Tracheostomy Products Market by Product (Tracheostomy Tube (Double Lumen, Cuffed, Fenestrated), Accessories), Technique (Ciaglia Blue Rhino, Translaryngeal, Percutwist, Shachner/Rapitrac, Translaryngeal/Fantoni), End-User & Region - Global Forecasts to 2024

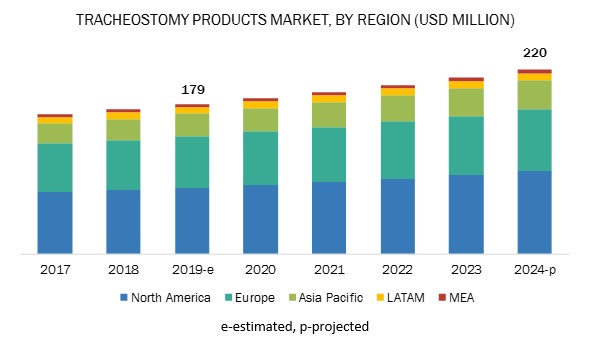

The tracheostomy products market is projected to reach USD 220 million by 2024, at a CAGR of 4.2%. Growth in the tracheostomy products industry is driven primarily by the growing public awareness related to tracheostomy procedures among medical professionals, increasing prevalence of respiratory diseases & disorders, and availability of medical reimbursement and insurance coverage.

The tracheostomy tubes segment is expected to register the highest CAGR during the forecast period

Tracheostomy tubes are utilized in the tracheostomy procedures that are performed in the case of conditions such as anaphylaxis, throat cancer, chronic lung disease, coma, diaphragm dysfunction, laryngectomy, obstructive sleep apnea, and vocal cord paralysis. The high growth of the tracheostomy tubes segment can be attributed to the significant benefits offered such as high accuracy, reduced air pollution & risk of aspiration, avoids multiple laryngoscopies & intubations, improved ventilation & accurate tidal volume, and end-tidal carbon dioxide monitoring.

By technique, the ciaglia blue rhino tracheostomy segment accounted for the largest share of the tracheostomy products market in 2018

Ciaglia blue rhino tracheostomy works in one-step dilation instead of the typically used sequential dilators. The large share of this segment is attributed to the ease of operation (owing to its slippery coating), low risk of damaging the membranous tracheal wall, rapid insertion (owing to the passage of a single dilator), limited hazard of bleeding at the lower level, low risk of cardiac dysrhythmias, and lack of damage of the curved dilator tip & kinking of the guiding catheter.

Hospitals & surgical centers will continue to dominate the tracheostomy products market during the forecast period

Hospitals & surgical centers formed the largest end-users of tracheostomy devices in 2018. This segment is also expected to grow at the highest rate during the forecast period. The growth of this market segment is attributed to the financial capabilities of hospitals to purchase expensive equipment and the availability of trained professionals to operate tracheostomy devices. The increase in this market is attributed to a large number of private enterprises are taking steps to cater to the needs of modern, well-equipped state-run healthcare facilities, and rapid developments in healthcare infrastructure & improving access to healthcare services.

North America is the largest regional market for tracheostomy products

North America is one of the major revenue-generating regions in the market. The presence of a highly developed healthcare system, increasing number of emergency department visits, high adoption of innovative tracheostomy devices among medical professionals, wide availability of advanced tracheostomy devices, the large number of tracheostomy devices manufacturing companies that have an established base, and the rising prevalence of chronic respiratory diseases are driving the growth of the tracheostomy products industry in North America.

Tracheostomy Products Market Key Players

Medtronic plc (Ireland), Smiths Group plc (UK), TRACOE Medical GmbH (Germany), Teleflex Incorporated (US), and Fisher & Paykel Healthcare Ltd. (New Zealand) were the top five players in the global tracheostomy products market. Other prominent players operating in this market include ConvaTec Group (US), Cook Group (US), Troge Medical GmbH (Germany), Well Lead Medical Co., Ltd. (US), Fuji Systems Corporation (Japan), Andreas Fahl Medizintechnik-Vertrieb GmbH (Germany), Xinxiang Huaxi Sanitary Materials Co., Ltd. (China), Medis Medical (Tianjin) Co. Ltd. (China), Boston Medical (US), and Pulmodyne (US), among others.

