Thermoplastic Vulcanizates Market by Processing Method (Injection Molding, Extrusion), Application (Automotive, Footwear, Consumer Goods, Fluid Handling, Medical), and Region (North America, Europe, South America, APAC, MEA) - Global Forecast to 2032

Updated on : October 25, 2024

Thermoplastic Vulcanizates Market

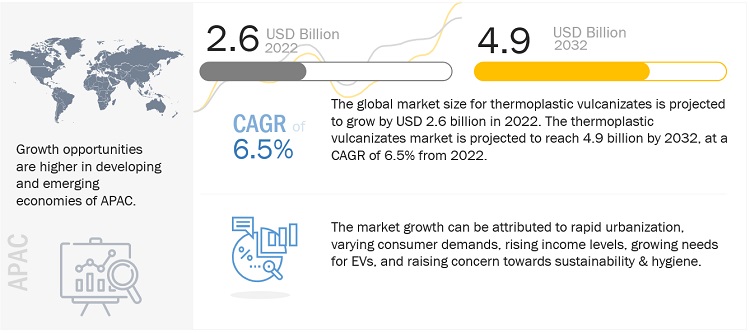

The global thermoplastic vulcanizates market was valued at USD 2.6 billion in 2022 and is projected to reach USD 4.9 billion by 2032, growing at 6.5% cagr from 2022 to 2032. Thermoplastic vulcanizates (TPVs) are a type of thermoplastic elastomers that combines the characteristics of both thermoplastic and elastomers. They are created by physically combining a thermoplastic resin with a vulcanized elastomer, resulting in a material that has the flexibility and elasticity of an elastomer but can also be melted and re-molded like a thermoplastic. TPVs have high strength, chemical resistance, and low-temperature flexibility. They are commonly utilised various segments such as automotive, construction, fluid handling, medical consumer goods, and others.

Attractive Opportunities in the Thermoplastic Vulcanizates Market

To know about the assumptions considered for the study, Request for Free Sample Report

Thermoplastic Vulcanizates Market Dynamics

Driver: Growth in Automotive sector and Raising penetration of EVs.

Thermoplastic vulcanizates have several favorable properties, such as excellent flexibility & elasticity, good chemical and temperature resistance, lightweight, ease of processing, etc. In the automotive industry, thermoplastic vulcanizates are commonly used for manufacturing panel hole plugs, gaskets, vibration dampeners, air inlet duct covers, headlamp seals, and weatherstripping seals. Raising concern about carbon emissions, & sustainability are the prime factors that drive the market of thermoplastic vulcanizates. Nowadays, many countries focus on eliminating the levels of carbon emissions, which drives the demand for EVs, and this helps in boosting the demand for TPV in the forecast period.

Restraint: Fluctuation in raw material prices

TPV (thermoplastic vulcanizate) prices fluctuate owing to a variety of reasons, such as changes in raw material supply and demand, geopolitical events, economic conditions, and currency exchange rates. Furthermore, production costs, technological advances, and market competition can all impact TPV prices. Oil prices play a dominant role in the price dynamics of thermoplastic vulcanizates, as most of the raw materials are derived from them. The majorily raw materials used for manufacturing the TPV are EPDM rubber and polypropylene.

Opportunities: Bio-based thermoplastic vulcanizates for various end-use industries

TPVs (thermoplastic vulcanizates) manufactured from renewable, biobased materials such as corn starch, sugar cane, or plant-based polymers are known as biobased thermoplastic vulcanizates. These Biobased TPVs offer better properties as compared to the traditional TPV and are used in various end-use industries such as automotive and electronics. They are considered to be environmentally friendly due to their reduced dependence on fossil fuels and lower carbon footprint compared to conventional TPVs made from petroleum-based polymers. However, The prices of biobased TPVs can fluctuate due to similar factors as conventional TPVs but also depend on the availability and cost of the biobased raw materials.

Challenges: Technological Advancements

In the era of technology, several innovations have taken place to enhance conventional materials' properties. It is very well known that thermoplastic vulcanizates have good chemical resistance, excellent fatigue resistance, and superior performance at elevated temperatures. Despite having excellent properties, thermoplastic vulcanizates cannot be used under aggressive temperatures and environmental oil conditions for prolonged periods of time because of the progressive change in their mechanical properties, such as fatigue resistance and strength. In view of this, several technological advancements are carried out nowadays to address these issues.

