Marine Interiors Market Size, Share & Industry Growth Analysis Report by Ship Type (Commercial, Defense), End User (New Fit, Refit), Material (Aluminum, Steel, Joinery, Composites), Product (Ceilings & Wall Panels, Furniture, Galleys & Pantries, Lighting), Application, Geography- Global Growth Driver and Industry Forecast to 2027

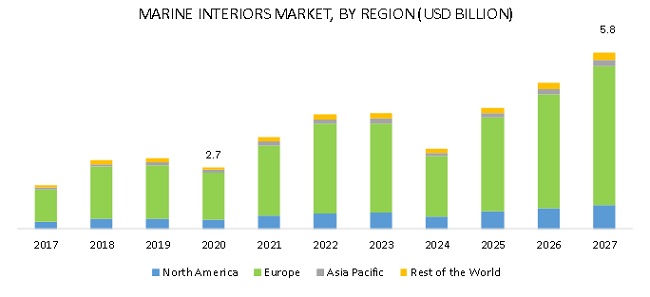

[304 Pages Report] The Global Marine Interior Market size is expected to grow from USD 2.7 Billion in 2020 to USD 5.8 Billion by 2027, at a Compound Annual Growth Rate (CAGR) of 11.6% during the forecast period. The growth of the Marine Interior Industry can be attributed to the rising demand for cruise ships and increasing refurbishment activities in the existing ships. The growing trend of marine tourism and the increasing disposable income of individuals across the globe are also driving the growth of the market. The high cost of materials and the impact of COVID-19 on the tourism industry may hinder the growth of the market to some extent.

Based on Ship Type, the Commercial Segment of the Marine Interiors Market is Projected to Grow at the Highest CAGR During the Forecast Period.

Based on the ship type, the commercial segment of marine interiors market is projected to grow at the highest CAGR from 2020 to 2027. The demand for interiors is majorly dependent on the cruise ship, and yachts new orderbooks and drydock schedule. The demand for interiors is fully dependent on the cruise ship orderbook. The demand for marine interiors is not only limited to the newbuild ship orderbook but also is dependent on drydock refurbishment, where cruise ships undergo partial or complete upgradation of interiors in every two-three years.

Based on the Material, the Composites Segment is Expected to Grow at the Highest Rate From 2020 to 2027.

Based on material, the marine interiors market is segmented into aluminum, steel, composites, joinery and others. The composites segment of the marine interiors market is projected to grow at the highest CAGR from 2020 to 2027. Composites offer considerable potential in weight saving and in developing complex shapes. Thus, they are used in manufacturing superstructures. Combined with their non-corroding finish and sheer versatility, composites appear to be natural material for use in shipbuilding.

Based on the End User, the Refit Segment is Expected to Grow at a Higher Rate From 2020 to 2027.

Based on end user, the re fit segment of the marine interiors market is projected to grow at a higher CAGR as compared to the newsegment during the forecast period. Various cruise lines are coming up with refurbishment programs to upgrade the interior of their ships and reduce the high capital expenditure.

Europe is Estimated to Account for the Largest Share of the Marine Interiors Market in 2020.

Based on the region, the European region of the marine interiors market is estimated to account for the largest share in 2020. The large share of this market can be attributed due to the presence of the leading manufacturers of marine interior providers such as Hella (Germany), Osram (Germany), Lumishore (UK), and Foresti & Saurdi (Italy) in this region. Countries such as Norway and Greece have a large number of passenger as well as commercial ships. The European region constituted a share of 28.2% of the global ships in 2019, and The EU continues to dominate the market for cruise ships and passenger vessels by a wide margin, with deliveries in terms of CGT in 2017, with 61%.

Marine Interiors Companies: Marine Interiors Key Market Players

The Marine Interior Companies are dominated by globally established players such as R&M Group (Germany), Almaco (Finland), Trimline (UK), Kaefer (Germany), Bourne Group (US), Marine Interiors (Italy), Mivan Marine (UK), Oy Lautex AB (Finland), Bolidt (Netherlands), Forbo Flooring Systems (Netherlands), Naval Interior Team (Finland), Tillberg Design of Sweden (Sweden), YSA Design (Norway), AROS Marine (Lithuania), NORAC AS (Norway), and Precetii INC (US), among others. These players have adopted various growth strategies such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements to expand their presence in the marine interiors market.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 2.7 billion in 2020 |

|

Projected Market Size |

USD 5.8 billion by 2027 |

|

Growth Rate |

11.6% |

|

Forecast Period |

2020 - 2027 |

| On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Regions Covered |

|

|

Companies Covered |

|

| Top Companies in North America |

|

|

Largest Growing Region |

Europe |

|

Largest Market Share Segment |

Composites Segment |

|

Highest CAGR Segment |

Commercial Segment |

|

Largest Application Market Share |

Refit Segment |

Based on Ship Type:

