Task Management Software Market by Business Function (Marketing, Human Resource, Finance), Component (Software and Services), Deployment Type (Cloud and On-Premises), Organization Size, Industry Vertical, and Region - Global Forecast to 2023

[154 Pages Report] The task management software market is expected to grow from USD 1.79 billion in 2017 to USD 4.33 billion by 2023, at a CAGR of 13.74% from 2018 to 2023. Task management software helps individuals and teams to create plans, control, track, manage, collaborate, and report tasks throughout its life cycle and make decisions based on it. Task management software enable organizations work effectively by automating and streamlining tasks. which, in turn, help in the growth of the market. The task management software market is expanding with the growing demand among enterprises to centrally manage and track tasks. Task management software is built for various business processes and industries, such as IT, marketing, human resource, finance, professional services, retail, healthcare, and real estate and construction projects. The base year considered for the study is 2017, and the forecast has been provided for the period between 2018 and 2023.

Market Dynamics For Task Management Software Market

Drivers

- Growing need among enterprises to centrally manage and track tasks

- Need to promote collaboration among teams and improve workforce utilization

Restraints

- Security concerns among enterprises regarding cloud-based task management software

Opportunities

- Recent advancements in the areas of AI and ML

- Integration of task management software with other third-party tools

Challenges

- Presence of many open source or free vendors in the task management software market

- Lack of awareness among enterprises about task management software

Growing need among enterprises to centrally managed and track tasks

Enterprises have multiple projects going on simultaneously. As a project keeps getting complex, the number of tasks associated with it also increases. The success of a project depends on the timely completion of individual tasks that make up each project. Managing all tasks from a central platform helps teams in saving time, avoiding loss of information, delegation of tasks, and tracking tasks to stay on schedule and hit deadlines. Tracking tasks enables the teams to understand which tasks are more important or require more time, thereby helping teams plan their time and prioritize tasks. Having a robust task management system helps in flexible planning and successful execution of projects. This has driven the adoption of task management software among enterprises.

The following are the major objectives of the study

- To describe and forecast the task management software market, in terms of value, by business function, component (software and services), deployment types, organization size, industry verticals and regions.

- To describe and forecast the task management software market, in terms of value, by regionAsia Pacific (APAC), Europe, North America, Middle East and Africa (MEA), and Latin America along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of task management software

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the task management software ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the reed task management software market

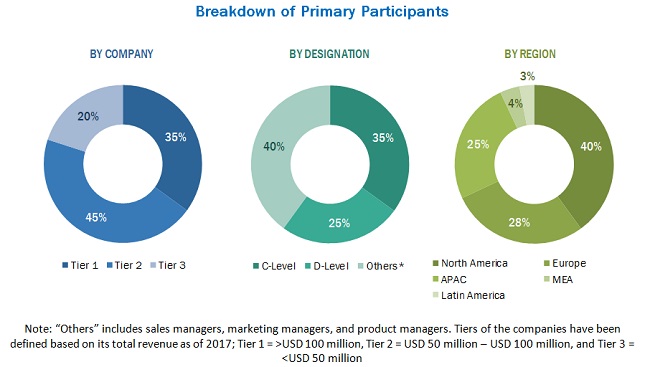

During this research study, major players operating in the task management software market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

The task management market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the task management software market are Microsoft (US), Upland Software (US), Atlassian (Australia), Pivotal Software (US), RingCentral (US), Azendoo (France), Asana (US), Bitrix (US), Doist (Spain), monday.com (Israel), Quick Base (US), Redbooth (US), todo.vu (Australia), Teamwork.com (Ireland), Workfront (US), Wrike (US), Zoho (US), Airtable (US), Basecamp (US), Clarizen (US), Evernote Corporation (US), Inflectra (US), MeisterLabs (Austria), Smartsheet (US), and TimeCamp (US).

Please visit 360Quadrants to see the vendor listing of Best Productivity Software Quadrant

Major Market Developments

- In April 2018, Atlassian opened a new office in Bengaluru, India. The company plans to grow the office into a world-class R&D and customer support center in the coming years. This expansion is aimed at increasing the global presence of the company.

- In June 2018, Quick base launched Quick Base Automations, a new capability that enhances the ability of task management solutions by automating workflows.

- In February 2018, Workfront launched a mobile application for marketers to manage their work from cell phones with the capability to assign work, and monitor tasks and workflows.

