Thermal Management Market Size, Share, Industry Growth, Trends & Analysis by Material, Device (Conduction Cooling Devices, Convection Cooling Devices), Service (Installation & Calibration, Optimization & Post-sales Support), End-user Industry and Region – Global Forecast to 2028

Updated on : March 03, 2023

The global thermal management market Size, Share, Industry Growth, Trends & Analysis was valued at USD 10.7 billion in 2022 and is projected to reach USD 19.3 billion by 2028, registering a CAGR of 9.7% during the forecast period. The increasing need for advanced heat dissipation solutions and thermal management components in the consumer electronics industry and the rising focus on developing miniature electronic devices are the key factors driving the demand for thermal management industry solutions.

Thermal Management Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing need for advanced heat dissipation solutions

Thermal interface materials are specifically designed to transfer heat while exhibiting a compression force characteristic that accommodates the component creating the heat and the chassis or heat sink used to dissipate the heat. Electronic components produce heat when they operate. How these products manage their heat-generating and -cooling systems determine their functionality and reliability. When temperatures get too high, there needs to be a way to wick the heat away from the components to a heat-dissipating mechanism, such as a liquid cooling plate, chassis, or traditional heat sink. For instance, if a printed circuit board (PCB) does not have a way to transfer heat, the reliability and longevity of its components will be adversely affected. In extreme cases, they can even melt or get damaged. Owing to these factors, heat dissipation solutions are used as thermal management components.

Restraint: Design complexities related to components of cooling systems

Complexes such as strong property variations, complicated domains, conjugate mechanisms, chemical reactions, and intricate boundary conditions are often encountered in practical thermal processes and systems. Issues associated with the manufacturing of cooling systems are optimization of their designs to reduce their power consumption, weight, and cost and verification of designs of components used in them. Developing optimal airflow channels, selecting coolants, etc., are other problems faced while manufacturing cooling system components. Lowering the power requirements of cooling systems without compromising on their performance and reliability is another major problem faced while designing thermal components.

A sudden increase in temperature due to high power may be hazardous to devices as it often leads to internal short circuits, physical damage, and fire or explosions. Cells in battery packs are placed close to each other; hence, overheating of one cell impacts surrounding cells as well. This phenomenon is referred to as thermal runaway propagation, which, in worst cases, causes fire or explosions. Power dissipation is a critical factor in designing different electronic systems. Increasing clock rate and microprocessor transistor count lead to design complexities in components used in cooling systems, thereby acting as a restraint for the growth of the thermal management market.

Opportunity: Stringent emission regulations and standards

Increased focus on vehicular emission reduction can be viewed as one of the major factors driving the need for thermal management solutions. With the growing environmental concerns, the demand for thermal management systems is increasing as they help reduce vehicle emissions. The fuel consumption and emission levels can go drastically up due to inefficient cabin climate control, which may also cause safety hazards due to fogging and damage to the windshield. Additionally, by 2024, the California Air Resources Board (CARB) is scheduled to tighten the regulations to improve NOx emission technologies that quickly get heat into an after-treatment system and keep the system hot without hurting fuel consumption.

This system helps maintain the temperature in the internal combustion engine, which, in turn, facilitates fuel efficiency in vehicles.Thus, increasing focus on thermal management for curbing vehicular emissions is expected to propel market growth.

Challenge: High development costs of customized thermal management solutions and systems

Energy is typically a significant expense across all industries as most processes are technology powered. The more power these processes require, the greater the company’s overall investment and costs spent on energy consumption. Management of the heat generated by electronic devices such as computers, laptops, servers, switches, and other networking devices is a major challenge for thermal management solutions and systems providers. Components such as microprocessors and microcontrollers require increased power to meet high-power applications' functional and computational requirements. Operations at elevated temperatures (above 125°C) or exposure to highly localized temperatures may lead to the degradation or failure of these components. Thus, three fundamental methods of heat transfer—conduction, convection, and radiation—are deployed to ensure the effective performance and reliability of these electronic components. Heat sinks, heat spreaders, heat pipes, and thermal interface materials are the most commonly used solutions for passive thermal management, while forced air, forced liquids, and solid-state heat pumps are commonly used active thermal management technologies.

By material type, the adhesive materials segment is expected to witness the second-highest CAGR during the forecast period.

The adhesive materials segment is expected to record the second-highest CAGR of 6.0% during the forecast period. Adhesive materials are formulated to withstand severe impact and peel forces, provide high sheer strength, and offer excellent chemical and temperature resistance. The demand for adhesive materials is driven by the unwanted and potentially harmful heat generated by ever-shrinking electronic components and systems used in consumer electronics and healthcare applications.

By device, the conduction cooling devices segment is expected to register the second-highest CAGR during the forecast period.

The conduction cooling devices are expected to exhibit the second-highest CAGR of 11 .1% during the forecast period. Conduction is a way of transferring thermal/heat energy through physical contact. The two objects are connected so that the object with a lower temperature can absorb thermal energy from another hooter object. Conduction is known as one of the most effective approaches to thermal management because it requires a minimal surface area to do the energy transfer operation. Typical examples of conduction-based thermal management products include heat sinks, heat spreaders, etc.

