Infrared & Terahertz Spectroscopy Market by Instrument Type (Benchtop Instruments, Microscopy Instruments, Portable Instruments, Hyphenated Instruments), Spectrum, Application - Global Forecast to 2025

Market Growth Outlook Summary

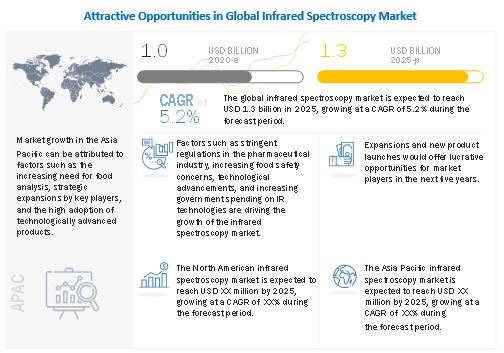

The global infrared spectroscopy market in terms of revenue, is poised to reach $1.3 billion by 2025, growing at a CAGR of 5.2%. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth in the market can primarily be attributed to factors such as stringent regulations in the pharmaceutical industry, growing food safety concerns, increasing government in Infrared technologies and technological advancements in the market.

The global terahertz spectroscopy market in terms of revenue, is poised to reach $45 million by 2025, growing at a CAGR of 8.3%. Growth in the market can primarily be attributed to factors such as increasing applications of terahertz spectroscopy as a screening technique in homeland security, growing semiconductor industry and technological advancements.

To know about the assumptions considered for the study, Request for Free Sample Report

Terahertz Spectroscopy Market Dynamics

Driver: Growing semiconductor industry

Terahertz spectroscopy is widely used for developing and testing semiconductor materials and for detecting faults in circuits. The ability to detect and quantify charge carriers is expected to create avenues for using the terahertz technology in semiconductors. In recent years, advanced terahertz spectrometers have enabled the non-destructive rapid isolation of semiconductor packages within a few hours. The growing semiconductor industry, coupled with the rising usage of terahertz spectroscopy in semiconductor applications, is expected to drive the growth of this market in the coming years.

Restraint: High equipment costs

Terahertz spectroscopy instruments are equipped with incredibly advanced features and functionalities and are, hence, quite expensive. The cost of a new instrument differs in accordance with the applications. Over the years, technological advancements and commercialization of these instruments have lowered the price, especially for pharmaceutical and biomedical applications. However, instruments used for industrial applications like semiconductor and non-destructive testing are still relatively higher priced. Since industrial applications are one of the most important applied markets for terahertz spectroscopy, high equipment costs restrict purchases of these instruments, affecting the market growth.

Opportunity: Potential applications of terahertz spectroscopy in healthcare

Rapid advances in technology have demonstrated the capability of terahertz spectroscopy in various healthcare applications. The focus on using terahertz spectroscopy in biomedical applications has increased rapidly, and several studies are being conducted to investigate its potential applications in pharmaceutical quality control, protein characterization, and cancer detection. T-rays are non-invasive and non-ionizing and can be focused harmlessly on the body to capture signs of cancer. Due to these advantages, terahertz spectroscopy is used in several cancer-related research activities.

Infrared Spectroscopy Market Dynamics

Driver: Growing food safety concerns

Infrared spectroscopy is one of the most commonly used analytical techniques in quality testing and quality control of food. Food contamination is one of the biggest concerns worldwide, with more than 200 types of diseases caused by the consumption of unsafe food every year [Source: World Health Organization (WHO)]. Diarrheal diseases are the most common illnesses caused due to the consumption of contaminated food, and it is estimated that 600 million people (1 in every ten people in the world) fall sick from the consumption of contaminated food and 420,000 die every year [Source: World Health Organization (WHO)]. Food safety is thus a major concern for governments across the globe.

Restraint: Availability of used IR devices

IR spectroscopy devices have a life span of around 5–7 years on average, and these products are expensive. It is also observed that the ASP of these products has increased slightly in the lastfew years because of various technological advancements.Currently, several used spectroscopy devices are available for resale; it has been observed that some industry segments prefer used devices instead of buying new ones. This would hamper the growth of the IR spectroscopy market.

