Tetrahydrofuran (THF) Market by Application (PTMEG, Solvents), Technology (Reppe Process, Davy Process, Propylene Oxide Process, Butadiene Process), and Region (Asia Pacific, North America, Europe, RoW) - Global Forecast to 2022

[100 Pages Report] Tetrahydrofuran (THF) market was valued at USD 2.77 Billion in 2016 and is projected to reach USD 4.12 Billion by 2022, at a CAGR of 6.9% during the forecast period from 2017 to 2022. The growing demand for spandex fibers and polyurethane across the globe is driving the growth of the THF market.

Objectives of the Study

- To analyze and forecast the size of the THF market, in terms of volume and value

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the THF market

- To define, describe, and forecast the THF market based on technology, application, and region

- To forecast the size of the THF market in four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall THF market

- To analyze competitive developments such as mergers & acquisitions and agreements & partnerships in the THF market

- To analyze the opportunities in the THF market for the stakeholders and provide a competitive landscape for the market leaders

- To strategically profile the key players operating in the THF market and comprehensively analyze their market shares and core competencies

Years considered for this report

2016 Base Year

2017 Estimated Year

2022 Projected Year

Research Methodology

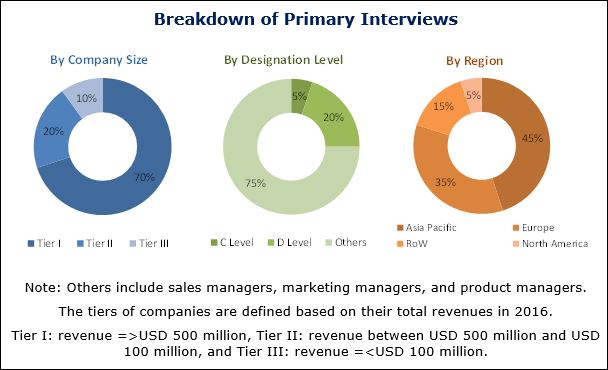

This study estimates the size of the THF market for 2017 and projects its growth by 2022. It provides a detailed qualitative and quantitative analysis of the THF market. Secondary sources such as Hoovers, Bloomberg Businessweek, and Factiva, among others have been used to identify and collect information useful for this extensive and commercial study of the THF market. Primary sources such as experts from the related industries and suppliers of tetrahydrofuran have been interviewed to obtain and verify critical information and assess the future prospects of the THF market.

To know about the assumptions considered for the study, download the pdf brochure

The key players profiled in the report include BASF (Germany), Dairen Chemical (Taiwan), Ashland (US), INVISTA (US), Mitsubishi Chemical (Japan), LyondellBasell (the Netherlands), Sipchem (Saudi Arabia), Penn A Kem (US), Nova Molecular Technologies (US), and BioAmber (US), among others.

Target Audience:

- Manufacturers of Tetrahydrofuran

- Chemical Suppliers

- Traders, Distributors, and Suppliers of Tetrahydrofuran

- Raw Material Suppliers

- Government and Research Organizations

- Industry Associations

This study answers several questions for stakeholders, primarily which market segments to focus upon during the next two to five years to prioritize their efforts and investments. It also provides a competitive landscape of the THF market.

Scope of the Report:

The THF market has been segmented as follows:

THF Market, by Technology:

- Reppe Process

- Davy Process

- Propylene Oxide

- Butadiene Process

THF Market, by Application:

- Polytetramethylene Ether Glycol (PTMEG)

- Solvents

- Others

THF Market, by Region:

- Asia Pacific

- Europe

- North America

- Rest of the World (RoW)

The THF market has further been analyzed for the key countries in each of these regions.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific requirements of the companies. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the Rest of Asia Pacific THF market into Australia and New Zealand

The Tetrahydrofuran (THF) market is projected to grow from USD 2.95 Billion in 2017 to USD 4.12 Billion by 2022, at a CAGR of 6.9% from 2017 to 2022. The growth of the THF market is driven by the increasing use of tetrahydrofuran in the manufacturing of spandex and polyurethane. The flourishing textile industry across the globe is driving the demand for Polytetramethylene Ether Glycol (PTMEG)which is used as a raw material for producing spandex. This, in turn, leads to the increased demand for tetrahydrofuran across the globe. In addition, the high demand for tetrahydrofuran from emerging economies such as China and various South Asian countries also offers enormous opportunities for the growth of the THF market.

