Thick Film Resistor Market by Industry (Automotive, Electrical & Electronics & Telecommunication), Resistor Type (Thick Film & Shunt), Vehicle Type (ICE, Electric & Hybrid Vehicles) and Region - Global Forecast to 2025

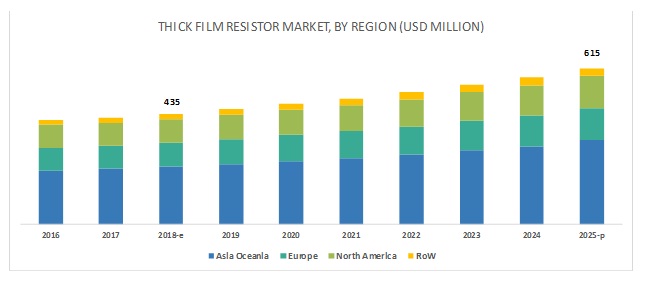

[160 Pages Report] The thick film resistor market is projected to reach USD 615 million by 2025 from USD 435 million in 2018, at a CAGR of 5.06% during the forecast period. The market is primarily driven by the increasing demand for high performance electrical and electronic products, increasing adoption of 4G networks, and advanced technologies in automotive industry.

Thick film resistor is expected to be the largest market, by technology, during the forecast period

Thick film resistor is estimated to dominate the global market from 2018 to 2025. The factors driving this thick film resistor market are the growing automotive industry, consumer electronics goods, and telecommunications products. Rising IC and electric & hybrid vehicles sales along with the government regulations to enhance fuel efficiency and safety standards have prompted the OEMs to install more electrical and electronic devices, which ultimately drives market in the automotive industry. Further, robust technological advancements in electronic goods and the increasing adoption of fast networks (4G/5G networks) across the globe have also spurred the demand for products with thick film power resistors. All these factors are expected to boost the thick film resistor market in coming years

Commercial vehicles are estimated to be the second fastest market for thick film and shunt resistors, by vehicle type, during the forecast period

Even though commercial vehicle has limited safety and luxury features as compared to passenger cars, regulatory authorities of different countries are making significant upgrades in regulatory norms for this vehicle segment. For instance, the European Union (EU) have made air conditioning system compulsory in all heavy vehicles from 2017, and HVAC and other safety features are also mandated for buses and coaches segment. Furthermore, by the end of 2019 all the heavy trucks must be installed with electronic logging devices (ELD) from the US Department of Transportations Federal Motor Carrier Safety Administration (FMCSA). The deployment of such regulations would increase the electronic devices installation which results in demand for more thick film and shunt resistors in this vehicle segment. These factors make the commercial vehicle segment to be the second fastest growing market for thick film and shunt resistors.

Hybric Electric Vehicles (HEV) is estimated to be the largest market for thick film and shunt resistor market from 2018 to 2025

HEV is estimated to lead the thick film and shunt resistors owing to its maximum application in the electric and hybrid vehicle segment. HEV has an internal combustion engine along with an electric propulsion system along with more installation of additional technologies such as regenerative braking, advanced motor assist, actuators, and automatic start/stop system. These technologies require more sophisticated electrical and electronic circuitry which are intended to provide additional auxiliary power. Thus, the installation of such technologies coupled with the increasing demand for HEVs will consequently boost the thick film and shunt resistor market.

Electrical and electronics is estimated to be the fastest growing market for thick film and shunt resistors, by end-use industry

The electrical and electronic industry is estimated to grow at the fastest rate, and the Asia Oceania region is expected to lead the market for this segment under the review period. According to German Electrical and Electronic Manufacturers Association (ZVEI Die Elektronikindustrie) statistics, electrical and electronics market for Asia, Europe, and America stood at nearly USD 3,229.3 billion, USD 606.1 billion, and USD 511.7 billion, respectively, in 2016. Owing to the increasing per capita income, urbanization, and standard of living, the demand for products such as personal computers, smartphones, tablets, notebooks, and storage devices has grown tremendously, especially in developing countries of Asia. Thick film and shunt resistors find application in these products as they offer satisfactory accuracy, precision, and performance at lower cost. Along with the rising demand for electrical and electronic products, the growth of thick film and shunt resistor market is also expected in the coming years.

