Thin-Film Encapsulation (TFE) Market by Application (OLED Display, OLED Lighting, and Thin-Film Photovoltaic), Deposition Type (Inorganic Layers (PECVD, ALD) and Organic Layers (Inkjet Printing and VTE), Vertical and Region - Global Forecast to 2027

Updated on : October 23, 2024

Thin-Film Encapsulation Market Size & Growth

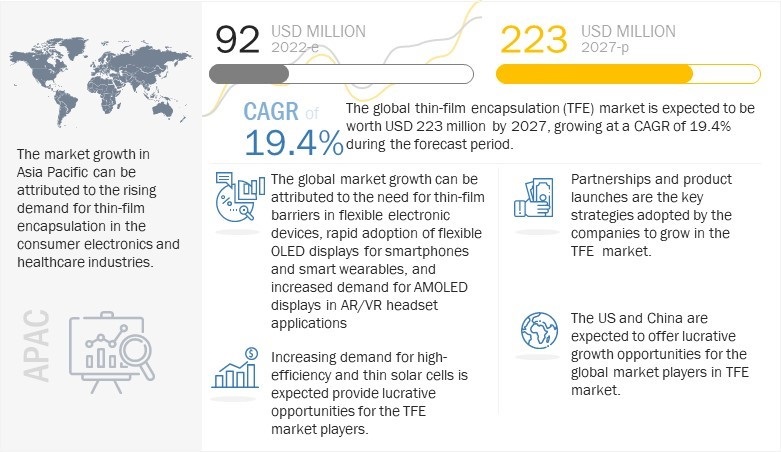

The thin-film encapsulation (TFE) market size is estimated to grow from USD 92 million in 2022 to reach USD 223 million by 2027; growing at a CAGR of 19.4% during the forecast period from 2022 to 2027.

The growth of the thin-film encapsulation (TFE) industry can be attributed to growing use of thin-film barriers in flexible and organic electronic devices and integration of flexible OLED displays into smartphones and smart wearables.

Thin-Film Encapsulation (TFE) Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Thin-Film Encapsulation Market Trends and Dynamics

Driver: Integration of flexible OLED displays into smartphones and smart wearables

Flexible OLED panels, which are currently being mass produced, use the hybrid encapsulation structure, where a gas barrier cover plate is applied to the organic and inorganic stacks of passivation. Samsung SDI mass produces TFE organic materials for flexible displays used in smartphones, while LG Chem significantly manufactures barrier films for wearable devices. OLEDs are suitable for smartphone applications as they are durable, flexible, lightweight, thin, and consume less power. Using a flexible plastic substrate can make OLED devices foldable, bendable, stretchable, and even rollable. Hence, the demand for flexible OLED display panels for high-definition applications, such as smartphone screens and HD televisions, is rising, which, in turn, is fueling the demand for TFE technology at present and is expected to be during the review period. Besides, the adoption of TFE materials in OLED display panels is rising as water can easily damage OLEDs.

Restraint: High capital expenditure associated with TFE

The equipment used for the deposition of thin encapsulant films include inkjet printers, plasma-enhanced chemical vapor deposition (PECVD) systems, atomic layer deposition systems, and vacuum thermal evaporation systems. The cost of these deposition systems is very high. Furthermore, manufacturers of OLED panels and thin film photovoltaics need to invest significantly in the R&D activities associated with matters such as shrinking geometries, complex device structures, multiple applications and process steps, and the use of new materials to improve the quality and technical features of the thin encapsulant films.

Opportunity: Rising demand for highly efficient thin solar cells

The use of thin-film solar cells is increasing with the rising demand for clean fuel electricity from off-grid areas, which supplements the insertion of renewable energy as it does not generate any pollution. Off-grid electrification projects are likely to propel the demand for renewable energy. With the introduction of thin-film and organic photovoltaics, the feasibility of coating/printing solar devices conformally onto various flexible substrate surfaces has increased the chance of fabricating economically compliant solar devices. The increasing adoption of polymer-based solar technologies is due to their ability to work in diffused light and promising large-scale scalability features.

Challenge: Complex value chain structure

The emerging TFE market is characterized by a complex value chain involving OLED manufacturers, electronics product manufacturers, material suppliers, technology developers, and equipment manufacturers. The value chain is dynamic in nature due to the involvement of several participants, which complicates product development and increases the time to market.

Thin-Film Encapsulation Market Segmentation

The thin-film encapsulation (TFE) market for inorganic layer deposition is expected to grow at the highest CAGR from 2022 to 2027.

