Top 10 Advanced Materials & Technologies Market by Product (G. Fast Chipset, Quantum Dots, Flexible Battery, Graphene, 3D IC & 2.5D IC Packaging, Organic Electronics, Smart Glass, Others) - Global Forecast to 2021

[314 Pages Report] The top 10 advanced materials & technologies in electronics report cover the emerging products in the electronics domain. In this study, 2015 has been considered the base year, 2016 to 2021 as the forecast period to project the market size of each advanced material & technology.

Objectives of the study:

- To define, describe, and project the top 10 advanced materials & technologies in electronics market based

- To forecast the market size, in terms of value and volume, of five main regional markets, namely, Asia-Pacific, Europe, North America, South America, and Middle East & Africa

- To provide detailed information on key factors influencing the market growth, such as drivers, restraints, opportunities, and industry-specific challenges for each advanced electronics material & technology

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contribution to the total market of each advanced electronics material & technology

- To analyze the opportunities in the market for stakeholders and competitive developments, such as merger & acquisition, partnership, agreements, joint ventures & collaborations, new product developments/launches, and expansions, in each top 10 advanced materials & technologies in electronics

- To strategically profile the top two players and comprehensively analyze their core competencies

Research Methodology:

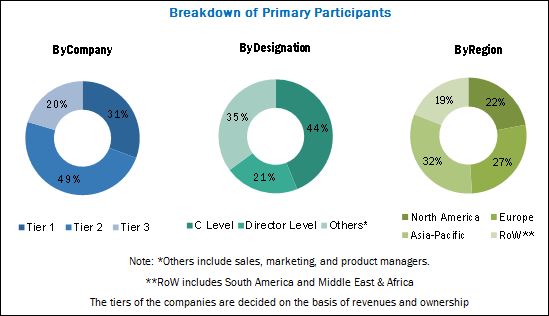

The research methodology used to estimate and forecast the market size included both, top-down and bottom-up approaches. The total market size for each advanced material & technology is identified through both, primary and secondary research. Each advanced material & technology market was further segmented, based on relevant parameters such as application, material, product type and region. Percentages were allotted to the different sectors in each of the segments and subsegments. These allotments and calculations were done on the basis of extensive primary interviews and secondary research. The secondary resources include annual reports, press releases and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as, Factiva, ICIS, Bloomberg, and others. Findings of each market were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Each of the product in the top 10 advanced materials & technologies market is led by various players who dominate their respective area. Few of the players in the top 10 advanced materials & technologies are Broadcom Ltd. (U.S.), Sckipio Technologies SI Ltd. (Israel), QD Vision Inc. (U.S.), Nanosys Inc. (U.S.), Samsung Electronics Co., Ltd. (South Korea), STMicroelectronics N.V. (Switzerland), Graphene NanoChem Plc (Malaysia), CVD Equipment Corporation (U.S.), Renesas Electronics Corporation (Japan), Toshiba Corporation (Japan), TSMC Ltd. (Taiwan), Universal Display Corporation (U.S.), BASF SE (Germany), Arkema S.A. (France), Hanwha Chemical Co. Ltd (Korea), and others.

Target Audience:

- Manufacturers of Advanced Electronics Materials & Technologies

- Manufacturers in End-Use Industries Such As Automotive, Medical, and Telecom

- Traders, Distributors, and Suppliers Of Advanced Electronics Materials & Technologies

- Regional Manufacturers Associations and General Associations Working on Electronics

- Government and Regional Agencies and Research Organizations

Scope of the Report:

This report categorizes the global top 10 advanced materials & technologies in electronics market based on product. Each of this product is further segmented by different parameters.

Market Segmentation, by Product:

- G. Fast Chipset

- By Deployment Type

- By End-user

- By Copper Line Length

- By Region

- Quantum Dots

- By Product Type

- By Material

- By Application

- By Region

- Flexible Battery

- By Type

- By Chargeability

- By Application

- By Region

- Graphene

- By Type

- By Application

- By Region

- Silicon Carbide in Semiconductor

- By Technology

- By Product

- By Application

- By Region

- 3D IC & 2.5D IC Packaging

- By Packaging Technology

- By Application

- By End-user Industry

- By Region

- Organic Electronics

- By Material

- By Application

- By Region

- Carbon Nanotubes

- By Type

- By Application

- By Region

- Smart Glass

- By Technology

- By End-use Industry

- By Region

- Biochips

- By Type

- By Fabrication Technology

- By End-user

- By Region

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the customers specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region to country level

- Regional and country level breakdown for the application segment

Company Information

- Detailed analysis and profiles of additional market players for each advanced material & technology

The top 10 advanced materials & technologies in electronics refers to the new or modifications to the existing materials & technologies to obtain superior performance or efficiency. The market for top 10 advanced materials & technologies in electronics is witnessing high growth owing to the increasing end-use applications, technological advances, and the high demand of these technologies from both the developed and emerging regions.

The top 10 advanced materials & technologies in electronics market includes high growth materials & technologies in the electronics domains such as G. fast chipset, quantum dots, graphene, 3D IC & 2.5D IC packaging, organic electronics, flexible battery, carbon nanotubes, biochip, silicon carbide in semiconductor, and smart glass.

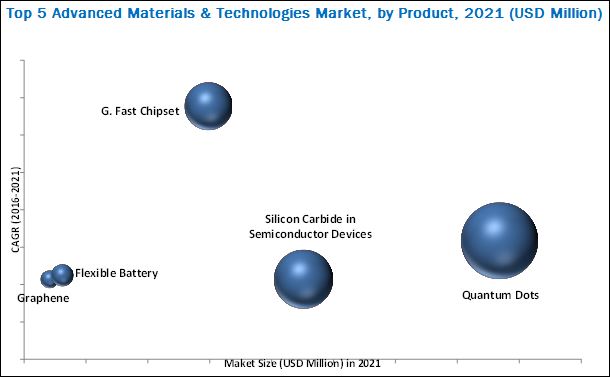

G. Fast Chipset is estimated to be the fastest-growing technology in the electronics domain. The G. fast chipset market is projected to grow from USD 41.0 Million in 2016 to reach USD 2,966.7 Million by 2021, at a CAGR of 135.4% from 2016 to 2021, due to the growing demand of ultrafast broadband services and lower cost of deployment. Also, the growth of 4K TV and increased competition among the broadband service providers in developed countries is expected to provide a significant opportunity for the G. fast technology. Apart from this, factors such as supportive government policies to meet national broadband plans, and faster speed of G.fast technology over shorter copper length are helping the G. fast chipset industry to grow rapidly in North America and Europe region.

