Subscriber Data Management Market by Solution (Policy Management, Subscriber Data Federation, Identity Management, and User Data Repository), Network Type, Application Type, Organization Size, Deployment Type, and Region - Global Forecast to 2021

[155 Pages Report] The Subscriber Data Management market size is estimated to grow from USD 1.97 Billion in 2016 to USD 4.44 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 17.6%. The need to reduce Operational Expenditure (OpEx) & enable cross-network consolidation, increasing subscriber demand for Long-Term Evolution (LTE) & Voice over LTE (VoLTE), deployment of Internet Protocol Multimedia Subsystem (IMS), and movement of telcos towards Network Function Virtualization (NFV) are some of the factors fueling the growth of the SDM market across the globe. The base year considered for this study is 2015 and the forecast period considered is 20162021.

Objectives of the Subscriber Data Management Market Study

- To define, describe, and forecast the global Subscriber Data Management market on the basis of solutions, network types, application types, deployment types, organization size, and regions

- To provide a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size and growth rate of market segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders and provide company profiles of the key players in the market to comprehensively analyze the core competencies and draw competitive landscape for the market

- To track and analyze competitive developments, such as Mergers & Acquisitions (M&A), new product developments, and Research & Development (R&D) activities in the market

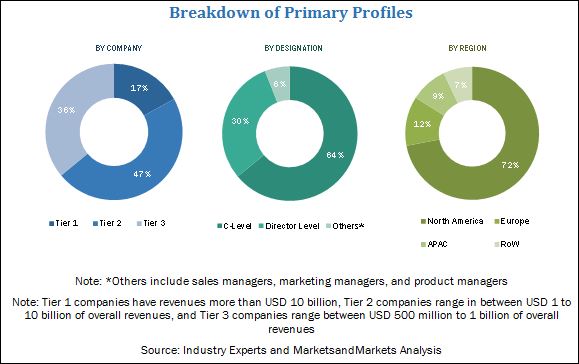

The research methodology used to estimate and forecast the SDM market begins with capturing data on key vendor revenues through secondary sources, such as annual reports, press releases, associations such as GSM association, and databases such as Factiva, BusinessWeek, company websites, and news articles. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure is employed to arrive at the overall market size of the global Subscriber Data Management market from the revenue of the key players in the market. After arriving at the overall market size, the total market is split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The SDM ecosystem comprises SDM solution providers, such as Ericsson (Kista, Stockholm), Hewlett Packard Enterprise (HPE) Company (California, U.S.), Huawei Technologies Co. Ltd. (Shenzhen, China), Nokia Corporation (Espoo, Finland), Oracle Corporation (California, U.S.), Amdocs Inc. (Missouri, U.S.), Cisco Systems, Inc. (California, U.S.), Computaris International Ltd. (Essex, U.K.), Openwave Mobility, Inc. (California, U.S.), Procera Networks, Inc. (California, U.S.), Redknee Solutions, Inc. (Ontario, Canada), and ZTE Corporation (Shenzhen, China). Other stakeholders of the Subscriber Data Management market include Communication Service Providers (CSPs), Mobile Network Operators (MNOs), Mobile Virtual Network Operators (MVNOs), Mobile Virtual Network Enablers (MVNEs), Mobile Virtual Network Aggregators (MVNAs), and system integrators.

Key Target Audience

- SDM solution providers

- CSPs

- Telecom equipment providers

- MNOs

- MVNAs

- MVNOs

- MVNEs

- Cloud service providers

- System integrators

- Research organizations

- Consulting companies

- Government agencies

The research study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the Subscriber Data Management market to forecast the revenues and analyze the trends in each of the following submarkets:

By Solution

- Policy management

- Subscriber data federation

- Identity management

- User data repository

By Network Type

- Mobile networks

- Fixed networks

By Application Type

- Mobile

- Fixed mobile convergence

- Voice over Internet Protocol (VoIP) and video over IP

- Others

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Deployment Type

- On-premises

- Cloud

By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given Subscriber Data Management market data, MarketsandMarkets offers customizations based on the company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC market into countries contributing 75% to the regional Subscriber Data Management market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries contributing 75% to the regional market size

- Further breakdown of the MEA market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (Up to 5).

