Surface Mount Technology (SMT) Market by Equipment (Placement, Inspection, Soldering, Screen Printing Equipment, Cleaning Equipment, Repair & Rework Equipment), Component, Service, End User and Geography - Global Forecast to 2028

Updated on : March 06, 2025

Surface Mount Technology Market Size & Share

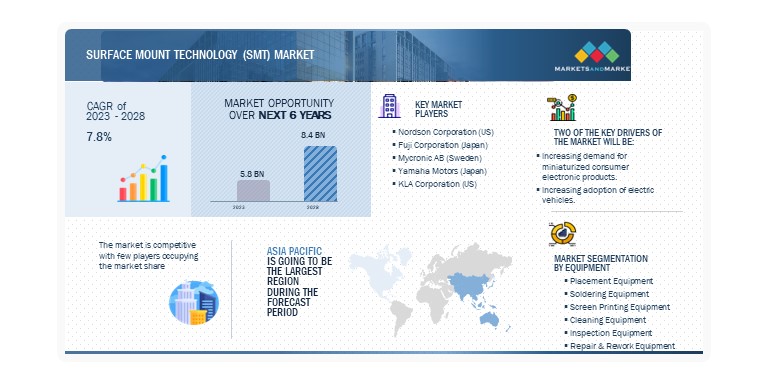

The global surface mount technology market size is projected to grow from USD 5.8 billion in 2023 to reach USD 8.4 billion by 2028; growing at a CAGR of 7.8% during the forecast period 2023 to 2028. Factors such as the high investment cost of machinery for setting up production units and the high frequency and need for thermal management act as restraints for the market's growth.

Surface Mount Technology (SMT) Market Size & Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Surface Mount Technology Market Trends :

Driver: Increased demand for miniaturized consumer electronics components

The consumer electronics industry is evolving, with innovations and technologies coming up constantly, such as fingerprint sensors in mobiles and smart televisions, offering consumers advanced features. The growing need for miniaturized products has led to the development of smaller electronic components that occupy less area. This is possible when the hardware components of the devices, such as PCB, are small in size and can run smoothly while being integrated with several components. The SMT helps use and assemble much smaller components, facilitating a smaller, portable, and lightweight electronic device. Smaller and thinner consumer electronics devices can be developed using SMT. It optimally enables a compact assembly of components on a PCB using the available space. It also makes the device lightweight since it does not have extra wiring and soldering, unlike the traditional through-hole technology.

Restraint: Need for high-frequency applications and thermal management

Designing an electronic device is a complicated process as many factors need to be considered while designing any electronic circuit, especially in SMT. The factors that need to be considered while designing the device include high-frequency applications and thermal management and stress on PCB due to coefficient of thermal expansion (CTE) mismatch. The CTE helps to understand how the object's size would change with temperature change. Additionally, the factors that must be considered when designing for high-frequency applications, such as telecommunications and consumer electronics, include the impedance of the package signal lines, cross-talk noise between these lines, and inductance interconnects on the PCB. With the increasing chip power used in electronic circuits using SMT, managing its thermal requirements with limited space inside the system poses a challenge. All factors together restrain the growth of the surface mount technology (SMT) market.

Opportunity: Advent of self-monitoring, analysis, and reporting technology (SMART)

The emergence of self-monitoring, analysis, and reporting technology (SMART) has revolutionized the technological landscape. SMART is slowly witnessing widespread adoption, from smart devices such as smartphones, smartwatches, and laptops to even broader applications in smart homes and factories. The need to mount and inspect all the components quickly and reliably has fueled the demand for SMT equipment. The SMT equipment plays a vital role in mounting and inspecting compact PCBs.

