Tobacco Packaging Market by Material (Paper, Paper Boxes, Plastic, Jute), Type (Primary, Secondary, Bulk), End Use (Smoking Tobacco, Smokeless Tobacco, Raw Tobacco), and Region - Global Forecast to 2022

[162 Pages Report] The market for tobacco packaging is estimated to grow from USD 14.27 Billion in 2017 to reach USD 16.65 Billion by 2022, at a CAGR of 3.1%. The base year considered for the study is 2016 and the market size is projected from 2017 to 2022.

The key objective of the global tobacco packaging report is to provide companies with a summary of the latest trends and lucrative business expansion opportunities for tobacco packaging manufacturers, suppliers, and distributors. The report also demonstrates the key business strategies and principles adopted by the key players around the world. The segments considered for this report are based on type, end use, material, and region.

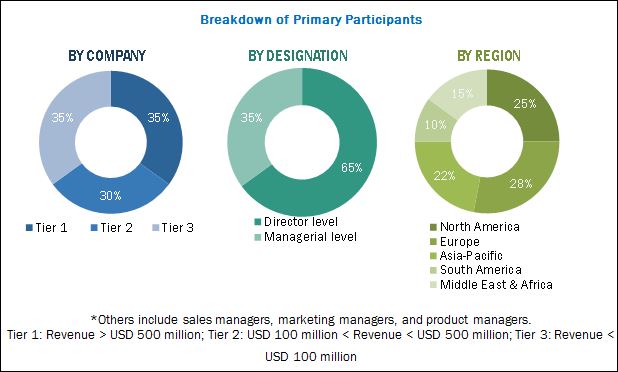

The research methodology used to forecast the market size focused on the bottom-up approach. The total market size of tobacco packaging was calculated based on the share of the various packaging types and materials derived. Providing weightage for the share and calculation were done on the basis of extensive primary interviews and secondary research from a variety of sources such as the Association for Packaging and Processing Technologies (PMMI), the Packaging Industry Association of India (PIAI), and the European Carton Makers Associations (ECMA). Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary sources is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The global tobacco packaging ecosystem comprises tobacco packaging manufacturers, vendors, and service providers such as Amcor Ltd. (Australia), Innovia Films (U.K.), WestRock (U.S.), ITC (India), Mondi Group (South Africa), Altria Group (U.S.), Ardagh Group (U.S.), British American Tobacco (U.K.), Reynolds American Corporation (U.S.), and Philip Morris International Inc. (U.S.).

Target Audience

- Tobacco packaging manufacturers

- Raw material suppliers and producers

- Regulatory bodies

- Tobacco distributors/suppliers

- Local government

- Market research and consulting firms

- End users (cigarettes, cigars, chewing gums, snuff, dissolvable tobacco)

Scope of the Report

This research report segments tobacco packaging into the following submarkets:

By Material:

- Paper

- Paper boxes

- Plastic

- Jute

- Others

By End Use:

- Smoking tobacco

- Smokeless tobacco

- Raw tobacco

By Type:

- Primary

- Secondary

- Bulk

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of markets for different recycled product types

Geographic Analysis

- Further analysis of the tobacco packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

MarketsandMarkets projects the tobacco packaging market size is estimated to grow from USD 14.27 Billion in 2017 to USD 16.65 Billion by 2022, at a CAGR of 3.1%. The tobacco packaging market is witnessing considerable growth due to the rise in per capita income and stressful lifestyles. Equality laws for women have developed a new market for female smokers, which is another key factor fueling the growth. Tobacco packaging has come across new opportunities due to the growth in population and the technological advancements

On the basis of material, the tobacco packaging market is segmented into paper boxes, paper, plastic, jute, and others. The paper box packaging segment is expected to have a high growth rate during the forecast period. Paper box packaging is a developing trend in the packaging industry. It is environment-friendly and cost-effective, and is hence gaining popularity in many regions. Due to the rising issues regarding the non-biodegradable nature of plastic and metal packaging, paper box packaging is highly preferred by manufacturers.

