Textile Finishing Chemicals Market by Type (Softening Finishes, Repellent Finishes, Wrinkle Free Finishes, Coating Finishes, Mothproofing Finishes), Process (Pad-Dry Cure Process, Exhaust Dyeing Process), Application , Region - Global Forecast to 2024

Updated on : June 18, 2024

Textile Finishing Chemicals Market

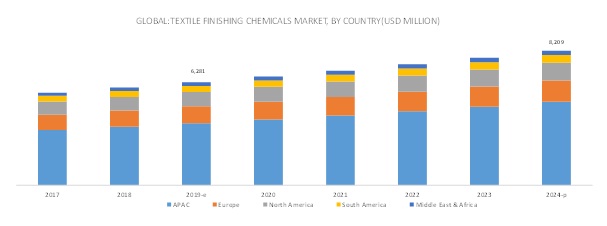

The textile finishing chemicals market was valued at USD 6.3 billion in 2019 and is projected to reach USD 8.2 billion by 2024, growing at 5.5% cagr from 2019 to 2024. The major factors driving the market include the growing demand of technical textiles and functional home textile finishes. However, stringent environmental regulations regarding the disposal of textile finishing effluents serve to be a major restraint for the market.

The technical textile application is projected to be the fastest-growing segment of the textile finishing chemicals market during the forecast period.

The technical textile application of the textile finishing chemicals market is the fastest-growing application, globally, during the forecast period. Technical textiles offer unique and exclusive characteristics and properties which are far different from those of regular textiles. They have a combination of advanced technology and solid chemical-properties (mechanical resistance, elasticity, reinforcement, anti-dust, tenacity, insulation, thermal & fire resistance, UV, and IR). They are widely used in various industries such as sports, agriculture, aerospace, health care and construction sectors. The widespread use of technical textiles is expected to drive the consumption of textile finishing chemicals.

The softening finishes segment is expected to be the largest contributor to the textile finishing chemicals market during the forecast period.

Softening finishes is the fastest-growing type of finishing chemical, globally, during the forecast period. Softeners form a coating over the fibers, thus decreasing fiber to fiber friction and enhancing the abrasion resistance simultaneously. Also, due to increased mobility, the fibers lose their rigidity and absorb and dissipate the mechanical stresses in a better manner, thereby reducing the tear strength and pilling tendency. These factors increases the use of softening finishes in clothing textile and home textile, thus boosting the growth of textile finishing chemicals altogether.

APAC is expected to account for the largest market share during the forecast period.

APAC is projected to be the largest region for textile finishing chemicals market and is expected to offer significant growth opportunities to the overall market during the forecast period. China and India are projected to be the fastest-growing countries in this region due to the increasing investments of global technical textile manufacturers in these countries. Also, low labor and operational costs and rapid technological advancements in these countries drive the growth of the textile industry. In addition, growing consumer awareness regarding dynamic fashion trends and increase in utility of various textile products are driving the consumption of textile finishing chemicals in the region.

Textile Finishing Chemicals Market Players

Huntsman Corporation (US), Wacker Chemie AG (Germany), The Dow Chemical Company (US), BASF (Germany), Archroma (Switzerland), Evonik Industries (Germany), Dupont (US), Solvay SA (Belgium), Tanatex Chemicals B.V (Netherlands), and Dystar Singapore PTE Ltd. (Singapore) are the leading textile finishing chemicals manufacturers.

Textile Finishing Chemicals Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Units considered |

Value (USD Billion ) |

|

Segments covered |

Type, Process, Application, and Region |

|

Geographies covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies covered |

Huntsman Corporation (US), Wacker Chemie AG (Germany), The Dow Chemical Company (US), Archroma (Switzerland), Evonik Industries (Germany), Dupont (US), Solvay SA (Belgium), Tanatex Chemicals B.V (The Netherlands) and Dystar Singapore PTE Ltd. (Singapore) |

This research report categorizes the textile finishing chemicals market based on type, process, application, and region.