Quantum dots is one of the fastest-growing material market in electronics domain. The overall market size of quantum dots is expected to reach USD 7,679.7 million by 2021 at a CAGR of 63.4% during the forecast period. The market is driven due to its superior performance and resolution quality. Moreover, the QD technology is flexible and versatile; it can be applied in numerous fields such as medical, optoelectronics, and solar energy and can also be used in the defense and security applications.

Flexible battery is fastest-growing material in electronics. The market for flexible battery was valued at USD 69.6 million in 2015, and it is expected to reach USD 615.4 million by 2021, at a CAGR of 44.9% during the forecast period. The growth of this market is being propelled by the growing demand for wearable electronics, rising demand for thin and flexible batteries in electronic devices, and increasing miniaturization of electronic products. This market has several opportunities that the existing and entry level companies can explore to expand their businesses.

The global graphene market is expected to grow at a CAGR of 42.8% in terms of value during the forecast period. Graphene is used in various industrial and commercial applications such as composites, coatings, and energy among others owing to its tensile strength, flexibility, and non-toxicity nature. It holds the potential to be used as a substitute for incumbent materials in various applications such as transport and automotive, environmental and health applications, and information and communication technologies. The demand of graphene has experienced exponential growth over recent years, due to its broad array of unique properties and environmentally friendly approach.

The Silicon Carbide (SiC) in semiconductor devices market is experiencing radical changes because of the continuous development of technologies. The Silicon Carbide material is superior in properties such as hardness, strength, shock resistance, and thermal conductivity. The SiC in semiconductor devices market is projected to grow from USD 537.6 million in 2015 to USD 4,520.7 million by 2021 at a CAGR of 42.8% during the forecast period. The growth can be attributed to its ability to perform in high temperature, power and frequency, growing demand in the solar power market, and huge demand for high resistant material and high voltage power semiconductor application.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 28)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 32)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 40)

3.1 G.Fast Chipset Market

3.2 Quantum Dots Market

3.3 Flexible Battery Market

3.4 Graphene Market

3.5 Silicon Carbide in Semiconductor Market

3.6 3D IC & 2.5D IC Packaging Market

3.7 Organic Electronics Market

3.8 Carbon Nanotubes Market

3.9 Smart Glass Market

3.10 Biochips Market

4 G. Fast Chipset Market (Page No. - 49)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Drivers

4.2.1.1 Increasing Impact of National Broadband Plan (NBP)

4.2.1.2 Increased Competition Among Broadband Service Providers

4.2.1.3 Growing Demand for Ultrafast Broadband Services

4.2.2 Restraints

4.2.2.1 Limited Residential Application of Gigabits Rates

4.2.2.2 Declining Market for Copper-Based Broadband Technology Globally

4.2.3 Opportunities

4.2.3.1 Greater Cost-Effectiveness of G.Fast Compared to FTTH

4.2.4 Challenges

4.2.4.1 Limitation of G.Fast in Areas With Low Population Density

4.2.4.2 Technical Complexity in Reverse Power Feeding

4.3 G.Fast Chipset Market, By Deployment Type

4.3.1 CPE

4.3.2 DPU

4.4 G.Fast Chipset Market By End User

4.4.1 Residential

4.4.2 Enterprise/Commercial

4.5 G.Fast Chipset Market, By Copper Line Length

4.5.1 Copper-Line Length of Shorter Than 100 Meters

4.5.2 Copper-Line Length of 100 Meters150 Meters

4.5.3 Copper-Line Length of 150 Meters200 Meters

4.5.4 Copper-Line Length of 200 Meters250 Meters

4.5.5 Copper-Line Length Longer Than 250 Meters

4.6 G.Fast Chipset Market, By Region

4.6.1 North America

4.6.2 Europe

4.6.3 Asia-Pacific

4.6.4 RoW

4.7 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

4.7.1 Broadcom Ltd.

4.7.2 Sckipio Technologies Si Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

5 Quantum Dots Market (Page No. - 70)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand of Quantum Dots for Superior Performance and Resolution Quality

5.2.1.2 Quantum Dot Nanomaterial is Used as an Energy Efficient Technology

5.2.1.3 Cost Effective Silicon Dioxide Quantum Dot Based Light Emitting Diodes are Expected to Drive the Market

5.2.1.4 The Need of the Ultra-Low Power Very Large Scale Integration (VLSI) Design is Expected to Increase the Use of Quantum Dots

