Marine Seats Market by Component, Ship Type (Military, Commercial), Seat Type (Captain Seats, Passenger Seats, Crew Seats, General Seats), End User (OEM, Aftermarket) and Region (North America, Europe, APAC and Rest of the World) - Forecast to 2027

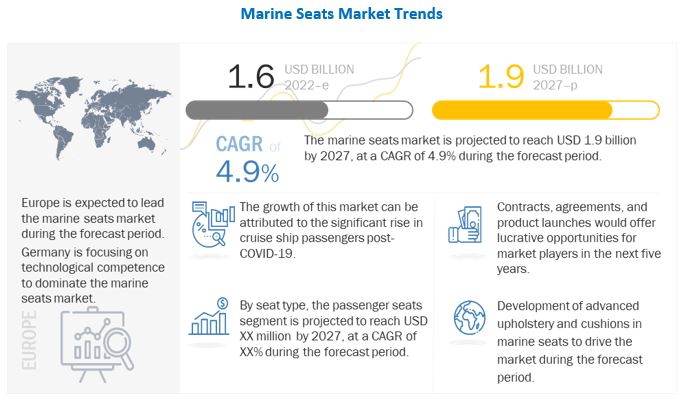

[210 Pages Report] The Marine Seats Market is estimated to be USD 1.6 billion in 2022 and is projected to reach USD 1.9 billion by 2027, at a CAGR of 4.9% from 2022 to 2027. The market is driven by factors such increasing number of cruise ship passengers in the World, Increasing seaborne trading, etc.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has disturbed supply chains of several products and services in several industries. The impact of COVID-19 on the supply chain of marine industry was no different. As several countries in the world reduced their defense budgets, it badly impacted the research & development (r&d), contracts and hence production of marine seats. The pandemic has also disturbed the trading of those systems, affected the development of marine seats.

Marine seats market Dynamics

Driver :Rising cruise travel worldwide

ajor cruise liners, such as Carnival Cruises (US), Royal Caribbean (US), and Norwegian (US), are increasing their capacities due to the increasing number of passengers for pleasure voyages. Due to COVID-19, the situation took a major hit as these cruise liners observed a fall in ticket sales onboard and other revenue generation at an average of 75% from 2019 to 2020. In 2019, the passenger count for marine travel went up to 30 million passengers, which steeped down to 7 million in 2020. In 2021, the numbers had risen again to 14 million. As per the Cruise Market Watch 2021, the total global ocean cruise passenger capacity at the end of 2021 was 581,000 passengers.

Increasing global seaborne trade

As per reports by the United Nations Conference on Trade and Development (UNCTAD), international seaborne trade has been steadily growing. There was an increase in goods volume in top-3 ship-owning countries: Greece, China, and Japan. Panama, Liberia, and Marshall Island lead carrying capacity as well as flag registration of ships for trading. Merchant fleet value in Vietnam increased by 12.1%, and in Russian Federation increased by 10.4%. Nigeria observed an increase from 0.50 to 0.78% in merchant fleet value. Shanghai carried maximum trade containers with a total capacity of 47 million TEU.

Opportunity:Increasing work engagement in marine industry

The marine industry has observed an increase in work engagement and job opportunities. As per UNCTAD, many businesses in marine believe that there has been an increase in opportunities offered by the industry in recent times. 95% of businesses were in a state of expansion in the second quarter of 2021. Whereas 55% of businesses expect business conditions to improve substantially by the end of 2022. 66% of marine manufacturers underwent substantial hiring in the second quarter of 2021.

Increase in defense spending

Naval forces across the world are focusing on upgrading and acquiring new ships to enhance sea warfare capabilities. Hence, defense agencies are increasing their budgets for the procurement of new navy ships. The increase in the number of undersea submarine threats from enemies has increased risks for the sea borders of countries, which is leading to the rise in demand for anti-submarine warfare ships by naval forces.

Challenges: Rising cost of materials and operations

The rising cost of material and operations is posing a challenge to the Marine Seats Market in several ways. The rising cost of raw materials, such as steel and aluminum, as well as components, such as foam and leather, is increasing the cost of goods sold (COGS) for marine seat manufacturers. This is putting pressure on margins and making it difficult for manufacturers to maintain profitability. The rising cost of labor, energy, and transportation is also increasing operating costs for marine seat manufacturers. This is further pressuring margins and making it difficult for manufacturers to compete. The rising cost of marine seats is leading to reduced demand from customers. This is especially true for budget-conscious customers and customers who are operating in challenging economic conditions.