On the basis of type, the tobacco packaging market is segmented into primary, secondary, and bulk. The secondary segment accounted for the largest share in 2016 and is also projected to grow at the highest CAGR over the next five years. Increase in consumption of cigarettes in social gatherings and rise in demand for innovative cigarette boxes have boosted the market for secondary packaging.

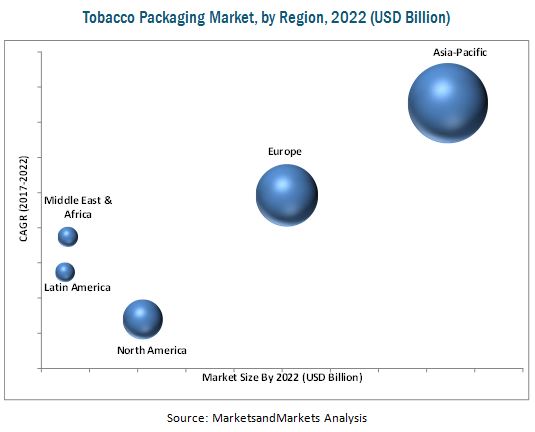

In 2016, the Asia-Pacific market accounted for the largest share of the global tobacco packaging market, followed by Europe and North America. Factors such as the growing stress in work life and rising demand for cigarettes among women have contributed to the growth in demand for tobacco packaging. In addition to this, the growing population in these countries presents a large customer base for tobacco products, which in turn is expected to drive the tobacco packaging market The rising trade of tobacco in the region drives the demand for tobacco products, subsequently driving the tobacco packaging market.

The global market for tobacco packaging is dominated by large players such as Amcor Ltd. (Australia), Innovia Films (U.K.), WestRock (U.S.), ITC (India), Mondi Group (South Africa), Altria Group (U.S.), Ardagh Group (U.S.), British American Tobacco (U.K.), Reynolds American Corporation (U.S.), and Philip Morris International Inc. (U.S.). These companies adopted various strategies such as mergers & acquisitions, expansions, new product launches, partnerships, divestitures, and joint ventures to strengthen their position in the market. Majorly adopted strategy by key players was mergers & acquisition.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Years Considered for Study

1.4 Currency Considered

1.5 Units

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Developing Economies to Witness High Demand for Tobacco Packaging

