Thermal Management Solutions Market by Type (Water, Gas/Steam, Alkyl Benzenes, Mineral Oils, Synthetic Fluids, Silicon Polymer, Glycol, Molten Salts), Form, Temperature Class, Package Type, End-Use Industry, and Region - Global Forecast to 2028

Updated on : April 15, 2024

Thermal Management Solutions Market

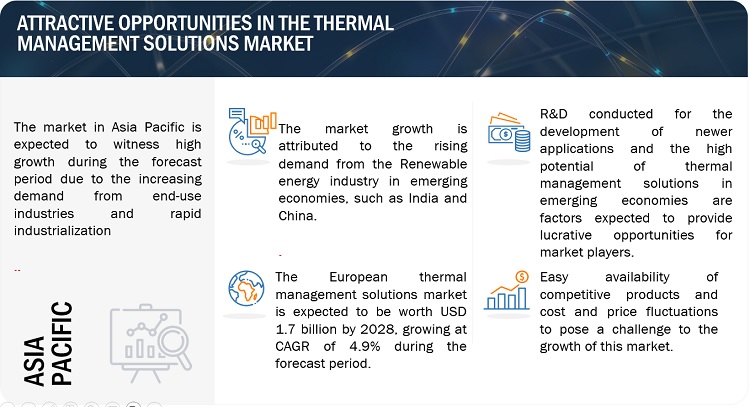

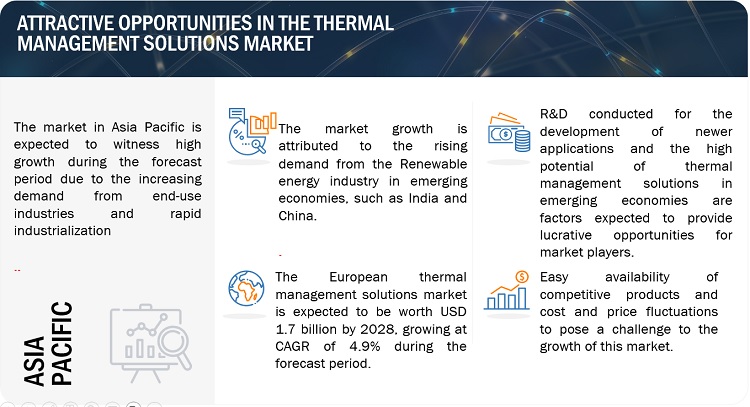

The global thermal management solutions market was valued at USD 4.3 billion in 2022 and is projected to reach USD 6.1 billion by 2028, growing at 5.9% cagr from 2023 to 2028. Increasing demand for thermal management solutions from emerging markets due to rapid industrialization and urbanization, and various end-use industries including automotive, energy & power, and pharmaceuticals are driving the market.

ATTRACTIVE OPPORTUNITIES IN THE THERMAL MANAGEMENT SOLUTIONS MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

Thermal Management Solutions Market Dynamics

Driver: Increased use of thermal management solutions to reduce operating costs and save energy

Thermal management solutions have better heat transfer properties than petroleum oils of comparable viscosity. They have exceptional thermal and oxidation stability and are widely used in open vented heat transfer systems; chemical processing equipment; laminating and calendaring rolls, molds, and dyes in the rubber and plastic industries; die-cast zinc; and aluminum alloys. The use of thermal management solutions in industrial plants leads to an increase in production volume and improving product quality. However, thermal management solutions are formulated to provide long-term stability and durability in high-temperature applications. They are designed to resist thermal degradation, oxidation, and other forms of degradation, which can extend their service life compared to other heat transfer methods. Longer service life means less frequent replacement or replenishment of thermal management solutions, resulting in cost savings and reduced energy consumption associated with manufacturing, transportation, and disposal of thermal management solutions. Additionally, thermal management solutions help processing industries reduce operating costs and energy consumption.

Restraint: Volatile raw material prices

Manufacturers of thermal management solutions face a significant challenge with the fluctuating prices of raw materials, including phenol, benzene, and glycol. These prices are directly influenced by the price changes of crude oil. As a result, manufacturers must adapt to the constantly changing costs of raw materials, which can decrease their profits. Consequently, market players are seeking to improve their efficiency and productivity to maintain their position in the market and achieve growth despite these challenges.

Opportunities: Electronic vehicles (EVs) and charging infrastructure

The shift towards EVs is driving the demand for thermal management solutions such as thermal management solutions to manage the temperature of the batteries, motors, and electronics. Heat transfer fluids help in efficient operation and prolong the lifespan of these components by maintaining the optimum temperature range. Moreover, with the growing demand for EV charging infrastructure, thermal management solutions are required for thermal management of charging stations, which provides opportunities for thermal management solutions manufacturers. As such, the thermal management solutions market is expected to grow significantly in the coming years due to the increasing adoption of EVs and the need for efficient thermal management solutions.

Challenges: Fire and explosion hazards related to thermal management solutions

Chemical plants use organic fluids for high-temperature applications like metal processing, plastic processing, and specialty chemical production. Thermal management solutions are not suitable for such applications as they can create explosive atmospheres. Heat-transfer fluids are utilized at temperatures above their flash point and fall under the Dangerous Substances and Explosive Atmosphere Regulations 2002 (DSEAR). Moreover, thermal management solutions that rely on mineral oils can degrade over time, lowering the fluid’s flash point. As a result, thermal fluids that were not flammable when installed may become flammable at operating conditions over time. Under pressure, these thermal fluids may also produce explosive mist atmospheres, even when below the flash point temperature. To minimize the risk of explosion, it is essential to follow strict procedures to change the thermal management solutions and eliminate the lower flashpoint components from the fluid. Regular thermal tests can help reduce the potential for risks. However, without adequate testing and maintenance, the risk of explosion associated with heat-transfer fluids is unavoidable, which restricts their usage.

