Tetrakis (Hydroxymethyl) Phosphonium Sulfate Market by Application (Oil & Gas, Water Treatment, Leather, Textile), by Function (Biocide, Iron Sulfide Scavenger, Flame Retardant, Tanning Agent) and Region - Global Forecast 2025

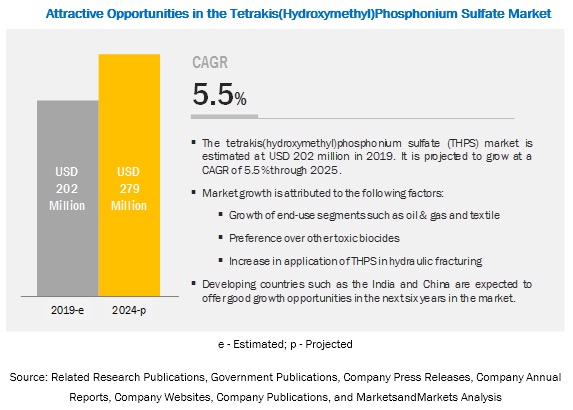

[133 Pages Report] The global tetrakis(hydroxymethyl)phosphonium sulfate market, in terms of value, is estimated to account for nearly USD 202 million in 2019 and projected to grow at a CAGR of 5.5%, to reach approximately USD 279 million by 2025. The growth of the oil & gas and textile industries is driving the THPS market as the demand and frequency of use have increased. With a large number of plants using THPS as an anti-microbial agent, the requirement for the chemical is expected to rise in the near future.

By function, the biocides segment is projected to be the fastest-growing segment in the tetrakis(hydroxymethyl)phosphonium sulfate market during the forecast period.

The biocides segment in the tetrakis(hydroxymethyl)phosphonium sulfate market is projected to be the fastest-growing segment. THPS as a biocide is an important chemical used in hydraulic fracturing as well as water treatment systems. Biocides are used mainly for killing and controlling bacteria, as they can cause instability in viscosity and pose high threats. THPS was used initially as an industrial biocide in cooling systems. THPS biocides are aqueous solutions that do not contain volatile organic compounds (VOCs).

By application, the oil & gas segment is projected to dominate the tetrakis(hydroxymethyl)phosphonium sulfate market during the forecast period.

THPS has become the most widely used biocide in oilfields, where sulfate-reducing bacteria create major problems. Another major reason for its use is that it is suitable for downhole applications (well drilling process). The treatment of oil wells with THPS has resulted in increased oil production due to the dissolution of iron sulfide after the use of THPS. However, it is the biocidal function of THPS, which is encouraging its increasing use in the oil & gas industry.

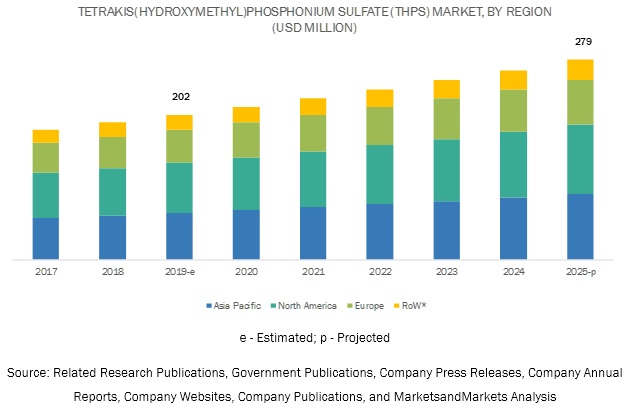

The increasing demand for THPS in oil & gas and leather industries in the Asia Pacific regions is driving the growth of the tetrakis(hydroxymethyl)phosphonium sulfate market.

THPS is also used on a larger scale in the leather industry, as it increases the strength properties for chrome in the tanning of hides (a process in which rawhides or skins are converted into leather). In the Asia Pacific region, China is the fifth-largest importer of leather and leather products in the world.