Opportunity: Growing opportunities in emerging nations

As compared to mature markets such as the US and Europe, emerging markets such as China and India are expected to provide significant growth opportunities for players operating in this market. Huge demand for spectroscopy is generated from China and India due to the Greenfield projects set up in various end-user industries in these countries. The life sciences industry in this region is also quite robust and is expected to contribute significantly to the growth of the infrared spectroscopy market in the coming years.

The terahertz spectroscopy market is projected to grow at a CAGR of 8.3%.

The global market is expected to reach USD 45 million by 2025 from USD 30 million in 2020, at a CAGR of 8.3% during the forecast period. Growth in the market can primarily be attributed to factors such as increasing applications of terahertz spectroscopy as a screening technique in homeland security, growing semiconductor industry and technological advancements.

The Infrared Spectroscopy market is projected to grow at a CAGR of 5.2%

The market is expected to reach USD 1.3 billion by 2025 from USD 1.0 billion in 2020, at a CAGR of 5.2% during the forecast period. Growth in the market can primarily be attributed to factors such as stringent regulations in the pharmaceutical industry, growing food safety concerns, increasing government in Infrared technologies and technological advancements in the market.

The benchtop segment to hold the largest share of the infrared & terahertz spectroscopy market.

Based on instrument type, the market is segmented into benchtop instruments, portable instruments, microscopy instruments and hyphenated instruments. The benchtop instruments segment is expected to command the largest share of the market. The large share of this segment can be attributed to the advantages offered by benchtop instruments such as improved workflow, minimum space requirements, and fewer maintenance requirements

The pharmaceutical and biotechnology applications segment to hold the largest share of the infrared & terahertz spectroscopy market.

Based on the applications, the market is segmented into food & beverage testing, pharmaceutical & biotechnology applications, industrial chemistry applications, environmental testing, and other applications (academic applications, forensic applications, biomonitoring, and agricultural applications). The pharmaceutical and biotechnology applications segment to command the largest share of the market. The large share of this segment can be attributed to the stringent regulations in the pharmaceutical industry.

The mid-infrared radiation segment to hold the largest share of the infrared & terahertz spectroscopy market.

Based on spectrum, the market is segmented into mid-infrared radiation, near-infrared radiation and far-infrared radiation. The mid-infrared radiation segment is expected to command the largest share of the market. The increase in the number of healthcare and pharmaceuticals applications and extensive usage in the food industry are driving the growth of this segment.

The semiconductor segment to hold the largest share of the infrared & terahertz spectroscopy market.

Based on application, the market is segmented into semiconductor, homeland security, non-destructive testing and research & development. The semiconductor segment is expected to command the largest share of the terahertz spectroscopy market. Technologicala dvancements in the growing semiconductor industry is the major factor riving the growth of this segment.

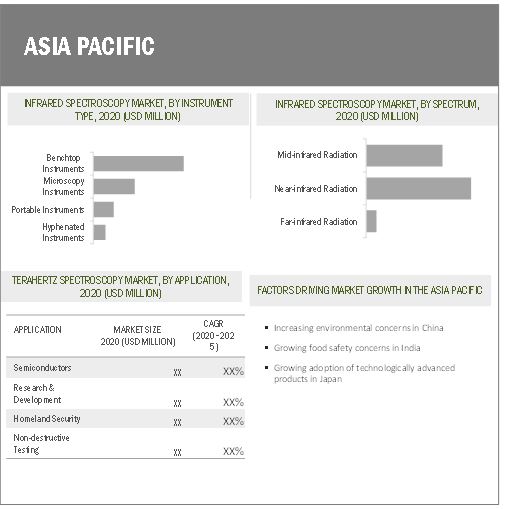

The Asia Pacific region to witness the highest growth in the global infrared & terahertz spectroscopy market during the forecast period.

Geographically, North America dominated the global infrared & terahertz spectroscopy market. However, the Asia Pacific market is expected to register the highest during the forecast period. The major factors driving the growth of the Asia Pacific market include strategic expansions by key players, increasing food safety concerns and adoption of technologically advanced products.