5.2.1.5 The Miniature Property of A Quantum Dot Helps Its Implementation in Almost All Applications

5.2.2 Restraints

5.2.2.1 Slow Adoption of Technology Due to the Lack of Awareness Among Consumers

5.2.2.2 Quantum Dot Material is Extremely Expensive

5.2.2.3 Reduced Prices of Competitive Technologies Could Impact the Launch of QD Products

5.2.2.4 Competition From Low Cost Competing Technologies

5.2.3 Opportunities

5.2.3.1 Penetration of Quantum Dots Technology in Defense and Security Applications

5.2.3.2 High Penetration of QD in Industrial Sector

5.2.3.3 Quantum Dot is Preferred By Display and Lighting Industries

5.2.4 Challenges

5.2.4.1 Raw Material Availability

5.2.4.2 Utilization of Heavy Metals as Raw Material

5.3 Quantum Dots Market, By Product Type

5.3.1 QD Medical Devices

5.3.2 QD Display

5.3.3 Others

5.3.3.1 QD Solar Cells

5.3.3.2 QD Laser

5.3.3.3 QD Chips

5.3.3.4 QD Sensors

5.3.3.5 QD Lighting (LED)

5.3.3.6 Batteries and Energy Storage

5.3.3.7 Transistor

5.4 Quantum Dots Market, By Material

5.4.1 Cadmium Selenide

5.4.1.1 Applications

5.4.2 Cadmium Sulfide

5.4.2.1 Applications

5.4.3 Cadmium Telluride

5.4.3.1 Applications

5.4.4 Indium Arsenide

5.4.4.1 Applications

5.4.5 Silicon

5.4.6 Graphene

5.5 Quantum Dot Market, By Application

5.5.1 Healthcare

5.5.2 Consumer

5.5.3 Defense

5.5.4 Industry

5.6 Quantum Dots Market, By Region

5.6.1 North America

5.6.2 Europe

5.6.3 Asia-Pacific

5.6.4 RoW

5.7 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

5.7.1 QD Vision Inc.

5.7.2 Nanosys Inc.

*Details Might Not Be Captured in Case of Unlisted Companies.

6 Flexible Battery Market (Page No. - 91)

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Growing Demand for Wearable Electronics

6.2.1.2 Demand for Thin and Flexible Batteries in Electronic Devices

6.2.1.3 Increasing Miniaturization of Electronic Devices

6.2.2 Restraints

6.2.2.1 Requirement for High Initial Investment

6.2.2.2 Lack of Standardization in the Development of Flexible Batteries

6.2.3 Opportunities

6.2.3.1 Implementation of Flexible Lithium-Air Batteries in Next-Generation Wearable Electronics

6.2.3.2 Huge Opportunity for Thin and Flexible Battery From Internet of Things

6.2.4 Challenges

6.2.4.1 Fabrication of Flexible Lithium Ion Batteries

6.2.4.2 Absence of Material That Can Provide Sufficient Power Supply

6.3 Flexible Battery Market, By Type

6.3.1 Thin-Film Battery

6.3.2 Printed Battery

6.3.3 Curved Battery

6.3.4 Other Types

6.4 Flexible Battery Market, By Chargeability

6.4.1 Rechargeable Battery

6.4.2 Single-Use Battery

6.5 Flexible Battery Market, By Application

6.5.1 Smart Packaging

6.5.2 Smart Cards (E-Cards)

6.5.3 Wearable Devices

6.5.4 Medical Devices

6.5.5 Consumer Electronics

6.5.6 Entertainment

6.5.7 Wireless Communication

6.5.8 Other Applications

6.6 Flexible Battery Market, By Region

6.6.1 North America

6.6.2 Europe

6.6.3 Asia-Pacific

6.6.4 RoW

6.7 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

6.7.1 Samsung SDI Co., Ltd.

6.7.2 Stmicroelectronics N.V.

*Details Might Not Be Captured in Case of Unlisted Companies.

7 Graphene Market (Page No. - 113)

7.1 Introduction

7.2 Market Dynamics

7.2.1 Drivers

7.2.1.1 Increasing Demand for Graphene in the Application Sectors

7.2.1.2 Increasing Focus on R&D Activities

7.2.2 Restraints

7.2.2.1 Lack of Band Gap

7.2.2.2 Incapability of Mass Production

7.2.3 Opportunities

7.2.3.1 Increasing Patents

7.2.3.2 Rising Cross-Industry Collaboration

7.2.4 Challenges

7.2.4.1 High Production Cost

7.3 Graphene Market Size, By Type

7.3.1 Graphene Oxide (Go)

7.3.2 Graphene Nanoplatelets

7.3.3 Others

7.4 Graphene Market, By Application

7.4.1 Electronics

7.4.2 Composites

7.4.3 Energy

7.4.4 Coatings

7.4.5 Sensors

7.4.6 Catalysts

7.4.7 Others

7.5 Graphene Market, By Region

7.5.1 North America

7.5.2 Asia-Pacific

7.5.3 Europe

7.5.4 RoW

7.6 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

7.6.1 Graphene Nanochem PLC

7.6.2 CVD Equipment Corporation

*Details Might Not Be Captured in Case of Unlisted Companies.

