Textile Testing, Inspection and Certification (TIC) Market by Application (Textile Testing, Textile Inspection, Textile Certification, & Toys), and Geography - Global Forecast to 2020

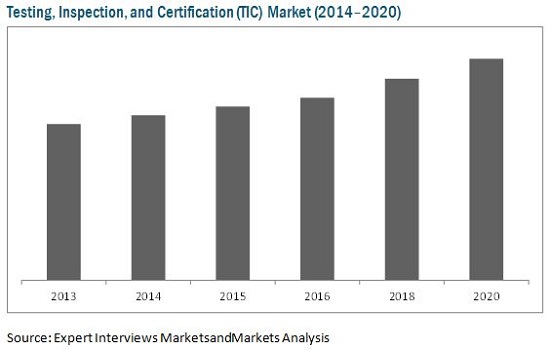

The global textile testing, inspection and certification market (TIC) is expected to reach USD 7,221.01 Million by 2020, at an estimated CAGR of 4.6% between 2015 and 2020. The textile TIC market is expected to be driven by introduction of new regulations and standards in the textile sector, technological innovations in the textile sector, and increase in the worldwide trading of textiles. Additionally, the market for textile certification is expected to grow at the highest CAGR of 8.1% during the forecast period due to the increase in trading of textiles.

Testing, inspection, and certification (TIC) services helps manufacturers ensure that their products conform to technical safety and quality related standards and regulations, which in turn increases the marketability of their products and reduces the pre-production cost of textiles. Examination of traded goods purchased from buyers by end-users and checking whether they comply with the buyer’s specification and expectations comes under inspection services. Certification of textile services provides confirmation of test or inspection done against governments and international standardization institutions’ set of pre-defined standards. Certification of textile helps manufacturers trade globally, as it assures buyers that a product complies with the technical safety, performance, and quality related regulatory standards.

The textile testing, inspection, and certification market is expected to reach USD 7,221.01 Million by 2020, growing at a CAGR of 4.6% between 2015 and 2020.

Textile TIC Market players such as SGS Group (Switzerland), Intertek Group plc (U.K.), and TUV SUD (Germany) have been focusing on geographical expansion, so as to broaden their portfolio and geographical presence. For Instance in February 2015, the SGS Group (Switzerland) opened a new softlines testing laboratory in Tianjin (China). The new lab offers testing services for various types of textiles, apparel, and leather products.

Increasing export of textiles from developing regions and growth of the technical textile market are some of the factors driving the textile testing, inspection, and certification market. Small to medium sized TIC companies face challenges in terms of receiving accreditation as it requires heavy investment. However, various government organizations are providing incentives in the form of funds and relaxation of accreditations for the SMEs in the textile TIC market, as the latter are required to make huge investments to get accredited by accreditation bodies such as International Organisation for Standardization (ISO) and American Society for Testing for Materials (ASTM).

The global textile testing, inspection, and certification market has been segmented into North America, Europe, APAC, and RoW. The studied market in North America has been further segmented into the U.S. Canada, and Mexico. The European Textile Testing Market has been segmented into Germany, Switzerland, U.K., Turkey, and others. Countries such as China, Japan, India, Bangladesh, and others are included in the APAC region. The said market in ROW has been further segmented into the Middle East, South America, Africa, and others. Europe was the leading region in terms of the market share in 2014, due to the presence of prominent market players such as SGS Group (Switzerland), Bureau Veritas Group (Belgium), Intertek Group PLC (U.K.), TUV Rheinland Group (Germany), and others.

Some of the key players in the Textile TIC Market include AsiaInspection (Hong Kong), BSI Group (U.K.), Bureau Veritas Group (Belgium), CTI (Centre Testing International) (China), Hohenstein (Germany), Intertek Group PLC (U.K.), SAI Global Ltd. (Australia), SGS Group (Switzerland), Testex AG (Switzerland), TUV Rheinland Group (Germany), TUV SUD Group (Germany), Eurofins Scientific (Luxembourg).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Export of Textiles From Developing Regions

2.2.2.2 Growth of the Technical Textile Market

2.2.3 Supply-Side Analysis

2.2.3.1 Consolidation of the Textile Testing Market

2.2.3.2 Expansion of TIC Services Into Emerging Markets By Textile Testing Market Players

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.1 Research Assumptions

2.1.1 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Textile Testing, Inspection and Certification Market

4.2 RoW has Emerged as A Lucrative Market

4.3 Regions Like Africa and South America are Likely to Be the Key Growth Regions

4.4 Textile TIC Market, By Textile Testing: the Chemical Testing Segment Accounted for the Highest Market Share in 2014

4.5 Life Cycle Analysis for the Textile Testing Market, By Geography

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Textile Testing Market, By Textile