The inorganic layer provides barrier capabilities against oxygen and moisture. PECVD, ALD, and sputtering processes deposit the inorganic layer to protect the device from moisture and oxygen. Major companies in the TFE market that fuel market growth by introducing equipment based on the PECVD technology include Applied Materials, Meyer Burger, and Aixtron. ALD is an important thin-film deposition technology because it offers precise control of the film thickness and uniform pinhole-free films, enabling the manufacture of conformal thin films on any shape. ALD can be employed at sufficiently low temperatures to deposit high-quality thin films on thermally fragile or flexible substrates. Companies such as Samsung Electronics and LG Display are considering ALD–based equipment for depositing barrier films.

The thin-film encapsulation (TFE) market for flexible OLED display to hold the largest share during the forecast period.

The largest market share is due to the increasing adoption of flexible OLED displays in various branded smartphones, such as iPhone 12, 13, and 14 series, Samsung Galaxy Series, and Xiaomi Note Series. Furthermore, the growing demand for flexible OLED displays in AR/VR headsets such as Sony PlayStation VR2, Apple AR/VR Headset, and Oculus Quest 2 is expected to drive the segment’s growth.

The thin-film encapsulation (TFE) market for consumer electronics to hold the largest share during the forecast period.

Factors driving the demand for OLED products in the consumer electronics segment include technological advancements in consumer devices and economic growth worldwide. Smartphones and television sets use OLED displays extensively. Various display panel manufacturers have reported an increase in the sale of mobile displays due to new product launches and an improved supply-demand environment for large panels, even during the pandemic. For instance, the global shipment of OLED smartphones in 2021 increased by 33.4% compared to the previous year, driving the consumer segment during the forecast period. LG plans to introduce a 20-inch OLED panel by the end of the year, and unlike most other offerings in this size, it will be used in consumer devices. The growth of OLED displays in the consumer electronics vertical is expected to drive the TFE market growth.

Thin-Film Encapsulation (TFE) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Thin-Film Encapsulation (TFE) Industry Regional Analysis

Thin-film encapsulation (TFE) market in Asia Pacific to grow at highest CAGR during the forecast period.

Asia Pacific is the largest consumer of TFE equipment and materials shipped worldwide, as many flexible electronic product manufacturing plants are established in the region. The major flexible electronic device manufacturers are based in China, Japan, Taiwan, South Korea, and Hong Kong. Samsung is investing in inkjet printing technology for depositing thin-film barriers for their OLED panels; LG, on the other hand, focuses on ALD technology for producing thin-film barriers. The demand for TFE materials and equipment for OLED display panels was highest in South Korea in the past, and a similar trend is expected to continue during the forecast period. China is the largest producer and consumer of solar PV glass in the Asia Pacific region. The increasing demand and production of solar cells in China are expected to drive the growth of the TFE market in China.

Top Thin-Film Encapsulation (TFE) Companies - Key Market Players

Key players in the thin-film encapsulation (TFE) companies are

- Samsung SDI Co., Ltd. (South Korea);

- LG Chem (South Korea);

- 3M (US);

- Toppan Inc. (Japan);

- Ergis Group (Poland);

- Veeco Instruments Inc. (US);

- Universal Display Corporation (US);

- Applied Materials, Inc. (US);

- Kateeva (US);

- Toray Industries, Inc. (Japan);

- tesa (Germany);

- Ajinomoto Fine-Techno Co., Inc. (Japan);

- Coat-X (Switzerland);

- Borealis AG (Austria).

Thin-Film Encapsulation Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 92 million in 2022 |

| Projected Market Size | USD 223 million by 2027 |

| Growth Rate | CAGR of 19.4% |

|

Years considered |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Thousand/Million), Volume (Thousand Square Meters) |

|

Segments covered |

Deposition Type, Application, and Vertical |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Samsung SDI Co., Ltd. (South Korea); LG Chem (South Korea); 3M (US); Toppan Inc. (Japan); Ergis Group (Poland); Veeco Instruments Inc. (US); Universal Display Corporation (US); Applied Materials, Inc. (US); Kateeva (US); Toray Industries, Inc. (Japan); tesa (Germany); Ajinomoto Fine-Techno Co., Inc. (Japan); Coat-X (Switzerland); and Borealis AG (Austria).-Total 25 companies covered |

Thin-Film Encapsulation (TFE) Market Highlights

This report categorizes the thin-film encapsulation (TFE) based on deposition type, application, vertical, and region

|

Aspect |

Details |

|

By Deposition Type |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments

- In June 2022, Applied Materials acquired Picosun, a privately held semiconductor equipment company based in Espoo, Finland. Picosun provides the most advanced ALD (Atomic Layer Deposition) thin-film coating solutions for global industries.

- In April 2022, Toray Industries developed a super high barrier film that costs at least 80% less than conventional counterparts. The company looks to commercialize the film in 2023 for high-barrier performance applications, including flexible devices and solar cell encapsulation.

