Temporary Power Market by Generator Rating (Less than 80 kW, 81-280kW, 281-600 kW), End Use (Events, Utilities, Oil & Gas, Construction, Mining, Manufacturing, & Shipping), Fuel Type (Diesel, Gas, & Others (Duel Fuel & HFO)) - Global Forecast to 2021

[167 Pages Report] The global temporary power market is estimated to reach USD 3.86 Billion in 2016, and is projected to grow at a CAGR of 10.6% from 2016 to 2021, to reach USD 6.40 Billion by 2021. Market growth is driven by factors such as the growing demand for power, aging grid infrastructure, and lack of access to electricity, and increasing construction and infrastructural activities across the globe.

The years considered for the study are as follows:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

2015 has been considered as the base year for company profiles in the report. Wherever information was unavailable for the base year, the prior year has been considered.

Objectives of the study

- To define, describe, analyze, and forecast the global temporary power market on the basis of fuel type, power rating, end-user, and region

- To provide detailed information on major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the markets with respect to individual growth trends and future prospects

- To identify the major stakeholders in the market and draw a competitive landscape for market leaders

- To project the market size of the market and its segments in key regionsnamely, North America, Africa, Asia-Pacific, South America, Europe, and the Middle East

- To analyze market opportunities for stakeholders by identifying the high-growth segments of the market

- To track and analyze recent developments such as expansions, new product launches, mergers & acquisitions, and contracts & agreements in the global temporary power market

Research Methodology

- Analysis of key operational and upcoming temporary power projects across the globe, along with voltage ratings

- Analysis of country-wise electrification rates for the past 3 years

- Analysis of value lost due to power outages across the globe

- Analysis of power infrastructure projects and trends related to construction and infrastructural activities across various regions

- Regional and country wise analysis have been analyzed to identify the largest contributors

- Secondaries have been conducted to find out generators based on power rating required across different industries and by the commercial sector

- Revenue of top companies (regional/global), cost of a generator unit, and industry trends along with top-down, bottom-up, and MnM KNOW have been used to estimate the market size

- The overall market size has been finalized by triangulation with the supply side data, which includes product development, supply chain, and annual generator sales across the globe.

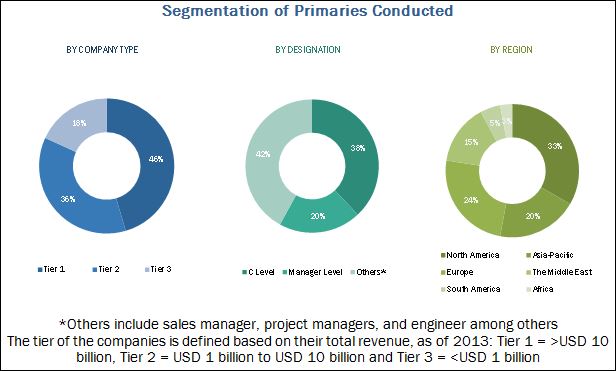

After arriving at the overall market size, the total market has been split into several segments and sub segments. The figure below provides a breakdown of primaries conducted during the research study, on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The study answers several questions for the stakeholders which include OEMs, utility service providers, distributers and suppliers, consulting firms, private equity groups, investment houses, equity research firms, and other stakeholders. It provides information about market segments to focus on for the next two to five years to prioritize efforts and investments.

Target Audience:

- Engine/generator manufacturers, dealers, and suppliers

- Power grid infrastructure companies

- Transmission & distribution utilities

- Temporary power companies

- Consulting companies in the energy and power sector

- Governments and research organizations

- Shareholders/investors

- Power plant project developers

- Renewable energy companies

- Consulting companies from the oil & gas sector

- Investment banks

Scope of the Report:

- Diesel

- Gas

- Others (Dual Fuel & HFO Generators, and Mobile Gas Turbine)

- Less than 80 kW

- 81 kW280 kW

- 281 kW600 kW

- Above 600 kW

- Utilities

- Oil & Gas

- Events

- Construction

- Mining

- Manufacturing

- Others (Shipping and Contracting)

- North America

- Africa

- Asia-Pacific

- South America

- Europe

- Middle East

By Fuel Type

By Power Rating

By End-User

By Region

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of the African market into Angola, and Mozambique, among others

- Further breakdown of the Asia-Pacific temporary power market into Indonesia, South Korea, Malaysia, and Philippines, among others

- Further breakdown of the South American market into Colombia, Venezuela and Peru, among others

- Further breakdown of the European temporary power market into Sweden, Finland, and Kazakhstan, among others

- Further breakdown of the Middle East market into Iraq, and Yemen, among others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Customer Interested in this report also can view

