Surgical Retractors Market by Product (Hand-held, Self-retaining, Wire), Design (Fixed, Angled, Elevated), Application (Abdominal, Cardiothoracic, Orthopedic, Urological, Aesthetic), End User (Hospitals, Fertility Centers, ASCs) & Region - Global Forecasts to 2027

Market Growth Outlook Summary

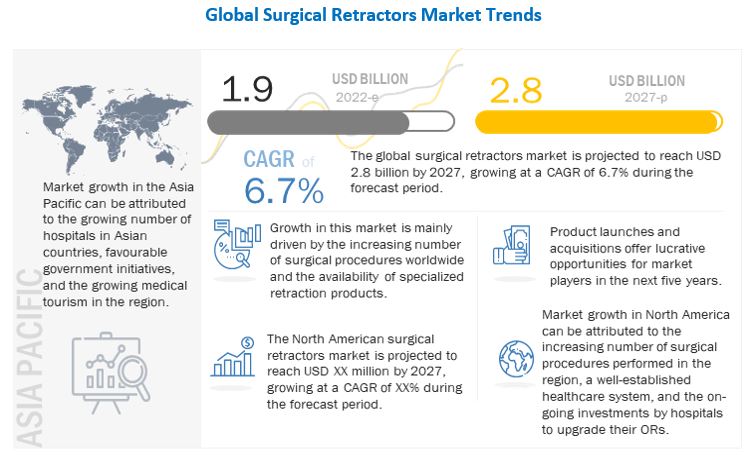

The global surgical retractors market growth forecasted to transform from USD 1.9 billion in 2022 to USD 2.8 billion by 2027, driven by a CAGR of 6.7%. Key drivers for this growth include the rising prevalence of chronic diseases, an aging population, and an increase in the number of surgical procedures. The market faces challenges such as a shift towards minimally invasive surgeries and a shortage of skilled surgeons. North America holds the largest market share, driven by a well-established healthcare system and high surgical volumes. Major players include Becton, Dickinson and Company, Johnson & Johnson, and Medtronic, among others. Opportunities for expansion are particularly evident in emerging markets like China, Brazil, and India, where healthcare infrastructure is rapidly improving and medical tourism is on the rise.

To know about the assumptions considered for the study, Request for Free Sample Report

Surgical Retractors Market Dynamics

Driver: Increasing number of surgical procedures worldwide

Surgical retractors are widely used in open surgeries, endoscopy, dermatology, ophthalmology, and dentistry. Over the years, the affordability and accessibility of surgical care have increased, leading to a significant rise in the number of surgical procedures performed utilizing surgical retractors. The increasing prevalence of chronic diseases and a subsequent rise in surgical procedures have increased the demand for advanced surgical equipment, including surgical retractors.

Restraint: Increased preference for minimally invasive surgeries

In the past decade, there has been a significant increase in the preference for minimally invasive and non-invasive surgical procedures over traditional surgical procedures. Minimally invasive surgeries offer several benefits over open surgical procedures, such as shorter hospitalization times, reduced postoperative complications, faster recovery times, higher efficacy, and reduced pain. These procedures are also more economical than traditional surgical procedures. Minimally invasive surgical procedures utilize uniquely designed surgical instruments and specialized visualization technologies (such as catheter-based cameras and guidewires) that eliminate the use of surgical retractors. Thus, the growing preference for minimally invasive and non-invasive aesthetic procedures is expected to negatively affect the revenue growth for surgical retractor devices during the study period.

Opportunity: High growth opportunities in emerging markets

Emerging countries (such as China, Brazil, Mexico, and India) present significant growth opportunities for players in the market. The demand for surgical retractor devices in these countries is increasing owing to the rapid growth in healthcare infrastructure, increasing public and private healthcare expenditure, and growth in medical tourism. Additionally, the rising number of well-skilled surgeons, coupled with a sharp rise in target surgical procedures across these countries, is also poised to contribute to overall demand growth. Other emerging countries are also witnessing rapid modernization of their healthcare facilities and the expansion of healthcare infrastructure. This factor is contributing to the increased procurement of medical devices and surgical instruments.