4.2 Tobacco Packaging Market, By Material

4.3 Tobacco Packaging Market, By Product Type

4.4 Tobacco Packaging Market, By Packaging Type

4.5 Asia-Pacific: Tobacco Packaging Market

4.6 Tobacco Packaging Market: Regional Snapshot

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stressful Lifestyles

5.2.1.2 Equality Laws Have Promoted Smoking Amongst Women

5.2.1.3 Rise in Disposable Income

5.2.2 Restraints

5.2.2.1 Stringent Laws on Cigarette Packaging

5.2.3 Opportunities

5.2.3.1 Technological Advancements Have Promoted Innovative Packaging

5.2.4 Challenges

5.2.4.1 Increased Public Awareness About the Effects of Consuming Tobacco

5.3 Microeconomic Indicators

6 Tobacco Packaging Market, By Material (Page No. - 38)

6.1 Introduction

6.1.1 Paper

6.1.2 Paper Boxes

6.1.2.1 White Board

6.1.2.2 Solid Board

6.1.2.3 Chipboard

6.1.2.4 Fiber Board

6.1.3 Plastic

6.1.3.1 LDPE

6.1.3.2 LLDPE

6.1.3.3 HDPE

6.1.3.4 BOPP

6.1.3.5 CPP

6.1.3.6 PVC

6.1.4 Jute

6.1.5 Others

7 Tobacco Packaging Market, By Type (Page No. - 44)

7.1 Introduction

7.2 Primary

7.3 Secondary

7.4 Bulk

8 Tobacco Packaging Market, By End Use (Page No. - 47)

8.1 Introduction

8.2 Smoking Tobacco

8.2.1 Cigarettes

8.2.2 Cigars

8.3 Smokeless Tobacco

8.3.1 Chewing Tobacco

8.3.2 Snuff

8.3.3 Dissolvable Tobacco

8.4 Raw Tobacco

9 Tobacco Packaging Market, By Region (Page No. - 51)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Russia

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 South Korea

9.4.5 Rest of Asia-Pacific

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 Qatar

9.5.4 Egypt

9.5.5 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Chile

9.6.4 Peru

9.6.5 Rest of South America

10 Competitive Landscape (Page No. - 118)

10.1 Introduction

10.2 Competitive Benchmarking

10.2.1 Products Offered (For All 25 Players)

10.2.2 Business Strategy (For All 25 Players)

10.3 Dynamic, Innovators, Vanguards, and Emerging

10.3.1 Dynamic

10.3.2 Innovators

10.3.3 Vanguards

10.3.4 Emerging

11 Company Profile (Page No. - 122)

(Business Overview, Product Offerings & Business Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Amcor Limited

11.2 Innovia Films Ltd

11.3 Westrock

11.4 ITC Limited.

11.5 Mondi Group

11.6 Altria Group

11.7 Ardagh Group

11.8 British American Tobacco P.L.C.

11.9 Reynolds American Inc.

11.10 Philip Morris International Inc.

11.11 Other Key Players

11.11.1 Sonoco Consumer Products Europe GmbH

11.11.2 Siegwerk

11.11.3 PT Hanjaya Mandala Sampoerna Tbk.

11.11.4 Karelia Tobacco Co. Inc.

11.11.5 Godfrey Phillips India Ltd

11.11.6 Ceylon Tobacco Company

11.11.7 Bulgartabac-Holding Ad

11.11.8 API Group PLC

11.11.9 Amvig Holdings Limited

11.11.10 Vector Tobacco Inc.

11.11.11 Carreras Limited

11.11.12 Marden Edwards

11.11.13 PGP Precision

11.11.14 NTC Industries Limited

11.11.15 Oracle Packaging

*Details on Business Overview, Product Offerings & Business Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 155)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (161 Tables)

Table 1 Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 2 By Market Size, By Material, 2015–2022 (Million Kg)

Table 3 Tobacco Packaging Market Size, By Type, 2015–2022 (USD Million)

Table 4 By Market Size, By End Use, 2015–2022 (USD Million)

Table 5 Tobacco Packaging Market Size, By End Use, 2015–2022 (KT)

Table 6 Tobacco Packaging Market Size, By Region, 2015–2022 (USD Million)

Table 7 By Market Size, By Region, 2015–2022 (KT)

Table 8 Tobacco Packaging Market Size, By End Use, 2015–2022 (USD Million)

Table 9 Tobacco Packaging Market Size, By End Use, 2015–2022 (KT)

Table 10 By Market Size, By Material, 2015–2022 (USD Million)

Table 11 Tobacco Packaging Market Size, By Material, 2015–2022 (KT)

Table 12 By Market Size, By Type, 2015–2022 (USD Million)

Table 13 North America: Tobacco Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 14 North America: By Market Size, By Country, 2015–2022 (KT)

Table 15 North America: By Market Size, By Material, 2015–2022 (USD Million)

Table 16 North America: By Market Size, By Material, 2015–2022 (KT)

Table 17 North America: By Market Size, By End Use, 2015–2022 (USD Million)

Table 18 North America: By Market Size, By End Use, 2015–2022 (KT)

Table 19 North America: By Market Size, By Type, 2015–2022 (USD Million)

Table 20 U.S.: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 21 U.S.: By Market Size, By Material, 2015–2022 (KT)

Table 22 U.S.: By Market Size, By End Use, 2015–2022 (USD Million)

Table 23 U.S.: By Market Size, By End Use, 2015–2022 (KT)

Table 24 U.S.: By Market Size, By Type, 2015–2022 (USD Million)

Table 25 Canada: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 26 Canada: By Market Size, By Material, 2015–2022 (KT)

Table 27 Canada: By Market Size, By End Use, 2015–2022 (USD Million)

Table 28 Canada: By Market Size, By End Use, 2015–2022 (KT)

Table 29 Canada: By Market Size, By Type, 2015–2022 (USD Million)

Table 30 Mexico: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 31 Mexico: By Market Size, By Material, 2015–2022 (KT)

