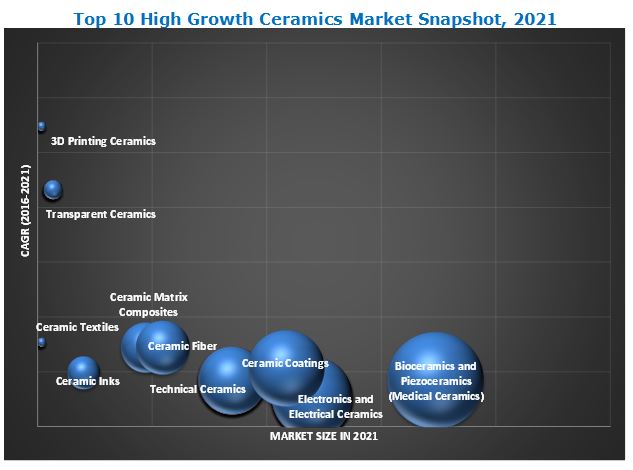

Top 10 High Growth Ceramics Market (Transparent Ceramics, Technical Ceramics, 3D Printing Ceramics, Electronics and Electrical Ceramics, Ceramic Textiles, Ceramic Coatings, Bioceramics & Piezoceramics) - Global Forecast to 2021

[188 Pages Report] The Top 10 High Growth Ceramics Market. It includes an analysis of the high growth ceramics, such as transparent ceramics, technical ceramics, 3D printing ceramic, electronics & electrical ceramics, ceramic textiles, ceramic matrix composites, ceramic coatings, ceramic inks, ceramic fibers, and bioceramics & piezoceramics.

Objectives of the report are as follows:

- To define, describe, and forecast the top 10 high growth ceramics market

- To analyze the market segmentation and project the market size, in terms of volume, value, or both for key regions

- To strategically analyze the market with respect to its segments

- To provide information regarding the major factors influencing the growth of the top 10 high growth ceramic market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for shareholders and draw a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze the key developments, such as new product launches, capacity expansions, mergers & acquisitions, and partnerships in the top 10 high growth ceramic market

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the sizes of various other dependent submarkets in the top 10 high growth ceramic market. The research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global top 10 high growth ceramics market.

To know about the assumptions considered for the study, download the pdf brochure

Key Target Audience:

- Raw Material Suppliers

- Ceramics Manufacturers

- Traders, Distributors, and Suppliers of ceramics

- Government & Regional Agencies, Research Organizations, and Investment Research Firms

Scope of the report:

This research report provides analysis of transparent ceramics (by product type, material type, end-use industry, and region), technical ceramic (by product type, material type, end-use industry, and region), 3D printing ceramic (by product type, form type, end-use industry and region), electronics & electrical ceramics (by product type, material type, end-use industry, and region), ceramic textiles (by fiber type, form type, end-use industry, and region), ceramic matrix composites (by matrix type, application, and region), ceramic coatings (by product type, technology, application, and region), ceramic inks (by technology, application, and region), ceramic fibers (by product type, end product, end-use industry, and region), and bioceramics & piezoceramics (by material type, application, and region).

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographic Analysis:

- Country-level analysis of top 10 high growth ceramics market and their respective segmentations

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Ceramics are inorganic and non-metallic materials composed of more than one element. They possess properties such as hardness, wear-resistance, brittleness, refractories, thermal insulation, electrical insulation, non-magnetic, oxidation resistance, thermal shock resistance, and chemical stability.

The top five attractive ceramics markets (in terms of highest market in value) out of the 10 covered in this report are bioceramics & piezoceramics, electronics ceramics & electrical ceramics, ceramic coatings, technical ceramic, and ceramic fibers.

Bioceramics & Piezoceramics

Bioceramics and piezoceramics are ceramics used to repair and reconstruct damaged human body parts. They are used in replacement of hard tissues of the body, such as hip joints and knee prostheses, and in replacement of oral tissues, such as enamel and dentine. The bioceramics & piezoceramics market was dominated by the bio-inert ceramic segment in 2015. Increasing end-use applications, mainly dental implants and orthopedic implants, are projected to drive the demand for bio-inert ceramics between 2016 and 2021.