Furthermore, conduction cooling removes heat from devices by transferring them from thermally conducting materials to other devices with low temperatures. Conduction cooling reduces thermal dissipation and lowers the thermal density of devices. The devices based on conduction cooling technology are generally called conduction cooling devices. One of the key benefits of conduction cooling solutions is that they are passive solutions that do not require moving components, providing features such as high reliability, less wear and tear, and low maintenance.

By service type, the market for installation & calibration services is expected to grow at the second-highest CAGR during the forecast period.

The market for installation & calibration services is expected to grow at the second-highest CAGR of 8.5% during the forecast period. These services are adopted for thermal material selection, equipment movement and placement, and piping installation for coolants or refrigerants. This helps understand the critical temperature and humidity level for each device. Hence, pre-installation checks are run to identify and select the appropriate solutions and systems for the thermal management of devices. Thereafter, the installation & calibration services are carried out to ensure increased efficiency and enhanced operational effectiveness of devices.

By end-user industry, the servers and data centers segment is expected to witness the second-highest CAGR during the forecast period.

The market for servers and data centers is expected to grow at the second-highest CAGR of 10.4% during the forecast period. Thermal management is crucial to ensure the optimum operation and performance of all electronic applications, regardless of complexity or scope. Data centers consist of thousands of data processing equipment, such as servers, switches, and routers, which radiate large quantities of energy and heat. The heat generated in these data centers must be properly dissipated to prevent a rise in their temperature and consequent degradation of their reliability and performance, which incurs additional maintenance costs. In data centers, thermal management is necessary to carry out smooth operations such as data placement, data migration, data replication, data access task distribution, and scheduling and controlling disk speeds. Moreover, efficient thermal management is necessary for the smooth conduct of different functions of data centers that include streaming videos, carrying out large-scale data analysis, and ensuring transaction processing to achieve the desired performance.

In 2028, Asia Pacific is projected to hold the largest share of the overall thermal management market.

Thermal Management Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is expected to exhibit the highest CAGR of 10.9% in the thermal management market during the forecast period. Flourishing chip manufacturing companies in countries such as China and South Korea contribute to the growth of the thermal management market in Asia Pacific. Additionally, the demand for consumer electronics and automobiles is increasing in this region. Also, technological and economic advancements in Asia Pacific are expected to drive the overall demand for thermal management systems.

Key Market Players

The thermal management companies such as Henkel (Germany), Honeywell International Inc. (US), Vertiv Co (US), Delta Electronics, Inc. (Taiwan), Parker Chomerics (US), TAT Technologies Ltd. (Israel), Autoneum Holding AG (Switzerland), Boyd (US), European Thermodynamics Ltd. (UK), and Laird Thermal Systems (US) are among a few key players in the thermal management market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By material, device, service type, end-user industry, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Henkel (Germany), Honeywell International Inc. (US), Vertiv Co (US), Delta Electronics, Inc. (Taiwan), Parker Chomerics (US), TAT Technologies Ltd. (Israel), Autoneum Holding AG (Switzerland), Boyd (US), European Thermodynamics Ltd. (UK), and Laird Thermal Systems (US) are among the top thermal management solution providers in the studied market. |

Thermal Management Market Highlights

This research report categorizes the thermal management market based on material, device, service type, end-user industry, and region.

|

Aspect |

Details |

|

Thermal Management Market, by Material Type |

|

|

Thermal Management Market, by Device |

|

|

Thermal Management Market, by Service |

|

|

Thermal Management Market, by End-User Industry |

|

|

Thermal Management Market, by Region |

|

Recent Developments

- In September 2022, Henkel acquired Thermexit, a thermal management materials business segment of Nanoramic Laboratories. With this acquisition, Henkel strengthened its position in the growing thermal interface material (TIM) market.

- In May 2022, the Nextreme Recirculating Chiller launched the platform featuring high-quality components, environmentally friendly refrigerants, low-noise components, and a user-friendly operator interface at a standard price. The new chiller utilizes high-performance variable speed motors for noise reduction, lower room heat input, and reduced energy consumption by up to 50% compared to conventional compressor-based systems.

- In October 2022, Limco Airepair, a wholly owned subsidiary of TAT, signed a contract expansion with Collins Aerospace, an aerospace and defense product supplier, to provide maintenance, repair, and overhaul (MRO) services for Boeing 777 thermal components. With this contract, Collins customers will benefit from TAT’s services.

- In August 2022, Honeywell International Inc. collaborated with Reaction Engines Limited, a British aerospace company, on developing thermal management technologies as a critical enabler to reduce aircraft emissions, regardless of the fuel type used in the aircraft. Honeywell and Reaction Engines will adapt the unique microtube heat exchanger technology from Reaction Engines and apply it across a broad range of Honeywell systems for sustainable aviation thermal management solutions. With this collaboration, Reaction Engines is expected to develop unique heat exchange technology that can reduce weight by more than 30%, which translates to less fuel consumption and longer range or higher aircraft capacity.

Frequently Asked Questions (FAQs):

Which are the major companies in the thermal management market? What strategies do they adopt to strengthen their market presence?

The major companies in the thermal management market are Henkel (Germany), Honeywell International Inc. (US), Vertiv Co (US), Delta Electronics, Inc. (Taiwan), Parker Chomerics (US), TAT Technologies Ltd. (Israel), Autoneum Holding AG (Switzerland), Boyd (US), European Thermodynamics Ltd. (UK), and Laird Thermal Systems (US) are some key players in the thermal management market. The major strategies adopted by these players are product launches.