- In September 2021, Ergis Group developed a new solution for OLED panel encapsulation. The noDiffusion film, developed in collaboration with Ergis' partners, can be adopted as both the flexible substrate and the encapsulation layer for OLED devices.

Frequently Asked Questions (FAQs):

Why is there an increasing need of thin-film encapsulation (TFE)?

The growth of the TFE market can be attributed to growing use of thin-film barriers in flexible, organic electronic devices and integration of flexible OLED displays into smartphones and smart wearables, rising trend of TFE using inkjet printing technology and increased application of OLED displays in AR/VR headsets

What are the recent trends in the TFE market?

The recent trends in TFE include a) Parylene-based Encapsulation Technology for Wearable and Implantable Electronic Devices. B) Perovskite Thin-film Solar Cells.

Which regions are expected to pose significant demand for TFE from 2022 to 2027?

Asia Pacific and North America are expected to pose significant demand from 2022 to 2027.

Which are the major applications of the thin-film encapsulation (TFE) market?

Smartphones, Tablets, TVs & Signage, Smart Wearables, Automobile Displays, and Thin-film Photovoltaics are the major applications of TFE.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 TFE MARKET: SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 UNIT CONSIDERED

1.8 LIMITATIONS

1.9 STAKEHOLDERS

1.1 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 TFE MARKET SIZE ESTIMATION AND PROCESS FLOW

FIGURE 3 TFE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF TFE IN 2021

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): ESTIMATION OF TFE MARKET SIZE, BY APPLICATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for deriving market size using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for deriving market size using top-down analysis do (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 MARKET SHARE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.4.1 GROWTH RATE ASSUMPTIONS/FORECASTS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 9 FLEXIBLE OLED DISPLAY TO BE LARGEST SEGMENT OF TFE MARKET DURING FORECAST PERIOD

FIGURE 10 ASIA PACIFIC TFE MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN TFE MARKET

FIGURE 11 HIGH DEMAND FOR TFE IN CONSUMER ELECTRONICS VERTICAL

4.2 TFE MARKET, BY DEPOSITION TECHNOLOGY

FIGURE 12 ORGANIC LAYERS DEPOSITION SEGMENT TO HOLD LARGER SHARE OF TFE MARKET DURING FORECAST PERIOD

4.3 TFE MARKET, BY VERTICAL

FIGURE 13 CONSUMER ELECTRONICS SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2027

4.4 TFE MARKET, BY FLEXIBLE OLED DISPLAY APPLICATION

FIGURE 14 SMARTPHONES SEGMENT TO HOLD LARGEST SHARE OF TFE MARKET FOR FLEXIBLE OLED DISPLAY DURING FORECAST PERIOD

4.5 ASIA PACIFIC TFE MARKET, BY COUNTRY AND VERTICAL

FIGURE 15 CONSUMER ELECTRONICS AND SOUTH KOREA TO HOLD MAJOR SHARES OF ASIA PACIFIC TFE MARKET IN 2022

4.6 TFE MARKET, BY COUNTRY

FIGURE 16 CHINA TO EXHIBIT HIGHEST CAGR IN TFE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 TFE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 18 TFE MARKET: DRIVERS AND THEIR IMPACT

5.2.1.1 Growing use of thin-film barriers in flexible and organic electronic devices

5.2.1.2 Rising trend of TFE using inkjet printing technology

5.2.1.3 Integration of flexible OLED displays into smartphones and smart wearables

5.2.1.4 Rising investments in building new facilities to manufacture OLED panels

5.2.1.5 Increased application of OLED displays in AR/VR headsets

5.2.2 RESTRAINTS

FIGURE 19 TFE MARKET: RESTRAINTS AND THEIR IMPACT

5.2.2.1 High capital expenditure associated with TFE

5.2.3 OPPORTUNITIES

FIGURE 20 TFE MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Rising demand for highly efficient thin solar cells

5.2.3.2 Increasing applications of smart mirrors in smart homes

5.2.4 CHALLENGES

FIGURE 21 TFE MARKET: CHALLENGES AND THEIR IMPACT

5.2.4.1 Complex value chain structure

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS AND TFE SYSTEM INTEGRATORS

5.4 ECOSYSTEM ANALYSIS

FIGURE 23 TFE MARKET: ECOSYSTEM ANALYSIS

TABLE 2 TFE MARKET: ROLE IN ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.6 PATENT ANALYSIS

FIGURE 24 NUMBER OF PATENTS FILED PER YEAR, 2012–2021

FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 3 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

