Track Geometry Measurement System Market by Measurement Type (Gauge, Twist, and Vertical Profile), Operation Type (No Contact and Contact), Railway Type (High Speed, Mass Transit, Heavy Haul, and Light), Component, and Geography - Global Forecast to 2025-2036

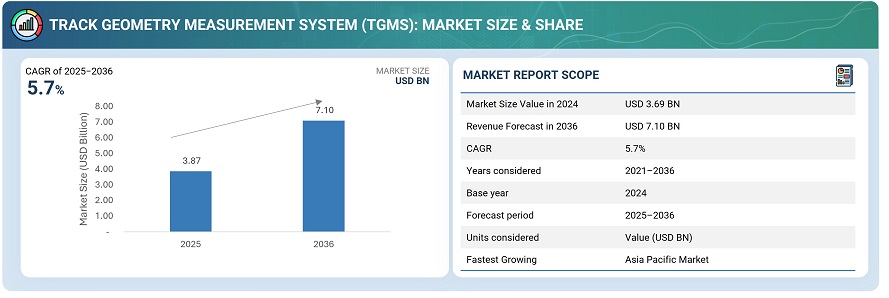

The track geometry measurement system (TGMS) market was valued at USD 3.69 billion in 2024 and is estimated to reach USD 7.10 billion by 2036, at a CAGR of 5.7% between 2025 and 2036.

Track geometry systems are a critical need to ensure safety and ride quality in railway operations. Accurate measurement and maintenance of track geometry parameters, such as gauge, alignment, cross-level, and twist, help prevent derailments and minimise wear on both the track and rolling stock. With increasing rail traffic volumes and higher train speeds, maintaining optimal track geometry is crucial for ensuring operational efficiency and passenger comfort. Additionally, advancements in sensor technology and automated monitoring systems are driving the adoption of sophisticated track geometry measurement solutions.

The track geometry measurement system (TGMS) ensures rail safety by utilising various measuring equipment to record the railway track's geometry conditions. The system is a combination of hardware and software components that derive track geometry parameters. It identifies track geometry anomalies and records the track data. By viewing and analysing the recorded data, construction and maintenance decisions are taken. Accurate and reliable track geometry data is required for the cost-effective track construction, maintenance, and operational safety.

Market by Components

In terms of components, cameras are expected to have the highest growth rate during the forecast period. High-resolution digital cameras are used during track geometry measurement procedures to capture images and videos of crucial parameters of the tracks. The cameras and advanced image processing algorithms have extremely reliable image acquisition and processing capabilities. Nowadays, advanced and innovative cameras and imaging systems are used for better inspection of a range of track parameters. For instance, ENSCO (US) developed the Track Component Imaging System (TCIS) that allows railways to automatically collect continuous images of the roadbed from a moving platform. The Rail Surface Imaging System (RSIS) collects and records continuous high-resolution images of the rail surface from a moving vehicle. Also, the Virtual Track Walk (VTW) software developed by ENSCO enables high-resolution track images to be inspected during data analysis. It allows the user to mark defects and track assets. The software then automatically tags these defects with milepost numbers and GPS coordinates. Fugro (Netherlands) provides aerial LiDAR and imaging capability, which is a fast, accurate, and cost-effective solution for mapping the complete railway networks for pre-feasibility track design.

Market by Operation Type

The no-contact segment holds a dominant position in the TGMS market. The leading position of this segment can be credited to the benefits of no-contact track geometry measurement systems. These systems are capable of measuring tract geometry at high speeds because no parts are in contact with the train or any other objects, and there are no moving parts. In addition, no-contact track geometry measurement systems can perform efficiently at low speeds and when all parameters are at the same speed. Inertial-based and chord-based are the two main types of non-contact track geometry measurement systems available in the TGMS market. MER MEC (Italy), DMA (Italy), Balfour Beatty (UK), Rail Vision Europe (UK), and Plasser & Theurer (Austria) are among the various companies operating in the TGMS market that offer no-contact track geometry measurement systems.