Medtronic plc dominated the market in 2018. The company has a strong product portfolio for tracheostomy procedures. The company is focused on inorganic business growth strategies such as partnerships, acquisitions, and expansions to strengthen its current position in the market. The company is also focusing on expanding its R&D capabilities to aid product development and commercialization across major and emerging markets. Medtronic is investing significantly in strengthening its localized product development capabilities, particularly in emerging markets. The company recently established R&D centers in Brazil and South Korea to enhance its research capabilities and presence in the Asian & Latin American markets, respectively.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Type, Technique, End User, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, the UK, France, Italy, Spain, and RoE), APAC (Japan, China, India, and the RoAPAC), LATAM (Brazil, Mexico, and RoLATAM), and the MEA |

|

Companies Covered |

Medtronic plc (Ireland), Smiths Group plc (UK), TRACOE Medical GmbH (Germany), Teleflex Incorporated (US), Fisher & Paykel Healthcare Ltd. (New Zealand), ConvaTec Group (US), Cook Group (US), Troge Medical GmbH (Germany), Well Lead Medical Co., Ltd. (US), Fuji Systems Corporation (Japan), Andreas Fahl Medizintechnik-Vertrieb GmbH (Germany), Xinxiang Huaxi Sanitary Materials Co., Ltd. (China), Medis Medical (Tianjin) Co. Ltd. (China), Boston Medical (US), and Pulmodyne (US) |

This research report categorizes the market based on type, technique, end user, and region.

By Type:

-

Tracheostomy Tubes

- Single Lumen Tubes

- Double Lumen Tubes

- Uncuffed Tubes

- Cuffed Tubes

- Fenestrated Tubes

- Adjustable Flange Tubes

- Tracheostomy Ventilation Accessories

- Tracheostomy Clean & Care Kits

- Other Accessories

By Technique:

- Surgical Tracheostomy

-

Percutaneous Dilatational Tracheostomy

- Ciaglia Tracheostomy

- Ciaglia Blue Rhino Tracheostomy

- Shachner/Rapitrac Tracheostomy

- Grigg's Tracheostomy

- Translaryngeal/Fantoni Tracheostomy

- PercuTwist Tracheostomy

By End-User:

- Hospitals and Surgery Centers

- Ambulatory Care Centers

- Home Care Settings

- Research Laboratories and Academic Institutes

By Region:

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In February 2019, Medtronic Plc entered into a partnership with Medical University of South Carolina (US) for the development of better and affordable healthcare solutions (including tracheostomy procedure for breathing assistance) for patients

- In October 2017, Medtronic Plc established the Chengdu Innovation Center at Singapore for cross-disciplinary clinical training and R&D.

Key Questions Addressed by the Report:

- Emerging countries are offering immense opportunities for the growth and adoption of market. Will this scenario continue in the coming years?

- Where will all the advancements in products offered by various companies take the industry in the mid-to-long term?

- What are the various research institutes where tracheostomy products find a high adoption rate?

- What are the new trends and advancements in the market?

- How is the shift in dynamics shaping the future of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Major Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.2 Market Estimation Methodology

2.2.1 End User-Based Market Estimation

2.2.2 Revenue Mapping-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Overview

4.2 Tracheostomy Products Market, By Type, 2019 Vs. 2024 (USD Million)

4.3 Market, By Technique, 2019 Vs. 2024 (USD Million)

4.4 Market Share, By End User and Region (2019)

4.5 Market, By Country

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Prevalence of Respiratory Diseases & Disorders

5.2.1.2 Technological Advancements

5.2.1.3 Favorable Reimbursement Scenario

5.2.1.4 Rising Patient Demand for Home Care Services

5.2.1.5 Clinical Evidence for the Safety and EffiCACy of Tracheostomy Devices

5.2.2 Restraints

5.2.2.1 High Cost of Tracheostomy Procedures

5.2.2.2 Increasing Pricing Pressure on Market Players

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.4 Challenges

5.2.4.1 Dearth of Skilled Surgeons

6 Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Tracheostomy Tubes

6.2.1 Double-Lumen Tubes

6.2.1.1 Technological Advancements in Double-Lumen Tubes Have Allowed for Greater Efficiency and Fast Lung Isolation

6.2.2 Cuffed Tubes

6.2.2.1 Reduced Risk of Aspiration and Improved Ventilation are the Major Advantages Driving the Demand for Cuffed Tubes

6.2.3 Uncuffed Tubes

6.2.3.1 Lower Resistance to Airflow and Easy Suctioning Capabilities are the Major Advantages Driving the Adoption of Uncuffed Tubes