Textile Finishing Chemicals Market by Type:

- Softening Finishes

- Repellent Finishes

- Wrinkle Free Finishes

- Coating Finishes

- Mothproofing Finishes

- Others

Textile Finishing Chemicals Market by Process:

- Pad-Dry Cure Process

- Exhaust Dyeing Process

- Others

Textile Finishing Chemicals Market by Application:

- Clothing Textile

- Home Textile

- Technical Textile

- Others

Textile Finishing Chemicals Market by Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In November 2019, Huntsman textile joined the ZDHC roadmap to zero programme as a contributor; this promotes sustainable chemistry and best practice in the textile and footwear industries and helps shift the sector to a more transparent global supply chain.

- In June 2019, Wacker Chemie AG expanded its silicone elastomer production in China with an annual capacity of 7,000 metric tons. This expansion will support Wacker’s future growth path in China and improve the availability of high consistency silicone rubber (HCR) in the APAC region.

- In May 2019, Archroma launched Appretan NTR, a break-through water-based textile coating binder based on renewable natural ingredients.

- In March 2018, The Dow Chemical Company launched ECOFAST Pure Sustainable Textile Treatment. This product imparts unique and brighter colors on natural textiles. It also significantly improves resource efficiency during the dyeing process.

- In May 2017, Archroma collaborated with the American clothing company, Patagonia (US). Patagonia created Clean Color Collection, a capsule collection using Archroma’s range of dyes manufactured from agricultural waste, EarthColors.

Key Questions Addressed by the Report

- Which are the future revenue pockets in the textile finishing chemicals market?

- Which key developments are expected to have a high impact on the global textile finishing chemicals market?

- Which products/technologies are expected to overpower the existing technologies?

- How the regulatory scenario further is expected to impact the textile finishing chemicals?

- What will be the future product mix in the textile finishing chemicals?

- What are the prime strategies of leaders in the global textile finishing chemicals market?

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the textile finishing chemicals market?

How are textile finishing chemicals different from other chemicals used in the manufacturing of textiles?

What are the factors contributing to the final price of textile finishing chemicals?

How is the textile finishing chemicals market aligned?

Who are the major manufacturers?

What are the types of textile finishing chemicals?

What are the major applications for textile finishing chemicals?

What is the most significant restraint for the textile finishing chemicals market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

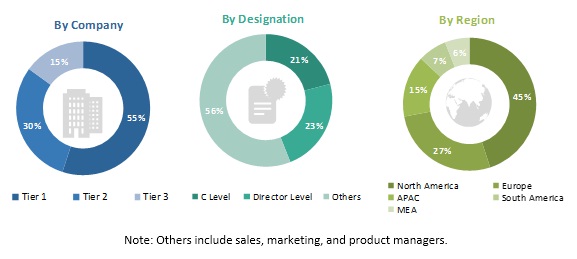

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Supply Side Analysis

2.2.2 Market Number Estimation

2.2.3 Forecast

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Fabric Finishing Chemicals Market

4.2 Fabric Finishing Chemicals Market, By Type

4.3 Fabric Finishing Chemicals Market, By Type and Region

4.4 Fabric Finishing Chemicals Market, By Application

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Technical Fabrics

5.2.1.2 Increasing Demand for Clothing and Home Furnishing

5.2.2 Restraints

5.2.2.1 Stringent Regulations on the Disposal of Fabric Finishing Effluents

5.2.3 Opportunities

5.2.3.1 Growing Adoption of Eco-Friendly Fabric Finishes for Textile Manufacturing

5.2.4 Challenges

5.2.4.1 Exposure to Toxic Chemicals

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.3.6 Macro Economic Indicators