Motor boats segment holds the largest share of marine seats market by commercial ship type

Motorboats are used for recreational purposes. These include in-board spoiler boats, outboard spoiler boats, small fishing boats, etc. The market for marine seats in motor boats is expected to grow from USD 1.41 Billion in 2022 to USD 1.73 billion in 2027.

Commercial Marine Ships market for Cruise ships to grow at a highest CAGR during the forecast period

Merchant vessels, which transport passengers from one place to other, are referred to as passenger cruises. The rise in maritime tourism across the globe, as well as an increase in international sea travel, are factors leading to a growing demand for blue water passenger cruises. The market for marine seats in cruise ships is expected to grow at a highest CAGR of 19.8% during the forecast period.

Aircraft Carriers segment holds the largest share of marine seats market by military ship type

Aircraft carriers are warships that serve as sea-going airbases. They are equipped with full-length flight decks and facilities to carry, arm, deploy, and recover aircraft. Typically, these warships allow naval forces to exercise their airpower without having to depend on local bases. Aircraft carriers have evolved since their launch in the early 20th century from the earlier wooden vessels used to deploy balloons to the present-day nuclear-powered warships that carry various fighter planes, strike aircraft, helicopters, and other types of aircraft. The market for marine seats in Aircraft Carrier ships is expected to grow from USD 1.92 Million in 2022 to USD 1.97 Million in 2027.

Military Marine Seats Market for Corvettes to grow at a highest CAGR during the forecast period.

Corvettes are small warships. These are the smallest vessel class among warships. The corvettes segment of the military marine seats market is projected to grow from USD 0.28 million in 2022 and reach USD 0.99 million by 2027, at a CAGR of 29.1%.

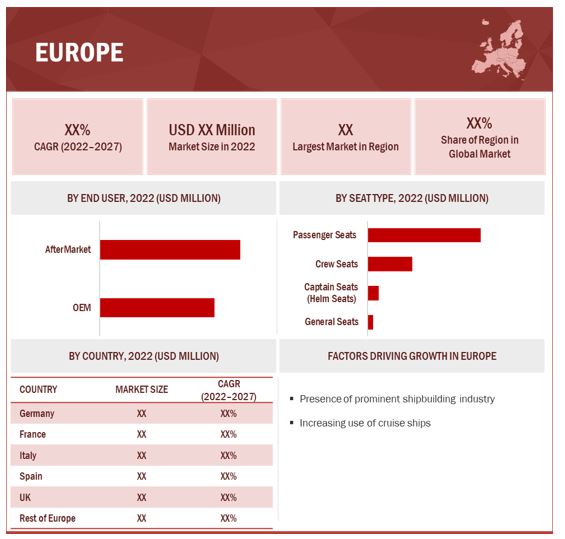

The European market is projected to contribute the largest share from 2022 to 2027

To know about the assumptions considered for the study, download the pdf brochure

Upholstery and cushion advancements

Advanced materials are being used to support upholstery to increase comfort of the users. Some companies are providing seat warmers and portable hot cushions to be used in cold temperatures. Whereas some companies are using different materials such as foam, cotton, foam padding, cotton, etc., to enhance comfort of end customers.

Shock-mitigating seats

There is a growing demand for shock-mitigating seats. These seats provide resistance against ocean shockwaves, which reduces physical fatigue during travel. These seats have high demand in military applications. It also provides a great solution to the problems associated with offshore vessels. The compact shock-mitigating seat bases manufactured now can be readily integrated into recreational boating applications. Shock mitigation also offers a cost-efficient option for seat manufacturers, as seats can be modified depending on the design. Rather than using complex supports, providing urethane bonding or base casting can also be useful. This solution is implemented by Sea Suspension Company, which manufactures seats for military uses. Such improvisations using available material can also be a crucial factor in implementing advanced technologies to make marine seats better.

Key Players

Major players in the Marine seats market include West Marine (US), Sun Marine (Netherlands), Recaro (Netherlands), Allsalts (Canada), and Shockwave (Canada). The report covers various industry trends and new technological innovations in the Marine seats market for the period, 2018-2027.

