Temperature Controlled Packaging Solutions Market by Type (Active, Passive), Product, Usability (Single, Reuse), Revenue type (Product, Service), End-Use Industry (Pharma and Biopharma) & Region - Trends and Forecasts (2022 - 2026)

Updated on : September 03, 2025

Temperature Controlled Packaging Solutions Market

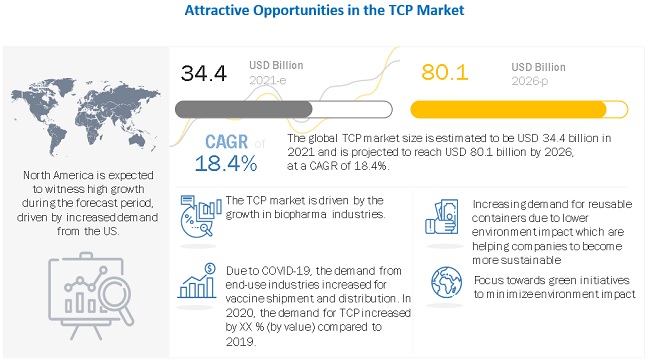

The Temperature Controlled Packaging Solutions Market was valued at USD 34.4 billion in 2021 and is projected to reach USD 80.1 billion by 2026, growing at 18.4% cagr from 2021 to 2026. The temperature controlled packaging solutions (TCP) market is driven by healthcare sector during the forecast period. North America is dominating region in healthcare sector with increase in demand from the US.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global Temperature Controlled Packaging Solutions market (TCP market)

In 2020, the Temperature Controlled Packaging Solutions market (TCP market) grew by 4% in terms of value, compared to 2019, amid the COVID-19 pandemic. The demand for temperature-sensitive packaging increased for the distribution of COVID-19 vaccines across the globe. The companies developed their packaging system for shipping vaccines, test kits, and other critical medicines. The temperature-controlled packaging is susceptible to product damage due to temperature excursion. The product's efficacy gets compromised with temperature deviation. COVID-19 accelerated trends in the temperature-controlled packaging solution market. The vaccine manufacturing companies collaborated with temperature-controlled packaging providers to develop customized products for the shipment of vaccines.

Temperature Controlled Packaging Solutions Market Dynamics

Driver: Growth in Biopharmaceuticals due to COVID-19

Biopharmaceuticals or BioPharma products are derived from biological sources (animal, human, and microorganisms). Vaccines, enzymes, tissues, gene therapies, and cell therapies are some examples of biopharmaceuticals. These products are susceptible to heat, humidity and are required to be stored in low temperatures for shipping and storage.

Vaccines and cell therapies transportation requires a lower temperature for shipping. In 2020, due to the COVID-19 pandemic, the demand for the COVID-19 vaccine, cell and gene therapies, other flu vaccines have increased significantly. According to Our World in Data, as of April 2020, about only 5% of the overall population have received at least one dose of COVID-19 vaccines. The demand for the shipment of vaccines across the globe is expected to increase, enhancing the market for temperature-controlled packaging. The COVID-19 vaccine developed by Pfizer – BioNTech is an Ultra-Low Temperature vaccine that requires to be stored at low temperature to maintain the quality and efficiency of the vaccine. The company collaborated with Softbox Systems Ltd. to develop reusable Ultra-Low Temperature (ULT) shippers that can store vaccines for up to 30 days. Apart from Pfizer, other biopharmaceutical companies collaborated with thermal packaging solution providers to ship their temperature-sensitive products worldwide.

Restraints: Stringent regulation on shipment of temperature sensitive products.

One of the risks involving in the supply of pharmaceutical products includes contamination. US Food and Drug Administration (FDA) has the authority to regulate the shipment of products. Regulation such as 21 CFR 211.150 talks about distribution procedures of temperature-sensitive products. World Health Organization (WHO) imposed regulations on the shipment of temperature-sensitive pharmaceutical products across the globe. These regulations come under Good Distribution Practices (GDP) Regulations. To maintain the efficiency of the product, regulation focuses on identifying & minimizing risks. Managing active and passive shipments for road and air transport for various cold chain points also came in the WHO regulations.

Standard tests are conducted to validate the ability of the packaging system to maintain the temperature range. According to International Air Transport Association (IATA), Temperature Control Regulations (TCR) contain all information and requirement (Government regulations, Carrier regulations, packaging, and other) before shipping a temperature-sensitive product. The International Safe Transit Association (ISTA) set standards for global package transportation. The ISTA test standards for temperature-sensitive shipping include 7D,20, 7E, and 3A.

Due to growing concern towards environmental pollution, the government is adopting strict regulation to minimize the impact. European Union imposed a regulation for the recovery of post-consumer waste. The packaging waste, particularly from the cold chain, is due to companies adapting outdated and cheapest solutions for delivery. The government and other public organizations focus on reducing carbon footprint in the cold chain and creating sustainable networks

Opportunity: Adoption of digitization in TCP market will help the companies to cut operational cost and decrease manual checks

The cold chain carries temperature sensitive payload. These payloads are at risk of damage and loss due to temperature excursion during shipment. Temperature-sensitive products are primarily from the biopharmaceutical industry and are of high importance. The industry encounters a loss of about USD 35 billion yearly due to failures in temperature-controlled logistics. The shipment of COVID-19 vaccines and other products such as cell and gene therapies has increased amid the COVID-19 pandemic in 2020. The temperature-sensitive packaging solution providers are focusing on developing a platform to improve the real-time visibility across the cold chain for temperature and location of cargos.

