Trocars Market by Product (Disposable, Reusable, Reposable), Tip (Bladeless Trocars, Bladed Trocars, Blunt Trocars, Optical), Application (General Surgery, Urology, Pediatric, Gynecological Surgery), End User (Hospitals) - Global Forecast to 2023

The global trocars market is expected to reach USD 762.3 million by 2023. The major factors driving the growth of this market are the increasing prevalence of cancer and hernia and growing preference for minimally invasive surgery.

The objectives of this study are as follows:

- To define, describe, and forecast the market by product, tip, application, end user, and region

- To forecast the size of the market with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as expansions, agreements, acquisitions, and collaborations in the market

Drivers

Growing preference for minimally invasive surgeries

The demand for minimally invasive surgeries (MIS) has grown over the years owing to their advantages over conventional surgical techniques. Apart from time and cost reductions, minimally invasive surgeries are also associated with increased safety, decreased scarring, faster recovery, and decreased hospital stay. A news article published on March 25, 2015, in JAMA (Journal of the American Medical Association) stated that research conducted by investigators at Johns Hopkins Medicine (Johns Hopkins University (US)) showed that American hospitals could collectively save between USD 280 million and USD 340 million a year by performing MIS instead of traditional surgeries.

Rising incidence of target conditions for laparoscopic surgery

Over the last few years, the prevalence and incidences cases of target diseases is increasing across the globe. For instance, according to GLOBOCAN, the number of colorectal cancer cases globally is expected to reach 0.85 million by 2025 from 0.66 million in 2015. The rising incidence of these diseases will correspondingly drive the number of laparoscopic procedures performed. Of these, appendectomies and hysterectomies are the most frequently performed laparoscopic procedures globally.

Research Methodology

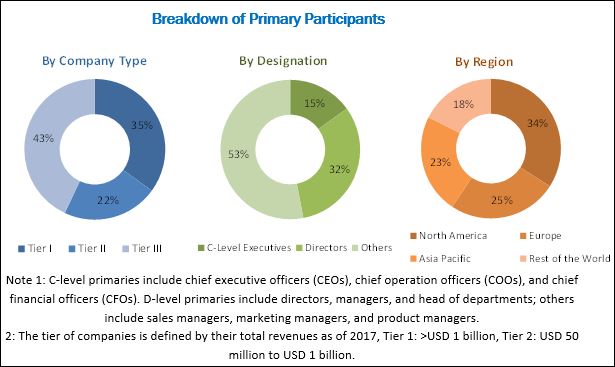

Top-down and bottom-up approaches were used to estimate and validate the size of the Trocars industry and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual submarkets (mentioned in the market segmentation—by product, tip, application, and end user) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources such as Bloomberg Business, Factiva, and Avention; white papers; annual reports; company house documents; and SEC filings of companies. Societies and organizations such as the Asia Pacific Endo-Lap Surgery Group (APELS), World Health Organization (WHO), Organisation for Economic Co-operation and Development, and Society of American Gastrointestinal and Endoscopic Surgeons (SAGES) have been used to identify and collect information useful for this extensive commercial study of the market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the trocars market include Medtronic (Ireland), Ethicon (US), B. Braun (Germany), Applied Medical (US), Cooper Companies (US), Teleflex (US), CONMED (US), LaproSurge (UK), Purple Surgical (UK), and GENICON (US).

Target Audience for this Report:

- Manufacturers and vendors of laparoscopic instruments products

- Distributors of laparoscopic & minimally invasive surgery products

- Venture capitalists

- Various research and consulting firms

- Hospitals and ambulatory surgery centers

- Government associations dedicated to laparoscopic and minimally invasive surgeries

Competitive Landscape

Expansions

|

Year |

Company |

Location |

Description |

|

2016 |

Medtronic |

Singapore |

The company established new Asia Pacific regional headquarters in Singapore. The expansion strengthened the company’s business operations in 80 locations across the Asia Pacific region |

|

2018 |

B. Braun |

Malaysia |

The company opened 5 new production and administration facilities in Panang, to cater end users in Malaysia. The company will manufacture medical devices for infusion therapy, pharmaceutical solutions, and surgical instruments in these facilities. |

Source: Press Releases

Collaborations & Agreements

|

Month/Year |

Nature of the Agreement |

Company 1 |

Company 2 |

Description |

|

2018 |

Agreement |

GENICON, INC, US |

Greenpine Pharma, China |

GENICON, INC entered distribution agreement with Greenpine Pharma, China to distribute its complete range of products in China. |

|

2017 |

Agreement |

GENICON, INC, US |

NHS, UK |

The GENICON, INC announced that it is an official supplier to the NHS supply chain. |