Challenge: Challenges in repair and rework of surface mount technology (SMT)-manufactured printed circuit boards (PCBs

The SMT-manufactured PCBs have revolutionized electronics manufacturing owing to the ease of construction and higher component density, which enables more components to be placed in a smaller area, thereby miniaturizing the electronic device. These SMT-manufactured devices are smaller, have more features, and are less expensive. However, this high density of components creates a challenge for repairing and reworking the PCB boards in case of any failure. Conventional soldering techniques are rendered useless for reworking on the board, and specialized techniques are needed to be used for rework, such as non-contact methods, to avoid additional damage to the assembly. These are combined with either computer controls or precise microscopes to guarantee accuracy but lead to greater cost and complexity in the process. Thus, this factor poses a major challenge for SMT repair or rework on an electronic device manufactured using this technology is highly complicated.

Inspection equipment is expected to grow with the highest CAGR during the forecast period

The inspection segment is expected to grow with the highest CAGR of the surface mount technology industry during the forecast period. The SMT inspection equipment market is driven by improving product technology, responsiveness, reliability, and quality of the inspection. The increasing need for this equipment in telecommunication, automotive, consumer electronics, and computing and storage is expected to drive its demand during the forecast period.

Telecommunications to account for a significant market share of the surface mount technology (SMT) market during the forecast period

The telecommunications segment is expected to have a significant market size in the end-user industry segment during the forecast period. The rising demand for wireless networks in high-performance computing and telecommunications applications is driving the need for surface mount technology (SMT) for the fast functioning of networks and achieving a high level of accuracy. The US is the major contributor for the telecommunications industry owing to the presence of major players present in the country.

Surface Mount Technology (SMT) Equipment Market

Surface Mount Technology Market Size Regional Analysis

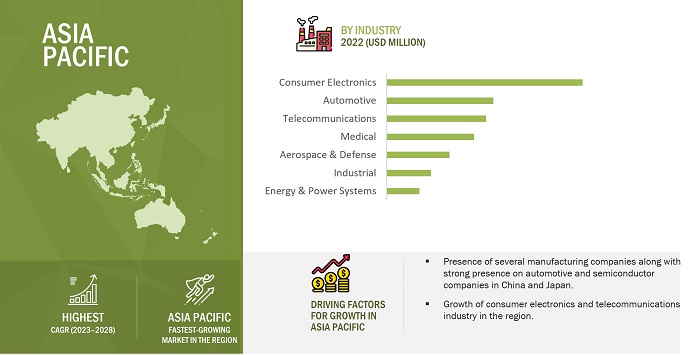

Asia Pacific to have the largest market share in the surface mount technology (SMT) market during the forecast period

Asia Pacific led the surface mount technology market share globally during the forecast period. China and Japan are some of the major countries contributing toward the growth of the surface mount technology market in this region. An increase in manufacturing activities, combined with the region's emergence as a cost-effective production hub, is expected to drive the SMT market size in the region. With many new electronics manufacturing projects planned in the region, Asia Pacific is expected to remain a high-growth market for SMT equipment.

Surface Mount Technology (SMT) Market Trends by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Surface Mount Technology Companies - Key Market Players:

The Surface Mount Technology companies such as

- Fuji Corporation (Japan),

- Mycronic AB (Sweden),

- Nordson Corporation (US),

- KLA Corporation (US),

- Yamaha Motor (Japan),

- Juki Corporation (Japan),

- Viscom AG (Germany),

- Hitachi High-Technologies Corporation (Japan),

- ASM Assembly Systems (Germany), and

- Saki Corporation (Japan) are some key players operating in the market.

Surface Mount Technology Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 5.8 billion in 2023 |

| Projected Market Size | USD 8.4 billion by 2028 |

| Growth Rate | CAGR of 7.8% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Surface Mount Technology Market Size Forecast period |

2023–2028 |

|

Forecast units |

USD Million & Billion |

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

Fuji Corporation (Japan), Mycronic AB (Sweden), Nordson Corporation (US), Viscom AG (Germany), KLA Corporation (US), Juki Corporation (Japan), Hitachi High-Technologies Corporation (Japan), ASM Assembly Systems (Germany), Yamaha Motor (Japan), and Saki Corporation (Japan) are among the key players operating in the surface mount technology (SMT) market. |