6.2.4 Single-Lumen Tubes

6.2.4.1 High Preference in Emergency Cases to Drive the Uptake of Single-Lumen Tubes in the Coming Years

6.2.5 Fenestrated Tubes

6.2.5.1 Risk of Oral and Stomach Content Entering the Lungs Through Fenestration to Lower the Adoption of These Tubes

6.2.6 Adjustable-Flange Tubes

6.2.6.1 Risk of Accidental Decannulation has Affected the Adoption of Adjustable-Flange Tubes

6.3 Tracheostomy Ventilation Accessories

6.3.1 Increasing Number of Tracheostomy Procedures Will Drive Market Growth

6.4 Tracheostomy Cleaning Kits

6.4.1 Regular Cleaning of Tracheostomy Equipment Helps Extend Usage and Cuts Down Overall Costs

6.5 Other Accessories

7 Market, By Technique (Page No. - 60)

7.1 Introduction

7.2 Percutaneous Dilatational Tracheostomy

7.2.1 Ciaglia Blue Rhino Tracheostomy

7.2.1.1 Ease of Operation and Rapid Insertion are Driving the Demand for This Technique

7.2.2 Ciaglia Tracheostomy

7.2.2.1 Procedural Benefits of the Ciaglia Technique Will Support the Growth of This Market Segment

7.2.3 Schachner/Rapitrac Tracheostomy

7.2.3.1 High Complication Rate of This Procedure has Limited Its Adoption

7.2.4 Griggs Tracheostomy

7.2.4.1 Short Operation Times and Ease of use Have Created Positive Demand

7.2.5 Fantoni Translaryngeal Tracheostomy

7.2.5.1 Low Risk of Bleeding and the Small Skin Incisions Involved Have Driven the Adoption of the Fantoni Technique

7.2.6 Percutwist Tracheostomy

7.2.6.1 Low Risk of Posterior Wall Injury and Single-Balloon Dilation are the Key Features of the Percutwist Technique

7.3 Surgical Tracheostomy

7.3.1 High Risk of Post-Procedural Complications to Restrain Market Growth

8 Market, By End User (Page No. - 68)

8.1 Introduction

8.2 Hospitals & Surgical Centers

8.2.1 Financial Capabilities of Hospitals to Purchase Expensive Equipment Leads for the Large Share of the Segment

8.3 Ambulatory Care Centers

8.3.1 Rising Number of Ambulatory Care Centers Across Developed Countries to Drive Market Growth

8.4 Home Care Settings

8.4.1 Growing Preference for Home & Remote Monitoring has Helped Increase the Adoption of Home Care

8.5 Research Laboratories & Academic Institutes

8.5.1 Growing Public-Private Initiatives to Support Tracheostomy Research Activities Will Drive Market Growth

9 Market, By Region (Page No. - 74)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Dominates the North American Tracheostomy Products Market

9.2.2 Canada

9.2.2.1 Favorable Government Investments, Awareness on Respiratory Care, and Implementation of Abf are Driving Market Growth

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Commands the Largest Share of the Market in Europe

9.3.2 UK

9.3.2.1 Market Growth in the UK is Mainly Driven By the Increasing Incidence of Chronic Respiratory Diseases

9.3.3 France

9.3.3.1 Increasing Hospitalizations Due to the High Prevalence of Respiratory Disorders in France Will Drive the Demand for Tracheostomy Devices

9.3.4 Italy

9.3.4.1 Ongoing Economic Crisis in the Country and Rising Government Pressure to Reduce Healthcare Costs May Restrain Market Growth

9.3.5 Spain

9.3.5.1 Increased Cost Burden on the State-Run Health Insurance System Will Hinder Market Growth

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Favorable Reimbursement and Regulatory Scenario Have Propelled Market Growth in Japan

9.4.2 China

9.4.2.1 Government Initiatives to Modernize Healthcare Facilities and Reimbursement Will Drive Market Growth

9.4.3 India

9.4.3.1 Availability of Skilled Personnel and Low Treatment Costs Have Made India an Important Medical Tourism Hub

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.5.1 Brazil

9.5.1.1 Brazil Dominates the Latin American Market, But Suffers From the Challenge of Inadequate Healthcare Accessibility

