Security System Integrators Market by Security Type (Application, Endpoint, Network, Data, Risk and Compliance Management, and Business Continuity and Disaster Recovery), Organization Size, Industry Vertical, and Region - Global Forecast to 2022

[143 Pages Report] The security system integrators market was valued at USD 8.89 Billion in 2016 and is projected to reach USD 14.72 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 8.6%. The base year considered for the study is 2016, and the market size is calculated from 2017 to 2022.

The objective of the report is to define, describe, and forecast the security system integrators market by security type, organization size, industry vertical, and region. The report analyzes the opportunities in the market for stakeholders by identifying the high-growth segments of the market. Furthermore, the report profiles the key players of the market and comprehensively analyzes their core competencies, such as new product launches, acquisitions, partnerships, agreements, and collaborations. Moreover, the report also covers detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

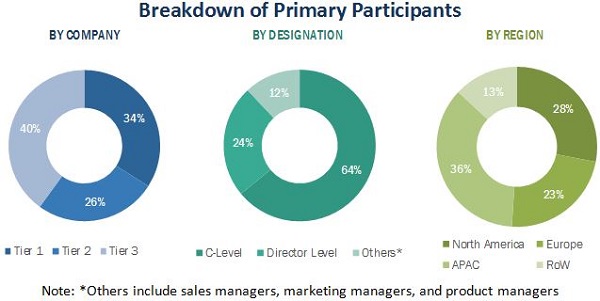

The research methodology used to estimate and forecast the security system integrators market begins with capturing data from various industry associations and consortiums, such as International Information System Security Certification Consortium (ISC)2, Cloud Security Alliance (CSA), RSA Security, SANS Institute, The Open Web Application Security Project (OWASP), International Organization for Standardization (ISO), IEEE Cybersecurity, SC Magazine, and other sources, including company financials, journals, press releases, paid databases, and annual reports. The bottom-up procedure was employed to arrive at the overall market size from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, executives, and cybersecurity technologists. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The security system integrators market comprises major service providers, such as Cisco Systems, Inc. (US), FireEye, Inc. (US), Hewlett Packard Enterprise (HPE) Development LP (US), International Business Machines (IBM) Corporation (US), McAfee, LLC (US), Accenture BCR (Ireland), Cognizant Technology Solutions U.S. Corporation (US), Deloitte Touche Tohmatsu Limited (US), HCL Technologies Limited (India), Wipro Limited (India), CIPHER Security LLC (US), Integrity360 (Ireland), Vandis, Inc. (US), Anchor Technologies, Inc. (US), and Innovative Solutions Co (Saudi Arabia). The stakeholders include cybersecurity vendors, government agencies, consulting firms, Independent Software Vendors (ISVs), Value-Added Resellers (VARs), and Information Technology (IT) service providers.

Key Target Audience For Security System Integrators Market

- Regulatory bodies

- Security solution vendors

- Security system integrators

- Network solution providers

- ISVs

- Information security consulting firms

- IT service providers

- VARs

- Managed Security Service Providers (MSSPs)

The study answers several questions for the stakeholders; primarily, which market segments to focus on in the next 2 to 5 years for prioritizing their efforts and investments.

Scope Of the Security System Integrators Market

The research report segments the security system integrators market into the following submarkets:

By Security Type

- Application Security

- Identity and Access Management (IAM)

- Web filtering and application whitelisting

- Endpoint Security

- Antivirus/anti-malware

- Security Information and Event Management (SIEM)

- Security analytics

- Network Security

- Firewall

- Distributed Denial of Service (DDoS) mitigation

- Intrusion Detection System (IDS)/Intrusion Prevention System (IPS)

- Vulnerability management

- Data Security

- Data Loss Prevention (DLP)

- Encryption and tokenization

- Risk and compliance management

- Business continuity and disaster recovery

By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Industry Vertical:

- Aerospace and defense

- Government

- Banking, Financial Services, and Insurance (BFSI)

- IT and telecom

- Healthcare

- Retail

- Manufacturing

- Energy and utilities

- Others (education, media and entertainment, and automotive)

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American security system integrators market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

Detailed analysis was performed to get detailed information regarding the competitors in the security system integrators market, on the basis of their service offerings and business strategies. The report reviews the major players who offer security system integrators. In addition, the report will outline the findings and analysis on how well each security system integration service provider performs within the MarketsandMarkets criteria.

The security system integrators market is expected to grow from USD 9.76 Billion in 2017 to USD 14.72 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 8.6%. The major growth drivers of the market include the increased network complexities due to third-party application deployment, lack of skilled cybersecurity professionals in enterprises, growing security needs for Internet of Things (IoT), Bring Your Own Device (BYOD) trends, and increasing adoption of cloud-based services.