Thermal Management Solutions Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of thermal management solutions. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Some of the prominent companies in this market include ExxonMobil (US), The Dow Chemical Company (US), Chevron (US), Shell PLC (UK), and Clariant AG (Germany).

The Silicon Polymer thermal management solutions segment, by type, is expected to be the second largest market during the forecast period.

Based on type, silicone polymer-based thermal management solutions are expected to dominate the market during the forecast period. Their high thermal stability, longer fluid life, lower maintenance cost, and excellent thermal performance make them a popular choice. Compared to other types, they are versatile and can be used in a wide range of applications such as heating and cooling systems, heat exchangers, solar thermal systems, and geothermal systems. This versatility has contributed to their growing popularity in various industries and applications.

Based on form, non- aqueous form accounts for the largest share of the overall market

Based on form, the non-aqueous form holds the majority of the market share for thermal management solutions. This is because non-aqueous thermal management solutions have higher thermal stability and can operate at higher temperatures compared to water-based fluids. Additionally, non-aqueous thermal management solutions offer better heat transfer efficiency, lower viscosity, and reduced fouling and corrosion, leading to improved system performance and longer equipment lifespan. Furthermore, non-aqueous thermal management solutions have low freezing points, allowing them to be used in cold climates without the need for antifreeze additives. These benefits make non-aqueous thermal management solutions preferred choices in a wide range of applications, driving their demand and market share.

Based on Packaging, bulk containers accounts for the largest share of the overall market

Based on packaging, bulk containers account for the major share. This is because thermal management solutions are typically used in large-scale industrial processes that require a continuous and reliable supply of fluid. Bulk containers, such as intermediate bulk containers (IBCs) or drums, provide a cost-effective and efficient way to store and transport a large volume of thermal management solutions, reducing the need for frequent replacements or refills. This can result in improved operational efficiency and reduced downtime in industrial processes.

Based on Temperature, high temperature thermal management solutions accounts for the largest share of the overall market

Based on the temperature, high temperature thermal management solutions accounts for the largest share. High temperature thermal management solutions, such as synthetic oils, molten salts, and liquid metals, offer superior thermal stability, allowing them to maintain their performance properties even at extreme temperatures. They exhibit high boiling points, low vapor pressure, and excellent thermal conductivity, enabling efficient heat transfer in demanding applications. Moreover, high temperature thermal management solutions are often designed with enhanced oxidation and thermal degradation resistance, minimizing the risk of system failures and extending the fluid's service life.

Based on end-use industry, renewable energy accounts for the second largest share of the overall market

Based on the end use industry, renewable energy accounts for the second largest share in the overall market. The renewable energy industry's rapid growth has created a significant demand for thermal management solutions that are specifically designed to meet the unique requirements of these renewable energy systems, such as high thermal stability, low environmental impact, and efficient heat transfer performance. As governments and industries around the world continue to prioritize renewable energy as a key component of their energy mix, the demand for thermal management solutions in the renewable energy sector is expected to remain strong, making it the largest industry in the thermal management solutions market.

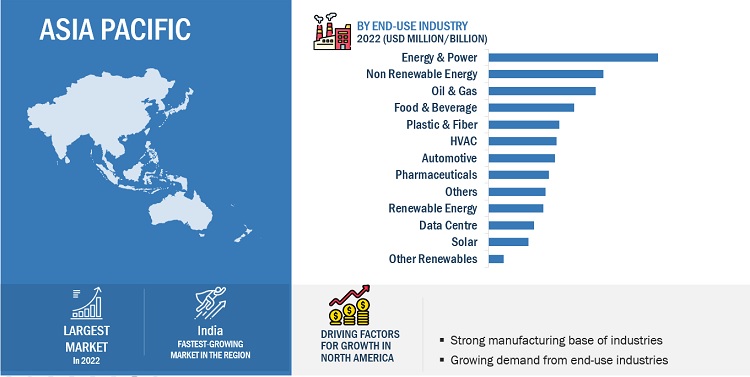

Asia Pacific is expected to account for the largest share of the global market during the forecast period.

Based on the region, Asia Pacific accounts for the largest share. The region's rapid industrialization and urbanization have resulted in a significant increase in demand for thermal management solutions in various industrial processes, including manufacturing, petrochemicals, automotive, and electronics. The growing industrial activities in countries like China, India, Japan, South Korea, and Southeast Asian countries have led to an increased need for efficient and reliable heat transfer solutions to support their expanding industrial sectors. Furthermore, the Asia Pacific region has also witnessed significant growth in renewable energy production, particularly in solar thermal and geothermal power generation. Thermal management solutions are crucial in these renewable energy systems to capture, store, and transfer heat for power generation. With a push towards renewable energy and sustainability in the region, the demand for thermal management solutions in the renewable energy sector has also increased which results in driving the thermal management solutions market in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Thermal Management Solutions Market Players

The thermal management solutions market is dominated by a few major players that have a wide regional presence. The key players in the thermal management solutions market are The Dow Chemical Company (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant AG (Germany), Wacker Chemie (AG), and Dupont (US). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the thermal management solutions market.