Electronics Ceramics & Electrical Ceramics

Electronics ceramics & electrical ceramics are highly specialized materials which possess unique electric, magnetic, optical, mechanical, biological, and environmental properties. Alumina ceramic segment dominates the global electronics ceramics & electrical ceramics market, by material type. This segment is also projected to be the fastest-growing material type segment, in terms of both value and volume, during the forecast period.

Ceramic Coatings

Ceramic coatings provide strength to materials, such as ceramics, metals, plastics, and so on by forming a distinct film on the materials to protect them from wear and corrosion. Oxide coatings and carbide coatings are the most widely used types of ceramic coatings. Transportation & automotive is the largest end-use industry segment of the ceramic coatings market.

Technical Ceramics

Technical ceramics are materials that have specialized and unique electric, magnetic, optical, mechanical, biological, and environmental properties. Non-oxides ceramics is projected to be the fastest-growing material type segment of the technical ceramics market, in terms of value, between 2016 and 2021. By end-use industry, the medical segment of the market is estimated to grow at the highest rate, in terms of value, during the forecast period.

Ceramic Fibers

Ceramic fibers comprise an alumina-silica composition, held together by an inorganic binder. A ceramic fiber is commonly used as a refractory material. By type, the refractory ceramic fiber (RCF) segment dominated the ceramic fibers market, by value, in 2015, while the petrochemicals industry is its largest end-use industry.

The top manufacturers catering to the top 10 high growth ceramics market include Morgan Advanced Materials, CeramTec GmbH, CoorsTek, Inc., Kyocera Corporation, and Rauschert Steinbach GmbH, among others.

- Morgan Advanced Materials: The Companys long-term strategy is to focus on building its three distinctive core capabilities which are applications enginseering, materials science, and customer focus. The company is also planning to increase its R&D investments to strengthen its technical lead in the market and accelerate new product developments.

- CeramTec GmbH: It is one of the leading players in the technical ceramics and ceramic matrix composites market. It has developed silicon nitride and other ceramic composites for various high-temperature applications, such as space stations. The company has tapped the Asia-Pacific ceramic matrix composites market by expanding its production capabilities in China.

- CoorsTek, Inc.: It acquired Covalent Materials Corporation (Japan) to increase its presence in Asia. The company acquired various companies to expand its geographical reach.

- Kyocera Corporation: It is among the leading manufacturers of advanced ceramic and has maintained its position in the market by focusing on R&D to launch innovative and new products. The company is also focused on launching its products into new markets to help expand its geographical imprint and consumer base.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 By Region

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

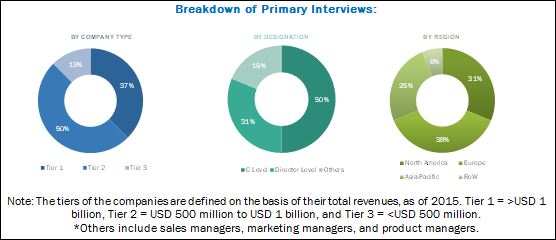

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Market Overview (Page No. - 28)