Target Audience For Task Management Software Market

- Task management software and service vendors

- Project management software and service vendors

- Retail Information Technology (IT) solution vendors

- Consulting service providers

- Resellers

- Research organizations

- Enterprise users

- Technology providers

- Value-Added Resellers (VARs)

- Cloud service providers

- Government organizations

- Communications Service Providers (CSPs)

Report Scope

By Business Function

- Marketing

- Human Resource

- Finance

- Others (Product Development and Customer Service)

By Component

- Software

- Services

- Integration and Implementation

- Consulting

- Training and Support

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Deployment Type

- On-premises

- Cloud

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Goods

- Healthcare

- IT and Telecom

- Government

- Real Estate and Construction

- Travel and Hospitality

- Media and Entertainment

- Others (Transportation and Logistics, Automotive, and Energy and Utilities)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Critical questions which the report answers

- What are new application areas which the task management software companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the clients specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American task management software market

- Further breakdown of the European task management software market

- Further breakdown of the APAC task management software market

- Further breakdown of the MEA task management software market

- Further breakdown of the Latin American task management software market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Digital transformation initiatives that have led to improved IT systems to meet customers dynamic requirements; Need to promote collaboration among teams and improve workforce utilization; and growing usage of advance technologies such as AI and ML are the key factors driving the growth of this market.

The report segments the task management software market by business function, component, deployment type, organization size, industry vertical, and region. The software segment is estimated to dominate the task management software market in 2018, while the services segment is expected to grow at a higher CAGR during the forecast period. Task management software and services are gaining popularity, as they empower enterprises to meet their project management requirements in a cost-effective manner.

Among deployment types, the cloud deployment type is expected to gain more traction during the forecast period, as it offers the agility of on-demand resource deployment and consumption. Organizations prefer the cloud deployment type, as it delivers ease of access along with reduced capital and operational expenses.

The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at a higher CAGR during the forecast period. The growing need to reduce operational costs and streamline workflows is expected to drive the adoption of task management software and services among SMEs.

Enterprises in industry verticals such as BFSI, retail and consumer goods, healthcare, IT and telecom, government, real estate and construction, travel and hospitality, media and entertainment, and others (transportation and logistics, automotive, and energy and utilities) are rapidly adopting task management software and services to optimize their workforce utilization. The IT and telecom industry vertical is expected to hold the largest market size during the forecast period, while the retail and consumer goods industry vertical would present prospective opportunities for task management software vendors during the forecast period.

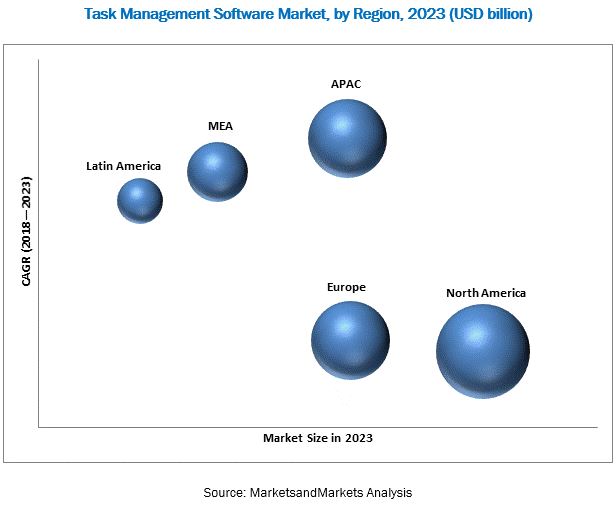

The market has also been segmented into 5 major geographic regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America, to provide a region-specific analysis. North America is expected to hold the largest market size during the forecast period, due to the presence of a large number of vendors in the region. The region is also one of the most advanced in terms of technology adoption and IT infrastructure optimization.

The task management software helps organizations with workforce optimization and project management. Enterprises adopting the task management software usually face security and privacy issues. These enterprises possess confidential data that needs to be protected to avoid data breaches and thefts, as such incidents may affect the reputation of the enterprises. These could be the restraining factors for the growth of the task management software market.