Thermal Management Solutions Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (KiloTon); Value (USD Billion) |

|

Segments |

Form, Type, Temperature-class, Package, End-use Industries, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The Dow Chemical Company (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant AG (Germany), Wacker Chemie (AG), and Dupont (US) |

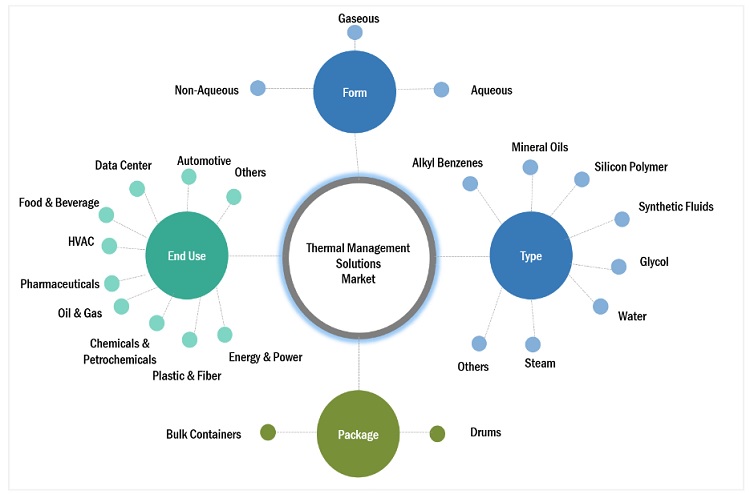

This report categorizes the global thermal management solutions market based on form, type, temperature, package, end-use industry, and region.

On the basis of form, the thermal management solutions market has been segmented as follows:

- Aqueous Form

- Non-Aqueous form

- Gaseous Form

On the basis of type, the thermal management solutions market has been segmented as follows:

- Alkyl Benzenes

- Mineral Oils

- Synthetic Fluids

- Silicon Polymer

-

Glycol

- Ethylene Glycol

- Propylene Glycol

- Water

- Steam

- Molten Salts

- Others

On the basis of temperature, the thermal management solutions market has been segmented as follows:

- High Temperature

- Low Temperature

On the basis of package type, the thermal management solutions market has been segmented as follows:

- Drums

- Bulk Containers

On the basis of end-use industry, the thermal management solutions market has been segmented as follows:

-

Energy & Power

- Non-Renewable Energy

-

Renewable Energy

- Solar

- Other Renewables

- Chemical & Petrochemical

- Plastic & Fiber

- Oil & Gas

- HVAC

- Pharmaceuticals

- Automotive

- Food & Beverage

- Data Center

- Others

On the basis of region, the thermal management solutions market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- Eastman plans to expand the Therminol 66 thermal management solutions manufacturing capacity in Anniston, Alabama in July 2022. By 2024, the expansion of the plant is anticipated to be finished, which will result in a 50% augmentation in the capacity of the US-based facility.

- In June 2022, Chevron finalized the acquisition of the Renewable Energy Group, with the aim of utilizing its expertise to provide energy with lower carbon emissions by leveraging the company's strengths.

- Eastman introduced Fluid Genius in June 2021, which is a patent-pending product that utilizes artificial intelligence technology and Eastman's proficiency to enhance the performance of heat transfer systems with predictive analytics. By providing end-users with predictive insights, Fluid Genius aids in optimizing the performance of thermal management solutions and maximizing the life cycle of thermal management solutions for diverse system applications.

- In April 2019, Eastman expanded its product offerings by acquiring Marlotherm from Sasol (South Africa). Marlotherm is a brand of thermal management solutions.

Frequently Asked Questions (FAQ):

What is the current size of the thermal management solutions market?

The current market size of the global thermal management solutions market is USD 4.3 billion in 2022.

What are the major drivers for the thermal management solutions market?

Supportive renewable energy policies in Asia Pacific, Increased use of thermal management solutions to reduce operating costs and save energy are the major drivers in the market.

Which is the fastest-growing region during the forecasted period in the thermal management solutions market?

Asia Pacific is expected to be the fastest-growing region for the global thermal management solutions market between 2022–2028. The region's rapid industrialization and urbanization have resulted in a significant increase in demand for thermal management solutions.

Which is the fastest-growing End use industry, during the forecasted period in the thermal management solutions market?

Renewable energy is the largest end use industry in the thermal management solutions market.

Which is the fastest growing segment by temperature during the forecasted period in the thermal management solutions market?

By temperature, high temperature thermal management solutions are the fastest growing segment in the forecasted period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapid industrialization and supportive renewable energy policies in Asia Pacific- Growing number of concentrated solar power projects- Increased use of thermal management solutions to reduce operating costs and save energyRESTRAINTS- Volatile raw material pricesOPPORTUNITIES- Increasing need for energy conservation and clean energy- Government schemes focused on energy efficiency and renewable energyCHALLENGES- Fire and explosion hazards related to thermal management solutions