5.3.6.1 Introduction

5.3.6.2 Trends and Forecast in the Construction Industry

6 Fabric Finishing Chemicals Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Softening Finishes

6.2.1 Improved Flexibility and Elasticity of Fabric Increasing the Demand for Softening Finishes

6.3 Repellent Finishes

6.3.1 Repellent Finishes Provide Stain Repellency and Release in A Wide Range of Fabrics

6.4 Wrinkle-Free Finishes

6.4.1 High Demand in Cotton Fabric Industry Boosts the Demand for Wrinkle-Free Finishes

6.5 Coating Finishes

6.5.1 Increasng Demand From the Technical Textile Application to Drive the Segment

6.6 Mothproofing Finishes

6.6.1 Growing Awareness Regarding Fabric Hygiene Spuring the Demand for Mothproofing Finishes

6.7 Others

7 Fabric Finishing Chemicals Market, By Process (Page No. - 50)

7.1 Introduction

7.2 Pad-Dry Cure Process

7.2.1 Use for Applying A Variety of Finishing Chemicals is Driving the Segment

7.3 Exhaust Dyeing Process

7.3.1 Applicability of the Process on Both Natural and Synthetic Resulting in High Use of the Process

7.4 Others

8 Fabric Finishing Chemicals Market, By Application (Page No. - 56)

8.1 Introduction

8.2 Clothing Fabric

8.2.1 Dynamic Fashion Trends, Increasing Disposable Income, and Improving Living Standards to Drive the Demand for Clothing Fabric

8.3 Home Fabric

8.3.1 Growing Residential and Commercial Constructions Boosting the Home Fabric Application

8.4 Technical Fabric

8.4.1 Rapid Technological Development and Increasing Purchasing Power of People Resulting in High Demand for Technical Fabric

8.5 Others

9 Fabric Finishing Chemicals Market, By Region (Page No. - 63)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 Shift From Traditional Low-Value Fabric to High-Value Fabric Products and High Demand for Technical Fabric to Boost the Market

9.2.2 India

9.2.2.1 Strong Domestic Demand, Increasing Disposable Income, and Changing Lifestyle to Drive the Market

9.2.3 Bangladesh

9.2.3.1 Increasing Demand for Clothing Fabrics and Availability of Cheap Labor are Positively Influencing the Market

9.2.4 Vietnam

9.2.4.1 Growing Demand for Low Labor Cost and Increasing Apparel Exports to Boost the Market

9.2.5 Indonesia

9.2.5.1 Robust Economic Growth, Rising Disposable Income, and Strong Government Initiatives to Drive the Fabric Finishing Chemicals Market

9.2.6 Rest of APAC

9.3 Europe

9.3.1 Italy

9.3.1.1 Technological Developments and Changing Consumer Preferences & Lifestyles to Drive the Market

9.3.2 Germany

9.3.2.1 Demand From Technical Fabric Application and Favorable Economic Conditions are Driving the Market

9.3.3 France

9.3.3.1 Increasing Use of Fabric Finishing Chemicals in the Clothing and Technical Fabric Application to Boost the Market

9.3.4 UK

9.3.4.1 Increasing Use of Fabric Finishing Chemicals Observed in Home and Clothing Fabric Applications

9.3.5 Spain

9.3.5.1 Clothing and Technical Fabric Applications to Drive the Market

9.3.6 Turkey

9.3.6.1 Increase in Production of Technical Fabric and the Presence of Numerous Fabric Educational & Research Institutes to Boost the Market

9.3.7 Belgium

9.3.7.1 Presence of Research Institutions Encouraging Technological Advancements in the Fabric Sector

9.3.8 Rest of Europe

9.4 North America

9.4.1 US

9.4.1.1 Favorable Demographics, Growing Disposable Income, and Increasing Penetration of E-Commerce Facilities to Drive the Market

9.4.2 Mexico

9.4.2.1 Growing Demand for Durable and Comfortable Clothing Fabric in the Country to Influence the Market

9.4.3 Canada

9.4.3.1 Rising Disposable Income to Boost the Demand for Fabric Finishing Chemicals in the Country

9.5 South America

9.5.1 Brazil

9.5.1.1 Increase in Customer Spending and Decline in Inflation Boosts the Textile Industry in the Country

9.5.2 Argentina

9.5.2.1 Increasing Demand for Fashionable Clothes Helps Fabric Finishing Industry to Grow

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 UAE

9.6.1.1 Growing Demand for Fashion Makes Clothing Fabric the Largest Used Application in the Country

9.6.2 Saudi Arabia

9.6.2.1 Growing Population and Increasing Purchasing Power Boost the Demand for Fabric Finishing Chemicals in the Country