Asia Oceania is expected to account for the largest market share during the forecast period

Asia Oceania is expected to hold the largest market share in the thick film and shunt resistor market during the period 20182025. The growth is attributed to the presence of a large number of automotive and consumer electronics manufacturers in this region. Moreover, the upcoming smart cities projects in Asia Oceania countries, which are inclusive of commercial and residential projects that demand electrical products like switchgears, energy meters, smart meters, and industrial machinery would drive the shunt resistor market in this region.

Key Market Players

Some prominent players in the thick film resistor market are Yageo (Taiwan), KOA Corporation (Japan), Panasonic (Japan), Vishay (US), ROHM Semiconductor (Japan), TE Connectivity (Switzerland), Bourns (US), Viking Tech Corporation (Taiwan), TT Electronics (UK).

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

20162025 |

|

Base Year Considered |

2017 |

|

Forecast Period |

20182025 |

|

Forecast Units |

Value (USD million/billion) and Volume (000/million units) (for automotive industry) |

|

Segments Covered |

Market by End-Use Industry, Resistor Type, Automotive, By ICE and Electric & Hybrid Vehicle Type, and Region |

|

Geographies Covered |

Asia Oceania, Europe, North America, and RoW |

|

Companies Covered |

Yageo (Taiwan), KOA Corporation (Japan), Panasonic (Japan), Vishay (US), ROHM Semiconductor (Japan), TE Connectivity (Switzerland), Murata (Japan), Bourns (US), TT Electronics (UK), and Viking Tech Corporation (Taiwan), Total 20 major players covered |

This research report categorizes the market based on end-use industry, resistor type, automotive, by IC and electric & hybrid vehicle type, and region.

By End-use Industry

- Automotive,

- Electrical & Electronics

- Telecommunication

By Resistor Type

- Thick film

- Shunt

Market for Electrical & Electronics, By Resistor Type

- Thick film

- Shunt

Market for Telecommunication, By Resistor Type

- Thick film

- Shunt

hick Film Resistor Market for Automotive, By Resistor Type

- Thick film

- Shunt

Market for Automotive, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Market for Electric and Hybrid Vehicles, By Vehicle Type

- BEV

- HEV

- PHEV

Key Questions addressed by the report

- Our study suggests that automotive is the largest end-user market for thick film and shunt resistors. What is the market size of the thick film and shunt resistor market across different regions in 2018? What would be the regional growth rate during the next seven years?

- The study indicates that thick film resistor dominates the market at a global level. How do you see the existing and upcoming market trends in the next few years?

- How much is the global market for resistors in 2018? What will be the market share of thick film and shunt resistors in the overall resistors market?

- Which are the major applications of thick film and shunt resistors in automotive, electrical and electronics, and telecommunication industries?

- What is the average cost of thick film and shunt resistors? Does it vary to a large extent with respect to its different applications? What would be the pricing trend for the next seven years?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives

1.2 Thick Film Resistor Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Vehicle Production Statistics

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach: Automotive Thick Film Resistor Market

2.4.2 Top-Down Approach-Global Shunt & Thick Film Resistor Market

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 36)

4.1 Thick Film Resistor Market Trend, Forecast & Opportunity

4.2 Market, By End-Use Industry

4.3 Market, By Type

4.4 Market for Electrical & Electronics Industry, By Type

4.5 Market for Telecommunication Industry, By Type

4.6 Market for Automotive Industry, By Ice Vehicle Type

4.7 Market for By Electric & Hybrid Vehicle, By Vehicle Type

4.8 Market for Automotive Industry, By Region

5 Overview (Page No. - 41)

5.1 Introduction

5.2 Thick Film Resistor Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for High-Performance Electronic and Electrical Systems

5.2.1.2 Increasing Adoption of 4g/5g Networks

5.2.1.3 Increasing Demand for Premium and Luxury Vehicles

5.2.1.4 Increasing Adoption of Advanced Technologies in the Automotive Industry

5.2.1.4.1 Advanced Driver Assistance System

5.2.1.4.2 Telematics and Infotainment System

5.2.2 Restraints

5.2.2.1 Falling Commodity Prices and Reduced Profit Margins

5.2.3 Opportunities

5.2.3.1 Increasing Sales of Electric Vehicles

5.2.4 Challenge

5.2.4.1 Increasing Presence of Local Manufacturers

6 By End-Use Industry (Page No. - 48)

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Assumptions

6.1.3 Industry Insights

6.2 Automotive

6.2.1 Automotive Industry Accounts for Largest Market as of 2018

6.3 Electrical & Electronics

6.3.1 Rising Urbanisation, and Upcoming Smart Cities Projects Drives the Electrical & Electronics Goods Demand.

6.4 Telecommunication

6.4.1 Emergence of Giga-Fiber Technologies to Increase Broadband Speed is Expected to Drive Thick Film Power & Shunt Resistor Market for the Telecommunication Industry