Surface Mount Technology (SMT) Market Highlights

This research report categorizes the surface mount technology (SMT) market based on Equipment, Component, Service, End User Industry and Region

|

Segment |

Subsegment |

|

Surface Mount Technology Market Size , By Equipment |

|

|

By Component |

|

|

By Service |

|

|

Surface Mount Technology Market Share, By End User Industry |

|

|

By Region |

|

Recent Developments in Surface Mount Technology Industry

- In February 2023, Yamaha Motors launched a new YRM20DL surface mounter, a premium high-efficiency modular that achieves improved actual and per-unit-area productivity with a high-rigidity dual-lane conveyor, further reducing transport losses.

- In December 2022, Mycronic AB received an order for a Prexision 800 Evo mask writer for display applications from an existing customer in Asia. Delivery of the system is planned for the second quarter of 2024.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the surface mount technology (SMT) market?

Product launch, acquisition, and collaboration have been and continue to be some of the major strategies adopted by the key players to grow in the surface mount technology (SMT) market.

What region is expected to dominate the surface mount technology (SMT) market?

Asia Pacific region will dominate the surface mount technology (SMT) market.

What end-user is projected to dominate the surface mount technology (SMT) market?

Consumer electronics is expected to dominate the surface mount technology (SMT) market.

What equipment is expected to dominate the surface mount technology (SMT) market?

Placement equipment is expected to have the largest market size during the forecast period.

Who are the major companies in the surface mount technology (SMT) market?

Fuji Corporation (Japan), Mycronic AB (Sweden), Nordson Corporation (US), KLA Corporation (US), and Yamaha Motor (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased demand for miniaturized consumer electronics components- Growing adoption of electric vehicles (EVs)- Rising need to increase productivity of electronic manufacturing services (EMS) companiesRESTRAINTS- Requirement for high investments to set up production units- Need for high-frequency applications and thermal managementOPPORTUNITIES- Integration of biometrics and security into consumer electronics and medical devices- Advent of Self-monitoring, Analysis, and Reporting Technology (SMART)CHALLENGES- Emergence of new assembly techniques- Challenges in repair and rework of surface mount technology (SMT)-manufactured printed circuit boards (PCBs)

-

5.3 VALUE CHAIN ANALYSISRAW MATERIAL AND CHIP PROCESSINGCOMPONENT PROVIDERSMANUFACTURING, ASSEMBLY, AND MODULE PACKAGINGEND USERS

-

5.4 CASE STUDY ANALYSISGSI HELMHOLTZ CENTRE PARTNERED WITH ASMPT TO DEPLOY PRINTING AND PLACEMENT SOLUTIONS

-

5.5 TECHNOLOGY ANALYSISHIGH-DENSITY INTERCONNECT (HDI) PRINTED CIRCUIT BOARDS (PCBS)WAFER BONDINGFLIP CHIPFAN-OUT WAFER-LEVEL PACKAGING (FOWLP)

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

-

5.8 AVERAGE SELLING PRICE (ASP) ANALYSISAVERAGE SELLING PRICE (ASP) TREND

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 ECOSYSTEM ANALYSIS

-

5.11 PATENT ANALYSIS

-

5.12 TARIFFS AND REGULATIONSTARIFFSTARIFF ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- Regulations- Standards

-

5.13 TRADE ANALYSISTRADE DATA FOR HS CODE 9031

- 5.14 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SURFACE MOUNT TECHNOLOGY (SMT) MARKET PLAYERS

- 5.15 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 INSPECTION EQUIPMENTINCREASING FOCUS ON MANUFACTURING STABLE AND HIGH-QUALITY PRODUCTS- Laser Inspection Equipment- X-Ray inspection equipment- Optical Inspection Equipment