Bruker Corporation (US), Agilent Technologies (US), Shimadzu Corporation (Japan), PerkinElmer (US), Thermo Fisher Scientific (US), FOSS (Denmark), HORIBA Ltd. (Japan), Teledyne Princeton Instruments (US), JASCO, Inc. (US), BaySpec (US), Spectra Analysis instruments (US), TeraView Ltd (UK), Microtech Instruments (US), EKSPLA (Lithuania), HÜBNER GmbH (Germany), and BATOP GmbH (Germany), Menlo Systems GmbH (Germany), Toptica Photonix AG (Germany), Advanced Photonix, Inc. (U.S.), and Advantest Corporation (Japan).

Infrared & Terahertz Spectroscopy Market Report Scope

|

Report Metrics |

Details |

|

Market Revenue in 2020 |

$1.0 billion |

|

Projected Revenue by 2025 |

$1.3 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.2% |

|

Market Driver |

Growing semiconductor industry |

|

Market Opportunity |

Potential applications of terahertz spectroscopy in healthcare |

Recent Developments:

- In 2020, Bruker Corporation Launched the OMEGA 5 FTIR Gas Analyzer. The OMEGA 5 is designed for applications like process monitoring, the investigation of catalytic processes, or the determination of gas impurities

- In 2020, Advantest Corporation (Japan) Launched the Time-Domain Reflectometry (TDR) option for its TS9001 system.

- In 2019, PerkinElmer (US) acquired China based Meizheng group to expand its portfolio for the grain and milling, dairy, meat, and seafood markets

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global infrared & terahertz spectroscopy market?

The global infrared & terahertz spectroscopy market boasts a total revenue value of $1.3 billion by 2025.

What is the estimated growth rate (CAGR) of the global infrared & terahertz spectroscopy market?

The global infrared & terahertz spectroscopy market has an estimated compound annual growth rate (CAGR) of 5.2% and a revenue size in the region of $1.0 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 INFRARED & TERAHERTZ SPECTROSCOPY MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 SECONDARY RESEARCH

2.3 KEY DATA FROM SECONDARY SOURCES

2.4 PRIMARY DATA

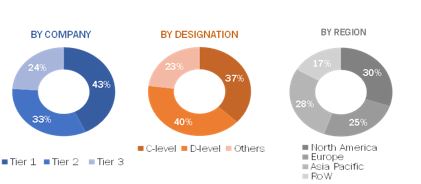

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.5 KEY INSIGHTS FROM PRIMARY SOURCES

2.6 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.7 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 4 REVENUE-BASED MAPPING

2.8 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.9 ASSUMPTIONS FOR THE STUDY

2.1 COVID-19-SPECIFIC ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 6 INFRARED SPECTROSCOPY MARKET, BY INSTRUMENT TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 GLOBAL MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY SPECTRUM, 2020 VS. 2025 (USD MILLION)

FIGURE 9 TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 INFRARED SPECTROSCOPY MARKET OVERVIEW

FIGURE 11 APPLICATIONS IN PHARMACEUTICAL ANALYSIS AND TECHNOLOGICAL ADVANCEMENTS ARE PROPELLING THE IR SPECTROSCOPY MARKET

4.2 TERAHERTZ SPECTROSCOPY MARKET OVERVIEW

FIGURE 12 APPLICATIONS IN NON-DESTRUCTIVE TESTING AND TECHNOLOGICAL ADVANCEMENTS ARE PROPELLING THE TERAHERTZ SPECTROSCOPY MARKET

4.3 NORTH AMERICA: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM & COUNTRY (2019)

FIGURE 13 MID-INFRARED RADIATION ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2019

4.4 INFRARED SPECTROSCOPY MARKET SHARE, BY INSTRUMENT TYPE, 2020 VS. 2025

FIGURE 14 BENCHTOP INSTRUMENTS WILL CONTINUE TO DOMINATE THE GLOBAL MARKET IN 2025

4.5 INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2020 VS. 2025

FIGURE 15 MID-INFRARED RADIATION SEGMENT WILL CONTINUE TO DOMINATE THE GLOBAL MARKET IN 2025

4.6 TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION, 2020 VS. 2025

FIGURE 16 SEMICONDUCTORS APPLICATION SEGMENT WILL CONTINUE TO DOMINATE THE TERAHERTZ SPECTROSCOPY MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 44)