7 By Type (Page No. - 55)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and Row. the Chapter Covers the Thick Film and Shunt Resistor Market in Terms of Value

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions

7.1.3 Industry Insights

7.2 Thick Film Power Resistor

7.2.1 Thick Film Power Resistors are Estimated to Hold the Largest Market Share

7.3 Shunt Resistor

7.3.1 Asia Oceania is Anticipated to Be the Largest Market

8 Market for Electrical & Electronics Industry, By Type (Page No. - 60)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and Row. the Chapter Covers the Thick Film and Shunt Resistor Market in Terms of Value

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions

8.1.3 Industry Insights

8.2 Thick Film Resistor

8.2.1 The Thick Film Resistors are the Most Preferred Type of Resistors in Electrical and Electronic Applications.

8.3 Shunt Resistor

8.3.1 Asia Oceania is Estimated to Be the Largest Market for Shunt Resistors

9 Market for Telecommunication Industry, By Type (Page No. - 65)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and Row. the Chapter Covers the Thick Film and Shunt Resistor Market in Terms of Value

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions

9.1.3 Industry Insights

9.2 Thick Film Resistor

9.2.1 Continuously Increasing Telecom Subscriber Base is Driver Factor for Asian Countries

9.3 Shunt Resistor

9.3.1 Asia Oceanic is Fastest Market for Shunt Resistor

10 Market for Automotive Industry, By Type (Page No. - 70)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and Row. the Chapter Covers the Thick Film and Shunt Resistor Market in Terms of Value

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Assumptions

10.1.3 Industry Insights

10.2 Thick Film Resistor

10.2.1 Thick Film Resistor Holds Largest Share for Automotive Industry

10.3 Shunt Resistor

10.3.1 Different Technological Advancements Drives the Shunt Resistor Market

11 Market for Automotive Industry, By Vehicle Type (Page No. - 76)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and Row. the Chapter Covers the Thick Film and Shunt Resistor Market in Terms of Value

11.1 Introduction

11.1.1 Research Methodology

11.1.2 Assumptions

11.1.3 Industry Insights

11.2 Passenger Car

11.2.1 Passenger Car Accounts for Maximum Share in the Overall Vehicle Production

11.3 Commerical Vehicle

11.3.1 Commercial Vehicles Have Limited Safety and Luxury Features, Which Results in A Lower Share in This Segement.

12 Market for Electric & Hybrid Vehicles, By Vehicle Type (Page No. - 83)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and Row. the Chapter Covers the Thick Film and Shunt Resistor Market in Terms of Value

12.1 Introduction

12.1.1 Research Methodology

12.1.2 Assumptions

12.1.3 Industry Insights

12.2 Battery Electric Vehicle

12.2.1 BEVs are the Most Preferred Type of Electric Vehicles as they Operate Without Any Form of Emissions.

12.3 Hybrid Electric Vehicle

12.3.1 Hybrid Electric Vehicle Leads the Thick Film and Shunt Resistor Market.

12.4 Plug-In Hybrid Electric Vehicle

12.4.1 Asia Oceania is the Fastest Growing Market for Phev

13 Market for Automotive Industry, By Region (Page No. - 91)

The Chapter is Further Segmented at Regional and Country Level By Resistor Type: Thick Film and Shunt Resistor)