8 Silicon Carbide in Semiconductor Market (Page No. - 129)

8.1 Introduction

8.2 Market Dynamics

8.2.1 Drivers

8.2.1.1 The Ability of SIC to Perform in High Temperature, Power, and Frequency

8.2.1.1.1 High Temperature

8.2.1.1.2 High Power

8.2.1.1.3 High Frequency

8.2.1.2 The Growing Solar Power Market

8.2.1.3 A Surge in Demand for High Resistant Material

8.2.1.4 Huge Demand for High-Voltage Power Semiconductor Applications

8.2.1.5 Demand From the Military, Defense, and Aerospace Sector

8.2.2 Restraints

8.2.2.1 Gallium Nitride- A Huge Competition to the Silicon Carbide Based Device Market

8.2.3 Challenges

8.2.3.1 Poor Oxidation Resistance at High Temperatures Expected to Create A Technical Challenge

8.2.4 Opportunities

8.2.4.1 Huge Opportunities Expected From the Automotive Sector

8.3 Silicon Carbide Market, By Technology

8.3.1 Silicon Carbide Semiconductor Market By SIC Polytypes

8.3.1.1 2H-SIC Semiconductors Market

8.3.1.2 3C-SIC Semiconductors Market

8.3.1.3 4H-SIC Semiconductors Market

8.3.1.4 6H-SIC Semiconductors Market

8.3.2 Silicon Carbide Semiconductor Market By Semiconductor Materials

8.3.2.1 IV-IV SIC Semiconductors Market

8.3.2.1.1 SIC-On-Silicon Semiconductors Market

8.3.2.1.2 SIC-On-Sapphire Semiconductors Market

8.3.2.1.3 SIC-On-Graphite Semiconductors Market

8.3.2.1.4 SIC-On-Graphene Semiconductors Market

8.3.2.2 III-V SIC Semiconductors Market

8.3.2.2.1 SIC-On-Gan Semiconductors Market

8.3.2.2.2 SIC-On-A|N Semiconductors Market

8.3.2.2.3 Composite Materials-Based SIC Semiconductors Market

8.3.2.2.4 Alloy Materials-Based SIC Semiconductors Market

8.4 Silicon Carbide Market, By Product

8.4.1 SIC Power Semiconductors Market

8.4.1.1 SIC Power Semiconductor Devices and Invertors

8.4.1.2 SIC Power Diodes

8.4.1.3 SIC Power Discrete Market

8.4.2 SIC Optosemiconductors Market

8.4.3 SIC High-Temperature Semiconductors Market

8.5 Silicon Carbide Market, By Application

8.5.1 Automotive Sector

8.5.1.1 Electric Vehicles & Hybrid Electric Vehicles (HEVS)

8.5.1.2 Automotive Braking Systems

8.5.1.3 Automobile Motor Drives

8.5.2 Aerospace and Defense

8.5.2.1 Combat Vehicles

8.5.2.2 Ships & Vessels

8.5.2.3 Microwave Radiation Applications

8.5.2.4 Radiation-Hard Electronics

8.5.3 Computers

8.5.3.1 Computer Hardware Power Modules

8.5.3.2 UPS Systems

8.5.4 Consumer Electronics

8.5.4.1 Inverters

8.5.4.2 LED (Light Emitting Diode) Lighting

8.5.4.3 SMPS (Switch Mode Power Supply)

8.5.5 Ict (Information & Communication Technology)

8.5.5.1 Signal Amplifiers and Switching Systems

8.5.5.2 Wireless Application Devices

8.5.5.3 Wired Communication Devices

8.5.5.4 Satellite Communication Applications

8.5.5.5 Radar Applications

8.5.5.6 RF (Radio Frequency) Applications

8.5.6 Industrial Sector

8.5.6.1 Industrial Motor Drives

8.5.6.2 Commercial Motor Drives

8.5.6.3 Electro-Mechanical Computing Systems

8.5.6.4 High-Temperature Electronics & Sensors

8.5.7 Medical & Healthcare

8.5.7.1 Implantable Medical Devices

8.5.7.2 Bio-Medical Electronics

8.5.8 Power Sector

8.5.8.1 Smart Grid Power Systems

8.5.8.2 Power Factor Correction (PFC) System

8.5.8.3 Power Distribution Systems

8.5.8.4 High Voltage Direct Current (HVDC) Systems

8.5.9 Railways

8.5.9.1 Railway Traction

8.5.10 Solar & Wind Power Sector

8.5.10.1 Wind Turbines and Wind Power Systems

8.5.10.2 Photovoltaic (PV) Inverters

8.5.10.3 Solar Panels

8.5.11 Others

8.5.11.1 Astronomy

8.5.11.2 Pyrometer

8.6 Silicon Carbide Market, By Region

8.6.1 North America

8.6.2 Europe

8.6.3 Asia-Pacific

8.6.4 RoW

8.7 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

8.7.1 Renesas Electronics Corporation

8.7.2 Toshiba Corporation

*Details Might Not Be Captured in Case of Unlisted Companies.

9 3D IC & 2.5D IC Packaging Market (Page No. - 159)

9.1 Introduction

9.2 Market Dynamics

9.2.1 Drivers

9.2.1.1 Increasing Need for Advanced Architecture in Electronic Products

9.2.1.2 Rising Trend of Miniaturization of Electronics Devices

9.2.1.3 Growing Market for Smartphones, Tablets, and Gaming Devices

9.2.2 Restraints

9.2.2.1 Higher Level of Integration Results in Thermal Issues

9.2.2.2 High Unit Cost of 3D IC and 2.5D IC Packages

9.2.3 Opportunities

9.2.3.1 Growing Adoption of High-End Computing, Servers, and Data Centers

9.2.4 Challenges

9.2.4.1 Effective Supply Chain Management

9.3 3D IC and 2.5D IC Packaging Market, By Packaging Technology

9.3.1 3D Wafer-Level Chip-Scale Packaging (WLCSP)