5.1 TERAHERTZ SPECTROSCOPY

5.1.1 INTRODUCTION

FIGURE 17 MARKET DYNAMICS: DRIVERS, RESTRAINTS, AND OPPORTUNITIES IN THE TERAHERTZ SPECTROSCOPY MARKET

5.1.2 DRIVERS

5.1.2.1 Increasing applications of terahertz spectroscopy as a screening technique for homeland security

5.1.2.2 Growing semiconductor industry

5.1.2.3 Technological advancements

5.1.3 RESTRAINTS

5.1.3.1 High equipment costs

5.1.4 OPPORTUNITIES

5.1.4.1 Potential applications of terahertz spectroscopy in healthcare

5.2 INFRARED SPECTROSCOPY

5.2.1 INTRODUCTION

FIGURE 18 MARKET DYNAMICS: DRIVERS, RESTRAINTS, AND OPPORTUNITIES IN THE INFRARED SPECTROSCOPY MARKET

5.2.2 DRIVERS

5.2.2.1 Stringent regulations in the pharmaceutical industry

5.2.2.2 Growing food safety concerns

5.2.2.3 Increasing government investments in infrared spectroscopy technologies

5.2.2.4 Technological advancements

5.2.3 RESTRAINTS

5.2.3.1 Technical limitations of IR spectroscopy

5.2.3.2 Availability of used IR devices

5.2.4 OPPORTUNITIES

5.2.4.1 Growing opportunities in emerging nations

5.2.4.2 Adoption of NIR spectroscopy in seed detection

5.2.4.3 Growing proteomics market

5.3 IMPACT OF COVID-19 ON THE TINFRARED & TERAHERTZ SPECTROSCOPY MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS (IR SPECTROSCOPY): MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASES

5.4.1 RESEARCH & PRODUCT DEVELOPMENT

5.4.2 MANUFACTURING & ASSEMBLY

5.4.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

5.5 SUPPLY CHAIN ANALYSIS

5.5.1 PROMINENT COMPANIES

5.5.2 SMALL AND MEDIUM-SIZED ENTERPRISES

5.5.3 END USERS

FIGURE 20 DISTRIBUTION (IR SPECTROSCOPY)—A STRATEGY PREFERRED BY PROMINENT COMPANIES

FIGURE 21 ECOSYSTEM ANALYSIS OF THE INFRARED SPECTROSCOPY MARKET

5.6 REGULATORY GUIDELINES IN THE TERAHERTZ AND INFRARED SPECTROSCOPY MARKET

5.7 AVERAGE SELLING PRICE TREND (INFRARED SPECTROSCOPY)

FIGURE 22 ASP TREND (2017–2025)

5.8 PORTER’S FIVE FORCES ANALYSIS (INFRARED SPECTROSCOPY)

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS FOR THE INFRARED SPECTROSCOPY MARKET

5.8.1 INTRODUCTION

TABLE 1 IMPACT OF EACH FORCE ON THE MARKET

5.8.2 BARGAINING POWER OF BUYERS

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 THREAT FROM NEW ENTRANTS

5.8.5 THREAT FROM SUBSTITUTES

5.8.6 INTENSITY OF COMPETITIVE RIVALRY

6 INFRARED & TERAHERTZ SPECTROSCOPY MARKET, BY INSTRUMENT TYPE (Page No. - 60)

6.1 INTRODUCTION

TABLE 2 INFRARED SPECTROSCOPY MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

6.1.1 BENCHTOP INSTRUMENTS

6.1.1.1 Ease of use and convenience of benchtop instruments to drive their demand

TABLE 3 GLOBAL MARKET FOR BENCHTOP INSTRUMENTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 4 NORTH AMERICA: MARKET FOR BENCHTOP INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 5 APAC: MARKET FOR BENCHTOP INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 6 EUROPE: MARKET FOR BENCHTOP INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

6.1.2 MICROSCOPY INSTRUMENTS

6.1.2.1 Emergence of microscopy instruments as powerful tools in tissue engineering to drive market growth

TABLE 7 INFRARED SPECTROSCOPY MARKET FOR MICROSCOPY INSTRUMENTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 NORTH AMERICA: MARKET FOR MICROSCOPY INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 9 EUROPE: MARKET FOR MICROSCOPY INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 APAC: MARKET FOR MICROSCOPY INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