Based on application, the THF market has been segmented into PTMEG, solvents, and others. The PTMEG application segment is projected to lead the THF market during the forecast period, in terms of volume. This segment of the market is also projected to grow at the highest CAGR, in terms of volume between 2017 and 2022. The growth of the PTMEG application segment of the THF market can be attributed to the extensive use of PTMEG in the production of spandex and polyurethane. Spandex is widely used in sportswear, trendy garments, and casual wear. Spandex is used in various types of womens clothing such as leggings, form-fit garments, and trendy outfits; swimwear, athletic wear, and aerobic garments; and casual wear. In addition, the growing health awareness among masses has led to an increase in the number of sports events and fitness activities across the globe, thereby leading to increased demand for sportswear. The flourishing chemical industry across the globe has also increased the demand for tetrahydrofuran in chemical intermediates. The solvents application segment is projected to account for the second-largest share of the THF market, in terms of volume during the forecast period. The increased consumption of tetrahydrofuran for manufacturing adhesives, paints & coatings, inks, cosmetics, consumer goods, and pharmaceutical products is leading to the growth of the THF market across the globe.

Based on technology, the THF market has been segmented into Reppe process, Davy process, propylene oxide process, and butadiene process. Among technologies, the Reppe process segment is projected to lead the THF market, in terms of volume during the forecast period. The growth of the Reppe process segment of the THF market can be attributed to the high production efficiency of Reppe process, safety associated with this process, low investments required to carry out Reppe process, its suitability for the mass production of tetrahydrofuran, and less number of steps involved in this process. The butadiene process segment of the THF market is projected to grow at the highest CAGR, in terms of volume during the forecast period, owing to the easy availability of low-cost raw materials.

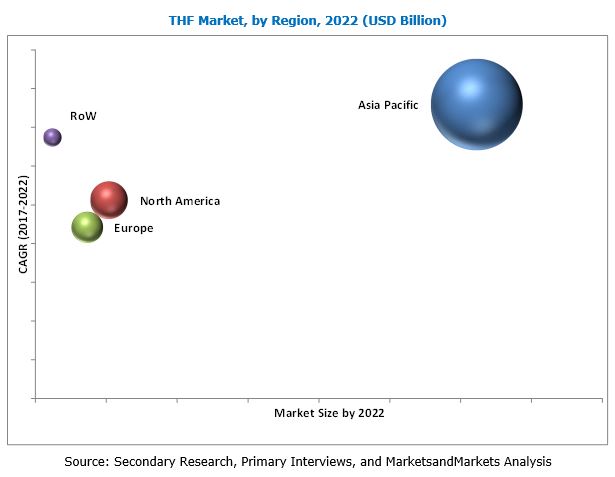

Based on region, the THF market has been segmented into Asia Pacific, North America, Europe, and RoW. The Asia Pacific region is the largest market for tetrahydrofuran across the globe. The Asia Pacific THF market is projected to grow at the highest CAGR, in terms of volume between 2017 and 2022. China is expected to lead the Asia Pacific THF market, in terms of volume as it accounts for half of the global demand for tetrahydrofuran. China, India, and various North and South Asian countries largely contribute to the demand for tetrahydrofuran. The growth of the THF market in these countries can be attributed to their flourishing textile, packaging, automotive, and chemical industries. The high growth of the automotive and packaging industries in the Asia Pacific region has fueled the growth of the THF market in this region.

The hazardous impact of tetrahydrofuran on human and animal health and its high manufacturing costs are the factors restraining the growth of the THF market across the globe. Tetrahydrofuran is flammable and carcinogenic. Exposure to tetrahydrofuran can cause acute health hazards to humans as well as animals.

BASF (Germany), Dairen Chemical (Taiwan), Ashland (US), INVISTA (US), Mitsubishi Chemical (Japan), LyondellBasell (the Netherlands), Sipchem (Saudi Arabia), Penn A Kem (US), Nova Molecular Technologies (US), and BioAmber (US), among others are the key players operating in the THF market. These leading players have adopted the strategies of mergers & acquisitions and agreements & partnerships to enhance their foothold in the THF market.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 27)

4.1 Significant Opportunities in THF Market

4.2 THF Market, By Process Technology

4.3 THF Market, By Region

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Spandex Fiber

5.2.1.2 High Demand for Polyurethane (PU)

5.2.2 Restraints

5.2.2.1 Hazardous Nature of THF

5.2.3 Opportunities

5.2.3.1 Increasing Importance of Green Chemistry

5.2.3.2 High Growth in Emerging Markets

5.2.4 Challenges

5.2.4.1 Increasing Environmental Regulations

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Regulations and Protocols of THF

