESS OVERVIEW

- TABLE 201 RUAG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 RUAG GROUP: DEALS

- TABLE 203 NORINCO INTERNATIONAL COOPERATION LTD.: BUSINESS OVERVIEW

- TABLE 204 NORINCO INTERNATIONAL COOPERATION LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 NORINCO INTERNATIONAL COOPERATION LTD.: DEALS

- TABLE 206 ROSTEC: BUSINESS OVERVIEW

- TABLE 207 ROSTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ROSTEC: PRODUCT LAUNCHES

- TABLE 209 ROSTEC: DEALS

- TABLE 210 THALES GROUP: BUSINESS OVERVIEW

- TABLE 211 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 THALES GROUP: PRODUCT LAUNCHES

- TABLE 213 THALES GROUP: DEALS

- TABLE 214 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 215 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 217 ST ENGINEERING: BUSINESS OVERVIEW

- TABLE 218 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 RHEINMETALL AG: BUSINESS OVERVIEW

- TABLE 220 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 LEONARDO: BUSINESS OVERVIEW

- TABLE 222 LEONARDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 LEONARDO: DEALS

- TABLE 224 DENEL SOC LTD.: BUSINESS OVERVIEW

- TABLE 225 DENEL SOC LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 AVIBRAS: BUSINESS OVERVIEW

- TABLE 227 AVIBRAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 AVIBRAS: PRODUCT LAUNCHES