Need to promote collaboration among teams and improve workforce utilization drive the growth of task management software market

IT and Telecom

The IT and telecom is the most significant industry vertical in terms of increasing the growth of the task management software market. The telecom companies are always eager to embrace digitalization opportunities. Enterprises in this vertical are modernizing their legacy applications to improve the digital customer experience. Moreover, the growing number of subscribers and the increasing adoption of various media and digital technologies are creating the need to optimize the resources for fulfilling customers demands in a timely manner. The rapid advancements in cloud computing and Internet of Things (IoT) have led the telcos to leverage their existing infrastructures and complement these technologies. The software systems needed in these enterprises need to be highly robust and reliable, as their failure can lead to revenue loss. Both IT and telecom enterprises have witnessed a high adoption of the task management software for effectively managing their projects and business operations. The task management software enables teams to work and collaborate better and make their projects a success.

Banking, Financial services, and Insurance

The BFSI industry vertical collectively includes organizations in banking services, such as core banking, corporate, retail, investment, private, and cards. Financial services include payment gateways, stockbroking, and mutual funds; whereas, insurance services cover both life and general insurance policies. The entry of FinTech companies has caused a lot of disruption in this industry vertical. To keep up with these disruptions, the traditional banking companies are digitalizing their services. A large number of enterprises in the BFSI vertical are undergoing digital transformation projects and make use of the task management software to keep track of their transformation projects. The IT teams working on the digital transformation follow Agile or DevOps methodologies. The success of these methodologies depends on the effective collaboration of cross-functional teams. Using the task management software enables this collaboration. Other activities such as building new branches, deployment of online and telephone banking, card services, risk management, ATM networks, and call center services are made up of a series of tasks. Using the task management software helps the BFSI staff carry out activities in an organized manner with better clarity.

Retail and Consumer goods

Retail is one of the fastest-growing industry verticals, due to the rising consumer purchasing power. With the proliferation of the online market, retailers are adopting innovative technologies, such as cloud computing, big data analytics, digital stores, and social media marketing. With the ever-increasing competition in this industry vertical, customer experience proves to be a very vital differentiating factor among the array of online shopping options. Retailers risk losing out on their users because of negative customer experiences. The task management software allows enterprises to manage their stores tasks intelligently while also providing real-time visibility into the ongoing tasks. It empowers staff with effective retail applications that remove manual work and automate shelf-replenishment, inventory checking, and returns processing. The task management software gives control over shop floors and the back-of-store operations and ensures that tasks are completed at the right time by the right person. This leads to a positive customer experience. These factors have led the retail and consumer goods industry vertical to adopt task management software for their business operations.

Healthcare

The healthcare industry vertical is inclusive of hospitals, health clinics, medical and dental practice centers, healthcare equipment and services, pharmaceuticals, biotechnology, and life sciences organizations. The increasing adoption of business applications in this industry vertical has empowered enterprises to run their business processes smoothly and improve their operational efficiencies. Enterprises in this industry vertical are implementing and adopting new technologies to provide better services to patients. The implementation of IT infrastructures in the healthcare industry vertical helps manage the health information in computerized systems. These systems need to be strong and robust, as their failure could lead to loss of patient information. It must be ensured that sensitive patient information is secured from malicious attacks. Therefore, the task management software helps healthcare institutions in task delegation, reporting, and communication between team members. The adoption of the task management software is increasing among the healthcare enterprises, and software providers are working toward making their offerings scalable, user-friendly, reliable, adaptable, and secure enough to match the ever-changing medical scenario.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What should be your go-to-market strategy to expand the reach into developing countries across APAC, MEA, and Latin America?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The advancements and applications of Machine Learning (ML), analytics, and Artificial intelligence (AI) in task management are expected to provide great opportunities to the vendors of task management software and service. The major vendors offering task management software and services across the globe include Microsoft (US), Upland Software (US), Atlassian (Australia), Pivotal Software (US), RingCentral (US), Azendoo (France), Asana (US), Bitrix (US), Doist (Spain), monday.com (Israel), Quick Base (US), Redbooth (US), todo.vu (Australia), Teamwork.com (Ireland), Workfront (US), Wrike (US), Zoho (US), Airtable (US), Basecamp (US), Clarizen (US), Evernote Corporation (US), Inflectra (US), MeisterLabs (Austria), Smartsheet (US), and TimeCamp (US). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their offerings in the global task management software market.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Task Management Software Market