These digital platforms track various aspects in cold chain payload shipment such as temperature, location, vibration and provide other information such as flight schedules, weather, and ensures timely delivery of payloads. The logistics monitoring system will also provide insight into the problem area along the cold chain so that necessary steps could be taken to minimize the loss beforehand. The pharmaceutical & biopharma industries reliance in temperature sensitive shipping is growing steadily with the development of new drugs, vaccines, and other products. The temperature-sensitive packaging solution providers are focusing on improving their services to these companies by providing more control over the cold chain for minimizing the loss of payload.

Challenges: Customs handling and lack of infrastructure for temperature sensitive shipment in developing economies

The custom personals having insufficient knowledge regarding temperature-sensitive products is one of the challenges faced by this market. The custom delaying the clearance of shipment increases the probability of damaging temperature-sensitive products due to opening and checking products which cause temperature excursion mainly for passive temperature-sensitive containers. Moreover, government compliance varies from country to country, with challenges regarding temperature compliance. The lack of expertise in handling and maintaining the active temperature-sensitive containers and improper loading & unloading of products is another challenge for the temperature control market.

Developing economies such as China and India are key players in the global pharmaceutical industry. China is the key supplier of Active Pharmaceutical Ingredient (API) and India is the primary producer of vaccine. The availability of skill level in labors and available infrastructure is different in developed and developing countries. However, this challenge can be bridged by giving trainings and increasing the various stakeholders' stringency in the developing economies.

Active system is largest segment by type in TCP market.

Active system is the largest type segment for Temperature Controlled Packaging Solutions market (TCP Market). Active containers have active temperature control and the temperature inside the container is maintained at a specific temperature range with electric cooling or with the help of dry ice. The temperature accuracy provided by the active system is highest compared to the passive system. The active system is an expensive option and provides a stable temperature for long-distance shipment. The system can efficiently manage the delay caused in the supply chain. There is less possibility of temperature excursion with the availability of a power source. The growing transportation of bulk volume payload of temperature-sensitive pharmaceutical products will drive the active systems during the forecast period.

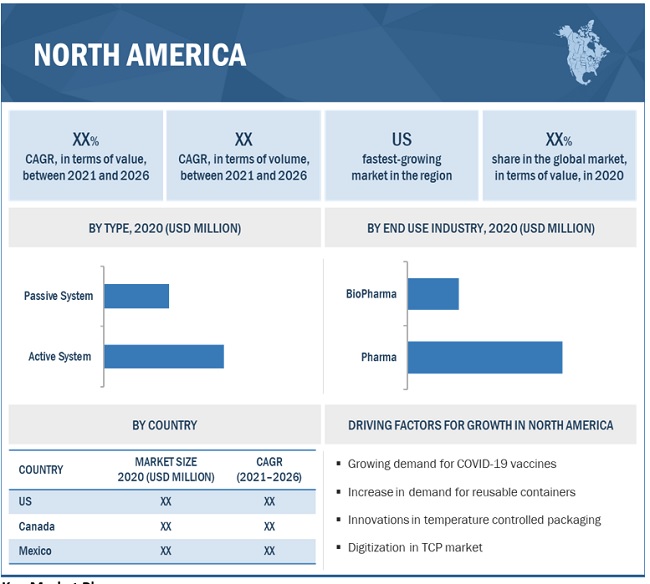

North America estimated to be the fastest-growing market for TCP.

North America accounted for the largest share of the Temperature Controlled Packaging Solutions market (TCP market) in 2020, followed by APAC and Europe. The utilization of TCP is expected to witness the highest growth in the region during the forecast period. The market in this region is driven by the presence of global pharma and biopharma industries. Due to COVID-19, the demand for COVID-19 vaccines and other related products have increased significantly. The supply and distribution of COVID-19 vaccines requires temperature-controlled packaging solution. Leading temperature-controlled packaging manufacturing companies such as Pelican BioThermal LLC (U.S.), Sonoco Products Company (U.S.), Cold Chain Technologies, Inc. (U.S.), FedEx Corp. (U.S.), and AmerisourceBergen Corp. (U.S.) are based in North America. These companies are investing in R&D activities to develop innovative products for the packaging industry.

To know about the assumptions considered for the study, download the pdf brochure

Temperature Controlled Packaging Solutions Market Players

The leading players in the TCP market are Sonoco Products Company (US), Cold Chain Technologies, LLC (US), Va-Q-Tec AG (Germany), Pelican BioThermal LLC (US), Softbox Systems (UK), Sofrigam SA (France), DGP Intelsius GMBH (UK), Inmark, LLC (US), Envirotainer AB (Sweden), Fedex Corporation (US), United Parcel Service, Inc. (US) and Amerisourcebergen Corporation (US)

Temperature Controlled Packaging Solutions Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Unit considered |

Value (USD Million) |

|

Segments |

Type, Usability, Revenue Type, Product, End-Use Industry and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa and South America |

|

Companies |

The major players are, Sonoco Products Company (US), Cold Chain Technologies, LLC (US), Va-Q-Tec AG (Germany), Pelican BioThermal LLC (US), Softbox Systems (UK), Sofrigam SA (France), DGP Intelsius GMBH (UK), Inmark, LLC (US), Envirotainer AB (Sweden), Fedex Corporation (US), United Parcel Service, Inc. (US) and Amerisourcebergen Corporation (US) are top 12 companies covered in TCP market. |

This research report categorizes the global temperature controlled packaging solutions market on the basis of Type, Usability, Revenue Type, Product, End-Use Industry and Region.