-

5.3 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSTHERMAL MANAGEMENT SOLUTION MANUFACTURERSDISTRIBUTORSEND USERS

-

5.5 ECOSYSTEM

- 5.6 RECESSION IMPACT

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY PRODUCT TYPEAVERAGE SELLING PRICE, BY KEY PLAYER

-

5.8 TRADE ANALYSISIMPORT–EXPORT SCENARIO OF THERMAL MANAGEMENT SOLUTIONS MARKET

-

5.9 MACROECONOMIC DATAOIL PRODUCTION DATARENEWABLE ENERGY PRODUCTION DATAAUTOMOTIVE PRODUCTION DATA

-

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.11 CASE STUDY ANALYSISTHE DOW CHEMICAL COMPANY OFFERS THERMAL MANAGEMENT SOLUTIONS TO THE UNIVERSITY OF NORTH DAKOTA (UND) IN GRAND FORKS FOR PROVIDING PEAK PERFORMANCE AT UND AND IMPROVING THE HEATING AND COOLING SYSTEMS OF RALPH ENGELSTAD ARENA IN DIFFERENT SEASONSEASTMAN CHEMICAL COMPANY PROVIDES THERMINOL THERMAL MANAGEMENT SOLUTIONS TO ROTTERDAM FACILITY OF INDORAMA VENTURES FOR CONTINUING WITH ITS PRODUCTIONCHROMALOX AND EASTMAN MEET HIGH-TEMPERATURE DEMANDS OF CHEMICAL PRODUCTION PLANT

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 FACTORS INFLUENCING BUYING DECISIONSQUALITYSERVICES

-

5.14 TARIFF AND REGULATORY LANDSCAPEASIA PACIFICEUROPENORTH AMERICA- US- Canada

-

5.15 PATENT ANALYSISMETHODOLOGYPATENTS GRANTED WORLDWIDE, 2012–2022PATENT PUBLICATION TRENDSINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION-WISE PATENT ANALYSISTOP COMPANIES/APPLICANTSTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.16 MATERIAL ANALYSIS

- 5.17 TECHNOLOGY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 DRUMSPROVIDES EASE OF TRANSPORTATION WITH COST-EFFECTIVENESS

-

6.3 BULK CONTAINERSTRANSPORTATION OF LARGE AMOUNTS OF THERMAL MANAGEMENT SOLUTIONS WITH EASE

- 7.1 INTRODUCTION

-

7.2 ALKYL BENZENEINCREASED USE IN HIGH-TEMPERATURE APPLICATIONS DUE TO HIGH THERMAL STABILITY

-

7.3 MINERAL OILWIDELY USED IN CHEMICAL AND OIL & GAS INDUSTRIES

-

7.4 SYNTHETIC FLUIDSUITABLE FOR HIGH-TEMPERATURE APPLICATIONS

-

7.5 SILICON POLYMERRISING DEMAND FROM FOOD & BEVERAGE AND PHARMACEUTICAL INDUSTRIES

-

7.6 GLYCOL-BASED FLUIDANTI-CORROSIVE ADDITIVES REDUCE MAINTENANCE COSTS

-

7.7 WATERNUMEROUS APPLICATIONS IN VARIOUS INDUSTRIES

-

7.8 STEAMEASY AVAILABILITY AND COST-EFFECTIVENESS DRIVE DEMAND IN POWER GENERATION INDUSTRY

- 7.9 OTHERS

- 8.1 INTRODUCTION

-

8.2 AQUEOUS FORMPREVENTS CORROSION, FREEZING, SCALING, AND FOULING OF EQUIPMENT

-

8.3 NON-AQUEOUS FORMDESIGNED FOR HIGH-TEMPERATURE INDUSTRIAL APPLICATIONS

-

8.4 GASEOUS FORMSUITABLE FOR BOTH LOW-TEMPERATURE AND HIGH- TEMPERATURE APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 HIGH-TEMPERATURE THERMAL MANAGEMENT SOLUTIONSHIGH THERMAL STABILITY ELIMINATES CORROSION AND DEGRADATION

-

9.3 LOW-TEMPERATURE THERMAL MANAGEMENT SOLUTIONSUTILIZED IN VARIOUS END-USE INDUSTRIES DUE TO EFFICIENT HEAT TRANSFER BELOW FREEZING POINT

- 10.1 INTRODUCTION

-

10.2 ENERGY & POWERTHERMAL MANAGEMENT SOLUTIONS FIND APPLICATION IN STEAM GENERATION IN POWER GENERATIONNON-RENEWABLE ENERGYRENEWABLE ENERGY

-

10.3 CHEMICAL & PETROCHEMICALTHERMAL MANAGEMENT SOLUTIONS USED IN CHEMICAL PROCESSING INDUSTRIES FOR DISTILLATION AND CRYSTALLIZATION PURPOSES

-

10.4 OIL & GASTHERMAL MANAGEMENT SOLUTIONS USED IN HEATING & COOLING OF EQUIPMENT, PROCESS HEATING, AND TEMPERATURE CONTROL

-

10.5 PLASTIC & FIBER PROCESSING INDUSTRYWATER AND MINERAL OIL COMMONLY USED THERMAL MANAGEMENT SOLUTIONS IN PLASTIC PROCESSING INDUSTRY

-

10.6 AUTOMOBILEENGINE OILS, BATTERIES, COMPRESSORS, AUTOMATIC TRANSMISSION, AND MOTORS UTILIZE THERMAL MANAGEMENT SOLUTIONS

-

10.7 FOOD & BEVERAGEWATER AND GLYCOL-BASED THERMAL MANAGEMENT SOLUTIONS FIND APPLICATION IN FOOD & BEVERAGE INDUSTRY

-

10.8 PHARMACEUTICALSILICONE FLUID USED IN PHARMACEUTICAL INDUSTRY FOR ITS BROAD OPERATING TEMPERATURE RANGE

-

10.9 HVACDUCT HEATING, BOILERS, FLANGED HEATERS, AND THERMAL ENERGY STORAGE SYSTEMS UTILIZE THERMAL MANAGEMENT SOLUTIONS IN HVAC SYSTEMS