5.6.1 TFE MARKET: LIST OF MAJOR PATENTS

TABLE 4 TFE MARKET: LIST OF MAJOR PATENTS

5.7 CASE STUDY ANALYSIS

5.7.1 BENEQ PROVIDES TFE FOR OLED LIGHTING

5.7.2 MEYER BURGER OFFERS INKJET + PECVD OLED ENCAPSULATION SYSTEM FOR FLEXIBLE OLEDS

5.7.3 AGORIA SOLAR TEAM USES BOREALIS’ QUENTYS-GRADE FILMS TO ENCAPSULATE AND PROTECT SOLAR CELLS MOUNTED ON RACING CARS

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES IN TFE MARKET

5.9 TRADE ANALYSIS

FIGURE 27 IMPORT DATA FOR HS CODE 848620, BY COUNTRY, 2017–2021

FIGURE 28 EXPORT DATA FOR HS CODE 848620, BY COUNTRY, 2017–2021

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 TFE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 INTENSITY OF COMPETITIVE RIVALRY

5.10.2 BARGAINING POWER OF SUPPLIERS

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 THREAT OF SUBSTITUTES

5.10.5 THREAT OF NEW ENTRANTS

5.11 TARIFF ANALYSIS

TABLE 6 TARIFF IMPOSED ON PRODUCTS UNDER HS CODE 848620 EXPORTED BY SOUTH KOREA

TABLE 7 TARIFF IMPOSED ON PRODUCTS UNDER HS CODE 848620 EXPORTED BY US

TABLE 8 TARIFF IMPOSED ON PRODUCTS UNDER HS CODE 848620 EXPORTED BY CHINA

5.12 STANDARDS AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 STANDARDS

5.12.3 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE) DIRECTIVES

5.12.4 REGISTRATION, EVALUATION, AUTHORIZATION, AND RESTRICTION OF CHEMICALS (REACH)

5.12.5 GENERAL DATA PROTECTION REGULATION (GDPR)

5.12.6 IMPORT–EXPORT LAWS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 VERTICALS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 VERTICALS (%)

5.13.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

TABLE 14 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

5.14 PRICING ANALYSIS

5.14.1 AVERAGE SELLING PRICE OF TFE OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE VERTICALS

FIGURE 31 AVERAGE SELLING PRICE OF TFE OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE VERTICALS

TABLE 15 AVERAGE SELLING PRICE OF TFE OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE VERTICALS

5.15 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 16 TFE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 TFE MARKET, BY DEPOSITION TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 32 TFE MARKET FOR INORGANIC LAYER DEPOSITION SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 17 TFE MARKET, BY DEPOSITION TYPE, 2018–2021 (USD MILLION)

TABLE 18 TFE MARKET, BY DEPOSITION TYPE, 2022–2027 (USD MILLION)

6.2 INORGANIC LAYER DEPOSITION

TABLE 19 INORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 20 INORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

6.2.1 PECVD

6.2.1.1 Deposits substrates at a lower temperature

6.2.2 ALD

6.2.2.1 Demand for ALD-based equipment to deposit barrier films on thermally fragile or flexible substrates

6.2.3 SPUTTERING

6.2.3.1 Provides improved sputter protection of organic materials used in flexible electronic devices

6.3 ORGANIC LAYER DEPOSITION

TABLE 21 ORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 22 ORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

6.3.1 INKJET PRINTING

6.3.1.1 Helps in high-volume production of organic electronic devices with TFE

6.3.2 VACUUM THERMAL EVAPORATION (VTE)

6.3.2.1 Used to deposit metals on OLEDs, solar cells, and thin-film transistors

7 TFE MARKET, BY APPLICATION (Page No. - 83)

7.1 INTRODUCTION

FIGURE 33 FLEXIBLE OLED LIGHTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 TFE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 TFE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 FLEXIBLE OLED DISPLAY

7.2.1 GROWING POPULARITY OF OLEDS IN SMARTPHONES, SMART WEARABLE DEVICES, AND LARGE DISPLAY PANELS

TABLE 25 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2018–2021 (THOUSAND SQUARE METERS)

TABLE 26 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2022–2027 (THOUSAND SQUARE METERS)

TABLE 27 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 28 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 29 FLEXIBLE OLED DISPLAY: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 30 FLEXIBLE OLED DISPLAY: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 31 ASIA PACIFIC: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 32 ASIA PACIFIC: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 33 EUROPE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 34 EUROPE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 35 NORTH AMERICA: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 36 NORTH AMERICA: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 37 ROW: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 38 ROW: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.2.2 SMARTPHONES

7.2.2.1 Rising use of TFE materials in smartphone manufacturing

TABLE 39 SMARTPHONES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 40 SMARTPHONES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.2.3 TABLETS

7.2.3.1 Growing use of OLED screens in Samsung Galaxy tablets

TABLE 41 TABLETS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 42 TABLETS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.2.4 TELEVISIONS (TVS) AND SIGNAGE