Market by Geography

Asia Pacific holds the largest market in 2024. Also, a high growth rate is expected for this market in the Asia Pacific. Based on country, the market is further divided into China, Japan, Australia, India, and the Rest of the Asia Pacific. This growth is attributed to the rapid expansion of high-speed rails and mass transit systems in the Asia Pacific countries in recent years. Further, rising demand for improved safety in railway transport and cost-effective smart technologies for maintaining tracks is the primary driver of the market.

Market Dynamics

Driver: Presence of various standards and regulations in the railway industry

Safety is among the key focus areas in the railway industry, and to ensure safety, there are various standards and regulations in this industry. The companies operating in the railway industry need to comply with these standards and regulations. With regard to track, there are standards for various aspects of track, including track geometry, track structure, and roadbed. Roadbed, drainage, and vegetation are the key factors that are monitored; under track structure, a few factors that are monitored are rail joints, tie plates, switches, and ballast; gauge, alignment, curvature, twist, and vertical profile are among the key parameters monitored under track geometry.

Restraint: Lack of required infrastructure

The track geometry measurement system provides accurate and reliable real-time track data, as well as helps in long-term maintenance planning. The system can be installed virtually on any rail-bound vehicle, and it provides all the data necessary for the optimum management of track assets. A centralised system is required to establish track geometry data management for the railway, as this is an integration of a large number of components, technologies, and solutions. Hence, all the segments need to operate smoothly and collectively. Malfunctioning or disconnection of any parameters can lead to several complications for users in terms of cost and technical complexities. The slow growth rate of the required infrastructure and, sometimes, the non-availability of advanced components, tools, or solutions are the major factors that can hinder the growth of the track geometry measurement system market for railways.

Opportunity: Growing demand for track geometry measurement systems from developing countries

The rapid development of railway infrastructure in developing countries such as India, China, Saudi Arabia, and Mexico has led to the rise in demand for track geometry measurement systems. Increasing urbanisation, rising income of individuals, and growing government investment towards infrastructural development are among the key factors boosting the development of railway infrastructure in developing countries. Various metro railway, light railway, and high-speed railway projects are in progress or are planned in the near future in developing countries.

Challenge: Data protection and management

It is imperative to collect and measure the track data at regular intervals for operational efficiency and maintenance. Protecting data from misuse is crucial as it can pose a major threat to the business. There is an inherent risk due to the number of companies involved in handling data and the stakeholders present in the value chain, along with observing the flow of data from end to end. Without sufficient computer security policies, businesses may find themselves unable to cope with these security threats.

Future Outlook

The future outlook for track geometry measurement systems (TGMS) is optimistic, with significant growth expected due to increasing investments in railway infrastructure and modernisation projects worldwide. Advances in sensor technology, AI, and data analytics are enhancing measurement accuracy and operational efficiency, enabling predictive maintenance and real-time monitoring. The rise of non-contact measurement methods like laser scanning and LiDAR is reducing track wear and improving safety during inspections. Growing urbanisation and expansion of high-speed rail and metro networks are driving demand for sophisticated TGMS solutions to ensure safety and optimise maintenance. Additionally, regulatory emphasis on strict safety standards and digital transformation initiatives will further propel market growth in the coming years.

Key Market Players

Top track geometry measurement system (TGMS) companies, ENSCO, Inc. (US), Fugro (Netherlands), MER MEC S.p.A. (Italy), Balfour Beatty (UK), and Plasser & Theurer (Austria).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 11 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for Research Study

3 Executive Summary

4 Premium Insights

4.1 Attractive Growth Opportunities in Track Geometry Measurement System Market

4.2 TGMS Market, By Operation Type

4.3 TGMS Market in Europe, By Country and Railway Type

4.4 TGMS Market, By Measurement Type

4.5 TGMS Market, By Country (2019)

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Presence of Various Standards and Regulations in Railway Industry