9.5.2 Mexico

9.5.2.1 Mexico is a Prominent Medical Tourism Destination for US Patients

9.5.3 Rest of Latin America

9.6 Middle East & Africa

9.6.1 Growing Healthcare Expenditure and Infrastructural Improvements Will Contribute to Market Growth in MEA

10 Competitive Landscape (Page No. - 112)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Scenario

10.3.1 Key Product Launches

10.3.2 Key Expansions

10.3.3 Key Mergers and Acquisitions

10.3.4 Key Partnerships, Agreements, and Collaborations

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Innovators

10.4.3 Dynamic Differentiators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 118)

11.1 Medtronic

11.2 Smiths Group PLC

11.3 TRACOE Medical GmbH

11.4 Teleflex Incorporated

11.5 Fisher & Paykel Healthcare Ltd.

11.6 Andreas Fahl Medizintechnik-Vertrieb GmbH

11.7 Boston Medical Products, Inc.

11.8 ConvaTec Group PLC

11.9 Cook Group

11.10 Fuji Systems Corporation

11.11 Medis Medical (Tianjin) Co. Ltd.

11.12 Pulmodyne

11.13 Troge Medical GmbH

11.14 Well Lead Medical Co., Ltd.

11.15 Xinxiang Huaxi Sanitary Materials Co., Ltd.

12 Appendix (Page No. - 148)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

List of Tables (102 Tables)

Table 1 Tracheostomy Products Market, By Type, 2017–2024 (USD Million)

Table 2 Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 3 Tracheostomy Tubes Market, By Region, 2017–2024 (USD Million)

Table 4 Tracheostomy Tubes Market, By Technique, 2017–2024 (USD Million)

Table 5 Tracheostomy Tubes Market, By End User, 2017–2024 (USD Million)

Table 6 Double-Lumen Tubes Market, By Region, 2017–2024 (USD Million)

Table 7 Double-Lumen Tubes Market, By Technique, 2017–2024 (USD Million)

Table 8 Double-Lumen Tubes Market, By End User, 2017–2024 (USD Million)

Table 9 Cuffed Tubes Market, By Region, 2017–2024 (USD Million)

Table 10 Cuffed Tubes Market, By Technique, 2017–2024 (USD Million)

Table 11 Cuffed Tubes Market, By End User, 2017–2024 (USD Million)

Table 12 Uncuffed Tubes Market, By Region, 2017–2024 (USD Million)

Table 13 Uncuffed Tubes Market, By Technique, 2017–2024 (USD Million)

Table 14 Uncuffed Tubes Market, By End User, 2017–2024 (USD Million)

Table 15 Single-Lumen Tubes Market, By Region, 2017–2024 (USD Million)

Table 16 Single-Lumen Tubes Market, By Technique, 2017–2024 (USD Million)

Table 17 Single-Lumen Tubes Market, By End User, 2017–2024 (USD Million)

Table 18 Fenestrated Tubes Market, By Region, 2017–2024 (USD Million)

Table 19 Fenestrated Tubes Market, By Technique, 2017–2024 (USD Million)

Table 20 Fenestrated Tubes Market, By End User, 2017–2024 (USD Million)

Table 21 Adjustable-Flange Tubes Market, By Region, 2017–2024 (USD Million)

Table 22 Adjustable-Flange Tubes Market, By Technique, 2017–2024 (USD Million)

Table 23 Adjustable-Flange Tubes Market, By End User, 2017–2024 (USD Million)

Table 24 Tracheostomy Ventilation Accessories Market, By Region, 2017–2024 (USD Million)

Table 25 Tracheostomy Ventilation Accessories Market, By Technique, 2017–2024 (USD Million)

Table 26 Tracheostomy Ventilation Accessories Market, By End User, 2017–2024 (USD Million)

Table 27 Tracheostomy Cleaning Kits Market, By Region, 2017–2024 (USD Million)

Table 28 Tracheostomy Cleaning Kits Market, By Technique, 2017–2024 (USD Million)

Table 29 Tracheostomy Cleaning Kits Market, By End User, 2017–2024 (USD Million)

Table 30 Other Accessories Market, By Region, 2017–2024 (USD Million)