Major security types in cybersecurity include application security, endpoint security, network security, data security, risk and compliance management, and business continuity and disaster recovery. Among the various security types, the data security type is expected to grow at the highest CAGR during the forecast period due to the increasing adoption of encryption solutions among enterprises.

The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at a higher CAGR during the forecast period, owing to the increasing incidences of data breaches on enterprise cloud applications, as well as, rise in the sophistication level of cyber-attacks. However, the large enterprises segment is estimated to account for a larger share of the security system integrators market in 2017. Large enterprises were the early adopters of security system integration services, as they have geographically dispersed and complex IT infrastructures.

Security system integrators have been adopted by various verticals, including the aerospace and defense; government; Banking, Financial Services, and Insurance (BFSI); IT and telecom; healthcare; retail; manufacturing; energy and utilities; and others (education, media and entertainment, and automotive). The government vertical is witnessing growth in advanced cyber threats, causing harm to valuable assets of the sector. Moreover, due to the rising trend of eGovernance, the cybersecurity domain in the government vertical is expected to grow at the highest CAGR during the forecast period.

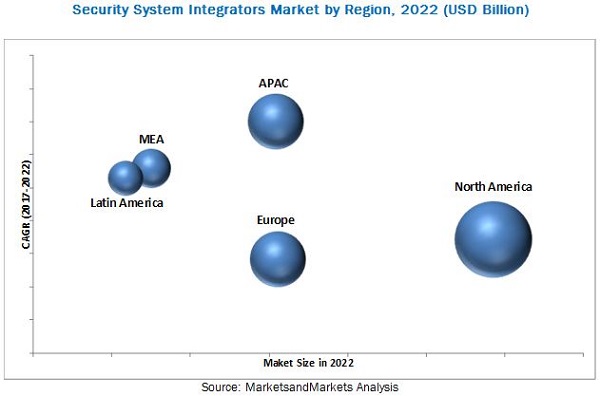

The global security system integrators market has been segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. The North American region, followed by Europe, is estimated to become the largest revenue-generating region for security system integrators in 2017. This is mainly because in the developed economies of the US and Canada, there is a high focus on innovations obtained from Research and Development (R&D), and technology. The APAC region is expected to be the fastest-growing region in the market. The growth in this region is primarily driven by the rapid digital transformation of the region, high adoption of cloud and web-based applications, and increasing BYOD trends.

The major restraint for the security system integrators is the difficulty in expanding their business at a global scale. The service providers have business restricted to their geographical presence only, and to expand their business in other regions, they need to open new offices and hire more workforce. These business complexities restrain their growth to generate higher revenue.

The major security system integrators market include Cisco Systems, Inc. (US), FireEye, Inc. (US), Hewlett Packard Enterprise (HPE) Development LP (US), International Business Machines (IBM) Corporation (US), McAfee, LLC (US), Accenture BCR (Ireland), Cognizant Technology Solutions U.S. Corporation (US), Deloitte Touche Tohmatsu Limited (US), HCL Technologies Limited (India), Wipro Limited (India), CIPHER Security LLC (US), Integrity360 (Ireland), Vandis, Inc. (US), Anchor Technologies, Inc. (US), and Innovative Solutions Co (Saudi Arabia). The strategy of partnerships, agreements, and collaborations is the key strategy majorly adopted by the market players to offer feature-rich products and services to their customers and penetrate deep into uncatered regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Security System Integrators Market

4.2 Market By Security Type, 20172022

4.3 Market By Organization Size, 20172022

4.4 Market By Industry Vertical, 20172022

4.5 Market By Region

5 Security System Integrators Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Complexities Due to High Usage of Third-Party Applications Deployment, Mergers and Acquisitions, and Globalization of Business

