Surgical Lasers Market by product type (Carbon Dioxide, Argon, Nd:YAG & Diode Lasers), Procedure (Open, Laparoscopic & Percutaneous), & Application (Ophthalmology, Urology, Gynaecology, Dermatology, Dental, Cardiology, & Oncology) - Global forecast to 2021

[166 Pages Report] The surgical lasers market is expected to reach USD 2.37 Billion by 2021 from USD 1.85 Billion in 2016; growing at a CAGR of 5.1% during the forecast period. Increasing prevalence of chronic diseases, technological advancements in surgical lasers, increasing incidence and prevalence of targeted diseases, and high prevalence of ophthalmic disorders are the major factors driving the growth of this market. In addition, growing preference for minimally invasive surgeries are further adding to the growth prospects of this market.

Emerging markets such as India, China, Brazil, and Mexico offer significant growth opportunities for players operating in the surgical lasers market. This growth in these regions can be attributed to factors such as rising geriatric population, prevalence of lifestyle disorders, and increasing investments by leading players in these countries.

A combination of bottom-up and top-down approaches was used to calculate the sizes and growth rates of the market and its subsegments. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. In this research study, all possible parameters that affect this market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative & qualitative data. Primary interviews with key opinion leaders were also used to determine the percentage shares of each product in emerging nations. The report provides qualitative insights about growth rates and market drivers for all subsegments. It maps market sizes and growth rates for each subsegment and identifies segments poised for rapid growth in each geographic region.

Lumenis (Israel), Cynosure, Inc. (U.S.), Alma Lasers (Israel), Abbott Laboratories, Inc., (U.S.), Boston Scientific Corporation (U.S.), IPG Photonics Corporation (U.S.), Spectranetics Corporation (U.S.), Biolitec AG (Austria), Fotona d.o.o. (Slovenia), and BISON MEDICAL Co., Ltd. (South Korea) are some of the key players in the surgical lasers market.

Target Audience:

- Surgical laser product manufacturing companies

- Product suppliers and distributors

- Healthcare service providers [including hospitals, specialty clinics, and ambulatory surgery centers (ASCs)]

- Research laboratories and academic institutes

- Clinical research organizations (CROs)

- Government regulatory authorities

- Independent authorities and non-government organizations

- Market research and consulting firms

- Venture capitalists

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

This research report categorizes the surgical lasers market into the following segments:

Global Surgical Lasers Market, by Type

- CO2 Lasers

- Argon Lasers

- Nd:YAG Lasers

- Diode Lasers

- Other Surgical Lasers

Global Surgical Lasers Market, by Procedure Type

- Open Surgery

- Laparoscopic Surgery

- Percutaneous Surgery

Global Surgical Lasers Market, by Application

- Ophthalmology

- Dentistry

- Dermatology

- Cardiology

- Gynecology

- Urology

- Oncology

- Other Applications

Global Surgical Lasers Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- RoE

-

Asia-Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the surgical lasers market

The global surgical lasers market is projected to reach USD 2.37 Billion by 2021 from USD 1.85 Billion in 2016; growing at a CAGR of 5.1% during 2016-2021. The rising demand for surgical lasers can be attributed to the growing prevalence of chronic diseases, technological advancements, increasing incidence and prevalence of targeted diseases, and high prevalence of ophthalmic disorders. In addition, growing preference for minimally invasive surgeries among patients and healthcare professionals is supporting the growth of the market.

On the basis of type, the market is categorized into five segments, namely, carbon dioxide (CO2) lasers, argon lasers, Nd:YAG lasers, diode lasers, and other surgical lasers (fiber lasers, dye lasers, Er:YAG lasers, and excimer lasers). The CO2 lasers segment is at the highest CAGR in the market due to the widespread availability of innovative CO2-based surgical lasers and ongoing technological advancements in cosmetic laser treatment.

By procedure type, the market is segmented into open surgery, laparoscopic surgery, and percutaneous surgery. The Laparoscopic Surgery segment is expected to dominate the market. This growth can be attributed to the procedural benefits of laparoscopic procedures, growing patient awareness, and market demand for less-invasive disease therapies.