- TABLE 229 NAVANTIA: COMPANY OVERVIEW

- TABLE 230 ROKETSAN AS: COMPANY OVERVIEW

- TABLE 231 TATA ADVANCED SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 232 ARSENAL JSCO: COMPANY OVERVIEW

- TABLE 233 OTOKAR: COMPANY OVERVIEW

- TABLE 234 OTO MELARA: COMPANY OVERVIEW

- TABLE 235 SOLTAM SYSTEMS: COMPANY OVERVIEW

- TABLE 236 POONGSAN CORPORATION: COMPANY OVERVIEW

- TABLE 237 KALYANI GROUP: COMPANY OVERVIEW

- TABLE 238 ASELSAN A.S.: COMPANY OVERVIEW

- FIGURE 1 ARTILLERY SYSTEMS MARKET SEGMENTATION

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 RESEARCH DESIGN

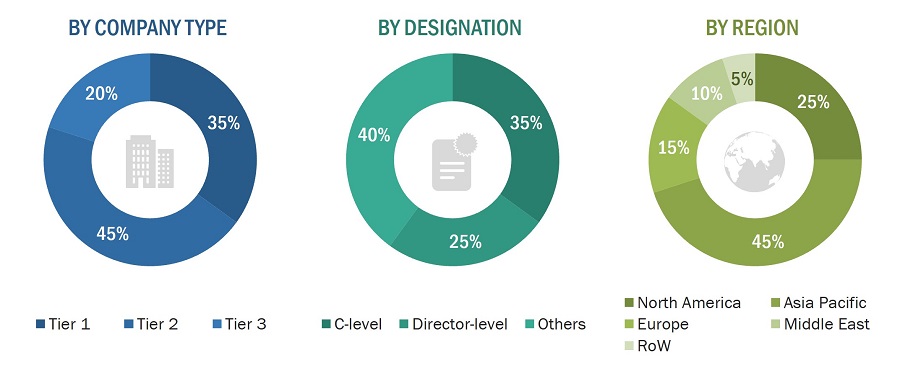

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

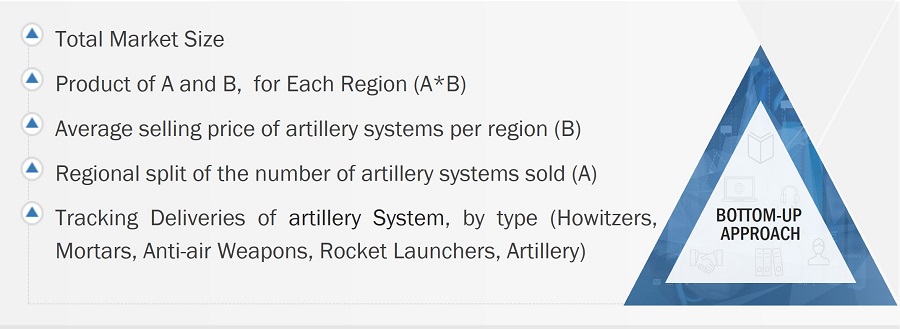

- FIGURE 5 BOTTOM-UP APPROACH

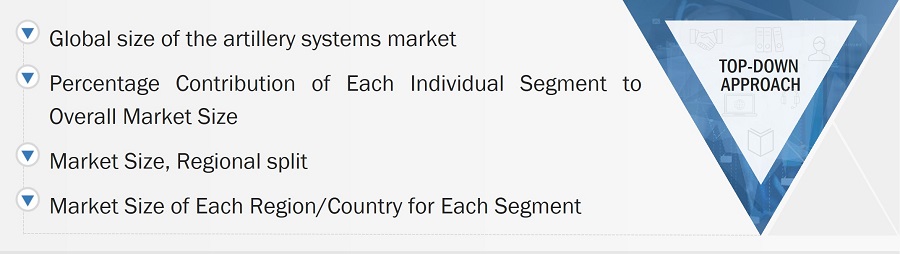

- FIGURE 6 TOP-DOWN APPROACH

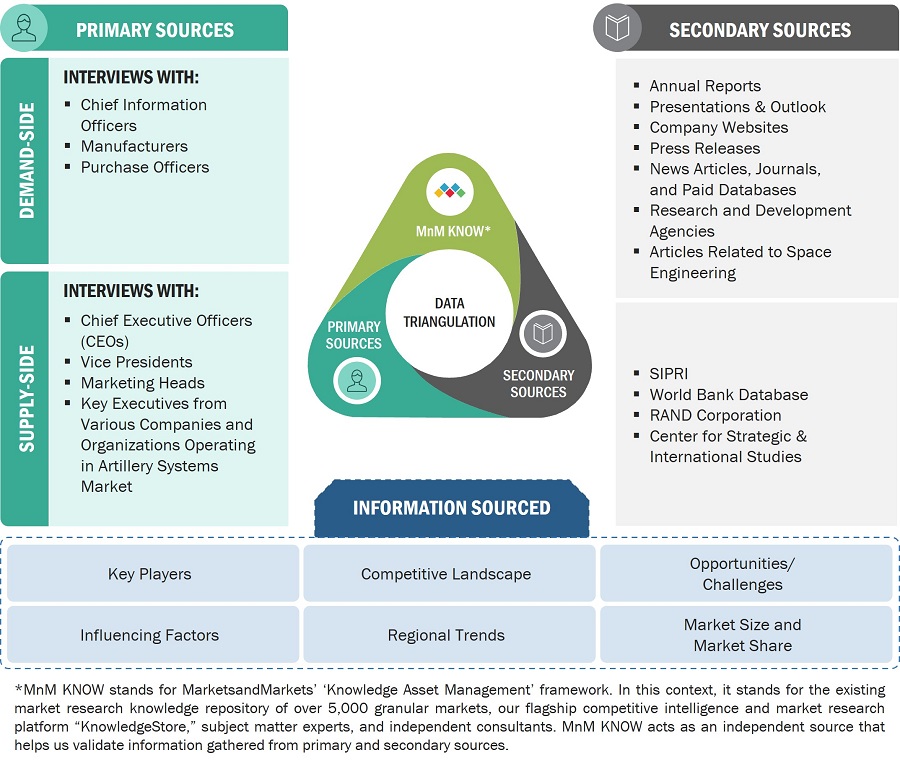

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 MEDIUM-RANGE TO EXCEED OTHER SEGMENTS BETWEEN 2023 AND 2028

- FIGURE 9 AUXILIARY SYSTEMS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ANTI-AIR WEAPONS TO BE FASTEST-GROWING SEGMENT FROM 2023 TO 2028