9.3.2 3D TSV

9.3.3 2.5D

9.4 3D IC and 2.5D IC Packaging Market, By Application

9.4.1 Logic

9.4.2 Imaging & Optoelectronics

9.4.3 Memory

9.4.4 MEMS/Sensors

9.4.5 LED

9.4.6 Power, Analog & Mixed Signal, RF, Photonics

9.5 3D IC and 2.5D IC Packaging Market, By End-User Industry

9.5.1 Consumer Electronics

9.5.2 Telecommunication

9.5.3 Industrial Sector

9.5.4 Automotive

9.5.5 Military & Aerospace

9.5.6 Smart Technologies

9.5.7 Medical Devices

9.6 3D IC and 2.5D IC Packaging Market, By Region

9.6.1 APAC

9.6.2 North America

9.6.3 Europe

9.6.4 Rest of the World

9.7 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

9.7.1 Taiwan Semiconductor Manufacturing Company Limited

9.7.2 Samsung Electronics Co., Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

10 Organic Electronics Market (Page No. - 178)

10.1 Introduction

10.2 Market Dynamics

10.2.1 Drivers

10.2.1.1 Rapidly Growing Consumer Electronics Industry Transforms Organic Electronics Market

10.2.1.2 Improved Performance and Sustainable Technology Accelerates the Growth of the Organic Electronics Market

10.2.1.3 Emerging Functionalities and Applications Driving the Growth of the Organic Electronics Market

10.2.2 Restraints

10.2.2.1 Competing Technologies

10.2.2.2 Low Electrical Conductivity

10.2.3 Opportunities

10.2.3.1 Penetration Into Multiple Applications

10.2.3.1.1 Military

10.2.3.1.2 Digital Signage

10.2.4 Challenges

10.2.4.1 Complex and Time Consuming Fabrication of Large Panel Oled Displays

10.3 Organic Electronics Market, By Material

10.3.1 Semiconductor Material

10.3.1.1 Small Molecules

10.3.1.2 Polymers

10.3.2 Conductive Materials

10.3.2.1 Organic

10.3.2.2 Inorganic

10.3.3 Dielectric Materials

10.3.3.1 Polycarbonate

10.3.3.2 PMMA

10.3.3.3 PP

10.3.3.4 PVA

10.3.3.5 PET

10.3.4 Substrate Materials

10.3.4.1 Glass Substrates

10.3.4.2 Plastic Substrates

10.3.4.3 Metal Foil

10.4 Organic Electronics Market, By Application

10.4.1 Display Application

10.4.1.1 Oled Displays

10.4.1.2 Electrochromic

10.4.1.3 Electroluminescent

10.4.1.4 Electrophoretic

10.4.2 Oled Lighting Application

10.4.3 Organic Photovoltaic Application

10.4.4 System Components Application

10.4.4.1 Logic & Memory Devices

10.4.4.2 Organic Sensors

10.4.4.3 Conductive Ink

10.4.4.4 Organic Radio Frequency Identification (ORFID) Tags

10.4.4.5 Printed Batteries

10.4.5 Other Organic Electronics Applications

10.4.5.1 Smart Applications

10.4.5.2 Disposable Electronics

10.4.5.3 Paper Substrates

10.4.5.4 Organic Transistors

10.5 Organic Electronics Market, By Region

10.5.1 North America

10.5.2 Europe

10.5.3 Asia-Pacific

10.5.4 RoW

10.6 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.6.1 Universal Display Corporation (UDC) (Organic Material Supplier)

10.6.2 BASF SE (Organic Material Supplier)

10.6.3 Samsung Display (Display Panel Manufacturer)

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Carbon Nanotubes Market (Page No. - 203)

11.1 Introduction

11.2 Market Dynamics

11.2.1 Drivers

11.2.1.1 Superior Properties

11.2.1.2 Surging Demand From End-Use Industries

11.2.1.3 Technological Advancements and Feasible Scenarios

11.3 Restraints

11.3.1 Health & Safety Issues

11.3.2 High Price & Processing Difficulties

11.3.3 Purification Required

11.4 Opportunities

11.4.1 Growing Opportunities in the Emerging Applications

11.4.2 Increasing Application Areas as Prices Decrease

11.4.3 Opportunities in the Emerging Economies

11.5 Challenges

11.5.1 Quality Issues

11.6 Carbon Nanotubes Market, By Type

11.6.1 Single-Walled Carbon Nanotubes (SWCNTs)

11.6.2 Multi-Walled Carbon Nanotubes (MWCNTs)

11.7 Carbon Nanotubes Market, By Application

11.7.1 Electronics & Semiconductors

11.7.2 Chemical & Polymers

11.7.3 Batteries & Capacitors

11.7.4 Energy

11.7.5 Medical Application

11.7.6 Advanced Materials Application

11.7.7 Aerospace & Defense Applications

11.7.8 Others

11.8 Carbon Nanotubes Market, By Region

11.8.1 Asia-Pacific

11.8.2 North America

11.8.3 Europe

11.8.4 RoW

11.9 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.9.1 Arkema S.A.

11.9.2 Hanwha Chemical Co. Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Smart Glass Market (Page No. - 222)

12.1 Introduction

12.2 Market Dynamics

12.2.1 Drivers

12.2.1.1 Optimal Energy Saving Performance

12.2.1.2 Emerging Eco-Friendly / Green Buildings

12.2.1.3 Robust Demand From Automotive Sector

12.2.1.4 Supportive Government Mandates and Legislations

12.2.2 Restraints

12.2.2.1 Related Performance Issues

12.2.2.2 Higher Cost of Smart Glass

12.2.2.3 Limited Commercialization

12.2.2.4 Lack of Awareness of Long Term Benefits

12.2.3 Opportunities

12.2.3.1 Increasing Demand for Energy Efficient Products

12.2.3.2 Emerging Applications Power Generation Plant (Solar)

12.2.3.3 Tapping Potential Avenues

12.2.4 Challenges

12.2.4.1 High Investment Required for Manufacturing and R&D

12.3 Smart Glass Market, By Technology

12.3.1 Technological Trends

12.3.1.1 Photovoltaic and Oled Lighting

12.3.1.2 3D Gorilla Glass

12.3.1.3 Smart Controls for Smart Glass

12.3.1.4 Comparison of Technologies

12.3.2 Low-E Glass

12.3.3 Active Glass

12.3.3.1 Suspended Particle Device Glass

12.3.3.2 Electrochromic Glass

12.3.3.3 Liquid Crystals (LCS)/Polymer Dispersed Liquid Crystals (PDLCS) Glass

12.3.3.4 Micro-Blinds

12.3.3.5 Nanocrystals

12.3.4 Passive Glass

12.3.4.1 Photochromic Glass

12.3.4.2 Thermochromic Glass

12.4 Smart Glass Market, By End-Use Industry

12.4.1 Architectural

12.4.1.1 Commercial

12.4.1.2 Residential

12.4.2 Transportation

12.4.2.1 Automotive

12.4.2.2 Bus/Rail

12.4.2.3 Aerospace

12.4.2.4 Marine

12.4.3 Power Generation Plant (Solar)

12.4.4 Conusmer Electronics and Others

12.5 Smart Glass Market, By Region

12.5.1 North America

12.5.2 Europe

12.5.3 Asia-Pacific

12.5.4 RoW

12.6 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.6.1 Sage Electrochromics, Inc.