On the basis of Type

- Active Systems

- Passive Systems

On the basis of Usability

- Single

- Reuse

On the basis of Revenue Type

- Products

- Services

On the basis of Product

- Insulated Shippers

- Insulated Containers

- Refrigerants

On the basis of Product

- Pharma

- Biopharma

On the basis of region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In March 2021, Cold Chain Technologies planned to expand its temperature-controlled solutions in EMEA (Europe, the Middle East, and Africa) region by opening new regional headquarters in the Netherlands.

- In November 2020, Sonoco Products Company launched EOS line of parcel shippers. The product is recyclable temperature control packaging system. The product is made for life science and perishable food products.

- In November 2020, Cold Chain Technologies planned to open new facility in Lebanon, US for distribution of COVID-19 vaccines.

- In October 2020, Pelican BioThermal LLC introduced the new line of Golden Hour One, the new line of products for military. The product is smaller and is suitable to carry blood and platelets.

- In February 2020, Pelican BioThermal LLC announced the acquisition of NanoCool LLC (Albuquerque, New Mexico). The company is involved in production of temperature-controlled packaging systems.

- In January 2020, Sonoco Products Company acquired Thermoform Engineered Quality, LLC from ESCO Technologies, Inc (US). The company is a manufacturer of thermoformed packaging for health care and other markets.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the TCP market?

The major driver influencing the growth of TCP is the growth of biopharmaceutical products such as vaccines, cell & gene therapy and others.

How is the TCP market segmented in terms of products?

The TCP market is segmented into Insulated Shippers, Insulated containers and refrigerants.

What are the major challenges in TCP market?

Customs handling and lack of infrastructure for temperature sensitive shipment in developing economies is major challenges in TCP market.

What are various insulated materials utilised in in production of TCP?

The insulating material includes vacuum insulated panels (VIPs), polyurethane (PUR), and expanded polystyrene (EPS).

What are the major opportunities in TCP market?

Adoption of digitization in TCP market will help the companies to cut operational cost and decrease manual checks and Focus towards green initiatives to minimize environment impact are opportunities in TCP market.

What are the Refrigerants?

Refrigerants are temperature stabilizing mediums that limit the exposure of payload to the external environment and maintaining the desired temperature.

Which region has the largest demand

North America has the largest demand for TCP owing to the presence of global pharma and biopharma industries.

On the basis of type, how TCP market is segmented?

TCP market is segmented into Active and Passive system on the basis of type.

On the basis of usability, how TCP market is segmented?

TCP market is segmented Single use and reuse on the basis of usability.

Who are the major manufacturers of TCP?

The major manufacturers of TCP are Sonoco Products Company (US), Cold Chain Technologies, LLC (US), Va-Q-Tec AG (Germany), Pelican BioThermal LLC (US), .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 MARKET SEGMENTATION DEFINITION, BY TYPE

TABLE 2 MARKET SEGMENTATION DEFINITION, BY USABILITY OF PASSIVE SYSTEMS

TABLE 3 MARKET SEGMENTATION DEFINITION, BY REVENUE OF PASSIVE SYSTEMS

TABLE 4 MARKET SEGMENTATION DEFINITION, BY PRODUCT

1.3 MARKET SCOPE

FIGURE 1 Temperature Controlled Packaging Solutions Market SEGMENTATION

1.3.1 INCLUSIONS & EXCLUSIONS

TABLE 5 TABLE DEFINING THE INCLUSIONS & EXCLUSIONS OF THE REPORT

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 Temperature Controlled Packaging Solutions Market: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH 1: BASED ON THE PHARMACEUTICAL LOGISTICS MARKET - 2018 (USD MILLION)

FIGURE 3 APPROACH 1: BASED ON THE PHARMACEUTICAL LOGISTICS MARKET - 2018 (USD MILLION)

2.2.2 APPROACH 2: BASED ON GLOBAL PHARMACEUTICAL CHAIN LOGISTICS MARKET - 2019 (USD MILLION)

FIGURE 4 APPROACH 2: BASED ON GLOBAL PHARMACEUTICAL CHAIN LOGISTICS MARKET – 2019 (USD MILLION)

2.3 DATA TRIANGULATION

FIGURE 5 Temperature Controlled Packaging Solutions Market: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 GROWTH RATE ASSUMPTIONS

2.6 FACTOR ANALYSIS IMPACTING GROWTH

FIGURE 6 FACTOR ANALYSIS IMPACTING GROWTH

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 7 ACTIVE SYSTEMS HELD THE LARGEST SHARE IN 2020

FIGURE 8 PHARMA END-USE INDUSTRY HELD THE LARGER SHARE IN 2020

FIGURE 9 INSULATED SHIPPERS HELD THE LARGEST SHARE IN 2020

FIGURE 10 APAC IS THE LARGEST Temperature Controlled Packaging Solutions Market

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 SIGNIFICANT OPPORTUNITIES IN THE Temperature Controlled Packaging Solutions Market

FIGURE 11 GROWTH IN PHARMA/BIOPHARMA SECTOR TO OFFER MARKET OPPORTUNITIES

4.2 NORTH AMERICA: Temperature Controlled Packaging Solutions Market, BY TYPE, END-USE INDUSTRY, AND COUNTRY, 2020

FIGURE 12 US ACCOUNTED FOR THE LARGEST SHARE IN NORTH AMERICA

4.3 Temperature Controlled Packaging Solutions Market, BY TYPE

FIGURE 13 ACTIVE SYSTEMS TO DOMINATE THE OVERALL Temperature Controlled Packaging Solutions Market, 2021–2026