Scope of the report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.6 Billion in 2022 |

|

Projected Market Size |

USD 1.9 Billion in 2027 |

|

Growth Rate (CAGR) |

4.9% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Ship Type, By Seat Type, By End User, By Component |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

West Marine (US), Sun Marine (Netherlands), Recaro (Netherlands), Allsalts (Canada), Shockwave (Canada) |

The study categorizes the marine seats market based on Ship Type, Seat Type, End User, Component, and Region.

Based on Ship Type, the marine seats market has been segmented as follows:

- Commercial

- Military

Based on Seat Type, the marine seats market has been segmented as follows:

- Captain Seats (Helm Seats)

- Passenger Seats

- Crew Seats

- General Seats

Based on the End User, the marine seats market has been segmented as follows:

- OEM

- Aftermarket

Based on Component, marine seats market has been segmented as follows:

- Frame

- Material

- Upholstery

Based on the region, marine seats market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Rest of the World includes Latin America, and Middle East

Recent Developments

- UK: In 2022, Scotseat Group merged with KPM Marine, acquiring 50% of KPM Marine. This is expected to bring more product upskilling for Scotseat.

- Sweden: In 2022, The Lebanese Army required high-performance interceptor boats for the military. To help ASIS deliver this requirement, Ullman Dynamics provided two Ullman Jockey Suspension seats and 12 Ullman Multi-Base jockey suspension seats.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Marine seats market?

Response: The Marine seats market is expected to grow substantially owing to the technological development in designing of the Marine seats based systems for several military & commercial applications.

What are the key sustainability strategies adopted by leading players operating in the Marine seats market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the Marine seats market. Major players including West Marine (US), Sun Marine (Netherlands), Recaro (Netherlands), Allsalts (Canada), and Shockwave (Canada) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Marine seats market?

Response: Some of the major emerging technologies and use cases disrupting the market include the use of COTS components in satellite manufacturing.

Who are the key players and innovators in the ecosystem of the Marine seats market?

Response: Major players in the Marine seats market include West Marine (US), Sun Marine (Netherlands), Recaro (Netherlands), Allsalts (Canada), and Shockwave (Canada).

Which region is expected to hold the highest market share in the Marine seats market?

Response: Marine seats market in The Europe region is estimated to account for the largest share of XX% of the market in 2022 and is expected to grow at the highest CAGR of XX% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARINE SEATS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY CONSIDERED

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

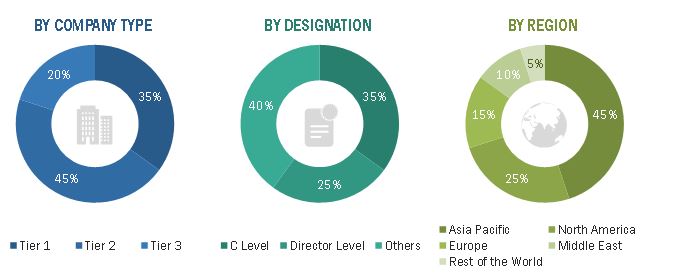

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.3 DEMAND-SIDE INDICATORS

2.1.4 SUPPLY-SIDE ANALYSIS

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

TABLE 1 MARINE SEATS MARKET ESTIMATION PROCEDURE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 RESEARCH STUDY ASSUMPTIONS

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 SEAT CUSHIONS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 AFTERMARKET SEGMENT ESTIMATED TO ACCOUNT FOR LARGER SHARE OF MARKET

FIGURE 10 PASSENGER SEATS SEGMENT ESTIMATED TO HOLD DOMINANT SHARE OF MARKET

FIGURE 11 COMMERCIAL SHIPS TO DOMINATE MARKET

FIGURE 12 EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARINE SEATS MARKET FROM 2022 TO 2027

FIGURE 13 INCREASING DEMAND FOR MAINTENANCE OF EXISTING SHIPS TO DRIVE MARKET

4.2 MARINE SEATS COMPONENT MARKET, BY FRAME, 2022 & 2027

FIGURE 14 SEAT CUSHIONS TO LEAD MARKET

4.3 MARINE SEATS MARKET, BY SHIP TYPE

FIGURE 15 COMMERCIAL SHIPS TO DOMINATE MARKET

4.4 MARINE SEATS MARKET, BY SEAT TYPE

FIGURE 16 PASSENGER SEATS TO BE LARGEST SEGMENT

4.5 MARINE SEATS MARKET, BY END USER

FIGURE 17 AFTERMARKET TO REGISTER FASTER GROWTH

4.6 MARINE SEATS MARKET, BY COUNTRY

FIGURE 18 US TO HOLD LARGEST SHARE OF MARKET AND GROW AT CAGR OF 4.7%

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARINE SEATS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for fishing and marine activities