5.2.2 Textile Testing Market, By Geography

5.3 Market Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Introduction of New Regulations and Standards in the Textile Sector

5.4.1.2 Reduced Cost Burden for Textile Manufacturers Due to Outsourcing of TIC Services

5.4.1.3 Technological Innovations in the Textile Sector

5.4.1.4 Increase in the Worldwide Trading of Textiles

5.4.2 Restraints

5.4.2.1 Domestic Regulations and Standards May Hamper the Trading of Textiles Globally

5.4.3 Opportunities

5.4.3.1 Emerging Markets Create Growth Opportunities for the Textile Testing Market Players

5.4.4 Challenges

5.4.4.1 Textile Products in the Overseas Market Take A Longer Time to Get Approved

5.4.5 Burning Issues

5.4.5.1 Significant Investment is Required for Accreditation of Standards

5.4.6 Winning Imperatives

5.4.6.1 Strict Quality and Safety Regulations in the Textile Industry

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of New Entrants

6.3.4 Threat of Substitutes

6.3.5 Degree of Competition

7 Textile Testing, Inspection, and Certification Market, By Textile Application (Page No. - 50)

7.1 Introduction

7.2 Textile Testing Market

7.2.1 Chemical Testing (Harmful Substances)

7.2.2 Color Fastness Test Parameters

7.2.3 Physical Test Parameters

7.2.4 Others

7.3 Textile Inspection Market

7.4 Textile Certification Market

7.5 Toys

8 Geographic Analysis (Page No. - 67)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 Switzerland

8.3.3 U.K.

8.3.4 Turkey

8.3.5 Others

8.4 APAC

8.4.1 China

8.4.2 Japan

8.4.3 India

8.4.4 Bangladesh

8.4.5 Others

8.5 RoW

8.5.1 Middle East

8.5.2 South America

8.5.3 Africa

8.5.4 Others

9 Competitive Landscape (Page No. - 89)

9.1 Overview

9.2 Market Ranking Analysis for the Textile Testing Market

9.3 Competitive Situation and Trends

9.3.1 Mergers & Acquisitions

9.3.2 New Product Launches

9.3.3 Expansions

9.3.4 Agreements, Partnerships, and Collaborations

10 Company Profiles (Page No. - 95)

10.1 Introduction

10.2 Asiainspection

10.2.1 Business Overview

10.2.2 Services Offered

10.2.3 Recent Developments

10.3 BSI Group

10.3.1 Business Overview

10.3.2 Services Offered

10.3.3 Recent Developments

10.4 Bureau Veritas Group

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 MnM View

10.5 CTI (Centre Testing International)

10.5.1 Business Overview

10.5.2 Services Offered

10.5.3 Recent Developments

10.6 Hohenstein

10.6.1 Business Overview

10.6.2 Services

10.6.3 Recent Developments

10.7 Intertek Group PLC

10.7.1 Business Overview

10.7.2 Products & Services

10.7.3 Recent Developments

10.7.4 MnM View

10.8 Sai Global Ltd.

10.8.1 Business Overview

10.8.2 Services

10.9 SGS Group

10.9.1 Business Overview

10.9.2 Services

10.9.3 Recent Developments

10.9.4 MnM View

10.10 Testex Ag

10.10.1 Business Overview

10.10.2 Products & Services

10.10.3 Recent Developments

10.11 TUv Rheinland Group

10.11.1 Business Overview

10.11.2 Products & Services

10.11.3 Recent Developments

10.11.4 MnM View

10.12 TUv Sud Group

10.12.1 Business Overview

10.12.2 Products & Services

10.12.3 Recent Development

10.12.4 MnM View

10.13 Eurofins Scientific

10.13.1 Business Overview

10.13.2 Services

List of Tables (58 Tables)

Table 1 Introduction of New Regulation and Standards in the Textile Sector is the Major Driving Factor for the Textile Testing Market

Table 2 Domestic Regulations and Standards Which Impact the Trading of Textiles Worldwide Constitute the Major Restraining Factor ForThe Textile Testing Market

Table 3 Emerging Markets Create Growth Opportunities For The Textile Testing, Inspection and Certification Market Players

Table 4 Textile Products in the Overseas Market Take A Longer Time to Get Approved Which is A Major Challenge for the Textile TIC Market

Table 5 Significant Investment is Required for Accreditation of Standards

Table 6 Strict Quality and Safety Regulations in the Textile Industry

Table 7 Textile Testing, Inspection and Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 8 Textile TIC Market Size, By Textile Testing Application, 2013 - 2020 (USD Million)