-

10.10 DATA CENTERSTHERMAL MANAGEMENT SOLUTIONS USED FOR ABSORBING HEAT GENERATED BY SERVERS AND IT EQUIPMENT

- 10.11 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICCHINA- Growing demand from energy-efficient HVAC systemsJAPAN- Booming chemical industry to witness high demand for thermal management solutionsINDIA- Abundant solar energy to create new avenues for growthSOUTH KOREA- Flourishing HVAC industry to drive demandREST OF ASIA PACIFIC

-

11.3 EUROPEGERMANY- Strong manufacturing sector to propel market growthFRANCE- Strong base of manufacturing firms to provide impetus to use thermal management solutionsITALY- Country’s strong focus on environmental protection to foster market growthUK- Rising use of renewable energy to spur demandSPAIN- Production of energy using renewables to propel market growthREST OF EUROPE

-

11.4 NORTH AMERICAUS- Increasing demand for renewable energy to boost marketCANADA- Expertise in emerging technologies to attract major investmentsMEXICO- Increased foreign investments in oil & gas industry to boost market

-

11.5 SOUTH AMERICABRAZIL- Growing industrialization to boost marketARGENTINA- Economic recovery to favor market growthREST OF SOUTH AMERICA

-

11.6 MIDDLE EAST & AFRICASAUDI ARABIA- Growing oil & gas and chemical industries to drive marketUAE- Rising demand for thermal management solutions from oil & gas industry to support market growthREST OF MIDDLE EAST & AFRICA

- 12.1 OVERVIEW

- 12.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 12.3 MARKET SHARE ANALYSIS

- 12.4 REVENUE ANALYSIS OF TOP PLAYERS

- 12.5 MARKET EVALUATION MATRIX

-

12.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 12.8 COMPANY END-USE INDUSTRY FOOTPRINT (1/2)

- 12.9 COMPANY END-USE INDUSTRY FOOTPRINT (2/2)

- 12.10 COMPANY PRODUCT TYPE FOOTPRINT (1/2)

- 12.11 COMPANY PRODUCT TYPE FOOTPRINT (2/2)

- 12.12 COMPANY REGION FOOTPRINT

- 12.13 STRENGTH OF PRODUCT PORTFOLIO

- 12.14 BUSINESS STRATEGY EXCELLENCE

-

12.15 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 MAJOR PLAYERSTHE DOW CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Product Type- Thermal Management Solutions Market: By Temperature Class- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- Recent developments- MnM viewEXXONMOBIL- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- Recent developments- MnM viewCHEVRON- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- Recent developments- MnM viewHUNTSMAN CORPORATION- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- MnM viewSHELL PLC- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- MnM viewLANXESS- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- MnM viewCLARIANT AG- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- MnM viewWACKER CHEMIE AG- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- MnM viewDUPONT- Business overview- Products/Solutions/Services offered- Thermal Management Solutions Market: By Type- Thermal Management Solutions Market: By Temperature Class- MnM view

-

13.2 OTHER PLAYERSDYNALENEDURATHERMINTERSTATE CHEMICAL COMPANYCHEMFAXGLYECOPARATHERMARKEMABASFHINDUSTAN PETROLEUM CORPORATIONPHILLIPS 66PETRO-CANADARADCO INDUSTRIESSCHAEFFER SPECIALIZED LUBRICANTSISELGLOBAL HEAT TRANSFER

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 THERMAL MANAGEMENT SOLUTIONS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 CONCENTRATED SOLAR POWER PLANTS WORLDWIDE

- TABLE 3 THERMAL MANAGEMENT SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 THERMAL MANAGEMENT SOLUTIONS MARKET: ROLE OF STAKEHOLDERS IN ECOSYSTEM

- TABLE 5 THERMAL MANAGEMENT SOLUTION PRICES FOR DIFFERENT PRODUCT TYPES, 2022(USD/KG)

- TABLE 6 IMPORT TRADE DATA FOR THERMAL MANAGEMENT SOLUTIONS

- TABLE 7 EXPORT TRADE DATA FOR THERMAL MANAGEMENT SOLUTIONS

- TABLE 8 REAL AND PROJECTED GDP GROWTH OF KEY COUNTRIES, 2018–2025 (ANNUAL PERCENTAGE)

- TABLE 9 OIL PRODUCTION DATA, BY COUNTRY, 2019–2021 (MILLION TONS

- TABLE 10 RENEWABLE ENERGY GENERATION DATA, BY COUNTRY, 2019–2021 (TERAWATT HOURS)

- TABLE 11 AUTOMOTIVE PRODUCTION DATA, BY COUNTRY, 2019–2021 (MILLION UNIT)

- TABLE 12 THERMAL MANAGEMENT SOLUTIONS MARKET: CONFERENCES AND EVENTS

- TABLE 13 THERMAL MANAGEMENT SOLUTIONS MARKET: KEY BUYING CRITERIA AND RATINGS

- TABLE 14 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 TOTAL NUMBER OF PATENTS

- TABLE 16 TOP 10 PATENT OWNERS

- TABLE 17 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 18 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 19 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (KILOTON)

- TABLE 20 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (KILOTON)