4.4 Temperature Controlled Packaging Solutions Market, BY USABILITY

FIGURE 14 SINGLE USE PACKAGING SYSTEM TO DOMINATE THE OVERALL Temperature Controlled Packaging Solutions Market, 2021–2026

4.5 Temperature Controlled Packaging Solutions Market, BY REVENUE TYPE

FIGURE 15 PRODUCTS TO DOMINATE THE OVERALL Temperature Controlled Packaging Solutions Market, 2021–2026

4.6 Temperature Controlled Packaging Solutions Market, BY PRODUCT

FIGURE 16 INSULATED SHIPPERS TO DOMINATE THE OVERALL Temperature Controlled Packaging Solutions Market, 2021–2026

4.7 Temperature Controlled Packaging Solutions Market, BY END-USE INDUSTRY

FIGURE 17 PHARMA TO DOMINATE THE OVERALL Temperature Controlled Packaging Solutions Market, 2021–2026

4.8 Temperature Controlled Packaging Solutions Market, BY COUNTRY

FIGURE 18 INDIA TO BE THE FASTEST-GROWING MARKET FOR TEMPERATURE-CONTROLLED PACKAGING

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET OVERVIEW

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE Temperature Controlled Packaging Solutions Market

5.2.1 DRIVERS

5.2.1.1 Growth in biopharmaceuticals due to COVID-19

TABLE 6 COVID-19 VACCINE BY REGION, APRIL 2021

5.2.1.2 Use of advanced insulation material, last mile delivery, and low cost driving the use of passive systems in Temperature Controlled Packaging Solutions Market

TABLE 7 ACTIVE VS PASSIVE SYSTEM

5.2.1.3 Increasing demand for reusable containers due to lower environmental impact helping companies to become more sustainable

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations on the shipment of temperature-sensitive products

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of digitization to help companies cut operational costs and decrease manual checks

5.2.3.2 Focus on green initiatives to minimize the environmental impact

5.2.4 CHALLENGES

5.2.4.1 Customs handling and lack of infrastructure for temperature-sensitive shipment in developing economies

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS OF THE TEMPERATURE-CONTROLLED PACKAGING MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 8 TEMPERATURE-CONTROLLED PACKAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 MACROECONOMIC INDICATORS

TABLE 9 WORLD GDP GROWTH PROJECTION

TABLE 10 PHARMACEUTICAL SPENDING, BY COUNTRY (US DOLLAR/CAPITA)

TABLE 11 PHARMACEUTICAL EXPORTS, BY COUNTRY (USD MILLION)

5.5 VALUE CHAIN ANALYSIS

FIGURE 21 TEMPERATURE-CONTROLLED PACKAGING MARKET - VALUE CHAIN

5.6 IMPACT OF COVID-19 ON Temperature Controlled Packaging Solutions Market

FIGURE 22 PRE & POST-COVID ANALYSIS OF TEMPERATURE-CONTROLLED PACKAGING SOLUTIONS DEMAND

5.7 TECHNOLOGY ANALYSIS

5.7.1 ACTIVE SYSTEM

5.7.2 PASSIVE SYSTEM

5.8 REGULATORY LANDSCAPE

5.8.1 GOOD DISTRIBUTION PRACTICES

5.9 PATENT ANALYSIS

5.9.1 INTRODUCTION

5.9.2 METHODOLOGY

5.9.3 DOCUMENT TYPE

TABLE 12 GRANTED PATENTS ARE 23 % OF THE TOTAL COUNT IN THE LAST 10 YEARS

FIGURE 23 NUMBER OF PATENTS YEAR-WISE IN THE LAST 10 YEARS

5.9.4 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 24 NUMBER OF PATENTS YEAR-WISE IN THE LAST 10 YEARS

5.9.5 INSIGHTS

5.9.6 JURISDICTION ANALYSIS

FIGURE 25 TOP JURISDICTION, BY DOCUMENT

5.9.7 TOP COMPANIES/APPLICANTS

FIGURE 26 TOP 10 COMPANIES/APPLICANTS WITH THE HIGHEST NUMBER OF PATENTS

TABLE 13 LIST OF PATENTS BY BERRY PLASTICS CORP.

TABLE 14 LIST OF PATENTS BY DAINIPPON PRINTING CO LTD.

TABLE 15 LIST OF PATENTS BY YETI COOLERS LLC

TABLE 16 LIST OF PATENTS BY SEKISUI PLASTICS

TABLE 17 LIST OF PATENTS BY CALIFORNIA INNOVATIONS INC.