Based application, the market is segmented into ophthalmology, dentistry, dermatology, cardiology, gynecology, urology, oncology, and other applications (liposuction, ENT, and GIT). The urology segment is expected to be the fastest-growing surgical laser application in the market. Growth in this application segment is mainly due to the rising prevalence of urological disorders (such as kidney stones, renal cancer, and prostate enlargement), growing patient preference for minimally invasive urological surgeries, and ongoing technological advancements in surgical laser products.

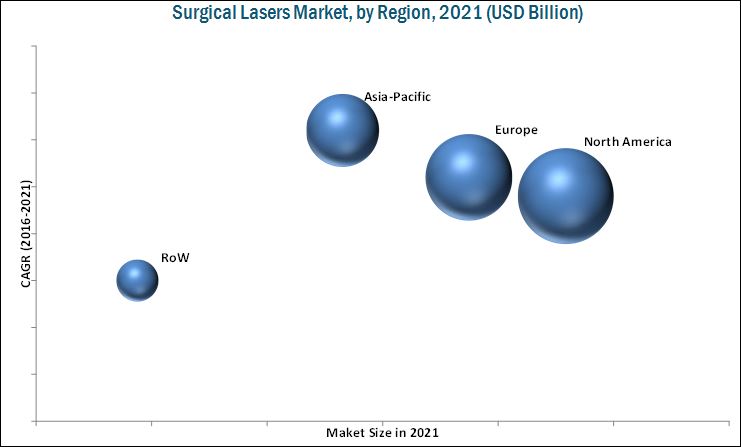

On the basis of region, the market is segmented into four regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World. In 2016, North America is estimated to dominate the global surgical lasers market. Factors such as the use of novel surgical technologies among healthcare professionals (owing to the growing number of clinical trials and significant medical reimbursement available in the U.S. for laser-assisted surgical procedures) and a large number of cosmetic laser equipment manufacturers in the region enabled the growth of this market. The Asia-Pacific market is expected to grow at the highest CAGR during the forecast period. The growth opportunities in the Asia-Pacific region can be attributed to the increasing aging population, rising prevalence of targeted diseases such as cardiovascular diseases and cancer, and a huge patient population.

Product launches, product enhancements, and approvals were the primary growth strategies adopted by major players to expand their product portfolio in the global market. Several market players also adopted strategies such as acquisition and agreements to expand their presence and increase their visibility in the market. As of 2015, Lumenis (Israel), Cynosure, Inc. (U.S.), Alma Lasers (Israel), Abbott Laboratories, Inc., (U.S.), Boston Scientific Corporation (U.S.) IPG Photonics Corporation (U.S.), Spectranetics Corporation (U.S.), Biolitec AG (Austria), Fotona d.o.o. (Slovenia), and BISON MEDICAL Co., Ltd. (South Korea) were some of the key players operating in the global surgical lasers market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Research Methodology

2.1.1.1 Secondary Research

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.2 Opportunity Indicators

2.2.1 Healthcare Expenditure Patterns

2.2.2 Rapid Growth in Geriatric Population

2.2.3 Incidence and Prevalence of Cancer

2.2.4 Growing Burden of Cardiovascular Diseases

2.2.5 Increasing Number of Target Diseases and Related Surgical Procedures

2.3 Market Size Estimation Methodology

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Data Validation and Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 40)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 45)