Thermoplastic Vulcanizates Market Ecosystem

By Application, the Automotive segment accounted for the highest CAGR during the forecast period

Thermoplastic vulcanizates industry offer several properties such as good elasticity, high durability, good heat & chemical resistance, and many more. These TPVs are light in weight have recyclable in nature. These are used in making several automobile parts, such as panel hole plugs, gaskets, vibration dampeners, air inlet duct covers, headlamp seals, and weatherstripping seals. Nowadays, many countries are focussing on decreasing carbon emissions, and in view of this, as TPVs offer less weight properties, so many automotive manufacturers are focussing on utilizing the TPVs made several products. This drives the demand for TPVs in the forecast period.

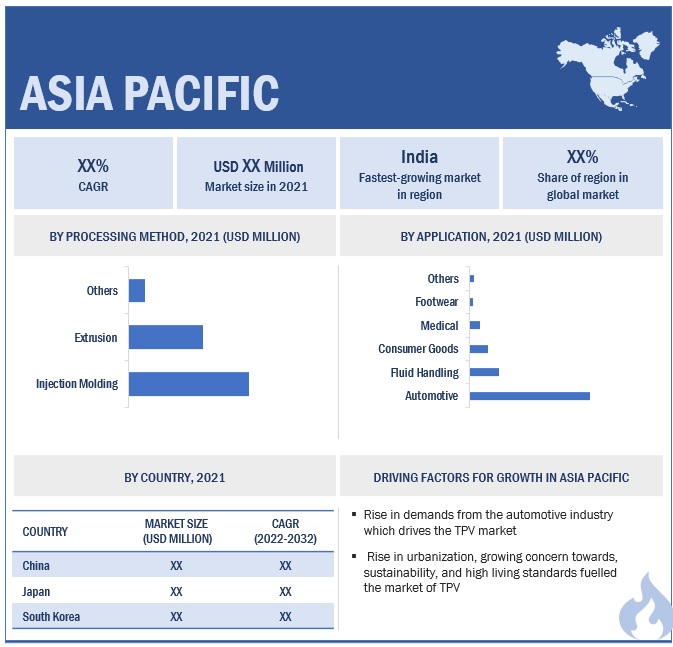

By Processing Method, the Injection Molding segment accounted for the highest CAGR during the forecast period

Injection Molding is one of the most important techniques for processing TPV material due to its high productivity and clean and residue-free operation. Apart from this, this processing method offers several advantages, such as high efficiency and high productivity, can be used for making complex shapes, reduces the need for manual labor, cost-effective, maintains tolerances values, and others. Due to these advantages, many manufacturers of several end-use industries use this processing method. Automotive manufacturers mainly use this processing method because of its excellent advantages.

Asia Pacific is projected to account for the highest CAGR in the thermoplastic vulcanizates market during the forecast period.

The Asia Pacific region is the hub of foreign investments and expanding industrial sectors largely due to the availability of low-cost labor and cheap availability of land. As a result of this, industrialization is rising in the region, which raises the demand for rubber products. In addition to this, the automotive industry is also growing in this region, as TPVs are used in making seals, gaskets, hoses, etc. Governments of several countries in this region focus on reducing their carbon footprint by shifting the utilization of conventional vehicles towards electric vehicles. This enhances the demand for EVs in the region, which escalates the demand for thermoplastic vulcanizates in the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Thermoplastic Vulcanizates Market Players

Thermoplastic vulcanizates comprises major manufacturers such as LyondellBasell Industries Holdings B.V. (Netherlands), Celanese Corporation (US), DuPont de Nemours, Inc. (US), Mitsui Chemicals, Inc.(Japan), and Trinseo Plc (US), were the leading players in the thermoplastic vulcanizates market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the thermoplastic vulcanizates industry.

Thermoplastic Vulcanizates Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 2.6 billion |

|

Revenue Forecast in 2032 |

USD 4.9 billion |

|

CAGR |

6.5% |

|

Years Considered |

2021–2032 |

|

Base year |

2021 |

|

Forecast period |

2022–2032 |

|

Unit considered |

Value (USD Million/USD Billion) and Volume (Kilotons) |

|

Segments |

Processing Method, Application, and Region |

|

Regions |

North America, Europe, South America, Asia Pacific, Middle East & Africa. |

|

Companies |

The major players are LyondellBasell Industries Holdings B.V. (Netherlands), Celanese Corporation (US), DuPont de Nemours, Inc. (US), Mitsui Chemicals, Inc.(Japan), Trinseo Plc (US)., Mitsubishi Chemical Corporation (Japan), Lotte Chemical Corporation (South Korea), RTP Company (US), HEXPOL AB.(Sweden), and Avient Corporation (US) among others are covered in the thermoplastic vulcanizates market. |

This research report categorizes the global thermoplastic vulcanizates market on the basis of Processing Method, Application, and Region.

