Hyperloop Technology Market Size, Share, Statistics and Industry Growth Analysis Report by Transportation System (Capsule, Guideway, Propulsion System, and Route), Carriage Type (Passenger, and Freight), Speed (Less than 700 kmph, and More than 700 kmph), and Region - Global Forecast to 2026

Updated on : October 22, 2024

The Hyperloop Technology Market is witnessing a surge in demand as interest in rapid, efficient transportation solutions continues to grow. With the potential to revolutionize long-distance travel, hyperloop systems promise speeds significantly faster than traditional rail and road transport. Key trends driving this market include advancements in magnetic levitation and vacuum technology, as well as increasing investments from both private and public sectors aiming to develop viable hyperloop systems. The future of the hyperloop technology market appears bright, with several pilot projects and feasibility studies underway, suggesting that as technology matures, we could see the first operational hyperloop routes within the next decade. This innovation not only aims to enhance connectivity but also seeks to contribute to sustainable transportation efforts, reducing the carbon footprint associated with conventional travel methods.

Hyperloop Technology Market Size

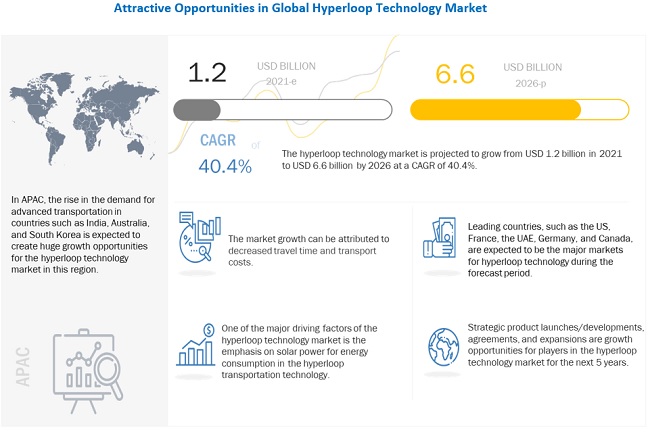

The Global Hyperloop Technology Market size in terms of revenue was estimated to be worth USD 1.2 billion in 2021 and is poised to reach USD 6.6 billion by 2026, growing at a CAGR of 40.4% from 2021 to 2026.

Few of the drivers for the growth of this Hyperloop Technology Industry include less expensive and minimum infrastructure maintenance, and decreased travel time and transport costs.

To know about the assumptions considered for the study, Request for Free Sample Report

Hyperloop Technology Market Dynamics

Driver: Creation of hyperloop network requires less land area

An increase in the number of connected devices has led to the requirement for high-speed internet connectivity, especially in digitally-advanced workplaces. With 3G becoming obsolete and 4G expanding its prospects rapidly across different applications, efforts are being made worldwide on a large scale for the development of the 5G technology. The 5G network infrastructures are expected to offer connectivity of ≥1 Gbps as speculated by several leading network providers, such as AT&T, Sprint, and T-Mobile, among others. The 5G network infrastructures are intended to cover end-to-end/point-to-point-based ecosystems to develop a fully connected world using a highly heterogeneous network. The 5G network is expected to offer high-speed data transfer, increased device connection density, and real-time services with minimum latency. This, in turn, is expected to contribute to the increasing requirement for network infrastructure testing services.

Restraint: Safety and security concerns

Passenger safety and security is one of the major concerns for the growth of the hyperloop market. Hyperloop is a new transportation system that is elevated and enables travel at very high speeds of around 650 mph inside a low air-pressure tube. In comparison with bullet trains and airplanes, which have past precedents in the form of regular trains or commercial airplanes, hyperloop has no resemblance to any conventional means of transportation. There is still skepticism about the reliability of hyperloop technology. Governments and capital investors have started believing more in the technology after the first hyperloop became operational. Currently, companies such as HTT and Virgin Hyperloop are conducting trials to expedite the development

Opportunity: Need for urban decongestion

The rapidly increasing population is one of the major reasons for traffic congestion worldwide. Every country in the world is facing problems related to road congestion. Countries such as China, Japan, India, the US, the Netherlands, the UK, and France are facing heavy road traffic issues in metro cities, and it is becoming difficult to control the growing number of vehicles on the roads on a daily basis. Other modes of transport are not always viable; air transport is costly, and water transport is time-consuming. Thus, hyperloop would be an efficient solution to overcome all these problems.