-

Commercial

-

PASSENGER VESSELS

- Ferries

-

Cruises

- Luxury

- PREMIUM

- BUDGET

-

Yachts

- LUXURY

- PREMIUM

- BUDGET

-

Cargo Vessels

- Bulk Carriers

- Gas Tankers

- Tankers

- General Cargo Ships

-

Others

- Dredgers

- Research Vessels

-

PASSENGER VESSELS

-

7.3 - defense

- Aircraft carriers

- Amphibious ships

- Destroyers

- Frigates

- Submarines

- Corvettes

- Offshore Patrol Vessels

By Material

- Aluminum

- Steel

- Composites

- Joinery

- Others

By Application

-

Passenger Area

- Inside and Outside Cabins

- Wet Units

- Suites

-

Public Area

- SPA & Wellness Areas

- Disco & Casinos

- Staircases & Corridors

-

Crew Area

- Cabin & Wet units

- Recreational Rooms

- Mess rooms

- Crew Corridors & Crew Staircases

-

Public Area

- Galleys, pantries, provision stores

- Bridges

- AC-rooms

- Laundries

- Engine Rooms

By End User:

- New Fit

- Refit

By Product

- Ceiling & Wall Panels

-

Lighting

- Ceiling & Walls

- Flooring

- Signage

- Decorative

- Furniture

- Galleys & Pantries

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Italy

- UK

- France

- Germany

- Finland

- Rest of Europe

-

Asia Pacific

- China

- India

- South Korea

- Japan

- Australia

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Latin America

Recent Developments

- In February 2020, Trimline signed a contract with TUI Cruises to start the interior refit of Mein Schiff 4 in Marseille, France

- In February 2020, Tillberg Design of Sweden provided design for Norwegian Encore Cruise Ship. The company designed the top guest areas on board; all cabins and suites, the Aft Main Restaurants, Steakhouse, and Los Lobos and many more restaurants and bars onboard.

- In November 2019, ALMACO signed a contract to deliver 30 new staterooms during an upcoming refit at Grand Bahama Shipyard in March 2020. The scope of work involves the full turnkey outfitting of 30 new staterooms on deck 9.

Frequently Asked Questions (FAQ):

What is the Marine Interior Market and What Factors Are Driving Its Growth?

The marine interior market refers to the market for interior products and services used in ships, boats, and other marine vessels. The market is driven by factors such as the rising demand for cruise ships, increasing refurbishment activities in existing ships, and the growing trend of marine tourism.

What is the Expected Size of the Marine Interior Market in the Coming Years?

According to MarketsandMarkets, the global marine interior market size is expected to grow from USD 2.7 billion in 2020 to USD 5.8 billion by 2027, at a CAGR of 11.6% during the forecast period.

What Are Some of the Challenges Faced by the Marine Interior Market?

The high cost of materials and the impact of COVID-19 on the tourism industry are two of the main challenges faced by the marine interior market.

What Are Some of the Products and Services Included in the Marine Interior Market?

The marine interior market includes a wide range of products and services, such as flooring, ceiling, wall panels, lighting, furniture, upholstery, and acoustic insulation, among others.

Which Regions Are Expected to Witness Significant Growth in the Marine Interior Market?

The European region is expected to witness significant growth in the marine interior market, owing to the increasing demand for cruise ships and the rising disposable income of individuals in the region. The large share of this market can be attributed due to the presence of the leading manufacturers of marine interior providers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET DEFINITION & SCOPE

2.2.1 SEGMENT DEFINITIONS

2.2.1.1 Industry, by ship type

2.2.1.2 Industry, by material

2.2.1.3 Industry, by end user

2.2.1.4 Industry, by application

2.2.1.5 Industry, by product

2.2.2 EXCLUSIONS

2.3 MARKET SIZE ESTIMATION & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 MARKET SIZING & FORECASTING

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN MARINE INTERIORS MARKET

4.2 INDUSTRY, BY END USER

4.3 INDUSTRY, BY PRODUCT

4.4 INDUSTRY, BY SHIP TYPE

4.5 INDUSTRY, BY REGION

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing maritime tourism industry

5.2.1.2 Rise in river cruise market

5.2.1.3 Growth in refurbishment market

5.2.2 RESTRAINTS

5.2.2.1 High downtime in retrofitting ships

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of additive manufacturing to produce lighter, faster, and fireproof interiors