-

6.3 PLACEMENT EQUIPMENTGROWING NEED FOR HIGHER ACCURACY AND SPEED, PRODUCT MINIATURIZATION, AND FLEXIBILITYBASED ON SPEED- Low-speed placement equipment- Medium-speed placement equipment- High-speed placement equipmentBASED ON TYPE- Dual-delivery placement machine- Multi-station placement machine- Turret-type placement machine- Multi-head placement machine- Sequential pick-and-place machine

-

6.4 SOLDERING EQUIPMENTRISING DEMAND FROM CONSUMER ELECTRONICS INDUSTRY- Wave oven- Reflow oven

-

6.5 SCREEN PRINTING EQUIPMENTRISING NEED TO INCREASE PRODUCTIVITY, FLEXIBILITY, AND COST-EFFECTIVENESS- Automatic- Semiautomatic- Manual

-

6.6 CLEANING EQUIPMENTGROWING USE OF CLEANING FLUXES FOR LEAD-FREE MANUFACTURING

-

6.7 REPAIR & REWORK EQUIPMENTRISING ADOPTION OF REPAIR & REWORK EQUIPMENT IN MEDICAL INDUSTRY- Automatic- Semiautomatic

- 7.1 INTRODUCTION

-

7.2 PASSIVE COMPONENTSRESISTORSCAPACITORS

-

7.3 ACTIVE COMPONENTSTRANSISTORS & DIODESINTEGRATED CIRCUITS

- 8.1 INTRODUCTION

- 8.2 DESIGNING

- 8.3 TEST AND PROTOTYPE

- 8.4 SUPPLY CHAIN SERVICES

- 8.5 MANUFACTURING

- 8.6 AFTERMARKET SERVICES

- 9.1 INTRODUCTION

-

9.2 CONSUMER ELECTRONICSMINIATURIZATION OF CONSUMER ELECTRONICS

-

9.3 TELECOMMUNICATIONSEMERGENCE OF WIRELESS COMMUNICATION TECHNOLOGIES

-

9.4 AEROSPACE & DEFENSERISING DEMAND FOR HIGH-QUALITY ELECTRONIC COMPONENTS

-

9.5 AUTOMOTIVEEXPANDING ELECTRIC VEHICLE (EV) MARKET

-

9.6 MEDICALRISING DIGITIZATION IN MEDICAL INDUSTRY

-

9.7 INDUSTRIALINCREASING ADOPTION OF AUTOMATION TECHNOLOGIES

-

9.8 ENERGY AND POWER SYSTEMSUPGRADE OF ENERGY INFRASTRUCTURE

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Surge in domestic manufacturingCANADA- Expanding consumer electronics industryMEXICO- Growing automotive industry

-

10.3 EUROPEUK- Government-led support to boost telecommunications industryGERMANY- Presence of established electronics manufacturing companiesFRANCE- Mass digitization of major industriesREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- Government-led initiatives to increase domestic electronics manufacturingJAPAN- Presence of key automobile manufacturersSOUTH KOREA- Rising deployment of automation technologiesINDIA- Rising foreign investmentsREST OF ASIA PACIFIC

-

10.5 ROWSOUTH AMERICA- Localization of electronics productionMIDDLE EAST & AFRICA- Healthy growth of electronics industry

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 REVENUE ANALYSIS

-

11.4 COMPETITIVE LEADERSHIP MAPPING, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.5 START-UP/SME EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.6 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY COMPANIESFUJI CORPORATION- Business overview- Products offered- MnM viewMYCRONIC AB- Business overview- Products offered- Recent developments- MnM viewNORDSON CORPORATION- Business overview- Products offered- Recent developments- MnM viewYAMAHA MOTORS- Business overview- Products offered- Recent developments- MnM viewKLA CORPORATION- Business overview- Products offered- Recent developments- MnM viewVISCOM AG- Business overview- Products offeredJUKI CORPORATION- Business overview- Products offeredHITACHI HIGH-TECHNOLOGIES CORPORATION- Business overview- Products offered- Recent developmentsASM ASSEMBLY SYSTEMS- Business overview- Products offeredSAKI CORPORATION- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSEUROPLACERNEODENPANASONIC CORPORATIONKASDON ELECTRONICSOHMITE MANUFACTURINGKBC ELECTRONICSDDM NOVASTARTHERMOMEGATECHALTEK ELECTRONICSABL CIRCUITSMIRTECMACHINE VISION PRODUCTSCIREXX4E TECHNOLOGYACD DIGITAL SYSTEMS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ANALYSIS OF RISK FACTORS