Power Rental Market by Fuel (Diesel, Gas, Duel Fuel & HFO), Power Rating, End User (Utilities, Oil & Gas, Events, Construction, Mining, Manufacturing, Shipping), Application (Peak Shaving, Base Load, Stand by), by Region - Global Trends & Forecast to 2021

Middle East and Africa Power Rental Market by End-user (Utilities, Construction, Oil & gas, and Others (Industrial, Shipping, Quarrying & Mining, and Events)), by Fuel Type (Diesel & Gas) and by Region - Trends and Forecast to 2019

The global temporary power market is projected to reach USD 6.40 Billion by 2021, growing at a CAGR of 10.6% from 2016 to 2021. This growth can be attributed to the lack of electricity supply, rise in construction and infrastructural activities, and increase in number of planned events, triggering an increasing demand for energy.

The report segments the temporary power market on the basis of end-users into utilities, oil & gas, events, construction, mining, manufacturing, shipping, and others (military, telecom, and residential). The utilities segment recorded the largest market size in 2015. The growth can be attributed to aging power grid infrastructure in the developed economies, followed by lack of electricity supply in the developing economies of the Asia-Pacific and Africa. Poor grid infrastructure causes frequent blackouts giving rise to the need for rental power. The oil & gas industry held the second largest market share. Growing industrialization and rising demand for continuous power supply by these industries are expected to drive the temporary power market from 2016 to 2021.

The temporary power market has also been classified on the basis of power rating into less than 80 kW, 81 kW280 kW, 281 kW600 kW and above 600 kW. The demand for above 600 kW power rated generators is expected to increase during the forecast period, as they are used in a wide range of applications in the oil & gas, utilities and mining sectors.

The temporary power market has also been classified on the basis of fuel type into diesel, gas, and other generators. The demand for diesel generators is expected to increase during the forecast period, as they are used in a wide range of applications, across various sectors.

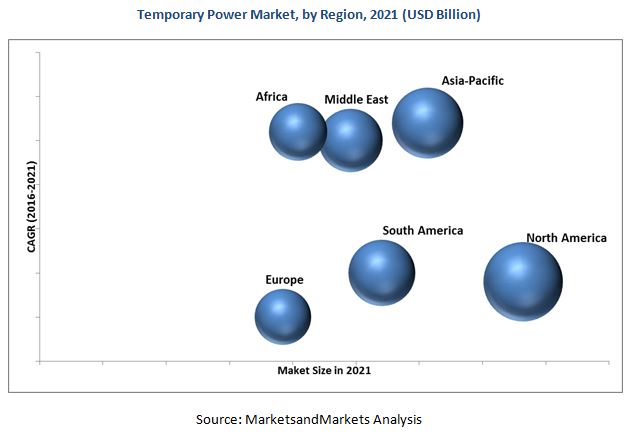

North America held the largest market share followed by the Asia-Pacific, and South America. Growth in power demand and capacity expansion plans by temporary power companies are the key market drivers. The Asia Pacific and Africa is estimated to grow at a faster rate, owing to low rate of electrification, and poor grid infrastructure, which propel the demand for diesel generators. In 2015, China dominated the Asia-Pacific temporary power market, due to the increase in number of planned events. The figure given below indicates the market size of various regions by 2021, with their respective CAGRs.

Environmental agencies constantly exert pressure on various countries to decrease carbon emissions, and aggressive targets have consequently been set by these countries. Owing to these targets, governments are moving towards renewable energy sources. This would adversely affect the market.

Some of the leading players in the temporary power market are Aggreko PLC (U.K.), APR Energy Inc. (U.S.), Ashtead Group Plc (U.K.), Caterpillar Inc.(U.S.), Power Electrics (U.K.), Speedy Hire (U.S.), United Rentals (U.S.), Cummins Inc.(U.S.), Hertz Corporation(U.S.), Kohler (U.S.), Smart Energy Solutions (UAE), and Rental Solutions and Services (UAE), among others. Contracts & agreements was the strategy most commonly used by top players in the market, followed by, expansions, and other developments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Temporary Power Market Segmentation

1.3.2 Countries Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

3 Executive Summary (Page No. - 28)

3.1 Introduction

3.1.1 Historical Backdrop

3.2 Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 33)

