Lung Cancer Surgery Market by Instrument ((Clamps, Foreceps, Trocars, Retractors, Scissors), Monitoring & Endoscopic Devices), Procedure (Thoracotomy (Lobectomy, Pneumonectomy, Segmentectomy, Sleeve Resection), MIS), Volume Data & Region - Global Forecast to 2026

Market Growth Outlook Summary

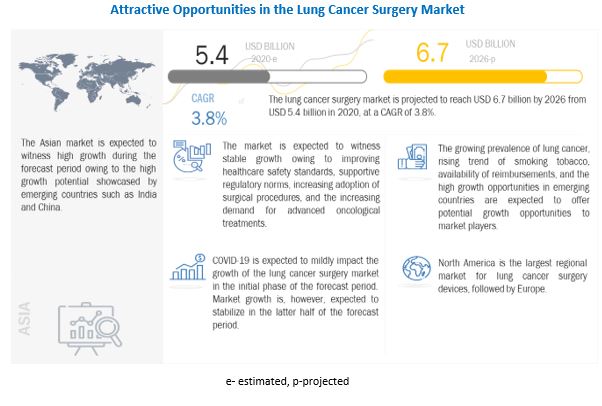

The global lung cancer surgery market growth forecasted to transform from $5.4 billion in 2020 to $6.7 billion by 2026, driven by a CAGR of 3.8%. Market growth is largely driven by factors such as the technological advancements in lung cancer treatment, the increasing incidence and prevalence of lung cancer, the growing trend of smoking tobacco, the rising geriatric population, the increasing emphasis on early diagnosis and treatment of cancers, and the availability of reimbursement. However, the high cost of lung cancer diagnosis and surgery is expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Lung Cancer Surgery Market Dynamics

Driver: Increasing incidence of lung cancer

Cancer is the second-leading cause of death worldwide, accounting for 10 million deaths in 2020. Globally, about 1 in 6 deaths occur due to cancer (source: World Health Organization). 19.3 million new cases were reported in 2020. The increase in cancer incidence on a global scale also indicates an increasing trend in the prevalence of lung cancers worldwide. In this scenario, characterised by a favourable funding environment and effective treatment options, the growing incidence and prevalence of cancer are expected to increase the number of patients opting for lung cancer surgery in the coming years. This, in turn, is expected to drive the growth of the market in the coming years.

Restraint: The high cost of lung cancer diagnosis & treatments

Lung cancer treatments are primarily broken down into four broad categories: diagnosis/imaging, surgeries, pharmaceutical support, and indirect costs (such as transportation, caregiver wages, lodging, secondary effects treatments, and lost wages/incomes). Both the government and insurance companies spend a lot on these categories, and patients are also responsible for additional expenses. The high cost of treating lung cancer has placed a heavy burden on governments worldwide and cancer patients. A small percentage of patients choose surgical interventions to treat their conditions because of the high costs, despite the fact that there is a large patient pool. This is a significant obstacle to market expansion.

Challenge: The dearth of skilled oncologists

Lung cancer surgeries are carried out by qualified specialists to produce better results. Due to issues like air leaks, tumor movement caused by breathing, and fluid buildup in the chest during the procedure, these surgeries are thought to carry higher risks than other surgeries. Lung cancer incidence and prevalence have risen over time and are predicted to continue rising in the years to come. Oncologists have not, however, increased in number since that time; this issue is more severe in developing nations. The population's aging and growth as well as improvements in cancer survival rates are driving factors in the increase in demand; however, factors like the oncology workforce's aging and rising retirement rates are responsible for the slow or lagging growth in skilled labor.

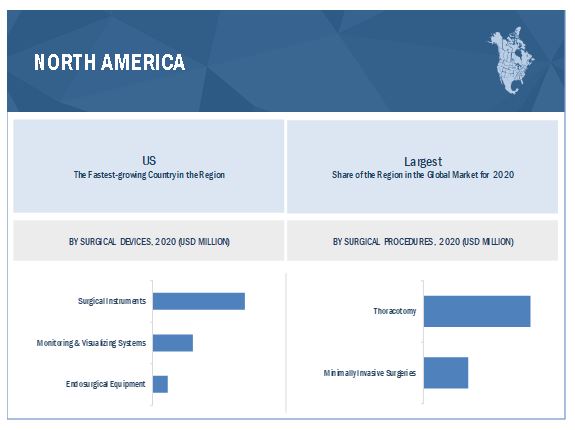

Surgical Instruments segment accounted for the largest share of the lung cancer surgery industry, by Surgical Devices

The lung cancer surgery market is divided into surgical instruments, monitoring and visualisation equipment, and endosurgical equipment based on devices. The largest market share belonged to the surgical instruments category. The factors driving market growth are the rising incidence and prevalence of lung cancer, the rising government funding and support, and the growing use of surgical procedures for lung cancer treatment.