TABLE 18 TOP 10 PATENT OWNERS (US) IN LAST 10 Y EARS

5.10 RANGE SCENARIO OF Temperature Controlled Packaging Solutions Market

FIGURE 27 RANGE SCENARIO OF TEMPERATURE-CONTROLLED PACKAGING SOLUTIONS

5.11 YC, YCC SHIFT

FIGURE 28 ENVIRONMENTALLY FRIENDLY PRODUCTS AND DIGITIZATION OF PRODUCTS TO ENHANCE FUTURE REVENUE MIX

TABLE 19 YC, YCC AND SHIFT IN Temperature Controlled Packaging Solutions Market

5.12 CASE STUDY

5.12.1 OPTIMIZING ACTIVE CONTAINERS TO MINIMIZE TEMPERATURE EXCURSION

FIGURE 29 CHARACTERISTICS OF ACTIVE CONTAINERS

5.12.2 SHIPMENT OF HARVESTED STEM CELLS IN TEMPERATURE-CONTROLLED PACKAGING

FIGURE 30 COLD CHAIN PROCESS FOR SHIPMENT OF HARVESTED STEM CELLS

5.13 CUSTOMER ANALYSIS

FIGURE 31 FACTORS IMPACTING CUSTOMERS ON THE SELECTION OF TEMPERATURE-CONTROLLED PACKAGING SOLUTIONS

5.14 ECOSYSTEM MAP

FIGURE 32 ECOSYSTEM MAP OF Temperature Controlled Packaging Solutions Market

5.15 ADJACENT AND RELATED MARKETS

5.15.1 INTRODUCTION

TABLE 20 ADJACENT MARKET

5.15.2 LIMITATIONS

5.15.3 METALIZED FLEXIBLE PACKAGING MARKET

5.15.3.1 Market definition

5.15.3.2 Metalized flexible packaging market, by material type

5.15.3.3 Metalized flexible packaging market, by structure

TABLE 21 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 2018–2025 (KILOTON)

TABLE 22 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 2018–2025 (USD MILLION)

5.15.3.4 Metalized flexible packaging market, by packaging type

TABLE 23 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 24 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

5.15.3.5 Metalized flexible packaging market, by end-use industry

TABLE 25 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 26 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

5.15.3.6 Metalized flexible packaging market, by region

TABLE 27 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 28 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

5.15.4 INSULATED PACKAGING MARKET

5.15.4.1 Market definition

5.15.4.2 Insulated packaging market, by material type

TABLE 29 INSULATED PACKAGING MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (KILOTON)

TABLE 30 INSULATED PACKAGING MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

5.15.4.3 Insulated packaging market, by application

TABLE 31 INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 32 INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

5.15.4.4 Insulated packaging market, by packaging type

TABLE 33 INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 34 INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

5.15.4.5 Insulated packaging market, by type

TABLE 35 INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 36 INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

5.15.4.6 Insulated packaging market, by electric & hybrid vehicle type

TABLE 37 INSULATED PACKAGING MARKET SIZE, BY ELECTRIC & HYBRID VEHICLE TYPE, 2020–2025 (TMT)

TABLE 38 INSULATED PACKAGING MARKET SIZE, BY ELECTRIC & HYBRID VEHICLE TYPE, 2020–2025 (USD BILLION)

5.15.4.7 Insulated packaging market, by region

TABLE 39 INSULATED PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 INSULATED PACKAGING MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6 Temperature Controlled Packaging Solutions Market, BY TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 33 ACTIVE SYSTEMS ACCOUNTED FOR THE LARGER MARKET SHARE IN 2020 (BY VALUE)

TABLE 41 Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

6.2 PASSIVE SYSTEMS

6.2.1 THE GROWTH OF BIOPHARMA INDUSTRIES IS A KEY DRIVER

TABLE 42 PASSIVE SYSTEMS: Temperature Controlled Packaging Solutions Market SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 ACTIVE SYSTEMS

6.3.1 RELIABLE SYSTEMS FOR SHIPMENT OF BULK VOLUME PAYLOAD

TABLE 43 ACTIVE SYSTEMS: Temperature Controlled Packaging Solutions Market SIZE, BY REGION, 2019–2026 (USD MILLION)

7 Temperature Controlled Packaging Solutions Market, BY USABILITY OF PASSIVE SYSTEMS (Page No. - 90)

7.1 INTRODUCTION

FIGURE 34 SINGLE USE ACCOUNTED FOR LARGER MARKET SHARE IN 2020 (BY VALUE)

TABLE 44 Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

7.2 SINGLE USE

7.2.1 INEXPENSIVE OPTION FOR THE SHIPMENT OF TEMPERATURE-SENSITIVE PRODUCTS

TABLE 45 Temperature Controlled Packaging Solutions Market SIZE IN SINGLE USE, BY REGION, 2019–2026 (USD MILLION)

7.3 REUSE

7.3.1 SHIFT TOWARD SUSTAINABILITY DRIVING THE DEMAND FOR REUSE SHIPPERS

FIGURE 35 REVERSE LOGISTICS FOR REUSE SHIPPERS

TABLE 46 REUSE PASSIVE TEMPERATURE-CONTROLLED PACKAGING

TABLE 47 Temperature Controlled Packaging Solutions Market SIZE IN REUSE, BY REGION, 2019–2026 (USD MILLION)

8 Temperature Controlled Packaging Solutions Market, BY REVENUE TYPE OF PASSIVE SYSTEM (Page No. - 95)

8.1 INTRODUCTION

FIGURE 36 PRODUCTS ACCOUNTED FOR LARGER MARKET SHARE IN 2020 (BY VALUE)

TABLE 48 Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE TYPE OF PASSIVE SYSTEM, 2019–2026 (USD MILLION)

8.2 PRODUCTS

8.2.1 THE GROWTH IN BIOPHARMA INDUSTRIES DRIVING THE USE OF TEMPERATURE-CONTROLLED PACKAGING PRODUCTS

TABLE 49 Temperature Controlled Packaging Solutions Market SIZE IN PRODUCTS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