Thermoplastic Vulcanizates Market by Processing Method:

- Injection Molding

- Extrusion

- Others

Thermoplastic Vulcanizates Market by Application:

- Automotive

- Fluid Handling

- Footwear

- Consumer Goods

- Medical

- Others

Thermoplastic Vulcanizates Market by Region:

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In November 2022, Mitsui Chemicals, Inc. has signed an agreement with Hokkaido University to establish an industry creation research and development department.

- In November 2022, Mitsui Chemicals, Inc.has signed an agreement with Kyoto University to build an autonomous testing system for automated synthesis.

- In November 2022, LyondellBasell Industries Holdings B.V., has collaborated with the automobile company Audi AG to use the plastic which is recovered from automobile plastic waste.

- In November 2022, Mitsui Chemicals, Inc opened a digital science lab to accelerate further the digital transformation (DX) of its R&D through digital science.

- In October 2022, LyondellBasell Industries Holdings B.V., has signed a Memorandum of Understanding (MoU) with The Shakti Plastic Industries to form a joint venture to build and operate a fully automated mechanical recycling plant in India.

- In October 2022, LyondellBasell Industries Holdings B.V., has signed a Memorandum of Understanding (MoU) with Genox Recycling Tech Co., Ltd. to establish a joint venture (JV) to build a plastics recycling plant in China.

- In June 2022, Mitsui Chemicals, Inc. has developed an environmentally friendly grade of MILASTOMER by using a recycled polyolefin as a principal component of the thermoplastic elastomer.

- In June 2022, Trinseo Plc opened its new Global Business Services (GBS) office in Dublin City Centre, welcoming representatives from leading local businesses and organizations.

- In February 2022, Celanese Corporation has announced the acquisition of the Mobility & Materials (“M&M”) business division of DuPont de Nemours, Inc.

- In January 2022, Trinseo Plc has completed the acquisition of Heathland B.V., a leading collector and recycler of post-consumer and post-industrial plastic wastes in Europe.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the thermoplastic vulcanizates market?

The major drivers influencing the growth of the thermoplastic vulcanizates market are increasing demand for electric vehicles and the presence of stringent emissions norms and regulations.

What are the major challenges in the thermoplastic vulcanizates market?

The major challenge in the thermoplastic vulcanizates market is the technological advancements that help in enhancing the properties of the thermoplastic vulcanizates.

What are the restraining factors in the thermoplastic vulcanizates market?

The major restraining factor faced by the thermoplastic vulcanizates market is the fluctuation in raw material prices.

What is the key opportunity in the thermoplastic vulcanizates market?

The growing demand for TPV in the medical & healthcare sector and biobased TPV for various end-use industries has a new opportunity for the thermoplastic vulcanizates market.

What are the applications where thermoplastic vulcanizates are used?

Thermoplastic vulcanizates are majorly used in various application areas such as automotive, fluid handling, consumer goods, footwear, medical, and others.

Which industries drive TPV demand in the US?

The automotive and construction sectors are the primary drivers, followed by healthcare, consumer goods, and industrial applications.

How are TPVs different from traditional rubber?

Unlike rubber, TPVs can be melted and reshaped, making them easier to process and recycle.

How do TPVs compare to traditional materials?

TPVs offer advantages such as lower weight, better fuel efficiency in vehicles, enhanced durability, and resistance to weathering compared to traditional thermoset rubbers or metals.

What challenges does the TPV market face?