Table 9 North America: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 10 North America: Textile Testing Market Size, By Textile Testing Application,2013 - 2020 (USD Million)

Table 11 U.S.: Textile Testing Market Size (2013 - 2020), By Application, 2013 - 2020 (USD Million)

Table 12 Canada: Textile Testing Market Size (2013 - 2020), By Application,2013 - 2020 (USD Million)

Table 13 Mexico: Textile Testing Market Size (2013 - 2020), By Application,2013 - 2020 (USD Million)

Table 14 Europe: Textile Testing Market Size, By Application, 2013 - 2020 (USD Million)

Table 15 Europe: Textile Testing Market Size, By Textile Testing Application,2013 - 2020 (USD Million)

Table 16 Germany: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 17 Switzerland: Textile Certification MarketSize, By Application, 2013 - 2020 (USD Million)

Table 18 U.K.: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 19 Turkey: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 20 Rest of the Europe : Textile Certification Market Size, By Application,2013 - 2020 (USD Million)

Table 21 APAC: Textile Testing MarketSize, By Application, 2013 - 2020 (USD Million)

Table 22 APAC: Textile Certification Market Size, By Textile Testing Application,2013 - 2020 (USD Million)

Table 23 China: Textile Testing Market Size, By Application, 2013 - 2020 (USD Million)

Table 24 Japan: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 25 India: Textile Testing Market Size, By Application, 2013 - 2020 (USD Million)

Table 26 Bangladesh: Textile Certification MarketSize, By Application, 2013 - 2020 (USD Million)

Table 27 Rest of the APAC : Textile Certification Market Size, By Application,2013 - 2020 (USD Million)

Table 28 RoW: Textile Certification MarketSize, By Application, 2013 - 2020 (USD Million)

Table 29 RoW: Textile Testing Market Size, By Textile Testing Application,2013 - 2020 (USD Million)

Table 30 Middle East: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 31 South America: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 32 Africa: Textile Certification Market Size, By Application, 2013 - 2020 (USD Million)

Table 33 Others: Textile Testing Market Size, By Application, 2013 - 2020 (USD Million)

Table 34 Textile Testing, Inspection and Certification Market Size, By Geography, 2013 - 2020 (USD Million)

Table 35 North America: Textile Certification Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 36 North America: Textile Testing TIC Market Size (2013 - 2020), By Country, 2013 - 2020 (USD Million)

Table 37 North America: Textile Inspection TIC Market Size (2013 - 2020),By Country, 2013 - 2020 (USD Million)

Table 38 North America: Textile Certification TIC Market Size (2013 - 2020),By Country, 2013 - 2020 (USD Million)

Table 39 Europe: Textile Testing Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 40 Europe: Textile Testing Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 41 Europe: Textile Inspection Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 42 Europe: Textile Certification Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 43 Europe: Toys Textile Testing Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 44 APAC: Textile Certification Market Size (2013 - 2020), By Country, 2013 - 2020 (USD Million)

Table 45 APAC: Textile Testing Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 46 APAC: Textile Inspection Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 47 APAC: Textile Certification Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 48 APAC: Toys Market Size (2013 - 2020), By Country, 2013 - 2020 (USD Million)

Table 49 RoW: Textile Testing Market Size (2013 - 2020), By Country, 2013 - 2020 (USD Million)

Table 50 RoW: Textile Testing Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 51 RoW: Textile Inspection Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 52 RoW: Textile Certification Market Size (2013 - 2020), By Country,2013 - 2020 (USD Million)

Table 53 RoW: Toys Market Size (2013 - 2020), By Country, 2013 - 2020 (USD Million)

Table 54 Textile Testing, Inspection and Certification Market Ranking Analysis, 2014

Table 55 Mergers and Acquisitions, 2013 – 2015

Table 56 New Product Launches, 2014 – 2015

Table 57 Expansions, 2014-2015

Table 58 Agreements, Partnerships, and Collaborations, 2011-2015

List of Figures (50 Figures)

Figure 1 Textile Testing, Inspection and Certification Market: Research Design

Figure 2 Indian Textile Export, 2009-2013

Figure 3 Global Technical Textile TIC Market Size, 2009-2013

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Textile Testing Market Size, By Textile Application, Snapshot(2014 vs. 2020) (USD Million)

Figure 9 Textile Certification Market, By Textile Testing, 2014

Figure 10 North America: Textile Inspection Textile Certification Market Value, By Country

Figure 11 APAC: Toys Market Value, By Country

Figure 12 Global Textile Certification Market Share, By Geography, 2014

Figure 13 Global Testing, Inspection, and Certification (TIC) Market Size,2014 - 2020 (USD Billion)