7.2.4.1 High demand for large format displays in retail, BFSI, sports, and education verticals

TABLE 43 TVS AND SIGNAGE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 44 TVS AND SIGNAGE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.2.5 PC MONITORS AND LAPTOPS

7.2.5.1 High use of OLED displays in PC monitors and laptops

TABLE 45 PC MONITORS AND LAPTOPS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 46 PC MONITORS AND LAPTOPS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.2.6 SMART WEARABLES

7.2.6.1 Increasing integration of OLED technology into smartwatches and AR/VR headsets

TABLE 47 SMART WEARABLES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 48 SMART WEARABLES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.2.7 AUTOMOBILE DISPLAYS

7.2.7.1 Growing integration of OLED technology into instrument clusters, dashboard displays, and center stack displays

TABLE 49 AUTOMOBILE DISPLAYS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 50 AUTOMOBILE DISPLAYS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.2.8 OTHERS

TABLE 51 OTHERS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 52 OTHERS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022–2027 (USD THOUSAND)

7.3 FLEXIBLE OLED LIGHTING

7.3.1 INCREASING DEMAND FOR OLED LIGHTING PANELS IN AUTOMOTIVE INDUSTRY

TABLE 53 FLEXIBLE OLED LIGHTING: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 54 FLEXIBLE OLED LIGHTING: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.4 THIN-FILM PHOTOVOLTAICS

7.4.1 RISING USE OF OLED TECHNOLOGY TO MANUFACTURE INSTRUMENT CLUSTERS, DASHBOARD DISPLAYS, AND CENTER STACK DISPLAYS

TABLE 55 THIN-FILM PHOTOVOLTAICS: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 56 THIN-FILM PHOTOVOLTAICS: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.5 OTHERS

TABLE 57 OTHERS: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 58 OTHERS: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8 TFE MARKET, BY VERTICAL (Page No. - 102)

8.1 INTRODUCTION

FIGURE 34 TFE MARKET FOR CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

TABLE 59 TFE MARKET, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 60 TFE MARKET, BY VERTICAL, 2022–2027 (USD THOUSAND)

8.2 CONSUMER ELECTRONICS

8.2.1 CONSUMER ELECTRONICS SEGMENT TO CAPTURE LARGEST MARKET SIZE

TABLE 61 CONSUMER ELECTRONICS: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 62 CONSUMER ELECTRONICS: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.3 AUTOMOTIVE

8.3.1 GROWING REPLACEMENT OF ANALOG COMPONENTS WITH DIGITAL ONES IN VEHICLES

TABLE 63 AUTOMOTIVE: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 64 AUTOMOTIVE: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.4 HEALTHCARE

8.4.1 DIGITALIZATION OF HEALTHCARE SYSTEMS

TABLE 65 HEALTHCARE: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 66 HEALTHCARE: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.5 INDUSTRIAL AND ENTERPRISE

8.5.1 INCREASING ADOPTION OF AR/VR HMDS

TABLE 67 INDUSTRIAL AND ENTERPRISE: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 68 INDUSTRIAL AND ENTERPRISE: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.6 AEROSPACE & DEFENSE

8.6.1 RISING ADOPTION OF AR AND VR HMDS IN AEROSPACE & DEFENSE VERTICAL

TABLE 69 AEROSPACE AND DEFENSE: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 70 AEROSPACE AND DEFENSE: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.7 RETAIL, HOSPITALITY, AND BFSI

8.7.1 HIGH ADOPTION OF OLED DIGITAL SIGNAGE DISPLAYS

TABLE 71 RETAIL, HOSPITALITY, AND BFSI: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 72 RETAIL, HOSPITALITY, AND BFSI: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.8 EDUCATION

8.8.1 TRANSITION TO ONLINE LEARNING

TABLE 73 EDUCATION: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 74 EDUCATION: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.9 TRANSPORTATION

8.9.1 HIGH DEMAND FOR TFE FOR LARGE FORMAT DISPLAYS

TABLE 75 TRANSPORTATION: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 76 TRANSPORTATION: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.10 SPORTS & ENTERTAINMENT

8.10.1 RAPID PENETRATION OF AR/VR HMDS INTO SPORTS & ENTERTAINMENT VERTICAL

TABLE 77 SPORTS AND ENTERTAINMENT: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 78 SPORTS AND ENTERTAINMENT: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.11 OTHERS

TABLE 79 OTHERS: TFE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 80 OTHERS: TFE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

9 TFE MARKET, BY REGION (Page No. - 115)

9.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC TO BE LARGEST TFE MARKET DURING FORECAST PERIOD

TABLE 81 TFE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 TFE MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: TFE MARKET SNAPSHOT

TABLE 83 ASIA PACIFIC: TFE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 84 ASIA PACIFIC: TFE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: TFE MARKET, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 86 ASIA PACIFIC: TFE MARKET, BY VERTICAL, 2022–2027 (USD THOUSAND)