Source: Press Releases

Acquisitions

|

Year |

Company 1 |

Company 2 |

Description |

|

2015 |

Teleflex Incorporated, US |

Human Medics, South Korea |

Teleflex acquired its distributor company Human Medics based in South Korea. This acquisition strengthened the company’s position in the APAC market. |

|

2015 |

Teleflex Incorporated, US |

N Stenning & Co PTY. LTD, Australia |

The company acquired its distributor company N Stenning & Co PTY. LTD, based in Australia, thereby expanding its presence in the country. |

Source: Press Releases

Other Developments

|

Year |

Company |

Country |

Description |

|

2018 |

Purple Surgical |

Switzerland |

The company promoted its laparoscopic portfolio at the Davos Course for gastrointestinal surgery scientific session held in Switzerland. |

|

2017 |

Purple Surgical |

Madrid, Panama and Malaysia |

The company commenced regional distribution training programs to guide its global distributors regarding the company’s product portfolio. |

Source: Press Releases

Scope of the Report:

This report categorizes the trocars market into the following segments:

Trocars Market, By Product

- Disposable Trocars

- Reposable Trocars

- Reusable Trocars

- Accessories

By Tip

- Bladeless Trocars

- Optical Trocars

- Blunt Trocars

- Bladed Trocars

By Application

- General Surgery

- Gynaecological Surgery

- Urological Surgery

- Pediatric Surgery

- Other Surgeries

By End User

- Hospitals

- Other End Users

By Region

-

North America

- US

- Canada

- Europe

-

Asia Pacific

- China

- Japan

- India

- RoAPAC (Rest of Asia Pacific)

- Rest of the World

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

Exclusive Insights on Medical Devices Market Research Reports & Consulting

Based on product, the market has been segmented into disposable trocars, reposable trocars, reusable trocars, and accessories. In 2018, the disposable trocars segment is expected to account for the largest share of the market. Their cost-effectiveness, user-friendliness, and safety have resulted in their greater adoption, as compared to reusable trocars.

On the basis of type, the market has been segmented into bladeless trocars, optical trocars, blunt trocars, and bladed trocars. In 2018, the bladeless trocars segment is estimated to account for the largest market share during the forecast period. This is primarily attributed to the advantages such as ease-of-use of bladeless tip trocars, no trauma to the internal body organs and vessels. Moreover, the ergonomic design of these trocars offers high stability.

Based on application, the market has been segmented into general surgery, gynecological surgery, pediatric surgery, urological surgery, and other surgeries. The general surgery segment is estimated to register highest growth rate during the forecast period. The highest growth rate of this segment is mainly due to the rising number of obesity, hernia, and appendicitis cases.

On the basis of end user, the market is categorized into hospitals and other end users. In 2018, the hospitals segment is expected to account for the largest share of this market. The presence of robust infrastructure to carryout laparoscopic surgeries and availability of skilled professionals are the major factors driving the growth of this market segment.

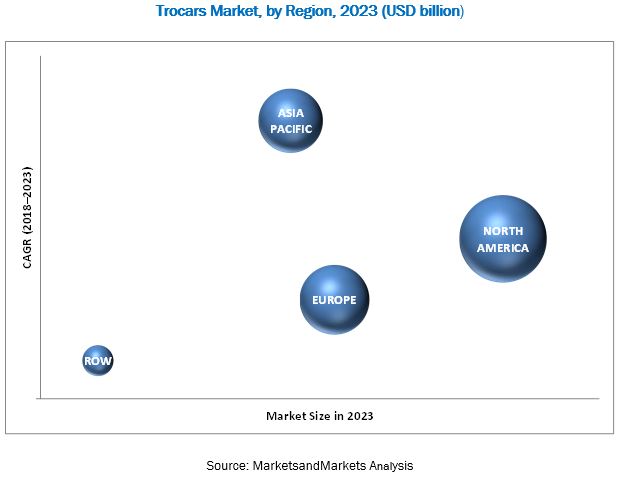

The market is dominated by North America, followed by Europe, Asia Pacific. North America will continue to dominate the market during the forecast period. The increasing incidence of various diseases such as cancer, hernia, and obesity in this region and availability of reimbursement in this region are the major factors supporting the growth of the market in North America.

The major players in the trocars market include Medtronic (Ireland), Ethicon (US), B. Braun (Germany), Applied Medical (US), Cooper Companies (US), Teleflex (US), CONMED (US), LaproSurge (UK), Purple Surgical (UK), and GENICON (US).