- TABLE 2 SURFACE MOUNT TECHNOLOGY (SMT) MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF KEY EQUIPMENT USED IN SMT

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA OF TOP THREE END-USER INDUSTRIES

- TABLE 6 SURFACE MOUNT TECHNOLOGY (SMT) MARKET: ECOSYSTEM ANALYSIS

- TABLE 7 TOP 20 PATENT OWNERS IN US, 2012–2022

- TABLE 8 SURFACE MOUNT TECHNOLOGY (SMT) MARKET: LIST OF PATENTS

- TABLE 9 TARIFF FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES EXPORTED BY GERMANY, 2021

- TABLE 10 TARIFF FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES EXPORTED BY CHINA, 2021

- TABLE 11 TARIFF FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES EXPORTED BY JAPAN, 2021

- TABLE 12 TARIFF FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES EXPORTED BY US, 2021

- TABLE 13 TARIFF FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES EXPORTED BY SINGAPORE, 2021

- TABLE 14 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 15 MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 16 MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 17 INSPECTION EQUIPMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 INSPECTION EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 INSPECTION EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 INSPECTION EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 INSPECTION EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 INSPECTION EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 INSPECTION EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 INSPECTION EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 INSPECTION EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 INSPECTION EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 INSPECTION EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 INSPECTION EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 INSPECTION EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 INSPECTION EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 INSPECTION EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 INSPECTION EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 PLACEMENT EQUIPMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 PLACEMENT EQUIPMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 PLACEMENT EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 PLACEMENT EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 PLACEMENT EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 PLACEMENT EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 PLACEMENT EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 PLACEMENT EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 PLACEMENT EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 PLACEMENT EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 PLACEMENT EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR MEDICAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 PLACEMENT EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 PLACEMENT EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 PLACEMENT EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 PLACEMENT EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 PLACEMENT EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 SOLDERING EQUIPMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 SOLDERING EQUIPMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 SOLDERING EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 SOLDERING EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 SOLDERING EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 SOLDERING EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 SOLDERING EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 SOLDERING EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 SOLDERING EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 SOLDERING EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 SOLDERING EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 SOLDERING EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 SOLDERING EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 SOLDERING EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 SOLDERING EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 SOLDERING EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 SCREEN PRINTING EQUIPMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 SCREEN PRINTING EQUIPMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 SCREEN PRINTING EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 SCREEN PRINTING EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 SCREEN PRINTING EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 SCREEN PRINTING EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 SCREEN PRINTING EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 SCREEN PRINTING EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 SCREEN PRINTING EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 SCREEN PRINTING EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 SCREEN PRINTING EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 SCREEN PRINTING EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 SCREEN PRINTING EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 SCREEN PRINTING EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 SCREEN PRINTING EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 SCREEN PRINTING EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 CLEANING EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 CLEANING EQUIPMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 CLEANING EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 CLEANING EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 CLEANING EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 CLEANING EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 CLEANING EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 CLEANING EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 CLEANING EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 CLEANING EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 CLEANING EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 CLEANING EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 CLEANING EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 CLEANING EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 CLEANING EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 CLEANING EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 REPAIR & REWORK EQUIPMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 REPAIR & REWORK EQUIPMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 REPAIR & REWORK EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 REPAIR & REWORK EQUIPMENT: MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 REPAIR & REWORK EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 REPAIR & REWORK EQUIPMENT: MARKET FOR TELECOMMUNICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 REPAIR & REWORK EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 REPAIR & REWORK EQUIPMENT: MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 REPAIR & REWORK EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 REPAIR & REWORK EQUIPMENT: MARKET FOR AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 REPAIR & REWORK EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 REPAIR & REWORK EQUIPMENT: MARKET FOR MEDICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 REPAIR & REWORK EQUIPMENT: SURFACE MOUNT TECHNOLOGY (SMT) MARKET FOR INDUSTRIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 REPAIR & REWORK EQUIPMENT: MARKET FOR INDUSTRIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 REPAIR & REWORK EQUIPMENT: MARKET FOR ENERGY & POWERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 112 REPAIR & REWORK EQUIPMENT: MARKET FOR ENERGY & POWER SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 SMT RESISTOR SIZES