Which region will provide lucrative opportunities for players in the thermal management market?

Asia Pacific is expected to dominate the thermal management market owing to the high demand for thermal management solutions by manufacturing companies in China and India.

Who are the winners in the global thermal management market?

Companies such as Henkel (Germany), Honeywell International Inc. (US), and Vertiv Co (US) have the right to win in this market. These companies meet the requirements of their customers by providing thermal management solutions. Moreover, these companies are adopting organic growth strategies to strengthen their market position and expand their customer base worldwide.

What are the drivers and opportunities pertaining to the thermal management market?

Factors such as the growing focus on the development of miniature electronic devices and the rising demand for thermal management solutions in EVs boost the growth of the thermal management market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing need for advanced heat dissipation solutions- Growing adoption of thermal management components in consumer electronics- Ongoing radical miniaturization of electronic devicesRESTRAINTS- Design complexities of components used in cooling systemsOPPORTUNITIES- Rising demand for thermal management solutions in EVs- Growing strictness regarding emission regulationCHALLENGES- High development costs of customized thermal management solutions and systems

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN THERMAL MANAGEMENT MARKET

-

5.5 THERMAL MANAGEMENT MARKET ECOSYSTEM

-

5.6 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE OF THERMAL MANAGEMENT SOLUTIONS OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TREND

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.8 TECHNOLOGY TRENDSCOMPLEMENTARY TECHNOLOGIESCOMBAT SYSTEMS IN VEHICLESHIGH POWER LEVELS AND POWER DENSITY5G TELECOMMUNICATIONSWIRELESS THERMAL MAPPING OF DATA CENTERSTHERMAL MANAGEMENT SOFTWARE

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 CASE STUDIESCOLOVORE DEPLOYS LIQUID-COOLING SOLUTIONS TO OFFER CUSTOMERS RACK CAPACITIES OF UP TO 50 KILOWATTSLOCTITE STRUCTURAL ADHESIVE ENABLES RELIABLE MOTOR PERFORMANCE IN CHALLENGING ENVIRONMENTSFORTUNE 500 ICT PROVIDER IMPROVES DATA CENTER COOLING TO ADD COMPUTING CAPACITY WITHOUT PHYSICAL EXPANSIONAUTOMOTIVE COMPONENT MANUFACTURER REQUIRES HEAT DISSIPATION FOR EV/HYBRID VEHICLE DC/DC CONVERTERS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS, 2012–2022

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS

- 5.15 TARIFF ANALYSIS

- 6.1 INTRODUCTION

-

6.2 ADHESIVE MATERIALSTAPES- Ability to provide preferential heat transfer path between heat-generating components and heat sinks to boost market growthFILMS- Excellent permanent adhesive strength of films with very high thermal conductivity to drive marketADHESIVE LIQUIDS- Ability to reduce size of devices and overall weight of assemblies to propel market growth

-

6.3 NON-ADHESIVE MATERIALSTHERMAL PADS- Advantages such as outstanding mechanical shock absorption to drive marketGAP FILLERS- Ability to cover junctions or components for improved shock absorption to boost market growthPHASE-CHANGE MATERIALS- Advantages including economical passive cooling to propel market growthGREASE- Increasing use in automotive, servers & data centers, and consumer electronics industries to boost market growth

- 7.1 INTRODUCTION

-

7.2 CONDUCTION COOLING DEVICESWEDGE LOCKS- Capability to transfer heat from heat sources to nearest composite layers to drive marketPOTTING MATERIALS- Ability to protect sensitive components from heat and humidity to boost market growth

-

7.3 CONVECTION COOLING DEVICESHEAT SINKS- Growing adoption of heat sinks to absorb heat from different systems to drive marketHEAT SPREADERS- Increasing use of heat spreaders as primary heat exchangers to boost market growthFORCED AIR AND NATURAL COOLING DEVICES- Ability of forced air cooling to provide effective cooling, improved lifecycle, and enhanced performance of electronic components to drive marketHEAT PUMPS- Rising adoption of heat pumps in automotive industry to accelerate market growth

-

7.4 ADVANCED COOLING DEVICESDIRECT IMMERSION COOLING DEVICES- Rising computing powers leading to increased temperatures within data centers to propel adoption of thermal managementMICROCHANNEL COOLING- Advantages of microchannel heat sinks such as compact design and light weight to boost marketCOLD PLATES- Adoption of cold plates in advanced cooling devices to drive marketOTHERS

-

7.5 HYBRID COOLING DEVICESELECTROWETTING DEVICES- Growing adoption of electronic devices at large scale to manipulate tiny amounts of liquids on surfaces to drive marketSPOT COOLERS- Increasing use as alternative to precision cooling and mini-split systems in data centers to boost marketVAPOR CHAMBERS- Rising traction in servers & data centers for thermal management of blade server CPUs to propel marketCOMPACT HEAT EXCHANGERS- Increasing adoption of compact heat exchangers to improve heat transfer to drive marketTHERMOELECTRIC COOLING- Growing use of thermoelectric cooling to reduce temperature of hot spots on chips to drive marketOTHERS