12.6.2 Research Frontiers Incorporated

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Biochips Market (Page No. - 252)

13.1 Introduction

13.2 Market Dynamics

13.2.1 Drivers

13.2.1.1 Increasing Adoption of Personalized Medicine

13.2.1.2 Growing Applications of Biochips

13.2.1.3 Technological Advancements

13.2.2 Restraints

13.2.2.1 Unclear Regulatory Guidelines

13.2.2.2 High Instrumentation Costs

13.2.2.3 Absolute Quantification of Specific Mrna Expressions

13.2.3 Opportunities

13.2.3.1 Significant Growth Prospects in Developing Countries

13.2.3.2 Biochip Technology, A Safe and Economical Alternative to Animal Testing

13.2.4 Challenges

13.2.4.1 Complexity of Biological Systems

13.3 Biochips Market, By Type

13.3.1 DNA Chips

13.3.1.1 DNA Chips Market, By Application

13.3.1.2 Gene Expression

13.3.1.3 SNP Genotyping

13.3.1.4 Cancer Diagnosis & Treatment

13.3.1.5 Genomics

13.3.1.6 Drug Discovery

13.3.1.7 Agricultural Biotechnology

13.3.1.8 Other DNA Chip Applications

13.3.2 Lab-On-A-Chip

13.3.2.1 Lab-On-A-Chip Market, By Application

13.3.2.2 Clinical Diagnostics

13.3.2.3 Genomics

13.3.2.4 IVD & POC

13.3.2.5 Proteomics

13.3.2.6 Drug Discovery

13.3.2.7 Other Loac Applications Market

13.3.3 Protein Chips

13.3.3.1 Protein Chips Market, By Applications

13.3.3.2 Proteomics

13.3.3.3 Expression Profiling

13.3.3.4 Diagnostics

13.3.3.5 High-Throughput Screening

13.3.3.6 Drug Discovery

13.3.3.7 Other Applications

13.3.4 Other Arrays

13.3.4.1 Cell Arrays

13.3.4.2 Tissue Arrays

13.4 Biochips Market, By Fabrication Technology

13.4.1 Microarrays

13.4.2 Microfluidics

13.5 Biochips Market, By End User

13.5.1 Biotechnology and Pharmaceutical Companies

13.5.2 Hospitals and Diagnostics Centers

13.5.3 Academic & Research Institutes

13.5.4 Others

13.6 Biochips Market, By Region

13.6.1 North America

13.6.2 Europe

13.6.3 Asia-Pacific

13.6.4 Rest of the World (RoW)

13.7 Company Profile

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.7.1 Thermo Fisher Scientific, Inc.

13.7.2 Agilent Technologies, Inc.

*Details Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 279)

14.1 Additional Company Profile

14.1.1 Quantum Dots Market

14.1.1.1 Quantum Material Corporation

14.1.1.2 Nanoco Group PLC.

14.1.1.3 QD Laser Inc.

14.1.1.4 Altair Nanotechnologies Inc.

14.1.1.5 Invisage Technologies Inc.

14.1.1.6 Evident Technologies

14.1.1.7 Nn-Labs LLC

14.1.1.8 Ocean Nanotech LLC

14.1.2 3D IC & 2.5D IC Packaging Market

14.1.2.1 Toshiba Corp.

14.1.2.2 ASE Group

14.1.2.3 Amkor Technology

14.1.2.4 United Microelectronics Corp.

14.1.2.5 Stmicroelectronics Nv

14.1.2.6 Broadcom Ltd.

14.1.2.7 Intel Corporation.

14.1.2.8 Jiangsu Changjiang Electronics Technology Co., Ltd

14.1.3 Flexible Battery Market

14.1.3.1 LG Chem Ltd.

14.1.3.2 Enfucell Oy Ltd.

14.1.3.3 Ultralife Corp.

14.1.3.4 Blue Spark Technologies, Inc.

14.1.3.5 Brightvolt Inc.

14.1.3.6 Panasonic Corp.

14.1.3.7 NEC Energy Solutions Inc.

14.1.3.8 Rocket Electric Co., Ltd.

14.1.3.9 Guangzhou Fullriver Battery New Technology Co., Ltd.

14.1.4 Graphene Market

14.1.4.1 Graphenea SA

14.1.4.2 Grafoid Inc.

14.1.4.3 Haydale Graphene Industries PLC

14.1.4.4 2D Carbon Tech Inc., Ltd.