- TABLE 114 MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 115 MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 116 CONSUMER ELECTRONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 117 CONSUMER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 118 TELECOMMUNICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 119 TELECOMMUNICATIONS: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 120 AEROSPACE & DEFENSE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 121 AEROSPACE & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 122 AUTOMOTIVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 123 AUTOMOTIVE: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 MEDICAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 125 MEDICAL: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 INDUSTRIAL: ) MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 127 INDUSTRIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 128 ENERGY & POWER SYSTEMS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 129 ENERGY & POWER SYSTEMS: S MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 130 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 131 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: ) MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 EUROPE: MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 139 EUROPE: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 140 EUROPE: MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 141 EUROPE: MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 142 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 143 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 150 ROW: SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 151 ROW: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 152 ROW: MARKET, BY EQUIPMENT, 2019–2022 (USD MILLION)

- TABLE 153 ROW: MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 154 ROW: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 155 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 MAJOR COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2019 TO 2022

- TABLE 157 MARKET: DEGREE OF COMPETITION

- TABLE 158 MARKET: RANKING ANALYSIS

- TABLE 159 COMPANY FOOTPRINT

- TABLE 160 EQUIPMENT: COMPANY FOOTPRINT

- TABLE 161 END-USER INDUSTRY: COMPANY FOOTPRINT

- TABLE 162 REGION: COMPANY FOOTPRINT

- TABLE 163 SURFACE MOUNT TECHNOLOGY (SMT) MARKET: LIST OF KEY START-UPS/SMES

- TABLE 164 MARKET: PRODUCT LAUNCHES, JANUARY 2019–FEBRUARY 2022

- TABLE 165 MARKET: DEALS, JANUARY 2019–FEBRUARY 2022

- TABLE 166 FUJI CORPORATION: COMPANY OVERVIEW

- TABLE 167 FUJI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 MYCRONIC AB: COMPANY OVERVIEW

- TABLE 169 MYCRONIC AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 MYCRONIC AB: DEALS

- TABLE 171 NORDSON CORPORATION: COMPANY OVERVIEW

- TABLE 172 NORDSON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 NORDSON CORPORATION: DEALS

- TABLE 174 NORDSON CORPORATION: OTHERS

- TABLE 175 YAMAHA MOTORS: COMPANY OVERVIEW

- TABLE 176 YAMAHA MOTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 YAMAHA MOTORS: PRODUCT LAUNCHES

- TABLE 178 YAMAHA MOTORS: DEALS

- TABLE 179 YAMAHA MOTORS: OTHERS

- TABLE 180 KLA CORPORATION: COMPANY OVERVIEW

- TABLE 181 KLA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 KLA CORPORATION: DEALS

- TABLE 183 KLA CORPORATION: OTHERS

- TABLE 184 VISCOM AG: COMPANY OVERVIEW

- TABLE 185 VISCOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 JUKI CORPORATION: COMPANY OVERVIEW

- TABLE 187 JUKI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 HITACHI HIGH-TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 189 HITACHI HIGH-TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 190 HITACHI HIGH-TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 191 HITACHI HIGH-TECHNOLOGIES CORPORATION: DEALS