Challenge: Possibility of passenger emergency due to power outage

The possibility of passenger emergency in the case of a power outage is one of the major challenges faced by the hyperloop technology. In case of an emergency, such as human control error or unpredictable weather attacks, the hyperloop has to be able to carry passengers to the nearest station to ensure their safety. Hyperloop pods and tubes need to be equipped with evacuation points such as windows, doors, and other emergency exits. All the capsules should have direct radio contact with station operators, allowing passengers to report any incident, request for help, and receive on-board assistance when required. An emergency situation in a hyperloop capsule requires the system to complete the planned journey and meet emergency personnel at the destination.

Capsules to grow at the highest CAGR in Hyperloop Market, by transportation during the forecast period.

Capsules are expected to grow at the highest CAGR in the coming years owing to additional technological developments in the architecture of capsules. Additionally, freight capsules will require modifications according to the requirements for the forecast period. Freight transportation is expected to grow at the highest CAGR due to less regulations and minimal environmental restraints (for instance, impact of acceleration and pressure) for freight. It is expected to attain higher adoption in the coming years.

Passenger segment to hold largest share of Hyperloop Technology Market during the forecast period

Passenger transportation is expected to hold a major share of the market as most companies are focusing on commuters and connecting major cities and countries to gain a higher share of the market. It is expected to reduce travel time by drastic hours.A passenger carriage pod is designed to carry only passengers. According to the design or prototype, each capsule or pod would be capable of carrying approximately 40 passengers and traveling at the speed of 760 mph (1,220 kmph). According to the Alpha Document by SpaceX, passenger carriage pods are designed to be 7 feet 4 inches (2.23 meters) in diameter. According to different industry experts, passenger hyperloop capsules are expected to be operational after freight hyperloop capsules, considering the possible threats to human health and safety posed by traveling at such high speeds. According to HTT (US), the final operational capsule would be ready for the public in early 2023.

More than 700 kmph speed in Hyperloop Technology Market to register highest CAGR during the forecast period

As vehicles are contained within a solid tube, any change of direction is difficult with hyperloop. As collisions with the tube wall at 1200 km/h are not tolerable, for reasons of weight, energy, and steering, the size of the vehicle is seriously constrained. It is also necessary to avoid curves or gradients of the guideway as much as possible in order to stay within the comfort level, and lateral acceleration of 0.1 g should not be exceeded, which means that at a maximum speed of 1200 km/h, the permitted curve radius would be more than 100 km. Existing interstates are a possibility because public rights-of-way are hundreds of feet wide on either side. Going down the middle is a possibility too. But those are options only if the route is straight. Negotiating a curve is not possible at higher speeds..

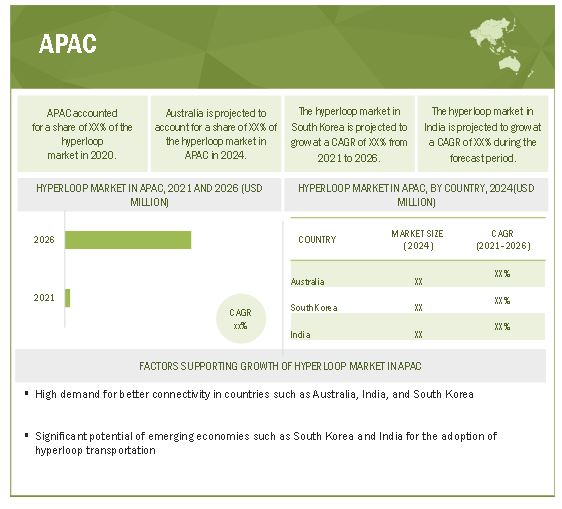

High demand for better connectivity in Australia, India and South Korea, to drive the market growth for hyperloop technology in Asia Pacific region

Australia is projected to hold the largest market in Asia Pacific for the forecast period. The proposed route of an Australian hyperloop would be between Sydney and Melbourne, which will reduce the 8-hour car journey to 55 minutes. To achieve this, the hyperloop system would send commuter and freight pods flying through a depressurized tube at speeds in excess of 1,000 km/h. Ultraspeed Australia, the official Australian representative of Virgin Hyperloop has flagged plans to have a functioning hyperloop in Australia.