5.2.3.2 Rising adoption of OLED lighting technology

5.2.3.3 Surging demand for passenger ships from Asian shipyards

5.2.4 CHALLENGES

5.2.4.1 Delay in passenger ship deliveries

5.2.4.2 Space constraints in cruise lines

5.2.4.3 COVID-19 impact on the marine industry

6 INDUSTRY TRENDS (Page No. - 52)

6.1 INTRODUCTION

6.2 ROADMAP TOWARD EMISSION-FREE SHIPPING INDUSTRY

6.3 TECHNOLOGY TRENDS IN THE INDUSTRY

6.3.1 RISING ADOPTION OF SMART CABINS IN PASSENGER SHIPS

6.3.2 SHIFTING FROM TRADITION CABIN MANUFACTURING TO PREFABRICATION

6.3.3 ADOPTION OF WATERPROOF LED LIGHTING IN PASSENGER SHIPS

6.3.4 ADOPTION OF DIGITAL WINDOWS IN LOW BUDGET CABINS

6.3.4.1 Virtual balconies

6.3.4.2 Magical portholes

6.3.5 SHOW KITCHENS

6.3.6 NORWEGIAN'S FREESTYLE CONCEPT

6.3.7 BREWERIES AND CRAFT BEER HALLS

6.3.8 NEW GREEN FLOORING

6.3.9 ADVANCED UPHOLSTERY MATERIALS

6.3.10 SHOCK MITIGATING SEATS

6.3.11 ADVANCEMENT IN GALLEYS & LAUNDRIES

6.3.11.1 Adoption of lightweight galleys

6.3.11.2 Adoption of energy efficient galley solutions

6.4 INNOVATIONS & PATENT REGISTRATIONS

7 MARINE INTERIORS MARKET, BY SHIP TYPE (Page No. - 58)

7.1 INTRODUCTION

7.2 COMMERCIAL

7.2.1 PASSENGER VESSELS

7.2.1.1 Yachts

7.2.1.1.1 Luxury

7.2.1.1.1.1 Luxury yachts are large-sized, luxurious vessels with length varying from 75-250 Feet

7.2.1.1.2 Premium

7.2.1.1.2.1 Premium yachts emphasize more on quality, comfort, and style over price factor

7.2.1.1.3 Budget

7.2.1.1.3.1 Budget yachts are also known as bargain/economy/contemporary vessels

7.2.1.2 Cruise

7.2.1.2.1 Luxury

7.2.1.2.1.1 Vacationers increasingly selecting smaller-ship voyages on luxury ocean and river cruise line

7.2.1.2.2 Premium

7.2.1.2.2.1 Premium cruise ships typically feature additional guest spaces and art collections

7.2.1.2.3 Budget

7.2.1.2.3.1 The budget cruise is less expensive than premium and luxury cruises

7.2.1.3 Ferries

7.2.1.3.1 Retrofitting of ferries is expected to drive the demand for marine interiors

7.2.2 CARGO VESSELS

7.2.2.1 Container ships

7.2.2.1.1 Increasing seaborne trade drive the demand for container vessels and thereby marine interiors

7.2.2.2 Bulk carriers

7.2.2.2.1 Increased demand for retrofitting existing bulk carriers will fuel the demand for marine interiors

7.2.2.3 Tankers

7.2.2.3.1 Rising demand for oil tankers to transport LNG is expected to drive the demand for marine interiors

7.2.2.4 General cargo ships

7.2.2.4.1 Modernization of general cargo vessels increases the demand for marine interiors

7.2.3 OTHERS

7.2.3.1 Dredgers

7.2.3.1.1 Growing demand for dredgers to remove contaminants from seabed is expected to fuel the demand for marine interiors

7.2.3.2 Research vessels

7.2.3.2.1 Increasing construction of research vessels will propel the demand for marine nteriors

7.2.4 DEFENSE

7.2.4.1 Destroyers

7.2.4.1.1 Increasing procurement of destroyers by countries is driving the demand for marine interiors

7.2.4.2 Frigates

7.2.4.2.1 Rising demand for construction and maintenance of frigates will drive the demand for marine interiors in the coming years

7.2.4.3 Corvettes

7.2.4.3.1 Ongoing procurement of corvettes across militaries is driving the demand of marine interior

7.2.4.4 Submarines

7.2.4.4.1 Development of advanced submarines by major countries expected to propel the demand for marine interiors in the coming years

7.2.4.5 Offshore patrol vessels

7.2.4.5.1 Increased demand for offshore patrol vessels by military forces will propel the demand for marine interiors

7.2.4.6 Aircraft carriers

7.2.4.6.1 Procurement of advanced aircraft carriers for strengthening naval fleet by countries will fuel the market for marine interiors