Frequently Asked Questions (FAQ):

How big is the Trocars Market?

Trocars Market worth $762.3 million by 2023.

What is the growth rate of Trocars Market?

Trocars Market grows at a CAGR of 7.2% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Market Overview

4.2 Asia Pacific: Market, By Product & Country

4.3 Market, By Region

4.4 Geographical Snapshot of the Trocars Market

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Preference for Minimally Invasive Surgeries

5.2.1.2 Rising Incidence of Target Conditions for Laparoscopic Surgery

5.2.1.3 Awareness Programs

5.2.2 Opportunities

5.2.2.1 Growth Potential of Emerging Economies

5.2.3 Challenges

5.2.3.1 Product Failures and Recalls

5.2.3.2 High Degree of Consolidation

5.2.3.3 Stringent Regulatory Framework and Time-Consuming Approval Process

6 Trocars Market, By Product (Page No. - 36)

6.1 Introduction

6.2 Disposable Trocars

6.3 Reusable Trocars

6.4 Reposable Trocars

6.5 Accessories

7 Trocars Market, By Tip (Page No. - 41)

7.1 Introduction

7.2 Bladeless Trocars

7.3 Optical Trocars

7.4 Blunt Trocars

7.5 Bladed Trocars

8 Trocars Market, By Application (Page No. - 46)

8.1 Introduction

8.2 General Surgery

8.3 Gynecologicals Surgery

8.4 Urological Surgery

8.5 Pediatric Surgery

8.6 Other Surgeries

9 Trocars Market, By End User (Page No. - 52)

9.1 Introduction

9.2 Hospitals

9.3 Other End Users

10 Trocars Market, By Region (Page No. - 56)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 80)

11.1 Overview

11.2 Market Ranking Analysis, 2017

11.3 Competitive Scenario

11.3.1 Expansions

11.3.2 Collaborations & Agreements

11.3.3 Acquisitions

11.3.4 Other Developments

12 Company Profiles (Page No. - 84)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Medtronic

12.2 Johnson & Johnson Services, Inc.

12.3 The Cooper Companies, Inc.

12.4 Conmed Corporation

12.5 B. Braun Melsungen AG

12.6 Teleflex Incorporated

12.7 Purple Surgical

12.8 Applied Medical Resources Corporation

12.9 Laprosurge

12.10 Genicon, Inc.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 102)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (63 Tables)

Table 1 Laparoscopic Procedures Data Per 100,000 Inhabitants in Hospitals, 2010 vs 2015

Table 2 Minimally Invasive Surgery Initiatives

Table 3 By Product, 2016–2023 (USD Million)

Table 4 Disposable Trocars Market, By Region, 2016–2023 (USD Million)

Table 5 Reusable Trocars Market, By Region, 2016–2023 (USD Million)

Table 6 Reposable Trocars Market, By Region, 2016–2023 (USD Million)

Table 7 Trocars Market for Accessories, By Region, 2016–2023 (USD Million)

Table 8 By Tip, 2016–2023 (USD Million)

Table 9 Bladeless Trocars Market, By Region, 2016–2023 (USD Million)

Table 10 Optical Trocars Market, By Region, 2016–2023 (USD Million)

Table 11 Blunt Trocars Market, By Region, 2016–2023 (USD Million)

Table 12 Bladed Trocars Market, By Region, 2016–2023 (USD Million)

Table 13 By Application, 2016–2023 (USD Million)

Table 14 Market for General Surgery, By Region, 2016–2023 (USD Million)

Table 15 Market for Gynecological Surgery, By Region, 2016–2023 (USD Million)

Table 16 Market for Urological Surgery, By Region, 2016–2023 (USD Million)

Table 17 Market for Pediatric Surgery, By Region, 2016–2023 (USD Million)

Table 18 Market for Other Surgeries, By Region, 2016–2023 (USD Million)

Table 19 Market, By End User, 2016–2023 (USD Million)

Table 20 Market for Hospitals, By Region, 2016–2023 (USD Million)

Table 21 Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 22 Market, By Region, 2016–2023 (USD Million)

Table 23 North America: Market, By Country, 2016–2023 (USD Million)

Table 24 North America: Market, By Product, 2016–2023 (USD Million)

Table 25 North America: Market, By Tip, 2016–2023 (USD Million)

Table 26 North America: Market, By Application, 2016–2023 (USD Million)

Table 27 North America: Market, By End User, 2016–2023 (USD Million)

Table 28 US: Market, By Product, 2016–2023 (USD Million)

Table 29 US: Market, By Tip, 2016–2023 (USD Million)

Table 30 US: Market, By Application, 2016–2023 (USD Million)