5.2.1.2 Increasing global seaborne trade

FIGURE 20 REGISTRATIONS OF FLAGS WORLDWIDE IN 2021 (BILLION TONS)

5.2.1.3 Rising cruise travel worldwide

FIGURE 21 RISING OCEAN CRUISE PASSENGERS (MILLION)

TABLE 2 TOTAL CRUISE PASSENGER GROWTH, 2017–2021

5.2.2 RESTRAINTS

5.2.2.1 New product development impact

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in defense spending

5.2.4 CHALLENGES

5.2.4.1 Rising cost of materials and operations

5.3 DEMAND-SIDE IMPACT

5.3.1 KEY DEVELOPMENTS FROM JANUARY 2019 TO MAY 2022

TABLE 3 KEY DEVELOPMENTS IN MARINE SEATS MARKET IN 2022

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.5 MARKET ECOSYSTEM

FIGURE 23 MARINE SEATS MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

TABLE 4 MARINE SEATS MARKET ECOSYSTEM

5.6 PRICING ANALYSIS

5.6.1 AVERAGE SELLING PRICE ANALYSIS OF MARINE SEATS, 2021

FIGURE 24 AVERAGE SELLING PRICE OF MARINE SEATS OFFERED BY TOP PLAYERS

5.7 TARIFF REGULATORY LANDSCAPE

5.7.1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.4 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.5 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.8 MARINE SEATS MARKET: TRADE DATA

5.8.1 TRADE ANALYSIS

TABLE 5 COUNTRY-WISE IMPORTS, 2019–2021 (USD THOUSAND)

TABLE 6 COUNTRY-WISE EXPORTS, 2019–2021 (USD THOUSAND)

5.9 MARINE SEATS MARKET: PATENT ANALYSIS

FIGURE 25 LIST OF MAJOR PATENTS FOR MARINE SEATS

TABLE 7 MAJOR PATENTS FOR MARINE SEATS

5.10 MARINE SEATS MARKET: VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS

5.11 TECHNOLOGY ANALYSIS

5.11.1 KEY TECHNOLOGIES

5.11.1.1 Advanced upholstery materials

5.11.1.2 Shock-mitigating seats

5.12 PORTER’S FIVE FORCES ANALYSIS

5.12.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCE ANALYSIS

5.12.2 THREAT OF NEW ENTRANTS

5.12.3 THREAT OF SUBSTITUTES

5.12.4 BARGAINING POWER OF SUPPLIERS

5.12.5 BARGAINING POWER OF BUYERS

5.12.6 INTENSITY OF COMPETITIVE RIVALRY

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS ON BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING MARINE SEATS, BY SEAT TYPE

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING MARINE SEATS, BY SEAT TYPE (%)

5.13.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR MARINE SEATS, BY SHIP TYPE

TABLE 9 KEY BUYING CRITERIA FOR MARINE SEATS, BY SHIP TYPE

5.14 USE CASES

5.14.1 LEBANESE ARMY UTILIZED ULLMAN DYNAMICS MARINE SEATS

5.15 KEY CONFERENCES & EVENTS, 2022-23

TABLE 10 MARINE SEATS MARKET: CONFERENCES & EVENTS

5.16 OPERATIONAL DATA

TABLE 11 NEW COMMERCIAL SHIP DELIVERIES, BY SHIP TYPE, 2017-2020

6 INDUSTRY TRENDS (Page No. - 72)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

6.3.1 MARINE SEATS FOR MILITARY APPLICATIONS

6.3.2 UPHOLSTERY AND CUSHION ADVANCEMENTS

6.3.3 SUSPENSION AND HEIGHT ADJUSTMENT

6.4 IMPACT OF MEGATRENDS

6.4.1 SIMPLIFIED 3D HUMAN BODY-SEAT INTERACTION MODEL

6.5 PATENT ANALYSIS (2012–2022)

TABLE 12 KEY PATENTS

7 MARINE SEATS MARKET, BY SHIP TYPE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 31 COMMERCIAL SEGMENT PROJECTED TO LEAD MARINE SEATS MARKET FROM 2022 TO 2027