Figure 14 Geographic Snapshot: Textile Certification Market, By Textile Application

Figure 15 Africa and South America are Some of the Key Growth Regions in the Textile Certification MarketFigure 16 Chemical Testing Was the Largest Segment in Terms of Market Size in the Textile Testing Market for TIC Services

Figure 17 Textile TIC Market: Life Cycle Analysis, By Geography

Figure 18 Testing, Inspection, and Certification Market, By Textile

Figure 19 Testing, Inspection, and Certification Market, By Geography

Figure 20 Evolution of Testing, Inspection, and Certification Services

Figure 21 Introduction of New Regulations and Standards in the Textile Sector is Expected to Drive the TIC Market

Figure 22 TIC Service Providers Play A Major Role in the Supply Chain of the TIC Market

Figure 23 Porter’s Five Forces Analysis for the Textile Certification Market

Figure 24 Bargaining Power of Suppliers in the TIC Market

Figure 25 Bargaining Power of Buyers in the Textile Certification Market

Figure 26 Threat of New Entrants in the TIC Market

Figure 27 Degree of Competition in the Textile Certification Market

Figure 28 Testing, Inspection, and Certification (TIC) Market, By Textile

Figure 29 Testing, Inspection, and Certification (TIC) Market, By Textile Testing

Figure 30 Geographical Snapshot: APAC is Emerging as A Key Growth Region for the Textile Certification Market,2014

Figure 31 Testing, Inspection and Certification Market, By Application

Figure 32 North American Market Snapshot

Figure 33 European Market Snapshot

Figure 34 APAC Market Snapshot

Figure 35 RoW Market Snapshot

Figure 36 Companies Adopted Expansion as the Key Growth Strategy Between2012 and 2015

Figure 37 Geographic Revenue Mix of the Major Market Players

Figure 38 BSI Group : Company Snapshot

Figure 39 Bureau Veritas Group : Company Snapshot

Figure 40 Bureau Veritas Sa : SWOT Analysis

Figure 41 Intertek Group PLC : Company Snapshot

Figure 42 Intertek Group PLC : SWOT Analysis

Figure 43 Sai Global : Company Snapshot

Figure 44 SGS Group : Company Snapshot

Figure 45 SGS Group : SWOT Analysis

Figure 46 TUV Rheinland Group : Company Snapshot

Figure 47 TUV Rheinland: SWOT Analysis

Figure 48 TUV Sud Group : Company Snapshot

Figure 49 TUV Sud Group : SWOT Analysis

Figure 50 Eurofins Scientific: Company Snapshot

The textile industry is majorly being driven by the rising production of textiles and increasing trading of textile products. The production and trading of textiles requires testing, inspection, and certification services to ensure that they conform to quality related standards, which also helps them gain recognition worldwide. According to the Apparel Export Promotion Council (AEPC), the exports from the Chinese textile industry were estimated to be worth USD 274 Billion in 2013 and USD 246 Billion in 2012.

This report profiles the major players which are active in the Textile TIC Market. The key players profiled in the report are SGS Group (Switzerland), Bureau Veritas SA (France), Intertek Group Plc (U.K.), TUV SUD Group (Germany), TÜV Rheinland Group (Germany), AsiaInspection Ltd (Hong Kong), British Standards Institution (BSI) Group (U.K.), Centre Testing International (CTI) (China), Hohenstein Institute (Germany), SAI Global Ltd (Australia), TESTEX AG (Switzerland), and Eurofins Scientific (Luxembourg).

Scope of the Report

This report categorizes the global textile testing, inspection, and certification market on the basis of textile application and geography, along with forecasting the revenue and analyzing the trends in the textile TIC market.

By textile application

In this section, the market has been segmented based on the textile applications for which the testing, inspection, and certification services are used. These include textile testing, textile inspection, textile certification, and toys. The market for textile application of TIC services has been further segmented into chemical testing, color fastness test parameters, physical test parameters, and others.

By geography

The Textile Testing Market has been split in to four regions based on geography, which include North America, Europe, Asia-Pacific, and ROW.

Target audience of the report

The intended audience for this report includes:

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Technology providers

- Analysts and strategic business planners

- End users who want to know more about TIC (Testing, Inspection, and Certification) services and the latest standards in the Textile Testing Market

- Government bodies, venture capitalists, and private equity firms

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Application

Further breakdown of some applications such as automotive, electronics, construction & infrastructure, chemical, finance, logistics, and energy

Company information

Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Textile Testing, Inspection and Certification (TIC) Market