- 8.1 INTRODUCTION

-

8.2 INSTALLATION & CALIBRATIONGROWING POLLUTION TO DRIVE NEED FOR INSTALLATION AND CALIBRATION

-

8.3 OPTIMIZATION & POST-SALES SUPPORTINCREASING COMPETITION IN THERMAL MANAGEMENT ECOSYSTEM TO BOOST ADOPTION

- 9.1 INTRODUCTION

-

9.2 CONSUMER ELECTRONICSLAPTOPS AND COMPUTERS- Increased complexity of computing systems to drive use of thermal management systems in laptops and computersAUDIO AMPLIFIER COMPONENTS- Growing adoption of class D amplifiers for amplification applications to drive marketPOWER SUPPLY UNITS- Increased installation of heat sinks and heat spreaders in power supply units to enhance market growthGAMING DEVICES- Significant generation of heat by gaming devices with high-specification hardware to drive adoption of thermal management solutions and systemsSMARTPHONES- Miniaturization of components and their high computing capabilities to boost adoption of thermal management solutions and systems in smartphonesHOME APPLIANCES- Growing use of smart home appliances to propel demand for thermal management solutions and systems

-

9.3 SERVERS AND DATA CENTERSSINGLE RACKS- Requirement for single-rack data centers to manage heat dissipation from power supplies and servers to drive marketMULTI RACKS- Increased use of network cabinets and high-density cabinets in multi-rack data centers to boost market

-

9.4 AUTOMOTIVEBATTERY THERMAL MANAGEMENT SYSTEMS- Increased use of batteries in electric vehicles to contribute to demand for thermal management solutions and systemsENGINE CONTROL THERMAL MANAGEMENT SYSTEMS- Increased use of engine control thermal management systems in vehicles to drive marketWASTE HEAT RECOVERY AND EMISSION REDUCTION SYSTEMS- Rise in use of thermal management solutions and systems for heat recovery and emission reduction in vehicles to fuel marketBRAKE AND SUSPENSION COOLING SYSTEMS- Growing adoption of brake and suspension cooling systems to boost marketSEAT HEATING AND COOLING SYSTEMS- Innovations in personalized seat comfort systems to fuel adoption of thermal management solutions and systems in vehiclesAUTOMOTIVE LIGHTING SYSTEMS- Development of stylish 3D LED daytime running lights, turn signal lights, and high/low beam lights to drive market

-

9.5 AEROSPACE & DEFENSEINCREASED INVESTMENTS IN DEFENSE SECTOR FOR DEVELOPMENT OF NEW SYSTEMS TO FUEL MARKET GROWTH

-

9.6 ENTERPRISESFLOURISHING IT INDUSTRY TO LEAD TO INCREASED ADOPTION OF COMPUTING DEVICES EQUIPPED WITH THERMAL MANAGEMENT SYSTEMS AND SOLUTIONS

-

9.7 HEALTHCARELARGE INFRASTRUCTURE EQUIPMENT- Increasing use of thermal management solutions and systems in large infrastructure equipment to boost marketPORTABLE EQUIPMENT- Growing adoption of portable equipment for effective thermal energy transfer to propel market

- 9.8 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Increasing demand for heat management in electric cars and smart cars to fuel market growthCANADA- Rising consumption of consumer electronics in Canada to contribute to market growthMEXICO- Improving economic conditions and increasing spending capacity of population to boost demand for consumer electronics

-

10.3 EUROPEUK- Flourishing automotive, servers & data centers, and consumer electronics industries to fuel growthGERMANY- Growing automotive industry to boost market growthFRANCE- Increasing demand for thermal management solutions and systems from servers & data centers and automotive industries to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICJAPAN- Growing consumer electronics and automotive industries to contribute to market growthCHINA- Rising demand for thermal management solutions and systems from automotive and consumer electronics industries to drive marketSOUTH KOREA- Growing consumer electronics industry to boost market growthINDIA- Increasing demand for thermal management solutions and systems from automotive, servers & data centers, and consumer electronics industries to propel market growthREST OF ASIA PACIFIC

-

10.5 ROWMIDDLE EAST & AFRICA- Growing government initiatives to boost adoption of EVsSOUTH AMERICA- Increasing middle-class population and improving standards of living to create opportunities for market players

- 11.1 OVERVIEW

-

11.2 MARKET EVALUATION FRAMEWORKPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2021

- 11.4 5-YEAR COMPANY REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPANY FOOTPRINT

-

11.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENKEL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERTIV CO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPARKER CHOMERICS (PARKER HANNIFIN)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDELTA ELECTRONICS, INC.- Business overview- Products/Solutions/Services offered- MnM viewTAT TECHNOLOGIES LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsBOYD- Business overview- Products/Solutions/Services offered- Recent developmentsEUROPEAN THERMODYNAMICS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsLAIRD THERMAL SYSTEMS (BREGAL UNTERNEHMERKAPITAL)- Business overview- Products/Solutions/Services offered- Recent developmentsAUTONEUM HOLDING AG- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSDAU THERMAL SOLUTIONS INC. (MIBA AG)AI TECHNOLOGY, INC.HEATEXLORD CORPORATIONAPI HEAT TRANSFERADVANCED COOLING TECHNOLOGIES, INC. (ACT)MASTER BOND INC.THERMOTEKJARO THERMALDANFOSSKELVIONGENTHERMOUTLAST TECHNOLOGIES LLCALLCELL TECHNOLOGIES, LLC (BEAM GLOBAL)COX & COMPANY, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 KEY ASSUMPTIONS: MACRO AND MICRO-ECONOMIC ENVIRONMENT