Rising medical tourism in emerging countries, due to the low cost of surgical treatment options, also presents new growth avenues for surgical retractor providers.

Challenge: Shortage of surgeons

The growth in the geriatric population increases the burden on the medical system. Older individuals require more medical services and care as compared to their younger counterparts. As the application of the surgical retractor during surgery is very complex, it requires skilled surgeons and physicians for effective utilization. Currently, the lack of skilled surgeons, both in developed and developing economies, is one of the major factors limiting the adoption of surgical retractor devices. Additionally, with an aging population and an increase in the incidence of chronic diseases, patients will require more surgical procedures over their lifetime. The increasing life span of the population is also boosting the need for surgical procedures. While the demand for surgeons is steadily increasing, the supply of future surgeons is not rising at the same rate. Therefore, this shortage is likely to reduce the number of surgeries performed per year, negatively impacting the use of surgical retractors.

The blade/elevated-tip retractors segment is expected to register the highest CAGR in the surgical retractors industry during the forecast period.

Based on design, the surgical retractors market is segmented into fixed/flat-frame retractors, angled/curved-frame retractors, and blade/elevated-tip retractors. The blade/elevated-tip retractors segment is expected to register the highest growth during the forecast period. This is mainly due to the improved traction and strong grip offered by blade and elevated-tip retractors.

By usage, the tissue handling and dissection segment held the largest share of the surgical retractors industry

Based on usage, the surgical retractors market is segmented into tissue handling and dissection and fluid swabbing. The large share of the tissue handling and dissection segment can be attributed to the increased handling of tissues, organs, and ligaments around the surgical area with the increasing number of surgical procedures globally.

The abdominal surgeries segment accounted for the largest share of the surgical retractors industry by application.

Based on application, the surgical retractors market is segmented into abdominal surgeries, cardiothoracic surgeries, orthopedic surgeries, obstetric and gynecological surgeries, urological surgeries, aesthetic surgeries, head, neck, and spinal surgeries, and other surgeries. The largest share of the abdominal surgeries segment can be attributed to the increased adoption of surgical retractors in abdominal surgeries and the large number of surgical procedures targeted through the abdominal area.

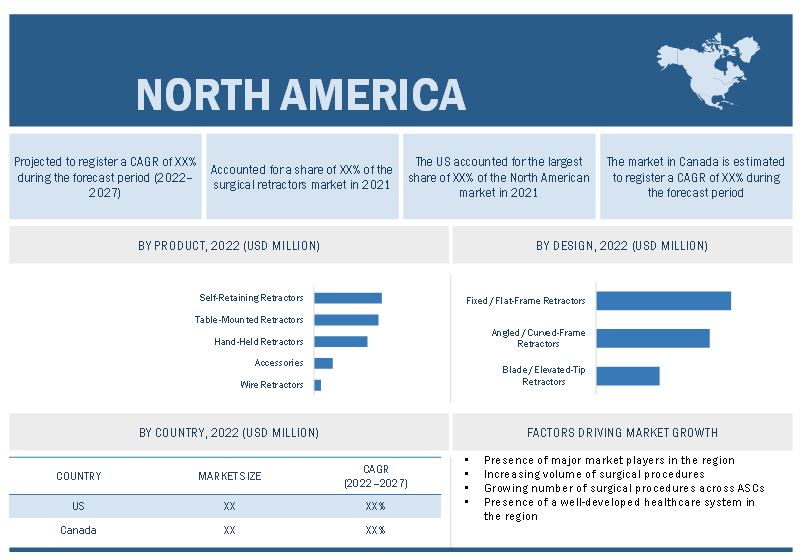

North America accounted for the largest share of the surgical retractors industry.

In 2021, North America accounted for the largest share of the surgical retractors market. Market growth in this region is characterized by the rising geriatric population and the subsequent increase in the prevalence of chronic diseases, such as arthritis, the large number of surgical procedures performed in the region, and the presence of a well-established healthcare system.