13.1 Introduction

13.1.1 Research Methodology

13.1.2 Assumptions

13.1.3 Industry Insights

13.2 Asia Oceania

13.2.1 China

13.2.1.1 China is Growing as Automotive Hub, and Estimated to Be the Largest Market

13.2.2 India

13.2.2.1 India is the Fastest Growing Market for Automotive Resistor Market

13.2.3 Japan

13.2.3.1 Thick Film Power Resistor is the Fastest Growing Market in Japan

13.2.4 South Korea

13.2.4.1 Vehicle and Road Safety Regulations Results in Installation of Adas Devices in South Korea

13.3 Europe

13.3.1 Germany

13.3.1.1 Germany is Identified as the Largest Automotive Industry in Europe.

13.3.2 France

13.3.2.1 France is the Fastest Growing Market for Thick Film & Shunt Resistor Market

13.3.3 Spain

13.3.3.1 Thick Film Power Resistor Leads the Market in Spain

13.3.4 Italy

13.3.4.1 Thick Film Power Resistor Leads the Market in Italy

13.3.5 UK

13.3.5.1 UK Automotive Industry has Regained Pre-Crisis Production Levels and is Expected to Grow the Vehicle Production.

13.3.6 Russia

13.3.6.1 Thick Film Power Resistor is the Fastest Growing Market

13.4 North America

13.4.1 US

13.4.1.1 The Automotive Market in the US is Inclined Toward Suvs and Light Trucks

13.4.2 Canada

13.4.2.1 High Standard of Living and High Per Capita Income is Leading to the Demand of the Premium Cars

13.4.3 Mexico

13.4.3.1 Mexico is Estimated to Be the Second Largest Market in North America Owing to the Increasing Vehicle Production in Recent Years.

13.5 Row

13.5.1 Brazil

13.5.1.1 Brazil is Estimated to Be the Largest Because of Its High Growth Potential and Easy Availability of Cheap and Skilled Labor

13.5.2 South Africa

13.5.2.1 Weak Economic Outlook and Lower Demand in the Market Have Led to A Slowdown in the Vehicle Production and Overcapacity in Production Facilities.

14 Competitive Landscape (Page No. - 115)

14.1 Overview

14.2 Market: Market Ranking Analysis

14.3 Competitive Leadership Mapping

14.3.1 Terminology

14.3.2 Strength of Product Portfolio

14.3.3 Business Strategy Excellence

14.4 Competitive Scenario

14.4.1 New Product Launches/New Product Developments

14.4.2 Mergers & Acquisitions

14.4.3 Expansions

14.4.4 Supply Contracts/ Partnerships/Joint Ventures/ Collaborations

15 Company Profiles (Page No. - 126)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 Yageo

15.2 Te Connectivity

15.3 KOA Corporation

15.4 Panasonic

15.5 Vishay

15.6 ROHM Semiconductor

15.7 Viking Tech Corporation

15.8 Murata

15.9 TT Electroncs

15.1 Bourns

15.11 Additional Companies

15.11.1 Asia Oceania

15.11.1.1 Ralec

15.11.1.2 Japan Resistor

15.11.1.3 Token Electronics

15.11.2 North America

15.11.2.1 Nic Components

15.11.2.2 Cal-Chip Electronics

15.11.2.3 International Manufacturing Services

15.11.2.4 Riedon

15.11.2.5 Ohmite

15.11.3 Europe

15.11.3.1 Amc Technologies

15.11.3.2 Isabellenhόtte Heusler

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 152)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets Subscription Portal

16.4 Available Customizations

16.4.1 Thick Film & Shunt Resistor Market, By Vehicle Type

16.4.1.1 Passenger Cars

16.4.1.2 Commercial Vehicles

16.4.2 Thick Film & Shunt Resistor Market for Electric & Hybrid Vehicles, By Resistor Type

16.4.2.1 Battery Electric Vehicle (BEV)

16.4.2.2 Hybrid Electric Vehicle (HEV)

16.4.2.3 Plug-In Hybrid Electric Vehicle (PHEV)

16.4.3 Detailed Analysis and Profiling of Additional Market Players (Upto 3)

16.5 Related Reports

16.6 Author Details

List of Tables (79 Tables)

Table 1 Currency Exchange Rates (W.R.T. Per USD)

Table 2 Smart City Projects, By Country

Table 3 Thick Film Resistor Market, By End-Use Industry, 20162025 (USD Million)

Table 4 Automotive: Market, By Region, 20162025 (USD Million)

Table 5 Electrical & Electronics: Thick Film Power & Shunt Resistor Market, By Region, 20162025 (USD Million)