4.2 Market By Industry Vertical (2018 vs 2023)

4.3 Market Share Across Major Regions

4.4 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need Among Enterprises to Centrally Manage and Track Tasks

5.2.1.2 Need to Promote Collaboration Among Teams and Improve Workforce Utilization

5.2.2 Restraints

5.2.2.1 Security Concerns Among Enterprises Regarding Cloud-Based Task Management Software

5.2.3 Opportunities

5.2.3.1 Recent Advancements in the Areas of AI and ML

5.2.3.2 Integration of Task Management Software With Other Third-Party Tools

5.2.4 Challenges

5.2.4.1 Presence of Many Open Source Or Free Vendors in the Task Management Software Market

5.2.4.2 Lack of Awareness Among Enterprises About Task Management Software

5.3 Industry Trends

5.3.1 Use Case 1: Meisterlabs

5.3.2 Use Case 2: Quick Base

5.3.3 Use Case 3: Quick Base

6 Task Management Software Market, By Business Function (Page No. - 39)

6.1 Introduction

6.2 Marketing

6.3 Human Resource

6.4 Finance

6.5 Others

7 Market By Component (Page No. - 45)

7.1 Introduction

7.2 Software

7.3 Services

7.3.1 Integration and Implementation

7.3.2 Consulting

7.3.3 Training and Support

8 Task Management Software Market, By Deployment Type (Page No. - 52)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Market By Organization Size (Page No. - 56)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Task Management Software Market, By Industry Vertical (Page No. - 60)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Retail and Consumer Goods

10.4 Healthcare

10.5 IT and Telecom

10.6 Government

10.7 Real Estate and Construction

10.8 Travel and Hospitality

10.9 Media and Entertainment

10.10 Others

11 Task Management Software Market, By Region (Page No. - 70)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.2 Canada

11.3 Europe

11.3.1 United Kingdom

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 Japan

11.4.3 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Kingdom of Saudi Arabia

11.5.2 United Arab Emirates

11.5.3 South Africa

11.5.4 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.2 Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 93)

12.1 Overview

12.2 Competitive Scenario

12.2.1 New Product Launches/Service Launches/Upgradations

12.2.2 Business Expansions

12.2.3 Acquisitions

12.2.4 Partnerships

13 Company Profiles (Page No. - 101)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Introduction

13.2 Microsoft

13.3 Upland Software

13.4 Atlassian

13.5 Pivotal Software

13.6 Ringcentral

13.7 Azendoo

13.8 Asana

13.9 Bitrix Inc.

13.10 Doist

13.11 Monday.Com

13.12 Quick Base

13.13 Redbooth

13.14 Todo.Vu

13.15 Teamwork.Com

13.16 Workfront

13.17 Wrike

13.18 Zoho

13.19 Airtable

13.20 Basecamp

13.21 Clarizen

13.22 Evernote Corporation

13.23 Inflectra

13.24 Meisterlabs

13.25 Smartsheet

13.26 Timecamp

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 147)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (69 Tables)

Table 1 Currency Conversion

Table 2 Task Management Software Market Size, By Business Function, 20162023 (USD Million)

Table 3 Marketing: Market Size By Region, 20162023 (USD Million)

Table 4 Human Resource: Market Size By Region, 20162023 (USD Million)

Table 5 Finance: Market Size By Region, 20162023 (USD Million)

Table 6 Others: Market Size By Region, 20162023 (USD Million)

Table 7 Task Management Software Market Size, By Component, 20162023 (USD Million)

Table 8 Software: Market Size By Region, 20162023 (USD Million)

Table 9 Services: Market Size By Type, 20162023 (USD Million)

Table 10 Services: Market Size By Region, 20162023 (USD Million)

Table 11 Integration and Implementation Market Size, By Region, 20162023 (USD Million)

Table 12 Consulting Market Size, By Region, 20162023 (USD Million)

Table 13 Training and Support Market Size, By Region, 20162023 (USD Million)

Table 14 Task Management Software Market Size, By Deployment Type, 20162023 (USD Million)

Table 15 Cloud: Market Size By Region, 20162023 (USD Million)

Table 16 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 17 Task Management Software Market Size, By Organization Size, 20162023 (USD Million)

Table 18 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 19 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 20 Market Size By Industry Vertical, 20162023 (USD Million)

Table 21 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 22 Retail and Consumer Goods: Market Size By Region, 20162023 (USD Million)