5.2.1.2 Use of Track Geometry Measurement Systems for Track Maintenance

5.2.1.3 Growth in Network of Metro Lines and High Speed Railway Lines

5.2.1.4 High Popularity of No Contact Track Geometry Measurement System

5.2.1.5 Deployment of Intelligent Techniques in Railways

5.2.2 Restraints

5.2.2.1 Lack of Required Infrastructure

5.2.3 Opportunities

5.2.3.1 Growing Demand for Track Geometry Measurement Systems From Developing Countries

5.2.3.2 Development of High-Speed Railway Network in Us

5.2.4 Challenges

5.2.4.1 Data Protection and Management

5.3 Value Chain Analysis

5.4 Industry Standards

6 Track Geometry Measurement System Market, By Measurement Type

6.1 Introduction

6.2 Gauge

6.3 Twist

6.4 Cant and Cant Deficiency

6.5 Vertical Profile

6.6 Curvature

6.7 Alignment

6.8 Dynamic Cross-Level

6.9 Dipped Joints

6.10 Others

7 Track Geometry Measurement System Market, By Operation Type

7.1 Introduction

7.2 No Contact

7.2.1 Inertial Based

7.2.2 Chord Based

7.3 Contact

8 Track Geometry Measurement System Market, By Railway Type

8.1 Introduction

8.2 High-Speed Railways

8.3 Mass Transit Railways

8.4 Heavy Haul Railways

8.5 Light Railways

9 Track Geometry Measurement System Market, By Component

9.1 Introduction

9.2 Software

9.3 Lighting Equipment

9.4 Navigation Equipment

9.5 Communication Equipment

9.6 Computer

9.7 Camera

9.8 Data Storage

9.9 Power Supply Equipment

9.10 Sensor

9.10.1 Accelerometer

9.10.2 Gyroscope

10 Track Geometry Measurement System Market, By Offering Type

10.1 Introduction

10.2 Hardware

10.3 Software

10.4 Serives

11 Track Video Inspection System Market

11.1 Introduction

11.2 Rail Surface Inspection

11.3 Track Component Inspection

11.4 Joint Bar Inspection

12 Geographic Analysis

12.1 Introduction

12.2 North America

12.2.1 US

11.2.2 Canada

11.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Italy

12.3.5 Rest of Europe

12.4 APAC

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Australia

12.4.5 Rest of APAC

12.5 RoW

12.5.1 South America

12.5.2 Middle East and Africa

13 Competitive Landscape

13.1 Overview

13.2 Market Ranking Analysis, 2017

13.3 Competitive Leadership Mapping

13.3.1 Visionary Leaders

13.3.2 Dynamic Differentiators

13.3.3 Innovators

13.3.4 Emerging Companies

13.4 Strength of Product Portfolio

13.5 Business Strategy Excellence

13.6 Competitive Situations and Trends

13.6.1 Product Launches

13.6.2 Contracts

13.6.3 Acquisitions and Expansions

14 Company Profiles

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.1 Key Players

14.1.1 Ensco

14.1.2 Fugro

14.1.3 MER MEC

14.1.4 Balfour Beatty

14.1.5 Plasser & Theurer

14.1.6 Siemens

14.1.7 R. Bance & Co.

14.1.8 Bentley Systems

14.1.9 Goldschmidt Thermit Group

14.1.10 Egis

14.2 Other Companies

14.2.1 DMA

14.2.2 Deutzer Technische Kohle

14.2.3 Kžv, Spol. Sro

14.2.4 Vista Instrumentation

14.2.5 ZG Optique

14.2.6 Harsco Corporation

14.2.7 Trimble

14.2.8 Amberg Technologies

14.2.9 Rail Vision Europe

14.2.10 Holland LP

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (97 Tables)

Table 1 TGMS Market, By Measurement Type, 2015–2024 (USD Million)

Table 2 TGMS Market for Gauge Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 3 TGMS Market for Gauge Measurement Type, By Region, 2015–2024 (USD Million)

Table 4 TGMS Market for Gauge Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 5 TGMS Market for Twist Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 6 TGMS Market for Twist Measurement Type, By Region, 2015–2024 (USD Million)

Table 7 TGMS Market for Twist Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 8 TGMS Market for Cant and Cant Deficiency Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 9 TGMS Market for Cant and Cant Deficiency Measurement Type, By Region, 2015–2024 (USD Million)

Table 10 TGMS Market for Cant and Cant Deficiency Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 11 TGMS Market for Vertical Profile Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 12 TGMS Market for Vertical Profile Measurement Type, By Region, 2015–2024 (USD Million)