TABLE 13 MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 14 MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

7.2 COMMERCIAL

TABLE 15 COMMERCIAL MARINE SEATS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 16 COMMERCIAL MARINE SEATS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2.1 BULK CARRIERS

7.2.1.1 Demand driven by increasing maritime trade in Asia Pacific

7.2.2 GAS TANKERS

7.2.2.1 Used in oil & gas operations

7.2.3 TANKERS

7.2.3.1 Required for international trading of LNG

7.2.4 CRUISES

7.2.4.1 Increasing maritime tourism to drive segment

7.2.5 PASSENGER FERRIES

7.2.5.1 Vital to water-based public transportation

7.2.6 DRY CARGO SHIPS

7.2.6.1 Useful in global maritime trade

7.2.7 RESEARCH VESSELS

7.2.7.1 Needed for oil & gas exploration and fishing activities

7.2.8 DREDGERS

7.2.8.1 Increasing upgrade of sea infrastructures to drive segment

7.2.9 MOTORBOATS

7.2.9.1 Backbone of water-based recreational activities

7.2.10 OTHERS

7.3 MILITARY

TABLE 17 MILITARY MARINE SEATS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 18 MILITARY MARINE SEATS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3.1 AIRCRAFT CARRIERS

7.3.1.1 Upgrade of new systems and marine seats

7.3.2 AMPHIBIOUS SHIPS

7.3.2.1 Consistent global demand

7.3.3 DESTROYERS

7.3.3.1 Used to protect large vessels against powerful short-range attackers

7.3.4 FRIGATES

7.3.4.1 Required to carry a variety of armaments

7.3.5 SUBMARINES

7.3.5.1 Increasing investments in development of advanced submarines

7.3.6 CORVETTES

7.3.6.1 Widely used in sea warfare

7.3.7 OFFSHORE PATROL VESSELS

7.3.7.1 Required to patrol water borders

7.3.8 OTHERS

8 MARINE SEATS MARKET, BY SEAT TYPE (Page No. - 88)

8.1 INTRODUCTION

FIGURE 32 PASSENGER SEATS SEGMENT PROJECTED TO DOMINATE MARINE SEATS MARKET FROM 2022 TO 2027

TABLE 19 MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 20 MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

8.2 CAPTAIN SEATS (HELM SEATS)

8.2.1 MAJOR USAGE IN PASSENGER CRUISES

8.3 CREW SEATS

8.3.1 AFTERMARKET AND RESELLING BOOST DEMAND

8.4 PASSENGER SEATS

8.4.1 DEMAND DRIVEN BY INCREASING GLOBAL SEA PASSENGER TRAFFIC

8.5 GENERAL SEATS

8.5.1 INCREASING SHIP CAPACITIES TO GENERATE DEMAND

9 MARINE SEATS MARKET, BY COMPONENT (Page No. - 91)

9.1 INTRODUCTION

9.2 FRAME

FIGURE 33 FOOTRESTS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 MARINE SEATS MARKET, BY FRAME 2018–2021 (USD MILLION)

TABLE 22 MARINE SEATS MARKET, BY FRAME 2022–2027 (USD MILLION)

9.2.1 PEDESTAL

9.2.1.1 Used in high-speed boats

9.2.2 BASE

9.2.2.1 Short replacement cycle leads to frequent demand

9.2.3 SWIVELS, SLIDERS, & SEAT MOUNTS

9.2.3.1 Replaced frequently due to harsh sea environments

9.2.4 FOOTRESTS

9.2.4.1 Widely used in passenger ferries

9.2.5 SEAT CUSHIONS

9.2.5.1 Require frequent repairs and replacement

9.2.6 OTHERS

9.3 MATERIAL

TABLE 23 MARINE SEATS MARKET, BY MATERIAL 2018–2021 (USD MILLION)

TABLE 24 MARINE SEATS MARKET, BY MATERIAL 2022–2027 (USD MILLION)