Increasing subscriber demand for LTE and VoLTE and deployment of Internet Protocol Multimedia Subsystem (IMS) to drive the global Subscriber Data Management (SDM) market to USD 4.4 Billion by 2021

SDM manages subscriber data across heterogeneous domains of network in a converged way. SDM solution consolidates and manages the network carriers subscriber data that encompass access preferences, services, locations, authentication, identities, and presence into unified data repositories. Moreover, it benefits the carrier networks by reducing their operating expenses while providing subscribers with consistent service experiences. It also allows operators to view subscriber data in a centralized fashion, which enables them to effectively monetize their subscriber data. Furthermore, SDM helps telecom operators in reducing network complexities, total cost of ownership, and time to market for new services.

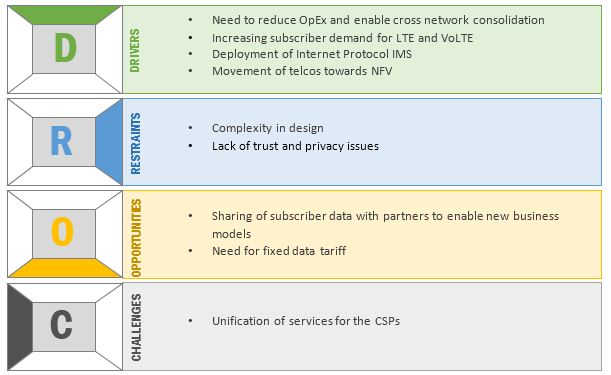

Need to reduce OpEx and enable cross network consolidation, increasing subscriber demand for LTE and VoLTE, deployment of IMS, and movement of telcos toward NFV tools will fuel the growth of Subscriber Data Management market.

The value chain of the SDM market can be analyzed by the number of intermediaries involved in the ecosystem of this market space. Various industries are deploying the SDM model across the world. The SDM market is a highly fragmented market with the presence of a large number of local and global players catering to the needs of the telecom operators. Large enterprises are deploying these services at a substantial rate; however, the SMEs are expected to show the highest growth rate during 20162021.

Sharing of subscriber data with partners to enable new business models and need for fixed data tariff are major opportunities in the Subscriber Data Management market

Third parties can be useful to telecom operators with new value chains which would be recognized slowly but definitely and help deliver new and advanced facilities. Telecom operators are exploring the prospects for offering similar levels of personalization and tracking of customer behavior. Subscriber data is potentially very attractive to third parties to augment the services they can offer, using the telecom operators infrastructure. It can also be provided in an anonymized format to advertisers. In the last decade, it has been realized that substantial value can be delivered if the CSP moves from the standalone network database approach to a holistic SDM approach. With this evolution, SDM can add noteworthy value by providing a consolidated view of subscribers and their behavior. It can also deliver efficiencies by reducing the number of SDM silos. For example, Amazon, eBay, Google, and Yahoo are some of the internet companies that have validated the pull of a business model founded on flexible customized way of services and following customer preferences.

Competitive pressures are the main reasons that are driving mobile and broadband CSPs to offer fixed data tariffs. As a result, CSPs are facing intense competition in data traffic and inadequate revenue growth to sustain the essential arrangement to be build-out. In some instances, it is also possible that subscribers create an unbalanced contribution to data growth by sharing large media files. SDM can assist CSPs address this issue by supporting subscriber specific policies. This authorizes the CSP to deal a number of flat rate data tariffs with differing caps on bandwidth, overall data volume, and allowed services.

Market Dynamics

The Subscriber Data Management market is expected to grow from USD 1.97 Billion in 2016 to USD 4.44 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 17.6% during the forecast period. The growing subscriber demand for Long-Term Evolution (LTE) & Voice over LTE (VoLTE), movement of telcos towards Network Function Virtualization (NFV), increasing need to reduce Operational Expenditure (OpEx), and enabling cross-network consolidation has led to the increased demand for SDM solutions.