Table 13 TGMS Market for Vertical Profile Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 14 TGMS Market for Curvature Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 15 TGMS Market for Curvature Measurement Type, By Region, 2015–2024 (USD Million)

Table 16 TGMS Market for Curvature Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 17 TGMS Market for Alignment Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 18 TGMS Market for Alignment Measurement Type, By Region, 2015–2024 (USD Million)

Table 19 TGMS Market for Alignment Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 20 TGMS Market for Dynamic Cross-Level Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 21 TGMS Market for Dynamic Cross-Level Measurement Type, By Region, 2015–2024 (USD Million)

Table 22 TGMS Market for Dynamic Cross-Level Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 23 TGMS Market for Dipped Joints Measurement Type, By Railway Type, 2015–2024 (USD Million)

Table 24 TGMS Market for Dipped Joints Measurement Type, By Region, 2015–2024 (USD Million)

Table 25 TGMS Market for Dipped Joints Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 26 TGMS Market for Other Measurement Types, By Railway Type, 2015–2024 (USD Million)

Table 27 TGMS Market for Other Measurement Types, By Region, 2015–2024 (USD Million)

Table 28 TGMS Market for Other Measurement Type, By Operation Mode, 2015–2024 (USD Million)

Table 29 TGMS Market, By Operation Type, 2015–2024 (USD Million)

Table 30 TGMS Market for No Contact Operation Type, By Railway Type, 2015–2024 (USD Million)

Table 31 TGMS Market for No Contact Operation Type, By Region, 2015–2024 (USD Million)

Table 32 TGMS Market for No Contact Operation Type, By Measurement Type, 2015–2024 (USD Million)

Table 33 TGMS Market for Contact Operation Type, By Railway Type, 2015–2024 (USD Million)

Table 34 TGMS Market for Contact Operation Type, By Region, 2015–2024 (USD Million)

Table 35 TGMS Market for Contact Operation Type, By Measurement Type, 2015–2024 (USD Million)

Table 36 TGMS Market, By Railway Type, 2015–2024 (USD Million)

Table 37 TGMS Market for High-Speed Railways, By Region, 2015–2024 (USD Million)

Table 38 TGMS Market for High-Speed Railways, By Operation Type, 2015–2024 (USD Million)

Table 39 TGMS Market for High-Speed Railways, By Measurement Type, 2015–2024 (USD Million)

Table 40 TGMS Market for Mass Transit Railways, By Region, 2015–2024 (USD Million)

Table 41 TGMS Market for Mass Transit Railways, By Operation Type, 2015–2024 (USD Million)

Table 42 TGMS Market for Mass Transit Railways, By Measurement Type, 2015–2024 (USD Million)

Table 43 TGMS Market for Heavy Haul Railways, By Region, 2015–2024 (USD Million)

Table 44 TGMS Market for Heavy Haul Railways, By Operation Type, 2015–2024 (USD Million)

Table 45 TGMS Market for Heavy Haul Railways, By Measurement Type, 2015–2024 (USD Million)

Table 46 TGMS Market for Light Railways, By Region, 2015–2024 (USD Million)

Table 47 TGMS Market for Light Railways, By Operation Type, 2015–2024 (USD Million)

Table 48 TGMS Market for Light Railways, By Measurement Type, 2015–2024 (USD Million)

Table 49 TGMS Market, By Component, 2015–2024 (USD Million)

Table 50 TGMS Market for Software, By Region, 2015–2024 (USD Million)

Table 51 TGMS Market for Lighting Equipment, By Region, 2015–2024 (USD Million)

Table 52 TGMS Market for Navigation Equipment, By Region, 2015–2024 (USD Million)

Table 53 TGMS Market for Communication Equipment, By Region, 2015–2024 (USD Million)

Table 54 TGMS Market for Computer, By Region, 2015–2024 (USD Million)

Table 55 TGMS Market for Camera, By Region, 2015–2024 (USD Million)

Table 56 TGMS Market for Data Storage, By Region, 2015–2024 (USD Million)

Table 57 TGMS Market for Power Supply Equipment, By Region, 2015–2024 (USD Million)

