Superdisintegrants Market by Product (Modified Starch, Modified Cellulose, Crospovidone, Ion Exchange Resin), Formulation (Tablet, Capsules), Therapeutic Area (Gastrointestinal, Cardiovascular, Neurology, Oncology, Hematology) - Global Forecast to 2023

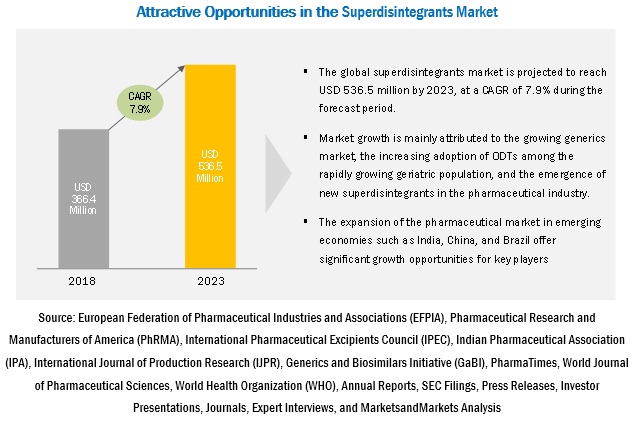

[182 Pages Report] The global superdisintegrants market is projected to reach USD 536.5 million by 2023 from USD 366.4 million in 2018, at a CAGR of 7.9% during the forecast period. The increasing adoption of orally disintegrating tablets, the growing generics market, and the emergence of new superdisintegrants for the pharmaceutical industry are factors driving the market for superdisintegrants. The shifting focus of pharmaceutical manufacturing to emerging markets and the growth of the overall pharmaceutical market in these markets present significant opportunities for market growth. However, safety and quality concerns are expected to challenge the growth of the superdisintegrants market to a certain extent during the forecast period.

By type, crospovidone segment to grow at the highest CAGR

This crospovidone segment is also expected to grow at the highest CAGR during the forecast period due to its wide use in fast-disintegrating oral solid dosage forms.

By formulation, tablets segment is expected to be the largest market during the forecast period

This market is also estimated to grow at a higher rate during the forecast period. The large share of this segment can be attributed to the widespread use of ODTs and fast-disintegrating tablets among healthcare providers and patients, resulting in the large-scale manufacture of these products by pharmaceutical manufacturers. The high demand for such ODTs and FDTs can be attributed to their advantages such as increasing drug bioavailability, better pre-gastric absorption, ease of swallowing in patients with dysphagia, ease of administration, and improved shelf-life.

By geography, Asia Pacific (APAC) to register the highest growth rate during the forecast period

With significant growth in pharmaceutical manufacturing in the past few years, China and India have emerged as high-growth markets for superdisintegrants. Other than APAC countries, Brazil also shows significant growth potential for the superdisintegrants market. A majority of this growth is driven by the significant growth in the healthcare market as well as the pharmaceutical industry in these regions. The low-cost manufacturing advantage, increasing per capita income, and low regulatory stringency are also factors supporting the growth of the superdisintegrants market in these regions.

Market Dynamics

Driver: Emergence of new superdisintegrants for the pharmaceutical industry

The preparation of special blends of superdisintegrants is an important development in the pharmaceutical industry. With these preparations, manufacturers now have access to a variety of superdisintegrants, including co-processed excipients which consist of a combination of synthetic and natural superdisintegrants or several synthetic superdisintegrants or synthetic superdisintegrants with other pharmaceutical excipients. This helps to improve the functioning of drugs due to the quick functioning of the active ingredients. Disintegrants are specially formulated for use in the direct compression method of tablet formulations that removes a number of processing steps used in wet and dry granulation. Orally disintegrating tablets (ODTs) are one of the fastest-growing drug delivery forms using superdisintegrants for direct compression.

Growth in the adoption of novel excipients is also increasingly being supported by a favorable regulatory environment in the developed regions. The International Pharmaceutical Excipients Council (IPEC) has encouraged the development and use of new excipients. The council has developed a novel excipient evaluation procedure as an independent process to decrease the cost and ambiguity related to the use of novel excipients in pharmaceutical formulations. This is expected to increase the demand for superdisintegrants in the pharmaceutical industry.

Opportunity: Pharmaceutical market expansion in emerging countries

The traditionally lucrative pharmaceuticals market is becoming challenging from a growth perspective due to the diminishing drug pipeline, government pressures to curtail healthcare costs, and the increasing regulations on innovative products. This is encouraging pharmaceutical manufacturers to move their manufacturing bases closer to high-growth emerging markets. Through this, manufacturers can take advantage of the low-cost manufacturing along with several financial benefits in terms of attractive tax rates and lenient regulatory guidelines for manufacturing in these countries. A number of major excipient manufacturers are either planning capacity expansions of their existing plants in emerging countries or setting up new manufacturing plants in emerging markets such as China and India.