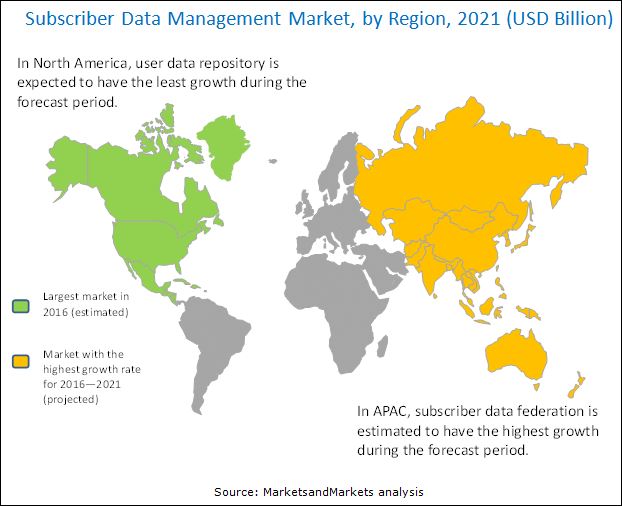

The SDM market has been segmented based on solutions, network types, application types, organization size, deployment types, and regions. The subscriber data federation segment in solutions is expected to grow at the highest CAGR during the forecast period, while policy management is projected to have the largest market size in 2016 in the Subscriber Data Management market. The demand for subscriber data federation is increasing as it provides telecom operators with an integrated view of information from diverse data repositories and also facilitates assimilation between unlike systems or applications by providing access to protocol translation, transactions, data schema manipulation, and data transformation.

Mobile networks are expected to grow at the highest CAGR during the forecast period in the network types segment and is also estimated to have the largest market size in 2016. The number of mobile subscriptions worldwide is increasing exponentially, which eventually is increasing the mobile networks market. Furthermore, mobile networks are expected to grow at a fast rate due to the increasing demand for mobile connectivity in locations with lack of terrestrial infrastructure; as a result, the subscriber base has increased.

The Voice over Internet Protocol (VoIP) and video over IP segment among the SDM application types is expected to grow at the highest rate in the Subscriber Data Management market during the forecast period. The emergence of 4G LTE has given a push to the VoIP and video over IP industry. Moreover, the arrival of 5G is expected to expand this segment further and will enable SDM application in this segment to grow at the fastest rate. SDM application in mobiles is estimated to have the largest market size in 2016. As there is a potential rise in the number of mobile devices and mobile users, there is a need for telecom operators to be able to synchronize this subscriber data with ease, thus leading to the creation of the largest market size for mobile segment.

The Small and Medium Enterprises (SMEs) segment is expected to grow at the highest CAGR in the SDM market during the forecast period. The medium-sized companies are significantly growing in this market by shifting from traditional SDM solution to next-generation SDM platform. They are more inclined towards cloud-based solutions for managing their subscriber data with the optimal utilization of resources.

The cloud deployment type is expected to grow at the highest rate in the Subscriber Data Management market during the forecast period. This type of deployment requires less capital investment, offers high scalability, and could be offered through subscription-based pricing models, thus, having the fastest growth rate.

North America is expected to have the largest market share in 2016, whereas the Asia-Pacific (APAC) region is expected to grow at the highest CAGR from 2016 to 2021, in the Subscriber Data Management market. North America leads the world for LTE; moreover, VoLTE adoption and increasing cloud-based monetization solutions are the major drivers for SDM growth in this region. The key reason for the high growth rate in APAC is the enormous population of this region, which has led to an extensive pool of subscriber base for the telecom companies.

The adoption of SDM is increasing in the market owing to the exponential rise in the number of subscribers. However, complexity in design and lack of trust & privacy issues are acting as barriers to the adoption of SDM solutions.

The major vendors in the Subscriber Data Management market include Ericsson (Kista, Stockholm), Hewlett Packard Enterprise (HPE) Company (California, U.S.), Huawei Technologies Co. Ltd. (Shenzhen, China), Nokia Corporation (Espoo, Finland), Oracle Corporation (California, U.S.), Amdocs Inc. (Missouri, U.S.), Cisco Systems, Inc. (California, U.S.), Computaris International Ltd. (Essex, U.K.), Openwave Mobility, Inc. (California, U.S.), Procera Networks, Inc. (California, U.S.), Redknee Solutions, Inc. (Ontario, Canada), and ZTE Corporation (Shenzhen, China). These players have adopted various strategies such as new product development; mergers & acquisitions; partnerships, agreements, contracts, and collaborations; and business expansions to cater to the SDM market.

The growth SDM market is depending on the factors, such as need to reduce OpEx and enable cross network consolidation, increasing subscriber demand for LTE and VoLTE, deployment of IMS, and movement of telcos toward NFV are expected to drive the market growth.