4.1 Surgical Lasers: Market Overview

4.2 Geographic Analysis: Surgical Lasers Market, By Procedure Type

4.3 Global Surgical Lasers Market, By Type, 2016 vs 2021

4.4 Global Market Size, By Procedure Type, 2016 vs 2021 (USD Million)

4.5 Geographical Snapshot of the Global Surgical Lasers Market

5 Market Overview (Page No. - 49)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Major Market Drivers

5.2.1.1 Technological Advancements

5.2.1.2 Increasing Incidence and Prevalence of Targeted Diseases

5.2.1.3 High Prevalence of Ophthalmic Disorders

5.2.1.4 Growing Preference for Minimally Invasive Surgeries

5.2.1.5 Growing Public-Private Investments and Funding

5.2.2 Major Market Restraints

5.2.2.1 High Procedural Costs Associated With Laser Surgeries

5.2.2.2 Limited Medical Reimbursements

5.2.2.3 Stringent Government Regulations

5.2.3 Major Market Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Growing Trend of Medical Tourism

5.2.4 Major Market Challenges

5.2.4.1 Safety Concerns Related to Medical Applications of Laser Technology

6 Industry Insights (Page No. - 61)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Key Stakeholders

6.2.2 Key Influencers

6.3 Major Industry Trends

6.3.1 Growing Market Preference for Excimer and Diode Lasers in Surgical Procedures

6.3.2 Ongoing Consolidation of the Medical Laser Industry

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Reimbursement Scenario

7 Surgical Lasers Market, By Type (Page No. - 70)

7.1 Introduction

7.2 Carbon Dioxide (CO2) Lasers

7.3 Argon Lasers

7.4 ND:Yag (Neodymium:Yttrium-Aluminum-Garnet) Lasers

7.5 Diode Lasers

7.6 Other Surgical Lasers

8 Surgical Lasers Market, By Procedure Type (Page No. - 80)

8.1 Introduction

8.2 Open Surgery

8.3 Laparoscopic Surgery

8.4 Percutaneous Surgery

9 Surgical Lasers Market, By Application (Page No. - 87)

9.1 Introduction

9.2 Ophthalmology

9.3 Dermatology

9.4 Dentistry

9.5 Urology

9.6 Cardiology

9.7 Gynecology

9.8 Oncology

9.9 Other Applications

10 Surgical Lasers Market, By Region (Page No. - 97)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 France

10.3.4 Rest of Europe (RoE)

10.4 Asia-Pacific

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 130)

11.1 Overview

11.2 Market Ranking

11.3 Competitive Scenario

11.4 Recent Developments

11.4.1 Product Launches and Product Enhancements

11.4.2 Approvals

11.4.3 Acquisitions

11.4.4 Agreements

11.4.5 Other Strategies

12 Company Profiles (Page No. - 136)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Lumenis

12.3 Cynosure, Inc.

12.4 Alma Lasers

12.5 Abbott Laboratories, Inc.

12.6 Boston Scientific Corporation

12.7 IPG Photonics Corporation

12.8 Spectranetics Corporation

12.9 Biolitec AG

12.10 Bison Medical Co., Ltd.

12.11 Fotona D.O.O.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 156)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (75 Tables)

Table 1 Public-Private Investments and Research Grants Offered for the Development of Surgical Laser Products

Table 2 Major Mergers & Acquisitions in the Medical Lasers Industry: 2011–2015

Table 3 Major Cpt Codes for Laser Surgical Procedures in the U.S. (2016)

Table 4 Global Surgical Lasers Market Size, By Type, 2014–2021 (USD Million)

Table 5 Surgical Lasers Market Size for Carbon Dioxide Lasers, By Region, 2014–2021 (USD Million)

Table 6 Surgical Lasers Market Size for Argon Lasers, By Region, 2014–2021 (USD Million)

Table 7 Surgical Lasers Market Size for ND:Yag Lasers, By Region, 2014–2021 (USD Million)

Table 8 Surgical Lasers Market Size for Diode Lasers, By Region, 2014–2021 (USD Million)

Table 9 Other Surgical Lasers Market Size, By Region, 2014–2021 (USD Million)

Table 10 Global Surgical Lasers Market Size, By Procedure Type, 2014–2021 (USD Million)

Table 11 Surgical Lasers Market Size for Open Surgery, By Region, 2014–2021 (USD Million)

Table 12 Surgical Lasers Market Size for Laparoscopic Surgery, By Region, 2014–2021 (USD Million)

Table 13 Surgical Lasers Market Size for Percutaneous Surgery, By Region, 2014–2021 (USD Million)

Table 14 Global Surgical Lasers Market Size, By Application, 2014–2021 (USD Million)

Table 15 Surgical Lasers Market Size for Ophthalmology, By Region, 2014–2021 (USD Million)

Table 16 Market Size for Dermatology, By Region 2014–2021 (USD Million)

Table 17 Market Size for Dentistry, By Region 2014–2021 (USD Million)

Table 18 Surgical Lasers Market Size for Urology, By Region 2014–2021 (USD Million)

