Data Center Fabric Market by Solutions (Switching, Routers, Controllers, SAN, Network Security Equipments, Management Software) & User Environment (Enterprises, Telecommunications, Cloud Providers) - Worldwide Forecasts & Analysis (2014 - 2019)

[193 Pages Report] MarketsandMarkets forecasts the global data center fabric market to grow from $5.13 billion in 2014 to $15.14 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 24.2%.

Continuously developing next-generation enterprise Information Technology (IT) architecture for data centers is enhancing the adoption and utilization of fabric in the data centers. Data center fabric market is emerging with the solutions to meet the networking demands for the virtual and cloud environments in new data centers. Fabric network reduces the tiers in the legacy network architecture, providing agility, flexibility and efficiency in operations. The traditional network is not efficient in handling east-west flow of data among servers due to virtualization of data centers. Fabric provides relatively simple network architecture than the three-tiered network, and helps in utilizing the advantages of new technologies such as virtual machines and cloud storage to the fullest.

Fabric switches play a vital role in reducing infrastructure cost by consolidating data centers. Ethernet switches and fiber channels are the building blocks for converging server and storage networking in data centers sharing common infrastructure. Fabric infrastructure is scalable enabling data centers to grow with increasing demands of the organization in future. The operational cost of networking in flattened networks reduces by huge margin when compared to the traditional networks. Rising cost of electricity, cloud adoption and big data storage requirement is motivating organizations to deploy fabric products in their data centers to reduce the overall cost of operating data centers and increase the capacity at the same time. Efficient fabric switches also reduces overhead cost of power and cooling facilities by significant margin. Growing IT infrastructure demand of organizations to enhance business performance by providing application solutions to its clients at any place and at any time require flat network architecture for the real-time analysis of information stored in physical and virtual servers. The fabric products make networking swift delivering best experience to mobile end users using applications such as online media streaming, social media and online data storage.

The data center fabric market is expected to witness huge growth in near future due to increasing trend of virtualization and cloud computing in data centers. Major players in this market are Cisco, HP, IBM, Dell, Brocade, Juniper and Extreme Networks. This research report discusses the strategies and insights of the key vendors in the industry and also provides in-depth study of driving forces and challenges for the market. The report also analyzes global adoption trends and future growth potentials across different geographical regions.

MarketsandMarkets has segmented the global data center fabric market by solutions, environment, industry verticals, and geographical regions. The report also consists of MarketsandMarkets’ views on the key players and analysts insights on various developments that are taking place in the industry. This research report covers the global market and categorizes it into the following sub-markets:

On the basis of solutions:

- Switching

- Routers

- Storage Area Network (SAN)

- Controllers

- Network security equipment

- Management software

On the basis of industry verticals:

- Banking, Financial Services and Insurance (BFSI)

- High Tech

- Media and entertainment

- Government

- Education

- Healthcare

- Retail

On the basis of environment:

- Cloud services providers

- Telecommunication providers

- Enterprises

On the basis of geographical regions:

- North America (NA)

- Europe (EU)

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America (LA)

Customization Options:

A company’s specific needs can be met by the customization. Customize to get comprehensive industry standard and deep dive analysis of the following parameters:

Product Analysis

- Usage pattern (in-depth trend analysis) of products (segment wise)

- Product Matrix which gives a detailed comparison of product portfolio of each company mapped at country and sub-segment level

- Applications of the products (segment wise and country wise)

- Comprehensive coverage of product approvals, pipeline products, and product recalls

- Industry vertical wise adoption of fabric products in data center(region wise)

Country Specific Analysis

- Country specific analysis of data center fabric market

- Country specific application of data center fabric in various industry verticals

- Country specific pattern analysis of adoption of fabric based data center infrastructure

Perception Matrix

- Fast turn-around analysis of market events and trends

- Experts opinion about products from different companies

Brand Perception Matrix

- Comprehensive study of customers’ perception and behavior through our inbuilt social connect tool checking the virality and tonality of blogs