Apart from established players in the industry, the new entrants in the market are introducing new SDM solutions to lure customers across multiple applications

Policy management

Policy-based differentiation of data requests the prioritization of critical apps over non-critical apps. Players such as Bridgewater (now acquired by Amdocs) have added a policy controller that panels subscribers access to network resources, quality of service, and applications. Subscriber-centric policy management permits the service providers to adjust to the distribution of network resources according to the subscribers payment. Hence, it focuses on the right size of resource allocation with the right size of pricing for networks. This helps improve business models with premium quality of IT services with proper management from service providers. Policy management gives network independence, provides a repository of subscriber profiles, and rules for carrying subscribers & applications together. The service provider has the authority to define these rules or policies, and the policy management system administers those rules on a per-subscriber basis. With the emergence of IMS architecture, policy is directly accessed through Policy Decision Function (PDF), HSS and PCRF. These modules of the architecture comprise centralized subscriber and application outlines and policies. The PCRF regulates policy for IP data flows and applies for QoS management. The HSS empowers the profiles to implement policy in the network by a logical chain of procedures. After a subscriber accesses an application, it is approved by the HSS at the point of request. This policy management can also be used by the Digital Subscriber Line (DSL), cable, or 3G service providers with benefits, such as proper usage of bandwidth and granular usage intelligence to develop new services.

Subscriber data federation

As the subscriber data is spread over multiple application silos, SDF enables the telecom operators to manage these multiple silos of data stores with flexibility, thus providing a single view, sometimes also referred to as virtual directory. This provides an integrate view of information from diverse data repositories. It supports multiple virtual schemas, protocols, and data transformation. This solution has enabled access to previously inaccessible data. Accessing data from multiple data servers through a unified interface and accessing data with an only request is the main objective of SDF. It also facilitates assimilation between unlike systems or applications by providing access to protocol translation, transactions, data schema manipulation, and data transformation. Data and protocol federation abilities permit operators to generate a unified interface for all applications to access data from all repositories.

Identity Management

Identity management is basically about managing and authenticating the identity of a user. In SDM, some components of the identity management segment are Equipment Identity Protocol (EPR) and Lightweight Directory Access Protocol (LDAP). Moreover, network databases, such as HLRs and AAA servers also act as keepers for subscriber profiles for authentication and facility configuration to maintain real-time performance of services. Customer access to web portals and web services are managed by identity management systems. It also does mobility management, accounting, and some server settings for the GSM service. The subscriber data that is to be handled includes identity information, such as International Mobile Subscriber Identity (IMSI) & multi-Mobile Subscriber Integrated Services Digital Network (MSISDN), personalization information, authentication information, policy settings, and settings for specific services. Along with this it enables operators to share subscriber information which mainly includes identity, context, and preferences, with third parties while taking care of the security issues.

User Data Repository

In SDM, the main component is its subscribed data; hence, the data should be stored with the utmost care. As the quantity is too large, proper management is also needed. A huge number of user data arrive regularly and are placed at multiple databases at multiple locations for which sometimes complexity arises. It is basically a facility where the user data can be retrieved, stored, and managed in a collective way; it also enables data integrity that performs as a solo logical storage of user data and is unique from application front-ends perspective. The user-related data that is usually stored in the application servers, HSS/HLR, and others is now stored in the UDR as per to a UDC information model. User identities (MSISDN, IMSI, IMPU, and IMPI), authentication data, and service data (service profile in IMS) are the examples of subscription data. Many companies offer UDR solutions, such as Ericssons 8661 directory server that act as an open repository of data that can simultaneously support various applications. The scope of UDR solutions is high with respect to redistribution capabilities, integrated data distribution, routing, configurable data replication, and consistency policies for optimal resource utilization.

Key questions

- Which are the substitute products and how big is the threat from them?

- Which are the top use cases where SDM can be implemented for revenue generation through new advancements?

- What are the potential opportunities in the adjacent markets, such as cloud billing database and telecom system integration?