Thoracotomy segment accounted for the largest share in the lung cancer surgery industry, by Surgical Procedures

Thoracotomy and minimally invasive surgeries are the two procedure-based market segments. In terms of share for lung cancer surgery market, thoracotomies accounted for the largest portion. But during the forecast period, the minimally invasive surgery segment is anticipated to grow at the fastest rate. The factors boosting the growth of this market segment include rising technological advancements, expanding adoption of minimally invasive procedures, the availability of reimbursement programs, and the rising popularity of robotic surgeries.

North America is the largest regional market for lung cancer surgery industry

The largest share of the lung cancer surgery market was held by North America. The large portion of North America can be attributed to the rising prevalence of lung cancer, rising incidence and prevalence of lung cancer, rising tobacco use, growing emphasis on early cancer diagnosis and treatment, and the accessibility of reimbursement.

Key players operating in the global lung cancer surgery market are Accuray Inc. (US), AngioDynamics Inc. (US), Ethicon US, LLC (US), Intuitive Surgical Inc. (US), Olympus Corporation (Japan), Teleflex Incorporated (US), Ackermann Instrumente GmbH (Germany), KARL STORZ GmbH (Germany), Scanlan International Inc. (US), TROKAMED GmbH (Germany), Medtronic Plc. (Ireland), Siemens Healthcare (Germany), Richard Wolf GmbH (Germany), Phoenix Surgical Holdings Limited (England), Key Surgical LLC (US), Surgical Holdings (England), FusionKraft (India), KLS Martin Group (Germany), Sontec Instruments Inc. (US), and Wexler Surgical Inc. (US).

Scope of the Lung Cancer Surgery Industry

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$5.4 billion |

|

Projected Revenue by 2026 |

$6.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 3.8% |

|

Market Driver |

Increasing incidence of lung cancer |

|

Market Opportunity |

Emerging economies |

This report categorizes the lung cancer surgery market to forecast revenue and analyze trends in each of the following submarkets:

By Surgical Devices

-

Surgical Instruments

-

Hand Instruments

- Staplers

- Foreceps

- Retractors

- Rib Shears

- Trocar

- Cutters

- Clamps

- Scissors

- Elevators

- Other Hand Instruments

- Powered Surgical Equipment

-

Hand Instruments

-

Monitoring & Visualizing Systems

- Cameras & Video Support

- Endoscopic Trocars with Optical Views

- Endosurgical Equipment

By Surgical Procedures

-

Thoracotomy

- Lobectomy

- Sleeve Resection

- Segmentectomy

- Pnuemenectomy

- Minimally Invasive Surgeries

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia

- Japan

- China

- India

- Rest of Asia

- Rest of the World

Recent Developments of Lung Cancer Surgery Industry

- In May 2021, Olympus Corporation (Japan) launched BF-UC190F endobronchial ultrasound (EBUS) bronchoscope.

- In February 2020, Intuitive Surgical Inc. (US) acquired Orpheus Medical (US).

- In October 2019, KLS Martin Group (Germany) opened a new training center at its site in Jacksonville, Florida, US.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global lung cancer surgery market?

The global lung cancer surgery market boasts a total revenue value of $6.7 billion by 2026.

What is the estimated growth rate (CAGR) of the global lung cancer surgery market?