Table 32 Mexico: By Market Size, By End Use, 2015–2022 (USD Million)

Table 33 Mexico: By Market Size, By End Use, 2015–2022 (KT)

Table 34 Mexico: By Market Size, By Type, 2015–2022 (USD Million)

Table 35 Europe: Tobacco Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 36 Europe: By Market Size, By Country, 2015–2022 (KT)

Table 37 Europe: By Market Size, By Material, 2015–2022 (USD Million)

Table 38 Europe: By Market Size, By Material, 2015–2022 (KT)

Table 39 Europe: By Market Size, By End Use, 2015–2022 (USD Million)

Table 40 Europe: By Market Size, By End Use, 2015–2022 (KT)

Table 41 Germany: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 42 Germany: By Market Size, By Material, 2015–2022 (KT)

Table 43 Germany: By Market Size, By End Use, 2015–2022 (USD Million)

Table 44 Germany: By Market Size, By End Use, 2015–2022 (KT)

Table 45 Germany: By Market Size, By Type, 2015–2022 (USD Million)

Table 46 France: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 47 France: By Market Size, By Material, 2015–2022 (KT)

Table 48 France: By Market Size, By End Use, 2015–2022 (USD Million)

Table 49 France: By Market Size, By End Use, 2015–2022 (KT)

Table 50 France: By Market Size, By Type, 2015–2022 (USD Million)

Table 51 U.K.: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 52 U.K.: By Market Size, By Material, 2015–2022 (KT)

Table 53 U.K.: By Market Size, By End Use, 2015–2022 (USD Million)

Table 54 U.K.: By Market Size, By End Use, 2015–2022 (KT)

Table 55 U.K.: By Market Size, By Type, 2015–2022 (USD Million)

Table 56 Russia: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 57 Russia: By Market Size, By Material, 2015–2022 (KT)

Table 58 Russia: By Market Size, By End Use, 2015–2022 (USD Million)

Table 59 Russia: By Market Size, By End Use, 2015–2022 (KT)

Table 60 Russia: By Market Size, By Type, 2015–2022 (USD Million)

Table 61 Rest of Europe: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 62 Rest of Europe: By Market Size, By Material, 2015–2022 (KT)

Table 63 Rest of Europe: By Market Size, By End Use, 2015–2022 (USD Million)

Table 64 Rest of Europe: By Market Size, By End Use, 2015–2022 (KT)

Table 65 Rest of Europe: By Market Size, By Type, 2015–2022 (USD Million)

Table 66 Asia-Pacific: Tobacco Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 67 Asia-Pacific: By Market Size, By Country, 2015–2022 (KT)

Table 68 Asia-Pacific: By Market Size, By Material, 2015–2022 (USD Million)

Table 69 Asia-Pacific: By Market Size, By Material, 2015–2022 (KT)

Table 70 Asia-Pacific: By Market Size, By End Use, 2015–2022 (USD Million)

Table 71 Asia-Pacific: By Market Size, By End Use, 2015–2022 (KT)

Table 72 Asia-Pacific: By Market Size, By Type, 2015–2022 (USD Million)

Table 73 China: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 74 China: By Market Size, By Material, 2015–2022 (KT)

Table 75 China: By Market Size, By End Use, 2015–2022 (USD Million)

Table 76 China: By Market Size, By End Use, 2015–2022 (KT)

Table 77 China: By Market Size, By Type, 2015–2022 (USD Million)

Table 78 Japan: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 79 Japan: By Market Size, By Material, 2015–2022 (KT)

Table 80 Japan: By Market Size, By End Use, 2015–2022 (USD Million)

Table 81 Japan: ByMarket Size, By End Use, 2015-2022 (KT)

Table 82 Japan: By Market Size, By Type, 2015–2022 (USD Million)

Table 83 India: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 84 India: By Market Size, By Material, 2015–2022 (KT)

Table 85 India: By Market Size, By End Use, 2015–2022 (USD Million)

Table 86 India: By Market Size, By End Use, 2015–2022 (KT)

Table 87 India: By Market Size, By Type, 2015–2022 (USD Million)