- TABLE 3 RISK ASSESSMENT: THERMAL MANAGEMENT MARKET

- TABLE 4 THERMAL MANAGEMENT MARKET: ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE: NON-ADHESIVE MATERIALS OFFERED BY KEY PLAYERS, BY TYPE (USD)

- TABLE 6 AVERAGE SELLING PRICE: ADHESIVE MATERIALS, BY TYPE (USD)

- TABLE 7 AVERAGE SELLING PRICE: NON-ADHESIVE MATERIALS, BY TYPE (USD)

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP SERVICE TYPES (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 10 THERMAL MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 12 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 13 PATENTS PERTAINING TO THERMAL MANAGEMENT, 2021–2022

- TABLE 14 THERMAL MANAGEMENT MARKET: DETAILED CONFERENCES AND EVENTS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 TARIFF FOR HS CODE 392690 EXPORTED BY CHINA (2021)

- TABLE 20 TARIFF FOR HS CODE 392690 EXPORTED BY US (2021)

- TABLE 21 THERMAL MANAGEMENT MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 22 THERMAL MANAGEMENT MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 23 MATERIAL TYPE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 24 MATERIAL TYPE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 25 MATERIAL TYPE: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 MATERIAL TYPE: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 ADHESIVE TAPES: THERMAL MANAGEMENT MARKET, 2019–2022 (THOUSAND UNITS)

- TABLE 30 ADHESIVE TAPES: THERMAL MANAGEMENT MARKET, 2023–2028 (THOUSAND UNITS)

- TABLE 31 ADHESIVE FILMS: THERMAL MANAGEMENT MARKET, 2019–2022 (MILLION UNITS)

- TABLE 32 ADHESIVE FILMS: THERMAL MANAGEMENT MARKET, 2023–2028 (MILLION UNITS)

- TABLE 33 ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 34 ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION))

- TABLE 35 TAPES: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 36 TAPES: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 37 FILMS: THERMAL MANAGEMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 38 FILMS: THERMAL MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 FILMS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 40 FILMS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 41 ADHESIVE LIQUIDS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 42 ADHESIVE LIQUIDS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 43 NON-ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 NON-ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 NON-ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 46 NON-ADHESIVE MATERIALS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 47 THERMAL PADS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 48 THERMAL PADS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 GAP FILLERS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 50 GAP FILLERS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 51 PHASE-CHANGE MATERIALS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 52 PHASE-CHANGE MATERIALS: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 53 GREASE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 54 GREASE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 55 THERMAL MANAGEMENT MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 56 THERMAL MANAGEMENT MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 57 DEVICE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 58 DEVICE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 DEVICE: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 DEVICE: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 THERMAL MANAGEMENT MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 62 THERMAL MANAGEMENT MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 63 THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 64 THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 74 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 SERVERS & DATA CENTERS: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 AUTOMOTIVE: THERMAL MANAGEMENT MARKET, BY SYSTEM TYPE, 2019–2022 (USD MILLION)

- TABLE 84 AUTOMOTIVE: THERMAL MANAGEMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 85 AUTOMOTIVE: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 AUTOMOTIVE: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 AUTOMOTIVE: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 AUTOMOTIVE: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 AUTOMOTIVE: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 AUTOMOTIVE: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 AUTOMOTIVE: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 AUTOMOTIVE: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 98 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 100 AEROSPACE & DEFENSE: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 ENTERPRISES: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 ENTERPRISES: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 ENTERPRISES: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 ENTERPRISES: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 ENTERPRISES: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 106 ENTERPRISES: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 ENTERPRISES: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 ENTERPRISES: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 HEALTHCARE: THERMAL MANAGEMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 110 HEALTHCARE: THERMAL MANAGEMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 111 HEALTHCARE: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 112 HEALTHCARE: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 HEALTHCARE: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 HEALTHCARE: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 HEALTHCARE: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 HEALTHCARE: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 HEALTHCARE: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 118 HEALTHCARE: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 OTHERS: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 120 OTHERS: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 OTHERS: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 122 OTHERS: THERMAL MANAGEMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 OTHERS: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 124 OTHERS: THERMAL MANAGEMENT MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 OTHERS: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 OTHERS: THERMAL MANAGEMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 128 THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: THERMAL MANAGEMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 130 NORTH AMERICA: THERMAL MANAGEMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 132 NORTH AMERICA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 133 US: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 134 US: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 135 CANADA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 136 CANADA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 137 MEXICO: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 138 MEXICO: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: THERMAL MANAGEMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 140 EUROPE: THERMAL MANAGEMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 142 EUROPE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 143 UK: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 144 UK: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 145 GERMANY: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 146 GERMANY: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 147 FRANCE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 148 FRANCE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 150 REST OF EUROPE: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: THERMAL MANAGEMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: THERMAL MANAGEMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 155 JAPAN: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 156 JAPAN: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 157 CHINA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 158 CHINA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 159 SOUTH KOREA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 160 SOUTH KOREA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 161 INDIA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 162 INDIA: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 165 ROW: THERMAL MANAGEMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 166 ROW: THERMAL MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 167 ROW: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 168 ROW: THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 169 OVERVIEW OF STRATEGIES DEPLOYED BY KEY THERMAL MANAGEMENT SOLUTION PROVIDERS

- TABLE 170 THERMAL MANAGEMENT MARKET: MARKET SHARE ANALYSIS (2021)

- TABLE 171 THERMAL MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 172 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) IN THERMAL MANAGEMENT MARKET