9.3.1 ALUMINUM

9.3.1.1 Used in making lightweight marine seats

9.3.2 STEEL

9.3.2.1 Growing container fleet to drive demand

9.3.3 OTHERS (COMPOSITES)

9.4 MARINE UPHOLSTERY

9.4.1 MARINE-GRADE VINYL

9.4.1.1 Increasing recreational boating to drive segment

9.4.2 LEATHER

9.4.2.1 Primarily used in luxury cruises

10 MARINE SEATS MARKET, BY END USER (Page No. - 97)

10.1 INTRODUCTION

FIGURE 34 AFTERMARKET TO DOMINATE DURING FORECAST PERIOD

TABLE 25 MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 26 MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2 OEM

10.2.1 RECREATIONAL ACTIVITIES AND DEMAND FOR MOTORBOATS

10.3 AFTERMARKET

10.3.1 REPLACEMENT OF MARINE-GRADE VINYL UPHOLSTERY

11 MARINE SEATS MARKET, BY REGION (Page No. - 100)

11.1 INTRODUCTION

FIGURE 35 EUROPE TO HOLD LARGEST SHARE OF MARINE SEATS MARKET IN 2022

TABLE 27 MARINE SEATS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 MARINE SEATS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS

FIGURE 36 NORTH AMERICA: MARINE SEATS MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: MARINE SEATS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 30 NORTH AMERICA: MARINE SEATS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 32 NORTH AMERICA: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 34 NORTH AMERICA: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 36 NORTH AMERICA: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Increase in commercial marine activities

TABLE 39 US: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 40 US: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 41 US: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 42 US: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 43 US: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 44 US: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 45 US: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 46 US: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Strategic coastal geography presents market opportunities

TABLE 47 CANADA: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 48 CANADA: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 49 CANADA: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 50 CANADA: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 51 CANADA: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 52 CANADA: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 53 CANADA: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 54 CANADA: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS

FIGURE 37 EUROPE: MARINE SEATS MARKET SNAPSHOT

TABLE 55 EUROPE: MARINE SEATS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 56 EUROPE: MARINE SEATS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 57 EUROPE: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 58 EUROPE: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 59 EUROPE: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 60 EUROPE: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 61 EUROPE: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 62 EUROPE: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 63 EUROPE: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 64 EUROPE: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 In-house development of naval vessels

TABLE 65 GERMANY: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 66 GERMANY: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 67 GERMANY: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 68 GERMANY: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 69 GERMANY: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 70 GERMANY: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 71 GERMANY: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 72 GERMANY: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Increasing deployment of ships for business purposes

TABLE 73 FRANCE: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 74 FRANCE: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 75 FRANCE: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 76 FRANCE: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 77 FRANCE: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 78 FRANCE: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 79 FRANCE: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 80 FRANCE: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.3.4 UK

11.3.4.1 Strong maritime industry

TABLE 81 UK: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 82 UK: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 83 UK: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 84 UK: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 85 UK: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 86 UK: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 87 UK: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 88 UK: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Home to tourist destinations like Venice

TABLE 89 ITALY: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 90 ITALY: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 91 ITALY: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 92 ITALY: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 93 ITALY: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 94 ITALY: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 95 ITALY: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 96 ITALY: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.3.6 SPAIN

11.3.6.1 Growth in government initiatives and tourism

TABLE 97 SPAIN: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 98 SPAIN: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 99 SPAIN: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 100 SPAIN: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 101 SPAIN: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 102 SPAIN: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 103 SPAIN: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 104 SPAIN: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 105 REST OF EUROPE: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 106 REST OF EUROPE: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 107 REST OF EUROPE: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 108 REST OF EUROPE: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 109 REST OF EUROPE: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 110 REST OF EUROPE: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 111 REST OF EUROPE: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 112 REST OF EUROPE: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS

FIGURE 38 ASIA PACIFIC: MARINE SEATS MARKET SNAPSHOT

TABLE 113 ASIA PACIFIC: MARINE SEATS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARINE SEATS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Technologically advanced marine infrastructure

TABLE 123 JAPAN: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 124 JAPAN: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 125 JAPAN: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 126 JAPAN: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 127 JAPAN: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 128 JAPAN: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 129 JAPAN: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 130 JAPAN: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.4.3 AUSTRALIA

11.4.3.1 Increase in marine and recreational activities

TABLE 131 AUSTRALIA: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 132 AUSTRALIA: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 133 AUSTRALIA: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 134 AUSTRALIA: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 135 AUSTRALIA: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 136 AUSTRALIA: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 137 AUSTRALIA: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 138 AUSTRALIA: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.4.4 CHINA