5.4.1 Regulations

5.4.1.1 U.S. Dot Hm-181 Rules

5.4.2 Handling Protocols

5.4.3 THF Exposure Limits

5.4.4 Chemical Storage and Disposal

5.5 Macroeconomic Indicators

5.5.1 GDP Growth Rate Forecast of Major Economies

5.5.2 Textile Industry

5.5.3 Major Importers and Exporters* of THF

6 THF Market, By Process Technology (Page No. - 38)

6.1 Introduction

6.2 Commercial Technologies for the Production of BDO

6.3 Reppe Process

6.4 Davy Process

6.5 Butadiene-Based Process

6.6 Propylene Oxide-Based Process

6.7 Other Technologies

6.7.1 Cyclization of BDO to THF

6.7.1.1 Furfural

6.7.2 Bio-Based Technologies

6.7.2.1 Hydrogenolysis of Succinic Acid

6.7.2.2 Fermentation of Sugar

6.7.2.3 Hydrogenation of Succinic Acid

7 THF Market, By Application (Page No. - 45)

(Note: Market Sizes are Not Provided for the Sub-Segments)

7.1 Introduction

7.2 Solvents

7.2.1 Coatings

7.2.2 Adhesives

7.2.3 Printing Inks

7.2.4 Resins

7.2.5 Reactions & Purification

7.2.6 Organic Synthesis

7.2.7 Others

7.3 PTMEG

7.3.1 Spandex

7.3.2 PU Resin

7.3.3 Thermoplastic Polyester Elastomer

7.4 Others

8 THF Market, By Region (Page No. - 50)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 Rest of APAC

8.3 North America

8.3.1 US

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 UK

8.4.4 Italy

8.4.5 Rest of Europe

8.5 RoW

8.5.1 Saudi Arabia

8.5.2 South Africa

8.5.3 Brazil

8.5.4 Others

9 Competitive Landscape (Page No. - 76)

9.1 Overview

9.2 Market Share Analysis of Key Players

9.2.1 BASF and Dairen Chemical

9.2.2 Others

10 Company Profiles (Page No. - 77)

(Business Overview, Products Offered, SWOT Analysis, MnM View)*

10.1 BASF

10.2 Dairen Chemical

10.3 Ashland

10.4 Mitsubishi Chemical Corporation

10.5 Invista

10.6 Bioamber

10.7 Lyondellbasell

10.8 Pennakem

10.9 Sipchem

*Details on Business Overview, Products Offered, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.10 Others

10.10.1 Tcc Chemical

10.10.2 Sinochem Qingdao

10.10.3 Bluestar New Chemical Materials

10.10.4 Shanxi Sanwei

10.10.5 Nan Ya Plastics

10.10.6 Korea PTG

11 Appendix (Page No. - 93)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (60 Tables)

Table 1 Forecast of Real GDP Growth Rates, 20162022

Table 2 Technologies Adopted By Different Companies for the Production of THF

Table 3 Tetrahydrofuran (THF) Market Size, By Process Technology, 20152022 (Kiloton)

Table 4 THF Market Size, By Process Technology, 20152022 (USD Million)

Table 5 Comparative Analysis of Production Technologies

Table 6 Tetrahydrofuran (THF) Market Size, By Application, 20152022 (Kiloton)

Table 7 THF Market Size, By Application, 20152022 (USD Million)

Table 8 Solvents Market Size, By Region, 20152022 (USD Million)

Table 9 PTMEG Market Size, By Region, 20152022 (USD Million)

Table 10 Other Applications Market Size, By Region, 20152022 (USD Million)

Table 11 Tetrahydrofuran (THF) Market Size, By Region, 20152022 (Kiloton)

Table 12 THF Market Size, By Region, 20152022 (USD Million)

Table 13 APAC: Tetrahydrofuran Market Size, By Country, 20152022 (Kiloton)

Table 14 APAC: THF Market Size, By Country, 20152022 (USD Million)

Table 15 APAC: THF Market Size, By Application, 20152022 (Kiloton)

Table 16 APAC: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 17 China: THF Market Size, By Application, 20152022 (Kiloton)

Table 18 China: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 19 Japan: Tetrahydrofuran (THF) Market Size, By Application, 20152022 (Kiloton)

Table 20 Japan: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 21 South Korea: Tetrahydrofuran Market Size, By Application, 20152022 (Kiloton)

Table 22 South Korea: Tetrahydrofuran (THF) Market Size, By Application, 20152022 (USD Million)

Table 23 Rest of APAC: THF Market Size, By Application, 20152022 (Kiloton)

Table 24 Rest of APAC: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 25 North America: Tetrahydrofuran (THF) Market Size, By Country, 20152022 (Kiloton)