Challenge:Safety and quality concerns

Despite the growing use of excipients in pharmaceuticals, the superdisintegrants industry faces the challenge of meeting the quality expectations of regulators, end users, drug makers, and more importantly, patients. Variations in superdisintegrant production affect drug performance along with its critical quality attributes. Supplier-to-supplier or batch-to-batch variations in superdisintegrant concentrations affect the excipient-drug interaction, in turn affecting drug efficacy and quality.

Furthermore, a large part of the pharmaceutical excipient manufacturing process is outsourced to smaller excipient manufacturers in low-cost countries such as India and China. This leads to low control over the excipient manufacturing process and quality, thereby increasing the need for process transparency in the entire supply chain. However, achieving immediate streamlining and maximum transparency in supply chain activities poses a challenge for both drug manufacturers and excipient manufacturers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

USD million |

|

Segments covered |

Type, Formulation, Therapeutic Area, and Region |

|

Geographies covered |

North America, APAC, Europe, Latin America Middle East & Africa |

|

Companies covered |

BASF SE (Germany), Ashland Global Holdings Inc. (US), DowDuPont (US), Roquette Freres (France), DFE Pharma (Germany), JRS PHARMA (Germany), Asahi Kasei Corporation (Japan), Merck KGaA (Germany), Corel Pharma Chem (India), Avantor Performance Materials (US) |

The research report categorizes the Superdisintegrants Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Type:

- Natural Superdisintegrants

- Synthetic Superdisintegrants

- Other Superdisintegrants

By Formulation

- Tablets

- Capsules

By Therapeutic Area:

- Gastrointestinal Diseases

- Neurological Diseases

- Oncology

- Infectious Diseases

- Cardiovascular Diseases

- Hematological Diseases

- Inflammatory Diseases

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa

Key Market Players

BASF SE (Germany), Ashland Global Holdings Inc. (US), DowDuPont (US), Roquette Freres (France)

Recent Developments

- In October 2017, Roquette opened a new Pharmaceutical R&D and Customer Technical Service (CTS) in Biopolis (Singapore) for the development of new products and new applications for existing products as well as pre-clinical research. This new facility operates as Roquette’s Asia Pacific headquarters and focuses on food, nutrition, and pharma products.

- In March 2017, BASF Group opened the Innovation Campus Asia Pacific in India, marking the company’s largest R&D investment in South Asia. The company invested USD 61.6 million (EUR 50 million) in this center to increase its global and regional research activities.

- In October 2016, Ashland opened a new pharmaceutical excipient facility in Nanjing, China, to produce excipients for the Asian market. The company supplies highly functional excipient technologies to manufacturers of oral pharmaceuticals and provide tailor-made formulation solutions through this facility

- In June 2016, DuPont opened its ASEAN (Association of Southeast Asian Nations) headquarters in Singapore in an effort to enhance the company’s competitive advantage in pivotal growth markets.

- In March 2016, Roquette received the EXCiPACT certification for Good Manufacturing Practices covering the manufacturing, testing, and packaging of a wide number of excipients.

Critical questions the report answers:

- Where will all these developments take the superdisintegrants market in the long term?

- What are the upcoming trends for the superdisintegrants market?

- Which segment in the superdisintegrants market provides the most opportunity for growth?

- Who are the leading vendors operating in this superdisintegrants market?

- What are the opportunities for new market entrants in the superdisintegrants market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 22)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Break Down of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Data Triangulation Approach

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Superdisintegrants Market Overview

4.2 Superdisintegrants Market: Geographic Growth Opportunities

4.3 Regional Mix: Superdisintegrants Market (2018–2023)

4.4 Synthetic Superdisintegrants Market, By Type and Region (2017)

4.5 Superdisintegrants Market: Developed vs Developing Markets, 2018 vs 2023

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Growing Adoption of Orally Disintegrating Tablets