- TABLE 173 THERMAL MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (END-USE INDUSTRY FOOTPRINT)

- TABLE 174 THERMAL MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (DEVICE TYPE FOOTPRINT)

- TABLE 175 THERMAL MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (REGION FOOTPRINT)

- TABLE 176 COMPANY FOOTPRINT

- TABLE 177 COMPANY-WISE DEVICE TYPE FOOTPRINT

- TABLE 178 COMPANY-WISE END-USE INDUSTRY FOOTPRINT

- TABLE 179 COMPANY-WISE REGION FOOTPRINT

- TABLE 180 PRODUCT LAUNCHES, APRIL 2019–OCTOBER 2022

- TABLE 181 DEALS, APRIL 2019–OCTOBER 2022

- TABLE 182 OTHERS, APRIL 2019–OCTOBER 2022

- TABLE 183 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 184 HONEYWELL INTERNATIONAL INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 185 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 186 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 187 HENKEL: COMPANY SNAPSHOT

- TABLE 188 HENKEL: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 189 HENKEL: PRODUCT LAUNCHES

- TABLE 190 HENKEL: DEALS

- TABLE 191 VERTIV CO: COMPANY SNAPSHOT

- TABLE 192 VERTIV CO: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 193 VERTIV CO: PRODUCT LAUNCHES

- TABLE 194 PARKER CHOMERICS: COMPANY SNAPSHOT

- TABLE 195 PARKER CHOMERICS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 196 PARKER CHOMERICS: PRODUCT LAUNCHES

- TABLE 197 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- TABLE 198 DELTA ELECTRONICS, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 199 TAT TECHNOLOGIES LTD.: COMPANY SNAPSHOT

- TABLE 200 TAT TECHNOLOGIES LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 201 TAT TECHNOLOGIES LTD.: DEALS

- TABLE 202 TAT TECHNOLOGIES LTD.: OTHERS

- TABLE 203 BOYD: COMPANY SNAPSHOT

- TABLE 204 BOYD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 205 BOYD: DEALS

- TABLE 206 BOYD: OTHERS

- TABLE 207 EUROPEAN THERMODYNAMICS LTD.: COMPANY SNAPSHOT

- TABLE 208 EUROPEAN THERMODYNAMICS LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 209 EUROPEAN THERMODYNAMICS LTD.: PRODUCT LAUNCHES

- TABLE 210 EUROPEAN THERMODYNAMICS LTD.: DEALS

- TABLE 211 LAIRD THERMAL SYSTEMS: COMPANY SNAPSHOT

- TABLE 212 LAIRD THERMAL SYSTEMS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 213 LAIRD THERMAL SYSTEMS: PRODUCT LAUNCHES

- TABLE 214 AUTONEUM HOLDING AG: COMPANY SNAPSHOT

- TABLE 215 AUTONEUM HOLDING AG.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 216 AUTONEUM HOLDING AG: DEALS

- TABLE 217 DAU THERMAL SOLUTIONS INC.: COMPANY SNAPSHOT

- TABLE 218 AI TECHNOLOGY, INC.: COMPANY SNAPSHOT

- TABLE 219 HEATEX: COMPANY SNAPSHOT

- TABLE 220 LORD CORPORATION: COMPANY SNAPSHOT

- TABLE 221 API HEAT TRANSFER: COMPANY SNAPSHOT

- TABLE 222 AI.: COMPANY SNAPSHOT

- TABLE 223 MASTER BOND INC.: COMPANY SNAPSHOT

- TABLE 224 THERMOTEK: COMPANY SNAPSHOT

- TABLE 225 JARO THERMAL: COMPANY SNAPSHOT

- TABLE 226 DANFOSS: COMPANY SNAPSHOT

- TABLE 227 KELVION: COMPANY SNAPSHOT

- TABLE 228 GENTHERM: COMPANY SNAPSHOT

- TABLE 229 OUTLAST TECHNOLOGIES LLC: COMPANY SNAPSHOT

- TABLE 230 ALLCELL TECHNOLOGIES, LLC: COMPANY SNAPSHOT

- TABLE 231 COX & COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 1 THERMAL MANAGEMENT MARKET SEGMENTATION

- FIGURE 2 THERMAL MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS) – REVENUES GENERATED BY COMPANIES FROM SALES OF PRODUCTS OFFERED IN THERMAL MANAGEMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (TOP-DOWN, SUPPLY-SIDE) – ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN THERMAL MANAGEMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 THERMAL MANAGEMENT MARKET: DATA TRIANGULATION

- FIGURE 10 AUTOMOTIVE SEGMENT TO EXPERIENCE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ADVANCED COOLING DEVICES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD THERMAL MANAGEMENT MARKET FROM 2023 TO 2028

- FIGURE 13 PRE- AND POST-RECESSION IMPACT ON THERMAL MANAGEMENT MARKET

- FIGURE 14 GROWING ADOPTION OF THERMAL MANAGEMENT TO REDUCE VEHICLE EMISSIONS TO DRIVE MARKET

- FIGURE 15 OPTIMIZATION & POST-SALES SUPPORT SEGMENT IS PROJECTED TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO HOLD LARGEST SHARE OF THERMAL MANAGEMENT MARKET IN 2028

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR IN OVERALL THERMAL MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 18 THERMAL MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 DRIVERS AND THEIR IMPACT ON THERMAL MANAGEMENT MARKET