The market faces challenges such as fluctuations in raw material prices and the need for continuous technological advancements to enhance product properties.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in automotive sector and rising penetration of EVs- Strict emission regulations and standards in developed countriesRESTRAINTS- Fluctuations in raw material pricesOPPORTUNITIES- Bio-based thermoplastic vulcanizates for various end-use industries- Increasing demand for thermoplastic vulcanizates in medical & healthcare sectorCHALLENGES- Technological advancements

-

6.1 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 TRADE ANALYSIS

-

6.4 TECHNOLOGY ANALYSISEXTRUSIONINJECTION MOLDING

- 6.5 REGULATORY LANDSCAPE

- 6.6 CASE STUDY ANALYSIS

-

6.7 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

- 6.8 KEY CONFERENCES & EVENTS, 2022–2023

-

6.9 PRICING ANALYSISCHANGES IN THERMOPLASTIC VULCANIZATES PRICING IN 2021

-

6.10 MARKET MAPPING/ECOSYSTEM MAP

-

6.11 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPE (2018–2022)INSIGHTSTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 EXTRUSIONPROVIDES HIGH DEGREE OF DESIGN FREEDOM

-

7.3 INJECTION MOLDINGMOST COMMONLY USED PROCESS

- 7.4 OTHERS

- 8.1 INTRODUCTION

-

8.2 AUTOMOTIVEGROWING DEMAND FOR EVS TO DRIVE MARKET

-

8.3 FLUID HANDLINGGROWING OIL, GAS, AND ENERGY DEMAND TO BOOST MARKET

-

8.4 CONSUMER GOODSGROWING ELECTRONICS INDUSTRY TO BOOST DEMAND

-

8.5 MEDICALGROWING MEDICAL DEVICE INDUSTRY TO INCREASE DEMAND

-

8.6 FOOTWEARFAVORABLE PROPERTIES HELP IN DRIVING DEMAND

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Growth of automotive industry to drive marketCANADA- Government initiatives help to drive marketMEXICO- Increase in automobile and auto parts manufacturing to boost market

-

9.3 ASIA PACIFICCHINA- Healthy growth of automotive industry to drive marketJAPAN- Strict emission standards to drive marketINDIA- Government initiatives to drive marketSOUTH KOREA- Increase in automobile manufacturing to propel marketREST OF ASIA PACIFIC

-

9.4 EUROPEGERMANY- Government support to boost electric vehicles marketUK- Growing electric vehicle penetration to meet vehicle emission targetsFRANCE- Growing consumption of thermoplastic vulcanizates in EVs to drive demandITALY- Growing demand for thermoplastic vulcanizates from manufacturing sectorSPAIN- Consumer goods industry to impact growth of thermoplastic vulcanizatesPOLAND- Automotive manufacturing to increase demand for thermoplastic vulcanizatesBENELUX- Government initiatives to provide growth opportunityAUSTRIA- Manufacturing to generate demand for thermoplastic vulcanizatesPORTUGAL- Medical equipment manufacturing to augment market growthCZECH REPUBLIC- Automotive industry to be major contributor to market growth

-

9.5 MIDDLE EAST & AFRICAGCC COUNTRIES- Government initiatives for vehicle electrification to propel demandSOUTH AFRICA- Steady recovery of automotive industry to support market growthREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Economic downturn and declining automobile production to significantly impact demandARGENTINA- Automotive industry to drive demandREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 COMPANIES ADOPTED EXPANSIONS AND M&AS AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2022

- 10.3 MARKET SHARE ANALYSIS

-

10.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE COMPANIES

-

10.5 SME MATRIX, 2021PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.6 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHES

-

11.1 KEY PLAYERSMITSUBISHI CHEMICAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLYONDELLBASELL INDUSTRIES HOLDINGS B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUI CHEMICALS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDUPONT DE NEMOURS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOTTE CHEMICAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCELANESE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVIENT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRINSEO PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEXPOL AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRTP COMPANY- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER PLAYERSHDC HYUNDAI ENGINEERING PLASTICS CO., LTD.RUSPLASTAPAR INDUSTRIES LTD.RAVAGO MANUFACTURINGTEKNOR APEXFM PLASTICSELASTRON TPEKRAIBURG TPECROSSPOLIMERIDIOSHY CO., LTD.KENT ELASTOMER PRODUCTS INC.KMI GROUP INC.MOCOM COMPOUNDS GMBH & CO. KGCUSTOMIZED COMPOUND SOLUTIONSAMERICHEM

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL AUTOMOTIVE VEHICLE PRODUCTION, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 2 GLOBAL ELECTRIC VEHICLE (BEV AND PHEV) SALES, BY VEHICLE TYPE, 2019–2021 (UNIT)

- TABLE 3 THERMOPLASTIC VULCANIZATES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 PROPYLENE, OTHER OLEFIN POLYMERS; POLYPROPYLENE IN PRIMARY FORMS (390210) IMPORTS, BY COUNTRY, 2021 (USD BILLION)