Table 88 South Korea: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 89 South Korea: By Market Size, By Material, 2015–2022 (KT)

Table 90 South Korea: By Market Size, By End Use, 2015–2022 (USD Million)

Table 91 South Korea: By Market Size, By End Use, 2015–2022 (KT)

Table 92 South Korea: By Market Size, By Type, 2015–2022 (USD Million)

Table 93 Rest of Asia-Pacific: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 94 Rest of Asia-Pacific: By Market Size, By Material, 2015–2022 (KT)

Table 95 Rest of Asia-Pacific: By Market Size, By End Use, 2015–2022 (USD Million)

Table 96 Rest of Asia-Pacific: By Market Size, By End Use, 2015–2022 (KT)

Table 97 Rest of Asia-Pacific: By Market Size, By Type, 2015–2022 (USD Million)

Table 98 Middle East & Africa: Tobacco Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 99 Middle East & Africa: By Market Size, By Country, 2015–2022 (KT)

Table 100 Middle East & Africa: By Market Size, By Material, 2015–2022 (USD Million)

Table 101 Middle East & Africa: By Market Size, By Material, 2015–2022 (KT)

Table 102 Middle East & Africa: By Market Size, By End Use, 2015–2021 (USD Million)

Table 103 Middle East & Africa: By Market Size, By End Use, 2015–2022 (KT)

Table 104 Middle East & Africa: By Market Size, By Type, 2015–2022(USD Million)

Table 105 South Africa: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 106 South Africa: By Market Size, By Material, 2015–2022 (KT)

Table 107 South Africa: By Market Size, By End Use, 2015–2022 (USD Million)

Table 108 South Africa: By Market Size, By End Use, 2015–2022 (KT)

Table 109 South Africa: By Market Size, By Type, 2015–2022(USD Million)

Table 110 Saudi Arabia: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 111 Saudi Arabia: By Market Size, By Material, 2015–2022 (KT)

Table 112 Saudi Arabia: By Market Size, By End Use, 2015–2022 (USD Million)

Table 113 Saudi Arabia: By Market Size, By End Use, 2015–2022 (KT)

Table 114 Saudi Arabia: By Market Size, By Type, 2015–2022 (USD Million)

Table 115 Qatar: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 116 Qatar: By Market Size, By Material, 2015–2022 (KT)

Table 117 Qatar: By Market Size, By End Use, 2015–2022 (USD Million)

Table 118 Qatar: By Market Size, By End Use, 2015–2022 (KT)

Table 119 Qatar: By Market Size, By Type, 2015–2022 (USD Million)

Table 120 Egypt: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 121 Egypt: By Market Size, By Material, 2015–2022 (KT)

Table 122 Egypt: By Market Size, By End Use, 2015–2022 (USD Million)

Table 123 Egypt: By Market Size, By End Use, 2015–2022 (KT)

Table 124 Egypt: By Market Size, By Type, 2015–2022 (USD Million)

Table 125 Rest of Middle East & Africa: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 126 Rest of Middle East & Africa: By Market Size, By Material, 2015–2022(KT)

Table 127 Rest of Middle East & Africa: By Market Size, By End Use, 2015–2022 (USD Million)

Table 128 Rest of Middle East & Africa: By Market Size, By End Use, 2015–2022 (KT)

Table 129 Rest of Middle East & Africa: By Market Size, By Type, 2015–2022 (USD Million)

Table 130 South America: By Market Size, By Country, 2015–2022 (USD Million)

Table 131 South America: By Market Size, By Country, 2015–2022 (KT)

Table 132 South America: By Market Size, By Material, 2015–2022 (USD Million)

Table 133 South America: By Market Size, By Material, 2015–2022 (KT)

Table 134 South America: By Market Size, By End Use, 2015–2022 (USD Million)

Table 135 South America: By Market Size, By End Use, 2015–2022 (KT)

Table 136 South America: By Market Size, By Type, 2015–2022 (USD Million)

Table 137 Brazil: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 138 Brazil: By Market Size, By Material, 2015–2022 (KT)

Table 139 Brazil: By Market Size, By End Use, 2015–2022 (USD Million)