To know about the assumptions considered for the study, download the pdf brochure

Key Players

The Hyperloop Technology Companies is dominated by a few globally established players such asVirgin Hyperloop(US), Hyperloop Transportation Technologies (US), Hardt B.V. (Netherlands), Zerelos (Spain), Nelove (Poland), AECOM (US), The Boring Company (US) and Transpod (Canada).

Hyperloop Technology Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 1.2 Billion |

| Revenue Forecast in 2026 | USD 6.6 Billion |

|

Historical Data Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast period |

2021–2026 |

|

CAGR |

40.4% |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Creation of hyperloop network requires less land area |

| Key Market Opportunity | Need for urban decongestion |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Passenger segment |

| Highest CAGR Segment | More than 700 kmph speed in Hyperloop Technology |

| Largest Application Market Share | Consumer Applications |

This report categorizes the Hyperloop Technology Market based on Transportation System, Carriage Type, Speed, and Region.

Based on Transportation System, the Hyperloop Technology Market been Segmented as follows:

- Capsule

- Guideway

- Propulsion System

- Route

Based on Carriage Type, the Hyperloop Technology Market been Segmented as follows:

- Passenger

- Cargo/Freight

Based on Speed, the Hyperloop Technology Market been Segmented as follows:

- More than 700 kmph

- Less than 700 kmph

Based on Region, the Hyperloop Technology Market been Segmented as follows:

- North America

- US

- Canada

- Europe

- Germany

- France

- Spain

- Netherlands

- Poland

- APAC

- Australia

- South Korea

- India

- RoW

- South America

- Middle East

Recent Developments

- In March 2021, Zeleros presented a large vehicle, an impressive 6-meter-long vehicle demonstrator, that will be exhibited from October 2021 at Expo Dubai 2021. The vehicle shows the main technologies of the Zeleros hyperloop transport system, which stands out for its scalability, since it includes most of the technologies integrated in the vehicle that will make long-distance routes profitable and energy efficient, connecting cities such as Barcelona with Paris in a matter of minutes, at speeds of up to 1000 km/h

- In July 2020,Hardt presented a fully functional life-size segment of the hyperloop interior, the CABIN-1. For the first time, future travelers can get an impression of what traveling with this new sustainable way of high-speed travel will be like. As soon as the current situation allows for it, CABIN-1 will be visiting public places throughout Europe.

- In August 2020, TRANSPOD signed an MoU with the Government of Alberta in Canada to support the development of safe, high-speed transportation in Alberta, based on the 1000 km/h TransPod vehicle

Frequently Asked Questions (FAQ):

What is the current size of the hyperloop technology market?

Hyperloop technology market size is valued at USD 1.2 billion in 2021and is anticipated to USD 6.6 billion by 2026; growing at a CAGR of 40.4% from 2021 to 2026.

What is guideway and why do they hold the largest market share during the forecast period?

Guideway consists of tubes and switches. The hyperloop route is formed with a partially evacuated cylindrical steel tube. The tube is placed on top of the concrete pylons that are placed at a distance of approximately 30 meters, which varies slightly depending on the location. The diameter of the tube permits optimal air flow around the capsule to enhance performance and reduce energy consumption at the expected travel speed. According to the Alpha document by SpaceX (US), the inner diameter of the hyperloop passenger tube is optimized to be 7 feet 4 inches, and that of the freight carriage tube is 10 feet 10 inches. The designated pressure inside the tube would be around 0.015 psi (100 pascals)—1/6th of the pressure on Mars. The low-pressure environment minimizes the drag force on the capsule vehicle and helps maintain high speed as increased drag force leads to additional power consumption.