4.1 Introduction

4.2 Market Segmentation

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.3.4 Challenges

5 Industry Trends (Page No. - 36)

5.1 Introduction

5.2 Value Chain Analysis

5.3 Porters Five Forces Analysis

6 Transparent Ceramic Market (Page No. - 40)

6.1 Transparent Ceramic Market, By Type

6.1.1 Overview

6.1.2 Monocrystalline Transparent Ceramics

6.1.3 Polycrystalline Transparent Ceramic

6.1.4 Other Transparent Ceramics

6.2 Transparent Ceramic Market, By Material

6.2.1 Overview

6.2.2 Sapphire

6.2.3 Yttrium Aluminum Garnet (YAG)

6.2.4 Aluminum Oxynitride

6.2.5 Spinel

6.2.6 Other Materials

6.3 Transparent Ceramics Market, By End-User Industry

6.3.1 Overview

6.3.2 Optics & Optoelectronics

6.3.3 Aerospace, Defense & Security

6.3.4 Mechanical/Chemical

6.3.5 Sensors & Instrumentation

6.3.6 Healthcare

6.3.7 Consumer

6.3.8 Energy

6.3.9 Other

6.4 Transparent Ceramics Market, By Region

6.4.1 Overview

6.5 Top Manufacturers

7 Technical Ceramics Market (Page No. - 52)

7.1 Technical Ceramics Market, By Material

7.1.1 Overview

7.1.2 Oxide Ceramics

7.1.2.1 Alumina Ceramics

7.1.2.2 Titanate Ceramic

7.1.2.3 Zirconia Ceramics

7.1.3 Non-Oxide Ceramics

7.1.3.1 Aluminum Nitride

7.1.3.2 Silicon Nitride

7.1.3.3 Silicon Carbide

7.2 Technical Ceramics Market, By Product Type

7.2.1 Overview

7.2.2 Monolithic Ceramics

7.2.3 Others

7.3 Technical Ceramics Market, By End-Use Industry

7.3.1 Overview

7.3.2 Electronics & Semiconductor

7.3.3 Automotive

7.3.4 Energy & Power

7.3.5 Industrial

7.3.6 Medical

7.3.7 Military & Defense

7.3.8 Others

7.4 Technical Ceramics Market, By Region

7.4.1 Overview

7.5 Top Manufacturers

8 3D Printing Ceramics Market (Page No. - 67)