14.1.4.5 Group Nanoxplore Inc.

14.1.4.6 Thomas Swan & Co., Ltd.

14.1.4.7 Vorbeck Materials

14.1.4.8 XG Sciences Inc.

14.1.5 Organic Electronics Market

14.1.5.1 Au Optronics Corporation (Display Panel Manufacturer)

14.1.5.2 Sumitomo Corporation (Organic Material Supplier)

14.1.5.3 Dupont (E. I. Du Pont De Nemours and Company) (Organic Material Supplier)

14.1.5.4 LG Display (Display Panel Manufacturer)

14.1.5.5 Merck KGaA (Organic Material Supplier)

14.1.5.6 Novaled GmbH (Organic Material Supplier)

14.1.5.7 Koninklijke Philips N.V. (End User)

14.1.5.8 Sony Corporation (End User)

14.1.6 Carbon Nanotubes Market

14.1.6.1 Kumho Petrochemical

14.1.6.2 Showa Denko K.K.

14.1.6.3 Toray Industries, Inc.

14.1.6.4 Cnano Technology Limited

14.1.6.5 Nanocyl S.A.

14.1.6.6 Hyperion Catalysis International Inc.

14.1.6.7 Arry International Group Limited

14.1.6.8 Carbon Solutions, Inc.

14.1.6.9 Cheap Tubes Inc.

14.1.6.10 Cnt Co., Ltd.

14.1.6.11 Continental Carbon Company

14.1.6.12 Klean Carbon Inc.

14.1.6.13 Nano-C Inc.

14.1.6.14 Nanointegris Inc.

14.1.6.15 Nanolab Inc.

14.1.6.16 Nanoshel LLC

14.1.6.17 Nanothinx S.A.

14.1.6.18 Southwest Nanotechnologies, Inc.

14.1.6.19 Thomas Swan & Co. Ltd.

14.1.7 Smart Glass Market

14.1.7.1 View Inc.

14.1.7.2 PPG Industries

14.1.7.3 Asahi Glass Co. Ltd.

14.1.7.4 Gentex Corporation

14.1.7.5 Hitachi Chemical Co. Ltd.

14.1.7.6 Glass Apps LLC

14.1.7.7 Pleotint, LLC

14.1.7.8 Ravenbrick LLC

14.1.7.9 Scienstry Inc.

14.1.7.10 Smartglass International Ltd.

14.1.7.11 SPD Control System Corporation

14.1.8 Biochips Market

14.1.8.1 ABBott Laboratories

14.1.8.2 Perkinelmer, Inc.

14.1.8.3 Fluidigm Corporation

14.1.8.4 Illumina, Inc.

14.1.8.5 GE Healthcare

14.1.8.6 Bio-Rad Laboratories Inc.

14.1.8.7 Cepheid Inc.

14.1.8.8 Roche Diagnostics

14.1.9 G. Fast Chipset Market

14.1.9.1 Qualcomm, Inc.

14.1.9.2 Metanoia Communications, Inc.

14.1.9.3 Chunghwa Telecom Co., Ltd.

14.1.9.4 Centurylink, Inc.

14.1.9.5 BT Group PLC

14.1.9.6 Swisscom AG

14.1.9.7 Mediatek, Inc.

14.1.9.8 Marvell Technology Group Ltd.

14.1.10 Silicon Carbide in Semiconductor Market

14.1.10.1 Cree Incorporated

14.1.10.2 Fairchild Semiconductor International Inc.

14.1.10.3 Genesic Semiconductor Inc.

14.1.10.4 Infineon Technologies AG

14.1.10.5 Microsemi Corporation

14.1.10.6 Norstel AB

14.1.10.7 Rohm Co. Ltd.

14.1.10.8 Stmicroelectronics N.V

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (69 Tables)

Table 1 Global G. Fast Chipset Market, 2014-2021

Table 2 Internet Speed Needed for Various Residential Applications

Table 3 G.Fast Chipset Market, By Deployment Type, 20142021 (USD Million)

Table 4 G.Fast Chipset Market, By End User, 20142021 (USD Million)

Table 5 G.Fast Chipset Market, By Copper-Line Length, 20142021 (USD Million)

Table 6 G.Fast Chipset Market, By Region, 20142021 (USD Million)

Table 7 Global Quantum Dots Market Size, 20142021

Table 8 Global QD Market Size, By Products (2014-2021), (USD Million)

Table 9 Quantum Dots Market Size, By Material , 2014-2021 (USD Million)

Table 10 Global Quantum Dot Market Size, By Application, 2014-2021 (USD Million)

Table 11 Quantum Dots Market Size, By Region, 20142021 (USD Million)

Table 12 Global Flexible Battery Market Size, 20142021 (USD Million)

Table 13 Flexible Battery Market, By Type, 20142021 (USD Million)

Table 14 Flexible Battery Market, By Type, 20142021 (Million Units)

Table 15 Flexible Battery Market, By Chargeability, 20142021 (USD Million)

Table 16 Flexible Battery Market Size, By Application, 20142021 (USD Million)

Table 17 Flexible Battery Market, By Region, 20142021 (USD Million)

Table 18 Global Graphene Market Size, 20142021

Table 19 Graphene Market Size, By Type, 20142021 (USD Million)

Table 20 Graphene Market Size, By Type, 20132020 (Ton)

Table 21 Graphene Market Size, By Application, 20142021 (USD Million)

Table 22 Graphene Market Size, By Application, 20152020 (Ton)

Table 23 Graphene Market Size, By Region, 20142021 (USD Million)

Table 24 Graphene Market Size, By Region, 20132020 (Tons)

Table 25 Global Silicon Carbide Market Size, 20142021

Table 26 Properties of SIC Materials & Competitor Materials

Table 27 SIC Market Size, By Polymer Type, 2014-2021 (USD Million)

Table 28 SIC Market Size, By Semiconductor Material, 2014-2021 (USD Million)

Table 29 Silicon Carbide Market, By Product, 2014-2021 (USD Million)

Table 30 Silicon Carbide Market, By Application, 2014-2021 (USD Million)

Table 31 Silicon Carbide Market, By Region, 2014-2021 (USD Million)

Table 32 Global 3D IC & 2.5D IC Packaging Market Size, 20142021

Table 33 3D IC and 2.5D IC Packaging Market, By Packaging Technology, 20142021 (USD Million)

Table 34 3D IC and 2.5D IC Packaging Market, By Application, 20142021 (USD Million)

Table 35 3D IC and 2.5D IC Wafer (12 Eq.) Market, By Application, 20142021 (Thousand Units)

Table 36 3D IC and 2.5D IC Packaging Market, By End-User Industry, 20142021 (USD Million)

Table 37 3D IC and 2.5D IC Packaging Market, By Region, 20142021 (USD Million)

Table 38 Global Organic Electronics Market Size, 20142021

Table 39 Organic Electronics Market, By Material, 2014-2021 (USD Million)

Table 40 Global Organic Electronics Market Size, By Application, 2014-2021 (USD Million)

Table 41 Organic Electronics Market Size, By Region, 20142021 (USD Million)

Table 42 Global Carbon Nanotubes Market Size, By Region, 20142021

Table 43 Mechanical Properties Cnts V/S Other Material Properties

Table 44 Cnts Prices Comparison With Other Competitive Materials

Table 45 Cnts: Future Applications

Table 46 Carbon Nanotubes Market Size, By Type, 20142021 (USD Million)

Table 47 Carbon Nanotubes Market Size, By Type, 20142021 (Ton)

Table 48 Carbon Nanotubes Market Size, By Application, 2014-2021 (USD Million)

Table 49 Carbon Nanotubes Market Size, By Application, 20142021 (Ton)

Table 50 Carbon Nanotubes Market Size, By Region, 20142021 (USD Million)

Table 51 Carbon Nanotubes Market Size, By Region, 20142021 (Ton)

Table 52 Global Smart Glass Market Size, 20142021

Table 53 Smart Glass Market Size, By Technology, 20142021 (USD Million)

Table 54 Smart Glass Market Size, By Technology, 20142021 (Million Units)