- What should be your go-to-market strategy to expand the reach into developing countries across APAC, MEA, and Latin America?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Subscriber Data Management Market

4.2 Subscriber Data Management Market: Market Share of Top Three Solutions and Regions

4.3 Lifecycle Analysis, By Region, 2016

4.4 Market Investment Scenario

4.5 Susbcriber Data Management Market: By Application Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Solution

5.3.2 By Network Type

5.3.3 By Application Type

5.3.4 By Organization Size

5.3.5 By Deployment Type

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need to Reduce Opex and Enable Cross Network Consolidation

5.4.1.2 Increasing Subscriber Demand for Lte and Volte

5.4.1.3 Deployment of Internet Protocol Multimedia Subsystem (IMS)

5.4.1.4 Movement of Telcos Towards NFV

5.4.2 Restraints

5.4.2.1 Complexity in Design

5.4.2.2 Lack of Trust and Privacy Issues

5.4.3 Opportunities

5.4.3.1 Sharing of Subscriber Data With Partners to Enable New Business Models

5.4.3.2 Need for Fixed Data Tariff

5.4.4 Challenges

5.4.4.1 Unification of Services for the Csps

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Subscriber Data Management Architecture

6.4 Innovation Spotlight

6.5 Strategic Benchmarking

7 Subscriber Data Management Market Analysis, By Solution (Page No. - 53)

7.1 Introduction

7.2 Policy Management

7.3 Subscriber Data Federation

7.4 Identity Management

7.5 User Data Repository

8 Subscriber Data Management Market Analysis, By Network Type (Page No. - 59)

8.1 Introduction

8.2 Mobile Networks

8.3 Fixed Networks

9 Subscriber Data Management Market Analysis, By Application Type (Page No. - 63)

9.1 Introduction

9.2 Mobile

9.3 Fixed Mobile Convergence

9.4 Voice Over IP and Video Over IP

9.5 Others

10 Subscriber Data Management Market Analysis, By Organization Size (Page No. - 69)

10.1 Introduction

10.2 Large Enterprises

10.3 Small and Medium Enterprises

11 Subscriber Data Management Market Analysis, By Deployment Type (Page No. - 73)

11.1 Introduction

11.2 On-Premises

11.3 Cloud

12 Geographic Analysis (Page No. - 78)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Others

12.4 Asia-Pacific

12.5 Middle East and Africa

12.5.1 Middle East

12.5.2 Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 103)

13.1 Overview

13.2 Growth Strategies

13.3 Subscriber Data Management: Vendor Analysis

13.3.1 Partnerships, Agreements, Contracts, and Collaborations

13.3.2 New Product Launches

13.3.3 Mergers and Acquisitions

13.3.4 Expansions

14 Company Profiles (Page No. - 112)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 Introduction

14.2 Ericsson

14.3 Hewlett Packard Enterprise Company

14.4 Huawei Technologies Co., Ltd.

14.5 Nokia Corporation

14.6 Oracle Corporation

14.7 Amdocs Inc.

14.8 Cisco Systems, Inc.

14.9 Computaris International Ltd.

14.10 Openwave Mobility, Inc.

14.11 Procera Networks, Inc.

14.12 Redknee Solutions, Inc.

14.13 ZTE Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 140)

15.1 Expert Interviews

15.1.1 CSG International

15.1.2 Formula Telecom Solutions(FTS)

15.1.3 Mind CTI

15.1.4 Openvault, LLC

15.1.5 Procera Networks, Inc.

15.2 Other Key Developments

15.2.1 New Product Launches, 20142016

15.2.2 Partnerships, Agreements, Contracts, and Collaborations, 20142016

15.3 Discussion Guide

15.4 Knowledge Store: Marketsandmarkets Subscription Portal

15.5 Introducing RT: Real-Time Market Intelligence

15.6 Available Customizations

15.7 Related Reports

15.8 Author Details

List of Tables (66 Tables)

Table 1 Subscriber Data Management Market Size and Growth Rate, 20142021 (USD Million, Yoy%)

Table 2 Market: Innovation Spotlight

Table 3 Market Size, By Solution, 20142021 (USD Million)

Table 4 Policy Management: Market Size, By Region, 20142021 (USD Million)

Table 5 Subscriber Data Federation: Market Size, By Region, 20142021 (USD Million)

Table 6 Identity Management: Market Size, By Region, 20142021 (USD Million)

Table 7 User Data Repository: Market Size, By Region, 20142021 (USD Million)

Table 8 Subscriber Data Management Market Size, By Network Type, 20142021 (USD Million)