Table 31 Other Accessories Market, By Technique, 2017–2024 (USD Million)

Table 32 Other Accessories Market, By End User, 2017–2024 (USD Million)

Table 33 Tracheostomy Devices Market, By Technique, 2017–2024 (USD Million)

Table 34 Percutaneous Dilatational Tracheostomy Market, By Type, 2017–2024 (USD Million)

Table 35 Percutaneous Dilatational Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 36 Ciaglia Blue Rhino Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 37 Ciaglia Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 38 Schachner/Rapitrac Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 39 Griggs Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 40 Fantoni Translaryngeal Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 41 Percutwist Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 42 Surgical Tracheostomy Market, By Region, 2017–2024 (USD Million)

Table 43 Tracheostomy Devices Market, By End User, 2017–2024 (USD Million)

Table 44 Tracheostomy Devices Market for Hospitals & Surgical Centers, By Region, 2017–2024 (USD Million)

Table 45 Tracheostomy Devices Market for Ambulatory Care Centers, By Region, 2017–2024 (USD Million)

Table 46 Tracheostomy Devices Market for Home Care Settings, By Region, 2017–2024 (USD Million)

Table 47 Market for Research Laboratories & Academic Institutes, By Region, 2017–2024 (USD Million)

Table 48 Tracheostomy Products Market, By Region, 2017–2024 (USD Million)

Table 49 North America: Market, By Country, 2017–2024 (USD Million)

Table 50 North America: Market, By Type, 2017–2024 (USD Million)

Table 51 North America: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 52 North America: Market, By Technique, 2017–2024 (USD Million)

Table 53 North America: Tracheostomy Devices Market, By End User, 2017–2024 (USD Million)

Table 54 US: Market, By Type, 2017–2024 (USD Million)

Table 55 US: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 56 Canada: Tracheostomy Products Market, By Type, 2017–2024 (USD Million)

Table 57 Canada: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 58 Europe: Market, By Country, 2017–2024 (USD Million)

Table 59 Europe: Market, By Type, 2017–2024 (USD Million)

Table 60 Europe: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 61 Europe: Market, By Technique, 2017–2024 (USD Million)

Table 62 Europe: Market, By End User, 2017–2024 (USD Million)

Table 63 Germany: Tracheostomy Devices Market, By Type, 2017–2024 (USD Million)

Table 64 Germany: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 65 UK: Tracheostomy Devices Market, By Type, 2017–2024 (USD Million)

Table 66 UK: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 67 France: Tracheostomy Devices Market, By Type, 2017–2024 (USD Million)

Table 68 France: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 69 Italy: Market, By Type, 2017–2024 (USD Million)

Table 70 Italy: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 71 Spain: Market, By Type, 2017–2024 (USD Million)

Table 72 Spain: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 73 RoE: Market, By Type, 2017–2024 (USD Million)

Table 74 RoE: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 75 Asia Pacific: Market, By Country, 2017–2024 (USD Million)

Table 76 Asia Pacific: Market, By Type, 2017–2024 (USD Million)

Table 77 Asia Pacific: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 78 Asia Pacific: Market, By Technique, 2017–2024 (USD Million)

Table 79 Asia Pacific: Tracheostomy Products Market, By End User, 2017–2024 (USD Million)

Table 80 Japan: Tracheostomy Devices Market, By Type, 2017–2024 (USD Million)

Table 81 Japan: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 82 China: Tracheostomy Devices Market, By Type, 2017–2024 (USD Million)

Table 83 China: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 84 India: Market, By Type, 2017–2024 (USD Million)

Table 85 India: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 86 Rest of Asia Pacific: Market, By Type, 2017–2024 (USD Million)

Table 87 Rest of Asia Pacific: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 88 Latin America: Market, By Country, 2017–2024 (USD Million)

Table 89 Latin America: Market, By Type, 2017–2024 (USD Million)

Table 90 Latin America: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 91 Latin America: Tracheostomy Devices Market, By Technique, 2017–2024 (USD Million)

Table 92 Latin America: Tracheostomy Devices Market, By End User, 2017–2024 (USD Million)

Table 93 Brazil: Tracheostomy Devices Market, By Type, 2017–2024 (USD Million)

Table 94 Brazil: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 95 Mexico: Market, By Type, 2017–2024 (USD Million)

Table 96 Mexico: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 97 Rest of Latin America: Market, By Type, 2017–2024 (USD Million)