4.1 Diesel Generator Segment is Expected to Dominate the Temporary Power Market During the Forecast Period

4.2 North America Held the Largest Market Share in the Temporary Power Market in 2015

4.3 Asia-Pacific: the Fastest Growing Temporary Power Market During the Forecast Period

4.4 Temporary Power Market: By End-User

5 Market Overview (Page No. - 36)

5.1 Market Segmentation

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Power Demand

5.2.1.2 Lack of Power Infrastructure

5.2.1.3 Lesser Turnaround Time

5.2.2 Restraints

5.2.2.1 Rise in T&D Expenditure

5.2.2.2 Payments Issues

5.2.3 Opportunities

5.2.3.1 Obsolete Permanent Power Plants

5.2.3.2 Growth Potential in Emerging Economies

5.2.3.3 Decreasing Cost of Power Generation

5.2.4 Challenges

5.2.4.1 Growing Focus on Renewable Energy

5.2.4.2 Stringent Emission Regulations

6 Temporary Power Market, By Fuel Type (Page No. - 43)

6.1 Introduction

6.2 Diesel Generator

6.3 Gas Generator

6.4 Others

7 Temporary Power Market, By Power Rating (Page No. - 48)

7.1 Introduction

7.2 Less Than 80 Kw Power Rating

7.3 81 Kw280 Kw Rating

7.4 281 Kw600 Kw Rating

7.5 Above 600 Kw Rating

8 Temporary Power Market, By End-User (Page No. - 53)

8.1 Introduction

8.2 Events

8.3 Utilities

8.4 Oil& Gas

8.5 Construction

8.6 Mining

8.7 Manufacturing

8.8 Others

9 Temporary Power Market, By Region (Page No. - 80)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Australia

9.2.4 Japan

9.2.5 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 South America

9.4.1 Brazil

9.4.2 Argentina

9.4.3 Chile

9.4.4 Rest of South America

9.5 Europe

9.5.1 U.K.

9.5.2 Germany

9.5.3 Russia

9.5.4 Italy

9.5.5 France

9.5.6 Turkey

9.5.7 Rest of Europe

9.6 Middle East

9.6.1 Saudi Arabia

9.6.2 UAE

9.6.3 Iran

9.6.4 Qatar

9.6.5 Oman

9.6.6 Rest of the Middle East

9.7 Africa

9.7.1 Algeria

9.7.2 Egypt

9.7.3 South Africa

9.7.4 Nigeria

9.7.5 Libya

9.7.6 Rest of Africa

10 Competitive Landscape (Page No. - 119)

10.1 Overview

10.2 Competitive Situation & Trends

10.3 Contracts & Agreements

10.4 Expansions

10.5 Mergers & Acquisitions

10.6 Joint Ventures

10.7 New Product/Technology Launches

11 Company Profiles (Page No. - 126)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

11.1 Introduction

11.2 Aggreko PLC.

11.3 APR Energy PLC.

11.4 Ashtead Group PLC.

11.5 Caterpillar, Inc.

11.6 Cummins, Inc.

11.7 Atlas Copco CB.

11.8 Speedy Hire PLC.

11.9 United Rentals, Inc.

11.10 Hertz Equipment Rental Corporation

11.11 Smart Energy Solutions

11.12 Rental Solutions & Services LLC.

11.13 Kohler Co., Inc.

11.14 Diamond Environmental Services, LLC.

11.15 Atco Power Ltd.

11.16 Temp-Power, Inc.

11.17 Trinity Power Rentals

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 160)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (115 Tables)

Table 1 Temporary vs Permanent Power Plant Cost Comparison

Table 2 Temporary Power Market Size, By Fuel Type, 20142021 (USD Million)

Table 3 Diesel Generator: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 4 Gas Generator: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 5 Others: Market Size, By Region, 20142021 (USD Million)

Table 6 Generator Power Rating Required By Different End-Users

Table 7 Temporary Power Market Size, By Power Rating, 20142021 (USD Million)

Table 8 Less Than 80 Kw: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 9 81 Kw280 Kw: Market Size, By Region, 20142021 (USD Million)

Table 10 281 Kw600 Kw: Market Size, By Region, 20142021 (USD Million)

Table 11 Above 600 Kw: Market Size, By Region, 20142021 (USD Million)

Table 12 Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 13 Events: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 14 North America: Events Market Size, By Country, 20142021 (USD Million)

Table 15 South America: Events Market Size, By Country, 20142021 (USD Million)

Table 16 Asia-Pacific: Events Market Size, By Country, 20142021 (USD Million)

Table 17 Europe: Events Market Size, By Country, 20142021 (USD Million)

Table 18 Middle East: Events Market Size, By Country, 20142021 (USD Million)

Table 19 Africa: Events Market Size, By Country, 20142021 (USD Million)

Table 20 Utilities: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 21 Africa: Utilities Market Size, By Country, 20142021 (USD Million)

Table 22 North America: Utilities Market Size, By Country, 20142021 (USD Million)