To know about the assumptions considered for the study, download the pdf brochure

Major players in the surgical retractors market are Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Integra LifeSciences (US), Teleflex Incorporated (US), Medtronic plc (US), Johnson & Johnson (US), Stryker Corporation (US), Henry Schein, Inc. (US), Sklar Surgical Instruments (US), Mediflex Surgical Products (US), Medline Industries, Inc. (US), Bausch Health Companies, Inc. (Canada), Thompson Surgical Instruments (US), BR Surgical, LLC (US), The Cooper Companies, Inc. (US), Innomed, Inc. (US), Terumo Corporation (Japan), Globus Medical, Inc. (US), Halma plc (UK), Enovis Corporation (US), CONMED Corporation (US), Olympus Corporation (Japan), Arthrex, Inc. (US), Applied Medical Resources Corporation (US), and LiNA Medical ApS (Denmark).

Scope of the Surgical Retractors Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$1.9 billion |

|

Projected Revenue Size by 2027 |

$2.8 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.7% |

|

Market Driver |

Increasing number of surgical procedures worldwide |

|

Market Opportunity |

High growth opportunities in emerging markets |

The study categorizes the surgical retractors market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Handheld Retractors

- Self-retaining Retractors

- Table-mounted Retractors

- Wire Retractors

- Accessories

By Design

- Fixed/Flat-Frame Retractors

- Angled/Curved-Frame Retractors

- Blade/Elevated-Tip Retractors

By Usage

- Tissue Handling and Dissection

- Fluid Swabbing

By Application

- Abdominal Surgeries

- Cardiothoracic Surgeries

- Orthopedic Surgeries

- Obstetric and Gynecological Surgeries

- Urological Surgeries

- Aesthetic Surgeries

- Head, Neck, and Spinal Surgeries

- Other Surgeries

By End User

- Hospitals, Clinics, and Surgical Centers

- Ambulatory Care Centers

- Maternity and Fertility Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC

- Rest of the World

Recent Developments of Surgical Retractors Industry:

- In 2022, Henry Schein acquired acquire Condor to expand its dental distribution business in Switzerland.

- In 2020, Henry Schein entered into an agreement with the Dentists Supply Company and this was aimed to form a new entity - TDSC.com, an online-only option for purchasing dental supplies that will serve the state dental association members.

- In 2019, Integra LifeSciences acquired Rebound Therapeutics to develop innovative products to address the unmet needs in neurosurgery.

- In 2019, Stryker Corporation acquired Mobius Imaging and Cardan Robotics to expand its presence in the orthopedics, spine, and neurotechnology divisions using advanced imaging and robotics as well as a wide product pipeline.

Frequently Asked Questions (FAQ):

What is the projected market value of the global surgical retractors market?

The global market of surgical retractors is projected to reach USD 2.8 billion.

What is the estimated growth rate (CAGR) of the global surgical retractors market for the next five years?

The global surgical retractors market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% from 2022 to 2027.

What are the major revenue pockets in the surgical retractors market currently?

In 2021, North America accounted for the largest share of the market. Market growth in this region is characterized by the rising geriatric population and the subsequent increase in the prevalence of chronic diseases, such as arthritis, large number of surgical procedures performed in the region, and the presence of a well-established healthcare system.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 SURGICAL RETRACTORS MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 2 SURGICAL RETRACTORS MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION: MARKET

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 TOP-DOWN APPROACH

FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 9 CAGR PROJECTIONS

2.4 DATA TRIANGULATION APPROACH

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.5 MARKET RANKING ESTIMATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 11 SURGICAL RETRACTORS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GEOGRAPHIC SNAPSHOT OF GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 SURGICAL RETRACTORS MARKET OVERVIEW

FIGURE 15 RISING NUMBER OF SURGICAL PROCEDURES PERFORMED TO DRIVE GROWTH

4.2 ASIA PACIFIC: MARKET, BY PRODUCT AND COUNTRY (2021)

FIGURE 16 HANDHELD RETRACTORS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.4 GLOBAL MARKET, BY REGION (2018–2027)

FIGURE 18 NORTH AMERICA TO DOMINATE MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 SURGICAL RETRACTORS MARKET: KEY DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing number of surgical procedures worldwide