9.2.1 SOUTH KOREA

9.2.1.1 Rising developments by Samsung and LG Display in OLED lighting

9.2.2 CHINA

9.2.2.1 Increasing demand and production of solar cells

9.2.3 JAPAN

9.2.3.1 Large presence of OLED lighting players and OLED display manufacturers

9.2.4 TAIWAN

9.2.4.1 Increasing demand for TFE in AMOLED panel display manufacturing

9.2.5 REST OF ASIA PACIFIC

9.3 EUROPE

FIGURE 37 EUROPE: TFE MARKET SNAPSHOT

TABLE 87 EUROPE: TFE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 EUROPE: TFE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: TFE MARKET, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 90 EUROPE: TFE MARKET, BY VERTICAL, 2022–2027 (USD THOUSAND)

9.3.1 GERMANY

9.3.1.1 High demand for flexible OLED lighting panels in automotive industry

9.3.2 UK

9.3.2.1 High demand from smartphone and AR/VR technology developers

9.3.3 FRANCE

9.3.3.1 Rising government-led investments in consumer electronics vertical

9.3.4 REST OF EUROPE

9.4 NORTH AMERICA

FIGURE 38 NORTH AMERICA: TFE MARKET SNAPSHOT

TABLE 91 NORTH AMERICA: TFE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: TFE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: TFE MARKET, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 94 NORTH AMERICA: TFE MARKET, BY VERTICAL, 2022–2027 (USD THOUSAND)

9.4.1 US

9.4.1.1 Large presence of OLED display consumer base

9.4.2 CANADA

9.4.2.1 High demand in food service industry

9.4.3 MEXICO

9.4.3.1 Expanding automotive, retail, medical, and industrial sectors

9.5 ROW

TABLE 95 ROW: TFE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 ROW: TFE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 97 ROW: TFE MARKET, BY VERTICAL, 2018–2021 (USD THOUSAND)

TABLE 98 ROW: TFE MARKET, BY VERTICAL, 2022–2027 (USD THOUSAND)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Increasing use of video walls, digital signage, and interactive kiosks in shopping malls and museums

9.5.2 SOUTH AMERICA

9.5.2.1 Growing outdoor advertising events

10 COMPETITIVE LANDSCAPE (Page No. - 136)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 99 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES IN TFE MARKET

10.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 39 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN TFE MARKET

10.4 MARKET SHARE ANALYSIS, 2021

TABLE 100 TFE MARKET: DEGREE OF COMPETITION

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 40 TFE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.6 STARTUP/SME EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 41 TFE MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

10.7 TFE MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 101 PRODUCT FOOTPRINT OF COMPANIES

TABLE 102 VERTICAL FOOTPRINT OF COMPANIES

TABLE 103 APPLICATION FOOTPRINT OF COMPANIES

TABLE 104 REGIONAL FOOTPRINT OF COMPANIES

10.8 TFE MARKET: COMPETITIVE BENCHMARKING

TABLE 105 TFE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 106 TFE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY VERTICAL

TABLE 107 TFE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

TABLE 108 TFE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

10.9 COMPETITIVE SCENARIOS AND TRENDS

TABLE 109 TFE MARKET: PRODUCT LAUNCHES, JANUARY 2020–AUGUST 2022

TABLE 110 TFE MARKET: DEALS, JANUARY 2020–AUGUST 2022

11 COMPANY PROFILES (Page No. - 152)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

11.1.1 SAMSUNG SDI CO., LTD.

TABLE 111 SAMSUNG SDI: COMPANY OVERVIEW

FIGURE 42 SAMSUNG SDI: COMPANY SNAPSHOT

11.1.2 LG CHEM LTD.

TABLE 112 LG CHEM: COMPANY OVERVIEW

FIGURE 43 LG CHEM: COMPANY SNAPSHOT

11.1.3 3M

TABLE 113 3M: COMPANY OVERVIEW

FIGURE 44 3M: COMPANY SNAPSHOT

11.1.4 TOPPAN INC.

TABLE 114 TOPPAN INC.: COMPANY OVERVIEW

FIGURE 45 TOPPAN INC.: COMPANY SNAPSHOT

11.1.5 TORAY INDUSTRIES, INC.

TABLE 115 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 46 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