7.2.4.7 Amphibious ships

7.2.4.7.1 Construction of amphibious ships will drive the demand for marine interiors

8 MARINE INTERIORS MARKET, BY END USER (Page No. - 75)

8.1 INTRODUCTION

8.2 NEW FIT

8.2.1 RISE IN COMMERCIAL SHIP ORDERBOOK IS DRIVING THE CRUISE NEW FIT MARKET

8.3 REFIT

8.3.1 CRUISE LINE OPERATORS AND OWNERS PREFER REFIT OVER NEWBUILD TO REDUCE THE CAPITAL EXPENDITURE

8.4 CRUISES

8.4.1 CRUISE LINE OPERATORS AND OWNERS PREFER REFIT OVER NEWBUILD TO REDUCE THE CAPITAL EXPENDITURE

8.5 YACHTS

8.5.1 ITALY TO HOLD THE LARGEST SHARE IN YACHT REFIT MARKET

9 MARINE INTERIORS MARKET, BY APPLICATION (Page No. - 84)

9.1 INTRODUCTION

9.2 PASSENGER AREA

9.2.1 INSIDE AND OUTSIDE CABINS

9.2.2 WET UNITS

9.2.3 SUITES

9.3 PUBLIC AREA

9.3.1 SPA & WELLNESS AREAS

9.3.2 DISCOS & CASINOS

9.3.3 STAIRCASES & CORRIDORS

9.4 CREW AREA

9.4.1 CABIN & WET UNITS

9.4.2 RECREATIONAL ROOMS

9.4.3 MESS ROOMS

9.4.4 CREW CORRIDORS & CREW STAIRCASES

9.5 UTILITY AREA

9.5.1 GALLEYS, PANTRIES & PROVISION STORES

9.5.2 BRIDGES

9.5.3 AC ROOMS

9.5.4 ENGINE ROOMS

9.5.5 LAUNDRIES

10 MARINE INTERIORS MARKET, BY MATERIAL (Page No. - 94)

10.1 INTRODUCTION

10.2 ALUMINUM

10.3 STEEL

10.4 COMPOSITES

10.5 JOINERY

10.6 OTHERS

11 MARINE INTERIORS MARKET, BY PRODUCT (Page No. - 100)

11.1 INTRODUCTION

11.2 CEILINGS & WALL PANELS

11.2.1 COMPOSITES, ALUMINUM, AND STEEL ARE USED IN MANUFACTURING CEILINGS & WALL PANELS

11.3 LIGHTING

11.3.1 CEILINGS & WALLS

11.3.1.1 Ceiling & wall lights are majorly used in cabins, wet units, spa & wellness, theaters, and restaurants

11.3.2 FLOORING

11.3.2.1 Floor path lights are useful during an emergency to guide passengers during an evacuation

11.3.3 DECORATIVE

11.3.3.1 LED, Halogen, Xenon, and fluorescent technologies are used in decorative lighting

11.3.4 SIGNAGE

11.3.4.1 Signage lights are also known as compartment & utility lights

11.4 GALLEYS & PANTRIES

11.4.1 THE DEMAND FOR GALLEY & PANTRIES IS HIGH IN NEWBUILD SHIPS AS WELL AS REFURBISHMENT MARKET

11.5 FURNITURE

11.5.1 FURNITURE USED IN SHIPS ARE CONSTRUCTED USING LIGHTWEIGHT NON-COMBUSTIBLE MATERIALS

11.6 OTHERS

11.6.1 WINDOWS AND DOORS ARE MADE OF ALUMINUM, STAINLESS STEEL, AND GLASS

12 REGIONAL ANALYSIS (Page No. - 106)

12.1 INTRODUCTION

12.2 EUROPE

12.2.1 ITALY

12.2.1.1 Presence of recognized cruise shipbuilders is expected to drive the marine interiors industry

12.2.2 UK

12.2.2.1 Growth of the shipbuilding industry expected to drive manufacturing of new vessels thereby fuel the demand for marine interiors

