Plastic Surgery Instruments Market by Type (Handheld (Forceps, Needle Holder, Scissors, Retractor), Electrosurgery (Bipolar, Monopolar)), Procedure (Cosmetic (Breast Augmentation, Face, Head, Extremities), Reconstructive), End User - Global Forecast to 2023

[134 Pages Report] The global plastic surgery instruments market was valued at USD 937.3 Million in 2017 and is projected to reach USD 1,479.0 Million by 2023, at a CAGR of 8.1%. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

The objectives of this study are as follows:

- To define, describe, and forecast the global plastic surgery instruments market on the basis of type, procedure, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To forecast the size of the market with respect to five regions: North America, Europe, Asia, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments in the plastic surgery instruments market, such as partnerships, expansions, and R&D activities

Research Methodology

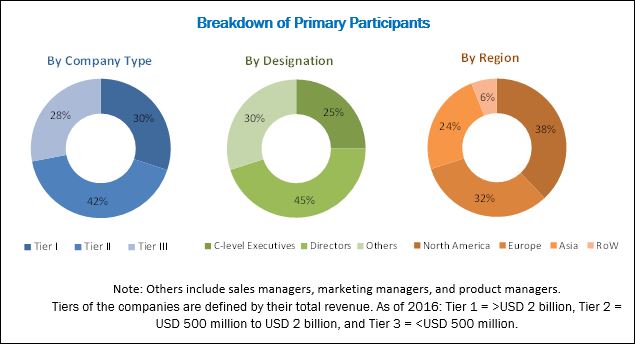

The study estimates the plastic surgery instruments market size for 2018 and projects its demand till 2023. In the primary research process, various sources from both demand side and supply side were interviewed to obtain qualitative and quantitative information for the report. Primary sources from the demand side include medical researchers, hospital purchase managers, and academic research institutes.

For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the plastic surgery instruments market as well as to estimate the market size of various other dependent submarkets. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report. Secondary sources such as directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies were referred.

To know about the assumptions considered for the study, download the pdf brochure

The plastic surgery instruments market is highly fragmented with the presence of several small and big players. Prominent players in the plastic surgery instruments market include Sklar Surgical Instruments (US), KLS Martin Group (Germany), Integra LifeSciences Corporation (US), Tekno-Medical Optik-Chirurgie GmbH (Germany), KARL STORZ GmbH & Co. KG (Germany), Zimmer Biomet (US), B. Braun Melsungen AG (Germany), BMT Medizintechnik GmbH (Germany), Anthony Products, Inc. (US), Bolton Surgical Ltd. (UK), Surgicon Pvt. Ltd. (Pakistan), and Blink Medical (UK).

Target Audience for this Report:

- Plastic surgery instrument manufacturers

- Plastic surgery instrument distributors

- Hospitals

- Research and consulting firms

- Venture capitalists

- Regulatory bodies

- Academic centers

- Teaching hospitals and academic medical centers (AMCs)

- Contract research organizations (CROs)

Scope of the Report

This report categorizes the plastic surgery instruments market into following segments and subsegments:

Plastic Surgery Instruments Market, by Type

-

Handheld Instruments

- Forceps

- Scissors

- Needle Holders

- Retractors

- Other Handheld Instruments

-

Electrosurgical Instruments

- Bipolar Instruments

- Monopolar Instruments

- Other Plastic Surgery Instruments

Plastic Surgery Instruments Market, by Procedure

-

Cosmetic Surgery

- Breast Procedures

- Face and Head Cosmetic Procedures

- Body and Extremities Cosmetic Procedures

-

Reconstructive Surgery

- Breast Reconstruction Surgery

- Congenital Deformity Correction

- Tumor Removal

- Other Reconstructive Surgeries

Plastic Surgery Instruments Market, by End User

- Hospitals

- Other End Users

Plastic Surgery Instruments Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia

- Japan

- China

- India

- RoA

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The global plastic surgery instruments market is expected to reach USD 1,479.0 Million by 2023 from USD 1,002.0 Million in 2018, at a CAGR of 8.1%. Increasing awareness and demand for cosmetic surgeries, growing number of age-related surgeries across the globe, and increasing incidence of cancer are the key drivers of the global plastic surgery instruments market.