6.1.3 PORTABLE INSTRUMENTS

6.1.3.1 Unique applications offered by portable spectrometers to drive market growth

TABLE 11 INFRARED SPECTROSCOPY MARKET FOR PORTABLE INSTRUMENTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 NORTH AMERICA: MARKET FOR PORTABLE INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 13 APAC: MARKET FOR PORTABLE INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 EUROPE: MARKET FOR PORTABLE INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

6.1.4 HYPHENATED INSTRUMENTS

6.1.4.1 Advancements in hyphenated spectrometers have widened the applications of these instruments in various industries

TABLE 15 INFRARED SPECTROSCOPY MARKET FOR HYPHENATED INSTRUMENTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 NORTH AMERICA: MARKET FOR HYPHENATED INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 APAC: MARKET FOR HYPHENATED INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 EUROPE: MARKET FOR HYPHENATED INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

7 INFRARED & TERAHERTZ SPECTROSCOPY MARKET, BY SPECTRUM (Page No. - 69)

7.1 INTRODUCTION

TABLE 19 INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

7.1.1 NEAR-INFRARED RADIATION (NIR)

7.1.1.1 Various applications of NIR in different industries to drive market growth

TABLE 20 NEAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: NEAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 APAC: NEAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 EUROPE: NEAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.1.2 MID-INFRARED RADIATION (MIR)

7.1.2.1 Growing use of mid-infrared radiation in the food industry to drive market growth

TABLE 24 MID-INFRARED RADIATION SPECTROSCOPY MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 NORTH AMERICA: MID-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 APAC: MID-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 EUROPE: MID-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.1.3 FAR-INFRARED RADIATION (FIR)

7.1.3.1 High demand for far-infrared technology in healthcare & pharmaceutical applications to drive market growth

TABLE 28 FAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: FAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION

TABLE 30 APAC: FAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 31 EUROPE: FAR-INFRARED RADIATION SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION

8 INFRARED & TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION (Page No. - 77)

8.1 INTRODUCTION

TABLE 32 INFRARED SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.1.1 PHARMACEUTICAL & BIOTECHNOLOGY APPLICATIONS

8.1.1.1 Increasing use of infrared spectroscopy in different pharmaceutical & biotechnology applications to drive growth

TABLE 33 INFRARED SPECTROSCOPY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 APAC: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 EUROPE: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

8.1.2 INDUSTRIAL CHEMISTRY APPLICATIONS

8.1.2.1 Increasing use of infrared spectroscopy in determining the molecular structure of compounds to drive market growth

TABLE 37 INFRARED SPECTROSCOPY MARKET FOR INDUSTRIAL CHEMISTRY APPLICATIONS, BY REGION, 2018–2020 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET FOR INDUSTRIAL CHEMISTRY APPLICATIONS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 39 APAC: MARKET FOR INDUSTRIAL CHEMISTRY APPLICATIONS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 40 EUROPE: MARKET FOR INDUSTRIAL CHEMISTRY APPLICATIONS, BY COUNTRY, 2018–2020 (USD MILLION)

8.1.3 FOOD & BEVERAGE TESTING

8.1.3.1 Growing use of infrared spectroscopy in determining the quality of food items and beverages to drive market growth

TABLE 41 INFRARED SPECTROSCOPY MARKET FOR FOOD & BEVERAGE TESTING, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET FOR FOOD & BEVERAGE TESTING, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 APAC: MARKET FOR FOOD & BEVERAGE TESTING, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET FOR FOOD & BEVERAGE TESTING, BY COUNTRY, 2018–2025 (USD MILLION)

8.1.4 ENVIRONMENTAL TESTING

8.1.4.1 Growing use of infrared spectroscopy instruments to analyze toxic compounds in the environment to drive market growth

TABLE 45 INFRARED SPECTROSCOPY MARKET FOR ENVIRONMENTAL TESTING, BY REGION, 2018–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 APAC: MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: MARKET FOR ENVIRONMENTAL TESTING, BY COUNTRY, 2018–2025 (USD MILLION)