12.2.3 FRANCE

12.2.3.1 Presence of stringent environmental regulations is driving the market in France

12.2.4 GERMANY

12.2.4.1 Growing demand for recreational boating in Germany is expected to fuel the demand for marine interiors

12.2.5 FINLAND

12.2.5.1 Increasing demand for polar cruise ships is expected to drive the marine interiors industry in Finland

12.2.6 REST OF EUROPE

12.3 NORTH AMERICA

12.3.1 US

12.3.1.1 Rising demand for river cruise is expected to drive the market for cabin interiors in the US

12.3.2 CANADA

12.3.2.1 Canada is a lucrative market for marine interiors from the demand side

12.4 ASIA PACIFIC

12.4.1 CHINA

12.4.1.1 Increasing cruising and rising demand for merchant ships expected to stimulate the demand for marine interiors

12.4.2 INDIA

12.4.2.1 Growth of maritime industry is driving the market for marine interiors in India

12.4.3 JAPAN

12.4.3.1 Increasing cruising activities expected to boost the demand for marine interiors

12.4.4 AUSTRALIA

12.4.4.1 Increasing commercial vessel manufacturing in Australia expected to boost the demand for marine interiors

12.4.5 SOUTH KOREA

12.4.5.1 Increasing commercial shipbuilding activities is expected to boost the demand for marine interiors

12.4.6 REST OF ASIA PACIFIC

12.4.6.1 Commercial ships to hold the largest share in the marine interiors market

12.5 REST OF THE WORLD

12.5.1 MIDDLE EAST

12.5.1.1 Increased investments in shipping infrastructures are driving the marine interiors market in the Middle East

12.5.2 LATIN AMERICA

12.5.2.1 Growth of marine sector is fueling the market for marine interiors in Latin America

13 COMPETITIVE LANDSCAPE (Page No. - 138)

13.1 INTRODUCTION

13.2 COMPETITIVE LEADERSHIP MAPPING

13.2.1 VISIONARY LEADERS

13.2.2 INNOVATORS

13.2.3 DYNAMIC DIFFERENTIATORS

13.2.4 EMERGING COMPANIES

13.3 RANKING OF KEY PLAYERS, 2019

13.3.1 WINNING IMPERATIVES, BY KEY PLAYERS

13.4 COMPETITIVE SCENARIO

13.4.1 CONTRACTS

13.4.2 COLLABORATIONS & PARTNERSHIPS

13.4.3 EXPANSIONS

13.5 CUSTOMER ANALYSIS

13.5.1 CRUISES

13.5.1.1 Meyer Werft (Germany)

13.5.1.2 Meyer Turku (Finland)

13.5.1.3 Lloyd Werft (Germany)

13.5.1.4 Mitsubishi (Japan)

13.5.1.5 Chantiers de l’Atlantique (STX France)

13.5.1.6 Fincantieri (Italy)

13.5.1.7 T. Mariotti (Italy)

13.5.1.8 Xiamen (China)

13.5.1.9 Grand Bahamas Shipyard (Bahamas)

13.5.1.10 Navantia Shipyard (Spain)

13.5.1.11 Sembawang (Singapore)

13.5.1.12 ST Engineering Marine (Singapore)

13.5.1.13 Remontowa (Poland)

13.5.1.14 Tallin (Estonia)

13.5.2 YACHTS

13.5.2.1 Koninklijke De Vries: Feadship (Netherlands)

13.5.2.2 Royal Van Lent: Feadship (Kaag Island)

13.5.2.3 Lurssen Yachts (Germany)

13.5.2.4 Amel (Netherlands)

13.5.2.5 Azimuth Yachts (Italy)

13.5.2.6 Benetti Yachts (Italy)

13.5.2.7 Fincantieri Yachts (Italy)

13.5.2.8 Heesen (Netherlands)

13.5.2.9 Nobiskrug (Germany)

13.5.2.10 Oceanco (Netherlands)

13.5.2.11 Sanlorenzo Yachts (Italy)

13.5.2.12 Westport Yachts (US)

13.6 CERTIFYING BODIES AND AUTHORITIES/PROCEDURE

13.6.1 IMO

13.6.1.1 2010 FTP CODE

13.6.1.2 SOLAS

13.6.1.3 MARPOL

13.6.1.4 COLREG

13.6.2 ISO 9001

13.6.3 OHASAS 18001

13.6.4 ISO14001

13.6.5 MED

13.6.6 LIOYD’S REGISTER

13.6.7 AMERICAN BOAT & YACHT COUNCIL

13.6.7.1 NMMA Boat & Yacht Certification

13.7 TOP EXHIBITIONS AND EVENTS

13.7.1 SMM

13.7.2 MARINTEC CHINA

13.7.3 NOR-SHIPPING

13.7.4 CRUISE SHIP INTERIORS EXPO EUROPE

13.7.5 CRUISE SHIP INTERIORS EXPO AMERICA

13.7.6 BOAT INTERNATIONAL’S SUPERYACHT DESIGN FESTIVAL

13.8 CONCLUSION AND RECOMMENDATIONS

13.8.1 MARKET GROWTH

13.8.1.1 Is the niche sectors (including cruises and yachts) going to experience market growth in the coming 5 to 10 years?

13.8.2 MARKET EXPANSION GEOGRAPHICALLY

13.8.2.1 Where is that market expansion mostly going to happen geographically?

13.8.3 SUPPLY AND DEMAND

13.8.3.1 How do the supply and demand look like for outfitting or joinery and decorative metal manufacturing companies in that sector?

13.8.4 STRATEGY RECOMMENDATIONS

13.8.4.1 Which business is perceived to be more profitable and a better target for acquisition in the marine interior sector (outfitting companies or joinery manufacturers)?

13.8.5 LISTING OF POTENTIAL COMPANIES

13.8.5.1 Potential companies

14 COMPANY PROFILES (Page No. - 191)

14.1 INTRODUCTION

(Business overview, Company information, Products & services offered, Customers and application area, Unique value proposition and right to win, R&M’s right to win, Growth strategies, Organic strategies, SWOT analysis, Recent developments)*

14.2 R&M GROUP

14.3 ALMACO

14.4 MIVAN MARINE LTD & MJM MARINE

14.5 TRIMLINE

14.6 KAEFER

14.7 MARINE INTERIORS

14.8 AROS MARINE

14.9 NORAC

14.10 BOLIDT

14.11 FORBO FLOORING SYSTEMS

14.12 TILLBERG DESIGN OF SWEDEN

14.13 NAVAL INTERIOR TEAM LTD (NIT)

14.14 ELATION LIGHTING INC.

14.15 OY LAUTEX AB

14.16 PRECETTI INC.

14.17 WINCH DESIGN

14.18 REDMAN WHITELEY DIXON (RWD)

14.19 SINOT EXCLUSIVE YACHT DESIGN

14.20 TERENCE DISDALE

14.21 RAYMOND LANGTON DESIGN

*Business overview, Company information, Products & services offered, Customers and application area, Unique value proposition and right to win, R&M’s right to win, Growth strategies, Organic strategies, SWOT analysis, Recent developmentsmight not be captured in case of unlisted companies.

14.22 INTERIOR DESIGNERS AND JOINERY COMPANIES

14.22.1 CRUISE INTERIOR DESIGNERS

14.22.2 YACHT INTERIOR DESIGNERS

14.22.3 JOINERY AND DECORATIVE METAL MANUFACTURING COMPANIES

14.22.3.1 Pfleiderer

14.22.3.2 Robos Contract Furniture

14.22.3.3 East Coast Flooring Blog

14.22.3.4 H.Y.S

14.22.3.5 Yachting Innovations

14.22.3.6 Ocean Refit Yacht Carpentary

14.22.3.7 World Surface Teak Decking and Yacht Refinishing

14.22.3.8 Classic Yacht Shipwrights

14.22.3.9 TW Joinery

14.22.3.10 Florida Teak

15 APPENDIX (Page No. - 298)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (123 Tables)

TABLE 1 RESEARCH ASSUMPTIONS

TABLE 2 CRUISE LINE REFURBISHMENT SCHEDULE (2018–2020)