9.6.3 Egypt

9.6.3.1 New Investments in R&D Activities and Adoption of Modern Technologies to Boost the Market

9.6.4 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 106)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 Acquisitions

10.3.3 Agreements & Joint Ventures

10.3.4 New Product Launches/Developments

11 Company Profiles (Page No. - 113)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Huntsman Corporation

11.2 Wacker Chemie AG

11.3 The Dow Chemical Company

11.4 BASF

11.5 Archroma

11.6 Evonik Industries AG

11.7 Dupont

11.8 Solvay

11.9 Tanatex Chemicals

11.10 Dystar Singapore PTE Ltd.

11.11 Rudolf Gmbh

11.12 Bozzetto Group

11.13 Other Company Profiles

11.13.1 Celanese Corporation

11.13.2 ORA Chem

11.13.3 Ethox Chemicals

11.13.4 Chungyo Chemicals

11.13.5 Resil Chemicals

11.13.6 CHT Group

11.13.7 Omnova Solutions

11.13.8 Croda International PLC

11.13.9 The Chemours Company

11.13.10 The Seydel Companies, Inc.

11.13.11 Fineotex Chemical Limited

11.13.12 Ht Fine Chemicals Co. Ltd

11.13.13 Clariant AG

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 151)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Related Reports

12.4 Author Details

List of Tables (93 Tables)

Table 1 Trends and Forecast of Per Capita Gdp (USD)

Table 2 Textile and Clothing Export of 25 Key Countries in 2016

Table 3 Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 4 Softening Finishes Market Size, By Region, 2017–2024 (USD Million)

Table 5 Repellent Finishes Market Size, By Region, 2017—2024 (USD Million)

Table 6 Wrinkle-Free Finishes Market Size, By Region, 2017—2024 (USD Million)

Table 7 Coating Finishes Market Size, By Region, 2017—2024 (USD Million)

Table 8 Mothproofing Finishes Market Size, By Region, 2017—2024 (USD Million)

Table 9 Other Finishes Market Size, By Region, 2017—2024 (USD Million)

Table 10 Fabric Finishing Chemicals Market Size, By Process, 2017–2024 (USD Million)

Table 11 Pad-Dry Cure Process: Fabric Finishing Chemicals Market Size, By Region, 2017–2024 (USD Million)

Table 12 Exhaust Dyeing Process: Fabric Finishing Chemicals Market Size, By Region, 2017–2024 (USD Million)

Table 13 Other Processes: Fabric Finishing Chemicals Market Size, By Region, 2017–2024 (USD Million)

Table 14 Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 15 Fabric Finishing Chemicals Market Size in Clothing Fabric, By Region, 2017–2024 (USD Million)

Table 16 Fabric Finishing Chemicals Market Size in Home Fabric, By Region, 2017—2024 (USD Million)

Table 17 Fabric Finishing Chemicals Market Size in Technical Fabric, By Region, 2017–2024 (USD Million)

Table 18 Fabric Finishing Chemicals Market Size in Others, By Region, 2017–2024 (USD Million)

Table 19 Fabric Finishing Chemicals Market Size, By Region, 2017–2024 (USD Million)

Table 20 APAC: Fabric Finishing Chemicals Market Size, By Country, 2017–2024 (USD Million)

Table 21 APAC: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 22 APAC: Fabric Finishing Chemicals Market Size, By Process, 2017–2024 (USD Million)

Table 23 APAC: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 24 China: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 25 China: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 26 India: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 27 India: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 28 Bangladesh: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 29 Bangladesh: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 30 Vietnam: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 31 Vietnam: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 32 Indonesia: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 33 Indonesia: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 34 Rest of APAC: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 35 Rest of APAC: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 36 Europe: Fabric Finishing Chemicals Market Size, By Country, 2017–2024 (USD Million)