- FIGURE 11 MEDIUM CALIBER TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 MULTIPLE LAUNCH ROCKET SYSTEMS TO SECURE MAXIMUM SHARE IN 2028

- FIGURE 13 AIR DEFENSE GUNS TO HOLD LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 15 INCREASED ADOPTION OF ARTILLERY SYSTEMS AND TECHNOLOGIES

- FIGURE 16 HOWITZERS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 17 TURRETS TO ACQUIRE LARGEST MARKET SHARE IN 2028

- FIGURE 18 MEDIUM-RANGE TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 19 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 20 INDIA TO BE FASTEST-GROWING COUNTRY FROM 2023 TO 2028

- FIGURE 21 ARTILLERY SYSTEMS MARKET DYNAMICS

- FIGURE 22 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (%)

- FIGURE 23 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ARTILLERY SYSTEM MANUFACTURERS

- FIGURE 24 IMPACT OF RECESSION ON ARTILLERY SYSTEMS MARKET

- FIGURE 25 ARTILLERY SYSTEMS MARKET ECOSYSTEM

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ARTILLERY SYSTEMS, BY TYPE

- FIGURE 29 KEY BUYING CRITERIA FOR ARTILLERY SYSTEMS, BY RANGE

- FIGURE 30 EVOLUTION OF ARTILLERY SYSTEMS: ROADMAP FROM 1980 TO 2050

- FIGURE 31 TECHNOLOGICAL TRENDS IN ARTILLERY SYSTEMS MARKET

- FIGURE 32 PROPERTIES OF ADVANCED AUTOLOADERS

- FIGURE 33 HYBRID POWER SYSTEMS

- FIGURE 34 BENEFITS OF HYBRID POWER SYSTEMS

- FIGURE 35 SUPPLY CHAIN ANALYSIS

- FIGURE 36 ARTILLERY SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- FIGURE 37 ARTILLERY SYSTEMS MARKET, BY HOWITZER, 2023–2028 (USD MILLION)

- FIGURE 38 ARTILLERY SYSTEMS MARKET, BY MORTAR, 2023–2028 (USD MILLION)

- FIGURE 39 ARTILLERY SYSTEMS MARKET, BY ANTI-AIR WEAPON, 2023–2028

- FIGURE 40 ARTILLERY SYSTEMS MARKET, BY ROCKET LAUNCHER, 2023–2028 (USD MILLION)

- FIGURE 41 ARTILLERY SYSTEMS MARKET, BY ARTILLERY, 2023–2028 (USD MILLION)

- FIGURE 42 ARTILLERY SYSTEMS MARKET, BY SUBSYSTEM, 2023–2028 (USD MILLION)

- FIGURE 43 ARTILLERY SYSTEMS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- FIGURE 44 ARTILLERY SYSTEMS MARKET, BY REGION, 2023–2028

- FIGURE 45 NORTH AMERICA: ARTILLERY SYSTEMS MARKET SNAPSHOT

- FIGURE 46 EUROPE: ARTILLERY SYSTEMS MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: ARTILLERY SYSTEMS MARKET SNAPSHOT

- FIGURE 48 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- FIGURE 49 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- FIGURE 50 REVENUE OF TOP FIVE PLAYERS, 2022

- FIGURE 51 ARTILLERY SYSTEMS MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 52 ARTILLERY SYSTEMS MARKET: START-UP/SME EVALUATION MATRIX, 2023

- FIGURE 53 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 55 ELBIT SYSTEMS: COMPANY SNAPSHOT

- FIGURE 56 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 57 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 59 LEONARDO: COMPANY SNAPSHOT

The research study conducted on the artillery systems market involved extensive use of secondary sources, including directories, databases of articles, journals on artillery systems, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the artillery systems market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the artillery systems market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess prospects of the market.

Secondary Research

The market share of the companies offering artillery systems was procured based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality. In the secondary research process, sources such as government databases; SIPRI; corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles by recognized authors; and directories and databases were used to identify and collect information for this study.