Table 26 North America: Tetrahydrofuran Market Size, By Country, 20152022 (USD Million)

Table 27 North America: THF Market Size, By Application, 20152022 (Kiloton)

Table 28 North America: Market Size, By Application, 20152022 (USD Million)

Table 29 US: THF Market Size, By Application, 20152022 (Kiloton)

Table 30 US: By Market Size, By Application, 20152022 (USD Million)

Table 31 Canada: Tetrahydrofuran (THF) Market Size, By Application, 20152022 (Kiloton)

Table 32 Canada: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 33 Mexico: THF Market Size, By Application, 20152022 (Kiloton)

Table 34 Mexico: Market Size, By Application, 20152022 (USD Million)

Table 35 Europe: THF Market Size, By Country, 20152022 (Kiloton)

Table 36 Europe: Tetrahydrofuran Market Size, By Country, 20152022 (USD Million)

Table 37 Europe: Tetrahydrofuran (THF) Market Size, By Application, 20152022 (Kiloton)

Table 38 Europe: By Market Size, By Application, 20152022 (USD Million)

Table 39 Germany: THF Market Size, By Application, 20152022 (Kiloton)

Table 40 Germany: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 41 France: THF Market Size, By Application, 20152022 (Kiloton)

Table 42 France: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 43 UK: Tetrahydrofuran (THF) Market Size, By Application, 20152022 (Kiloton)

Table 44 UK: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 45 Italy: THF Market Size, By Application, 20152022 (Kiloton)

Table 46 Italy: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 47 Rest of Europe: Tetrahydrofuran (THF) Market Size, By Application, 20152022 (Kiloton)

Table 48 Rest of Europe: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 49 RoW: Tetrahydrofuran Market Size, By Country, 20152022 (Kiloton)

Table 50 RoW: Tetrahydrofuran (THF) Market Size, By Country, 20152022 (USD Million)

Table 51 RoW: THF Market Size, By Application, 20152022 (Kiloton)

Table 52 RoW: Market Size, By Application, 20152022 (USD Million)

Table 53 Saudi Arabia: THF Market Size, By Application, 20152022 (Kiloton)

Table 54 Saudi Arabia: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

Table 55 South Africa: Tetrahydrofuran (THF) Market Size, By Application, 20152022 (Kiloton)

Table 56 South Africa: Market Size, By Application, 20152022 (USD Million)

Table 57 Brazil: Tetrahydrofuran Market Size, By Application, 20152022 (Kiloton)

Table 58 Brazil: By Market Size, By Application, 20152022 (USD Million)

Table 59 Others: THF Market Size, By Application, 20152022 (Kiloton)

Table 60 Others: Tetrahydrofuran Market Size, By Application, 20152022 (USD Million)

List of Figures (33 Figures)

Figure 1 Tetrahydrofuran Market Segmentation

Figure 2 THF Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Tetrahydrofuran Market : Data Triangulation

Figure 6 Tetrahydrofuran (THF) Market Size, By Volume (Kiloton) and Value (USD Billion), 20152022

Figure 7 Reppe Process to Be the Dominating Technology for THF

Figure 8 PTMEG to Be the Dominating Application of THF

Figure 9 China to Be the Largest THF Market

Figure 10 APAC Dominated the Tetrahydrofuran (THF) Market in 2016

Figure 11 Increasing Demand From PTMEG Application to Drive THF Market

Figure 12 PTMEG to Be the Largest Application of THF

Figure 13 Butadiene-Based Process Technology to Be the Fastest-Growing Application

Figure 14 APAC Dominated THF Market in 2016

Figure 15 Factors Governing THF Market

Figure 16 Porters Five Forces Analysis of THF Market

Figure 17 World Textile Trade Data (20052014)

Figure 18 Reppe Process to Be the Leading Technology for THF

Figure 19 Various Technologies Used for BDO Production

Figure 20 Davy Process

Figure 21 Cyclization of BDO

Figure 22 Furfural Technology

Figure 23 Bio-Based Process

Figure 24 PTMEG to Be the Leading Application of THF

Figure 25 APAC: THF Market Snapshot

Figure 26 North America: THF Market Snapshot

Figure 27 Europe: THF Market Snapshot

Figure 28 Market Ranking of Key Players, 2016

Figure 29 BASF: Company Snapshot

Figure 30 Ashland: Company Snapshot

Figure 31 Bioamber: Company Snapshot

Figure 32 Lyondellbasell: Company Snapshot

Figure 33 Sipchem: Company Snapshot

Growth opportunities and latent adjacency in Tetrahydrofuran (THF) Market