This market is segmented on the basis of type, procedure, end user, and region. By type, the market is segmented into handheld instruments, electrosurgical instruments, and other plastic surgery instruments. In 2018, the handheld instruments segment is expected to account for the largest share of the market. The large share of this segment is attributed to factors such as increasing number of plastic surgeries and the wide range of uses of handheld instruments in almost all types of plastic surgical procedures.

Based on procedure, the plastic surgery instruments market is segmented into cosmetic surgery and reconstructive surgery. The cosmetic surgery segment is expected to dominate the market in 2018. The large share of this market segment can primarily be attributed to the high demand and growing public acceptance of cosmetic procedures, changing lifestyles, and growing willingness to spend on cosmetic surgeries across the globe.

The plastic surgery instruments market, by end user is segmented into hospitals and other end users segment. In 2018, the hospitals segment is expected to account for the largest share of the market. The large share of this segment is majorly attributed to the growing volume of surgical procedures performed in hospitals and increasing demand for cosmetic and reconstructive surgeries.

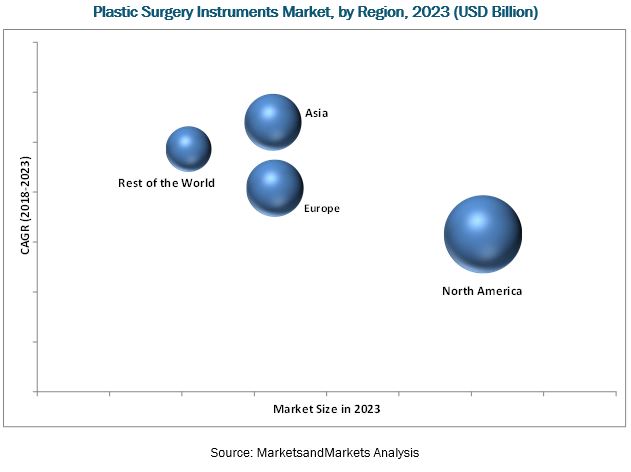

In 2018, North America is expected to dominate the market followed by Europe. Asia is expected to grow at the highest CAGR during the forecast period. The high growth rate of the region is attributed to factors such as the growing middle-class disposable income in emerging Asian countries, growing aging population and age-related cosmetic procedures, and increasing medical tourism in the region. The increasing focus of prominent players in Asia is also supporting market growth in the region.

The presence of stringent safety regulations for cosmetic procedures and the growing adoption of nonsurgical approaches and minimally invasive surgeries are the major factors that are expected to restrain the growth of this market.

The plastic surgery instruments market is highly fragmented with the presence of several large as well as emerging players. Prominent players in the plastic surgery instruments market include Sklar Surgical Instruments (US), KLS Martin Group (Germany), Integra LifeSciences Corporation (US), Tekno-Medical Optik-Chirurgie GmbH (Germany), KARL STORZ GmbH & Co. KG (Germany), Zimmer Biomet (US), B. Braun Melsungen AG (Germany), BMT Medizintechnik GmbH (Germany), Anthony Products, Inc. (US), Bolton Surgical Ltd. (UK), Surgicon Pvt. Ltd. (Pakistan), and Blink Medical (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Plastic Surgery Instruments: Market Overview

4.2 Plastic Surgery Instruments Market, By Procedure, 2018 vs 2023 (USD Million)

4.3 Cosmetic Surgery Market, By Type (2018–2023)

4.4 Plastic Surgery Instruments Market, By Type, 2018 vs 2023 (USD Million)

4.5 Geographical Snapshot of the Plastic Surgery Instruments Market

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Awareness of Cosmetic Procedures

