Functional Fluids Market by Type (Process Oil, Hydraulic & Transmission Fluid, Metal Working Fluid, Heat Transfer Fluid, and Others) & by Application (Industrial, Construction, Transportation, and Others) - Global Trends and Forecast to 2020

[127 Pages Report] The market size of functional fluids is estimated to be worth USD 32.4 Billion in 2014 and is projected to reach USD 42.2 Billion by 2020, at a CAGR of 4.5% between 2015 and 2020. In this report, 2014 is considered as the base year and forecast period is between 2015 and 2020. The global functional fluids market has been segmented on the basis of type, application, and region. Process oil is expected to play a key role in fueling the growth of the overall market owing to its unique properties which makes them suitable for use in various industrial applications. Process oil enhances the quality and performance of the products used in polymer, fiber, deformer, cable, tire & rubber, and other industries. Moreover, they also have heat transfer characteristics and superior oxidation and thermal stability, which make them ideal for various industrial applications.

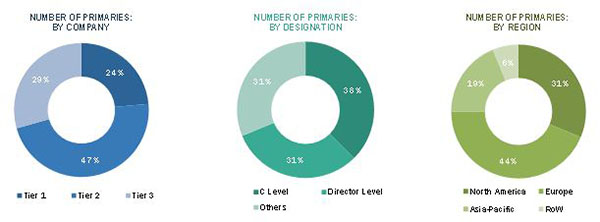

In this report, market sizes have been derived using both bottom-up and top-down approaches. First, the market size for each product type (process oil, hydraulic & transmission fluid, metal working fluid, heat transfer fluid, and others) for various regions (Asia-Pacific, North America, Europe, and ROW) and countries have been identified using secondary and primary research. The overall market sizes for various regions and countries have been calculated by adding these individual markets. Regional level functional fluids market sizes have been further broken down on the basis application using percentage split gathered during the research. For future growth (CAGR) trends of the functional fluids, applications industrial, construction, transportation, and others have been analyzed. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, Directors, and executives. The breakdown of profiles of primary interviewees is depicted in the below figure:

The major functional fluids manufacturers are ExxonMobil Corporation (U.S.), Royal Dutch Shell Plc. (Netherlands), BP Plc (U.K.) Fuchs Petrolub SE (Germany), Chevron Corporation (U.S.), Idemitsu Kosan Co. Ltd (Japan), The Dow Chemical Company (U.S.), BASF SE (Germany), Petroliam Nasional Berhad (Malaysia), and others.

The target audiences for the functional fluids market report are as follows:

- Functional fluids manufacturers

- Functional fluids suppliers

- Functional fluids formulators

- Raw material suppliers

- Service providers

- End users such as automobile, aviation, marine, and manufacturing companies

Scope of the Report:

This report categorizes the global market for functional fluids on the basis of type, application, and region.

Market Segmentation, by Type:

The functional fluids market has been segmented on the basis of type process oil, hydraulic & transmission fluid, metal working fluid, heat transfer fluid, and others.

Market Segmentation, by Application:

The functional fluids market has been segmented on the basis of application into industrial, construction, transportation, and others.

Market Segmentation, by region:

The region analysis covers Asia-Pacific North America, Europe, and RoW.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options (not limited to) are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional application, and/or type

Country Information

- Additional country information (Up to 3)

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

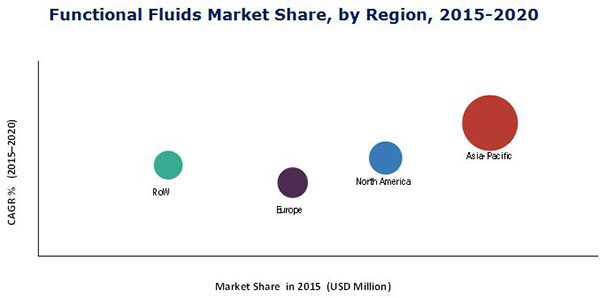

The global functional fluids market is projected to be worth USD 42.2 Billion by 2020, registering a CAGR of 4.5% between 2015 and 2020. The growth of market is primarily driven by the processing industries for manufacturing the finished goods. The massive industrial growth in Asia-Pacific and Africa drive the functional fluid market. Moreover, strong OEM recommendation to use high-performance functional fluids coupled with the stringent emission control regulations in these regions is also driving the demand for function fluids.

The industrial application dominated the functional fluids market in 2014; however, the industrial application is projected to register the highest growth rate in the overall market between 2015 and 2020. The improved living standard and increasing consumer awareness regarding high-performance functional fluids over the conventional mineral oil lubricants in emerging economies are contributing to the growth of the global market.