Table 23 South America: Utilities Market Size, By Country, 20142021 (USD Million)

Table 24 Asia-Pacific: Utilities Market Size, By Country, 20142021 (USD Million)

Table 25 Middle East: Utilities Market Size, By Country, 20142021 (USD Million)

Table 26 Europe: Utilities Market Size, By Country, 20142021 (USD Million)

Table 27 Oil & Gas: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 28 North America: Oil & Gas Market Size, By Country, 20142021 (USD Million)

Table 29 Africa: Oil & Gas Market Size, By Country, 20142021 (USD Million)

Table 30 Asia-Pacific: Oil & Gas Market Size, By Country, 20142021 (USD Million)

Table 31 South America: Oil & Gas Market Size, By Country, 20142021 (USD Million)

Table 32 Europe: Oil & Gas Market Size, By Country, 20142021 (USD Million)

Table 33 Middle East: Oil & Gas Market Size, By Country, 20142021 (USD Million)

Table 34 Construction: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 35 North America: Construction Market Size, By Country, 20142021 (USD Million)

Table 36 Africa: Construction Market Size, By Country, 20142021 (USD Million)

Table 37 Asia-Pacific: Construction Market Size, By Country, 20142021 (USD Million)

Table 38 South America: Construction Market Size, By Country, 20142021 (USD Million)

Table 39 Europe: Construction Market Size, By Country, 20142021 (USD Million)

Table 40 Middle East: Construction Market Size, By Country, 20142021 (USD Million)

Table 41 Mining: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 42 North America: Mining Market Size, By Country, 20142021 (USD Million)

Table 43 Africa: Mining Market Size, By Country, 20142021 (USD Million)

Table 44 Asia-Pacific: Mining Market Size, By Country, 20142021 (USD Million)

Table 45 South America: Mining Market Size, By Country, 20142021 (USD Million)

Table 46 Europe: Mining Market Size, By Country, 20142021 (USD Million)

Table 47 Middle East: Mining Market Size, By Country, 20142021 (USD Million)

Table 48 Manufacturing: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 49 North America: Manufacturing Market Size, By Country, 20142021 (USD Million)

Table 50 Africa: Manufacturing Market Size, By Country, 20142021 (USD Million)

Table 51 Asia-Pacific: Manufacturing Market Size, By Country, 20142021 (USD Million)

Table 52 South America: Manufacturing Market Size, By Country, 20142021 (USD Million)

Table 53 Europe: Manufacturing Market Size, By Country, 20142021 (USD Million)

Table 54 Middle East: Manufacturing Market Size, By Country, 20142021 (USD Million)

Table 55 Others: Temporary Power Market Size, By Region, 20142021 (USD Million)

Table 56 North America: Others Market Size, By Country, 20142021 (USD Million)

Table 57 Africa: Others Market Size, By Country, 20142021 (USD Million)

Table 58 Asia-Pacific: Others Market Size, By Country, 20142021 (USD Million)

Table 59 South America: Others Market Size, By Country, 20142021 (USD Million)

Table 60 Europe: Others Market Size, By Country, 20142021 (USD Million)

Table 61 Middle East: Others Market Size, By Country, 20142021 (USD Million)

Table 62 Asia-Pacific: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 63 Asia-Pacific: Temporary Power Market Size, By Fuel Type, 20142021 (USD Million)

Table 64 Asia-Pacific: Temporary Power Market Size, By Country, 20142021 (Million)

Table 65 China: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 66 India: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 67 Australia: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 68 Japan: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 69 Rest of Asia-Pacific: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 70 North America: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 71 North America: Temporary Power Market Size, By Fuel Type, 20142021 (USD Million)

Table 72 North America: Temporary Power Market Size, By Country, 20142021 (USD Million)

Table 73 U.S.: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 74 Canada: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 75 Mexico: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 76 South America: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 77 South America: Temporary Power Market Size, By Fuel Type, 20142021 (USD Million)

Table 78 South America: Temporary Power Market Size, By Country, 20142021 (USD Million)

Table 79 Brazil: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 80 Argentina: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 81 Chile: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 82 Rest of South America: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 83 Europe: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 84 Europe: Temporary Power Market Size, By Fuel Type, 20142021 (USD Million)

Table 85 Europe: Temporary Power Market Size, By Country, 20142021 (USD Million)

Table 86 U.K.: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 87 Germany: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 88 Russia: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 89 Italy: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 90 France: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 91 Turkey: Market Size, By End-User, 20142021 (USD Million)

Table 92 Rest of Europe: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 93 Middle East: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 94 Middle East: Temporary Power Market Size, By Fuel Type, 20142021 (USD Million)