- TABLE 21 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 22 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 23 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 24 THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 25 THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 26 THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 27 THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 28 THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 29 THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (USD MILLION)

- TABLE 30 THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (USD MILLION)

- TABLE 31 THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (KILOTON)

- TABLE 32 THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (KILOTON)

- TABLE 33 THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 34 THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 35 THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 36 THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 37 THERMAL MANAGEMENT SOLUTIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 THERMAL MANAGEMENT SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 THERMAL MANAGEMENT SOLUTIONS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 40 THERMAL MANAGEMENT SOLUTIONS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 41 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 42 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 44 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 45 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 46 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 48 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 49 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 52 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 53 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 54 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (KILOTON)

- TABLE 56 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (KILOTON)

- TABLE 57 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (USD MILLION)

- TABLE 58 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (KILOTON)

- TABLE 60 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (KILOTON)

- TABLE 61 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 62 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 64 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 65 CHINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 66 CHINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 67 CHINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 68 CHINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 69 JAPAN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 70 JAPAN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 JAPAN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 72 JAPAN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 73 INDIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 74 INDIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 INDIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 76 INDIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 77 SOUTH KOREA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 78 SOUTH KOREA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 79 SOUTH KOREA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 80 SOUTH KOREA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 84 REST OF ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 85 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 88 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 89 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 92 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 93 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 96 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 97 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (KILOTON)

- TABLE 100 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (KILOTON)

- TABLE 101 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (KILOTON)

- TABLE 104 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (KILOTON)

- TABLE 105 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 108 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 109 GERMANY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 110 GERMANY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 111 GERMANY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 112 GERMANY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 113 FRANCE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 114 FRANCE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 115 FRANCE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 116 FRANCE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 117 ITALY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 118 ITALY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 ITALY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 120 ITALY: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 121 UK: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 122 UK: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 123 UK: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 124 UK: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 125 SPAIN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 126 SPAIN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 127 SPAIN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 128 SPAIN: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 129 REST OF EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 130 REST OF EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 131 REST OF EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 132 REST OF EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 133 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 136 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 137 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 140 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 141 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 142 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 144 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 145 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (KILOTON)

- TABLE 148 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (KILOTON)

- TABLE 149 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (USD MILLION)

- TABLE 150 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (KILOTON)

- TABLE 152 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (KILOTON)

- TABLE 153 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 155 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 156 NORTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 157 US: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 158 US: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 159 US: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 160 US: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 161 CANADA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 162 CANADA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 163 CANADA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 164 CANADA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 165 MEXICO: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 166 MEXICO: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 167 MEXICO: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 168 MEXICO: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 169 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 170 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 171 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 172 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 173 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 174 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 175 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 176 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 177 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 178 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 180 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 181 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 182 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (KILOTON)

- TABLE 184 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (KILOTON)

- TABLE 185 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (KILOTON)

- TABLE 188 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (KILOTON)

- TABLE 189 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 191 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 192 SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 193 BRAZIL: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 194 BRAZIL: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 195 BRAZIL: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 196 BRAZIL: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 197 ARGENTINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 198 ARGENTINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 199 ARGENTINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 200 ARGENTINA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 201 REST OF SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 203 REST OF SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 204 REST OF SOUTH AMERICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 205 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 208 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 209 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 212 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 213 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 216 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 217 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2019–2022 (KILOTON)

- TABLE 220 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY PACKAGE TYPE, 2023–2028 (KILOTON)

- TABLE 221 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2019–2022 (KILOTON)

- TABLE 224 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY TEMPERATURE CLASS, 2023–2028 (KILOTON)

- TABLE 225 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 228 MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 229 SAUDI ARABIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 230 SAUDI ARABIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 231 SAUDI ARABIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 232 SAUDI ARABIA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 233 UAE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 234 UAE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 235 UAE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 236 UAE: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 237 REST OF MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 238 REST OF MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 239 REST OF MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 240 REST OF MIDDLE EAST & AFRICA: THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 241 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- TABLE 242 THERMAL MANAGEMENT SOLUTIONS MARKET: DEGREE OF COMPETITION

- TABLE 243 THERMAL MANAGEMENT SOLUTIONS MARKET: REVENUE ANALYSIS (USD)

- TABLE 244 MARKET EVALUATION MATRIX

- TABLE 245 PRODUCT LAUNCHES, 2015–2022

- TABLE 246 DEALS, 2017—2022

- TABLE 247 OTHER DEVELOPMENTS, 2015–2022

- TABLE 248 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 249 THE DOW CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 250 THE DOW CHEMICAL COMPANY: BY PRODUCT TYPE

- TABLE 251 THE DOW CHEMICAL COMPANY: BY TEMPERATURE CLASS

- TABLE 252 THE DOW CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 253 THE DOW CHEMICAL COMPANY: OTHER DEVELOPMENTS

- TABLE 254 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 255 EASTMAN CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 256 EASTMAN CHEMICAL COMPANY: BY TYPE

- TABLE 257 EASTMAN CHEMICAL COMPANY: BY TEMPERATURE CLASS

- TABLE 258 EASTMAN CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 259 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 260 EASTMAN CHEMICAL COMPANY: OTHER DEVELOPMENTS