The global lung cancer surgery market has an estimated compound annual growth rate (CAGR) of 3.8% and a revenue size in the region of $5.4 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 LUNG CANCER SURGERY INDUSTRY DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 LUNG CANCER SURGERY MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 LUNG CANCER SURGERY MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 30)

FIGURE 6 LUNG CANCER SURGERY INDUSTRY, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 7 LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 8 LUNG CANCER SURGICAL INSTRUMENTS MARKET, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 9 LUNG CANCER SURGICAL PROCEDURES MARKET, BY REGION, 2020 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 LUNG CANCER SURGICAL DEVICES MARKET OVERVIEW

FIGURE 10 RISING INCIDENCE OF LUNG CANCER TO DRIVE OVERALL MARKET GROWTH DURING THE FORECAST PERIOD

4.2 HAND INSTRUMENT MARKET, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 11 STAPLER SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2020

4.3 MONITORING & VISUALIZING SYSTEMS MARKET, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 12 THE CAMERAS AND VIDEO SUPPORT SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020 (USD MILLION)

4.4 LUNG CANCER SURGERY DEVICES MARKET, BY REGION, (2020−2026)

FIGURE 13 ASIA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 LUNG CANCER SURGERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing incidence of lung cancer

5.2.1.1.1 The growing trend of smoking tobacco

5.2.1.1.2 Rising geriatric population

5.2.1.2 Increasing emphasis on early diagnosis & treatment of cancers

5.2.1.2.1 Increasing funding for early detection of cancer

5.2.1.2.2 Rising number of diagnostic centers for the early detection of cancer

5.2.1.3 Rising technological advancements in lung cancer treatment

5.2.1.4 Availability of reimbursements

5.2.2 RESTRAINTS

5.2.2.1 The high cost of lung cancer diagnosis & treatments

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.4 CHALLENGES

5.2.4.1 Increasing adoption of refurbished imaging systems

5.2.4.2 The dearth of skilled oncologists

5.3 COVID - 19 IMPACT ANALYSIS IN THE LUNG CANCER SURGERY MARKET

6 LUNG CANCER SURGERY MARKET, BY TYPE (Page No. - 44)

6.1 INTRODUCTION

TABLE 1 LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 2 LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

6.2 SURGICAL INSTRUMENTS

TABLE 3 SURGICAL INSTRUMENTS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 4 SURGICAL INSTRUMENTS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 5 SURGICAL INSTRUMENTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 6 SURGICAL INSTRUMENTS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.1 POWERED SURGICAL INSTRUMENTS

6.2.1.1 Consistent performance and optimum functionality during surgical procedures to drive the market growth for powered instruments

TABLE 7 POWERED SURGICAL INSTRUMENTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 POWERED SURGICAL INSTRUMENTS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.2 HAND INSTRUMENTS

TABLE 9 HAND INSTRUMENTS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 10 HAND INSTRUMENTS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 11 HAND INSTRUMENTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 HAND INSTRUMENTS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.2.2.1 Staplers

6.2.2.1.1 Time effectivity of staplers over suturing to drive the market growth

TABLE 13 HAND INSTRUMENTS MARKET FOR STAPLERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 HAND INSTRUMENTS MARKET FOR STAPLERS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.2 Forceps

6.2.2.2.1 Surgical forceps are the most widely used instruments

TABLE 15 HAND INSTRUMENTS MARKET FOR FORCEPS, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 HAND INSTRUMENTS MARKET FOR FORCEPS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.3 Retractors

6.2.2.3.1 Retractors are flexible; key factor driving market growth

TABLE 17 HAND INSTRUMENTS MARKET FOR RETRACTORS, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 HAND INSTRUMENTS MARKET FOR RETRACTORS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.4 Rib Shears

6.2.2.4.1 Increasing thoracotomy procedures worldwide to drive the adoption of rib shears

TABLE 19 HAND INSTRUMENTS MARKET FOR RIB SHEARS, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 HAND INSTRUMENTS MARKET FOR RIB SHEARS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.5 Cutters

6.2.2.5.1 Use of mechanical cutters for debridement procedures to drive the market growth

TABLE 21 HAND INSTRUMENTS MARKET FOR CUTTERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 HAND INSTRUMENTS MARKET FOR CUTTERS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.6 Clamps

6.2.2.6.1 Clamps are lightweight; key factor driving market growth

TABLE 23 HAND INSTRUMENTS MARKET FOR CLAMPS, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 HAND INSTRUMENTS MARKET FOR CLAMPS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.7 Scissors

6.2.2.7.1 Scissors are an essential tool in surgeries as they have versatile applications

TABLE 25 HAND INSTRUMENTS MARKET FOR SCISSORS, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 HAND INSTRUMENTS MARKET FOR SCISSORS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.8 Trocars