8.1 3D Printing Ceramics Market, By Type

8.1.1 Overview

8.1.2 Glass

8.1.3 Fused Silica

8.1.4 Quartz

8.1.5 Other Types

8.2 3D Printing Ceramics Market, By Form

8.2.1 Overview

8.2.2 Filament

8.2.3 Liquid

8.2.4 Powder

8.3 3D Printing Ceramics Market, By End Use Industry

8.3.1 Overview

8.3.2 Aerospace & Defense

8.3.3 Healthcare

8.3.4 Automotive

8.3.5 Consumer Goods & Electronics

8.3.6 Manufacturing & Construction

8.3.7 Other End Users

8.4 3D Printing Ceramics Market, By Region

8.4.1 Overview

8.5 Top Manufacturers

9 Electronics Ceramics & Electrical Ceramics Market (Page No. - 79)

9.1 Electronics Ceramics & Electrical Ceramics Market, By Material Type

9.1.1 Overview

9.1.2 Alumina Ceramics

9.1.2.1 Aluminum Nitride

9.1.2.2 Aluminum Oxide

9.1.3 Zirconia Ceramics

9.1.4 Silica

9.1.5 Silicon Carbide

9.1.6 Silicon Nitride

9.1.7 Titanate

9.2 Electronics Ceramics & Electrical Ceramics Market, By Product Type

9.2.1 Overview

9.2.2 Monolithic Ceramics

9.2.3 Others

9.3 Electronics Ceramics & Electrical Ceramics Market, By End-Use Industry

9.3.1 Overview

9.3.2 Home Appliances

9.3.3 Power Grid

9.3.4 Medical Devices

9.3.5 Mobile Phones

9.3.6 Others

9.4 Electronics Ceramics & Electrical Ceramics Market, By Region

9.4.1 Overview

9.5 Top Manufacturers

10 Ceramics Textiles Market (Page No. - 92)

10.1 Ceramics Textiles Market, By Fiber Type

10.1.1 Overview

10.1.2 Classification of Ceramics Fiber

10.1.2.1 Vitreous Alumina-Silica Ceramics Fiber

10.1.2.1.1 Refractory Ceramics Fiber (RCF)

10.1.2.1.2 Low Bio-Persistence Ceramics Fiber

10.1.2.2 Polycrystalline Ceramics Fiber

10.2 Ceramics Textile Market, By Form Type

10.2.1 Overview

10.2.2 Cloth

10.2.3 Ropes

10.2.4 Tapes

10.2.5 Sleeving

10.2.6 Braids

10.2.7 Others

10.3 Ceramics Textiles Market, By End-Use Industry

10.3.1 Overview

10.3.2 Industrial

10.3.2.1 Petrochemicals

10.3.2.2 Iron & Steel

10.3.2.3 Aluminum

10.3.2.4 Power Generation

10.3.2.5 Others

10.3.3 Transportation

10.3.3.1 Aerospace

10.3.3.2 Automotive and Marine

10.4 Ceramics Textile Market, By Region

10.4.1 Overview

10.5 Top Manufacturers

11 Ceramics Matrix Composites Market (Page No. - 104)

11.1 Ceramics Matrix Composites Market, By Matrix Type

11.1.1 Overview

11.1.2 C/C Ceramics Matrix Composites

11.1.3 C/SiC Ceramics Matrix Composites

11.1.4 Oxide/Oxide Ceramics Matrix Composites

11.1.5 SiC/SiC Ceramics Matrix Composites

11.2 Ceramics Matrix Composites Market, By Application

11.2.1 Overview

11.2.2 Aerospace & Defense

11.2.3 Automotive

11.2.4 Energy & Power

11.2.5 Electricals & Electronics

11.2.6 Others

11.3 Ceramics Matrix Composites Market, By Region

11.3.1 Overview

11.4 Top Manufacturers

12 Ceramics Coatings Market (Page No. - 113)

12.1 Ceramics Coatings Market, By Type

12.1.1 Overview

12.1.2 Oxide Coatings

12.1.3 Carbide Coatings

12.1.4 Nitride Coatings

12.1.5 Others

12.2 Ceramics Coatings Market, By Technology

12.2.1 Overview

12.2.2 Thermal Spray

12.2.3 Physical Vapor Deposition (PVD)

12.2.4 Chemical Vapor Deposition (CVD)

12.2.5 Others

12.3 Ceramics Coatings Market, By Application

12.3.1 Overview

12.4 Ceramics Coatings Market, By Region

12.4.1 Overview

12.5 Top Manufacturers

13 Ceramics INK Market Size, By Technology (Page No. - 125)

13.1 Ceramics INK Market Size, By Technology

13.1.1 Overview

13.1.2 Analog Printing

13.1.3 Digital Printing

13.2 Ceramics INK Market Size, By Application

13.2.1 Overview

13.2.2 Ceramics Tiles

13.2.3 Glass Printing

13.2.4 Food Containers

13.2.5 Others

13.3 Ceramics INK Market Size, By Region

13.3.1 Overview

13.4 Top Manufacturers

14 Ceramics Fibers Market (Page No. - 132)

14.1 Ceramics Fiber Market, By Type

14.1.1 Overview

14.1.2 Refractory Ceramics FiberRCF

14.1.3 Low Bio-Persistent Ceramics Fiber

14.1.4 Polycrystalline Ceramics Fibers

14.2 Ceramics Fiber Market, By End Product

14.2.1 Overview

14.2.2 Bulk

14.2.3 Blanket

14.2.4 Board

14.2.5 Paper

14.2.6 Modules

14.2.7 Others

14.3 Ceramics Fiber Market, By End-Use Industry

14.3.1 Overview

14.3.2 Petrochemicals

14.3.3 Iron & Steel

14.3.4 Aluminum

14.3.5 Ceramics

14.3.6 Power Generation

14.3.7 Other End-Use Industries

14.4 Ceramics Fiber Market,By Region

14.4.1 Overview

14.5 Top Manufacturers

15 Bioceramics and Piezoceramics (Medical Ceramics) Market (Page No. - 144)

15.1 Bioceramics and Piezoceramics (Medical Ceramics) Market, By Material

15.1.1 Overview

15.1.2 Bio-Inert Ceramics

15.1.2.1 Aluminum Oxide (Al2O3)

15.1.2.2 Zirconia Oxide (ZrO2)

15.1.3 Bio-Active Ceramics

15.1.3.1 Bio Glass

15.1.3.2 Glass Ceramics

15.1.4 Bio-Resorbable Ceramics

15.1.5 Piezo Ceramics

15.2 Bioceramics and Piezoceramics (Medical Ceramics) Market, By Application

15.2.1 Overview

15.2.2 Dental Implants

15.2.3 Orthopedic Implants

15.2.4 Surgical Instruments

15.2.5 Implantable Electronic Devices

15.2.6 Diagnostic Instruments

15.2.7 Other Applications

15.3 Bioceramics and Piezoceramics (Medical Ceramics) Market, By Region

15.3.1 Overview

15.4 Top Manufacturers

16 Company Profiles (Page No. - 154)

Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

16.1 Morgan Advanced Materials

16.2 Ceramtec GmbH

16.3 Coorstek Inc.

16.4 Saint-Gobain S.A

16.5 3M Company

16.6 Kyocera Corporation

16.7 Rauschert Steinbach GmbH

16.8 Ibiden Co. Ltd

16.9 Rath Inc.

16.10 Unifrax Corporation

16.11 Product Mapping

*Details on (Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)