Table 19 Market Size for Cardiology, By Region 2014–2021 (USD Million)

Table 20 Major Laser Technologies Used for Gynecological Applications

Table 21 Surgical Lasers Market Size for Gynecology, By Region 2014–2021 (USD Million)

Table 22 Market Size for Oncology, By Region 2014–2021 (USD Million)

Table 23 Market Size for Other Applications, By Region, 2014–2021 (USD Million)

Table 24 Surgical Lasers Market Size, By Region, 2014-2021 (USD Million)

Table 25 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 26 North America: Market Size, By Type, 2014-2021 (USD Million)

Table 27 North America: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 28 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 29 U.S.: Market Size, By Type, 2014-2021 (USD Million)

Table 30 U.S.: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 31 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 32 Canada: Market Size, By Type, 2014-2021 (USD Million)

Table 33 Canada: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 34 Canada: Market Size, By Application, 2014-2021 (USD Million)

Table 35 Europe: Market Size, By Country, 2014-2021 (USD Million)

Table 36 Europe: Market Size, By Type, 2014-2021 (USD Million)

Table 37 Europe: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 38 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 39 Germany: Market Size, By Type, 2014-2021 (USD Million)

Table 40 Germany: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 41 Germany: Market Size, By Application, 2014-2021 (USD Million)

Table 42 U.K.: Market Size, By Type, 2014-2021 (USD Million)

Table 43 U.K.: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 44 U.K.: Market Size, By Application, 2014-2021 (USD Million)

Table 45 France: Market Size, By Type, 2014-2021 (USD Million)

Table 46 France: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 47 France: Market Size, By Application, 2014-2021 (USD Million)

Table 48 RoE: Market Size, By Type, 2014-2021 (USD Million)

Table 49 RoE: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 50 RoE: Market Size, By Application, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Country, 2014-2021 (USD Million)

Table 52 APAC: Market Size, By Type, 2014-2021 (USD Million)

Table 53 APAC: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 54 APAC: Market Size, By Application, 2014-2021 (USD Million)

Table 55 Japan: Market Size, By Type, 2014-2021 (USD Million)

Table 56 Japan: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 57 Japan: Market Size, By Application, 2014-2021 (USD Million)

Table 58 China: Market Size, By Type, 2014-2021 (USD Million)

Table 59 China: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 60 China: Market Size, By Application, 2014-2021 (USD Million)

Table 61 India: Market Size, By Type, 2014-2021 (USD Million)

Table 62 India: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 63 India: Market Size, By Application, 2014-2021 (USD Million)

Table 64 RoAPAC: Market Size, By Type, 2014-2021 (USD Million)

Table 65 RoAPAC: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 66 RoAPAC: Market Size, By Application, 2014-2021 (USD Million)

Table 67 RoW: Market Size, By Type, 2014-2021 (USD Million)

Table 68 RoW: Market Size, By Procedure Type, 2014-2021 (USD Million)

Table 69 RoW: Market Size, By Application, 2014-2021 (USD Million)

Table 70 Global Surgical Lasers Market Ranking, Key Player (2015)

Table 71 Product Launches and Product Enhancements (2013–2016)

Table 72 Approvals (2013–2016)

Table 73 Top Acquisitions (2013–2016)

Table 74 Agreements (2013–2016)

Table 75 Other Strategies (2013–2016)

List of Figures (55 Figures)

Figure 1 Global Surgical Lasers Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Breakdown of Primaries: Surgical Lasers Market

Figure 4 Healthcare Expenditure Across Major Countries: 2000 vs 2014

Figure 5 Healthcare Expenditure Across Major Regions: 2000 vs 2014

Figure 6 Healthcare Spending Matrix: Key Markets (2014)

Figure 7 Increase in Geriatric Population, By Country (2010 vs 2015)

Figure 8 Increase in the Proportion of the Elderly in the Overall Population, By Country (2011–2030)

Figure 9 Percentage Increase in Geriatric Population, By Region (1980–2010 vs 2010–2040)

Figure 10 Global Burden of Cancer, By Region (2005–2030)

Figure 11 Number of New Cancer Cases: By Type (2008–2020)