To satisfy the increasing demand for energy, oil & gas, and petrochemicals, and to encourage regional economic growth, the developing countries in the Asia Pacific region are keen on boosting the productivity of new and established oil & gas reserves within its territories. Further, the high rate of urbanization is projected to generate huge demand for leather, textile, and oil & gas, leading to the growth of the tetrakis(hydroxymethyl)phosphonium sulfate (THPS) market in the region.

North America is estimated to account the largest market share, in terms of value, in 2019.

North America is the largest market for tetrakis(hydroxymethyl)phosphonium sulfate (THPS) followed by Asia Pacific. The demand for THPS in this region is primarily driven by the increasing consumption of oil and gas activity levels that are rising in the region. Thus, as there is increasing demand from several applications—such as water treatment, leather, textile, oil & gas, and others—thus, THPS plays an important role in increasing the high demand in developed countries, such as the US and Canada, owing to the increasing consumption of leather and leather products. North America is anticipated to be the largest player for industrial wastewater treatment, owing to the presence of huge infrastructure for oil and gas and mining, and strict regulations against wastewater treatment, which in turn, helps in growing the demand for THPS in industrial wastewater applications in the region.

Key Market Players

Key players in the tetrakis(hydroxymethyl)phosphonium sulfate market include Arkema S.A. (France), DowDuPont (US), Solvay (Belgium), Sigma-Aldrich (Merck KGaA) (Germany), and Hubei Xingfa Chemicals Group Co., Ltd (China). Major players in this market are focusing on increasing their presence through new product launches. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report:

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD Million) & Volume (Tons) |

|

Segments covered |

Application and Function |

|

Geographies covered |

North America, Europe, Asia Pacific, & RoW |

|

Companies covered |

Arkema S.A. (France), Solvay (Belgium), Sigma-Aldrich (Merck KGaA) (Germany), DowDuPont (US), Hubei Xingfa Chemicals Group Co., Ltd (China), Changshu New-Tech Chemicals Co., Ltd. (China), Jiangxi Fuerxin Medicine Chemical Co., Ltd. (China), Jiangsu Kangxiang Industrial Group Co., Ltd. (China), Prasol Chemicals Pvt. Ltd. (India), Hubei Lianxing Chemical Co., Ltd. (China), Jiangsu Danai Chemical Co., Ltd.(China), Finoric LLC (US), Compass Chemical (US). |

This research report categorizes the tetrakis(hydroxymethyl)phosphonium sulfate market based on function, application, and region.

Based on function, the market has been segmented as follows:

- Biocide

- Iron sulfide scavenger

- Flame retardant

- Tanning agent

Based on application, the market has been segmented as follows:

- Oil & gas

- Water treatment

- Textile

- Leather

- Others* (paper & paperboard manufacturing; paints, coatings, and emulsion; agriculture; and aquaculture)

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of World (RoW)*

*Rest of the World (RoW) includes South America and the Middle East & Africa

Key questions addressed by the report:

- What are the new application areas for the tetrakis(hydroxymethyl)phosphonium sulfate market that companies are exploring?

- Who are some of the key players operating in the tetrakis(hydroxymethyl)phosphonium sulfate market and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the tetrakis(hydroxymethyl)phosphonium sulfate market projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders, due to the benefits offered by tetrakis(hydroxymethyl)phosphonium sulfate markets, such as increasing revenue, environmental regulatory compliance, and sustainable profits for the suppliers?

Frequently Asked Questions (FAQ):

What is the competitive scenario of the top players in THPS Market?

There is an increase in Agreements, Collaborations and Expansions by the key players such as Arkema S.A, Solvay, and Sigma-Aldrich

Which mode of application is largely adopted in the THPS Market?

The oil & gas segment accounted for the largest share in 2018, as THPS has become the most widely used biocide in oilfields, where sulfate-reducing bacteria create major problems.

Which are the major opportunity areas of THPS market?

Product innovations and customizations to meet growing consumer demand are the major opportunity areas for the THPS market

Why does North America hold the largest share in THPS market?