Secondary research was primarily used to obtain critical information about the value and supply chain of the market. It was also used to identify key players by various products, market classifications, and segmentation per their offerings. Secondary information helps understand industry trends related to artillery systems subsystems, type, range, regions, and developments from the market and technology-oriented perspectives.

Primary Research

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the trends based on subsystem, range, type and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customers/end users of artillery systems, were interviewed to understand the perspective of the buyers on the suppliers, products, and component providers, their current usage of various artillery systems, and the future outlook of their businesses.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the artillery systems market. The research methodology used to estimate the market size includes the following details.

- Key players in the artillery systems market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies in the artillery systems market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the artillery systems market. This data was consolidated, enhanced with detailed inputs, analysed by MarketsandMarkets, and presented in this report. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

The bottom-up approach has been employed to arrive at the overall size of the artillery systems market by determining revenues of the key players and their shares in the market. Calculations based on the revenues of the key players identified in the market have led to the estimation of the overall size of the artillery systems market.

Market size estimation methodology: Top-down Approach

In In the top-down approach, the size of the artillery systems market has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. For the calculation of the sizes of specific market segments, the size of the most appropriate immediate parent market has been used.

Market shares have been estimated for each company to verify revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the parent market and each individual market have been determined and confirmed in this study on the artillery systems market.

Data Triangulation

After arriving at the total market size, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for artillery systems segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Market Definition

Artillery systems are a category of military weapons that are designed to deliver indirect fire support to ground forces. They are capable of launching projectiles, typically known as artillery shells or rounds, over long distances to engage targets such as enemy personnel, vehicles, or structures. Artillery systems play a crucial role in modern warfare by providing firepower, suppression, and area denial capabilities. Artillery systems provide fire support to infantries on battlefields. Artillery systems come in various forms, including towed artillery, self-propelled artillery, naval guns, anti air weapons and rocket artillery. Artillery platforms such as Multiple Launch Rocket Systems (MLRS), howitzers, and mortars enable the transfer of ammunition or weapons from magazines or storage units to firing systems. This transfer of ammunition or weapons involves a number of mechanisms and operations to ensure safe handling of ammunition or weapons. Artillery systems enable ease-of-firing ammunition or weapons from weapon systems, thereby increasing their reliability. The artillery systems market majorly focuses on various components, which are used for ammunition handling. It also focuses on mechanisms of operations used by different platforms on which artillery systems are deployed. Artillery systems are capable of firing a wide range of projectiles with varying characteristics. The most common types of projectiles include high-explosive (HE) shells, which are used for general-purpose targets; smoke rounds, which create a smoke screen to obscure vision; and precision-guided munitions (PGMs), which can be guided to a specific target with greater accuracy.

The introduction of advanced technologies has transformed artillery systems, enhancing their accuracy, range, mobility, and overall effectiveness. Modern artillery systems often feature digital fire control systems, automated loading mechanisms, advanced ammunition types, and improved communication capabilities, enabling faster response times and increased operational flexibility. Furthermore, advancements in guidance systems have led to the development of guided artillery projectiles, improving accuracy, and enabling engagement of moving targets. The artillery system market is highly competitive and driven by both domestic and international manufacturers.

Key Stakeholders

- Raw Material Providers

- Original Equipment Manufacturers (OEMs)

- Small Component Manufacturers/Suppliers

- Ministries of Defense

- R&D Companies

Report Objectives

- To define, describe, and forecast the size of the artillery system systems market based on subsystem, type, range, and region from 2023 to 2028

- To forecast the size of the market segments with respect to major regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW), which comprises the Middle East & Africa and Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the artillery system market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the artillery system market

- To analyze opportunities for stakeholders in the artillery system market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and research and development (R&D) activities in the artillery system market

- To provide a detailed competitive landscape of the artillery system market, along with an analysis of business and corporate strategies adopted by leading market players

- To strategically profile key market players and comprehensively analyze their core competencies2

Micro markets refer to further segments and subsegments of the artillery systems market included in the report.

Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Artillery Systems Market