5.2.1.2 Growing Number of Age-Related Plastic Surgeries

5.2.1.3 Increasing Incidence of Cancer

5.2.2 Restraints

5.2.2.1 Stringent Safety Regulations for Aesthetic and Cosmetic Procedures

5.2.2.2 Growing Adoption of Non-Surgical and Minimally Invasive Surgical Procedures

5.2.3 Opportunities

5.2.3.1 Emerging Markets Offer Lucrative Growth Opportunities

5.2.4 Challenges

5.2.4.1 Social Stigma Associated With Cosmetic Treatments

6 Plastic Surgery Instruments Market, By Type (Page No. - 35)

6.1 Introduction

6.2 Handheld Instruments

6.2.1 Forceps

6.2.2 Needle Holders

6.2.3 Scissors

6.2.4 Retractors

6.2.5 Other Handheld Instruments

6.3 Electrosurgical Instruments

6.3.1 Bipolar Instruments

6.3.2 Monopolar Instruments

6.4 Other Plastic Surgery Instruments

7 Plastic Surgery Instruments Market, By Procedure (Page No. - 45)

7.1 Introduction

7.2 Cosmetic Surgery

7.2.1 Breast Procedures

7.2.2 Face and Head Cosmetic Surgery

7.2.3 Body & Extremities Cosmetic Procedures

7.3 Reconstructive Surgery

7.3.1 Breast Reconstruction Surgery

7.3.2 Congenital Deformity Correction

7.3.3 Tumor Removal

7.3.4 Other Reconstructive Surgeries

8 Plastic Surgery Instruments Market, By End User (Page No. - 61)

8.1 Introduction

8.2 Hospitals

8.3 Other End Users

9 Plastic Surgery Instruments Market, By Region (Page No. - 66)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 RoE

9.4 Asia

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of Asia (RoA)

9.5 RoW

10 Competitive Landscape (Page No. - 107)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Expansions (2015–2018)

10.3.2 Partnerships (2015–2018)

11 Company Profiles (Page No. - 109)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Sklar Surgical Instruments

11.2 Zimmer Biomet

11.3 KLS Martin Group

11.4 B. Braun Melsungen

11.5 Integra Lifesciences

11.6 Karl Storz

11.7 Tekno-Medical Optik-Chirurgie

11.8 Bmt Medizintechnik

11.9 Anthony Products

11.10 Bolton Surgical

11.11 Surgicon

11.12 Blink Medical

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 126)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (110 Tables)

Table 1 Global Number of Cosmetic Procedures, By Age (2016)

Table 2 Share of Plastic Surgeons and Plastic Surgery Procedures in Emerging Countries, 2016

Table 3 Share of Medical Tourists, By Country, 2016

Table 4 Plastic Surgery Instruments Market, By Type, 2016–2023 (USD Million)

Table 5 Handheld Instruments Market, By Region, 2016–2023 (USD Million)

Table 6 Handheld Instruments Market, By Type, 2016–2023 (USD Million)

Table 7 Forceps Market, By Region, 2016–2023 (USD Million)

Table 8 Needle Holders Market, By Region, 2016–2023 (USD Million)

Table 9 Scissors Market, By Region, 2016–2023 (USD Million)

Table 10 Retractors Market, By Region, 2016–2023 (USD Million)

Table 11 Other Handheld Instruments Market, By Region, 2016–2023 (USD Million)

Table 12 Electrosurgical Instruments Market, By Region, 2016–2023 (USD Million)

Table 13 Electrosurgical Instruments Market, By Type, 2016–2023 (USD Million)

Table 14 Bipolar Instruments Market, By Region, 2016–2023 (USD Million)

Table 15 Monopolar Instruments Market, By Region, 2016–2023 (USD Million)

Table 16 Other Plastic Surgery Instruments Market, By Region, 2016–2023 (USD Million)