TABLE 3 NUMBER OF SURGICAL PROCEDURES, BY COUNTRY, 2019

5.2.1.2 Rising prevalence of chronic diseases along with significant rise in geriatric population

FIGURE 20 GLOBAL CANCER INCIDENCE, 2015–2040

5.2.1.3 Availability of specialized retraction products

5.2.1.4 Rising demand for plastic and reconstructive surgeries

5.2.2 RESTRAINTS

5.2.2.1 Increased preference for minimally invasive surgeries

TABLE 4 MINIMALLY INVASIVE SURGICAL PROCEDURES, BY COUNTRY (2019)

5.2.3 OPPORTUNITIES

5.2.3.1 High-growth opportunities in emerging markets

TABLE 5 AVERAGE SURGICAL PROCEDURE COST (2021)

5.2.3.2 Increasing adoption of outpatient surgeries

5.2.4 CHALLENGES

5.2.4.1 Surgical errors

5.2.4.2 Shortage of surgeons

5.3 PATENT ANALYSIS

5.3.1 PATENT PUBLICATION TRENDS FOR SURGICAL RETRACTORS

FIGURE 21 PATENT PUBLICATION TRENDS (JANUARY 2011–JUNE 2022)

5.3.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 22 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR SURGICAL RETRACTORS (JANUARY 2011–JUNE 2022)

FIGURE 23 TOP APPLICANT JURISDICTIONS FOR SURGICAL RETRACTOR PATENTS (JANUARY 2011–JUNE 2022)

TABLE 6 PATENTS IN MARKET, 2020–2022

5.4 IMPACT OF COVID-19 ON MARKET

6 SURGICAL RETRACTORS MARKET, BY PRODUCT (Page No. - 71)

6.1 INTRODUCTION

TABLE 7 MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 8 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

6.2 HANDHELD RETRACTORS

6.2.1 RISING NUMBER OF SURGICAL PROCEDURES TO AID ADOPTION OF HANDHELD RETRACTORS

TABLE 9 HANDHELD RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 10 HANDHELD RETRACTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

6.3 SELF-RETAINING RETRACTORS

6.3.1 EASE OF USE, COMFORT, AND EFFICIENCY ARE ADVANTAGES OF SELF-RETAINING RETRACTORS

TABLE 11 SELF-RETAINING RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 12 SELF-RETAINING RETRACTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

6.4 TABLE-MOUNTED RETRACTORS

6.4.1 PREMIUM PRICING OF TABLE-MOUNTED RETRACTORS MAKES THEM INACCESSIBLE TO SMALL END USERS

TABLE 13 TABLE-MOUNTED RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 14 TABLE-MOUNTED RETRACTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

6.5 WIRE SURGICAL RETRACTORS

6.5.1 LIMITED APPLICATIONS AND RELIABILITY HAVE HINDERED USE OF WIRE RETRACTORS

TABLE 15 WIRE RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 16 WIRE RETRACTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

6.6 ACCESSORIES

6.6.1 ACCESSORIES PROVIDE BETTER VISIBILITY AND ACCESSIBILITY TO SURGICAL SITE

TABLE 17 SURGICAL RETRACTOR ACCESSORIES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 18 SURGICAL RETRACTOR ACCESSORIES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

7 SURGICAL RETRACTORS MARKET, BY DESIGN (Page No. - 82)

7.1 INTRODUCTION

TABLE 19 MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY DESIGN, 2022–2027 (USD MILLION)

7.2 FIXED/FLAT-FRAME RETRACTORS

7.2.1 HIGH MARKET AVAILABILITY OF FLAT-FRAME RETRACTORS TO SUPPORT MARKET GROWTH

TABLE 21 FIXED/FLAT-FRAME RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 22 FIXED/FLAT-FRAME RETRACTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

7.3 ANGLED/CURVED-FRAME RETRACTORS

7.3.1 BETTER TRACTION AND STABILITY OFFERED BY CURVED-FRAME RETRACTORS TO DRIVE MARKET

TABLE 23 ANGLED/CURVED-FRAME RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 24 ANGLED/CURVED-FRAME RETRACTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