- TABLE 192 ASM ASSEMBLY SYSTEMS: COMPANY OVERVIEW

- TABLE 193 ASM ASSEMBLY SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 SAKI CORPORATION: COMPANY OVERVIEW

- TABLE 195 SAKI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 SURFACE MOUNT TECHNOLOGY (SMT) MARKET: SEGMENTATION

- FIGURE 2 REGIONAL SCOPE

- FIGURE 3 PROCESS FLOW: SURFACE MOUNT TECHNOLOGY (SMT) MARKET SIZE ESTIMATION

- FIGURE 4 MARKET: RESEARCH DESIGN

- FIGURE 5 MARKET: BOTTOM-UP APPROACH

- FIGURE 6 MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RECESSION IMPACT: GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 9 RECESSION IMPACT ON SURFACE MOUNT TECHNOLOGY (SMT) MARKET, 2019–2028 (USD MILLION)

- FIGURE 10 INSPECTION SEGMENT TO REGISTER HIGHEST CAGR IN MARKET FROM 2023 TO 2028

- FIGURE 11 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 13 GROWING USE OF ADVANCED AUTOMATION SYSTEMS REQUIRING HIGHLY RELIABLE NETWORKS FOR MACHINE-TO-MACHINE (M2M) COMMUNICATION

- FIGURE 14 PLACEMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 15 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN MARKET FROM 2023 TO 2028

- FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 ELECTRIC VEHICLE SALES, 2013–2020 (MILLION UNITS)

- FIGURE 19 MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 20 MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 21 MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 22 SURFACE MOUNT TECHNOLOGY (SMT) MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 23 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- FIGURE 25 MARKET: AVERAGE SELLING PRICE OF EQUIPMENT (HISTORIC)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- FIGURE 27 KEY BUYING CRITERIA OF TOP THREE END-USER INDUSTRIES

- FIGURE 28 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2022

- FIGURE 30 NUMBER OF PATENTS GRANTED, 2012–2022

- FIGURE 31 IMPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

- FIGURE 32 EXPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

- FIGURE 33 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 34 SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY EQUIPMENT

- FIGURE 35 PLACEMENT EQUIPMENT TO LEAD MARKET BETWEEN 2023 AND 2028

- FIGURE 36 ADVANTAGES OF LASER INSPECTION EQUIPMENT

- FIGURE 37 TYPES OF LIGHTING USED IN OPTICAL INSPECTION EQUIPMENT

- FIGURE 38 SELECTION CRITERIA FOR PLACEMENT EQUIPMENT

- FIGURE 39 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF MARKET FOR PLACEMENT EQUIPMENT IN 2023

- FIGURE 40 ASIA PACIFIC PLACEMENT EQUIPMENT MARKET FOR CONSUMER ELECTRONICS TO LEAD MARKET BETWEEN 2023 AND 2028

- FIGURE 41 AEROSPACE & DEFENSE SEGMENT TO HOLD SIGNIFICANT SHARE OF MARKET FOR SCREEN PRINTING EQUIPMENT IN 2028

- FIGURE 42 MARKET, BY COMPONENT

- FIGURE 43 TYPES OF CAPACITORS IN SMT

- FIGURE 44 CLASSIFICATION OF SMT INTEGRATED CIRCUITS

- FIGURE 45 SURFACE MOUNT TECHNOLOGY (SMT) MARKET, BY SERVICE

- FIGURE 46 PHASES IN DESIGNING PROCESS

- FIGURE 47 BENEFITS OF PROTOTYPE

- FIGURE 48 ELECTRONIC MANUFACTURING PRINTED CIRCUIT BOARD USING SMT

- FIGURE 49 MARKET, BY END-USER INDUSTRY

- FIGURE 50 CONSUMER ELECTRONICS SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 51 ADVANTAGES OF SURFACE MOUNT TECHNOLOGY (SMT) OVER THROUGH-HOLE TECHNOLOGY FOR AEROSPACE & DEFENSE INDUSTRY