8.1.5 OTHER APPLICATIONS

TABLE 49 INFRARED SPECTROSCOPY MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 APAC:MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

9 INFRARED & TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION (Page No. - 89)

9.1 INTRODUCTION

TABLE 53 TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.2 SEMICONDUCTORS

9.2.1 INCREASING TECHNOLOGICAL ADVANCEMENTS TO DRIVE THE MARKET GROWTH

TABLE 54 TERAHERTZ SPECTROSCOPY MARKET FOR SEMICONDUCTOR APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

9.3 HOMELAND SECURITY

9.3.1 BETTER PENETRATION CAPABILITIES OF TERAHERTZ SPECTROSCOPY TO DRIVE GROWTH IN VARIOUS HOMELAND SECURITY APPLICATIONS

TABLE 55 TERAHERTZ SPECTROSCOPY MARKET FOR HOMELAND SECURITY APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

9.4 NON-DESTRUCTIVE TESTING

9.4.1 INCREASING USE OF TERAHERTZ SPECTROSCOPY AS A SCREENING TECHNIQUE TO DRIVE GROWTH

TABLE 56 TERAHERTZ SPECTROSCOPY MARKET FOR NON-DESTRUCTIVE TESTING APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

9.5 RESEARCH & DEVELOPMENT

9.5.1 CONTINUOUS DEVELOPMENT IN BIOMEDICAL APPLICATIONS TO BOOST THE MARKET

TABLE 57 TERAHERTZ SPECTROSCOPY MARKET FOR RESEARCH & DEVELOPMENT APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

10 INFRARED & TERAHERTZ SPECTROSCOPY MARKET, BY REGION (Page No. - 95)

10.1 INTRODUCTION

TABLE 58 TERAHERTZ SPECTROSCOPY MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 59 INFRARED SPECTROSCOPY MARKET, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 24 NORTH AMERICA: TERAHERTZ AND INFRARED SPECTROSCOPY MARKET SNAPSHOT

TABLE 60 NORTH AMERICA: INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: INFRARED SPECTROSCOPY MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: INFRARED SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.1 US

TABLE 65 US: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 66 US: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 67 US: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Funding for innovation-based research to drive the Canadian terahertz and infrared spectroscopy market

TABLE 68 CANADA: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 69 CANADA: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 70 CANADA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.3 EUROPE

TABLE 71 EUROPE: INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 75 EUROPE: INFRARED SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.1 UK

10.3.1.1 Rising usage of infrared spectroscopy for food authenticity testing in the UK to drive market growth

TABLE 76 UK: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 77 UK: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 78 UK: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Favorable funding scenario in Germany to boost the adoption of terahertz and infrared spectroscopy

TABLE 79 GERMANY: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 80 GERMANY: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.3 ITALY

10.3.3.1 Advancements in the biotechnology and pharmaceutical industries in Italy to boost the market

TABLE 82 ITALY: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 83 ITALY: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 84 ITALY: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Increasing investments in infrastructure development to drive market growth

TABLE 85 FRANCE: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 86 FRANCE: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 87 FRANCE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5 ROE

TABLE 88 ROE: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 89 ROE: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 90 ROE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: TERAHERTZ AND INFRARED SPECTROSCOPY MARKET SNAPSHOT

TABLE 91 ASIA PACIFIC: INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 92 ASIA PACIFIC: TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 94 ASIA PACIFIC: INFRARED SPECTROSCOPY MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 95 ASIA PACIFIC: INFRARED SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Strategic expansions by key players in china to boost the growth of the infrared spectroscopy market

TABLE 96 CHINA: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 97 CHINA: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 98 CHINA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Rising food safety concerns support the market growth in India

TABLE 99 INDIA: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 100 INDIA: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 101 INDIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Increasing research and growing adoption of technologically advanced products will drive market growth

TABLE 102 JAPAN: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 103 JAPAN: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 104 JAPAN: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 105 ROAPAC: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 106 ROAPAC: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 107 ROAPAC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 108 ROW: TERAHERTZ SPECTROSCOPY MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 109 ROW: INFRARED SPECTROSCOPY MARKET, BY SPECTRUM, 2018–2025 (USD MILLION)