8.3 SERVICES

8.3.1 GROWTH IN RENTAL SOLUTIONS TO DRIVE THE SEGMENT DURING THE FORECAST PERIOD

TABLE 50 Temperature Controlled Packaging Solutions Market IN SERVICES SEGMENT, BY REGION, 2019–2026 (USD MILLION)

9 Temperature Controlled Packaging Solutions Market, BY PRODUCT (Page No. - 99)

9.1 INTRODUCTION

FIGURE 37 INSULATED SHIPPERS ACCOUNTED FOR THE LARGEST SHARE OF THE OVERALL MARKET IN 2020 (BY VALUE)

TABLE 51 Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

9.2 INSULATED SHIPPERS

9.2.1 INCREASE IN CLINICAL TRIAL SHIPMENTS TO DRIVE THE MARKET FOR INSULATED SHIPPERS

TABLE 52 Temperature Controlled Packaging Solutions Market SIZE IN INSULATED SHIPPERS, BY REGION, 2019–2026 (USD MILLION)

9.3 INSULATED CONTAINERS

9.3.1 DISTRIBUTION OF COVID-19 VACCINES DRIVING THE MARKET FOR INSULATED CONTAINERS

TABLE 53 Temperature Controlled Packaging Solutions Market SIZE IN INSULATED CONTAINERS, BY REGION, 2019–2026 (USD MILLION)

9.4 REFRIGERANTS

9.4.1 GROWING DEMAND FOR LOW-COST AND EFFICIENT PASSIVE SYSTEMS DRIVING THE DEMAND FOR ADVANCED PHASE CHANGE MATERIALS

TABLE 54 Temperature Controlled Packaging Solutions Market SIZE IN REFRIGERANTS, BY REGION, 2019–2026 (USD MILLION)

10 Temperature Controlled Packaging Solutions Market, BY END-USE INDUSTRY (Page No. - 103)

10.1 INTRODUCTION

FIGURE 38 PHARMA INDUSTRY ACCOUNTED FOR LARGER MARKET SHARE IN 2020 (BY VALUE)

TABLE 55 Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.2 PHARMA

10.2.1 GROWTH IN PHARMACEUTICAL INDUSTRY TO DRIVE THE MARKET

TABLE 56 Temperature Controlled Packaging Solutions Market SIZE IN PHARMA, BY REGION, 2019–2026 (USD MILLION)

10.3 BIOPHARMA

10.3.1 INCREASE IN DEMAND FOR COVID-19 VACCINES TO DRIVE THE MARKET

TABLE 57 Temperature Controlled Packaging Solutions Market SIZE IN BIOPHARMA, BY REGION, 2019–2026 (USD MILLION)

11 Temperature Controlled Packaging Solutions Market, BY REGION (Page No. - 107)

11.1 INTRODUCTION

FIGURE 39 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 58 Temperature Controlled Packaging Solutions Market SIZE, BY REGION, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 40 NORTH AMERICA: TEMPERATURE-CONTROLLED PACKAGING MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, PASSIVE SYSTEMS BY USABILITY, 2019–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Growing pharmaceutical market and distribution of vaccine in the country are major drivers

TABLE 65 US: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 US: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 67 US: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 68 US: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 69 US: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Presence of major pharmaceutical companies in the country with vaccine distribution will drive the market

TABLE 70 CANADA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 CANADA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 72 CANADA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 73 CANADA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 74 CANADA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Growing pharmaceutical production in the country will be a key driver

TABLE 75 MEXICO: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 MEXICO: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 77 MEXICO: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 78 MEXICO: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 79 MEXICO: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3 EUROPE

TABLE 80 EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 83 EUROPE: Temperature Controlled Packaging Solutions Market SIZE, PASSIVE SYSTEMS BY REVENUE TYPE, 2019–2026 (USD MILLION)

TABLE 84 EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 85 EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Spike in clinical trials for COVID-19 vaccine to increase the demand for temperature-controlled packaging solutions

TABLE 86 GERMANY: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 GERMANY: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 88 GERMANY: Temperature Controlled Packaging Solutions Market SIZE, PASSIVE SYSTEMS, BY REVENUE TYPE, 2019–2026 (USD MILLION)

TABLE 89 GERMANY: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 90 GERMANY: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.2 SWITZERLAND

11.3.2.1 Increasing imports and exports for COVID-19-related supplies to boost the demand for temperature-controlled packaging solutions

TABLE 91 SWITZERLAND: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 SWITZERLAND: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 93 SWITZERLAND: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 94 SWITZERLAND: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 95 SWITZERLAND: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Increasing imports and exports for COVID-19-related supplies along with increasing clinical trials to boost product demand

TABLE 96 FRANCE: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 FRANCE: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 98 FRANCE: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 99 FRANCE: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 100 FRANCE: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Increase in pharmaceutical exports to drive the demand

TABLE 101 ITALY: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 ITALY: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 103 ITALY: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 104 ITALY: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 105 ITALY: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.5 UK

11.3.5.1 Uncertainty in pharmaceutical industry due to Brexit

TABLE 106 UK: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 UK: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 108 UK: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 109 UK: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 110 UK: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 111 REST OF EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 REST OF EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 113 REST OF EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 114 REST OF EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 115 REST OF EUROPE: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4 APAC

FIGURE 41 APAC: Temperature Controlled Packaging Solutions Market SNAPSHOT

TABLE 116 APAC: Temperature Controlled Packaging Solutions Market SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 117 APAC: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 APAC: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 119 APAC: Temperature Controlled Packaging Solutions Market SIZE, PASSIVE SYSTEMS BY REVENUE TYPE, 2019–2026 (USD MILLION)