Table 6 Telecommunication: Thick Film Power & Shunt Resistor Market, By Region, 20162025 (USD Million)

Table 7 By Type, 20162025 (USD Million)

Table 8 By Region, 20162025 (USD Million)

Table 9 Shunt Resistor Market, By Region, 20162025 (USD Million)

Table 10 Market for Electrical & Electronics Industry, By Type, 20162025 (USD Million)

Table 11 Electrical & Electronics: Market, By Region, 20162025 (USD Million)

Table 12 Electrical & Electronics: Shunt Resistor Market, By Region, 20162025 (USD Million)

Table 13 Thick Film Resistor Market for Telecommunication Industry, By Type, 20162025 (USD Million)

Table 14 Telecommunication: Market, By Region, 20162025 (USD Million)

Table 15 Telecommunication: Shunt Resistor Market, By Region, 20162025 (USD Million)

Table 16 Automotive: Thick Film & Shunt Resistor Market, By Type, 20162025 (Million Units)

Table 17 Automotive: Thick Film & Shunt Resistor Market, By Type, 20162025 (USD Million)

Table 18 Automotive: Market, By Region, 20162025 (Million Units)

Table 19 Automotive: Market, By Region, 20162025 (USD Million)

Table 20 Automotive: Shunt Resistor Market, By End-Use Region, 20162025 (Million Units)

Table 21 Automotive: Shunt Resistor Market, By Region, 20162025 (USD Million)

Table 22 Automotive: Thick Film Resistor Market, By Vehicle Type, 2016-2025 (Million Units)

Table 23 Automotive: Market, By Vehicle Type, 2016-2025 (USD Million)

Table 24 Passenger Car: Market, By Region, 20162025 (Million Units)

Table 25 Passenger Car: Market, By Region, 20162025 (USD Million)

Table 26 Commerical Vehicle: Market, By Region, 20162025 (Million Units)

Table 27 Commerical Vehicle: Market, By Region, 20162025 (USD Million)

Table 28 Market for Electric & Hybrid Vehicles, By Vehicle Type 2016-2025 (Million Units)

Table 29 Electric & Hybrid Vehicle Resistor Market, By Vehicle Type, 2016-2025 (USD Million)

Table 30 Battery Electric Vehicle: Thick Film Resistor Market, By Region, 2016-2025 (Million Units)

Table 31 Battery Electric Vehicle: Market, By Region, 2016-2025 (USD Million)

Table 32 Hybrid Electric Vehicle: Market, By Region, 2016-2025 (Million Units)

Table 33 Hybrid Electric Vehicle: Market, By Region, 2016-2025 (USD Million)

Table 34 Plug-In Hybrid Electric Vehicle: Market, By Region, 2016-2025 (Million Units)

Table 35 Plug-In Hybrid Electric Vehicle: Market, By Region, 2016-2025 (USD Million)

Table 36 Market for Automotive Industry, By Region, 20162025 (Million Units)

Table 37 Market for Automotive Industry, By Region, 20162025 (USD Million)

Table 38 Asia Oceania: Market for Automotive Industry, By Country, 20162025 (USD Million)

Table 39 Asia Oceania: Market for Automotive Industry, By Country, 20162025 (Million Units)

Table 40 China: Thick Film Resistor Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 41 China: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 42 India: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 43 India: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 44 Japan: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 45 Japan: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 46 South Korea: for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 47 South Korea: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 48 Europe: Thick Film Resistor Market for Automotive Industry, By Country, 20162025 (USD Million)

Table 49 Europe: Market for Automotive Industry, By Country, 20162025 (Million Units)

Table 50 Germany: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 51 Germany: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 52 France: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 53 France: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 54 Spain: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 55 Spain: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 56 Italy: Thick Film Resistor Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 57 Italy: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 58 UK: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 59 UK: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 60 Russia: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 61 Russia: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 62 North America: Market for Automotive Industry, By Country, 20162025 (Million Units)

Table 63 North America: Market for Automotive Industry, By Country, 20162025 (USD Million)

Table 64 US: Thick Film Resistor Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 65 US: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 66 Canada: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 67 Canada: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 68 Mexico: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 69 Mexico: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 70 Row: Market for Automotive Industry, By Country, 20162025 (Million Units)

Table 71 Row: Market for Automotive Industry, By Country, 20162025 (USD Million)