Table 98 Rest of Latin America: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 99 Middle East & Africa: Market, By Type, 2017–2024 (USD Million)

Table 100 Middle East & Africa: Tracheostomy Tubes Market, By Type, 2017–2024 (USD Million)

Table 101 Middle East & Africa: Market, By Technique, 2017–2024 (USD Million)

Table 102 Middle East & Africa: Market, By End User, 2017–2024 (USD Million)

List of Figures (32 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primaries: Tracheostomy Products Market

Figure 3 Research Methodology: Hypothesis Building

Figure 4 Market Size Estimation: Market

Figure 5 Data Triangulation Methodology

Figure 6 Tracheostomy Devices Market, By Type, 2019 Vs. 2024 (USD Million)

Figure 7 Tracheostomy Products Market Share, By Technique, 2019 Vs. 2024

Figure 8 Tracheostomy Devices Market Share, By End User, 2019 Vs. 2024

Figure 9 Geographic Snapshot: Market

Figure 10 Increasing Prevalence of Respiratory Diseases & Disorders to Drive the Demand for Tracheostomy Devices During the Forecast Period

Figure 11 Double-Lumen Tubes Segment to Register the Highest CAGR During the Forecast Period

Figure 12 Ciaglia Blue Rhino Tracheostomy Segment to Dominate the Market During the Forecast Period

Figure 13 North America to Dominate the Market

Figure 14 China is Estimated to be the Fastest-Growing Market for Tracheostomy Products

Figure 15Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Europe, Home to the World’s Largest Tobacco-Smoking Population (As of December 2018)

Figure 17 Ongoing Clinical Research Projects on Tracheostomy Devices Across the Globe (As of December 2018)

Figure 18 Ciaglia Blue Rhino Tracheostomy Segment to Dominate the Tracheostomy Products Market During the Forecast Period

Figure 19 Hospitals & Surgical Centers are the Largest End Users of Tracheostomy Products

Figure 20 North America: Market Snapshot

Figure 21 Europe: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Latin America: Market Snapshot

Figure 24 Middle East and Africa: Market Snapshot

Figure 25 Key Developments in the Tracheostomy Devices Market From 2014 to 2019

Figure 26 Medtronic PLC Held the Leading Position in the Tracheostomy Products Market in 2018

Figure 27 Market (Global) Competitive Leadership Mapping, 2018

Figure 28 Medtronic: Company Snapshot

Figure 29 Smiths Group PLC: Company Snapshot

Figure 30 Teleflex Incorporated: Company Snapshot

Figure 31 Fisher & Paykel Healthcare Ltd.: Company Snapshot

Figure 32 ConvaTec Group PLC: Company Snapshot

The study involved four major activities in estimating the current size of the tracheostomy products market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

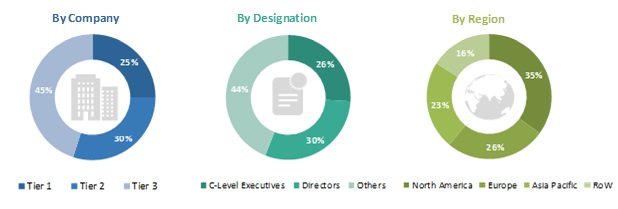

The tracheostomy devices market comprises several stakeholders such as hospitals and surgical centers, ambulatory care centers, home care settings, and research laboratories & academic institutes. The demand side of this market is characterized by the increasing prevalence of respiratory diseases & disorders, technological advancements, and rising patient demand for home care services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the tracheostomy products market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the tracheostomy industry.

Report Objectives

- To define, describe, and forecast the tracheostomy market based on product, technique, end user, region, and country

- To provide detailed information on the major factors influencing market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall tracheostomy market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market value of various segments and sub-segments with respect to five regions—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the tracheostomy market and comprehensively analyze their global revenue shares and core competencies2

- To track and analyze competitive market-specific developments such as product launches, partnerships, expansions, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players

Product Analysis

- Further breakdown of the Rest of Europe market into Poland, Sweden, and other European countries (aggregated)

- Further breakdown of the Rest of Asia Pacific into Australia, New Zealand, and other Asia Pacific countries (aggregated)

Company Information

- Detailed analysis and profiling of additional market players (up to 5 OEMs)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tracheostomy Products Market