7.4 BLADE/ELEVATED-TIP RETRACTORS

7.4.1 BLADE/ELEVATED-TIP RETRACTORS HELP PREVENT SLIPPAGE AND OFFER BETTER VISUALIZATION

TABLE 25 BLADE/ELEVATED-TIP RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 26 BLADE/ELEVATED-TIP RETRACTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8 SURGICAL RETRACTORS MARKET, BY USAGE (Page No. - 89)

8.1 INTRODUCTION

TABLE 27 MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY USAGE, 2022–2027 (USD MILLION)

8.2 TISSUE HANDLING AND DISSECTION

8.2.1 USE OF RETRACTORS FOR BETTER VISIBILITY AND EXPOSURE DURING SURGICAL PROCEDURES TO AID MARKET GROWTH

TABLE 29 MARKET FOR TISSUE HANDLING AND DISSECTION, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 30 MARKET FOR TISSUE HANDLING AND DISSECTION, BY COUNTRY, 2022–2027 (USD MILLION)

8.3 FLUID SWABBING

8.3.1 ADDED ADVANTAGES OFFERED BY ASPIRATOR/SWAB-INTEGRATED RETRACTORS TO FUEL MARKET GROWTH

TABLE 31 MARKET FOR FLUID SWABBING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 32 MARKET FOR FLUID SWABBING, BY COUNTRY, 2022–2027 (USD MILLION)

9 SURGICAL RETRACTORS MARKET, BY APPLICATION (Page No. - 94)

9.1 INTRODUCTION

TABLE 33 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 34 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 ABDOMINAL SURGERIES

9.2.1 INCREASING PREVALENCE OF TARGET DISEASE CONDITIONS TO DRIVE MARKET

TABLE 35 MARKET FOR ABDOMINAL SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 36 MARKET FOR ABDOMINAL SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

9.3 ORTHOPEDIC SURGERIES

9.3.1 INCREASING PREVALENCE OF ARTHRITIS TO SUPPORT MARKET GROWTH

TABLE 37 MARKET FOR ORTHOPEDIC SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR ORTHOPEDIC SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

9.4 HEAD, NECK, AND SPINAL SURGERIES

9.4.1 HEAD, NECK, AND SPINAL SURGERIES SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 39 MARKET FOR HEAD, NECK, AND SPINAL SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR HEAD, NECK, AND SPINAL SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

9.5 OBSTETRIC & GYNECOLOGICAL SURGERIES

9.5.1 RISING INCIDENCE OF CESAREAN SECTION PROCEDURES WILL INCREASE DEMAND FOR SURGICAL RETRACTORS

TABLE 41 MARKET FOR OBSTETRIC & GYNECOLOGICAL SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR OBSTETRIC & GYNECOLOGICAL SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

9.6 CARDIOTHORACIC SURGERIES

9.6.1 RISING CARDIOTHORACIC SURGERIES TO DRIVE ADOPTION OF SURGICAL RETRACTORS

TABLE 43 MARKET FOR CARDIOTHORACIC SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR CARDIOTHORACIC SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

9.7 UROLOGICAL SURGERIES

9.7.1 HIGH COST ASSOCIATED WITH KIDNEY TRANSPLANT PROCEDURES TO HAMPER MARKET GROWTH

TABLE 45 MARKET FOR UROLOGICAL SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR UROLOGICAL SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

9.8 AESTHETIC SURGERIES

9.8.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES TO RESTRAIN MARKET GROWTH

TABLE 47 MARKET FOR AESTHETIC SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR AESTHETIC SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

9.9 OTHER SURGERIES

TABLE 49 MARKET FOR OTHER SURGERIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR OTHER SURGERIES, BY COUNTRY, 2022–2027 (USD MILLION)

10 SURGICAL RETRACTORS MARKET, BY END USER (Page No. - 111)

10.1 INTRODUCTION

TABLE 51 MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 52 MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2 HOSPITALS, CLINICS, AND SURGICAL CENTERS

10.2.1 INCREASING NUMBER OF HOSPITALS TO PROPEL MARKET GROWTH

TABLE 54 MARKET FOR HOSPITALS, CLINICS, AND SURGICAL CENTERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR HOSPITALS, CLINICS, AND SURGICAL CENTERS, BY COUNTRY, 2022–2027 (USD MILLION)