11.1.6 ERGIS GROUP

TABLE 116 ERGIS GROUP: COMPANY OVERVIEW

11.1.7 VEECO INSTRUMENTS INC.

TABLE 117 VEECO INSTRUMENTS: COMPANY OVERVIEW

FIGURE 47 VEECO INSTRUMENTS: COMPANY SNAPSHOT

11.1.8 UNIVERSAL DISPLAY CORP.

TABLE 118 UNIVERSAL DISPLAY CORP.: COMPANY OVERVIEW

FIGURE 48 UNIVERSAL DISPLAY CORP.: COMPANY SNAPSHOT

11.1.9 APPLIED MATERIALS, INC.

TABLE 119 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

FIGURE 49 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

11.1.10 KATEEVA

TABLE 120 KATEEVA: COMPANY OVERVIEW

11.2 OTHER PLAYERS

11.2.1 TESA

11.2.2 AJINOMOTO FINE-TECHNO CO., INC.

11.2.3 COAT-X

11.2.4 BOREALIS AG

11.2.5 AMS TECHNOLOGIES

11.2.6 ANGSTROM ENGINEERING

11.2.7 BENEQ

11.2.8 ENCAPSULIX

11.2.9 LOTUS APPLIED TECHNOLOGY

11.2.10 BASF

11.2.11 HOLST CENTRE

11.2.12 SNU PRECISION

11.2.13 KYORITSU CHEMICAL & CORPORATION LIMITED

11.2.14 SAES GETTERS SPA

11.2.15 MBRAUN

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 188)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