Table 72 Brazil: Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 73 Brazil: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 74 South Africa: Thick Film Resistor Market for Automotive Industry, By Resistor Type, 20162025 (Million Units)

Table 75 South Africa: Market for Automotive Industry, By Resistor Type, 20162025 (USD Million)

Table 76 New Product Launches/New Product Developments, 20162019

Table 77 Mergers & Acquisitions, 20132018

Table 78 Expansions, 20162018

Table 79 Supply Contracts, 20172019

List of Figures (47 Figures)

Figure 1 Thick Film Resistor Market Segmentation: Market

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach: Automotive Market

Figure 6 Top-Down Approach: Global Shunt and Market

Figure 7 Data Triangulation

Figure 8 Thick Film Resistor: Market Outlook

Figure 9 Thick Film Resistor Market, By Industry, 20182025 (USD Million)

Figure 10 Rising Premium Vehicle Sales and Growing Usage of High Perfromance Electrical and Electonic Products Offer Attractive Opportunities for Thick Film Resistor Manufacturers

Figure 11 Automotive Industry Held the Largest Share in the Market in 2018

Figure 12 Thick Film Power Resistor Held the Largest Share in the Global Market in 2018

Figure 13 Thick Film Power Resistor Leads the Market for Electrical & Electronic Industry

Figure 14 Thick Film Resistor Held the Largest Share for Telecommunication Industry in 2018

Figure 15 Passenger Cars Lead the Automotive Market, 20182025 (USD Million)

Figure 16 Hev Segment Held the Largest Share in the Electric & Hybrid Vehicle Segment as of 2018

Figure 17 Asia Ocenia to Dominate the Market for Automotive Industry During the Forecast Period

Figure 18 Thick Film Resistor: Market Dynamics

Figure 19 Power Consumption of Key Countries, 20072017 (Terawatt Hour)

Figure 20 Premium Car Sales, By Region, 20122016 (000 Units)

Figure 21 Advanced Driver Assistance System (Adas) Market, By Region, 20182025 (USD Billion)

Figure 22 Infotainment System & Telematics Control Unit Market, 20172022 (USD Billion)

Figure 23 Sales of Electric & Hybrid Vehicles, 20182025 (Thousand Units)

Figure 24 Thick Film Resistor Market, By End-Use Industry, 2016-2025 (USD Million)

Figure 25 Market, By Type, 2018-2025 (USD Million)

Figure 26 Market for Electrical & Electronics Industry, By Type, 2016-2025 (USD Million)

Figure 27 MThick Film Resistor arket for Telecommunication Industry, By Type, 2018-2025 (USD Million)

Figure 28 Automotive: Thick Film & Shunt Resistor Market, By Type, 2016-2025 (USD Million)

Figure 29 Market for Automotive Industry, By Vehicle Type, 2016-2025 (USD Million)

Figure 30 Market for Electric & Hybrid Vehicles, 2018-2025 (USD Million)

Figure 31 Thick Film Resistor Market for Automotive Industry, By Region, 20182025 (USD Million)

Figure 32 Asia Oceania: Market Snapshot

Figure 33 Europe: Market Snapshot

Figure 34 Thick Film Resistor: Market Ranking (2017)

Figure 35 Thick Film Power & Shunt Resistor Manufacturers: Competitive Leadership Mapping (2017)

Figure 36 Thick Film Power & Shunt Resistor Manufacturers: Company-Wise Product Offering Analysis

Figure 37 Thick Film Power & Shunt Resistor: Company-Wise Business Strategy Analysis

Figure 38 Companies Adopted New Product Development and Mergers & Acquisition as the Key Growth Strategies, 20152017

Figure 39 Yageo: Company Snapshot

Figure 40 TE Connectivity: Company Snapshot

Figure 41 KOA Corporation: Company Snapshot

Figure 42 Panasonic: Company Snapshot

Figure 43 Vishay: Company Snapshot

Figure 44 ROHM Semiconductor: Company Snapshot

Figure 45 Viking Tech Corporation: Company Snapshot

Figure 46 Murata: Company Snapshot

Figure 47 TT Electronics: Company Snapshot

The study involved four main activities to estimate the current size of the thick film resistor market. Exhaustive secondary research was done to collect information about the market, by resistor type, by end-use industry, by region, by vehicle type, and by electric & hybrid vehicle type. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. A mix of top-down and bottom-up approach were employed to estimate the overall market size for different segments considered in this study.