What are the challenges faced by hyperloop technology market?

Shortages of capital from government and capital investors, possibility of passenger emergency due to power outage and capsule depressurization risk are some of the challenges faced by the hyperloop technology market.

What are the technological trends going inthe hyperloop technology market?

Maglev, also called a magnetic levitation train or maglev train, is a floating vehicle for land transportation that is supported by either electromagnetic attraction or repulsion. Maglevs were conceptualized during the early 1900s by American professor and inventor Robert Goddard and French-born American engineer Emile Bachelet and have been in commercial use since 1984, with several units operating at present and extensive networks proposed for the future.

Which are the major companies in thehyperloop technology market?

Virgin Hyperloop (US), Hyperloop Transportation Technologies (US), and Transpod (Canada)are some of the players dominating the global hyperloop technology market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 HYPERLOOP TECHNOLOGY MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKET COVERED

FIGURE 1 MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 HYPERLOOP TECHNOLOGY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Breakdown of primaries

2.1.3.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH METHODOLOGY: APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size by top-down analysis (supply side)

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RISK ASSESSMENT

TABLE 1 RISK FACTORS ANALYSIS

2.5 FORECASTING ASSUMPTIONS

2.6 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

3.1 IMPACT OF COVID-19 ON HYPERLOOP TECHNOLOGY MARKET

FIGURE 8 PRE- AND POST-COVID-19 SCENARIO: HYPERLOOP MARKET

3.2 PRE-COVID-19

3.3 POST-COVID-19

3.4 REGIONAL IMPACT

FIGURE 9 MARKET: GROWTH TREND

FIGURE 10 CAPSULE TO GROW AT HIGHEST CAGR IN MARKET FROM 2021 TO 2026

FIGURE 11 PASSENGER SEGMENT TO HOLD MAJOR MARKET SHARE IN 2026

FIGURE 12 MORE THAN 700 KMPH TO GROW AT HIGHER CAGR IN MARKET FROM 2021 TO 2026

FIGURE 13 APAC TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN HYPERLOOP TECHNOLOGY MARKET

FIGURE 14 RISING DEMAND FOR DECREASED TRAVEL TIME TO PROPEL MARKET GROWTH FROM 2021 TO 2026

4.2 MARKET, TRANSPORTATION SYSTEM

FIGURE 15 CAPSULE TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY CARRIAGE TYPE