- Analysis of overall brand usage and familiarity and brand advocacy distribution (detractor/neutral/familiar)

Business demands are continuously growing with technological advancements and increase in the availability of resources. To cater to these increasing business demands, organizations have increased their dependency on IT. In the present scenario, organizations need to have a strong, agile, and cost-effective IT infrastructure in order to cope up with customers’ demands. Even in the data center industry, business demands are growing rapidly, with continuously surging need for efficient and cost-effective data storage. Shrinking IT budgets are making the situation more critical, by impacting the need for extensive reduction in the operational cost of data centers. Data center fabric market is emerging with cost-effective and efficient networking solutions. This service refers to a single network-based infrastructure that connects the server, storage, and legacy network and unifies these components to support the data center operations in a more efficient manner. Data center fabric decreases the energy consumption, enhances the agility and flexibility, and reduces the capital expenditure.

Fabric-based architecture aids the data center by eliminating the need of multiple layers of devices, switch-to-switch interactions, and also the shared network protocols. It reduces the complexity of a data center network and enhances its efficiency. In a data center, fabric represents interconnection of thousands of servers, storage, and other networking ports in an ultra-low latency infrastructure, which provides any-to-any connectivity, making each device only single hop away from every other device. Nowadays, many organizations have started adopting solutions offered by the data center fabric market, as they facilitate the reduction of operational and capital expenses, resulting in reduced Total Cost of Ownership (TCO).

The data center fabric market is thriving, and in the coming years, the fabric networking is expected to replace the traditional and legacy networking infrastructure to a great extent. Some companies have already transformed their legacy networking infrastructure with the fabric infrastructure, and a significant number of companies are planning to do so. In the coming years, MarketsandMarkets is expecting a huge number of organizations to implement the fabric infrastructure in their infrastructure. For the forecast duration, from 2014 to 2019, the market is estimated to grow significantly, presenting potential opportunity for various data center infrastructure vendors and operators in the data center industry.

In this report, MarketsandMarkets provides an in-depth study of the market trends, market sizing, competitive mapping, and market dynamics. The global market is segmented into various solutions across geographical regions such as North America (NA), Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America (LA). Also, the market has been segmented into diverse industry verticals which include high tech, Banking, Financial Services, and Insurance (BFSI), media and entertainment, government, healthcare, retail, education, and other verticals. In terms of end-user environment, MarketsandMarkets has segmented the market into cloud service providers, telecommunication providers, and enterprises.

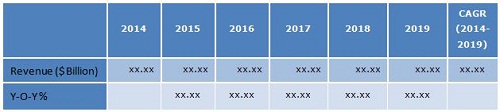

MarketsandMarkets forecasts the global data center fabric market to grow from $5.13 billion in 2014 to $15.14 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 24.2%. The figure given below highlights the overall market opportunity in terms of absolute dollar value and Y-O-Y growth.

Data Center Fabric: Market Size, 2014-2019 ($Billion, Y-O-Y %)

Source: MarketsandMarkets Analysis

Table Of Contents

1 Introduction (Page No. - 20)

1.1 Key Take Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation and Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary (Page No. - 27)