- TABLE 5 PROPYLENE, OTHER OLEFIN POLYMERS; POLYPROPYLENE IN PRIMARY FORMS (390210) EXPORTS, BY COUNTRY, 2021 (USD BILLION)

- TABLE 6 RUBBER; SYNTHETIC, ETHYLENE-PROPYLENE-NON-CONJUGATED DIENE RUBBER (EPDM), IN PRIMARY FORMS OR IN PLATES, SHEETS, OR STRIPS (400270) IMPORTS, BY COUNTRY, 2021 (USD BILLION)

- TABLE 7 RUBBER; SYNTHETIC, ETHYLENE-PROPYLENE-NON-CONJUGATED DIENE RUBBER (EPDM), IN PRIMARY FORMS OR IN PLATES, SHEETS, OR STRIPS (400270) EXPORTS, BY COUNTRY, 2021 (USD BILLION)

- TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 CREATING ANTI-SKID, MATTE FINISH CAR MATS FOR EUROPEAN MARKET

- TABLE 10 THERMOPLASTIC VULCANIZATES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 11 LIST OF PATENTS

- TABLE 12 THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 13 THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 14 THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 15 THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 16 THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 17 THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 18 THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 19 THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 20 THERMOPLASTIC VULCANIZATES MARKET, BY REGION, 2021–2025 (USD MILLION)

- TABLE 21 THERMOPLASTIC VULCANIZATES MARKET, BY REGION, 2026–2032 (USD MILLION)

- TABLE 22 THERMOPLASTIC VULCANIZATES MARKET, BY REGION, 2021–2025 (KILOTON)

- TABLE 23 THERMOPLASTIC VULCANIZATES MARKET, BY REGION, 2026–2032 (KILOTON)

- TABLE 24 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

- TABLE 25 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

- TABLE 26 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (KILOTON)

- TABLE 27 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (KILOTON)

- TABLE 28 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 29 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 30 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 31 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 32 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 33 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 34 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 35 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 36 US: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 37 US: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 38 US: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 39 US: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 40 US: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 41 US THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 42 US: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 43 US: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 44 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 45 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 46 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 47 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 48 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 49 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 50 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 51 CANADA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 52 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 53 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 54 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 55 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 56 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 57 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 58 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 59 MEXICO: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 60 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

- TABLE 61 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

- TABLE 62 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (KILOTON)

- TABLE 63 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (KILOTON)

- TABLE 64 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 65 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 66 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 67 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 68 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 69 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 70 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 71 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 72 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 73 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 74 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 75 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 76 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 77 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 78 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 79 CHINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 80 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 81 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 82 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 83 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 84 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 85 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 86 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 87 JAPAN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 88 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 89 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 90 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 91 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 92 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 93 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 94 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 95 INDIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 96 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 97 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 98 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 99 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 100 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 101 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 102 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 103 SOUTH KOREA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 104 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 107 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 108 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 111 REST OF ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 112 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

- TABLE 113 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

- TABLE 114 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (KILOTON)

- TABLE 115 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (KILOTON)

- TABLE 116 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 117 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 118 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 119 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 120 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 121 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 122 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 123 EUROPE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 124 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 125 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 126 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 127 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 128 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 129 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 130 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 131 GERMANY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 132 UK: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 133 UK: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 134 UK: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 135 UK: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 136 UK: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 137 UK: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 138 UK: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 139 UK: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 140 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 141 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 142 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 143 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 144 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 145 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 146 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 147 FRANCE: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 148 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 149 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 150 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 151 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 152 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 153 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 154 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 155 ITALY: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 156 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 157 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 158 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 159 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 160 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 161 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 162 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 163 SPAIN: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 164 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 165 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 166 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 167 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 168 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 169 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 170 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 171 POLAND: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 172 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 173 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 174 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 175 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 176 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 177 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 178 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 179 BENELUX: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 180 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 181 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 182 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 183 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 184 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 185 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 186 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 187 AUSTRIA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 188 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 189 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 190 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 191 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 192 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 193 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 194 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 195 PORTUGAL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 196 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 197 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 198 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 199 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 200 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 201 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 202 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 203 CZECH REPUBLIC: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 204 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (KILOTON)

- TABLE 207 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (KILOTON)