The demand for THPS in this region is primarily driven by the increasing consumption of oil and gas activity levels that are rising in the region. Thus, as there is increasing demand from several applications—such as water treatment, leather, textile, oil & gas, and others—thus, THPS plays an important role in increasing the high demand in developed countries, such as the US and Canada, owing to the increasing consumption of leather and leather products. North America is anticipated to be the largest player for industrial wastewater treatment, owing to the presence of huge infrastructure for oil and gas and mining, and strict regulations against wastewater treatment, which in turn, helps in growing the demand for THPS in industrial wastewater applications in the region.

Which region is the fastest growing THPS market in terms of application?

To satisfy the increasing demand for energy, oil & gas, and petrochemicals, and to encourage regional economic growth, the developing countries in the Asia Pacific region are keen on boosting the productivity of new and established oil & gas reserves within its territories.THPS is also used on a larger scale in the leather industry, as it increases the strength properties for chrome in the tanning of hides (a process in which rawhides or skins are converted into leather). In the Asia Pacific region, China is the fifth-largest importer of leather and leather products in the world. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Segmentation

1.4 Periodization Considered

1.5 Currency Considered

1.6 Volume Units Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Primary Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Opportunities in the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market

4.2 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market: Key Countries

4.3 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market, By Application (USD Thousand)

4.4 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market, By Function (USD Thousand)

4.5 North America: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market, By Application & Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Supply Chain Analysis

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of End-Use Segments Such as Oil & Gas and Textile

5.3.1.2 Preference Over Other Toxic Biocides

5.3.1.3 Increase in Application of THPS in Hydraulic Fracturing

5.3.2 Restraints

5.3.2.1 Alternative Technologies are Being Developed to Replace Biocides

5.3.2.2 Increase in Focus on Oxidizing Biocides

5.3.3 Opportunities

5.3.3.1 Product Innovations and Customizations to Meet Growing Consumer Demand

5.3.3.2 Increase in Focus on High-Growth Markets Such as the Middle East & Asia Pacific

5.3.4 Challenges

5.3.4.1 Rise in Price of Raw Materials

5.3.4.2 Health Hazards Associated With Exposure to THPS

6 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market, By Function (Page No. - 43)

6.1 Introduction

6.2 Biocide

6.2.1 THPS is Eco-Friendly and Effective in Both Acidic and Alkaline Media

6.3 Flame Retardant

6.3.1 THPS is Majorly Used as A Flame Retardant in Cotton and Cellulose Blend Fabrics

6.4 Iron Sulfide Scavenger

6.4.1 THPS Changes the Physical Form and Bacterial Content of the Iron Sulfide Deposits

6.5 Tanning Agent

6.5.1 Rise in the Use of THPS as A Substitute for Hazardous Chemical Salts During the Leather Tanning Process to Drive the Market Growth

7 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market, By Application (Page No. - 52)

7.1 Introduction

7.2 Oil & Gas

7.2.1 THPS is Stable at High-Temperatures and Prolongs Downhole Protection in Oilfields

7.3 Water Treatment

7.3.1 THPS has Emerged as A Preferred Biocide in the Cooling Towers of Water Treatment Plants

7.4 Textile

7.4.1 THPS is Used More as A Flame Retardant Than A Leather Tanning Agent in the Textile Industry

7.5 Leather

7.5.1 THPS is Preffered Leather Tanning Agent Over Other Agents

7.6 Others

7.6.1 Increased Applications of THPS Across Industries Due to Its Environment-Friendly Nature

8 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market, By Region (Page No. - 62)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 High Demand for THPS in Industrial Water Processes and Growing Manufacturing Industries Drive the Market