The functional fluids market is classified on the basis of type: process oil, hydraulic & transmission fluids, metal working fluids, heat transfer fluids, and others. The market is dominated by process oil because of its improved oxidative property and thermal stability. Process oil provides smoothness to the processing unit during the manufacturing of finished goods. It improves the efficiency of machines and helps in producing quality products. Process oil is expected register high growth during the forecast period.

Currently, Asia-Pacific is the largest and fastest-growing market for functional fluids due to high demand from major markets such as China, India, and Japan. The growing automotive industry in the region is also driving the market for functional fluids.

The major factor restraining the growth of the functional fluids market is the slow growth of end-use sector in North America and Western Europe. The 2008 global economic turmoil has virtually hit almost all the sectors in developed nations of North America and Western Europe. There have been no significant investments in the key end-use industries such as manufacturing, energy, and automotive. Some of the important functional fluids companies are ExxonMobil Corporation (U.S.), Royal Dutch Shell Plc. (Netherlands), BP Plc (U.K.) Fuchs Petrolub SE (Germany), Chevron Corporation (U.S.), Idemitsu Kosan Co. Ltd (Japan), The Dow Chemical Company (U.S.), BASF SE (Germany), and Petroliam Nasional Berhad (Malaysia). The players in this market need to compete with each other with respect to prices and offering wide product range to meet the market requirements.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Functional Fluids Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stake Holders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Functional Fluids Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Significant Opportunities for Functional Fluids

4.2 Functional Fluids Market: Major Regions

4.3 Market in Asia-Pacific

4.4 Market Attractiveness

4.5 Market, By Application

4.6 Market: Developed vs. Developing Nations

4.7 Lifecycle Analysis, By Region, 2014

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Functional Fluids Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Augmented Industrial Growth in Asia-Pacific & Africa

5.3.1.2 Growing Automotive Industry

5.3.2 Restraints

5.3.2.1 Slow Growth of End-Use Industries in North America & Western Europe

5.3.3 Opportunities

5.3.3.1 Rapidly Increasing Demand From the Asia-Pacific Region

5.3.3.2 Increasing Industrial Growth in the Middle East

5.4 Value Chain Analysis

5.5 Porters Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Functional Fluids Market, By Type (Page No. - 49)

6.1 Introduction

6.2 Market Size & Projection

6.2.1 Process Oil

6.2.2 Hydraulic & Transmission Fluid

6.2.3 Metal Working Fluid

6.2.4 Heat Transfer Fluid

6.2.5 Other Functional Fluids

7 Market, By Application (Page No. - 58)

7.1 Introduction

7.2 Industrial

7.3 Construction

7.4 Transportation

7.5 Others

8 Functional Fluids Market, By Region (Page No. - 65)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 India

8.2.3 Japan

8.2.4 Rest of Asia-Pacific

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 Russia

8.4.3 U.K.

8.4.4 France

8.4.5 Rest of Europe

8.5 Rest of the World

8.5.1 Middle East

8.5.2 Africa

8.5.3 Latin America

9 Competitive Landscape (Page No. - 95)

9.1 Overview

9.2 Expansions: the Most Adopted Growth Strategy

9.3 Maximum Developments in 2015

9.4 Competitive Situation & Trends

9.4.1 Expansions

9.4.2 New Product Launches

9.4.3 Joint Ventures

9.4.4 Mergers & Acquisitions

9.4.5 Contracts & Agreements

10 Company Profiles (Page No. - 101)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Regional Revenue Mix of Market Players

10.2 Royal Dutch Shell PLC

10.3 Exxon Mobil Corporation

10.4 BP PLC

10.5 Chevron Corporation

10.6 Petroliam Nasional Berhad (Petronas)

10.7 BASF SE

10.8 Idemitsu Kosan Co. Ltd.

10.9 The DOW Chemical Company

10.10 Huntsman International LLC

10.11 Fuchs Petrolub AG

*Details Might Not Be Captured in Case of Unlisted Companies

11 Appendix (Page No. - 122)

11.1 Excerpts From Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (68 Tables)

Table 1 North America & Western Europe: Annual Gdp Growth Rate (%), By Country, 20092013

Table 2 Functional Fluids Market Size, By Type, 20132020 (Kiloton)

Table 3 Market Size, By Type, 20132020 (USD Million)

Table 4 Process Oil Market Size, By Region, 20132020 (USD Million)