- TABLE 208 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 212 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 215 MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 216 GCC COUNTRIES: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 217 GCC COUNTRIES: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 218 GCC COUNTRIES: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 219 GCC COUNTRIES: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 220 GCC COUNTRIES: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 221 GCC COUNTRIES THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 222 GCC COUNTRIES: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 223 GCC COUNTRIES: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 224 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 225 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 226 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 227 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 228 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 229 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 230 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 231 SOUTH AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 232 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 235 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 236 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 237 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 238 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 239 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 240 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

- TABLE 241 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

- TABLE 242 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2021–2025 (KILOTON)

- TABLE 243 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY COUNTRY, 2026–2032 (KILOTON)

- TABLE 244 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 245 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 246 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 247 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 248 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 249 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 250 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 251 SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 252 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 253 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 254 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 255 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 256 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 257 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 258 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 259 BRAZIL: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 260 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 261 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 262 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 263 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 264 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 265 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 266 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 267 ARGENTINA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 268 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (USD MILLION)

- TABLE 269 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (USD MILLION)

- TABLE 270 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2021–2025 (KILOTON)

- TABLE 271 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY PROCESSING METHOD, 2026–2032 (KILOTON)

- TABLE 272 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (USD MILLION)

- TABLE 273 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (USD MILLION)

- TABLE 274 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2021–2025 (KILOTON)

- TABLE 275 REST OF SOUTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET, BY APPLICATION, 2026–2032 (KILOTON)

- TABLE 276 DEALS, 2018–2022

- TABLE 277 PRODUCT LAUNCHES, 2018–2022

- TABLE 278 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 279 MITSUBISHI CHEMICAL CORPORATION: DEALS

- TABLE 280 MITSUBISHI CHEMICAL CORPORATION: OTHERS

- TABLE 281 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY OVERVIEW

- TABLE 282 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: DEALS

- TABLE 283 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: OTHERS

- TABLE 284 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 285 MITSUI CHEMICALS, INC.: DEALS

- TABLE 286 MITSUI CHEMICALS, INC.: PRODUCT LAUNCHES

- TABLE 287 MITSUI CHEMICALS, INC.: OTHERS

- TABLE 288 DUPONT DE NEMOURS INC.: COMPANY OVERVIEW

- TABLE 289 DUPONT DE NEMOURS INC.: DEALS

- TABLE 290 DUPONT DE NEMOURS INC.: OTHERS

- TABLE 291 LOTTE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 292 LOTTE CHEMICAL CORPORATION: DEALS

- TABLE 293 LOTTE CHEMICAL CORPORATION: OTHERS

- TABLE 294 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 295 CELANESE CORPORATION: DEALS

- TABLE 296 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 297 AVIENT CORPORATION: OTHERS

- TABLE 298 TRINSEO PLC: COMPANY OVERVIEW

- TABLE 299 TRINSEO PLC: DEALS

- TABLE 300 TRINSEO PLC: OTHERS

- TABLE 301 HEXPOL AB: COMPANY OVERVIEW

- TABLE 302 HEXPOL AB: OTHERS

- TABLE 303 RTP COMPANY: COMPANY OVERVIEW

- TABLE 304 HDC HYUNDAI ENGINEERING PLASTICS CO., LTD.: COMPANY OVERVIEW

- TABLE 305 RUSPLAST: COMPANY OVERVIEW

- TABLE 306 APAR INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 307 RAVAGO MANUFACTURING: COMPANY OVERVIEW

- TABLE 308 TEKNOR APEX: COMPANY OVERVIEW

- TABLE 309 FM PLASTICS: COMPANY OVERVIEW

- TABLE 310 ELASTRON TPE: COMPANY OVERVIEW

- TABLE 311 KRAIBURG TPE: COMPANY OVERVIEW

- TABLE 312 CROSSPOLIMERI: COMPANY OVERVIEW

- TABLE 313 DIOSHY CO., LTD.: COMPANY OVERVIEW

- TABLE 314 KENT ELASTOMER PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 315 KMI GROUP INC.: COMPANY OVERVIEW

- TABLE 316 MOCOM COMPOUNDS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 317 CUSTOMIZED COMPOUND SOLUTIONS: COMPANY OVERVIEW