FIGURE 16 PASSENGER TO HOLD LARGER SHARE OF MARKET IN 2026

4.4 MARKET, BY SPEED

FIGURE 17 MORE THAN 700 KMPH TO EXHIBIT HIGHER CAGR IN MARKET DURING FORECAST PERIOD

4.5 MARKET, BY REGION (USD MILLION)

FIGURE 18 APAC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET EVOLUTION

FIGURE 19 MARKET EVOLUTION

FIGURE 20 MARKET EVOLUTION

5.3 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.3.1 DRIVERS

FIGURE 22 HYPERLOOP TECHNOLOGY MARKET DRIVERS AND THEIR IMPACT

5.3.1.1 Decreased travel time and transport costs

TABLE 2 COMPARISON OF HYPERLOOP WITH OTHER MODES OF TRANSPORT

5.3.1.2 Less expensive and minimum infrastructural maintenance

5.3.1.3 Creation of hyperloop network requires less land area

5.3.1.4 Tolerance to earthquakes and other natural calamities

5.3.1.5 Emphasis on solar power for energy consumption in the hyperloop transportation technology

5.3.2 RESTRAINTS

FIGURE 23 MARKET RESTRAINTS AND THEIR IMPACT

5.3.2.1 Lack of awareness regarding hyperloop transportation technology

5.3.2.2 Regulations not yet implemented for hyperloop transportation technology by governments and bureaucrats

5.3.2.3 Safety and security concerns

5.3.3 OPPORTUNITIES

FIGURE 24 MARKET OPPORTUNITIES AND THEIR IMPACT

5.3.3.1 Reduction in travelling-related expenses

5.3.3.2 Need for urban decongestion

5.3.3.3 Boost to energy-efficient transportation with the use of hyperloop technology

5.3.4 CHALLENGES

FIGURE 25 MARKET CHALLENGES AND THEIR IMPACT

5.3.4.1 Shortages of capital from government and capital investors

5.3.4.2 Possibility of passenger emergency due to power outage

5.3.4.3 Capsule depressurization risk

5.4 TECHNOLOGY ANALYSIS

5.4.1 COMPETITIVE TECHNOLOGIES

5.4.1.1 Maglev

5.4.1.2 High-speed Rail

5.4.2 VENTURE FUNDING IN MARKET

TABLE 3 VENTURE FUNDING IN MARKET

5.4.3 LISTS OF PROJECT PROPOSALS IN MARKET

TABLE 4 LISTS OF PROJECT PROPOSALS IN MARKET

5.5 CASE STUDIES

5.5.1 CARGO HYPERLOOP TEST TRACK IN DUBAI

FIGURE 26 HYPERLOOP TO REDUCE TRAVEL TIMES FROM DUBAI TO ABU DHABI

5.5.2 HYPERLOOP TEST TRACKS IN US

5.5.3 HYPERLOOP TEST TRACKS IN EUROPE

5.6 HYPERLOOP GROUPS/ALLIANCES WORKING WORLDWIDE

TABLE 5 HYPERLOOP GROUPS/ALLIANCES WORLDWIDE

5.7 PARTICIPANTS OF HYPERLOOP ONE GLOBAL CHALLENGE (HOGC)

TABLE 6 PARTICIPANTS OF HYPERLOOP ONE GLOBAL CHALLENGE (HOGC)

5.8 PRICING ANALYSIS

FIGURE 27 AVERAGE SELLING PRICE ANALYSIS

TABLE 7 AVERAGE SELLING PRICE OF CAPSULES, 2019–2026

5.8.1 CAPITAL COST ESTIMATE BREAKDOWN

TABLE 8 CAPITAL COST ESTIMATE BREAKDOWN FOR 500-KM GENERIC HYPERLOOP CORRIDOR IN CANADA

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 28 MARKET: SUPPLY CHAIN ANALYSIS

5.9.1 HYPERLOOP ORIGINAL EQUIPMENT MANUFACTURERS

5.9.2 TRACK PROVIDERS

5.9.3 END USERS

5.10 ECOSYSTEM

FIGURE 29 HYPERLOOP ECOSYSTEM

TABLE 9 HYPERLOOP MARKET: ECOSYSTEM

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 COMPETITIVE RIVALRY

FIGURE 31 MARKET GROWTH WOULD HAVE MAJOR IMPACT ON HYPERLOOP MARKET

5.11.2 THREAT OF NEW ENTRANTS

FIGURE 32 CAPITAL REQUIRED HINDERS NEW ENTRANTS FROM ENTERING HYPERLOOP MARKET

5.11.3 THREAT OF SUBSTITUTES

FIGURE 33 SUBSTITUTE COST HAS MAJOR IMPACT ON HYPERLOOP MARKET

5.11.4 BARGAINING POWER OF BUYERS

FIGURE 34 ROLE OF BRAND IMPACTS LARGELY ON BARGAINING POWER OF BUYERS

5.11.5 BARGAINING POWER OF SUPPLIERS

FIGURE 35 BRAND LOYALTY MAXIMIZES BARGAINING POWER OF SUPPLIERS IN HYPERLOOP MARKET

5.12 TRADE ANALYSIS

TABLE 11 IMPORT DATA OF UNITS FOR ARTICLES OF STONE OR OF OTHER MINERAL SUBSTANCES INCLUDING CARBON FIBERS, BY COUNTRY, 2016–2019 (USD MILLION)

FIGURE 36 IMPORT DATA FOR HS CODE 6815 FOR TOP 5 COUNTRIES IN HYPERLOOP MARKET, 2016-2019 (USD MILLION)