Table 31 US: Market, By End User, 2016–2023 (USD Million)

Table 32 Canada: Market, By Product, 2016–2023 (USD Million)

Table 33 Canada: Market, By Tip, 2016–2023 (USD Million)

Table 34 Canada: Market, By Application, 2016–2023 (USD Million)

Table 35 Canada: Market, By End User, 2016–2023 (USD Million)

Table 36 Europe: Market, By Product, 2016–2023 (USD Million)

Table 37 Europe: Market, By Tip, 2016–2023 (USD Million)

Table 38 Europe: Market, By Application, 2016–2023 (USD Million)

Table 39 Europe: Market, By End User, 2016–2023 (USD Million)

Table 40 Asia Pacific: Market, By Product, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market, By Tip, 2016–2023 (USD Million)

Table 42 Asia Pacific: Market, By Application, 2016–2023 (USD Million)

Table 43 Asia Pacific: Market, By End User, 2016–2023 (USD Million)

Table 44 China: Market, By Product, 2016–2023 (USD Million)

Table 45 China: Market, By Tip, 2016–2023 (USD Million)

Table 46 China: Market, By Application, 2016–2023 (USD Million)

Table 47 China: Market, By End User, 2016–2023 (USD Million)

Table 48 India: Market, By Product, 2016–2023 (USD Million)

Table 49 India: Market, By Tip, 2016–2023 (USD Million)

Table 50 India: Market, By Application, 2016–2023 (USD Million)

Table 51 India: Market, By End User, 2016–2023 (USD Million)

Table 52 Japan: Market, By Product, 2016–2023 (USD Million)

Table 53 Japan: Market, By Tip, 2016–2023 (USD Million)

Table 54 Japan: Market, By Application, 2016–2023 (USD Million)

Table 55 Japan: Market, By End User, 2016–2023 (USD Million)

Table 56 RoAPAC: Market, By Product, 2016–2023 (USD Million)

Table 57 RoAPAC: Market, By Tip, 2016–2023 (USD Million)

Table 58 RoAPAC: Market, By Application, 2016–2023 (USD Million)

Table 59 RoAPAC: Market, By End User, 2016–2023 (USD Million)

Table 60 RoW: Market, By Product, 2016–2023 (USD Million)

Table 61 RoW: Market, By Tip, 2016–2023 (USD Million)

Table 62 RoW: Market, By Application, 2016–2023 (USD Million)

Table 63 RoW: Trocars Market, By End User, 2016–2023 (USD Million)

List of Figures (32 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Trocars Market, By Product, 2018 vs 2023 (USD Billion)

Figure 7 By Tip, 2018 vs 2023 (USD Billion)

Figure 8 By Application, 2018 vs 2023 (USD Billion)

Figure 9 By End User, 2018 vs 2023 (USD Billion)

Figure 10 By Region, 2018 vs 2023 (USD Billion)

Figure 11 Increasing Prevalence of Target Diseases & Disorders to Support Market Growth During the Forecast Period

Figure 12 Reusable Trocars Segment to Account for the Largest Market Share in 2018

Figure 13 North America to Account for the Largest Market Share in 2018

Figure 14 China to Register the Highest CAGR During the Forecast Period

Figure 15 Trocars Market: Drivers, Opportunities, and Challenges

Figure 16 Calendar Days From Submission to FDA Clearance (Traditional 510(K) Only)

Figure 17 Calendar Days From Submission to FDA Clearance (Abbreviated and Special 510(K) Only)

Figure 18 Number of 510(K) Submissions Cleared, 2012–2016

Figure 19 Disposable Trocars to Dominate the Global Market During the Forecast Period

Figure 20 Bladeless Trocars to Register the Highest Growth Rate in the Global Market During the Forecast Period

Figure 21 General Surgery Forms the Largest Application Segment of the Global Market

Figure 22 Hospitals to Dominate the Trocars Market During the Forecast Period

Figure 23 North America to Dominate the Global Market During the Forecast Period

Figure 24 North America: Trocars Market Snapshot

Figure 25 Key Developments in the Trocars Market, 2015-2018

Figure 26 Top Five Companies in the Trocars Market, 2017

Figure 27 Medtronic: Company Snapshot (2017)

Figure 28 Johnson & Johnson Services, Inc.: Company Snapshot (2017)

Figure 29 The Cooper Companies, Inc: Company Snapshot (2017)

Figure 30 Conmed Corporation: Company Snapshot (2017)

Figure 31 B. Braun Melsungen AG: Company Snapshot (2017)

Figure 32 Teleflex Incorporated: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Trocars Market