8.2.2 Canada

8.2.2.1 Highly Diversified Oil & Gas Industry Driving the Market

8.2.3 Mexico

8.2.3.1 Rise in Investments in the Oil & Gas Industry

8.3 Europe

8.3.1 Germany

8.3.1.1 The Growth in the Oil & Gas Industry in the Country to Drive the Sales of THPS in the Market

8.3.2 Italy

8.3.2.1 The Demand for THPS in the Oil & Gas Sector is Projected to Drive the Market in the Country

8.3.3 France

8.3.3.1 The Demand for THPS in the Oil & Gas Industry Offers Lucrative Opportunities for Manufacturers in the Country

8.3.4 Spain

8.3.4.1 The Oil Sector is Projected to Offer Lucrative Opportunities for THPS Manufacturers in the Coming Years

8.3.5 Netherlands

8.3.5.1 The Demand for THPS in the Oil Industry is Projected to Drive the Growth of the Market

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 The Rising Government Support and Funding in Various Activities Drive the Chinese Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market

8.4.2 India

8.4.2.1 Increase in Manufacturing Facilities Propelling the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market in the Country

8.4.3 Japan

8.4.3.1 Increase in the Imports of Leather and Leather Products Enhancing the Growth of the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market in Japan

8.4.4 Australia & New Zealand

8.4.4.1 Australian Chemical Companies Adopting Advanced Technological Methods for Enhancing Water Treatment Applications in the Country

8.4.5 Rest of Asia Pacific

8.5 Rest of the World (RoW)

8.5.1 South America

8.5.1.1 The Increasing Global Demand for Durable Materials in the Leather Industry is A Major Factor Driving the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market in the Region

8.5.2 Middle East & Africa

8.5.2.1 Increasing Demand for Oil & Gas-Related Products is Projected to Drive the Growth of the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market in the Region

9 Competitive Landscape (Page No. - 100)

9.1 Overview

9.2 Competitive Leadership Mapping

9.2.1 Dynamic Differentiators

9.2.2 Innovators

9.2.3 Visionary Leaders

9.2.4 Emerging Companies

9.2.5 New Product Launch

10 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

10.1 Arkema S.A.

10.2 Solvay

10.3 Sigma-Aldrich (Merck KGaA)

10.4 Dowdupont

10.5 Hubei Xingfa Chemicals Group Co., Ltd.

10.6 Changshu New-Tech Chemicals Co., Ltd.

10.7 Jiangxi Fuerxin Medicine Chemical Co., Ltd.

10.8 Jiangsu Kangxiang Industrial Group Co., Ltd.

10.9 Prasol Chemicals Pvt. Ltd.

10.10 Hubei Lianxing Chemical Co., Ltd.

10.11 Jiangsu Dan AI Chemical Co., Ltd.

10.12 Finoric LLC

10.13 Compass Chemical

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 124)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (84 Tables)

Table 1 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Compound Summary

Table 2 USD Exchange Rate, 2014–2018

Table 3 Middle East: Performance of the Oil & Gas Sector, By Key Country, 2018

Table 4 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2017–2025 (USD Thousand)

Table 5 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size, By Function, 2017–2025 (Ton)

Table 6 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size for Biocide, By Region, 2017–2025 (USD Thousand)

Table 7 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size for Biocide, By Region, 2017–2025 (Ton)

Table 8 THPS Market Size for Flame Retardant, By Region, 2017–2025 (USD Thousand)

Table 9 THPS Market Size for Flame Retardant, By Region, 2017–2025 (Ton)

Table 10 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size for Iron Sulfide Scavenger, By Region, 2017–2025 (USD Thousand)

Table 11 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size for Iron Sulfide Scavenger, By Region, 2017–2025 (Ton)

Table 12 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size for Tanning Agent, By Region, 2017–2025 (USD Thousand)

Table 13 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size for Tanning Agent, By Region, 2017–2025 (Ton)

Table 14 THPS Market Size, By Application, 2017–2025 (USD Thousand)

Table 15 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size, By Application, 2017–2025 (Ton)

Table 16 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size in Oil & Gas, By Region, 2017–2025 (USD Thousand)

Table 17 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size in Oil & Gas, By Region, 2017–2025 (Ton)

Table 18 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size in Water Treatment, By Region, 2017–2025 (USD Thousand)