- FIGURE 52 CHINA SURFACE MOUNT TECHNOLOGY (SMT) MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICA: SNAPSHOT OF MARKET

- FIGURE 54 EUROPE: SNAPSHOT OF MARKET

- FIGURE 55 ASIA PACIFIC: SNAPSHOT OF MARKET

- FIGURE 56 MARKET SHARE OF KEY COMPANIES IN MARKET, 2022

- FIGURE 57 THREE-YEAR REVENUE ANALYSIS OF KEY COMPANIES, 2019–2021 (USD MILLION)

- FIGURE 58 MARKET (KEY PLAYERS): EVALUATION QUADRANT, 2022

- FIGURE 59 MARKET (SME): EVALUATION QUADRANT, 2022

- FIGURE 60 FUJI CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 MYCRONIC AB: COMPANY SNAPSHOT

- FIGURE 62 NORDSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 YAMAHA MOTORS: COMPANY SNAPSHOT

- FIGURE 64 KLA CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 VISCOM AG: COMPANY SNAPSHOT

- FIGURE 66 JUKI CORPORATION: COMPANY SNAPSHOT

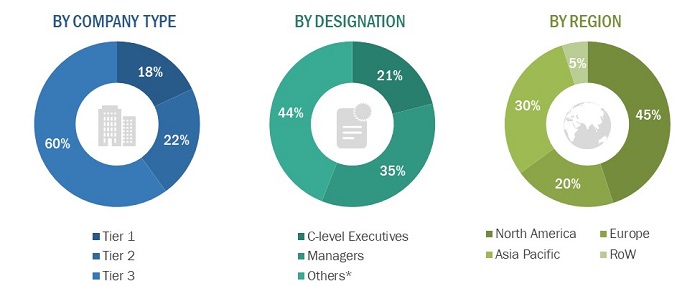

The study involved four major activities in estimating the current size of the surface mount technology (SMT) market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include surface mount technology journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the surface mount technology (SMT) market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

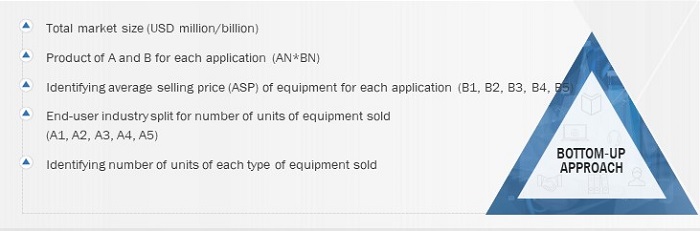

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the surface mount technology (SMT) market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Surface Mount Technology (Smt) Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments.To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Market Definition

Surface mount technology (SMT) is a method of assembling electrical components on the surface of printed circuit boards (PCB) instead of inserting them through holes drilled on the PCB. The circuit thus assembled is known as a surface mount device (SMD) and the special components that are mounted on these devices are known as surface mount components (SMCs). SMCs are smaller in size than their through-hole counterparts, since these devices have eliminated the need for leads to connect to the PCB.

Key Stakeholders

- Integrated circuit designers

- Original equipment manufacturers (OEMs)

- Product manufacturers

- Semiconductor product designers and fabricators

- Surface mount component and device distributors and providers

- Raw material and manufacturing equipment suppliers

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the surface mount technology market size, by equipment, and end-user industry, in terms of value(USD million) & volume(million units)

- To describe the services and components related to surface mount technology

- To forecast the market size, in terms of value, for segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To provide a detailed Porter’s five forces analysis of the surface mount technology market

- To provide an overall view of the global market through illustrative segmentations, analyses, and market size estimations of the major geographic segments

- To analyze the competitive intelligence of players based on company profiles, key player strategies, and game-changing developments such as product launches and acquisitions

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and contribution to the total market

- To analyze strategic developments such as joint ventures, mergers and acquisitions, product developments, and R&D in the surface mount technology market

- To analyze the probable impact of the recession on the market in the future

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surface Mount Technology (SMT) Market