Table 58 TGMS Market for Sensor, By Region, 2015–2024 (USD Million)

Table 59 TGMS Market, By Region, 2015–2024 (USD Million)

Table 60 TGMS Market in North America, By Country, 2015–2024 (USD Million)

Table 61 TGMS Market in North America, By Railway Type, 2015–2024 (USD Million)

Table 52 TGMS Market in North America, By Component, 2015–2024 (USD Million)

Table 63 TGMS Market in North America, By Measurement Type, 2015–2024 (USD Million)

Table 64 TGMS Market in North America, By Operation Mode, 2015–2024 (USD Million)

Table 65 TGMS Market in US, By Operation Mode, 2015–2024 (USD Million)

Table 66 TGMS Market in Canada, By Operation Mode, 2015–2024 (USD Million)

Table 67 TGMS Market in Mexico, By Operation Mode, 2015–2024 (USD Million)

Table 68 TGMS Market in Europe, By Country, 2015–2024 (USD Million)

Table 69 TGMS Market in Europe, By Railway Type, 2015–2024 (USD Million)

Table 70 TGMS Market in Europe, By Component, 2015–2024 (USD Million)

Table 71 TGMS Market in Europe, By Measurement Type, 2015–2024 (USD Million)

Table 72 TGMS Market in Europe, By Operation Mode, 2015–2024 (USD Million)

Table 73 TGMS Market in Germany, By Operation Mode, 2015–2024 (USD Million)

Table 74 TGMS Market in France, By Operation Mode, 2015–2024 (USD Million)

Table 75 TGMS Market in Italy, By Operation Mode, 2015–2024 (USD Million)

Table 76 TGMS Market in UK, By Operation Mode, 2015–2024 (USD Million)

Table 77 TGMS Market in Rest of Europe, By Operation Mode, 2015–2024 (USD Million)

Table 78 TGMS Market in APAC, By Country, 2015–2024 (USD Million)

Table 79 TGMS Market in APAC, By Railway Type, 2015–2024 (USD Million)

Table 80 TGMS Market in APAC, By Component, 2015–2024 (USD Million)

Table 81 TGMS Market in APAC, By Measurement Type, 2015–2024 (USD Million)

Table 82 TGMS Market in APAC, By Operation Mode, 2015–2024 (USD Million)

Table 83 TGMS Market in China, By Operation Mode, 2015–2024 (USD Million)

Table 84 TGMS Market in Japan, By Operation Mode, 2015–2024 (USD Million)

Table 85 TGMS Market in Australia, By Operation Mode, 2015–2024 (USD Million)

Table 86 TGMS Market in India, By Operation Mode, 2015–2024 (USD Million)

Table 87 TGMS Market in Rest of APAC, By Operation Mode, 2015–2024 (USD Million)

Table 88 TGMS Market in RoW, By Country, 2015–2024 (USD Million)

Table 89 TGMS Market in RoW, By Railway Type, 2015–2024 (USD Million)

Table 90 TGMS Market in RoW, By Component, 2015–2024 (USD Million)

Table 91 TGMS Market in RoW, By Measurement Type, 2015–2024 (USD Million)

Table 92 TGMS Market in RoW, By Operation Mode, 2015–2024 (USD Million)

Table 93 TGMS Market in South America, By Operation Mode, 2015–2024 (USD Million

Table 94 TGMS Market in Middle East and Africa, By Operation Mode, 2015–2024 (USD Million

Table 95 Product Launches (2016–2017)

Table 96 Contracts (2016–2018)

Table 97 Acquisitions and Expansions (2016)

List of Figures (45 Figures)

Figure 1 Track Geometry Measurement System Market Segmentation

Figure 2 Process Flow: Track Geometry Measurement System Market Size Estimation

Figure 3 TGMS Market: Research Design

Figure 4 TGMS Market: Bottom-Up Approach

Figure 5 TGMS Market: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 TGMS Market Size (2015–2024)

Figure 8 Gauge to Hold Largest Size of TGMS Market By 2024

Figure 9 TGMS Market, By Operation Type (2019 vs 2024): No Contact Segment to Hold Larger Market in 2019 and 2024