2.1 Abstract

2.2 Overall Market Size

3 Market Overview of Data Center Fabric (Page No. - 30)

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Data Center Virtualization

3.4.1.2 Cloud Computing

3.4.1.3 Big Data

3.4.2 Restraints and Challenges

3.4.2.1 Security

3.4.2.2 Scalability Challenges in Transparent Bridging

3.4.3 Opportunities

3.4.3.1 Advanced Data Center Fabric Solutions offering More Security

3.4.3.2 Technology Companies

3.4.4 Impact Analysis of Dros

3.5 Value Chain

4 Data Center Fabric: Market Size and Forecast By Solution (Page No. - 40)

4.1 Introduction

4.2 Switching

4.2.1 Overview

4.2.2 Market Size and Forecast By Region

4.3 Router

4.3.1 Overview

4.3.2 Market Size and Forecast By Region

4.4 Controller

4.4.1 Overview

4.4.2 Market Size and Forecast By Region

4.5 Storage Area Networking (San)

4.5.1 Overview

4.5.2 Market Size and Forecast By Region

4.6 Network Security Equipment

4.6.1 Overview

4.6.2 Market Size and Forecast By Region

4.7 Management Software

4.7.1 Overview

4.7.2 Market Size and Forecast By Region

5 Data Center Fabric : Market Size and Forecast By Vertical (Page No. - 69)

5.1 Introduction

5.2 High-Tech

5.2.1 Overview

5.2.2 Market Size and Forecast By Solution

5.3 Banking, Financial Services, and Insurance (BFSI)

5.3.1 Overview

5.3.2 Market Size and Forecast By Solution

5.4 Government

5.4.1 Overview

5.4.2 Market Size and Forecast By Solution

5.5 Healthcare

5.5.1 Overview

5.5.2 Market Size and Forecast By Solution

5.6 Retail

5.6.1 Overview

5.6.2 Market Size and Forecast By Solution

5.7 Education

5.7.1 Overview

5.7.2 Market Size and Forecast By Solution

5.8 Media and Entertainment

5.8.1 Overview

5.8.2 Market Size and Forecast By Solution

5.9 Other Vertical

5.9.1 Overview

5.9.2 Market Size and Forecast By Solution

6 Data Center Fabric : Market Size and Forecast By End User Environment (Page No. - 105)

6.1 Introduction

6.2 Enterprise

6.2.1 Overview

6.2.2 Market Size and Forecast

6.2.2.1 Market Size and Forecast By Vertical

6.2.2.2 Market Size and Forecast By Region

6.3 Telecommunication Provider

6.3.1 Overview

6.3.1.1 Market Size and Forecast By Vertical

6.3.1.2 Market Size and Forecast By Region

6.4 Cloud Service Provider

6.4.1 Overview

6.4.2 Market Size and Forecast

6.4.2.1 Market Size and Forecast By Vertical

6.4.2.2 Market Size and Forecast By Region

7 Data Center Fabric : Market Size and Forecast By Region (Page No. - 130)

7.1 Introduction

7.1.1 Parfait Chart

7.2 North America (NA)

7.2.1 Overview

7.2.2 Market Size and Forecast By Vertical

7.3 Europe (EU)

7.3.1 Overview

7.3.2 Market Size and Forecast By Vertical

7.4 Asia Pacific (APAC)

7.4.1 Overview

7.4.2 Market Size and Forecast By Vertical

7.5 Middle East and Africa (MEA)

7.5.1 Overview

7.5.2 Market Size and Forecast By Vertical

7.6 Latin America (LA)

7.6.1 Overview

7.6.2 Market Size and Forecast By Vertical

8 Data Center Fabric : Market Landscape (Page No. - 152)

8.1 Competitive Landscape

8.1.1 Ecosystem and Roles

8.1.2 Portfolio Comparison

8.1.2.1 Overview

8.1.2.2 Product Category Mapping

8.2 End User Landscape

8.2.1 End User Analysis

8.2.1.1 Market For Converged Infrastructure Solutions Is Estimated to Reach $15.27 Billion By 2015

8.2.1.2 Virtualization Solutions to Acquire 21.37% of the Overall System Infrastructure Solutions Market By 2016

8.2.1.3 Mobile Data Traffic Is Estimated to Grow At A Cagr of 39.57% From 2014 to 2019

8.2.1.4 Big Data Market Expected to Reach $46.34 Billion By 2018

9 Company Profiles (Page No. - 157)

9.1 Arista Networks

9.1.1 Overview

9.1.2 Products & Services

9.1.3 Strategies & Insights

9.1.4 Developments

9.1.5 MNM Views

9.2 Avaya

9.2.1 Overview

9.2.2 Products & Services

9.2.3 Strategies & Insights

9.2.4 Developments

9.2.5 MNM Views

9.3 Brocade

9.3.1 Overview

9.3.2 Products & Services

9.3.3 Strategies & Insights

9.3.4 Developments