- TABLE 261 EXXONMOBIL: COMPANY OVERVIEW

- TABLE 262 EXXONMOBIL: PRODUCT OFFERINGS

- TABLE 263 EXXONMOBIL: BY TYPE

- TABLE 264 EXXONMOBIL: BY TEMPERATURE CLASS

- TABLE 265 EXXONMOBIL: DEALS

- TABLE 266 CHEVRON: COMPANY OVERVIEW

- TABLE 267 CHEVRON: PRODUCT OFFERINGS

- TABLE 268 CHEVRON: BY TYPE

- TABLE 269 CHEVRON: BY TEMPERATURE CLASS

- TABLE 270 CHEVRON: DEALS

- TABLE 271 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- TABLE 272 HUNTSMAN CORPORATION: PRODUCT OFFERINGS

- TABLE 273 HUNTSMAN CORPORATION: BY TYPE

- TABLE 274 HUNTSMAN CORPORATION: BY TEMPERATURE CLASS

- TABLE 275 SHELL PLC: COMPANY OVERVIEW

- TABLE 276 SHELL PLC: PRODUCT OFFERINGS

- TABLE 277 SHELL PLC: BY TYPE

- TABLE 278 SHELL PLC: BY TEMPERATURE CLASS

- TABLE 279 LANXESS: COMPANY OVERVIEW

- TABLE 280 LANXESS: PRODUCT OFFERINGS

- TABLE 281 LANXESS: BY TYPE

- TABLE 282 LANXESS: BY TEMPERATURE CLASS

- TABLE 283 CLARIANT AG: COMPANY OVERVIEW

- TABLE 284 CLARIANT AG: PRODUCT OFFERINGS

- TABLE 285 CLARIANT AG: BY TYPE

- TABLE 286 CLARIANT AG: BY TEMPERATURE CLASS

- TABLE 287 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 288 WACKER CHEMIE AG: PRODUCT OFFERINGS

- TABLE 289 WACKER CHEMIE AG: BY TYPE

- TABLE 290 WACKER CHEMIE AG: BY TEMPERATURE CLASS

- TABLE 291 DUPONT: COMPANY OVERVIEW

- TABLE 292 DUPONT: PRODUCT OFFERINGS

- TABLE 293 DUPONT: BY TYPE

- TABLE 294 DUPONT: BY TEMPERATURE CLASS

- FIGURE 1 THERMAL MANAGEMENT SOLUTIONS: MARKET SEGMENTATION

- FIGURE 2 THERMAL MANAGEMENT SOLUTIONS MARKET: RESEARCH DESIGN

- FIGURE 3 THERMAL MANAGEMENT SOLUTIONS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 THERMAL MANAGEMENT SOLUTIONS MARKET: TOP-DOWN APPROACH

- FIGURE 5 THERMAL MANAGEMENT SOLUTIONS: MARKET SIZE ESTIMATION

- FIGURE 6 MARKET PROJECTIONS

- FIGURE 7 THERMAL MANAGEMENT SOLUTIONS MARKET: DATA TRIANGULATION

- FIGURE 8 MINERAL OIL SEGMENT TO LEAD THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 9 NON-AQUEOUS SEGMENT TO DOMINATE THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 10 LOW-TEMPERATURE SEGMENT TO LEAD THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 11 DRUMS SEGMENT TO LEAD THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 12 CHEMICAL & PETROCHEMICAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 ASIA PACIFIC LED THERMAL MANAGEMENT SOLUTIONS MARKET IN 2022

- FIGURE 14 GROWING DEMAND FOR CSP TECHNOLOGY TO DRIVE MARKET

- FIGURE 15 CHINA AND ENERGY & POWER SEGMENT LED THERMAL MANAGEMENT SOLUTIONS MARKET IN ASIA PACIFIC IN 2022

- FIGURE 16 WATER TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 17 BULK CONTAINERS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 NON-AQUEOUS FORM TO BE SECOND-LARGEST MARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 19 HIGH-TEMPERATURE THERMAL MANAGEMENT SOLUTIONS TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 20 OIL & GAS SEGMENT TO BE THIRD-LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 21 INDIA TO BE FASTEST-GROWING THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMAL MANAGEMENT SOLUTIONS MARKET

- FIGURE 23 INDUSTRIAL DEVELOPMENTS IN ASIA PACIFIC IN 2021

- FIGURE 24 THERMAL MANAGEMENT SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 OVERVIEW OF THERMAL MANAGEMENT SOLUTIONS MARKET VALUE CHAIN

- FIGURE 26 ECOSYSTEM OF THERMAL MANAGEMENT SOLUTIONS MARKET

- FIGURE 27 THERMAL MANAGEMENT SOLUTION PRICES IN DIFFERENT REGIONS, 2022 (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICE OF THERMAL MANAGEMENT SOLUTIONS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 29 RISE IN ADOPTION OF RENEWABLE ENERGY TO INFLUENCE THERMAL MANAGEMENT SOLUTIONS MARKET

- FIGURE 30 KEY BUYING CRITERIA

- FIGURE 31 TOTAL NUMBER OF PATENTS (2012–2022)

- FIGURE 32 TOTAL NUMBER OF PATENTS DURING LAST 10 YEARS

- FIGURE 33 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 34 TOP JURISDICTIONS FOR THERMAL MANAGEMENT SOLUTION PATENTS

- FIGURE 35 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 36 DRUMS SEGMENT TO LEAD THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 37 MINERAL OIL SEGMENT TO LEAD THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 38 NON-AQUEOUS SEGMENT TO DOMINATE THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 39 LOW-TEMPERATURE SEGMENT TO LEAD THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 40 CHEMICAL & PETROCHEMICAL SEGMENT TO LEAD THERMAL MANAGEMENT SOLUTIONS MARKET, BY END-USE INDUSTRY