17 Appendix (Page No. - 186)

17.1 Knowledge Store: Marketsandmarkets Subscription Portal

17.2 Author Details

List of Tables (72 Tables)

Table 1 Market Segmentation, By High Potential Areas Opportunities in Ceramics Market

Table 2 Porters Five Forces Analysis

Table 3 Transparent Ceramics Market Size, By Type, 20142021 (USD Million)

Table 4 Transparent Ceramics Market Size, By Material, 20142021 (USD Million)

Table 5 Transparent Ceramics Market Size, By End-User Industry, 2014-2021 (USD Million)

Table 6 Transparent Ceramics Market, By Region, 20142021 (USD Million)

Table 7 Technical Ceramics Market, By Material, 20142021 (USD Million)

Table 8 Technical Ceramics Market, By Material, 20142021 (Kiloton)

Table 9 Oxide Ceramics Market, By Material, 20142021 (USD Million)

Table 10 Oxide Ceramics Market, By Material, 20142021 (Kiloton)

Table 11 Non-Oxide Ceramics Market, By Material, 20142021 (USD Million)

Table 12 Technical Ceramics Market, By Product Type, 20142021 (USD Million)

Table 13 Technical Ceramic Market, By Product Type, 20142021 (Kilotons)

Table 14 Technical Ceramics Market Size, By End-Use Industry, 20142021 (USD Million)

Table 15 Technical Ceramic Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 16 Technical Ceramics Market Size, By Region, 20142021 (USD Million)

Table 17 Technical Ceramic Market Size, By Region, 20142021 (Kiloton)

Table 18 3D Printing Ceramics Market, By Type, 2014-2021 (USD Million)

Table 19 3D Printing Ceramic Market, By Type, 2014-2021 (Ton)

Table 20 3D Printing Ceramics Market, By Form, 2014-2021 (USD Million)

Table 21 3D Printing Ceramic Market, By Form, 2014-2021 (Ton)

Table 22 3D Printing Ceramics Market, By End User, 2014-2021 (USD Million)

Table 23 3D Printing Ceramic Market, By End User, 2014-2021 (Ton)

Table 24 3D Printing Ceramics Market, By Region, 2014-2021 (USD Million)

Table 25 3D Printing Ceramic Market, By Region, 2014-2021 (Ton)

Table 26 Electronics Ceramics & Electrical Ceramics Market Size, By Material Type, 20142021 (USD Million)

Table 27 Electronics Ceramic & Electrical Ceramics Market Size, By Material Type, 20142021 (Kiloton)

Table 28 Electronics Ceramics & Electrical Ceramics Market Size, By Product Type, 20142021 (USD Million)

Table 29 Electronics Ceramic & Electrical Ceramics Market Size, By Product Type, 20142021 (Kiloton)

Table 30 Electronics Ceramics & Electrical Ceramics Market Size, By End-Use Industry, 20142021 (USD Million)

Table 31 Electronics Ceramic & Electrical Ceramics Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 32 Electronics Ceramics & Electrical Ceramics Market, By Region, 20142021 (USD Million)

Table 33 Electronics Ceramic & Electrical Ceramics Market, By Region, 20142021 (Kiloton)

Table 34 Global Ceramics Textiles Market Size, By Fiber Type, 20142021 (USD Million)

Table 35 Global Ceramic Textiles Market Size, By Fiber Type, 20142021 (Ton)

Table 36 Global Ceramics Textiles Market Size, By Form Type, 20142021 (USD Million)

Table 37 Global Ceramic Textiles Market Size, By Form Type, 20142021 (Ton)

Table 38 Global Ceramics Textiles Market Size, By End-Use Industry, 2014-2021 (USD Million)

Table 39 Global Ceramic Textiles Market Size, By End-Use Industry, 2014-2021 (Tons)

Table 40 Global Ceramics Textiles Market Size, By Region, 20142021 (USD Million)

Table 41 Global Ceramic Textiles Market Size, By Region, 20142021 (Tons)

Table 42 Ceramics Matrix Composites Market Size, By Matrix Type, 20142021 (USD Million)

Table 43 Ceramic Matrix Composites Market Size, By Matrix Type, 20142021 (Kiloton)