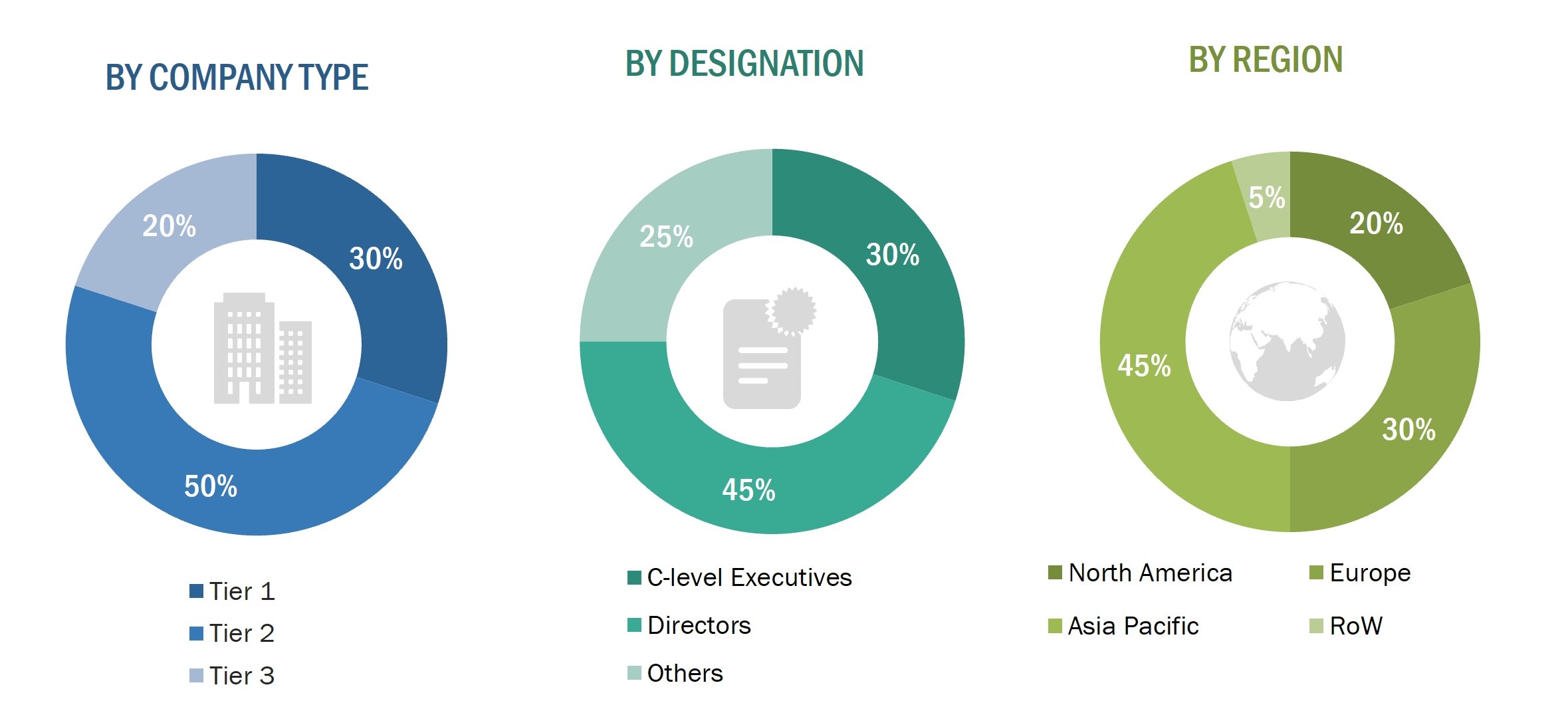

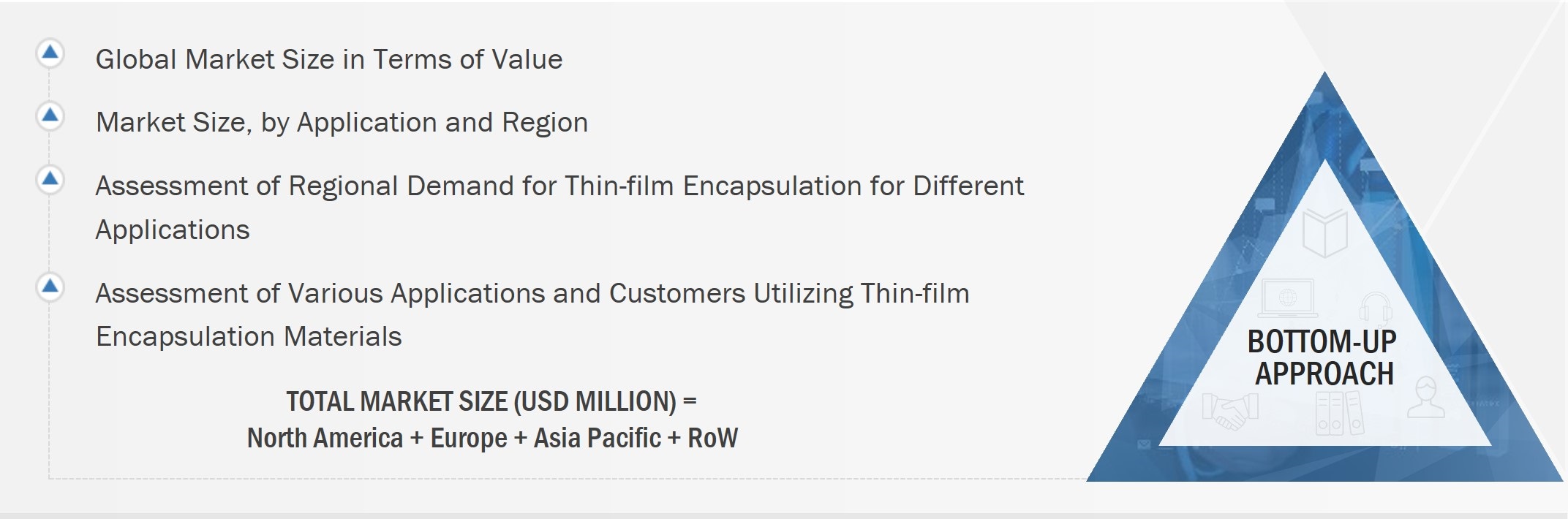

The study involved 4 major activities to estimate the size of the thin-film encapsulation (TFE) market. Exhaustive secondary research has been conducted to collect information on the TFE market. Validation of these findings, assumptions, and sizing with industry experts across value chain through primary research has been the next step. Both, top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, machine condition monitoring related journals, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases. Semiconductor Industry Association (SIA), American Lighting Association, European Semiconductor Industry Association (ESIA), IEEE Spectrum, OLED Association, Consumer Technology Association, and Society for Information Display (SID) are a few examples of secondary sources.

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed with to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the TFE market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the overall TFE market and the market based on subsegments. The research methodology used to estimate the market size has been given below:

- To identify different applications requiring a TFE process

- To segregate materials required during the TFE process for different applications

- To analyze the trend of usage of TFE materials for different applications

- The data from all regions for each application have been combined to obtain a global application market size, which has given the global market size of different applications and regions

- To discuss with key opinion leaders to understand different technological trends, changing market environments, and emerging processing technologies to analyze the breakup of the scope of work by major TFE material suppliers and thin encapsulation film providers.

- To arrive at the market estimates by analyzing these companies according to the country where products are produced and consumed; this is combined to arrive at the market estimate by region

- To refer to various paid and unpaid sources such as annual reports, press releases, white papers, and databases to validate market estimations

Data Triangulation

After arriving at the overall size of the thin-film encapsulation (TFE) market from the estimation process explained above, the total market was split into several segments and subsegments. Market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the thin-film encapsulation (TFE) market based on deposition type, application, vertical, and region in terms of value

- To forecast the size of the application segment with regard to four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To forecast the TFE market, in terms of thousand square meters, segmented based on application

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the TFE market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, and regulations pertaining to the TFE market

- To provide a detailed overview of the value chain of the TFE ecosystem

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market position in terms of ranking and core competencies, and provide information about the competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the TFE market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thin-Film Encapsulation (TFE) Market

Want to understand the flow of content in the actual report, please send me some sample pages. Thanks!