Table 37 Europe: Fabric Finishing Chemicals Market Size, By Type,2017–2024 (USD Million)

Table 38 Europe: Fabric Finishing Chemicals Market Size, By Process, 2017–2024 (USD Million)

Table 39 Europe: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 40 Italy: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 41 Italy: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 42 Germany: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 43 Germany: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 44 France: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 45 France: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 46 UK: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 47 UK: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 48 Spain: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 49 Spain: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 50 Turkey: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 51 Turkey: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 52 Belgium: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 53 Belgium: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 54 Rest of Europe: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 55 Rest of Europe: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 56 North America: Fabric Finishing Chemicals Market Size,By Country, 2017–2024 (USD Million)

Table 57 North America: Fabric Finishing Chemicals Market Size, By Type, 2017–2024(USD Million)

Table 58 North America: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 59 North America: Fabric Finishing Chemicals Market Size, By Process, 2017–2024 (USD Million)

Table 60 US: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 61 US: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 62 Mexico: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 63 Mexico: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 64 Canada: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 65 Canada: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 66 South America: Fabric Finishing Chemicals Market Size, By Country, 2017–2024 (USD Million)

Table 67 South America: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 68 South America: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 69 South America: Fabric Finishing Chemicals Market Size, By Process, 2017–2024 (USD Million)

Table 70 Brazil: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 71 Brazil: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 72 Argentina: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 73 Argentina: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 74 Rest of South America: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 75 Rest of South America: Silicone Market Size, By Application, 2017–2024 (USD Million)

Table 76 Middle East & Africa: Fabric Finishing Chemicals Market Size, By Country, 2017–2024 (USD Million)

Table 77 Middle East & Africa: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 78 Middle East & Africa: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 79 Middle East & Africa: Fabric Finishing Chemicals Market Size, By Process, 2017–2024 (USD Million)

Table 80 UAE: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 81 UAE: Fabric Finishing Chemicals Market Size, By Application,2017–2024 (USD Million)

Table 82 Saudi Arabia: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 83 Saudi Arabia: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 84 Egypt: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 85 Egypt: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 86 Rest of Middle East & Africa: Fabric Finishing Chemicals Market Size, By Type, 2017–2024 (USD Million)

Table 87 Rest of Middle East & Africa: Fabric Finishing Chemicals Market Size, By Application, 2017–2024 (USD Million)

Table 88 Expansions, 2016–2019

Table 89 Acquisitions, 2016–2019

Table 90 Agreements & Joint Ventures, 2016–2019

Table 91 New Product Launches/Developments, 2016–2019

Table 92 Huntsman Corporation: Major Manufacturing Plant Locations

Table 93 Wacker Chemie AG: Major Manufacturing Plant Locations

List of Figures (54 Figures)

Figure 1 Market Segmentation

Figure 2 Fabric Finishing Chemicals Market: Research Design

Figure 3 Market Number Estimation

Figure 4 Fabric Finishing Chemicals Market: Data Triangulation

Figure 5 Softening Finishes to Be the Fastest-Growing Type

Figure 6 Pad-Dry Cure to Be the Largest Process Segment of the Fabric Finishing Chemicals Market

Figure 7 Clothing Fabrics to Be the Largest Application in the Fabric Finishing Chemicals Market

Figure 8 APAC Accounted for the Largest Market Share in 2018

Figure 9 Clothing Fabric Application to Drive the Demand for Fabric Finishing Chemicals During the Forecast Period

Figure 10 Softening Finishes to Be the Largest Type

Figure 11 Softening Finishes Was the Largest Type and APAC the Largest Market in 2018

Figure 12 Clothing Fabric to Be the Largest Application

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Fabric Finishing Chemicals Market