TABLE 120 APAC: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 121 APAC: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Spike in demand for pharmaceutical products owing to surge in clinical trials due to the outbreak of COVID-19 along with favorable conditions such as low cost of labor and raw materials

TABLE 122 CHINA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 CHINA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 124 CHINA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 125 CHINA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 126 CHINA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Lowest growth rate in the region owing to tough environment for foreign players in the country

TABLE 127 JAPAN: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 JAPAN: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 129 JAPAN: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 130 JAPAN: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 131 JAPAN: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.3 SOUTH KOREA

11.4.3.1 Increasing approval to clinical trials over the past two decades boosted by the outbreak of COVID-19

TABLE 132 SOUTH KOREA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 SOUTH KOREA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY, 2019–2026 (USD MILLION)

TABLE 134 SOUTH KOREA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 135 SOUTH KOREA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 136 SOUTH KOREA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.4 INDIA

11.4.4.1 Favorable environment in the country owing to benefits such as cost-efficiency, economic drivers, policy support, and increasing investments

TABLE 137 INDIA: Temperature Controlled Packaging Solutions Market SIZE, PASSIVE SYSTEMS BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 INDIA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY, 2019–2026 (USD MILLION)

TABLE 139 INDIA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 140 INDIA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 141 INDIA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.5 REST OF APAC

TABLE 142 REST OF APAC: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 REST OF APAC: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 144 REST OF APAC: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 145 REST OF APAC: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 146 REST OF APAC: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

TABLE 147 MEA: Temperature Controlled Packaging Solutions Market SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 148 MEA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 MEA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 150 MEA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 151 MEA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 152 MEA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.1 SAUDI ARABIA

11.5.1.1 High dependence of the pharmaceutical industry on imports to boost the demand

TABLE 153 SAUDI ARABIA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 SAUDI ARABIA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 155 SAUDI ARABIA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 156 SAUDI ARABIA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 157 SAUDI ARABIA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.2 SOUTH AFRICA

11.5.2.1 Increasing need for the development of temperature-controlled storage and transportation owing to the outbreak of COVID-19

TABLE 158 SOUTH AFRICA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 SOUTH AFRICA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 160 SOUTH AFRICA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 161 SOUTH AFRICA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 162 SOUTH AFRICA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.3 REST OF MEA

TABLE 163 REST OF MEA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 REST OF MEA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 165 REST OF MEA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 166 REST OF MEA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 167 REST OF MEA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 168 SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 169 SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 171 SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 172 SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 173 SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 High dependence of pharmaceutical industry on imports to boost the demand

TABLE 174 BRAZIL: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 175 BRAZIL: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 176 BRAZIL: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 177 BRAZIL: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 178 BRAZIL: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Imports of COVID-19 vaccines, mainly from China, Russia, and India, to boost the demand

TABLE 179 ARGENTINA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 ARGENTINA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 181 ARGENTINA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 182 ARGENTINA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 183 ARGENTINA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6.3 REST OF SOUTH AMERICA

TABLE 184 REST OF SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 REST OF SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY USABILITY OF PASSIVE SYSTEMS, 2019–2026 (USD MILLION)

TABLE 186 REST OF SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY REVENUE OF PASSIVE SYSTEMS TYPE, 2019–2026 (USD MILLION)

TABLE 187 REST OF SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 188 REST OF SOUTH AMERICA: Temperature Controlled Packaging Solutions Market SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 159)

12.1 OVERVIEW

FIGURE 42 COMPANIES MAINLY ADOPTED ORGANIC GROWTH STRATEGIES BETWEEN 2017 AND 2020

12.2 MARKET RANKING ANALYSIS

12.3 MARKET SHARE ANALYSIS

FIGURE 43 MARKET SHARE OF KEY PLAYERS, 2020 (BY VALUE)

12.4 MARKET EVALUATION FRAMEWORK

TABLE 189 MARKET EVALUATION FRAMEWORK

12.5 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 190 REVENUE ANALYSIS OF KEY PLAYERS

12.6 COMPANY EVALUATION QUADRANT DEFINITION

12.6.1 STAR

12.6.2 EMERGING LEADER

12.6.3 PERVASIVE

12.6.4 PARTICIPANT

FIGURE 44 COMPANY EVALUATION QUADRANT, 2020

TABLE 191 COMPANY PRODUCT FOOTPRINT, BY PRODUCT

TABLE 192 COMPANY PRODUCT FOOTPRINT, BY TYPE

TABLE 193 COMPANY REGION FOOTPRINT

12.7 COMPETITIVE SCENARIO

12.7.1 EXPANSION

TABLE 194 EXPANSION, 2018–2020

12.7.2 NEW PRODUCT DEVELOPMENT

TABLE 195 NEW PRODUCT DEVELOPMENT, 2018–2020

12.7.3 DEALS

TABLE 196 DEALS, 2018–2021

12.7.4 JOINT VENTURE

TABLE 197 JOINT VENTURE, 2018–2021

12.7.5 COLLABORATION

TABLE 198 COLLABORATION, 2018–2021

13 COMPANY PROFILES (Page No. - 173)

(Business overview, Products offered, Services offered, Impact of COVID-19 & MnM View)*