Table 55 Smart Glass Characteristics, By Technology

Table 56 SPD Glass Product Specification

Table 57 LC Product Specifications

Table 58 Technological Challenges and Shortcomings of Photochromic Glass

Table 59 Global Smart Glass Market, By End-Use Industry, 20142021 (USD Million)

Table 60 Global Smart Glass Market Size, By Region, 20142021 (USD Million)

Table 61 Global Biochips Market, 2014-2021

Table 62 Biochips Market Size, By Type, 20142021 (USD Million)

Table 63 DNA Chips Market Size, By Application, 20132020 (USD Million)

Table 64 Lab-On-A-Chip Market Size, By Application, 20142021 (USD Million)

Table 65 Protein Chips Market Size, By Application, 20142021 (USD Million)

Table 66 Other Arrays Market Size, By Type, 20132020 (USD Million)

Table 67 Biochip Market Size, By Fabrication Technology, 20142021 (USD Million)

Table 68 Biochips Market Size, By End User, 20142021 (USD Million)

Table 69 Biochips Market Size, By Region, 20142021 (USD Million)

List of Figures (69 Figures)

Figure 1 Top 10 Advanced Materials & Technologies in Electronics: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Research Methodology: Data Triangulation

Figure 5 CPE Deployment to Hold A Larger Share of the G.Fast Chipset Market By 2021

Figure 6 Quantum Dots Market, By Application, 2021

Figure 7 Demand in Consumer Electronics Expected to Create Attractive Growth Opportunities in the Flexible Battery Market

Figure 8 Graphene Oxide Projected to Dominate the Graphene Market, By Type

Figure 9 Silicon Carbide in Semiconductor Market, By Product (USD Million)

Figure 10 Asia-Pacific to Dominate the 3D IC & 2.5D IC Packaging Market in 2015

Figure 11 Global Organic Electronics Market, By Material, 2013

Figure 12 Asia-Pacific to Dominate the Carbon Nanotubes Market Between 2016 & 2021

Figure 13 Global Smart Glass Market, By Region,2015

Figure 14 Hospitals and Diagnostics Centers Segment Dominated the Biochips End-User Market in 2015

Figure 15 Increased Competition Among Broadband Service Providers is Driving the G.Fast Chipset Market

Figure 16 Last 200 Meters Deployment Cost for FTTH and G.Fast

Figure 17 Broadcom Ltd: Company Snapshot

Figure 18 Broadcom Ltd: SWOT Analysis

Figure 19 SWOT Analysis: Sckipio Technologies Si Ltd.

Figure 20 Growing Demand of Quantum Dots for Superior Performance and Resolution Quality is the Main Driver

Figure 21 Quantum Dots Market Segmentation, By Product Type

Figure 22 SWOT Analysis: QD Vision, Inc.

Figure 23 Nanosys Inc.: SWOT Analysis

Figure 24 Flexible Battery Market Dynamics

Figure 25 Market for Wearable Technology (20132020)

Figure 26 Flexible Battery Market, By Application

Figure 27 Samsung SDI Co., Ltd.: Company Snapshot

Figure 28 Samsung SDI Co., Ltd.: SWOT Analysis

Figure 29 Stmicroelectronics N.V.: Company Snapshot

Figure 30 Stmicroelectronics N.V.: SWOT Analysis

Figure 31 Drivers, Restraints, Opportunities, and Challenges in Graphene Market

Figure 32 Graphene Nanochem PLC: Company Snapshot

Figure 33 Graphene Nanochem PLC: SWOT Analysis

Figure 34 CVD Equipment Corporation: Company Snapshot

Figure 35 CVD Equipment Corporation: SWOT Analysis

Figure 36 SIC Semiconductor Devices Market, By Technology

Figure 37 SIC Semiconductor Market By Product

Figure 38 Silicon Carbide Market, By Application

Figure 39 Renesas Electronics Corp.: Company Snapshot

Figure 40 Renesas Electronics Corporation: SWOT Analysis

Figure 41 Toshiba Corporation: Company Snapshot

Figure 42 Toshiba Corporation: SWOT Analysis

Figure 43 Rising Trend of Miniaturization of Electronic Devices is the Major Driver for the 3D IC and 2.5D IC Packaging Market

Figure 44 TSMC Ltd.: Company Snapshot

Figure 45 TSMC Ltd. (Taiwan): SWOT Analysis

Figure 46 Samsung Electronics Co., Ltd. (South Korea): Company Snapshot

Figure 47 Samsung Electronics Co., Ltd. (South Korea): SWOT Analysis

Figure 48 Rapidly Growing Consumer Electronics Industry Will Spur the Demand for Organic Electronics

Figure 49 The Substrate Materials Share is the Highest in the Organic Materials Market

Figure 50 Universal Display Corporation: Business Overview

Figure 51 Universal Display Corporation: SWOT Analysis

Figure 52 BASF SE: Business Overview

Figure 53 BASF SE: SWOT Analysis

Figure 54 Samsung Electronics Co., Ltd.: Business Overview

Figure 55 SWOT Analysis

Figure 56 Drivers, Restraints, Opportunities, and Challenges in Carbon Nanotubes Market

Figure 57 Arkema S.A.: Company Snapshot

Figure 58 Arkema S.A.: SWOT Analysis

Figure 59 Hanwha Chemical Co. Ltd.: Company Snapshot

Figure 60 Hanwha Chemical Co. Ltd.: SWOT Analysis

Figure 61 Energy Saving Performance and Emerging Green Buildings Technology Expected to Lead to Growth Opportunities in the Smart Glass Market

Figure 62 Smart Glass Market Segmentation, By Technology

Figure 63 Smart Glass Market, By End-Use Industry

Figure 64 Sage Electrochromics Inc.: SWOT Analysis

Figure 65 Research Frontiers Incorporated: Company Snapshot

Figure 66 RFI: SWOT Analysis

Figure 67 Biochips Market: Drivers, Restraints, Opportunities and Challenges

Figure 68 Thermo Fisher Scientific: Company Snapshot

Figure 69 Agilent Technologies, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Top 10 Advanced Materials & Technologies Market