5.2.1.2 Lack of Skilled Cybersecurity Professionals in Enterprises

5.2.1.3 Lack of Security Solution Vendors With Complete Security Solution Suite Offerings

5.2.2 Restraints

5.2.2.1 Difficulty in Expanding Business on A Global Scale

5.2.3 Opportunities

5.2.3.1 Innovations in IoT and Development of Smart Cities Across the World

5.2.3.2 Increased Digitalization in Developing Countries

5.2.4 Challenges

5.2.4.1 Less Awareness Towards Advanced Cyber Threats

5.3 Regulatory Landscape

5.3.1 International Organization for Standardization 27001

5.3.2 European Union Model Clauses

5.3.3 Health Insurance Portability and Accountability Act

5.3.4 Federal Information Security Management Act

5.3.5 SarbanesOxley Act

5.3.6 GrammLeachBliley Act

5.3.7 General Data Protection Regulation

5.3.8 Cloud Security Alliance Security, Trust, and Assurance Registry (CSA STAR)

5.4 Market Ecosystem

6 Security System Integrators Market, By Security Type (Page No. - 38)

6.1 Introduction

6.2 Application Security

6.2.1 Identity and Access Management

6.2.2 Web Filtering and Application Whitelisting

6.3 Endpoint Security

6.3.1 Antivirus/Anti-Malware

6.3.2 Security Information and Event Management

6.3.3 Security Analytics

6.4 Network Security

6.4.1 Firewall

6.4.2 Distributed Denial of Service Mitigation

6.4.3 Intrusion Detection System/Intrusion Prevention System

6.4.4 Vulnerability Management

6.5 Data Security

6.5.1 Data Loss Prevention

6.5.2 Encryption and Tokenization

6.6 Risk and Compliance Management

6.7 Business Continuity and Disaster Recovery

7 Security System Integrators Market, By Organization Size (Page No. - 56)

7.1 Introduction

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises

8 Market, By Industry Vertical (Page No. - 60)

8.1 Introduction

8.2 Aerospace and Defense

8.3 Government

8.4 Banking, Financial Services, and Insurance

8.5 IT and Telecom

8.6 Healthcare

8.7 Retail

8.8 Manufacturing

8.9 Energy and Utilities

8.10 Others

9 Security System Integrators Market, By Region (Page No. - 71)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 92)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 Partnerships, Agreements, and Collaborations

10.3.2 New Service Launches

10.3.3 Mergers and Acquisitions

10.3.4 Business Expansions

11 Company Profiles (Page No. - 99)

(Business Overview, Services Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Cisco Systems

11.2 HPE

11.3 IBM

11.4 Fireeye

11.5 Mcafee

11.6 HCL Technologies

11.7 Accenture

11.8 Cognizant

11.9 Deloitte

11.10 Wipro

11.11 Cipher

11.12 Integrity360

11.13 Vandis

11.14 Anchor Technologies

11.15 Innovative Solutions

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 135)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (76 Tables)

Table 1 Security System Integrators Market Size, By Security Type, 20152022 (USD Million)

Table 2 Application Security: Market Size By Product, 20152022 (USD Million)

Table 3 Application Security: Market Size By Region, 20152022 (USD Million)

Table 4 Identity and Access Management Market Size, By Region, 20152022 (USD Million)

Table 5 Web Filtering and Application Whitelisting Market Size, By Region, 20152022 (USD Million)

Table 6 Endpoint Security: Market Size By Product, 20152022 (USD Million)

Table 7 Endpoint Security: Market Size By Region, 20152022 (USD Million)

Table 8 Antivirus/Anti-Malware Market Size, By Region, 20152022 (USD Million)

Table 9 Security Information and Event Management Market Size, By Region, 20152022 (USD Million)

Table 10 Security Analytics Market Size By Region, 20152022 (USD Million)

Table 11 Network Security: Market Size By Product, 20152022 (USD Million)

Table 12 Network Security: Market Size By Region, 20152022 (USD Million)

Table 13 Firewall Market Size, By Region, 20152022 (USD Million)

Table 14 Distributed Denial of Service Mitigation Market Size, By Region, 20152022 (USD Million)

Table 15 Intrusion Detection System/Intrusion Prevention System Market Size, By Region, 20152022 (USD Million)

Table 16 Vulnerability Management Market Size, By Region, 20152022 (USD Million)

Table 17 Data Security: Security System Integrators Market Size, By Product, 20152022 (USD Million)

Table 18 Data Security: Market Size By Region, 20152022 (USD Million)

Table 19 Data Loss Prevention Market Size, By Region, 20152022 (USD Million)

Table 20 Encryption and Tokenization Market Size, By Region, 20152022 (USD Million)

Table 21 Risk and Compliance Management: Market Size By Region, 20152022 (USD Million)

Table 22 Business Continuity and Disaster Recovery: Market Size By Region, 20152022 (USD Million)

Table 23 Security System Integrators Market Size, By Organization Size, 20152022 (USD Million)

Table 24 Large Enterprises: Market Size By Region, 20152022 (USD Million)

Table 25 Small and Medium-Sized Enterprises: Market Size By Region, 20152022 (USD Million)

Table 26 Market Size, By Industry Vertical, 20152022 (USD Million)

Table 27 Aerospace and Defense: Market Size By Region, 20152022 (USD Million)

Table 28 Government: Market Size By Region, 20152022 (USD Million)

Table 29 Banking, Financial Services, and Insurance: Market Size By Region, 20152022 (USD Million)

Table 30 IT and Telecom: Security System Integrators Market Size, By Region, 20152022 (USD Million)

Table 31 Healthcare: Market Size By Region, 20152022 (USD Million)

Table 32 Retail: Security Market Size By Region, 20152022 (USD Million)

Table 33 Manufacturing: Market Size By Region, 20152022 (USD Million)

Table 34 Energy and Utilities: Market Size By Region, 20152022 (USD Million)