6.2.2.8.1 The increasing number of cardiothoracic surgeries to drive the market growth for trocars

TABLE 27 HAND INSTRUMENTS MARKET FOR TROCARS, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 HAND INSTRUMENTS MARKET FOR TROCARS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.9 Elevators

6.2.2.9.1 Elevators help in the clear visualization of a body cavity

TABLE 29 HAND INSTRUMENTS MARKET FOR ELEVATORS, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 HAND INSTRUMENTS MARKET FOR ELEVATORS, BY REGION, 2020–2026 (USD MILLION)

6.2.2.10 Other Hand Instruments

TABLE 31 OTHER HAND INSTRUMENTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 OTHER HAND INSTRUMENTS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.3 MONITORING AND VISUALIZING SYSTEMS

TABLE 33 MONITORING AND VISUALIZING SYSTEMS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 34 MONITORING AND VISUALIZING SYSTEMS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 35 MONITORING AND VISUALIZING SYSTEMS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 MONITORING AND VISUALIZING SYSTEMS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.3.1 CAMERAS AND VIDEO SUPPORT

6.3.1.1 Improved quality of images and visualization during surgeries to drive the market growth of this segment

TABLE 37 MONITORING AND VISUALIZING SYSTEMS MARKET FOR CAMERAS AND VIDEO SUPPORT, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 MONITORING AND VISUALIZING SYSTEMS MARKET FOR CAMERAS AND VIDEO SUPPORT, BY REGION, 2020–2026 (USD MILLION)

6.3.2 ENDOSCOPIC TROCARS WITH OPTICAL VIEWS

6.3.2.1 Increasing endoscopic surgeries for lung cancer to drive the market growth of this segment

TABLE 39 MONITORING AND VISUALIZING SYSTEMS MARKET FOR ENDOSCOPIC TROCARS WITH OPTICAL VIEWS, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 MONITORING AND VISUALIZING SYSTEMS MARKET FOR ENDOSCOPIC TROCARS WITH OPTICAL VIEWS, BY REGION, 2020–2026 (USD MILLION)

6.4 ENDOSURGICAL EQUIPMENT

6.4.1 INCREASING ADOPTION OF ROBOTIC SURGERIES FOR LUNG CANCER TO DRIVE THE MARKET GROWTH

TABLE 41 ENDOSURGICAL EQUIPMENT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 ENDOSURGICAL EQUIPMENT MARKET, BY REGION, 2020–2026 (USD MILLION)

7 LUNG CANCER SURGERY MARKET, BY TYPE (Page No. - 64)

7.1 INTRODUCTION

TABLE 43 LUNG CANCER SURVIVAL RATE FOR DIFFERENT STAGES, BY TYPE OF LUNG CANCER, 2021

TABLE 44 LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 45 LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 46 LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 47 LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

7.2 THORACOTOMY

TABLE 48 LUNG CANCER SURGICAL PROCEDURES MARKET FOR THORACOTOMY, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 49 LUNG CANCER SURGICAL PROCEDURES MARKET FOR THORACOTOMY, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 50 LUNG CANCER SURGICAL PROCEDURES MARKET FOR THORACOTOMY, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 LUNG CANCER SURGICAL PROCEDURES MARKET FOR THORACOTOMY, BY REGION, 2020–2026 (USD MILLION)

TABLE 52 LUNG CANCER SURGICAL PROCEDURES MARKET SIZE THORACOTOMY, BY REGION, 2016–2019 (NO. OF PROCEDURES)

TABLE 53 LUNG CANCER SURGICAL PROCEDURES MARKET FOR THORACOTOMY, BY REGION, 2020–2026 (NO. OF PROCEDURES)

7.2.1 LOBECTOMY

7.2.1.1 The probability of getting rid of the primary source of cancer with this technique is a major factor driving the market growth

TABLE 54 LUNG CANCER SURGICAL PROCEDURES MARKET FOR LOBECTOMY, BY REGION, 2016–2019 (NO. OF PROCEDURES)

TABLE 55 LUNG CANCER SURGICAL PROCEDURES MARKET FOR LOBECTOMY, BY REGION, 2020–2026 (NO. OF PROCEDURES)