Figure 12 Number of New Cancer Cases, By Country (2012–2020)

Figure 13 Global Burden of Cardiovascular Diseases, By Region (2005–2030)

Figure 14 Bottom-Up Approach: Surgical Lasers Industry

Figure 15 Top-Down Approach: Surgical Lasers Industry

Figure 16 Data Triangulation Methodology: Surgical Lasers Industry

Figure 17 Carbon Dioxide Lasers to Dominate the Global Surgical Lasers Market in 2016

Figure 18 Laparoscopic Surgery to Be the Fastest-Growing Procedural Segment During the Forecast Period

Figure 19 Urology Segment to Register the Highest CAGR From 2016 to 2021

Figure 20 North America to Account for the Largest Market Share in 2016

Figure 21 Technological Advancements and Growing Market Preference for Minimally Invasive Surgeries are Driving Growth in the Global Surgical Lasers Market

Figure 22 Open Surgery Segment to Account for the Largest Market Share in 2016

Figure 23 Carbon Dioxide (CO2) Lasers Segment Will Continue to Dominate the Global Surgical Lasers Market in 2021

Figure 24 Open Surgery Segment to Dominate the Global Surgical Lasers Market in 2016

Figure 25 Asia-Pacific to Register the Highest CAGR in the Forecast Period

Figure 26 Market Drivers, Restraints, Opportunities, & Challenges

Figure 27 China to Account for the Highest Number of Cancer Cases By 2020

Figure 28 The Americas to Register the Highest Number of Annual Deaths Due to Cvd Till 2020

Figure 29 Annual Healthcare Expenditure (%GDP): Developed vs Developing Countries (2010-2015)

Figure 30 Prominent Market Players Prefer Both Direct & Indirect Distribution Strategies

Figure 31 Porter’s Five Forces Analysis: Global Surgical Lasers Market (2016)

Figure 32 Carbon Dioxide Lasers to Witness Highest Growth During the Forecast Period

Figure 33 North America is Expected to Hold the Largest Share in the Surgical Lasers Market for Carbon Dioxide Lasers During the Forecast Period

Figure 34 North America to Dominate the Surgical Lasers Market for Argon Lasers During the Forecast Period

Figure 35 North America to Command the Largest Share of the Surgical Lasers Market for ND:Yag Lasers in 2021

Figure 36 North America to Hold the Largest Share in the Surgical Lasers Market for Diode Lasers

Figure 37 Asia-Pacific is Expected to Grow at the Highest CAGR in the Other Surgical Lasers Market During the Forecast Period

Figure 38 Surgical Lasers Market for Laparoscopic Surgeries to Witness Highest Growth During the Forecast Period

Figure 39 North America is Expected to Capture the Largest Market Share of the Surgical Lasers Market for Open Surgery

Figure 40 Asia-Pacific to Witness Highest Growth in the Surgical Lasers Market for Laparoscopic Surgery

Figure 41 Asia-Pacific to Witness Highest Growth in the Surgical Lasers Market for Percutaneous Surgery

Figure 42 The Ophthalmology Application Segment is Expected to Dominate the Market During the Forecast Period

Figure 43 North America to Hold the Largest Share in the Surgical Lasers Market for Ophthalmology Applications

Figure 44 North America: Surgical Lasers Market Snapshot

Figure 45 Europe: Surgical Lasers Market Snapshot

Figure 46 Asia-Pacific: Surgical Lasers Market Snapshot

Figure 47 Product Launches, Agreements, and Acquisitions, Key Growth Strategies Adopted By Market Players From 2013 to 2016

Figure 48 Product Launches and Product Enhancements Was the Key Growth Strategy Pursued By Market Players Between 2013 & 2016

Figure 49 Geographic Revenue Mix of the Top Three Players

Figure 50 Company Snapshot: Lumenis (2014)

Figure 51 Company Snapshot: Cynosure, Inc. (2015)

Figure 52 Company Snapshot: Abbott Laboratories, Inc. (2015)

Figure 53 Company Snapshot: Boston Scientific Corporation (2015)

Figure 54 Company Snapshot: IPG Photonics Corporation (2015)

Figure 55 Company Snapshot: Spectranetics Corporation (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Lasers Market