Table 35 Others: Market Size By Region, 20152022 (USD Million)

Table 36 Market Size, By Region, 20152022 (USD Million)

Table 37 North America: Security Market Size By Security Type, 20152022 (USD Million)

Table 38 North America: Application Security Market Size, By Product, 20152022 (USD Million)

Table 39 North America: Endpoint Security Market Size, By Product, 20152022 (USD Million)

Table 40 North America: Network Security Market Size, By Product, 20152022 (USD Million)

Table 41 North America: Data Security Market Size, By Product, 20152022 (USD Million)

Table 42 North America: Security System Integrators Market Size, By Organization Size, 20152022 (USD Million)

Table 43 North America: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 44 Europe: Market Size, By Security Type, 20152022 (USD Million)

Table 45 Europe: Application Security Market Size, By Product, 20152022 (USD Million)

Table 46 Europe: Endpoint Security Market Size, By Product, 20152022 (USD Million)

Table 47 Europe: Network Security Market Size, By Product, 20152022 (USD Million)

Table 48 Europe: Data Security Market Size, By Product, 20152022 (USD Million)

Table 49 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 50 Europe: Security System Integrators Market Size, By Industry Vertical, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Security Type, 20152022 (USD Million)

Table 52 Asia Pacific: Application Security Market Size, By Product, 20152022 (USD Million)

Table 53 Asia Pacific: Endpoint Security Market Size, By Product, 20152022 (USD Million)

Table 54 Asia Pacific: Network Security Market Size, By Product, 20152022 (USD Million)

Table 55 Asia Pacific: Data Security Market Size, By Product, 20152022 (USD Million)

Table 56 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 57 Asia Pacific: Security System Integrators Market Size, By Industry Vertical, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size, By Security Type, 20152022 (USD Million)

Table 59 Middle East and Africa: Application Security Market Size, By Product, 20152022 (USD Million)

Table 60 Middle East and Africa: Endpoint Security Market Size, By Product, 20152022 (USD Million)

Table 61 Middle East and Africa: Network Security Market Size, By Product, 20152022 (USD Million)

Table 62 Middle East and Africa: Data Security Market Size, By Product, 20152022 (USD Million)

Table 63 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 64 Middle East and Africa: Security System Integrators Market Size, By Industry Vertical, 20152022 (USD Million)

Table 65 Latin America: Market Size, By Security Type, 20152022 (USD Million)

Table 66 Latin America: Application Security Market Size, By Product, 20152022 (USD Million)

Table 67 Latin America: Endpoint Security Market Size, By Product, 20152022 (USD Million)

Table 68 Latin America: Network Security Market Size, By Product, 20152022 (USD Million)

Table 69 Latin America: Data Security Market Size, By Product, 20152022 (USD Million)

Table 70 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 71 Latin America: Security System Integrators Market Size, By Industry Vertical, 20152022 (USD Million)

Table 72 Market Ranking Analysis

Table 73 Partnerships, Agreements, and Collaborations, 20152017

Table 74 New Service Launches, 20152017

Table 75 Mergers and Acquisitions, 20152017

Table 76 Business Expansions, 20152017

List of Figures (35 Figures)

Figure 1 Global Market Segmentation

Figure 2 Global Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 North America is Estimated to Hold the Largest Market Share in 2017

Figure 7 Network Security Segment is Expected to Contribute the Largest Share in the Security System Integrators Market in 2017

Figure 8Market is Expected to Witness Remarkable Growth Opportunities Due to the Rising Complexities of Networks, Globalization, and Sophistication of Cyber-Attacks

Figure 9 Data Security Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 Small and Medium-Sized Enterprises Segent is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 11 Government Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Market has Immense Opportunities for Growth in the Asia Pacific Region

Figure 13 Market Drivers, Restraints, Opportunities, and Challenges

Figure 14 Market Ecosystem

Figure 15 Data Security Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 17 Government Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 North America: Market Snapshot

Figure 20 Asia Pacific: Market Snapshot

Figure 21 Key Developments By the Leading Players in the Security System Integrators Market for 20152017

Figure 22 Cisco Systems: Company Snapshot

Figure 23 Cisco Systems: SWOT Analysis

Figure 24 HPE: Company Snapshot

Figure 25 HPE: SWOT Analysis

Figure 26 IBM: Company Snapshot

Figure 27 IBM: SWOT Analysis

Figure 28 Fireeye: Company Snapshot

Figure 29 Fireeye: SWOT Analysis

Figure 30 Mcafee: SWOT Analysis

Figure 31 HCL Technologies: Company Snapshot

Figure 32 Accenture: Company Snapshot

Figure 33 Cognizant: Company Snapshot

Figure 34 Deloitte: Company Snapshot

Figure 35 Wipro: Company Snapshot

Growth opportunities and latent adjacency in Security System Integrators Market