13.1 SONOCO PRODUCTS COMPANY

FIGURE 45 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

TABLE 199 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

TABLE 200 IMPACT OF COVID-19 ON SONOCO PRODUCTS COMPANY

13.2 COLD CHAIN TECHNOLOGIES, LLC

TABLE 201 COLD CHAIN TECHNOLOGIES, LLC: COMPANY OVERVIEW

13.3 VA-Q-TEC AG

FIGURE 46 VA-Q-TEC AG: COMPANY SNAPSHOT

TABLE 202 VA-Q-TEC AG: COMPANY OVERVIEW

TABLE 203 IMPACT OF COVID-19 ON VA-Q-TEC AG

13.4 PELICAN BIOTHERMAL LLC

TABLE 204 PELICAN BIOTHERMAL LLC: COMPANY OVERVIEW

13.5 SOFTBOX SYSTEMS

TABLE 205 SOFTBOX SYSTEMS: COMPANY OVERVIEW

13.6 SOFRIGAM SA

TABLE 206 SOFRIGAM SA: COMPANY OVERVIEW

13.7 DGP INTELSIUS GMBH

TABLE 207 DGP INTELSIUS GMBH: COMPANY OVERVIEW

13.8 INMARK, LLC

TABLE 208 INMARK, LLC: COMPANY OVERVIEW

13.9 FEDEX CORPORATION

FIGURE 47 FEDEX CORPORATION: COMPANY SNAPSHOT

TABLE 209 FEDEX CORPORATION: COMPANY OVERVIEW

TABLE 210 IMPACT OF COVID-19 ON FEDEX CORPORATION

13.10 UNITED PARCEL SERVICE, INC.

FIGURE 48 UNITED PARCEL SERVICE, INC.: COMPANY SNAPSHOT

TABLE 211 UNITED PARCEL SERVICE, INC.: COMPANY OVERVIEW

13.11 DEUTSCHE POST DHL GROUP

FIGURE 49 DEUTSCHE POST DHL GROUP: COMPANY SNAPSHOT

TABLE 212 DEUTSCHE POST DHL GROUP: COMPANY OVERVIEW

TABLE 213 IMPACT OF COVID-19 ON DEUTSCHE POST DHL GROUP

13.12 AMERISOURCEBERGEN CORPORATION

FIGURE 50 AMERISOURCEBERGEN CORPORATION: COMPANY SNAPSHOT

TABLE 214 AMERISOURCEBERGEN CORPORATION: COMPANY OVERVIEW

13.13 CARDINAL HEALTH, INC.

FIGURE 51 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT

TABLE 215 CARDINAL HEALTH, INC.: COMPANY OVERVIEW

13.14 MCKESSON CORPORATION

FIGURE 52 MCKESSON CORPORATION: COMPANY SNAPSHOT

TABLE 216 MCKESSON CORPORATION: COMPANY OVERVIEW

13.15 ENVIROTAINER AB

TABLE 217 ENVIROTAINER AB: COMPANY OVERVIEW

*Details on Business overview, Products offered, Services offered, Impact of COVID-19 & MnM View might not be captured in case of unlisted companies.

13.16 OTHERS

13.16.1 CRYOPAK INDUSTRIES INC.

13.16.2 ECOCOOL GMBH

13.16.3 CRYOPORT, INC.

13.16.4 EXELTAINER SL

13.16.5 CSAFE GLOBAL, LLC

13.16.6 AMERICAN AEROGEL CORPORATION

13.16.7 INSULATED PRODUCTS CORPORATION

13.16.8 SEALED AIR CORPORATION

13.16.9 NORDIC COLD CHAIN SOLUTIONS

13.16.10 AERIS DYNAMICS PTE LTD

13.16.11 LIFOAM INDUSTRIES, LLC

14 APPENDIX (Page No. - 218)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

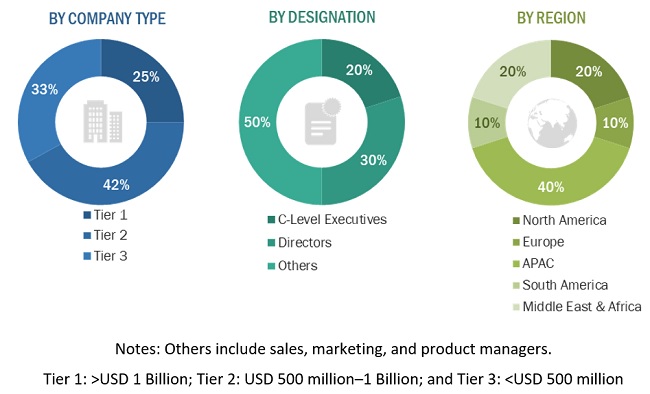

The study involved four major activities for estimating the current size of the global TCP market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of TCP through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the TCP market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, journals & newsletters, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The TCP market comprises several stakeholders in the supply chain, which include suppliers, processors, distributors and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the TCP market. Primary sources from the supply side include associations and institutions involved in the TCP industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global TCP market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the global TCP market in terms of value.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, product, usability, revenue type and end-use industry.

- To analyze the impact of COVID-19 on the market.

- To forecast the market size, in terms of volume and value, with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To analyze competitive developments in the market, such as new product launch, capacity expansion, and merger & acquisition.

- To strategically profile the leading players and comprehensively analyze their key developments, such as expansions and mergers & acquisitions, in the TCP market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Catalyst Handling Services market

- Further breakdown of Rest of Europe Catalyst Handling Services market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Temperature Controlled Packaging Solutions Market