TABLE 3 LIST OF CRUISE SHIPBUILDING IN ASIA PACIFIC

TABLE 4 COVID-19 IMPACT SCENARIOS, 2018–2027 (USD MILLION)

TABLE 5 INNOVATIONS & PATENT REGISTRATIONS, 2011–2020

TABLE 6 INDUSTRY SIZE, SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 7 COMMERCIAL: SEGMENT SIZE, BY TYPE, 2018–2027 (USD MILLION)

TABLE 8 PASSENGER VESSELS: SEGMENT SIZE, BY TYPE, 2018–2027 (USD MILLION)

TABLE 9 YACHT DELIVERIES (1999–2018)

TABLE 10 NEW-BUILD YACHTS, BY OWNERSHIP & SHIPYARD, 2019

TABLE 11 NEW-BUILD YACHTS, BY OWNERSHIP & SHIPYARD, 2020

TABLE 12 NEW-BUILD YACHT, BY OWNERSHIP & SHIPYARD, 2021–2024

TABLE 13 YACHTS: SEGMENT SIZE, BY SHIP CATEGORY, 2018–2027 (USD MILLION)

TABLE 14 CRUISES: SEGMENT SIZE, BY SHIP CATEGORY, 2018–2027 (USD MILLION)

TABLE 15 COMPETING BRANDS OFFERED WITHIN THE LUXURY CRUISE CATEGORY

TABLE 16 COMPETING BRANDS OFFERED WITHIN THE PREMIUM CRUISE CATEGORY

TABLE 17 COMPETING BRANDS OFFERED WITHIN THE BUDGET CRUISE CATEGORY

TABLE 18 CARGO VESSELS: SEGMENT SIZE, BY TYPE, 2018–2027 (USD MILLION)

TABLE 19 OTHER SHIPS: SEGMENT SIZE, BY TYPE, 2018–2027 (USD MILLION)

TABLE 20 DEFENSE SHIPS: SEGMENT SIZE, BY TYPE, 2018–2027 (USD MILLION)

TABLE 21 MARINE INTERIORS MARKET SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 22 CRUISE ORDERBOOK (2019–2025)

TABLE 23 CRUISE INDUSTRY EXPENDITURE IN NEW FIT (USD MILLION)

TABLE 24 DRYDOCK REFURBISHMENT PROGRAMS

TABLE 25 CRUISE INDUSTRY EXPENDITURE IN REFURBISHMENT (USD MILLION)

TABLE 26 MARINE INTERIORS MARKET FOR CRUISES, BY END USER, 2018-2027 (USD MILLION)

TABLE 27 MARINE INTERIORS MARKET FOR YACHTS, BY END USER, 2018–2027 (USD MILLION)

TABLE 28 MARINE INTERIORS MARKET SIZE, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 29 DRYDOCK REFURBISHMENT SCHEDULES (FOR CABINS)

TABLE 30 DRYDOCK REFURBISHMENT SCHEDULES (FOR SUITES)

TABLE 31 DRYDOCK REFURBISHMENT SCHEDULES (FOR SPA & WELLNESS AREAS)

TABLE 32 DRYDOCK REFURBISHMENT SCHEDULES (FOR DISCOS & CASINOS)

TABLE 33 DRYDOCK REFURBISHMENT SCHEDULES (FOR STAIRCASES & CORRIDORS)

TABLE 34 MARINE INTERIORS MARKET SIZE, BY MATERIAL, 2018–2027 (USD MILLION)

TABLE 35 COMPARISON OF SHIP MATERIAL WEIGHT (TONS)

TABLE 36 PLANNING, DESIGN, AND PRODUCTION COST BREAKDOWN OF MATERIAL

TABLE 37 PASSENGER SHIPS: COMPARISON BETWEEN STEEL AND COMPOSITES

TABLE 38 MARINE INTERIORS MARKET SIZE, BY PRODUCT, 2018—2027 (USD MILLION)

TABLE 39 LIGHTING: SEGMENT SIZE, BY TYPE, 2018—2027 (USD MILLION)

TABLE 40 EUROPE REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 41 EUROPE REGIONAL SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 42 EUROPE REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 43 EUROPE REGIONAL SIZE, BY MATERIAL, 2018–2027 (USD MILLION)

TABLE 44 EUROPE REGIONAL SIZE, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 45 CRUISE INDUSTRY: EXPENDITURE FOR NEWBUILDING AND REFURBISHMENT (USD MILLION), 2017

TABLE 46 ITALY: YACHT CONSTRUCTION (2019)

TABLE 47 ITALY: CRUISE SHIPS DELIVERY, BY CRUISE LINES, SHIP MODEL, AND YARD (2015-2027)

TABLE 48 ITALY MARINE CABIN INTERIORS MARKET SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 49 ITALY REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 50 UK: YACHT CONSTRUCTION (2019)

TABLE 51 UK REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 52 UK REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 53 FRANCE: CRUISE SHIPS DELIVERY, BY CRUISE LINES, SHIP MODEL, AND YARD (2016-2027)