Table 19 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size in Water Treatment, By Region, 2017–2025 (Ton)

Table 20 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size in Textile, By Region, 2017–2025 (USD Thousand)

Table 21 Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) Market Size in Textile, By Region, 2017–2025 (Ton)

Table 22 Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) Market Size in Leather, By Region, 2017–2025 (USD Thousand)

Table 23 THPS Market Size in Leather, By Region, 2017–2025 (Ton)

Table 24 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size in Other Applications, By Region, 2017–2025 (USD Thousand)

Table 25 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size in Other Applications, By Region, 2017–2025 (Ton)

Table 26 THPS Market Size, By Region, 2017–2025 (USD Thousand)

Table 27 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Region, 2017–2025 (Ton)

Table 28 North America:THPS Market Size, By Country, 2017–2025 (USD Thousand)

Table 29 North America: Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size, By Country, 2017–2025 (Ton)

Table 30 North America: Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 31 North America: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 32 North America: THPS Market Size, By Function, 2017–2025 (USD Thousand)

Table 33 North America: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2017–2025 (Ton)

Table 34 US: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 35 US: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 36 Canada: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 37 Canada: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 38 Mexico: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 39 Mexico: THPS Market Size, By Application, 2017–2025 (Ton)

Table 40 Europe: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Country, 2017–2025 (USD Thousand)

Table 41 Europe: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Country, 2017–2025 (Ton)

Table 42 Europe: THPS Market Size, By Application, 2017–2025 (USD Thousand)

Table 43 Europe: Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size, By Application, 2017–2025 (Ton)

Table 44 Europe: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2017–2025 (USD Thousand)

Table 45 Europe: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2017–2025 (Ton)

Table 46 Germany: Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size, By Application, 2017–2025 (USD Thousand)

Table 47 Germany: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 48 Italy: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 49 Italy: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 50 France: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 51 France: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 52 Spain: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 53 Spain: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 54 Netherlands: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 55 Netherlands: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 56 Rest of Europe: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 57 Rest of Europe: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 58 Asia Pacific: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Country, 2017–2025 (USD Thousand)

Table 59 Asia Pacific: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Country, 2017–2025 (Ton)

Table 60 Asia Pacific: THPS Market Size, By Application, 2017–2025 (USD Thousand)

Table 61 Asia Pacific: THPS Market Size, By Application, 2017–2025 (Ton)

Table 62 Asia Pacific: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2017–2025 (USD Thousand)

Table 63 Asia Pacific: Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size, By Function, 2017–2025 (Ton)

Table 64 China: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 65 China: Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Size, By Application, 2017–2025 (Ton)

Table 66 India: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 67 India: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 68 Japan: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 69 Japan: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 70 Australia & New Zealand: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 71 Australia & New Zealand: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 72 Rest of Asia Pacific: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 73 Rest of Asia Pacific: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 74 RoW: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Region, 2017–2025 (USD Thousand)

Table 75 RoW: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Region, 2017–2025 (Ton)

Table 76 RoW: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 77 RoW: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 78 RoW: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2017–2025 (USD Thousand)

Table 79 RoW: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2017–2025 (Ton)

Table 80 South America: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 81 South America: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 82 Middle East: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (USD Thousand)

Table 83 Middle East: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2017–2025 (Ton)

Table 84 New Product Launch, 2018

List of Figures (35 Figures)

Figure 1 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Segmentation

Figure 2 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market: Research Design

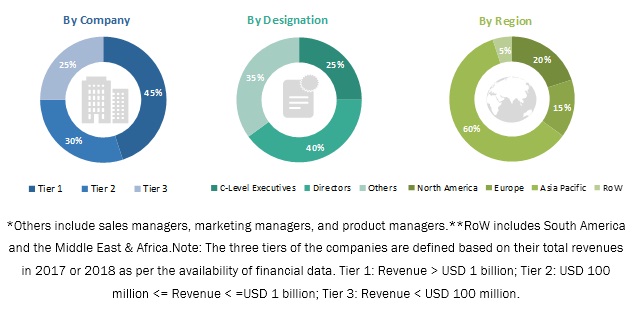

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Breakdown and Data Triangulation