11.4.4.1 Various shipbuilding opportunities prevalent

TABLE 139 CHINA: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 140 CHINA: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 141 CHINA: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 142 CHINA: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 143 CHINA: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 144 CHINA: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 145 CHINA: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 146 CHINA: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.4.5 INDIA

11.4.5.1 Growing shipbuilding capacity

TABLE 147 INDIA: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 148 INDIA: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 149 INDIA: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 150 INDIA: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 151 INDIA: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 152 INDIA: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 153 INDIA: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 154 INDIA: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 Presence of major shipbuilding companies

TABLE 155 SOUTH KOREA: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 156 SOUTH KOREA: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 157 SOUTH KOREA: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 158 SOUTH KOREA: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 159 SOUTH KOREA: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 160 SOUTH KOREA: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 161 SOUTH KOREA: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 162 SOUTH KOREA: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 163 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 169 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.5 REST OF THE WORLD

11.5.1 PESTLE ANALYSIS

FIGURE 39 REST OF THE WORLD: MARINE SEATS MARKET SNAPSHOT

TABLE 171 REST OF THE WORLD: MARINE SEATS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 172 REST OF THE WORLD: MARINE SEATS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 173 REST OF THE WORLD: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 174 REST OF THE WORLD: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 175 REST OF THE WORLD: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 176 REST OF THE WORLD: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 177 REST OF THE WORLD: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 178 REST OF THE WORLD: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 179 REST OF THE WORLD: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 180 REST OF THE WORLD: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.2.1 Increasing sea trade opportunities with high investments

TABLE 181 MIDDLE EAST: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 182 MIDDLE EAST: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 183 MIDDLE EAST: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 184 MIDDLE EAST: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 185 MIDDLE EAST: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 186 MIDDLE EAST: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 187 MIDDLE EAST: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 188 MIDDLE EAST: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

11.5.3 LATIN AMERICA

11.5.3.1 High number of internal water bodies fuels market growth

TABLE 189 LATIN AMERICA: MARINE SEATS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: MARINE SEATS MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARINE SEATS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARINE SEATS MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARINE SEATS MARKET, BY SEAT TYPE, 2018–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARINE SEATS MARKET, BY SEAT TYPE, 2022–2027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARINE SEATS MARKET, BY FRAME, 2018–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARINE SEATS MARKET, BY FRAME, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 158)

12.1 INTRODUCTION

TABLE 197 KEY DEVELOPMENTS IN MARINE SEATS MARKET BETWEEN JANUARY 2022 AND JUNE 2022

12.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2022

TABLE 198 DEGREE OF COMPETITION

12.3 RANK ANALYSIS, 2021

FIGURE 40 REVENUE SHARE OF TOP FIVE PLAYERS IN MARINE SEATS MARKET IN 2021

TABLE 199 COMPANY REGION FOOTPRINT

TABLE 200 COMPANY APPLICATION FOOTPRINT

TABLE 201 COMPANY MOBILITY FOOTPRINT

12.4 COMPETITIVE EVALUATION QUADRANT

12.4.1 STARS

12.4.2 PERVASIVE COMPANIES

12.4.3 EMERGING LEADERS

12.4.4 PARTICIPANTS

FIGURE 41 MARINE SEATS MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

12.5 COMPETITIVE BENCHMARKING

FIGURE 42 MARINE SEATS MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 STARTING BLOCKS

12.5.4 DYNAMIC COMPANIES

12.6 DETAILED LIST & COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 202 MARINE SEATS MARKET: KEY START-UPS/SMES

TABLE 203 MARINE SEATS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.7 COMPETITIVE SCENARIO