10.3 AMBULATORY CARE CENTERS

10.3.1 PATIENTS ARE INCREASINGLY OPTING TO GET TREATED IN AMBULATORY CARE CENTERS DUE TO COST-EFFECTIVE TREATMENTS

TABLE 56 MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2022–2027 (USD MILLION)

10.4 MATERNITY AND FERTILITY CENTERS

10.4.1 GROWING NUMBER OF SURGICAL PROCEDURES PERFORMED IN FERTILITY CENTERS TO DRIVE MARKET

TABLE 58 MARKET FOR MATERNITY AND FERTILITY CENTERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR MATERNITY AND FERTILITY CENTERS, BY COUNTRY, 2022–2027 (USD MILLION)

11 SURGICAL RETRACTORS MARKET, BY REGION (Page No. - 120)

11.1 INTRODUCTION

FIGURE 24 GEOGRAPHIC SNAPSHOT: MARKETS IN ASIA PACIFIC ARE EMERGING HOTSPOTS

TABLE 60 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: SURGICAL RETRACTORS MARKET SNAPSHOT

TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 US to dominate North American global market in forecast period

TABLE 74 MOST FREQUENT OPERATING ROOM SURGICAL PROCEDURES PERFORMED IN THE US, 2018

TABLE 75 MOST FREQUENT AMBULATORY SURGICAL PROCEDURES PERFORMED IN HOSPITAL-OWNED FACILITIES IN THE US, 2019

TABLE 76 US: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 77 US: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 78 US: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 79 US: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 80 US: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 81 US: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 82 US: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 83 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 84 US: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 85 US: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing geriatric population and increasing volume of surgeries to drive demand for surgical retractors in Canada

TABLE 86 CANADA: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 87 CANADA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 88 CANADA: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 89 CANADA: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 90 CANADA: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 91 CANADA: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 92 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 CANADA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 95 CANADA: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3 EUROPE

TABLE 96 EUROPE: SURGICAL RETRACTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany is largest market for surgical retractors in Europe

TABLE 108 GERMANY: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 111 GERMANY: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 112 GERMANY: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 113 GERMANY: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 114 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Presence of well-established healthcare system and growing geriatric population to boost market growth

TABLE 118 FRANCE: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 119 FRANCE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 120 FRANCE: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 121 FRANCE: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 122 FRANCE: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 123 FRANCE: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 124 FRANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 Growing volume of hernia repair and cardiovascular surgeries in the UK stimulating market growth

TABLE 128 SURGICAL PROCEDURES PERFORMED IN THE UK, 2018

TABLE 129 UK: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 130 UK: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 131 UK: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 132 UK: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 133 UK: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 134 UK: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 135 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 136 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 137 UK: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 138 UK: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.4 REST OF EUROPE

TABLE 139 ROE: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 140 ROE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 141 ROE: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 142 ROE: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 143 ROE: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 144 ROE: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 145 ROE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 ROE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 147 ROE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 148 ROE: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: SURGICAL RETRACTORS MARKET SNAPSHOT

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Rising geriatric population is supporting growth of surgical retractors market in Japan

TABLE 161 JAPAN: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 162 JAPAN: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 163 JAPAN: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 165 JAPAN: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 166 JAPAN: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 167 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 168 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 169 JAPAN: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 170 JAPAN: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Growing number of hospitals and healthcare policy reforms stimulating growth of market

TABLE 171 CHINA: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 172 CHINA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 173 CHINA: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 174 CHINA: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 175 CHINA: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 176 CHINA: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 177 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 178 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 179 CHINA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 180 CHINA: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Rising healthcare awareness and favorable government support to drive market in India

TABLE 181 INDIA: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 182 INDIA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 183 INDIA: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 184 INDIA: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 185 INDIA: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 186 INDIA: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 187 INDIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 188 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 189 INDIA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 190 INDIA: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 191 ROAPAC: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 192 ROAPAC: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 193 ROAPAC: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 194 ROAPAC: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 195 ROAPAC: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 196 ROAPAC: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 197 ROAPAC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 198 ROAPAC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 199 ROAPAC: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 200 ROAPAC: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5 REST OF THE WORLD