9.3.5 MNM Views

9.4 Cisco

9.4.1 Overview

9.4.2 Products & Services

9.4.3 Strategies & Insights

9.4.4 Developments

9.4.5 MNM Views

9.5 Dell

9.5.1 Overview

9.5.2 Products & Services

9.5.3 Strategies & Insights

9.5.4 Developments

9.5.5 MNM Views

9.6 Extreme Networks

9.6.1 Overview

9.6.2 Products & Services

9.6.3 Strategies & Insights

9.6.4 Developments

9.6.5 MNM Views

9.7 HP

9.7.1 Overview

9.7.2 Products & Services

9.7.3 Strategies & Insights

9.7.4 Developments

9.7.5 MNM Views

9.8 Huawei

9.8.1 Overview

9.8.2 Products & Services

9.8.3 Strategies and Insights

9.8.4 Developments

9.8.5 MNM Views

9.9 Ibm

9.9.1 Overview

9.9.2 Products & Services

9.9.3 Strategies & Insights

9.9.4 Developments

9.9.5 MNM Views

9.10 Juniper

9.10.1 Overview

9.10.2 Products & Services

9.10.3 Strategies & Insights

9.10.4 Developments

9.10.5 MNM Views

Appendix (Page No. - 190)

Data Center Fabric: Mergers and Acquisitions

List of Table (73 Tables)

Table 1 Data Center Fabric: Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 2 Data Center Fabric Solutions Market Size, By Type, 2014-2019 ($Billion)

Table 3 Solutions Market Size, By Type, 2014-2019, Y-O-Y (%)

Table 4 Switching Solutions Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 5 Switching Solutions Market Size, By Region, 2014-2019 ($Million)

Table 6 Switching Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Table 7 Routers Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 8 Routers Market Size, By Region, 2014-2019 ($Million)

Table 9 Routers Market, By Region, 2014-2019, Y-O-Y (%)

Table 10 Controllers Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 11 Controllers Market Size, By Region, 2014-2019 ($Million)

Table 12 Controllers Market, By Region, 2014-2019, Y-O-Y (%)

Table 13 San Solutions Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 14 San Solutions Market Size, By Region, 2014-2019 ($Million)

Table 15 San Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Table 16 Network Security Equipment Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 17 Network Security Equipment Market Size, By Region, 2014-2019 ($Million)

Table 18 Network Security Equipment Market, By Region, 2014-2019, Y-O-Y (%)

Table 19 Management Software Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 20 Management Software Market Size, By Region, 2014-2019 ($Million)

Table 21 Management Software Market, By Region, 2014-2019, Y-O-Y (%)

Table 22 Data Center Fabric: Market Size, By Vertical, 2014-2019 ($Billion)

Table 23 Data Center Fabric: Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 24 High-Tech Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 25 High-Tech Market Size, By Solution, 2014-2019 ($Million)

Table 26 High-Tech Market, By Solution, 2014-2019, Y-O-Y (%)

Table 27 BFSI Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 28 BFSI Market Size, By Solution, 2014-2019 ($Million)

Table 29 BFSI Market, By Solution, 2014-2019, Y-O-Y (%)

Table 30 Government Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 31 Government Market Size, By Solution, 2014-2019 ($Million)

Table 32 Government Market, By Solution, 2014-2019, Y-O-Y (%)

Table 33 Healthcare Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 34 Healthcare Market Size, By Solution, 2014-2019 ($Million)

Table 35 Healthcare Market, By Solution, 2014-2019, Y-O-Y (%)

Table 36 Retail Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 37 Retail Market Size, By Solution, 2014-2019 ($Million)

Table 38 Retail Market, By Solution, 2014-2019, Y-O-Y (%)

Table 39 Education Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 40 Education Market Size, By Solution, 2014-2019 ($Million)

Table 41 Education Market, By Solution, 2014-2019, Y-O-Y (%)

Table 42 Media and Entertainment Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 43 Media and Entertainment Market Size, By Solution, 2014-2019 ($Million)