Table 17 Plastic Surgery Instruments Market, By Procedure, 2016–2023 (USD Million)

Table 18 Cosmetic Surgery Market, By Region, 2016–2023 (USD Million)

Table 19 Breast Augmentation Surgical Procedure By Country (2016)

Table 20 Liposuction Surgical Procedure By Country (2016)

Table 21 Eyelid Surgery By Country (2016)

Table 22 Rhinoplasty Surgery By Country (2016)

Table 23 Abdominoplasty Surgery By Country (2016)

Table 24 Cosmetic Surgery Market, By Type, 2016–2023 (USD Million)

Table 25 Global Statistics for Breast Procedures, 2015 vs 2016

Table 26 Breast Procedures Market, By Region, 2016–2023 (USD Million)

Table 27 Global Statistics for Face and Head Cosmetic Procedures, 2015 vs 2016

Table 28 Face and Head Cosmetic Surgery Market, By Region, 2016–2023 (USD Million)

Table 29 Global Statistics for Body & Extremities Cosmetic Procedures, 2015 vs 2016

Table 30 Body & Extremities Cosmetic Procedures Market, By Region, 2016–2023 (USD Million)

Table 31 Reconstructive Surgery Market, By Type, 2016–2023 (USD Million)

Table 32 Reconstructive Surgery Market, By Region, 2016–2023 (USD Million)

Table 33 Breast Reconstruction Surgery Market, By Region, 2016–2023 (USD Million)

Table 34 Congenital Deformity Correction Market, By Region, 2016–2023 (USD Million)

Table 35 Tumor Removal Market, By Region, 2016–2023 (USD Million)

Table 36 Other Reconstructive Surgeries Market, By Region, 2016–2023 (USD Million)

Table 37 Plastic Surgery Instruments Market, By End User, 2016–2023 (USD Million)

Table 38 Proportion of Cosmetic Procedures Performed in Hospitals, By Country, 2015 vs 2016 (As A Percentage of the Total)

Table 39 Plastic Surgery Instruments Market for Hospitals, By Region, 2016–2023 (USD Million)

Table 40 Plastic Surgery Instruments Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 41 Plastic Surgery Instruments Market, By Region, 2016–2023 (USD Million)

Table 42 North America: Plastic Surgery Instruments Market, By Country, 2016–2023 (USD Million)

Table 43 North America: Plastic Surgery Instruments Market, By Type, 2016–2023 (USD Million)

Table 44 North America: Handheld Instruments Market, By Type, 2016–2023 (USD Million)

Table 45 North America: Electrosurgical Instruments Market, By Type, 2016–2023 (USD Million)

Table 46 North America: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 47 North America: Cosmetic Surgery Market, By Type, 2016–2023 (USD Million)

Table 48 North America: Reconstructive Surgery Market, By Type, 2016–2023 (USD Million)

Table 49 North America: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 50 Most Common Cosmetic Surgical Procedure in US (2015-2016)

Table 51 US: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 52 US: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 53 US: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 54 Canada: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 55 Canada: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 56 Canada: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 57 Europe: Plastic Surgery Instrument Market, By Country, 2016–2023 (USD Million)

Table 58 Europe: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 59 Europe: Handheld Instruments Market, By Type, 2016–2023 (USD Million)

Table 60 Europe: Electrosurgical Instruments Market, By Type, 2016–2023 (USD Million)

Table 61 Europe: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 62 Europe: Cosmetic Surgery Market, By Type, 2016–2023 (USD Million)

Table 63 Europe: Reconstructive Surgery Market, By Type, 2016–2023 (USD Million)

Table 64 Europe: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 65 Most Common Cosmetic Surgical Procedure in Germany (2015-2016)

Table 66 Germany: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 67 Germany: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 68 Germany: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 69 Most Common Cosmetic Surgical Procedure in France (2015-2016)