Figure 7 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Share (Value), By Application, 2019 vs 2025

Figure 8 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2019 vs 2025 (USD Thousand)

Figure 9 North America Dominated the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market, in Terms of Value, in 2018

Figure 10 Growth of End-Use Segments Such as Oil & Gas and Textile and Preference Over Other Toxic Biocides Drive the Global Market for Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS)

Figure 11 US Dominated the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market in 2018

Figure 12 The Oil & Gas Segment to Dominate the Market Through 2025

Figure 13 The Biocide Segment to Dominate the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Through 2025

Figure 14 The US Accounted for the Largest Share in 2018

Figure 15 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market: Supply Chain Analysis

Figure 16 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market: Market Dynamics

Figure 17 Annual Crude Oil Production, 2009-2018 (Million Ton)

Figure 18 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2019 vs 2025 (USD Thousand)

Figure 19 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Function, 2019 vs 2025 (Ton)

Figure 20 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2019 vs 2025 (USD Thousand)

Figure 21 Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Size, By Application, 2019 vs 2025 (Ton)

Figure 22 India to Record the Highest Growth Rate in the Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market During the Forecast Period

Figure 23 North America: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Snapshot

Figure 24 Asia Pacific: Tetrakis(Hydroxymethyl)Phosphonium Sulfate (THPS) Market Snapshot

Figure 25 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market (Global) Competitive Leadership Mapping, 2018

Figure 26 Tetrakis(Hydroxymethyl)Phosphonium Sulfate Market Ranking, By Key Player, 2018

Figure 27 Arkema S.A.: Company Snapshot

Figure 28 Arkema S.A.: SWOT Analysis

Figure 29 Solvay: Company Snapshot

Figure 30 Solvay: SWOT Analysis

Figure 31 Sigma-Aldrich (Merck KGaA): Company Snapshot

Figure 32 Sigma-Aldrich (Merck KGaA): SWOT Analysis

Figure 33 Dowdupont: Company Snapshot

Figure 34 Dowdupont: SWOT Analysis

Figure 35 Hubei Xingfa Chemicals Group Co., Ltd.: SWOT Analysis

The study involves four major activities to estimate the current market size of the tetrakis(hydroxymethyl)phosphonium sulfate market in terms of both value and volume. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The tetrakis(hydroxymethyl)phosphonium sulfate market comprises several stakeholders such as manufacturers, importers and exporters, traders, distributors, and suppliers of tetrakis(hydroxymethyl)phosphonium sulfate, government & research organizations, and raw material manufacturers. It also includes manufacturers of leather goods, textiles, paints, paper & paper boards, coatings, and emulsions companies. The demand-side of this market is characterized by the rising demand for THPS in oil & gas, water treatment, leather, and textile industries. The supply-side is characterized by the supply of THPS from various suppliers in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the tetrakis(hydroxymethyl)phosphonium sulfate market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the tetrakis(hydroxymethyl)phosphonium sulfate market.

Report Objectives

- To define, segment, and project the global market size of the tetrakis(hydroxymethyl)phosphonium sulfate market.

- To understand the tetrakis(hydroxymethyl)phosphonium sulfate market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as new product launches

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the World tetrakis(hydroxymethyl)phosphonium sulfate (THPS) market into Brazil, Argentina, Saudi Arabia, and South Africa

- Further breakdown of the Rest of Asia Pacific tetrakis(hydroxymethyl)phosphonium sulfate (THPS) market into Vietnam, Malaysia, Thailand, Indonesia, the Philippines, and South Korea

- Further breakdown of the Rest of Europe tetrakis(hydroxymethyl)phosphonium sulfate (THPS) market into the UK, Belgium, Poland, Denmark, and Sweden

Company Information

- · Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Tetrakis (Hydroxymethyl) Phosphonium Sulfate Market