Table 23 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 24 IT and Telecom: Market Size By Region, 20162023 (USD Million)

Table 25 Government: Market Size By Region, 20162023 (USD Million)

Table 26 Real Estate and Construction: Market Size By Region, 20162023 (USD Million)

Table 27 Travel and Hospitality: Market Size By Region, 20162023 (USD Million)

Table 28 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 29 Others: Market Size By Region, 20162023 (USD Million)

Table 30 Task Management Software Market Size, By Region, 20162023 (USD Million)

Table 31 North America: Market Size By Country, 20162023 (USD Million)

Table 32 North America: Market Size By Component, 20162023 (USD Million)

Table 33 North America: Market Size By Business Function, 20162023 (USD Million)

Table 34 North America: Market Size By Service, 20162023 (USD Million)

Table 35 North America: Market Size By Deployment Type, 20162023 (USD Million)

Table 36 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 37 North America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 38 Europe: Task Management Software Market Size, By Country, 20162023 (USD Million)

Table 39 Europe: Market Size By Business Function, 20162023 (USD Million)

Table 40 Europe: Market Size By Component, 20162023 (USD Million)

Table 41 Europe: Market Size By Service, 20162023 (USD Million)

Table 42 Europe: Market Size By Deployment Type, 20162023 (USD Million)

Table 43 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 44 Europe: Market Size By Industry Vertical, 20162023 (USD Million)

Table 45 Asia Pacific: Task Management Software Market Size, By Country, 20162023 (USD Million)

Table 46 Asia Pacific: Market Size By Business Function, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size By Component, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size By Deployment Type, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size By Industry Vertical, 20162023 (USD Million)

Table 52 Middle East and Africa: Task Management Software Market Size, By Country, 20162023 (USD Million)

Table 53 Middle East and Africa: Market Size By Business Function, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size By Component, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 56 Middle East and Africa: Market Size By Deployment Type, 20162023 (USD Million)

Table 57 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 58 Middle East and Africa: Market Size By Industry Vertical, 20162023 (USD Million)

Table 59 Latin America: Task Management Software Market Size, By Country, 20162023 (USD Million)

Table 60 Latin America: Market Size By Business Function, 20162023 (USD Million)

Table 61 Latin America: Market Size By Component, 20162023 (USD Million)

Table 62 Latin America: Market Size By Service, 20162023 (USD Million)

Table 63 Latin America: Market Size By Deployment Type, 20162023 (USD Million)

Table 64 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 65 Latin America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 66 New Product Launches/Service Launches/Upgradations, 20162018

Table 67 Business Expansions, 20162018

Table 68 Acquisitions, 20172018

Table 69 Partnerships and Agreements, 20162018

List of Figures (38 Figures)

Figure 1 Task Management Software Market Segmentation

Figure 2 Regional Scope

Figure 3 Task Management Software Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Task Management Software Market: Assumptions

Figure 9 Market is Expected to Witness Substantial Growth During the Forecast Period

Figure 10 Market By Organization Size (2018)

Figure 11 Market By Deployment Type (2018)

Figure 12 Increasing Need to Improve Productivity is Expected to Drive the Task Management Software Market

Figure 13 Task Management Software Market, By Industry Vertical (2018 vs 2023)

Figure 14 North America is Estimated to Hold the Largest Market Share in 2018

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investments Over the Next 5 Years

Figure 16 Task Management Software Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Finance Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Retail and Consumer Goods Industry Vertical is Expected to Register the Highest CAGR During the Forecast Period

Figure 22 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By the Leading Players in the Task Management Software Market, 20162018

Figure 26 Market Evaluation Framework

Figure 27 Geographic Revenue Mix of the Top Market Players

Figure 28 Microsoft: Company Snapshot

Figure 29 Microsoft: SWOT Analysis

Figure 30 Upland Software: Company Snapshot

Figure 31 Upland Software: SWOT Analysis

Figure 32 Atlassian: Company Snapshot

Figure 33 Atlassian: SWOT Analysis

Figure 34 Pivotal Software: Company Snapshot

Figure 35 Pivotal Software: SWOT Analysis

Figure 36 Ring Central: Company Snapshot

Figure 37 Ringcentral: SWOT Analysis

Figure 38 Smartsheet: Company Snapshot

Growth opportunities and latent adjacency in Task Management Software Market