Table 9 Mobile Networks: Market Size, By Region, 20142021 (USD Million)

Table 10 Fixed Networks: Market Size, By Region, 20142021 (USD Million)

Table 11 Subscriber Data Management Market Size, By Application Type, 20142021 (USD Million)

Table 12 Mobile: Market Size, By Region, 20142021 (USD Million)

Table 13 Fixed Mobile Convergence: Market Size, By Region, 20142021 (USD Million)

Table 14 Voice Over IP and Video Over IP: Market Size, By Region, 20142021 (USD Million)

Table 15 Others: Market Size, By Region, 20142021 (USD Million)

Table 16 Subscriber Data Management Market Size, By Organization Size, 20142021 (USD Million)

Table 17 Large Enterprises: Subscriber Data Management Market Size, By Region, 20142021 (USD Million)

Table 18 Small and Medium Enterprises: Subscriber Data Management Market Size, By Region, 20142021 (USD Million)

Table 19 Subscriber Data Management Market Size, By Deployment Type, 20142021 (USD Million)

Table 20 On-Premises: Subscriber Data Management Market Size, By Region, 20142021 (USD Million)

Table 21 Cloud: Subscriber Data Management Market Size, By Region, 20142021 (USD Million)

Table 22 Subscriber Data Management Market Size, By Region, 20142021 (USD Million)

Table 23 North America: Subscriber Data Management Market Size, By Solution, 20142021 (USD Million)

Table 24 North America: Market Size, By Network Type, 20142021 (USD Million)

Table 25 North America: Market Size, By Application Type, 20142021 (USD Million)

Table 26 North America: Market Size, By Organization Size, 20142021 (USD Million)

Table 27 North America: Market Size, By Deployment Type, 20142021 (USD Million)

Table 28 North America: Market Size, By Country, 20142021 (USD Million)

Table 29 United States: Subscriber Data Management Market Size, By Solution, 20142021 (USD Million)

Table 30 United States: Market Size, By Network Type, 20142021 (USD Million)

Table 31 United States: Market Size, By Application Type, 20142021 (USD Million)

Table 32 United States: Market Size, By Organization Size, 20142021 (USD Million)

Table 33 United States: Market Size, By Deployment Type, 20142021 (USD Million)

Table 34 Canada: Subscriber Data Management Market Size, By Organization Size, 20142021 (USD Million)

Table 35 Canada: Market Size, By Deployment Type, 20142021 (USD Million)

Table 36 Europe: Subscriber Data Management Market Size, By Solution, 20142021 (USD Million)

Table 37 Europe: Market Size, By Network Type, 20142021 (USD Million)

Table 38 Europe: Market Size, By Application Type, 20142021 (USD Million)

Table 39 Europe: Market Size, By Organization Size, 20142021 (USD Million)

Table 40 Europe: Market Size, By Deployment Type, 20142021 (USD Million)

Table 41 Europe: Market Size, By Country, 20142021 (USD Million)

Table 42 United Kingdom: Subscriber Data Management Market Size, By Solution, 20142021 (USD Million)

Table 43 United Kingdom: Market Size, By Network Type, 20142021 (USD Million)

Table 44 United Kingdom: Market Size, By Application Type, 20142021 (USD Million)

Table 45 United Kingdom: Market Size, By Organization Size, 20142021 (USD Million)

Table 46 United Kingdom: Market Size, By Deployment Type, 20142021 (USD Million)

Table 47 Asia-Pacific: Subscriber Data Management Market Size, By Solution, 20142021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Network Type, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Application Type, 20142021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Deployment Type, 20142021 (USD Million)

Table 52 Middle East and Africa: Subscriber Data Management Market Size, By Solution, 20142021 (USD Million)

Table 53 Middle East and Africa: Market Size, By Network Type, 20142021 (USD Million)

Table 54 Middle East and Africa: Market Size, By Application Type, 20142021 (USD Million)

Table 55 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Million)

Table 56 Middle East and Africa: Market Size, By Deployment Type, 20142021 (USD Million)

Table 57 Middle East and Africa: Market Size, By Country, 20142021 (USD Million)

Table 58 Latin America: Subscriber Data Management Market Size, By Solution, 20142021 (USD Million)

Table 59 Latin America: Market Size, By Network Type, 20142021 (USD Million)