12.7.1 PRODUCT LAUNCHES

TABLE 204 PRODUCT LAUNCHES, JANUARY 2019–JUNE 2022

12.7.2 DEALS

TABLE 205 DEALS, JANUARY 2019–JUNE 2022

13 COMPANY PROFILES (Page No. - 172)

13.1 INTRODUCTION

(Business overview, Products offered, Recent Developments, MNM view)*

13.2 WEST MARINE

TABLE 206 WEST MARINE: BUSINESS OVERVIEW

13.3 NORSAP

TABLE 207 NORSAP: BUSINESS OVERVIEW

13.4 TRASEA

TABLE 208 TRASEA: BUSINESS OVERVIEW

13.5 SCOT SEAT GROUP

TABLE 209 SCOT SEAT: BUSINESS OVERVIEW

13.6 STIDD SYSTEMS

TABLE 210 STIDD SYSTEMS: BUSINESS OVERVIEW

13.7 TEK SEATING

TABLE 211 TEK SEATING: BUSINESS OVERVIEW

13.8 GRAMMER AG

TABLE 212 GRAMMER: BUSINESS OVERVIEW

13.9 SPRINGFIELD MARINE COMPANY

TABLE 213 SPRINGFIELD: BUSINESS OVERVIEW

13.10 THOMAS SCOTT SEATING

TABLE 214 THOMAS SCOTT: BUSINESS OVERVIEW

13.11 SHOCKWAVE

TABLE 215 SHOCKWAVE: BUSINESS OVERVIEW

13.12 ULLMAN DYNAMICS

TABLE 216 ULLMAN DYNAMICS: BUSINESS OVERVIEW

13.13 ALU DESIGN & SERVICES

TABLE 217 ALU DESIGN & SERVICES: BUSINESS OVERVIEW

13.14 TODD MARINE

TABLE 218 TODD MARINE: BUSINESS OVERVIEW

13.15 ALLSALT

TABLE 219 ALLSALT: BUSINESS OVERVIEW

13.16 PACIFIC MARINE & INDUSTRIAL

TABLE 220 PACIFIC MARINE & INDUSTRIAL: BUSINESS OVERVIEW

13.17 CROWNSEATS

TABLE 221 CROWNSEATS: BUSINESS OVERVIEW

13.18 RECARO

TABLE 222 RECARO: BUSINESS OVERVIEW

13.19 UES MARINE

TABLE 223 UES MARINE: BUSINESS OVERVIEW

13.20 SUN MARINE

TABLE 224 SUN MARINE: BUSINESS OVERVIEW

13.21 TACO MARINE

TABLE 225 TACO MARINE: BUSINESS OVERVIEW

13.22 SANHUI

TABLE 226 SANHUI: BUSINESS OVERVIEW

13.23 WISE SEATS

TABLE 227 WISE SEATS: BUSINESS OVERVIEW

13.24 CLEEMANN CHAIR-SYSTEMS

TABLE 228 CLEEMAN CHAIRS-SYSTEMS: BUSINESS OVERVIEW

13.25 X-CRAFT SUSPENSION SEATS

TABLE 229 X-CRAFT SUSPENSION SEATS: BUSINESS OVERVIEW

13.26 BESENZONI

TABLE 230 BESENZONI: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 204)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

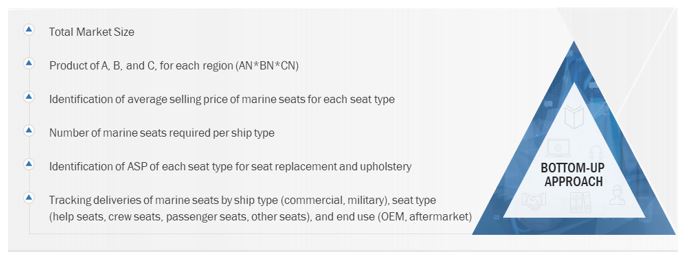

The study involved four major activities in estimating the current size of the marine seats market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from marine seats vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using marine seats were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of marine seats and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

MARINE SEATS OEM |

OTHERS |

|

West Marine |

Alu Design & Services |

|

STIDD Systems |

TEK Seating |

|

Ullman Dynamics |

Trasea |

|

Allsalt (Shoxs) |

Sun Marine |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the marine seats market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global marine seats market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the marine seats market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the marine seats market.

Report Objectives

- To define, describe, and forecast the marine seats market size based on seat type, ship type, end user, component, and region

- To forecast the size of different segments of the market with respect to 4 major regions: North America, Europe, Asia Pacific, Middle East, and the Rest of the World (Middle East and Latin America), along with their respective key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to their individual growth trends, prospects, and contribution to the overall market

- To profile companies operating in the marine seats market based on their product portfolios, market share, and key growth strategies

- To analyze the degree of competition among players in the market by identifying and analyzing their business overview, products offered, and recent developments and ranking them based on these parameters

- To analyze competitive developments such as deals, new product developments, and partnerships/acquisitions undertaken by key market players

- To strategically profile key players and comprehensively analyze their share and core competencies2 in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marine Seats Market