- FIGURE 20 RESTRAINTS AND THEIR IMPACT ON THERMAL MANAGEMENT MARKET

- FIGURE 21 GROWTH IN SALES OF EV (2018–2028)

- FIGURE 22 OPPORTUNITIES AND THEIR IMPACT ON THERMAL MANAGEMENT MARKET

- FIGURE 23 CHALLENGES AND THEIR IMPACT ON THERMAL MANAGEMENT MARKET

- FIGURE 24 SUPPLY CHAIN OF THERMAL MANAGEMENT MARKET

- FIGURE 25 REVENUE SHIFT IN THERMAL MANAGEMENT MARKET

- FIGURE 26 ECOSYSTEM OF THERMAL MANAGEMENT

- FIGURE 27 AVERAGE SELLING PRICE OF THERMAL MANAGEMENT SOLUTIONS OFFERED BY KEY PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE: NON-ADHESIVE MATERIALS, BY TYPE (USD)

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP SERVICE TYPES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 31 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 NUMBER OF PATENTS GRANTED FOR THERMAL MANAGEMENT, 2012–2022

- FIGURE 33 REGIONAL ANALYSIS OF PATENTS GRANTED FOR THERMAL MANAGEMENT SOLUTIONS, 2022

- FIGURE 34 NON-ADHESIVE MATERIALS TO CONTINUE TO HOLD LARGER SHARE IN THERMAL MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 35 AUTOMOTIVE END-USE INDUSTRY TO HOLD LARGEST SHARE OF MARKET FOR ADHESIVE MATERIALS DURING FORECAST PERIOD

- FIGURE 36 SERVERS & DATA CENTERS TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR NON-ADHESIVE MATERIALS DURING FORECAST PERIOD

- FIGURE 37 CONVECTION COOLING DEVICES TO OCCUPY LARGEST MARKET SHARE IN 2028

- FIGURE 38 OPTIMIZATION & POST-SALES SUPPORT SERVICE TYPE TO OCCUPY LARGER MARKET SHARE IN 2028

- FIGURE 39 THERMAL MANAGEMENT MARKET, BY END-USE INDUSTRY

- FIGURE 40 AUTOMOTIVE END-USE INDUSTRY TO CONTINUE TO HOLD LARGEST SHARE IN THERMAL MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 41 MULTI RACKS SEGMENT TO WITNESS LARGER SHARE OF MARKET FOR SERVERS AND DATA CENTERS DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET FOR AUTOMOTIVE END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO OCCUPY LARGEST MARKET SHARE IN 2028

- FIGURE 44 NORTH AMERICA: SNAPSHOT OF THERMAL MANAGEMENT MARKET

- FIGURE 45 EUROPE: SNAPSHOT OF THERMAL MANAGEMENT MARKET

- FIGURE 46 ASIA PACIFIC: SNAPSHOT OF THERMAL MANAGEMENT MARKET

- FIGURE 47 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN THERMAL MANAGEMENT MARKET, 2017 TO 2021

- FIGURE 48 THERMAL MANAGEMENT MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 49 STARTUP/SME EVALUATION MATRIX

- FIGURE 50 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 51 HENKEL: COMPANY SNAPSHOT

- FIGURE 52 VERTIV CO: COMPANY SNAPSHOT

- FIGURE 53 PARKER CHOMERICS: COMPANY SNAPSHOT

- FIGURE 54 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 55 TAT TECHNOLOGIES LTD.: COMPANY SNAPSHOT

- FIGURE 56 AUTONEUM HOLDING AG: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the thermal management market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering thermal management solutions and services have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the thermal management market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to determine the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of thermal management to identify key players based on their products and prevailing industry trends in the thermal management market by material, device, service type, end-user industry, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

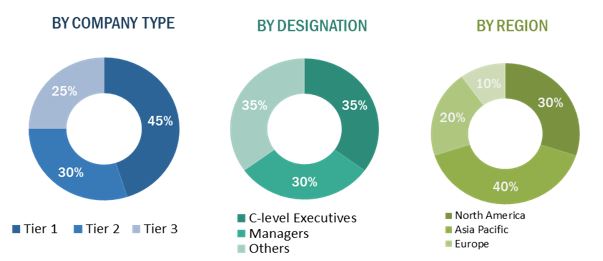

Extensive primary research has been conducted after understanding and analyzing the current scenario of the thermal management market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions have been conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the thermal management market.

- Identifying approximate revenues of companies involved in the thermal management ecosystem

- Identifying different thermal management solutions offered by key market players

- Analyzing the global penetration of each thermal management solution through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand different thermal management solutions available in the market and their applications; analyzing the breakup of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally, with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information such as press releases, white papers, and databases of the company- and region-specific developments undertaken in the thermal management solutions market

The Top-Down Approach has been used to Estimate and Validate the Total size of the Thermal Management Market.

- Focusing initially on the top-line investments and expenditures made in the thermal management ecosystem; further splitting into offering and listing key developments in key market areas

- Identifying a variety of thermal management solutions offered by all major players and verifying this data through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and thermal management solutions offered by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key potential domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the thermal management market.