7.2.2 SLEEVE RESECTION

7.2.2.1 Sleeve resection enables the removal of centrally located tumors

TABLE 56 LUNG CANCER SURGICAL PROCEDURES MARKET FOR SLEEVE RESECTION, BY REGION, 2016–2019 (NO. OF PROCEDURES)

TABLE 57 LUNG CANCER SURGICAL PROCEDURES MARKET FOR SLEEVE RESECTION, BY REGION, 2020–2026 (NO. OF PROCEDURES)

7.2.3 SEGMENTECTOMY

7.2.3.1 Segmentectomy is performed to remove the portion of a lobe during early-stage cancer

TABLE 58 LUNG CANCER SURGICAL PROCEDURES MARKET FOR SEGMENTECTOMY, BY REGION, 2016–2019 (NO. OF PROCEDURES)

TABLE 59 LUNG CANCER SURGICAL PROCEDURES MARKET FOR SEGMENTECTOMY, BY REGION, 2020–2026 (NO. OF PROCEDURES)

7.2.4 PNEUMONECTOMY

7.2.4.1 Pneumonectomy is an open surgery performed to treat lung cancer

TABLE 60 LUNG CANCER SURGICAL PROCEDURES MARKET FOR PNEUMONECTOMY, BY REGION, 2016–2019 (NO. OF PROCEDURES)

TABLE 61 LUNG CANCER SURGICAL PROCEDURES MARKET FOR PNEUMONECTOMY, BY REGION, 2020–2026 (NO. OF PROCEDURES)

7.3 MINIMALLY INVASIVE SURGERIES

7.3.1 SHORTER HOSPITAL STAYS, QUICKER RECOVERY, AND SMALLER INCISIONS ARE FACTORS DRIVING THE GROWTH OF MIS

TABLE 62 LUNG CANCER SURGICAL PROCEDURES MARKET FOR MINIMALLY INVASIVE SURGERIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 LUNG CANCER SURGICAL PROCEDURES MARKET FOR MINIMALLY INVASIVE SURGERIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 64 LUNG CANCER SURGICAL PROCEDURES MARKET FOR MINIMALLY INVASIVE SURGERIES, BY REGION, 2016–2019 (NO. OF PROCEDURES)

TABLE 65 LUNG CANCER SURGICAL PROCEDURES MARKET FOR MINIMALLY INVASIVE SURGERIES, BY REGION, 2020–2026 (NO. OF PROCEDURES)

8 LUNG CANCER SURGERY MARKET, BY REGION (Page No. - 76)

8.1 INTRODUCTION

TABLE 66 LUNG CANCER SURGERY INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 LUNG CANCER SURGICAL DEVICES MARKET, BY REGION, 2020–2026 (USD MILLION)

TABLE 68 LUNG CANCER SURGICAL PROCEDURES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 69 LUNG CANCER SURGICAL PROCEDURES MARKET, BY REGION, 2020–2026 (USD MILLION)

TABLE 70 LUNG CANCER SURGICAL PROCEDURES MARKET, BY REGION, 2016–2019 (NO. OF PROCEDURES)

TABLE 71 LUNG CANCER SURGICAL PROCEDURES MARKET, BY REGION, 2020 – 2026 (NO. OF PROCEDURES)

8.2 NORTH AMERICA

8.2.1 RISING GROWTH INITIATIVES UNDERTAKEN BY KEY PLAYERS TO DRIVE MARKET GROWTH

TABLE 72 LIST OF RELATED CONFERENCES IN NORTH AMERICA, 2021

FIGURE 15 NORTH AMERICA: LUNG CANCER SURGERY MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2016–2019 (NO. OF PROCEDURES)

TABLE 76 NORTH AMERICA: LUNG CANCER SURGERY MARKET, BY COUNTRY, 2020–2026 (NO. OF PROCEDURES)

TABLE 77 NORTH AMERICA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 82 NORTH AMERICA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 83 NORTH AMERICA: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 84 NORTH AMERICA: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.2.2 US

8.2.2.1 Rising healthcare spending to drive the market growth in the US

TABLE 85 US: LUNG CANCER SURGERY INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 86 US: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 87 US: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 88 US: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 89 US: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 90 US: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 91 US: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 92 US: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.2.3 CANADA

8.2.3.1 Increasing incidences of lung cancer to drive the market growth in Canada

TABLE 93 CANADA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 94 CANADA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 95 CANADA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 96 CANADA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 97 CANADA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 98 CANADA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 99 CANADA: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 100 CANADA: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.3 EUROPE