5.2.1.2 Growing Generics Market

5.2.1.3 Emergence of New Superdisintegrants for the Pharmaceutical Industry

5.2.2 Market Opportunities

5.2.2.1 Pharmaceutical Market Expansion in Emerging Countries

5.2.3 Market Challenges

5.2.3.1 Safety and Quality Concerns

6 Regulatory Analysis (Page No. - 46)

6.1 Introduction

6.2 North America

6.2.1 US

6.2.2 Canada

6.3 Europe

6.4 Asia Pacific

6.4.1 Japan

6.4.2 China

6.4.3 India

7 Superdisintegrants Market, By Type (Page No. - 52)

7.1 Introduction

7.2 Synthetic Superdisintegrants

7.2.1 Crospovidone

7.2.2 Modified Starch (Sodium Starch Glycolate)

7.2.3 Modified Cellulose

7.2.3.1 Croscarmellose Sodium

7.2.3.2 Low-Substituted Hydroxypropyl Cellulose

7.2.4 Calcium Silicates

7.2.5 Ion Exchange Resins

7.3 Natural Superdisintegrants

7.4 Other Superdisintegrants

8 Superdisintegrants Market, By Formulation (Page No. - 66)

8.1 Introduction

8.2 Tablets

8.3 Capsules

9 Superdisintegrants Market, By Therapeutic Area (Page No. - 71)

9.1 Introduction

9.2 Neurological Diseases

9.3 Gastrointestinal Diseases

9.4 Oncology

9.5 Inflammatory Diseases

9.6 Infectious Diseases

9.7 Cardiovascular Diseases

9.8 Hematological Diseases

10 Superdisintegrants Market, By Region (Page No. - 87)

10.1 Introduction

10.2 Europe

10.2.1 Switzerland

10.2.2 Germany

10.2.3 Italy

10.2.4 France

10.2.5 UK

10.2.6 Spain

10.2.7 Rest of Europe

10.3 North America

10.3.1 US

10.3.2 Canada

10.4 Asia Pacific

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Rest of Asia Pacific

10.5 Latin America

10.6 Middle East & Africa

11 Competitive Landscape (Page No. - 144)

11.1 Overview

11.2 Competitive Situation and Trends

11.3 Market Share Analysis

12 Company Profiles (Page No. - 149)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 BASF SE

12.2 Ashland Global Holdings Inc.

12.3 DowDuPont Inc.

12.4 Roquette Freres

12.5 DFE Pharma

12.6 JRS Pharma

12.7 Asahi Kasei Corporation

12.8 Merck KGaA

12.9 Corel Pharma Chem

12.10 Avantor Performance Materials, LLC

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 173)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (124 Tables)

Table 1 Increase in Geriatric Population Across the Globe

Table 2 Drugs Facing Patent Expiry

Table 3 Key Market Drivers: Impact Analysis

Table 4 Key Market Opportunities: Impact Analysis

Table 5 Key Market Challenges: Impact Analysis

Table 6 Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 7 Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 8 Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 9 Synthetic Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 10 Crospovidone Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 11 Modified Starch Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 12 Modified Cellulose Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 13 Modified Cellulose Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 14 Croscarmellose Sodium Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 15 Low-Substituted Hydroxypropyl Cellulose Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 16 Calcium Silicates Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 17 Ion Exchange Resins Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 18 Natural Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 19 Other Superdisintegrants Market, By Country/Region, 2016–2023 (USD Million)

Table 20 Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 21 Superdisintegrants Market for Tablets, By Country, 2016–2023 (USD Million)

Table 22 Superdisintegrants Market for Capsules, By Country, 2016–2023 (USD Million)

Table 23 Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 24 Superdisintegrants Market for Neurological Diseases, By Country/Region, 2016–2023 (USD Million)

Table 25 Superdisintegrants Market for Gastrointestinal Diseases, By Country/Region, 2016–2023 (USD Million)

Table 26 Superdisintegrants Market for Oncology, By Country/Region, 2016–2023 (USD Million)

Table 27 Superdisintegrants Market for Inflammatory Diseases, By Country/Region, 2016–2023 (USD Million)

Table 28 Superdisintegrants Market for Infectious Diseases, By Country/Region, 2016–2023 (USD Million)

Table 29 Superdisintegrants Market for Cardiovascular Diseases, By Country/Region, 2016–2023 (USD Million)

Table 30 Superdisintegrants Market for Hematological Diseases, By Country/Region, 2016–2023 (USD Million)

Table 31 Superdisintegrants Market, By Region, 2016–2023 (USD Million)

Table 32 Europe: Superdisintegrants Market, By Country, 2016–2023 (USD Million)

Table 33 Europe: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 34 Europe: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 35 Europe: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 36 Europe: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 37 Europe: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 38 Switzerland: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 39 Switzerland: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 40 Switzerland: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 41 Switzerland: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 42 Switzerland: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 43 Germany: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 44 Germany: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 45 Germany: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 46 Germany: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 47 Germany: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 48 Italy: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 49 Italy: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 50 Italy: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 51 Italy: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 52 Italy: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 53 France: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 54 France: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 55 France: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 56 France: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 57 France: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 58 UK: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 59 UK: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 60 UK: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 61 UK: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 62 UK: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 63 Spain: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 64 Spain: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 65 Spain: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 66 Spain: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 67 Spain: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 68 RoE: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 69 RoE: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 70 RoE: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 71 RoE: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 72 RoE: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 73 North America: Superdisintegrants Market, By Country, 2016–2023 (USD Million)