TABLE 12 EXPORT DATA OF UNITS FOR ARTICLES OF STONE OR OF OTHER MINERAL SUBSTANCES INCLUDING CARBON FIBERS, BY COUNTRY, 2016–2019 (USD MILLION)

FIGURE 37 EXPORT DATA FOR HS CODE 6815 FOR TOP 5 COUNTRIES IN HYPERLOOP MARKET, 2016-2019 (USD MILLION)

5.13 REGULATORY STANDARDS

TABLE 13 REGULATORY STANDARDS FOR HYPERLOOP MARKET

5.14 PATENT ANALYSIS

FIGURE 38 PATENT ANALYSIS

TABLE 14 NOTICEABLE PATENTS OF HYPERLOOP TRANSPORTATION TECHNOLOGIES

6 HYPERLOOP MARKET, BY TRANSPORTATION SYSTEM (Page No. - 78)

6.1 INTRODUCTION

FIGURE 39 CAPSULES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 HYPERLOOP TECHNOLOGY MARKET, BY TRANSPORTATION SYSTEM, 2019–2026 (USD MILLION)

6.2 CAPSULE

6.2.1 CAPSULE TO GROW AT HIGHEST CAGR IN COMING YEARS

TABLE 16 TOTAL COST OF HYPERLOOP PASSENGER TRANSPORTATION SYSTEM

TABLE 17 TOTAL COST OF HYPERLOOP PASSENGER PLUS FREIGHT TRANSPORTATION SYSTEM

TABLE 18 MARKET FOR TRANSPORTATION SYSTEM FOR CAPSULE, BY CARRIAGE TYPE, 2019–2026 (USD MILLION)

6.3 GUIDEWAY

6.3.1 GUIDEWAY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 19 MARKET FOR TRANSPORTATION SYSTEM FOR GUIDEWAY, BY CARRIAGE TYPE, 2019–2026 (USD MILLION)

6.4 PROPULSION SYSTEM

6.4.1 PROPULSION SYSTEM ACCELERATES CAPSULE, INCREASES AND MAINTAINS HIGH SPEED, AND DECELERATES WHEN REQUIRED

TABLE 20 MARKET FOR TRANSPORTATION SYSTEM FOR PROPULSION SYSTEM, BY CARRIAGE TYPE, 2019–2026 (USD MILLION)

6.5 ROUTE

6.5.1 ROUTE COMPRISES SUPPORT FACILITIES, PROFESSIONAL SERVICES, AND SITEWORKS

TABLE 21 MARKET FOR TRANSPORTATION SYSTEM FOR ROUTE, BY CARRIAGE TYPE, 2019–2026 (USD MILLION)

7 HYPERLOOP MARKET, BY CARRIAGE TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 40 PASSENGER SEGMENT TO HOLD MAJOR HYPERLOOP MARKET SHARE DURING FORECAST PERIOD

TABLE 22 MARKET, BY CARRIAGE TYPE, 2019–2026 (USD MILLION)

7.2 PASSENGER

7.2.1 PASSENGER CARRIAGE TO BE MAJOR MARKET SHAREHOLDER

7.2.2 PROPOSED PASSENGER TRANSPORTATION ROUTES

TABLE 23 PROPOSED PASSENGER TRANSPORTATION ROUTES STAGE /COUNTRY AND FUNDING DETAILS

TABLE 24 PASSENGER TYPE MARKET, BY TRANSPORTATION SYSTEM, 2019–2026 (USD MILLION)

7.3 FREIGHT

7.3.1 MANUFACTURING COST OF FREIGHT POD TO BE LOWER THAN THAT OF PASSENDER POD

7.3.2 PROPOSED FREIGHT TRANSPORTATION ROUTES

TABLE 25 PROPOSED FREIGHT TRANSPORTATION ROUTES STAGE /COUNTRY AND FUNDING DETAILS

TABLE 26 FREIGHT TYPE MARKET, BY TRANSPORTATION SYSTEM, 2019–2026 (USD MILLION)