TABLE 101 EUROPE: LUNG CANCER SURGERY INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 102 EUROPE: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 103 EUROPE: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 104 EUROPE: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 105 EUROPE: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 106 EUROPE: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 107 EUROPE: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 108 EUROPE: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 109 EUROPE: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 110 EUROPE: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.3.1 GERMANY

8.3.1.1 The majority of the costs related to treatments in Germany are covered by the GKV system, thus driving market growth

TABLE 111 GERMANY: LUNG CANCER SURGERY INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 112 GERMANY: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

8.3.2 UK

8.3.2.1 The increasing burden of lung cancer in the UK to drive market growth

TABLE 113 UK: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 114 UK: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Favorable reimbursement support in France to drive the adoption rate for advanced treatments & surgeries

TABLE 115 FRANCE: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 116 FRANCE: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 The growing geriatric population in Italy drives the demand for associated treatments

TABLE 117 ITALY: LUNG CANCER SURGERY INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 118 ITALY: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Rising life expectancy to drive the geriatric population, thus positively impacting overall market growth in Spain

TABLE 119 SPAIN: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 120 SPAIN: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

8.3.6 REST OF EUROPE (ROE)

TABLE 121 LUNG CANCER INCIDENCE IN KEY ROE COUNTRIES, 2018 VS. 2025

TABLE 122 ROE: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 123 ROE: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

8.4 ASIA

FIGURE 16 ASIA: LUNG CANCER SURGERY MARKET SNAPSHOT

TABLE 124 ASIA: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 125 ASIA: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 126 ASIA: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2016–2019 (NO. OF PROCEDURES)

TABLE 127 ASIA: LUNG CANCER SURGICAL DEVICES MARKET, BY COUNTRY, 2020–2026 (NO. OF PROCEDURES)

TABLE 128 ASIA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 129 ASIA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 130 ASIA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 131 ASIA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 132 ASIA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 133 ASIA: LUNG CANCER SURGERY INDUSTRY, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 134 ASIA: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 135 ASIA: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.4.1 CHINA

8.4.1.1 Rising geriatric population and healthcare spending to drive the market growth in China

TABLE 136 CHINA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 137 CHINA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 138 CHINA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 CHINA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 140 CHINA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 141 CHINA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 142 CHINA: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 143 CHINA: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.4.2 JAPAN

8.4.2.1 Government initiatives for cancer control to drive the market growth in Japan

TABLE 144 JAPAN: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 145 JAPAN: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 146 JAPAN: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 147 JAPAN: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 148 JAPAN: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 149 JAPAN: LUNG CANCER SURGERY INDUSTRY, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 150 JAPAN: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 151 JAPAN: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.4.3 INDIA

8.4.3.1 The rising population and the growing prevalence of lung cancer due to smoking drives the market growth in India

TABLE 152 INDIA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 153 INDIA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 154 INDIA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 155 INDIA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 156 INDIA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 157 INDIA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 158 INDIA: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 159 INDIA: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.4.4 REST OF ASIA

TABLE 160 INCIDENCE OF CANCER IN ASIAN COUNTRIES

TABLE 161 ROA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 162 ROA: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 163 ROA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 164 ROA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 165 ROA: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 166 ROA: LUNG CANCER SURGERY INDUSTRY, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 167 ROA: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 168 ROA: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

8.5 REST OF THE WORLD

TABLE 169 LUNG CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 170 ROW: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 171 ROW: LUNG CANCER SURGICAL DEVICES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 172 ROW: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 173 ROW: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 174 ROW: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 175 ROW: LUNG CANCER SURGICAL PROCEDURES MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

TABLE 176 ROW: THORACOTOMY MARKET, BY TYPE, 2016–2019 (NO. OF PROCEDURES)

TABLE 177 ROW: THORACOTOMY MARKET, BY TYPE, 2020–2026 (NO. OF PROCEDURES)

9 COMPETITIVE LANDSCAPE (Page No. - 116)

9.1 OVERVIEW

FIGURE 17 KEY DEVELOPMENTS IN THE LUNG CANCER SURGERY MARKET(2018 TO 2021)