Table 140 Brazil: By Market Size, By End Use, 2015–2022 (KT)

Table 141 Brazil: By Market Size, By Type, 2015–2022 (USD Million)

Table 142 Argentina: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 143 Argentina: By Market Size, By Material, 2015–2022 (KT)

Table 144 Argentina: By Market Size, By End Use, 2015–2022 (USD Million)

Table 145 Argentina: By Market Size, By End Use, 2015–2022 (KT)

Table 146 Argentina: By Market Size, By Type, 2015–2022 (USD Million)

Table 147 Chile: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 148 Chile: By Market Size, By Material, 2015–2022 (KT)

Table 149 Chile: By Market Size, By End Use, 2015–2022 (USD Million)

Table 150 Chile: By Market Size, By End Use, 2015–2022 (KT)

Table 151 Chile: By Market Size, By Type, 2015–2022 (USD Million)

Table 152 Peru: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 153 Peru: By Market Size, By Material, 2015–2022 (KT)

Table 154 Peru: By Market Size, By End Use, 2015–2022 (USD Million)

Table 155 Peru: By Market Size, By End Use, 2015–2022 (KT)

Table 156 Peru: By Market Size, By Type, 2015–2022 (USD Million)

Table 157 Rest of South America: Tobacco Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 158 Rest of South America: By Market Size, By Material, 2015–2022 (KT)

Table 159 Rest of South America: By Market Size, By End Use, 2015–2022 (USD Million)

Table 160 Rest of South America: By Market Size, By End Use, 2015–2022 (KT)

Table 161 Rest of South America: By Market Size, By Type, 2015–2022 (USD Million)

List of Figures (33 Figures)

Figure 1 Market Segmentation

Figure 2 Tobacco Packaging Market, By Region

Figure 3 Tobacco Packaging Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Tobacco Packaging: Data Triangulation Methodology

Figure 7 Paper Box is Projected to Remain the Largest Material Through 2022

Figure 8 Smoking Tobacco is Estimated to Account for the Largest Share in the Tobacco Packaging Market Through 2022

Figure 9 Secondary is Expected to Lead the Market for Tobacco Packaging Through 2022

Figure 10 Asia-Pacific Dominated the Tobacco Packaging Market in 2016

Figure 11 Emerging Economies Offer Attractive Opportunities in the Tobacco Packaging Market in the Forecast Period

Figure 12 Paper Boxes Packaging Segment to Lead the Market Through 2022

Figure 13 Smoking Tobacco Segment to Grow at the Highest Rate During the Forecast Period

Figure 14 Secondary Segment to Lead the Market Through 2022

Figure 15 Paper Boxes Segment Captured the Largest Share in the Asia-Pacific Market, in 2016

Figure 16 Market in China is Projected to Grow at the Highest Rate From 2017 to 2022

Figure 17 Evolution of the Tobacco Packaging Market

Figure 18 Stringent Laws on Cigarette Packaging Restrain the Growth of the Tobacco Packaging Market

Figure 19 Tobacco Packaging Market, By Material, 2017 vs 2022 (USD Million)

Figure 20 Tobacco Packaging Market, By Type, 2017 vs 2022 (USD Million)

Figure 21 Tobacco Packaging Market, By End Use, 2017 vs 2022 (USD Million)

Figure 22 Geographic Snapshot: Asia-Pacific Tobacco Packaging Market Emerging as the New Hotspot in the Forecast Period

Figure 23 Asia-Pacific: Tobacco Packaging Market Snapshot

Figure 24 Dive Chart

Figure 25 Amcor Limited: Company Snapshot

Figure 26 Westrock: Company Snapshot

Figure 27 ITC Ltd: Company Snapshot

Figure 28 Mondi Group: Company Snapshot

Figure 29 Altria Group: Company Snapshot

Figure 30 Ardagh: Company Snapshot

Figure 31 British American Tobacco: Company Snapshot

Figure 32 Reynolds American Inc.: Company Snapshot

Figure 33 Philip Morris International Inc.: Company Snapshot

Growth opportunities and latent adjacency in Tobacco Packaging Market