Target drones Market by Type (Fixed Wing, Rotary Wing), End-use Sector (Defense, Commercial), End Use (Aerial, Ground, Marine), Application, Mode of Operation, Payload Capacity, Build, Target Type, Engine Type, Speed, and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

The Target Drones Market is experiencing significant growth driven by increasing demand from various sectors, including military, defense, and commercial applications. Technological advancements, such as enhanced flight capabilities, improved accuracy, and real-time data processing, are elevating the performance of target drones, making them essential for training and testing in various scenarios. The rising focus on simulation and training exercises to improve combat readiness is further propelling market expansion. Additionally, the integration of advanced materials and automation technologies is enabling the development of more versatile and cost-effective target drones, creating new opportunities for market players and fostering innovation in this dynamic field.

Target Drones Market Size & Growth

To know about the assumptions considered for the study, Request for Free Sample Report

Target Drones Market Trends:

Driver: Increased emphasis on enhanced military training

Restraint: Lack of skilled and trained personnel

Target drones do not carry an onboard pilot, and thus, human error in operating these drones may have severe implications. As target drones rely more on computer technology, autopilot, and radio transmission as compared to conventional target aircraft, expert knowledge is required to operate and control them.

Target drones need to exhibit greater maneuverability to simulate a real war environment, and thus, require skilled personnel for remote piloting. Several drone accidents occur owing to poor operator control. Currently, efforts are being made to reduce such mishaps by improving the autonomy of these drones and reducing the degree of human operator involvement. Various training programs are also being undertaken to train pilots for the precise operation of drones, thereby reducing the probability of drone accidents.

Opportunity: Full-scale conversion of target drones for simulation of a war scenario

Challenges: Lack of sustainable power sources to improve endurance of drones

Target drones Market Ecosystem:

The key stakeholders in the target drones market ecosystem include companies which provide platforms and soldier systems. The major influencers in this market are investors, funders, academic researchers, integrators, service providers, and licencing agencies.

Target Drones Market Segmentation

Combat training segment held largest market share in terms of value in target drones market

Reconnaissance is anticipated to grow at highest CAGR during forecast period

The reconnaissance application segment is expected to grow at the highest CAGR of 9.8% during the forecast period. Reconnaissance involves the subtasks of avoiding obstacles or no-fly-zones, reaching the close vicinity of a specific target, avoiding inter agent collision, and forming equilateral formation around a target. Target drones performing such tasks usually fly at a constant speed.

Some target drones used for reconnaissance applications are the RQ-21A Blackjack from the Boeing Company and BQM-74 from Northrop Grumman Corporation, among others.

Target Drones Market Regional Analysis

In terms of value, North America led the target drones market

To know about the assumptions considered for the study, download the pdf brochure

Top Target Drones Companies - Key Market Players

Target Drones Market Report Scope

|

Report Metric |

Details |

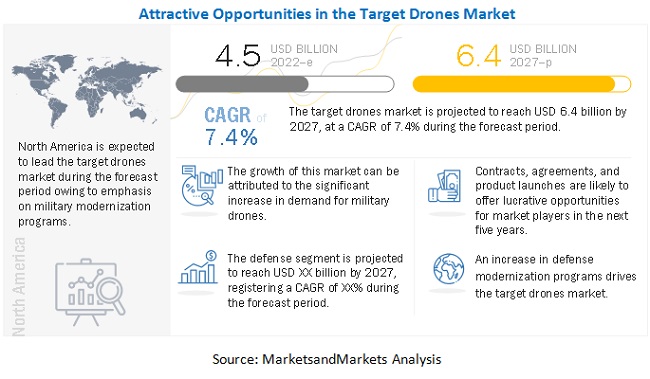

| Estimated Market Size | USD 4.5 Biilion in 2022 |

| Projected Market Size | USD 6.4 Billion by 2027 |

| Growth Rate (CAGR) | 7.4% |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Engine Type, End-Use Sector, Build, End Use, Target Type, Application, Mode Of Operation, Speed, Payload Capacity, Type |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World |

|

Companies covered |

QinetiQ Group plc (UK), Kratos Defense & Security Solutions, Inc. (US), Airbus Group (Netherlands), Northrop Grumman Corporation (US), and Boeing Company (US) among others |

This research report categorizes the Target drones Market based on Engine Type, End-Use Sector, Build, End Use, Target Type, Application, Mode Of Operation, Speed, Payload Capacity, Type, and Region.