8 HYPERLOOP TECHNOLOGY MARKET, BY SPEED (Page No. - 91)

8.1 INTRODUCTION

FIGURE 41 MORE THAN 700 KMPH TO WITNESS HIGHER CAGR IN COMING YEARS

TABLE 27 MARKET, BY SPEED, 2019–2026 (USD MILLION)

8.2 LESS THAN 700 KMPH

8.2.1 LESS THAN 700 KMPH TO HOLD MAJOR SHARE DURING INITIAL COMMERCIALIZATION YEARS

8.3 MORE THAN 700 KMPH

8.3.1 TOP SPEED FOR PASSENGER VEHICLE OR LIGHT CARGO WILL BE 670 MILES/HOUR OR 1080 KM/HOUR

8.4 ANALYSIS OF HYPERLOOP AND COMPETING MODE OF TRANSPORTATION

TABLE 28 SPEED COMPARISON FOR DIFFERENT TRANSPORT MODES

TABLE 29 INTERCITY CONNECTION OVER 500 KM FOR DIFFERENT TRANSPORT MODES

9 GEOGRAPHIC ANALYSIS (Page No. - 95)

9.1 INTRODUCTION

FIGURE 42 MARKET IN SOUTH KOREA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 30 MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 MAJOR PROPOSED HYPERLOOP ROUTES ACROSS COUNTRIES

TABLE 31 LIST OF PROPOSED HYPERLOOP ROUTES

9.3 NORTH AMERICA

FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

TABLE 32 MARKET IN US, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.1 US

9.3.1.1 PESTLE analysis

9.3.2 CANADA

9.3.2.1 PESTLE analysis

9.4 EUROPE

FIGURE 44 EUROPE: MARKET SNAPSHOT

TABLE 33 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.1 FRANCE

9.4.1.1 PESTLE analysis

9.4.2 GERMANY

9.4.2.1 PESTLE analysis

9.4.3 SPAIN

9.4.3.1 PESTLE analysis

9.4.4 NETHERLANDS

9.4.4.1 PESTLE analysis

9.4.5 POLAND

9.4.5.1 PESTLE analysis

9.5 APAC

FIGURE 45 APAC: MARKET SNAPSHOT

TABLE 34 MARKET IN APAC, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.1 AUSTRALIA

9.5.1.1 PESTLE analysis

9.5.2 INDIA

9.5.2.1 PESTLE analysis

9.5.3 SOUTH KOREA

9.5.3.1 PESTLE analysis

9.6 ROW

FIGURE 46 ROW: MARKET SNAPSHOT

TABLE 35 MARKET IN ROW, BY REGION, 2019–2026 (USD MILLION)

9.6.1 SOUTH AMERICA

9.6.1.1 Brazil

9.6.1.1.1 PESTLE analysis

9.6.2 MIDDLE EAST

9.6.2.1 UAE

9.6.2.1.1 PESTLE analysis

10 COMPETITIVE LANDSCAPE (Page No. - 118)

10.1 INTRODUCTION

FIGURE 47 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS, AGREEMENTS, AND INVESTMENTS AS KEY GROWTH STRATEGIES FROM JANUARY 2019 TO MARCH 2021