Table 60 Latin America: Market Size, By Application Type, 20142021 (USD Million)

Table 61 Latin America: Market Size, By Organization Size, 20142021 (USD Million)

Table 62 Latin America: Market Size, By Deployment Type, 20142021 (USD Million)

Table 63 Partnerships, Agreements, Contracts, and Collaborations, 20142016

Table 64 New Product Launches, 20142016

Table 65 Mergers and Acquisitions, 20132016

Table 66 Expansions, 20142016

List of Figures (57 Figures)

Figure 1 Subscriber Data Management Market: Market Segmentation

Figure 2 Subscriber Data Management Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Subscriber Data Management Market: Assumptions

Figure 8 Subscriber Data Management Market, By Network Type (2016 vs 2021)

Figure 9 Susbcriber Data Management Market, By Organization Size (2016 vs 2021)

Figure 10 North America is Estimated to Hold the Largest Market Share in 2016

Figure 11 Top Three Revenue Segments for the Subscriber Data Management Market, 20162021

Figure 12 Demand for LTE and Volte is A Major Driving Factor for the Growth of the Subscriber Data Management Market (20162021)

Figure 13 Policy Management Solution and North America is Estimated to Have the Largest Market Share in 2016

Figure 14 Regional Lifecycle Analysis: Asia-Pacific to Enter the Growth Phase During the Forecast Period

Figure 15 Market Investment Scenario: Asia-Pacific Would Emerge as the Best Market for Investments in the Next Five Years

Figure 16 Subscriber Data Management Application in Mobile is Estimated to Have the Largest Market Size in 2016

Figure 17 Evolution of the Subscriber Data Management Market

Figure 18 Market Segmentation: By Solution

Figure 19 Market Segmentation: By Network Type

Figure 20 Market Segmentation: By Application Type

Figure 21 Market Segmentation: By Organization Size

Figure 22 Market Segmentation: By Deployment Type

Figure 23 Market Segmentation: By Region

Figure 24 Subscriber Data Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 25 Subscriber Data Management Enables Applications to Be Handled By A Single Central Repository

Figure 26 Subscriber Data Management Market: Value Chain Analysis

Figure 27 Subscriber Data Management Market: Architecture

Figure 28 Strategic Benchmarking: Companies Adopted Partnerships, Acquisitions, and New Product Launches to Gain Competitive Advantage in the Market

Figure 29 Subscriber Data Federation Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Mobile Networks Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Voice Over IP and Video Over IP Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Small and Medium Enterprises Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Cloud Deployment Type is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 35 Regional Snapshot: Asia-Pacific is the Emerging Region in the Subscriber Data Management Market During the Forecast Period

Figure 36 North America Market Snapshot

Figure 37 Asia-Pacific Market Snapshot

Figure 38 Companies Adopted New Product Launches as the Key Growth Strategy (20132016)

Figure 39 Business Offering Comparison

Figure 40 Business Strategy Comparison

Figure 41 Market Evaluation Framework

Figure 42 Battle for Market Share: Partnerships, Agreements, Contracts, and Collaborations Have Been the Key Strategy for Growth in the Subscriber Data Management Market During the Period 2014-2016

Figure 43 Geographic Revenue Mix of Top Market Players

Figure 44 Ericsson: Company Snapshot

Figure 45 Ericsson: SWOT Analysis

Figure 46 Hewlett Packard Enterprise Company: Company Snapshot

Figure 47 Hewlett Packard Enterprise Company: SWOT Analysis

Figure 48 Huawei Technologies Co., Ltd.: Company Snapshot

Figure 49 Huawei Technologies Co., Ltd.: SWOT Analysis

Figure 50 Nokia Corporation: Company Snapshot

Figure 51 Nokia Corporation: SWOT Analysis

Figure 52 Oracle Corporation: Company Snapshot

Figure 53 Oracle Corporation: SWOT Analysis

Figure 54 Amdocs Inc.: Company Snapshot

Figure 55 Cisco Systems, Inc.: Company Snapshot

Figure 56 Redknee Solutions, Inc.: Company Snapshot

Figure 57 ZTE Corporation: Company Snapshot

Growth opportunities and latent adjacency in Subscriber Data Management Market

Wants to study current market, expected growth, drivers and vendors positioning and readiness. Also, what current solution exists with different vendors and what would be strategy for evolution to 5G