Report Objectives

- To describe and forecast the size of the thermal management market, by material type, device, service, and end-user industry, in terms of value

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide the overall thermal management market size, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the thermal management market

- To provide an overview of the value chain pertaining to the thermal management ecosystem, along with the average selling prices of thermal management solutions

- To strategically analyze the ecosystem, tariff and regulatory landscape, patent landscape, Porter’s five forces, regulations, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze competitive developments such as product launches, expansions, partnerships, collaborations, agreements, contracts, and acquisitions in the thermal management market

- To profile key players in the thermal management market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies2

- Updated market developments of profiled players: The current report includes the market developments from April 2019 to October 2022.

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

How is Convection Devices or Conduction Devices going to impact the Thermal Management Market?

Both convection and conduction devices play an important role in thermal management, which involves managing the heat generated by electronic devices and preventing overheating. Here are some ways that convection and conduction devices are likely to impact the thermal management market:

Increased efficiency: Convection and conduction devices can both help to improve the efficiency of thermal management systems by providing effective ways to transfer heat away from electronic components. Convection devices, such as fans and heat sinks, use air flow to dissipate heat, while conduction devices, such as thermal interface materials and heat pipes, use materials with high thermal conductivity to transfer heat.

Growing demand for compact and portable devices: With the increasing trend towards smaller and more portable electronic devices, there is a growing need for thermal management solutions that are compact and lightweight. Both convection and conduction devices are important for achieving this, as they can be designed to be small and efficient.

Expansion of applications: Convection and conduction devices are used in a wide range of industries, from automotive to aerospace to medical devices. As new applications emerge, there is likely to be growing demand for thermal management solutions that can meet the unique requirements of each industry.

Integration with other technologies: As the Internet of Things (IoT) and other connected technologies continue to evolve, there is likely to be growing demand for thermal management solutions that can be integrated with these systems. For example, smart thermostats and other IoT devices could be used to monitor and control the temperature of electronic components, helping to optimize performance and reduce energy consumption.

Outlook and Growth of Thermal Management and Conduction Devices Market

The thermal management and conduction devices market is expected to experience strong growth in the coming years, driven by a range of factors, including the increasing use of electronic devices in a wide range of industries, growing demand for compact and portable solutions, and ongoing technological advancements. Here are some key trends that are likely to shape the outlook for this market:

Increasing demand for thermal management solutions: With the rapid growth of industries such as automotive, aerospace, and consumer electronics, there is a growing need for thermal management solutions that can help to prevent overheating and ensure reliable performance. This is driving demand for a range of conduction and convection devices, such as heat sinks, fans, and thermal interface materials.

Growing trend towards miniaturization: As electronic devices become smaller and more complex, there is a growing need for thermal management solutions that are compact and lightweight. This is driving innovation in the development of new materials, designs, and manufacturing techniques for conduction devices, such as heat pipes and vapor chambers.

Advancements in technology: As technology continues to evolve, there are many new opportunities for growth and innovation in the thermal management and conduction devices market. For example, the use of advanced materials and manufacturing processes is enabling the development of more efficient and reliable thermal solutions, while the integration of IoT technologies is enabling real-time monitoring and control of temperature.

Increasing focus on energy efficiency: With growing concerns about climate change and energy consumption, there is an increasing focus on the development of energy-efficient thermal management solutions. This is driving the adoption of new technologies, such as phase change materials and advanced heat exchangers, which can help to reduce energy consumption and improve overall system efficiency.

Industries That Will Be Impacted in the Future by Convection Devices

Convection devices, such as fans and heat sinks, are important components of thermal management systems, which are used to manage the heat generated by electronic devices and prevent overheating. Here are some examples of the industries that are likely to be impacted by convection devices in the future:

Electronics: The electronics industry is one of the primary users of convection devices, as they are essential for managing the heat generated by components such as microprocessors and graphic cards. As the demand for high-performance computing and smaller, more compact devices continues to grow, there is likely to be increasing demand for more efficient and effective thermal management solutions.

Automotive: As the automotive industry continues to adopt more advanced electronics, there is a growing need for thermal management solutions that can ensure reliable performance and prevent overheating. Convection devices, such as fans and heat sinks, are essential for achieving this, and are used in a range of applications, from engine control units to infotainment systems.

Aerospace: The aerospace industry is another major user of convection devices, particularly for avionics and other electronic components used in aircraft. With the increasing focus on reducing weight and improving efficiency in aerospace design, there is likely to be growing demand for more compact and lightweight thermal management solutions.

Medical devices: Medical devices such as imaging equipment and diagnostic tools generate a significant amount of heat, which must be managed to ensure accurate and reliable performance. Convection devices, such as fans and heat sinks, are often used in these applications to ensure that the devices operate within their designed temperature range.

Data centers: With the growth of cloud computing and other data-intensive applications, there is a growing need for efficient and effective thermal management solutions in data centers. Convection devices, such as fans and heat sinks, are often used to manage the heat generated by servers and other electronic equipment, helping to ensure reliable performance and minimize downtime.

Top companies in conduction devices market

The conduction devices market is dominated by companies that produce heat sinks, heat pipes, thermal interface materials, and other thermal management solutions. Honeywell International, Laird Thermal Systems, Delta Electronics, Fujipoly America Corporation, and Wakefield-Vette are some of the top companies in the conduction devices market, serving a wide range of industries, including electronics, automotive, aerospace, medical, and telecommunications. The demand for conduction devices is likely to continue to grow as the demand for high-performance electronics and more efficient, reliable devices continues to increase.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermal Management Market