Figure 14 Fabric Finishing Chemicals Market: Porter’s Five Forces Analysis

Figure 15 Distribution of Export Product of Top 25 Countries in 2016

Figure 16 Softening Finishes to Be the Fastest-Growing Segment of the Market

Figure 17 APAC to Be the Fastest-Growing Market for Softening Finishes

Figure 18 APAC to Be the Largest Market for the Repellent Finishes

Figure 19 APAC to Be the Fastest-Growing Market for Wrinkle-Free Finishes

Figure 20 Europe to Be the Second-Largest Market for Coating Finishes

Figure 21 APAC to Be the Fastest-Growing Market for Mothproofing Finishes

Figure 22 APAC to Be the Largest Market for Other Finishes

Figure 23 Pad-Dry Cure Process to Be the Fastest-Growing Segment of the Market

Figure 24 APAC to Be the Fastest-Growing Market for Pad-Dry Cure Process

Figure 25 APAC to Be the Largest Market for Exhaust Dyeing Process

Figure 26 APAC to Be the Fastest-Growing Market for Others Process

Figure 27 Clothing Fabric to Be the Largest Application of Fabric Finishing Chemicals

Figure 28 APAC to Be the Dominant Market in Clothing Fabrics Application

Figure 29 Europe to Be the Second-Largest Market in Home Fabric Application

Figure 30 Technical Fabric to Be the Largest Application of Fabric Finishing Chemicals in APAC

Figure 31 APAC to Be the Fastest-Growing Market in Other Applications

Figure 32 India to Be the Fastest-Growing Fabric Finishing Chemicals Market Globally

Figure 33 APAC: Fabric Finishing Chemicals Market Snapshot

Figure 34 Europe: Fabric Finishing Chemicals Market Snapshot

Figure 35 North America: Fabric Finishing Chemicals Market Snapshot

Figure 36 South America: Fabric Finishing Chemicals Market Snapshot

Figure 37 Middle East & Africa: Fabric Finishing Chemicals Market Snapshot

Figure 38 Companies Primarily Adopted Expansions as the Key Growth Strategy Between 2016 and 2019

Figure 39 Fabric Finishing Chemicals Market Ranking, 2018

Figure 40 Huntsman Corporation: Company Snapshot

Figure 41 SWOT Analysis: Huntsman Corporation

Figure 42 Wacker Chemie AG: Company Snapshot

Figure 43 SWOT Analysis: Wacker Chemie AG

Figure 44 The Dow Chemical Company: Company Snapshot

Figure 45 SWOT Analysis: the Dow Chemical Company

Figure 46 BASF: Company Snapshot

Figure 47 SWOT Analysis: BASF

Figure 48 SWOT Analysis: Archroma

Figure 49 Evonik Industries AG: Company Snapshot

Figure 50 SWOT Analysis: Evonik Industries AG

Figure 51 Dupont: Company Snapshot

Figure 52 Solvay: Company Snapshot

Figure 53 Dystar: Company Snapshot

Figure 54 Bozzetto Group: Company Snapshot

The study involved four major activities in estimating the current size of the global textile finishing chemicals market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg Business Week, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

The textile finishing chemicals market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side is characterized by developments in the market. The supply side is characterized by market consolidation activities undertaken by manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the global textile finishing chemicals market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the global textile finishing chemicals market size were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key market players, along with extensive interviews of leaders, such as directors and marketing executives

Data Triangulation

After arriving at the global market size-using the market size estimation processes as explained above-the market was split into several segments and sub segments. To complete the market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the textile finishing chemicals market.

Report Objectives

- To define, describe, and forecast the global textile finishing chemicals market

- To identify and analyze the key drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define and segment the market size by type, process, and application

- To forecast the size of the global textile finishing chemicals market on the basis of regions

- To analyze the market opportunities and competitive landscape of the stakeholders and market leaders

- To analyze recent market developments and competitive strategies, such as expansion, acquisition, new product launch, agreement & joint venture, and partnership

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of country-level by type and end-use Industry

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Textile Finishing Chemicals Market