Figure 10 High-Speed Railways Held Largest Share in TGMS Market in 2018

Figure 11 Software Segment to Dominate TGMS Market During Forecast Period

Figure 12 APAC Accounted for Largest Share of TGMS Market in 2018

Figure 13 Increasing Adoption of Track Geometry Measurement Systems in APAC Driving Market Growth

Figure 14 Track Geometry Measurement System Market for No Contact Segment to Grow at Higher CAGR During Forecast Period

Figure 15 High-Speed Railways Segment to Hold Largest Share of Track Geometry Measurement System Market in Europe By 2024

Figure 16 Gauge to Hold Largest Size of Track Geometry Measurement System Market During Forecast Period

Figure 17 China to Hold Largest Share of Track Geometry Measurement System Market in 2019

Figure 18 Growing Network of Metro and High-Speed Railway Lines Drives Track Geometry Measurement System Market

Figure 19 Length of Metro Infrastructure (In Km), 2016 vs 2017

Figure 20 Value Chain Analysis: Major Value Addition During Component and Product Manufacturing Stage

Figure 21 Track Geometry Measurement System Market, By Measurement Type

Figure 22 Gauge Measurement Type to Hold Largest Size of TGMS Market By 2024

Figure 23 High-Speed Railways to Dominate TGMS Market for Vertical Profile Measurement Type

Figure 24 APAC to Dominate TGMS Market for Alignment Measurement Type By 2024

Figure 25 Track Geometry Measurement System Market, By Operation Type

Figure 26 No Contact Operation Type to Dominate TGMS Market By 2024

Figure 27 Track Geometry Measurement System Market, By Railway Type

Figure 28 High-Speed Railways to Dominate TGMS Market By 2024

Figure 29 No Contact Segment to Dominate TGMS Market for Mass Transit Railways

Figure 30 Track Geometry Measurement System Market, By Component

Figure 31 Software Segment to Hold Largest Size of TGMS Market By 2024

Figure 32 APAC to Dominate TGMS Market for Communication Equipment

Figure 33 APAC to Dominate TGMS Market for Sensor By 2024

Figure 34 Track Video Inspection System Market

Figure 35 Geographic Snapshot (2019–2024): TGMS Market to Witness Significant Growth in APAC Countries Such as Australia During Forecast Period

Figure 36 North America: TGMS Market Snapshot

Figure 37 Europe: TGMS Market Snapshot

Figure 38 APAC: TGMS Market Snapshot

Figure 39 Ranking of Key Players in TGMS Market (2017)

Figure 40 Track Geometry Measurement System Market (Global) Competitive Leadership Mapping, 2017

Figure 41 Fugro: Company Snapshot

Figure 42 Balfour Beatty: Company Snapshot

Figure 43 Siemens: Company Snapshot

Figure 44 Bentley Systems: Company Snapshot

Figure 45 EGIS: Company Snapshot

The study involved 4 major activities to estimate the current market size for track geometry measurement system (TGMS). Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include railway journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

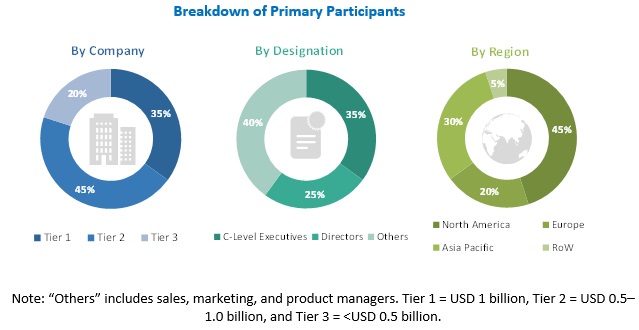

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the TGMS market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the TGMS market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data have been triangulated by studying various factors and trends identified from both demand and supply sides in industrial and nonindustrial verticals.

Report Objectives

The following are the major objectives of the study.

- To describe and forecast the track geometry measurement system market, in terms of value, by measurement type, operation type, railway type, and component

- To describe and forecast the track geometry measurement system market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To describe and forecast the track video inspection system market

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research and development (R&D) in the track geometry measurement system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Track Geometry Measurement System Market