Table 44 Media and Entertainment Market, By Solution, 2014-2019, Y-O-Y (%)

Table 45 Other Verticals Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 46 Other Verticals Market Size, By Solution, 2014-2019 ($Million)

Table 47 Other Verticals Market, By Solution, 2014-2019, Y-O-Y (%)

Table 48 Market Size, By End User Environment, 2014-2019 ($Billion)

Table 49 Market, By End User Environment Type, 2014-2019, Y-O-Y (%)

Table 50 Enterprises Market Size, By Vertical, 2014-2019 ($Million)

Table 51 Enterprises Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 52 Enterprises Market Size, By Region, 2014-2019 ($Million)

Table 53 Enterprises Market, By Region, 2014-2019, Y-O-Y (%)

Table 54 Telecommunication Providers Market Size, By Vertical, 2014-2019 ($Million)

Table 55 Telecommunication Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 56 Telecommunication Providers Market Size, By Region, 2014-2019 ($Million)

Table 57 Telecommunication Providers Market, By Region, 2014-2019, Y-O-Y (%)

Table 58 Cloud Service Providers Market Size, By Vertical, 2014-2019 ($Million)

Table 59 Cloud Service Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 60 Cloud Service Providers Market Size, By Region, 2014-2019 ($Million)

Table 61 Cloud Service Providers Market, By Region, 2014-2019, Y-O-Y (%)

Table 62 Market Size, By Region, 2014-2019 ($Billion)

Table 63 Market, By Region, 2014-2019, Y-O-Y (%)

Table 64 NA Market Size, By Vertical, 2014-2019 ($Million)

Table 65 NA Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 66 EU Market Size, By Vertical, 2014-2019 ($Million)

Table 67 EU Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 68 APAC Market Size, By Vertical, 2014-2019 ($Million)

Table 69 APAC Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 70 MEA Market Size, By Vertical, 2014-2019 ($Million)

Table 71 MEA Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 72 LA Market Size, By Vertical, 2014-2019 ($Million)

Table 73 LA Market, By Vertical, 2014-2019, Y-O-Y (%)

List of Figure (39 Figures)

Figure 1 Research Methodology

Figure 2 Data Center Fabric: Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 3 Market Evolution

Figure 4 Market Segmentation

Figure 5 Impact Analysis of Dros

Figure 6 Value Chain

Figure 7 Data Center Fabric Solutions Market Size, By Type, 2014-2019, Y-O-Y (%)

Figure 8 Switching Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Figure 9 Routers Market, By Region, 2014-2019, Y-O-Y (%)

Figure 10Controllers Market, By Region, 2014-2019, Y-O-Y (%)

Figure 11 San Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Figure 12 Network Security Equipment Market, By Region, 2014-2019, Y-O-Y (%)

Figure 13 Management Software Market, By Region, 2014-2019, Y-O-Y (%)

Figure 14 Data Center Fabric Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 15 High-Tech Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 16 BFSI Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 17 Government Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 18 Healthcare Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 19 Retail Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 20 Education Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 21 Media and Entertainment Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 22 Data Center Fabric Other Verticals Market, By Solution, 2014-2019, Y-O-Y (%)

Figure 23 Data Center Fabric: Market, By End User Environment Type, 2014-2019, Y-O-Y (%)

Figure 24 Enterprises Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 25 Enterprises Market, By Region, 2014-2019, Y-O-Y (%)

Figure 26 Telecommunication Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 27 Telecommunication Providers Market, By Region, 2014-2019, Y-O-Y (%)

Figure 28 Cloud Service Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 29 Cloud Service Providers Market, By Region, 2014-2019, Y-O-Y (%)

Figure 30 Data Center Fabric: Market, By Region, 2014-2019, Y-O-Y (%)

Figure 31 Parfait Chart

Figure 32 NA Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 33 EU Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 34 APAC Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 35 MEA Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 36 LA Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 37 Ecosystem

Figure 38 Roles of Ecosystem Players

Figure 39 Product Category Mapping

Growth opportunities and latent adjacency in Data Center Fabric Market