By Engine Type

- IC

- Jet

- Others

By End-Use Sector

- Defense

- Commercial

By Build

- New Build

- Converted

By End Use

- Aerial Targets

- Ground Targets

- Marine Targets

By Target Type

- Full-Scale

- Sub-Scale

- Free-Flying

- Towing

- Sporting

By Application

- Combat Training

- Target & Decoy

- Reconnaissance

- Target Identification

- Target Acquisition

By Mode Of Operation

- Autonomous

- Remotely Piloted

- Optionally Piloted

By Payload Capacity

- High (>40 Kg)

- Medium (20 Kg to 40 Kg)

- Low (<20 Kg)

By Type

- Fixed Wing

- Rotary Wing

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Rest of the World

Recent Developments

- In March 2022, Qinteiq received a contract from the Japan Ground Self-Defense Force for providing Banshee Jet 80+ unmanned aerial vehicle targets.

- In February 2022, Kratos Defense & Security Solutions Inc. received a contract worth $20 million from an international customer for providing an unmanned aerial target drone system and related services.

- In February 2022, Kratos Defense & Security Solutions Inc. received a contract worth $14 million from an international customer for providing logistics support, spares, consumables, and support.

- In December 2021, Kratos Defense & Security Solutions received a contract worth $5O million for providing 65 BQM – 177A subsonic aerial targets (SSATs) from the Naval Air Systems Command (NAVAIR).

- In November 2021, The Boeing Company received a contract worth $49.7 million from the United States Air Force for converting retired F-16 fighters into unmanned aerial vehicles.

- In May 2021, Northrop Grumman Corporation received a contract worth $55.4 million from the U.S. Navy for providing 18 GQM-163 A “Coyote” supersonic sea-skimming target vehicles.

Frequently Asked Questions (FAQ):

What is the current size of the target drones market?

The global target drones market size is projected to grow from USD 4.5 billion in 2022 to USD 6.4 billion by 2027, at a CAGR of 7.4% from 2022 to 2027

Who are the winners in the target drones market?

QinetiQ Group plc (UK), Kratos Defense & Security Solutions, Inc. (US), Airbus Group (Netherlands), Northrop Grumman Corporation (US), and Boeing Company (US) are some of the winners in the market.

What are some of the technological advancements in the market?

Target scoring systems, converted drones, electronic countermeasures and chaff dispensers are some of the technological advancements in the target drones market.

What are the factors driving the growth of the market?

The target drones market is being driven by factors such as rising investments into military modernization. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

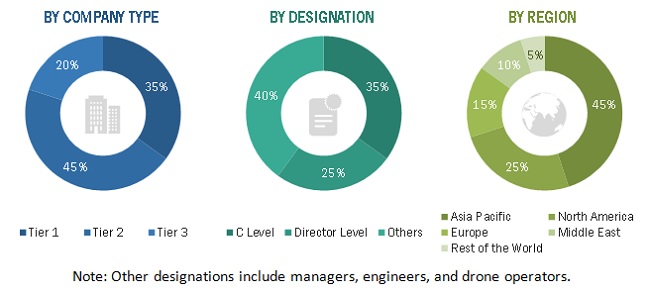

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the target drones market. Primary sources included industry experts from the core and related industries as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess prospects for the growth of the market during the forecast period.

Secondary Research:

The share of companies in the target drones market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the target drones market included financial statements of companies offering and developing target drones products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the target drones market, which was further validated by primary respondents.

Primary Research:

Extensive primary research was conducted after obtaining information about the current scenario of the target drones market through secondary research. Several primary interviews were conducted with market experts from both, the demand- and supply-side across 5 major regions, namely, North America, Europe, Asia Pacific, the Middle East and Africa and Rest of the World. This primary data was collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

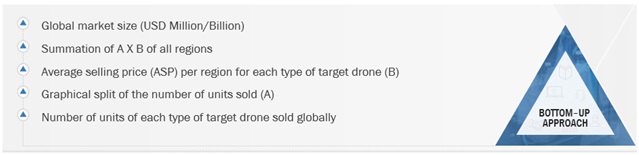

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the target drones market.

The research methodology that was used to estimate the size of the target drones market includes the following details.

Key players in the target drones market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders such as chief executive officers, directors, and marketing executives of the leading companies operating in the target drones market.

All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the target drones market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the target drones market from the market size estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both, top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the size of the target drones market based on engine type, end-use sector, build, end use, target type, application, mode of operation, speed, payload capacity, type, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and R&D activities in the market

- To estimate the procurement of target drones by different countries to track the market size of target drones

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the target drones market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Market analysis of additional countries (subject to the data availability)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Target drones Market

We produce turbojet engines (200-1500 N thrust), turboprop and turboshaft engines (180 kW of power), and APU for helicopters and trainers. We are looking for UAV market that mainly include target drones, missiles, and fast moving UAVs.