10.2 HYPERLOOP TECHNOLOGY MARKET EVALUATION FRAMEWORK

TABLE 36 OVERVIEW OF STRATEGIES DEPLOYED BY KEY HYPERLOOP SOLUTION PROVIDERS

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

10.3 HYPERLOOP TECHNOLOGY MARKET SHARE ANALYSIS, 2020

FIGURE 48 SHARE RANGE OF KEY COMPANIES IN HYPERLOOP MARKET, 2020

TABLE 37 HYPERLOOP MARKET: DEGREE OF COMPETITION

10.4 RANKING ANALYSIS OF KEY PLAYERS IN HYPERLOOP MARKET

FIGURE 49 HYPERLOOP MARKET RANKING, 2020

10.5 COMPANY EVALUATION QUADRANT

TABLE 38 COMPANY REGION FOOTPRINT

TABLE 39 COMPANY FOOTPRINT

10.6 COMPETITIVE EVALUATION QUADRANT

10.6.1 STAR

10.6.2 EMERGING LEADER

10.6.3 PERVASIVE

10.6.4 PARTICIPANT

FIGURE 50 HYPERLOOP MARKET: COMPANY EVALUATION QUADRANT, 2020

10.7 STARTUP/SME EVALUATION MATRIX

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 51 HYPERLOOP MARKET: STARTUP/SME EVALUATION MATRIX, 2020

10.8 COMPETITIVE SCENARIO

FIGURE 52 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES, AGREEMENTS, AND INVESTMENTS HAVE BEEN KEY GROWTH STRATEGIES ADOPTED HYPERLOOP SOLUTION PROVIDERS BY MARKET PLAYERS FROM JANUARY 2019 TO MARCH 2021

10.9 COMPETITIVE SITUATIONS AND TRENDS

10.9.1 PRODUCT LAUNCHES

TABLE 40 HYPERLOOP MARKET: PRODUCT LAUNCHES, JANUARY 2019 TO MARCH 2021

10.9.2 AGREEMENTS

TABLE 41 HYPERLOOP MARKET: AGREEMENTS, JANUARY 2019 TO MARCH 2021

10.9.3 DEALS

TABLE 42 HYPERLOOP MARKET: DEALS, JANUARY 2019 TO MARCH 2021

11 COMPANY PROFILES (Page No. - 131)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View)*

11.1.1 VIRGIN HYPERLOOP

TABLE 43 VIRGIN HYPERLOOP: BUSINESS OVERVIEW

11.1.2 HYPERLOOP TRANSPORTATION TECHNOLOGIES

TABLE 44 HYPERLOOP TRANSPORTATION TECHNOLOGIES: BUSINESS OVERVIEW

11.1.3 HARDT B.V.

TABLE 45 HARDT B.V.: BUSINESS OVERVIEW

11.1.4 TRANSPOD

TABLE 46 TRANSPOD: BUSINESS OVERVIEW

11.1.5 ZELEROS

TABLE 47 ZELEROS: BUSINESS OVERVIEW

11.1.6 NEVOMO

TABLE 48 NEVOMO: BUSINESS OVERVIEW

11.1.7 AECOM

TABLE 49 AECOM: BUSINESS OVERVIEW

FIGURE 53 AECOM: COMPANY SNAPSHOT

11.1.8 THE BORING COMPANY (SPACEX)

TABLE 50 THE BORING COMPANY (SPACEX): BUSINESS OVERVIEW

* Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 151)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

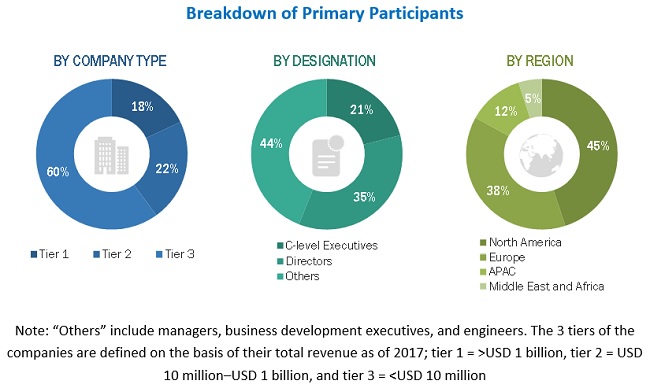

The study involved 4 major activities in estimating the current size of the Hyperloop Technology market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the Hyperloop Technology market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the Hyperloop Technology market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the Hyperloop Technology market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the Hyperloop Technology market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the Hyperloop Technology market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Hyperloop Technology market, by transportation system and carriage type, in terms of value

- To describe and forecast the market size for various segments with regard to 4 main regions, namely North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To describe the hyperloop technology supply chain analysis, ecosystem, Porter’s five forces analysis, trade data analysis, pricing analysis, patent analysis, tariffs, and regulatory landscape

- To provide a detailed impact of COVID-19 on the Hyperloop Technology market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the Hyperloop Technology market and describe the competitive landscape of the market

- To analyze competitive developments such as product launches/developments, agreements, and expansions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hyperloop Technology Market