TABLE 201 ROW: SURGICAL RETRACTORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 202 ROW: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 203 ROW: MARKET, BY DESIGN, 2018–2021 (USD MILLION)

TABLE 204 ROW: MARKET, BY DESIGN, 2022–2027 (USD MILLION)

TABLE 205 ROW: MARKET, BY USAGE, 2018–2021 (USD MILLION)

TABLE 206 ROW: MARKET, BY USAGE, 2022–2027 (USD MILLION)

TABLE 207 ROW: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 208 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 209 ROW: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 210 ROW: MARKET, BY END USER, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 193)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 211 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SURGICAL RETRACTORS MARKET

12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 27 REVENUE ANALYSIS OF KEY PLAYERS IN GLOBAL MARKET

12.4 MARKET RANKING ANALYSIS

TABLE 212 MARKET: RANKING OF KEY PLAYERS

12.5 COMPETITIVE SCENARIO

12.5.1 DEALS (JANUARY 2019–JUNE 2022)

13 COMPANY PROFILES (Page No. - 198)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 KEY PLAYERS

13.1.1 BECTON, DICKINSON AND COMPANY

TABLE 213 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 28 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

13.1.2 B. BRAUN MELSUNGEN AG

TABLE 214 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 29 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

13.1.3 INTEGRA LIFESCIENCES

TABLE 215 INTEGRA LIFESCIENCES: BUSINESS OVERVIEW

FIGURE 30 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2021)

13.1.4 TELEFLEX INCORPORATED

TABLE 216 TELEFLEX INCORPORATED: BUSINESS OVERVIEW

FIGURE 31 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2021)

13.1.5 MEDTRONIC PLC

TABLE 217 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 32 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

13.1.6 JOHNSON & JOHNSON (DEPUY SYNTHES)

TABLE 218 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 33 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

13.1.7 STRYKER CORPORATION

TABLE 219 STRYKER CORPORATION: BUSINESS OVERVIEW

FIGURE 34 STRYKER CORPORATION: COMPANY SNAPSHOT (2021)

13.1.8 HENRY SCHEIN, INC.

TABLE 220 HENRY SCHEIN, INC.: BUSINESS OVERVIEW

FIGURE 35 HENRY SCHEIN, INC.: COMPANY SNAPSHOT (2021)

13.1.9 SKLAR SURGICAL INSTRUMENTS

TABLE 221 SKLAR SURGICAL INSTRUMENTS: BUSINESS OVERVIEW

13.1.10 MEDIFLEX SURGICAL PRODUCTS

TABLE 222 MEDIFLEX SURGICAL PRODUCTS: BUSINESS OVERVIEW

13.1.11 MEDLINE INDUSTRIES, LP

TABLE 223 MEDLINE INDUSTRIES, LP: BUSINESS OVERVIEW

13.1.12 BAUSCH HEALTH COMPANIES INC.

TABLE 224 BAUSCH HEALTH COMPANIES INC.: BUSINESS OVERVIEW

FIGURE 36 BAUSCH HEALTH COMPANIES INC.: COMPANY SNAPSHOT (2021)

13.1.13 THOMPSON SURGICAL INSTRUMENTS

TABLE 225 THOMPSON SURGICAL INSTRUMENTS: BUSINESS OVERVIEW

13.1.14 BR SURGICAL, LLC

TABLE 226 BR SURGICAL, LLC: BUSINESS OVERVIEW

13.1.15 THE COOPER COMPANIES INC.

TABLE 227 THE COOPER COMPANIES INC.: BUSINESS OVERVIEW

FIGURE 37 THE COOPER COMPANIES, INC.: COMPANY SNAPSHOT (2021)

13.1.16 INNOMED, INC.

TABLE 228 INNOMED, INC.: BUSINESS OVERVIEW

13.1.17 TERUMO CORPORATION

TABLE 229 TERUMO CORPORATION: BUSINESS OVERVIEW

FIGURE 38 TERUMO CORPORATION: COMPANY SNAPSHOT (2020)