Table 44 Ceramics Matrix Composites Market Size, By Application, 20142021 (USD Million)

Table 45 Ceramic Matrix Composites Market Size, By Application, 20142021 (Kiloton)

Table 46 Ceramics Matrix Composites Market Size, By Region, 20142021 (USD Million)

Table 47 Ceramic Matrix Composites Market Size, By Region, 20142021 (Kiloton)

Table 48 Ceramics Coatings Market Size, By Type, 20142021 (USD Million)

Table 49 Ceramic Coatings Market Size, By Type, 20142021 (Kiloton)

Table 50 Ceramics Coatings Market Size, By Technology, 20142021 (USD Million)

Table 51 Ceramic Coatings Market Size, By Technology, 20142021 USD Million

Table 52 Ceramics Coatings Market Size, By Application, 20142021 (USD Million)

Table 53 Ceramic Coatings Market Size, By Application, 20142021 USD Million

Table 54 Ceramics Coatings Market Size, By Region, 20142021 (USD Million)

Table 55 Ceramic Coatings Market Size, By Region, 20142021 (Kiloton)

Table 56 Global Ceramics INK Market Size, By Technology, 2014-2021 (USD Million)

Table 57 Global Ceramic INK Market Size, By Technology, 2014-2021 (Kiloton)

Table 58 Global Ceramics INK Market Size, By Application, 2014-2021 (USD Million)

Table 59 Global Ceramic INK Market Size, By Application, 2014-2021 (Kiloton)

Table 60 Ceramics INK Market Size, By Region, 20142021 (USD Million)

Table 61 Ceramic INK Market Size, By Region, 20142021 (Kiloton)

Table 62 Ceramics Fiber Market Size, By Type, 2014-2021 (USD Million)

Table 63 Ceramic Fiber Market Size, By Type, 2014-2021 (Kiloton)

Table 64 Ceramics Fiber Market Size, By End-Product, 2014-2021 (USD Million)

Table 65 Ceramic Fiber Market Size, By End-Product, 2014-2021 (Kiloton)

Table 66 Ceramics Fiber Market Size, By End-Use Industry, 2014-2021 (USD Million)

Table 67 Ceramic Fiber Market Size, By End-Use Industry, 2014-2021 (Kilotons)

Table 68 Ceramics Fiber Market Size, By Region, 20142021 (USD Million)

Table 69 Ceramic Fiber Market Size, By Region, 20142021 (Kiloton)

Table 70 Bioceramics and Piezoceramics (Medical Ceramics) Market Size, By Material, 20142021 (USD Million)

Table 71 Bioceramic and Piezoceramic (Medical Ceramic) Market Size, End Product, 20142021 (USD Million)

Table 72 Bioceramics and Piezoceramics (Medical Ceramics) Market Size, By Region, 20142021 (USD Million)

List of Figures (21 Figures)

Figure 1 Breakdown of Primary Interviews

Figure 2 Data Triangulation: Top 10 High Growth Ceramics Market

Figure 3 Top 10 High Growth Ceramic Market, By Value and Volume With Regional Split, 2015

Figure 4 Top 10 High Growth Ceramics Market, By Value, 20162021

Figure 5 Top 10 High Growth Ceramic Market, By Volume, 20162021

Figure 6 Value Chain of Different Ceramics

Figure 7 Morgan Advanced Materials: Company Snapshot

Figure 8 Morgan Advanced Materials: SWOT Analysis

Figure 9 Ceramtec GmbH: Company Snapshot

Figure 10 SWOT Analysis: Ceramtec GmbH

Figure 11 SWOT Analysis: Coorstek Inc.

Figure 12 Saint Gobain S.A: Company Snapshot

Figure 13 Saint-Gobain Ceramics Materials: SWOT Analysis

Figure 14 3M Company.: Company Snapshot

Figure 15 3M Company:SWOT Analysis

Figure 16 Kyocera Corporation: Company Snapshot

Figure 17 Kyocera Corporation: SWOT Analysis

Figure 18 Ibiden Co. Ltd.: Company Snapshot

Figure 19 Ibiden Co. Ltd.: SWOT Analysis

Figure 20 Rath Inc.: Company Snapshot

Figure 21 Unifrax Corp.: SWOT Analysis

Growth opportunities and latent adjacency in Top 10 High Growth Ceramics Market