Table 5 Hydraulic & Transmission Fluid Market Size, By Region,20132020 (USD Million)

Table 6 Metal Working Fluid Market Size, By Region, 20132020 (USD Million)

Table 7 Heat Transfer Fluid Market Size, By Region, 20132020 (USD Million)

Table 8 Other Market Size, By Region,20132020 (USD Million)

Table 9 Functional Fluids Market Size, By Application, 20132020 (Kiloton)

Table 10 Functional Fluids Market Size, By Application, 20132020 (USD Million)

Table 11 Functional Fluids Market Size in Industrial, By Region,20132020 (USD Million)

Table 12 Functional Fluids Market Size in Construction, By Region,2013-2020 (USD Million)

Table 13 Functional Fluids Market Size in Transportation, By Region,2013-2020 (USD Million)

Table 14 Functional Fluids Market Size in Others, By Region,2013-2020 (USD Million)

Table 15 Functional Fluids Market Size, By Region, 20132020 (Kiloton)

Table 16 Functional Fluids Market Size, By Region, 20132020 (USD Million)

Table 17 Functional Fluids Market Size, By Type, 20132020 (Kiloton)

Table 18 Functional Fluids Market Size, By Type, 20132020 (USD Million)

Table 19 Functional Fluids Market Size, By Application, 20132020 (Kiloton)

Table 20 Functional Fluids Market Size, By Application, 20132020 (USD Million)

Table 21 Asia-Pacific: Functional Fluids Market Size, By Country,20132020 (Kiloton)

Table 22 Asia-Pacific: Market Size, By Country,20132020 (USD Million)

Table 23 Asia-Pacific: Market Size, By Type,20132020 (USD Million)

Table 24 Asia-Pacific: Market Size, By Application,20132020 (USD Million)

Table 25 China: Market Size, By Type, 20132020 (USD Million)

Table 26 China: Market Size, By Application,20132020 (USD Million)

Table 27 India: Market Size, By Type, 20132020 (USD Million)

Table 28 India: Market Size, By Application,20132020 (USD Million)

Table 29 Japan: Market Size, By Type, 20132020 (USD Million)

Table 30 Japan: Market Size, By Application,20132020 (USD Million)

Table 31 Rest of Asia-Pacific: Market Size, By Types,20132020 (USD Million)

Table 32 Rest of Asia-Pacific: Market Size, By Application, 20132020 (USD Million)

Table 33 North America: Functional Fluids Market Size, By Country,20132020 (Kiloton)

Table 34 North America: Market Size, By Country,20132020 (USD Million)

Table 35 North America: Market Size, By Type,20132020 (USD Million)

Table 36 North America: Market Size, By Application,20132020 (USD Million)

Table 37 U.S.: Market Size, By Type, 2013-2020 (USD Million)

Table 38 U.S.: Market Size, By Application, 2013-2020 (USD Million)

Table 39 Canada: Market Size, By Type, 20132020 (USD Million)

Table 40 Canada: Market Size, By Application,20132020 (USD Million)

Table 41 Mexico: Market Size, By Type, 2013-2020 (Kiloton)

Table 42 Mexico: Market Size, By Application,20132020 (USD Million)

Table 43 Europe: Market Size, By Country,20132020 (Kiloton)

Table 44 Europe: Market Size, By Country,20132020 (USD Million)

Table 45 Europe: Market Size, By Type, 20132020 (USD Million)

Table 46 Europe: Market Size, By Application,20132020 (USD Million)

Table 47 Germany: Functional Fluids Market Size, By Type, 20132020 (USD Million)

Table 48 Germany: Market Size, By Application,20132020 (USD Million)

Table 49 Russia: Market Size, By Type, 20132020 (USD Million)

Table 50 Russia: Market Size, By Application,20132020 (USD Million)

Table 51 U.K.: Market Size, By Type, 20132020 (USD Million)

Table 52 U.K.: Market Size, By Application,20132020 (USD Million)

Table 53 France: Market Size, By Type, 20132020 (USD Million)

Table 54 France: Market Size, By Application,20132020 (USD Million)

Table 55 Rest of Europe: Market Size, By Type,20132020 (USD Million)

Table 56 Rest of Europe: Market Size, By Application,20132020 (USD Million)

Table 57 RoW: Functional Fluids Market Size, By Country,20132020 (USD Million)

Table 58 Middle East: Market Size, By Type,20132020 (USD Million)

Table 59 Middle East: Market Size, By Application,20132020 (USD Million)

Table 60 Africa: Market Size, By Type, 20132020 (USD Million)