Secondary Research

The secondary sources referred for this research study include automotive industry organizations such as European Electronic Component Manufacturers Association; European Semiconductor Industry Association; Indian Electronics and Semiconductor Association; Institute of Electrical and Electronics Engineers (IEEE); Organisation Internationale des Constructeurs d'Automobiles (OICA); European Automobile Manufacturers Association (ACEA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and regional component-related associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

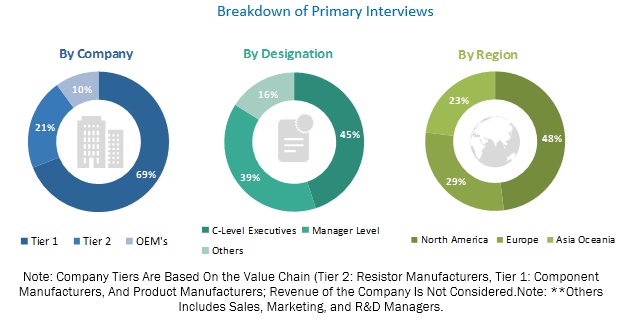

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs and system manufacturers) and the supply-side (resistor manufacturers) across four major regions, namely, Asia Oceania, Europe, North America, and the Rest of the World (RoW). Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach has been used to estimate and validate the size of the market, by end-use industry and resistor type. The market penetration of shunt and thick film power resistor is multiplied with the market, in terms of value, to get the global shunt and market, in terms of value. Further, the industry-wise breakup of the global shunt and market is derived from and validated through primary interviews to get the global shunt and market, by industry (automotive, electrical & electronics, and telecommunication). The regional-level penetration is multiplied with the industry-wise market derived from the secondary and primary research to get the regional-level market, by industry and resistor type, in terms of value

The bottom-up approach has been used to estimate and validate the size of the market, by vehicle and resistor type, in the automotive industry. To determine the market size, the number of shunts and thick film power resistors have been identified in different automotive applications (electronic power steering, lighting, ADAS, powertrain, battery management, etc.) for each vehicle type. Further, the identified number of shunts and thick film power resistors per automotive application is multiplied with the application-wise penetration rate and country-level production of each vehicle type. This gives country-level market, by vehicle type, and shunt type, in terms of volume. The country-level vehicle type market, by type, is then multiplied by the country-level average selling price of the shunt and thick film power, resulting in the country-level market size, in terms of value. The further addition of country-level markets gives the regional level market, and then the summation of regional level markets gives the market for the automotive industry, by vehicle and resistor type, in terms of volume and value.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends in the demand and supply sides in market.

Report Objectives

- To define, describe, and forecast the global thick film resistor and shunt resistor market, in terms of value (USD million)

- To define, describe, and forecast the thick film and shunt resistor market, by value and volume, on the basis of resistor type (thick film and shunt resistors) at country and regional levels

- To define, describe, and forecast the thick film and shunt resistor market, by value and volume, on the basis of IC vehicle type (passenger cars and commercial vehicles) and electric & hybrid vehicles, by vehicle type [battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug-in-hybrid electric vehicle (PHEV)] at regional level

- To define, describe, and forecast the market, by value, on the basis of end-use industry (automotive, electrical & electronics, and telecommunication) at regional level

- To define, describe, and forecast the market for the electrical & electronics, and telecommunication industry, by value, on the basis of type (thick film and shunt) at regional level

- To define, describe, and forecast the thick film and shunt resistor market, by value, on the basis of region (Asia Oceania, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of thick film and shunt resistor market

- To analyze the market share of the key players operating in the thick film and shunt resistor market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the thick film and shunt resistor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Thick Film & Shunt Resistor Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Note: The market of thick film and shunt resistors can be offered for aforementioned IC vehicle type in terms of volume and value

Thick Film & Shunt Resistor Market for Electric and Hybrid Vehicles, By Vehicle Type

- BEV

- HEV

- PHEV

Note: The market of thick film and shunt resistors can be offered for aforementioned IC vehicle type in terms of volume and value

Growth opportunities and latent adjacency in Thick Film Resistor Market