TABLE 54 FRANCE REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 55 FRANCE REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 56 GERMANY: YACHT CONSTRUCTION (2019)

TABLE 57 GERMANY: CRUISE SHIPS DELIVERY, BY CRUISE LINES, SHIP MODEL, AND YARD, (2015-2027)

TABLE 58 GERMANY REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 59 GERMANY REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 60 FINLAND: CRUISE SHIPS DELIVERY, BY CRUISE LINES, SHIP MODEL, AND YARD (2016-2025)

TABLE 61 FINLAND REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 62 FINLAND REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 63 REST OF EUROPE REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 64 REST OF THE EUROPE REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 65 NORTH AMERICA MARINE CABIN INTERIORS MARKET SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 66 NORTH AMERICA REGIONAL SIZE, BY APPLICATION, 2018–2027(USD MILLION)

TABLE 67 NORTH AMERICA REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 68 NORTH AMERICA REGIONAL SIZE, BY MATERIAL, 2018–2027 (USD MILLION)

TABLE 69 NORTH AMERICA REGIONAL SIZE, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 70 US: YACHT CONSTRUCTION (2019)

TABLE 71 US REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 72 US REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 73 CANADA REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 74 CANADA REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC REGIONAL SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 77 ASIA PACIFIC REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC REGIONAL SIZE, BY MATERIAL, 2018–2027 (USD MILLION)

TABLE 79 ASIA PACIFIC REGIONAL SIZE, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 80 CHINA: YACHT CONSTRUCTION (2019)

TABLE 81 CHINA MARINE INTERIOR MARKET SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 82 CHINA REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 83 INDIA REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 84 INDIA REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 85 JAPAN REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 86 JAPAN REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 87 AUSTRALIA REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 88 AUSTRALIA REGIONAL SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 89 SOUTH KOREA REGIONAL SIZE, BY SHIP TYPE, 2018–2028 (USD MILLION)

TABLE 90 SOUTH KOREA REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 91 REST OF ASIA PACIFIC REGIONAL SIZE, BY SHIP TYPE, 2018–2028 (USD MILLION)

TABLE 92 REST OF ASIA PACIFIC REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 93 REST OF THE WORLD REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 94 REST OF THE WORLD REGIONAL SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 95 REST OF THE WORLD REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 96 REST OF THE WORLD REGIONAL SIZE, BY MATERIAL, 2018–2027 (USD MILLION)

TABLE 97 REST OF THE WORLD REGIONAL SIZE, BY REGION, 2018–2027 (USD MILLION)

TABLE 98 MIDDLE EAST REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 99 REST OF THE WORLD REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 100 LATIN AMERICA REGIONAL SIZE, BY SHIP TYPE, 2018–2027 (USD MILLION)

TABLE 101 LATIN AMERICA REGIONAL SIZE, BY END USER, 2018–2027 (USD MILLION)

TABLE 102 CONTRACTS, 2017–2020

TABLE 103 COLLABORATIONS & PARTNERSHIPS, 2017–2019

TABLE 104 EXPANSIONS, 2018

TABLE 105 MEYER WERFT SHIPYARD: CUSTOMER SNAPSHOT

TABLE 106 MEYER TURKU SHIPYARD CUSTOMER SNAPSHOT

TABLE 107 LLOYD WERFT SHIPYARD: CUSTOMER SNAPSHOT

TABLE 108 MITSUBISHI SHIPYARD: CUSTOMER SNAPSHOT

TABLE 109 CHANTIERS DE L’ATLANTIQUE (STX FRANCE) SHIPYARD: CUSTOMER SNAPSHOT

TABLE 110 FINCANTIERI SHIPYARD: CUSTOMER SNAPSHOT

TABLE 111 T. MARIOTTI SHIPYARD: CUSTOMER SNAPSHOT

TABLE 112 WHO-TO-WHOM ANALYSIS XIAMEN SHIPYARD

TABLE 113 GRAND BAHAMAS SHIPYARD: CUSTOMER SNAPSHOT

TABLE 114 NAVANTIA SHIPYARD: CUSTOMER SNAPSHOT

TABLE 115 SEMBAWANG SHIPYARD: CUSTOMER SNAPSHOT

TABLE 116 ST ENGINEERING MARINE SHIPYARD: CUSTOMER SNAPSHOT

TABLE 117 REMONTOWA SHIPYARD: CUSTOMER SNAPSHOT

TABLE 118 TALLIN SHIPYARD: CUSTOMER SNAPSHOT

TABLE 119 KONINKLIJKE FEADSHIP SHIPYARD: CUSTOMER SNAPSHOT

TABLE 120 ROYAL VAN LENT FEADSHIP SHIPYARD: CUSTOMER SNAPSHOT

TABLE 121 LURSSEN YACHTS SHIPYARD: CUSTOMER SNAPSHOT

TABLE 122 AMEL SHIPYARD: CUSTOMER SNAPSHOT

TABLE 123 KAEFER: SWOT ANALYSIS

LIST OF FIGURES (36 Figures)