Table 95 Middle East: Temporary Power Market Size, By Country, 20142021 (USD Million)

Table 96 Saudi Arabia: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 97 UAE: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 98 Iran: Market Size, By End-User, 20142021 (USD Million)

Table 99 Qatar: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 100 Oman: Market Size, By End-User, 20142021 (USD Million)

Table 101 Rest of the Middle East: Market Size, By End-User, 20142021 (USD Million)

Table 102 Africa: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 103 Africa: Temporary Power Market Size, By Fuel Type, 20142021 (USD Million)

Table 104 Africa: Temporary Power Market Size, By Country, 20142021 (USD Million)

Table 105 Algeria: Market Size, By End-User, 20142021 (USD Million)

Table 106 Egypt: Market Size, By End-User, 20142021 (USD Million)

Table 107 South Africa: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 108 Nigeria: Market Size, By End-User, 20142021 (USD Million)

Table 109 Libya: Market Size, By End-User, 20142021 (USD Million)

Table 110 Rest of Africa: Temporary Power Market Size, By End-User, 20142021 (USD Million)

Table 111 Contracts & Agreements, 20152016

Table 112 Expansions, 2015

Table 113 Mergers & Acquisitions, 20152016

Table 114 Joint Ventures, 20132015

Table 115 Joint Ventures, 20142015

List of Figures (47 Figures)

Figure 1 Temporary Power Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Assumptions of the Research Study

Figure 6 North America Dominated the Temporary Power Market in 2015

Figure 7 281 Kw600 Kw Power Rated Segment is Expected to Occupy the Largest Market Share (Value) During the Forecast Period

Figure 8 Temporary Power Market Size, By Fuel Type, 2016 & 2021 (USD Million)

Figure 9 Events End-User Segment Generated the Highest Demand for Temporary Power in 2015

Figure 10 Temporary Power Market Size, By Power Rating, 20162021 (USD Million)

Figure 11 Attractive Market Opportunities in the Temporary Power Market

Figure 12 Diesel Generator Segment is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 13 North America Accounted for the Largest Share (Value) in the Temporary Power Market in 2015

Figure 14 Temporary Power Market Regional Snapshot, 2015

Figure 15 Events Segment is Expected to Account for the Maximum Share in the Temporary Power Market During the Forecast Period

Figure 16 Market Segmentation: By Fuel Type, Power Rating, End-User, & Region

Figure 17 Temporary Power Market: By Fuel Type

Figure 18 Temporary Power Market: By Power Rating

Figure 19 Temporary Power Market: By End-User

Figure 20 Temporary Power Market: By Country

Figure 21 Market Dynamics for the Temporary Power Market

Figure 22 Temporary Power Market Share (Value), By Fuel Type, 2015

Figure 23 Diesel Generator Segment is Expected to Hold the Largest Market Size During the Forecast Period

Figure 24 Temporary Power Market Share (Value), By Power Rating, 2015

Figure 25 Temporary Power Market Share (Value), By End-User, 2015

Figure 26 Country-Wise Snapshot: China & Qatar are Expected to Be the Fastest Growing Markets, in Terms of CAGR, During the Forecast Period

Figure 27 Temporary Power Market Share (Value), By Region, 2015

Figure 28 North America & Asia-Pacific are Projected to Dominate the Temporary Power Market, in Terms of Market Size, During the Forecast Period

Figure 29 Asia-Pacific Temporary Power Market Snapshot, 2015

Figure 30 North America Temporary Power Market Snapshot, 2015

Figure 31 Companies Adopted Contracts & Agreements as the Key Growth Strategy, 20112016

Figure 32 Battle for Market Share: Contracts & Agreements Was the Key Strategy

Figure 33 Market Evaluation Framework, 20112016

Figure 34 Regional Revenue Mix of the Top 5 Players

Figure 35 Aggreko PLC.: Company Snapshot

Figure 36 Aggreko PLC.: SWOT Analysis

Figure 37 APR Energy PLC.: Company Snapshot

Figure 38 APR Energy PLC.: SWOT Analysis

Figure 39 Ashtead Group PLC.: Company Snapshot

Figure 40 Ashtead Group PLC.: SWOT Analysis

Figure 41 Caterpillar, Inc.: Company Snapshot

Figure 42 Caterpillar, Inc.: SWOT Analysis

Figure 43 Cummins, Inc.: Company Snapshot

Figure 44 Cummins, Inc.: SWOT Analysis

Figure 45 Atlas Copco CB: Company Snapshot

Figure 46 Speedy Hire PLC.: Company Snapshot

Figure 47 United Rentals, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Temporary Power Market