- TABLE 318 AMERICHEM: COMPANY OVERVIEW

- FIGURE 1 THERMOPLASTIC VULCANIZATES MARKET SEGMENTATION

- FIGURE 2 THERMOPLASTIC VULCANIZATES MARKET: RESEARCH DESIGN

- FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE

- FIGURE 7 THERMOPLASTIC VULCANIZATES MARKET: DATA TRIANGULATION

- FIGURE 8 INJECTION MOLDING TO LEAD THERMOPLASTIC VULCANIZATES MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC LED THERMOPLASTIC VULCANIZATES MARKET IN 2021

- FIGURE 10 RISING DEMAND FROM AUTOMOTIVE INDUSTRY TO DRIVE THERMOPLASTIC VULCANIZATES MARKET

- FIGURE 11 ASIA PACIFIC: CHINA ACCOUNTED FOR LARGEST SHARE OF THERMOPLASTIC VULCANIZATES MARKET IN 2021

- FIGURE 12 INJECTION MOLDING SEGMENT TO LEAD THERMOPLASTIC VULCANIZATES MARKET DURING FORECAST PERIOD

- FIGURE 13 AUTOMOTIVE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 THERMOPLASTIC VULCANIZATES MARKET IN INDIA TO RECORD HIGHEST CAGR FROM 2022 TO 2032

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMOPLASTIC VULCANIZATES MARKET

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 NEXT-GEN MOBILITY, LIGHTWEIGHTING, AND DIGITALIZATION TO CHANGE FUTURE REVENUE MIX OF SUPPLIERS

- FIGURE 18 ECOSYSTEM MAP

- FIGURE 19 DOCUMENT TYPE (2018–2022)

- FIGURE 20 PUBLICATION TRENDS (2018–2022)

- FIGURE 21 JURISDICTION ANALYSIS (2018–2022)

- FIGURE 22 TOP APPLICANTS, BY NUMBER OF PATENTS (TILL 2022)

- FIGURE 23 INJECTION MOLDING ACCOUNTED FOR HIGH CAGR DURING FORECAST PERIOD

- FIGURE 24 AUTOMOTIVE SEGMENT TO RECORD HIGHEST DEMAND FOR THERMOPLASTIC VULCANIZATES THROUGH 2032

- FIGURE 25 GLOBAL FOOTWEAR PRODUCTION SHARE IN 2021, BY REGION

- FIGURE 26 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 NORTH AMERICA: THERMOPLASTIC VULCANIZATES MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: THERMOPLASTIC VULCANIZATES MARKET SNAPSHOT

- FIGURE 29 THERMOPLASTIC VULCANIZATES: MARKET SHARE ANALYSIS

- FIGURE 30 COMPETITIVE LEADERSHIP MAPPING: THERMOPLASTIC VULCANIZATES MARKET, 2021

- FIGURE 31 SME MATRIX: THERMOPLASTIC VULCANIZATES MARKET, 2021

- FIGURE 32 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 33 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

- FIGURE 34 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 35 DUPONT DE NEMOURS INC.: COMPANY SNAPSHOT

- FIGURE 36 LOTTE CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 37 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 TRINSEO PLC: COMPANY SNAPSHOT

- FIGURE 40 HEXPOL AB: COMPANY SNAPSHOT

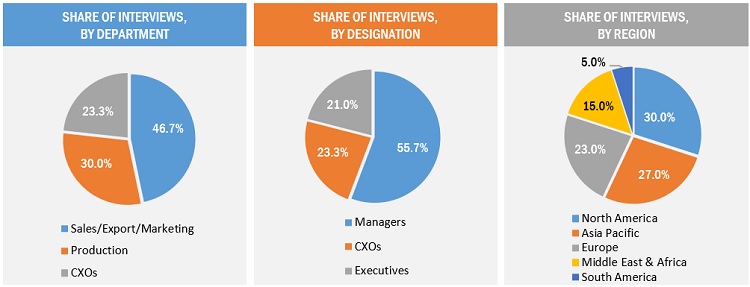

This research involved using extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect valuable information for a technical and market-oriented study of the thermoplastic vulcanizates market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of this industry's value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The thermoplastic vulcanizates market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, and CXOs of companies in the thermoplastic vulcanizates industry. Primary sources from the supply side include associations and institutions involved in the thermoplastic vulcanizates industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2021, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global thermoplastic vulcanizates market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global thermoplastic vulcanizates market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on processing method, application, and region.

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, South America, Asia Pacific, Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Thermoplastic vulcanizates market

- Further breakdown of the Rest of Europe's Thermoplastic vulcanizates market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermoplastic Vulcanizates Market