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 MARINE INTERIORS INDUSTRY: RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION & REGION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 COMPOSITES SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2027

FIGURE 8 CRUISE SHIPS SEGMENT IN EUROPE EXPECTED TO LEAD FROM 2020 TO 2027

FIGURE 9 NEW FIT SEGMENT IS ESTIMATED TO LEAD FROM 2020 TO 2027

FIGURE 10 EUROPE ESTIMATED TO HOLD THE LARGEST SHARE IN 2020

FIGURE 11 INCREASING MARITIME TOURISM INDUSTRY AND REFURBISHMENT OF CRUISES AND YACHTS ARE DRIVING MARINE INTERIORS MARKET FROM 2020 TO 2027

FIGURE 12 NEW FIT SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER SHARE OF MARINE INTERIORS MARKET AS COMPARED TO REFIT SEGMENT IN 2020

FIGURE 13 CEILING & WALL PANELS SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MARINE INTERIORS MARKET DURING FORECAST PERIOD

FIGURE 14 COMMERCIAL SEGMENT EXPECTED TO LEAD MARINE INTERIORS MARKET DURING FORECAST PERIOD

FIGURE 15 MARINE INTERIORS MARKET IN NORTH AMERICA EXPECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 16 MARINE INTERIORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17 CLIA GLOBAL OCEAN CRUISE PASSENGERS (IN MILLION), 2009—2020

FIGURE 18 GLOBAL CRUISE INDUSTRY SHARE, BY REGION, 2019

FIGURE 19 RIVER CRUISE PASSENGERS (IN THOUSANDS), 2012–2018

FIGURE 20 ROADMAP TOWARD EMISSION-FREE SHIPPING INDUSTRY

FIGURE 21 INDUSTRY EXPERTS VIEWS ON MARINE GALLEY ADVANCEMENT

FIGURE 22 MARINE INTERIORS MARKET, BY SHIP TYPE, 2020 & 2027 (USD MILLION)

FIGURE 23 MARINE INTERIORS MARKET, BY END USER, 2020 & 2027 (USD MILLION)

FIGURE 24 NEW ORDERS OF CARGO SHIPS, 2010-2018 (MILLION DWT)

FIGURE 25 40M+ YACHT REFIT, 2017–2018 (USD MILLION)

FIGURE 26 MARINE INTERIORS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

FIGURE 27 MARINE INTERIORS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

FIGURE 28 MARINE INTERIORS MARKET SIZE, BY PRODUCT, 2020 & 2027 (USD MILLION)

FIGURE 29 EUROPE ESTIMATED TO HOLD LARGEST SHARE OF MARINE INTERIORS MARKET IN 2020

FIGURE 30 EUROPE MARINE INTERIORS MARKET SNAPSHOT

FIGURE 31 NORTH AMERICA MARINE INTERIORS MARKET SNAPSHOT

FIGURE 32 ASIA PACIFIC MARINE INTERIORS MARKET SNAPSHOT

FIGURE 33 KEY DEVELOPMENTS BY LEADING PLAYERS IN MARINE INTERIORS MARKET BETWEEN 2016 AND 2020

FIGURE 34 MARINE INTERIORS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 35 MARKET RANKING OF TOP PLAYERS IN MARINE INTERIORS MARKET, 2019

FIGURE 36 FORBO FLOORING SYSTEMS: COMPANY SNAPSHOT

Exhaustive secondary research was undertaken to collect information on the marine interiors market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand and supply-side analyses were employed to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the market sizes of different segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Publications of Statista, Clarksons Research, the International Maritime Organization (IMO), the United Nations Conference on Trade and Development (UNCTAD), Shipyard Orderbook, OECD, and Global Firepower, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the marine Interiors market.

Primary Research

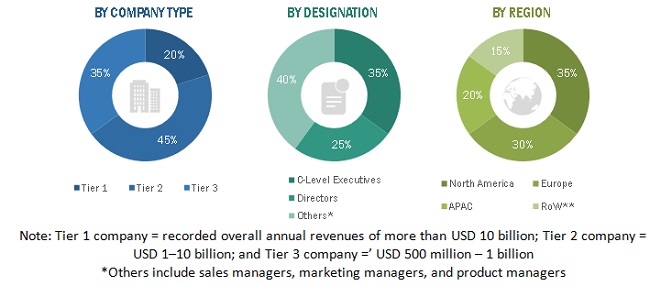

The marine interiors market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and integratory and regulatory organizations in its supply chain. The demand side of this market includes various end users such as commercial and government & defense organizations of different countries. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the marine interiors market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the marine interiors market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size of the marine interiors market using the market size estimation processes explained above, the market was split into several segments and subsegments. Data triangulation and market breakdown were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from demand as well as supply sides of the marine interiors market.

Report Objectives

- To define, describe, and forecast the size of the Marine Interior market based on ship type, material, application, end user, product, and region

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends, prospects, and their contribution to the overall market

- To forecast the size of segments of marine interiors market based on four regions, namely, North America, Europe, Asia Pacific, the Rest of the World, along with key countries in each of these regions

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as contracts, partnerships, agreements, and acquisitions adopted by key players in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies2

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Marine Interiors Market