13.1.18 GLOBUS MEDICAL, INC.

TABLE 230 GLOBUS MEDICAL, INC.: BUSINESS OVERVIEW

FIGURE 39 GLOBUS MEDICAL, INC: COMPANY SNAPSHOT (2021)

13.1.19 HALMA PLC (MICROSURGICAL TECHNOLOGY)

TABLE 231 HALMA PLC: BUSINESS OVERVIEW

FIGURE 40 HALMA PLC: COMPANY SNAPSHOT (2021)

13.1.20 ENOVIS CORPORATION (DJO GLOBAL, INC.)

TABLE 232 ENOVIS CORPORATION: BUSINESS OVERVIEW

FIGURE 41 ENOVIS CORPORATION: COMPANY SNAPSHOT (2021)

13.2 OTHER PLAYERS

13.2.1 CONMED CORPORATION

TABLE 233 CONMED CORPORATION: BUSINESS OVERVIEW

FIGURE 42 CONMED CORPORATION: COMPANY SNAPSHOT (2020)

13.2.2 OLYMPUS CORPORATION

TABLE 234 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 43 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2021)

13.2.3 ARTHREX, INC.

TABLE 235 ARTHREX, INC.: BUSINESS OVERVIEW

13.2.4 APPLIED MEDICAL RESOURCES CORPORATION

TABLE 236 APPLIED MEDICAL RESOURCES CORPORATION: BUSINESS OVERVIEW

13.2.5 LINA MEDICAL APS

TABLE 237 LINA MEDICAL APS: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 275)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

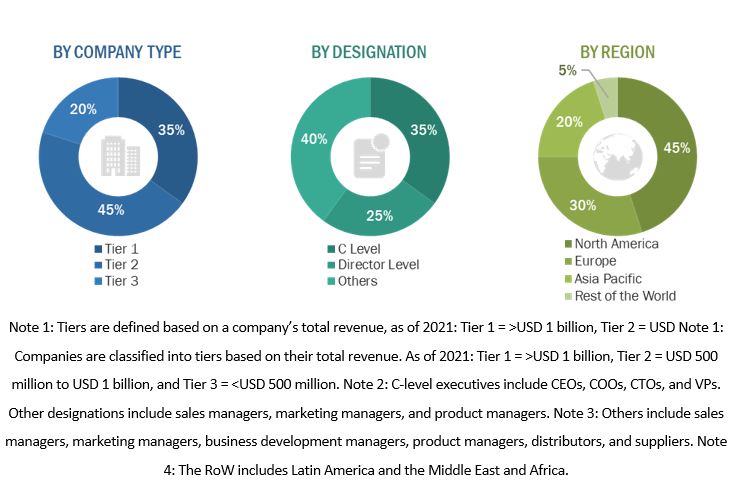

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape of the surgical retractors market, and key market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the surgical retractors market. It was also used to obtain important information about the top players, market classification and segmentation, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side and demand side are detailed below. Industry experts such as CEOs, presidents, vice presidents, directors, marketing directors, marketing managers, and related executives from various key companies and organizations in the surgical retractors industry were interviewed to obtain and verify both the qualitative and quantitative aspects of this research study. A robust primary research methodology has been adopted to validate the contents of the report and fill in the gaps. Telephonic and electronic communications were adopted to conduct interviews. Questionnaires were designed and sent to primary participants at their convenience.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the surgical retractors market was arrived at after data triangulation from different approaches, as mentioned below. After each approach, the weighted average of the approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The market validation, source structure, and data triangulation methodology have been implemented in the market engineering process.

Objectives of the Study

- To define, describe, segment, and forecast the surgical retractors market by product, design, usage, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall surgical retractors market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the surgical retractors market in four main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To profile the key players in the surgical retractors market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, joint ventures, agreements, partnerships, and R&D activities of the leading players in the surgical retractors market

- To benchmark players within the surgical retractors market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the Rest of Europe surgical retractors market into Spain, Italy, Switzerland, and others

- Further breakdown of the Rest of the World surgical retractors market into Latin America and the Middle East & Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Retractors Market