Table 61 Africa: Market Size, By Application,20132020 (USD Million)

Table 62 Latin America: Market Size, By Type,20132020 (USD Million)

Table 63 Latin America: Market Size, By Application,20132020 (USD Million)

Table 64 Expansions, 20122015

Table 65 New Product Launches, 20122015

Table 66 Joint Ventures, 20122015

Table 67 Mergers & Acquisitions, 20122015

Table 68 Contracts and Agreements, 20122015

List of Figures (51 Figures)

Figure 1 Functional Fluids Market, Research Design

Figure 2 Secondary Data

Figure 3 Primary Data

Figure 4 Key Insights

Figure 5 Breakdown of Primaries, By Company Type, Designation , and Region

Figure 6 Market Size Estimation: Bottom-Up Approach

Figure 7 Market Size Estimation: Top-Down Approach

Figure 8 Functional Fluids Market: Data Triangulation

Figure 9 Process Oil to Dominate the Functional Fluids Market During the Forecast Period

Figure 10 Industrial Segment to Register the Highest CAGR Between 2015 & 2020

Figure 11 Asia-Pacific to Witness the Highest Growth During the Forecast Period

Figure 12 Asia-Pacific Estimated to Be the Largest Market for Functional Fluids (20152020)

Figure 13 Functional Fluids Market to Witness Rapid Growth Between2015 & 2020

Figure 14 Asia-Pacific to Witness the Highest Growth Rate Between 2015 & 2020

Figure 15 China Accounted for the Largest Share in the Asia-Pacific Region in 2014

Figure 16 Increasing Demand From the End-Use Industries to Boost the Functional Fluids Market in Asia-Pacific Between 2015 and 2020

Figure 17 Asia-Pacific Dominated the Functional Fluids Market in 2014

Figure 18 China to Emerge as A Lucrative Market Between 2015 & 2020

Figure 19 Asia-Pacific Functional Fluids Market to Register High Growth During the Forecast Period

Figure 20 Overview of the Forces Governing the Functional Fluids Market

Figure 21 Raw Materials Account for the Major Value Addition

Figure 22 Functional Fluids Market: Porters Five Forces Analysis

Figure 23 Types of Functional Fluids

Figure 24 Process Oil are the Most Preferred Functional Fluids

Figure 25 Process Oil to Dominate the Functional Fluids Market Between 2015 and 2020 (USD Million)

Figure 26 Asia-Pacific to Register the Highest Growth Rate for Hydraulic & Transmission Fluid Between 2015 & 2020

Figure 27 Types of Heat Transfer Fluid

Figure 28 Industrial Segment to Witness High Growth During the Forecast Period

Figure 29 Asia-Pacific to Drive the Industrial Market Between 2015 and 2020

Figure 30 Rising Demand From the Developing Nations to Drive the Market for Construction Between 2015 & 2020

Figure 31 Asia-Pacific to Account for Largest Market During the Forecast Period

Figure 32 North America to Register High Growth During the Forecast Period

Figure 33 Regional Snapshot (20152020): China and India are Emerging as New Hotspots

Figure 34 China & India to Be the Fastest-Growing Markets for Functional Fluids Between 2015 and 2020

Figure 35 Asia-Pacific Market Snapshot: China to Continue to Dominate the Market

Figure 36 North America Market Snapshot: U.S. to Register High Growth

Figure 37 Europe Market Snapshot: Process Oil to Dominate the Functional Fluids Market

Figure 38 Middle East to Register the Highest CAGR Between 2015 & 2020

Figure 39 Companies Adopted Expansions as the Key Growth Strategy Between 2012 & 2015

Figure 40 Functional Fluid Market Developmental Share, 20122015

Figure 41 European Functional Fluids Market Witnessed Maximum Number of Developments Between 2012 & 2015

Figure 42 Royal Dutch Shell PLC: Company Snapshot

Figure 43 Exxon Mobil Corporation: Company Snapshot

Figure 44 BP PLC: Company Snapshot

Figure 45 Chevron Corporation: Company Snapshot

Figure 46 Petroliam Nasional Berhad (Petronas): Company Snapshot

Figure 47 BASF SE: Company Snapshot

Figure 48 Idemitsu Kosan Co. Ltd.: Company Snapshot

Figure 49 The DOW Chemical Company: Company Snapshot

Figure 50 Huntsman International LLC: Company Snapshot

Figure 51 Fuchs Petrolub AG: Company Snapshot

Growth opportunities and latent adjacency in Functional Fluids Market