Table 70 France: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 71 France: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 72 France: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 73 UK: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 74 UK: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 75 UK: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 76 Most Common Cosmetic Surgical Procedure in Italy (2015-2016)

Table 77 RoE: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 78 RoE: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 79 RoE: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 80 Asia: Plastic Surgery Instrument Market, By Country, 2016–2023 (USD Million)

Table 81 Asia: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 82 Asia: Handheld Instruments Market, By Type, 2016–2023 (USD Million)

Table 83 Asia: Electrosurgical Instruments Market, By Type, 2016–2023 (USD Million)

Table 84 Asia: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 85 Asia: Cosmetic Surgery Market, By Type, 2016–2023 (USD Million)

Table 86 Asia: Reconstructive Surgery Market, By Type, 2016–2023 (USD Million)

Table 87 Asia: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 88 Most Common Cosmetic Surgical Procedure in Japan 2016

Table 89 Japan: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 90 Japan: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 91 Japan: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 92 China: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 93 China: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 94 China: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 95 Most Common Cosmetic Surgical Procedure in India 2016

Table 96 India: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 97 India: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 98 India: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 99 Most Common Cosmetic Surgical Procedure in South Korea 2015

Table 100 RoA: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 101 RoA: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 102 RoA: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 103 RoW: Plastic Surgery Instrument Market, By Type, 2016–2023 (USD Million)

Table 104 RoW: Handheld Instruments Market, By Type, 2016–2023 (USD Million)

Table 105 RoW: Electrosurgical Instruments Market, By Type, 2016–2023 (USD Million)

Table 106 RoW: Plastic Surgery Instrument Market, By Procedure, 2016–2023 (USD Million)

Table 107 RoW: Cosmetic Surgery Market, By Type, 2016–2023 (USD Million)

Table 108 RoW: Reconstructive Surgery Market, By Type, 2016–2023 (USD Million)

Table 109 RoW: Plastic Surgery Instrument Market, By End User, 2016–2023 (USD Million)

Table 110 Plastic Surgery Instrument Market Ranking Analysis, By Key Player (2017)

List of Figures (25 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Plastic Surgery Instrument Market, By Type, 2018 vs 2023 (USD Million)

Figure 6 Plastic Surgery Instrument Market, By Procedure, 2018 vs 2023 (USD Million)

Figure 7 Cosmetic Surgery Market, By Type, 2018

Figure 8 Plastic Surgery Instrument Market, By End User, 2018 vs 2023 (USD Million)

Figure 9 Geographical Snapshot of the Plastic Surgery Instrument Market

Figure 10 Emerging Markets Offer Lucrative Growth Opportunities for the Growth of the Plastic Surgery Instrument Market

Figure 11 Cosmetic Surgery to Dominate the Plastic Surgery Instrument Market in 2018

Figure 12 Body and Extremities Cosmetic Procedures Segment to Witness the Highest Growth From 2018 to 2023

Figure 13 Handheld Instruments to Dominate the Plastic Surgery Instrument Market During the Forecast Period

Figure 14 Market in Asia Projected to Witness the Highest Growth During the Forecast Period

Figure 15 Plastic Surgery Instrument Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Handheld Instruments to Dominate the Plastic Surgery Instrument Market During the Forecast Period

Figure 17 Cosmetic Surgery to Dominate the Plastic Surgery Instrument Market During the Forecast Period

Figure 18 Hospitals Segment to Dominate the Plastic Surgery Instrument Market During the Forecast Period

Figure 19 North America: Plastic Surgery Instrument Market Snapshot

Figure 20 Europe: Plastic Surgery Instrument Market Snapshot

Figure 21 Asia: Plastic Surgery Instrument Market Snapshot

Figure 22 RoW: Plastic Surgery Instrument Market Snapshot

Figure 23 Zimmer Biomet: Company Snapshot (2017)

Figure 24 B. Braun Melsungen: Company Snapshot (2016)

Figure 25 Integra Lifesciences: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plastic Surgery Instruments Market