Table 74 North America: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 75 North America: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 76 North America: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 77 North America: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 78 North America: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 79 US: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 80 US: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 81 US: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 82 US: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 83 US: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 84 Canada: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 85 Canada: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 86 Canada: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 87 Canada: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 88 Canada: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 89 Asia Pacific: Superdisintegrants Market, By Country, 2016–2023 (USD Million)

Table 90 Asia Pacific: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 91 Asia Pacific: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 92 Asia Pacific: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 93 Asia Pacific: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 94 Asia Pacific: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 95 Japan: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 96 Japan: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 97 Japan: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 98 Japan: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 99 Japan: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 100 China: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 101 China: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 102 China: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 103 China: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 104 China: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 105 India: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 106 India: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 107 India: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 108 India: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 109 India: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 110 RoAPAC: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 111 RoAPAC: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 112 RoAPAC: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 113 RoAPAC: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 114 RoAPAC: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 115 Latin America: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 116 Latin America: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 117 Latin America: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 118 Latin America: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 119 Latin America: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

Table 120 Middle East & Africa: Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 121 Middle East & Africa: Synthetic Superdisintegrants Market, By Type, 2016–2023 (USD Million)

Table 122 Middle East & Africa: Modified Cellulose Market, By Type, 2016–2023 (USD Million)

Table 123 Middle East & Africa: Superdisintegrants Market, By Formulation, 2016–2023 (USD Million)

Table 124 Middle East & Africa: Superdisintegrants Market, By Therapeutic Area, 2016–2023 (USD Million)

List of Figures (37 Figures)

Figure 1 Superdisintegrants Market

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designations, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Superdisintegrants Market, By Product, 2018 vs 2023 (USD Million)

Figure 8 Synthetic Superdisintegrants Market, By Type, 2018 vs 2023 (USD Million)

Figure 9 Superdisintegrants Market, By Formulation, 2018 vs 2023 (USD Million)

Figure 10 Superdisintegrants Market, By Therapeutic Area, 2018 vs 2023 (USD Million)

Figure 11 Geographical Snapshot: Superdisintegrants Market

Figure 12 Increasing Adoption of Orally Disintegrating Tablets is Expected to Drive Market Growth During the Forecast Period

Figure 13 US Dominated the Global Superdisintegrants Market in 2017

Figure 14 APAC to Register the Highest Growth Rate During the Forecast Period (2018–2023)

Figure 15 Crospovidone Accounted for the Largest Share of the Global Superdisintegrants Market in 2017

Figure 16 Developing Markets to Register A Higher Growth Rate Between 2018 & 2023

Figure 17 Superdisintegrants Market: Drivers, Opportunities, and Challenges

Figure 18 Synthetic Superdisintegrants to Dominate the Global Superdisintegrants Market During the Forecast Period

Figure 19 Tablets Segment to Dominate the Superdisintegrants Market During the Forecast Period

Figure 20 Neurological Diseases to Dominate the Superdisintegrants Market During 2018–2023

Figure 21 Cancer Incidence Across Key Countries, 2012

Figure 22 Annual Number of Deaths Due to Infectious Diseases, 2016

Figure 23 Superdisintegrants Market: Geographic Snapshot (2017)

Figure 24 Europe: Pharmaceutical Production, 2015 (USD Million)

Figure 25 Europe: Generics Market (2014)

Figure 26 Europe: Superdisintegrants Market Snapshot

Figure 27 North America: Superdisintegrants Market Snapshot

Figure 28 Asia Pacific: Superdisintegrants Market Snapshot

Figure 29 Key Developments in the Superdisintegrants Market From 2015 to May 2018

Figure 30 Superdisintegrants Market Share, By Key Player, 2017

Figure 31 BASF SE: Company Snapshot (2017)

Figure 32 Ashland Global Holdings Inc.: Company Snapshot (2017)

Figure 33 Dowdupont Inc.: Company Snapshot (2017)

Figure 34 Roquette Freres: Company Snapshot (2017)

Figure 35 Asahi Kasei Corporation: Company Snapshot (2017)

Figure 36 Merck KGaA: Company Snapshot (2017)

Figure 37 Marketsandmarkets Knowledge Store: Healthcare Industry Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Superdisintegrants Market