9.2 MARKET SHARE ANALYSIS, 2020

FIGURE 18 LUNG CANCER SURGERY INDUSTRY SHARE ANALYSIS, BY KEY PLAYER, 2020

9.3 KEY STRATEGIES

9.3.1 PARTNERSHIPS AND COLLABORATIONS

TABLE 178 PARTNERSHIPS AND COLLABORATIONS, 2018–2021

9.3.2 PRODUCT LAUNCHES & REGULATORY APPROVALS

TABLE 179 PRODUCT LAUNCHES AND REGULATORY APPROVALS, 2018–2021

9.3.3 EXPANSIONS

TABLE 180 EXPANSIONS, 2018–2021

9.3.4 ACQUISITIONS

TABLE 181 ACQUISITIONS, 2018–2021

9.3.5 OTHER DEVELOPMENTS

TABLE 182 OTHER DEVELOPMENTS, 2018–2021

9.4 COMPANY EVALUATION QUADRANT

9.4.1 STARS

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE PLAYERS

9.4.4 PARTICIPANTS

FIGURE 19 LUNG CANCER SURGERY INDUSTRY: COMPETITIVE LEADERSHIP MAPPING (2020)

10 COMPANY PROFILES (Page No. - 123)

(Business Overview, Products, Key Insights, Recent Developments, MnM View)*

10.1 ETHICON LLC. (A PART OF JOHNSON & JOHNSON GROUP)

FIGURE 20 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2020)

10.2 MEDTRONIC PLC.

FIGURE 21 MEDTRONIC PLC.: COMPANY SNAPSHOT (2020)

10.3 OLYMPUS CORPORATION

FIGURE 22 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2020)

10.4 INTUITIVE SURGICAL INC.

FIGURE 23 INTUITIVE SURGICAL INC.: COMPANY SNAPSHOT (2020)

10.5 SIEMENS HEALTHINEERS

FIGURE 24 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2020)

10.6 TELEFLEX INCORPORATED

FIGURE 25 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2020)

10.7 ACCURAY INCORPORATED

FIGURE 26 ACCURAY INCORPORATED: COMPANY SNAPSHOT (2020)

10.8 ANGIODYNAMICS INC.

FIGURE 27 ANGIODYNAMICS INC.: COMPANY SNAPSHOT (2020)

10.9 KEY SURGICAL LLC.

10.10 KLS MARTIN GROUP

10.11 ACKERMANN INSTRUMENTE GMBH

10.12 KARL STORZ GMBH

10.13 SCANLAN INTERNATIONAL, INC.

10.14 TROKAMED GMBH

10.15 SURGICAL HOLDINGS

10.16 FUSIONKRAFT SURGICAL INSTRUMENTS

10.17 RICHARD WOLF GMBH

10.18 SONTEC INSTRUMENTS INC.

10.19 WEXLER SURGICAL INC.

10.20 PHOENIX SURGICAL INSTRUMENTS LTD. (A PART OF STERIS IMS)

*Details on Business Overview, Products, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 157)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

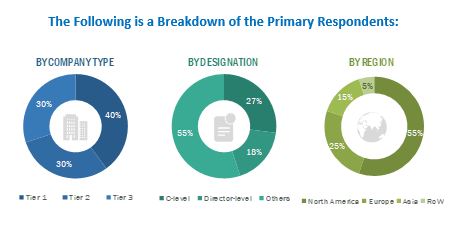

This study involved four major activities in estimating the current size of the lung cancer surgery market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information and assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the lung cancer surgery market total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the lung cancer surgery market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the lung cancer surgery market, by surgical devices, surgical procedures, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of market segments with respect to four main regional segments, namely, North America, Europe, Asia, and Rest of the World

- To profile key players in the market and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as collaborations, partnerships, acquisitions, expansions, and product launches in the lung cancer surgery market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Lung cancer surgery market size and growth rate estimates for counties in Rest of Europe, the Rest of Asia, and Rest of the World

Company profiles

- Additional five company profiles of players operating in the lung cancer surgery market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lung Cancer Surgery Market

Want to gain knowledge of instruments used in Lung Cancer Surgery and what will be the overall growth of Lung Cancer Surgery Market

Only details of procedures like Thoracotomy, Pneumonectomy, Sleeve Resection and such others involved in lung cancer surgery industry

Dear team, we require expert advice and support on lung cancer surgery market to dive in and sustain