- FIGURE 41 INDIA TO BE FASTEST-GROWING THERMAL MANAGEMENT SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC: THERMAL MANAGEMENT SOLUTIONS MARKET SNAPSHOT

- FIGURE 43 EUROPE: THERMAL MANAGEMENT SOLUTIONS MARKET SNAPSHOT

- FIGURE 44 RANKING OF TOP FIVE PLAYERS IN THERMAL MANAGEMENT SOLUTIONS MARKET, 2022

- FIGURE 45 THERMAL MANAGEMENT SOLUTIONS MARKET SHARE, BY COMPANY (2022)

- FIGURE 46 THERMAL MANAGEMENT SOLUTIONS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 47 THERMAL MANAGEMENT SOLUTIONS MARKET: START-UPS AND SMES MATRIX, 2022

- FIGURE 48 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 49 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 50 EXXONMOBIL: COMPANY SNAPSHOT

- FIGURE 51 CHEVRON: COMPANY SNAPSHOT

- FIGURE 52 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 54 LANXESS: COMPANY SNAPSHOT

- FIGURE 55 CLARIANT AG: COMPANY SNAPSHOT

- FIGURE 56 WACKER CHEMIE AG: COMPANY SNAPSHOT

- FIGURE 57 DUPONT: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the thermal management solutions market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The thermal management solutions market involves a variety of stakeholders across the value chain, including raw material suppliers, manufacturers, and end-users. For this study, both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. Key opinion leaders from various end-use sectors were interviewed from the demand side, while manufacturers, associations, and institutions involved in the thermal management solutions industry were interviewed from the supply side.

Primary interviews helped to gather insights on market statistics, revenue data, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to identify trends related to grade, application, end-use industries, and region. C-level executives from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand their perspective on suppliers, products, component providers, and their current and future usage of thermal management solutions, which will affect the overall market.

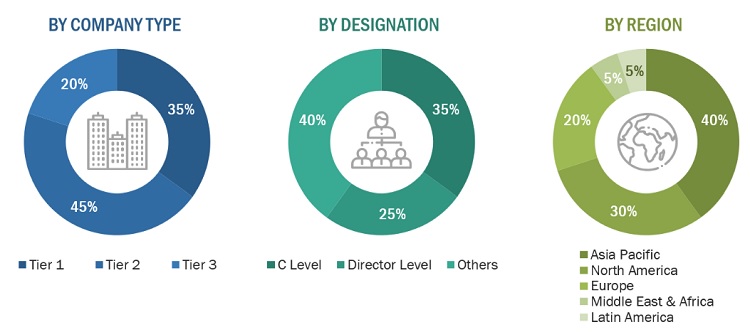

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Eastman Chemical Comapny |

Sales Manager |

|

Global Heat Transfer Fluid UK Ltd. |

Sales Manager |

|

Hindustan Petroleum Corporation Ltd. |

Technical Sales Manager |

|

Kost USA |

Marketing Manager |

|

Paratherm |

R&D Manager |

|

|

|

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for thermal management solutions for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on grade, application, end-use industry, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

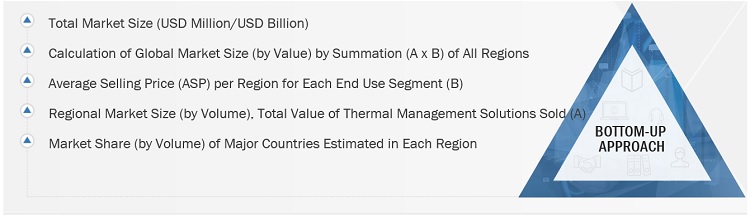

Thermal Management Solutions Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

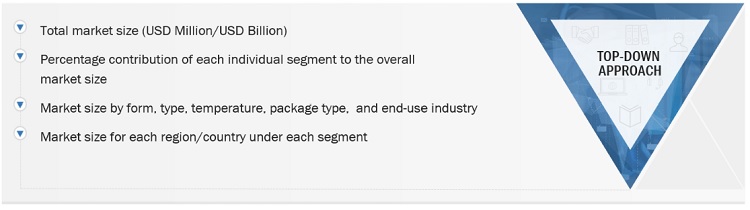

Thermal Management Solutions Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Thermal management solutions are substances, such as gas or liquid, that are designed to transfer heat from one system to another. These solutions play a crucial role in processes where cooling or heating is required to achieve and maintain a specific temperature. Common thermal management solutions include molten salt, synthetic oil, air, water, and other fluids. A good thermal management solution should have high thermal conductivity, low viscosity, high boiling point, high thermal diffusivity, and low freezing points. By exhibiting these characteristics, thermal management solutions are able to efficiently transfer heat energy and maintain thermal stability in various applications.

Key Stakeholders

- Manufacturers of thermal management solutions

- Feedstock Suppliers

- Manufacturers In End-use Industries

- Traders, Distributors, and Suppliers

- Regional Manufacturers’ Associations

- Government & Regional Agencies and Research Organizations

Report Objectives

- To define, describe, and forecast the size of the thermal management solutions market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on package type, form type, temperature, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on thermal management solutions market

By Form Analysis

- Market size for thermal management solutions in terms of value and volume

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermal Management Solutions Market