TABLE 110 ROW: MARKET, BY INSTRUMENT TYPE, 2018–2025 (USD MILLION)

TABLE 111 ROW: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 124)

11.1 OVERVIEW

FIGURE 26 KEY DEVELOPMENTS IN THE TERAHERTZ AND INFRARED SPECTROSCOPY MARKET

11.1.1 INFRARED SPECTROSCOPY

FIGURE 27 MARKET SHARE ANALYSIS: INFRARED SPECTROSCOPY MARKET

11.1.1.1 Key market developments

11.1.1.1.1 Product launches

11.1.1.1.2 Acquisitions

11.1.1.1.3 Partnerships, collaborations, and agreements

11.1.1.1.4 Expansions

11.1.2 TERAHERTZ SPECTROSCOPY

11.1.2.1 Key market developments

11.1.2.1.1 Product launches

11.1.2.1.2 Acquisitions

11.1.2.1.3 Expansions

11.1.2.1.4 Partnerships & collaborations

12 COMPETITIVE EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 131)

12.1 COMPETITIVE EVALUATION MATRIX

12.2 COMPETITIVE LEADERSHIP MAPPING: MAJOR MARKET PLAYERS (2019)

12.2.1 STARS

12.2.2 EMERGING LEADERS

12.2.3 EMERGING COMPANIES

12.2.4 PERVASIVE PLAYERS

FIGURE 28 INFRARED & TERAHERTZ SPECTROSCOPY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12.3 START-UP EVALUATION MATRIX

12.3.1 PROGRESSIVE COMPANIES

12.3.2 RESPONSIVE COMPANIES

12.3.3 DYNAMIC COMPANIES

12.3.4 STARTING BLOCKS

FIGURE 29 SME EVALUATION MATRIX: INFRARED & TERAHERTZ SPECTROSCOPY MARKET

12.4 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.4.1 PERKINELMER, INC.

FIGURE 30 PERKINELMER, INC.: COMPANY SNAPSHOT

12.4.2 BRUKER CORPORATION

FIGURE 31 BRUKER CORPORATION: COMPANY SNAPSHOT

12.4.3 THERMO FISHER SCIENTIFIC, INC.

FIGURE 32 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

12.4.4 SHIMADZU CORPORATION

FIGURE 33 SHIMADZU CORPORATION: COMPANY SNAPSHOT

12.4.5 AGILENT TECHNOLOGIES, INC.

FIGURE 34 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

12.4.6 HORIBA LTD.

FIGURE 35 HORIBA LTD.: COMPANY SNAPSHOT

12.4.7 FOSS

12.4.8 JASCO, INC.

12.4.9 BAYSPEC INC.

12.4.10 SPECTRA ANALYSIS INSTRUMENTS INC.

12.4.11 TELEDYNE PRINCETON INSTRUMENTS

12.4.12 TERAVIEW LTD.

12.4.13 ADVANTEST CORPORATION

FIGURE 36 ADVANTEST CORPORATION: COMPANY SNAPSHOT

12.4.14 MENLO SYSTEMS GMBH

12.4.15 TOPTICA PHOTONIX AG

12.4.16 MICROTECH INSTRUMENTS INC.

12.4.17 BATOP GMBH

12.4.18 HÜBNER GMBH

12.4.19 ADVANCED PHOTONIX, INC.

12.4.20 EKSPLA

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 171)

13.1 DISCUSSION GUIDE: TERAHERTZ SPECTROSCOPY

13.2 DISCUSSION GUIDE: INFRARED SPECTROSCOPY

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for Infrared & terahertz spectroscopy. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, D&B, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The infrared & terahertz spectroscopy market comprises several stakeholders such as analytical equipment manufacturers, suppliers and distributors, academic centres and research institutes. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the infrared & terahertz spectroscopy market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the infrared & terahertz spectroscopy industry.

Report Objectives

- To define, describe, and forecast the infrared & terahertz spectroscopy market on the basis of instrument type, application, region and spectrum.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints and opportunities)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the infrared and terahetz spectroscopy market segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches & approvals; agreements, partnerships, & collaborations; expansions; and acquisitions in the infrared & terahertz spectroscopy market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global infrared & terahertz spectroscopy market report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Infrared & Terahertz Spectroscopy Market